Founded by Nate Anderson, Hindenburg Research specializes in forensic financial research.

While we use fundamental analysis to aid our investment decision-making, we believe the most impactful research results from uncovering hard-to-find information from atypical sources. In particular we often look for situations where companies may have any combination of:

- Accounting irregularities

- Bad actors in management or key service provider roles

- Undisclosed related-party transactions

- Illegal/unethical business or financial reporting practices

- Undisclosed regulatory, product, or financial issues

Our aim is to provide critical insights and evidence to the public, market and regulators to effect meaningful change. To date, Hindenburg and its founders’ investigations have preceded SEC fraud charges against 65 individuals, Department of Justice criminal indictments against 24 individuals, and foreign regulator sanctions and fraud charges against 7 individuals.

Track Record

2024 (October): In August, 2023, we began researching Wags Capital, an investment firm run by Utah financial influencer Aaron Wagner. As part of our investigation, whistleblowers shared evidence with us showing how Wagner had misrepresented his investment performance, falsified financial records, and misappropriated investor assets. We examined these issues in addition to evidence that Wagner fabricated key elements of his background, ultimately sharing our findings with the government. In October 2024, Wagner was arrested and then criminally indicted in November 2024, along with business partner Michael Mains. We published our public report days after the arrest.

2023 (October): In February 2023, we began researching Nanban Ventures, a private investment firm making “too good to be true” promises. Following our multi-month investigation, we concluded that Nanban was likely an affinity scam targeting the Indian-American community, and we submitted our findings to regulators. In October 2023, the SEC froze Nanban’s assets and filed a complaint alleging that its key principals and entities ran a $130 million fraud. We published our full report on our investigation the next day.

2023 (June): We wrote about Tingo Group, an African fintech conglomerate with a peak fully diluted market cap of ~$3 billion. We alleged that the company faked its financials and virtually all of its operations. The company’s shares were halted by the SEC 6 months later, in November 2023. In December, the SEC charged Tingo and its founder Dozy Mmobuosi with a fraud of “staggering” scope. In January 2024, the Department of Justice unsealed a criminal indictment against Dozy over allegations of securities fraud. In September 2024, the SEC charged auditor Olayinka Oyebola & Co. with helping facilitate and conceal the fraud.

2023 (May): We wrote about Carl Icahn and his publicly traded vehicle, Icahn Enterprises, alleging that it lured in retail investors by paying an unsustainable distribution while Icahn masked details about his risky personal margin loans, which we suspected were sizeable.

In August 2024, the SEC charged Icahn over allegations that he misled investors by failing to disclose his multi-billion margin loans, fining him $2 million to settle the charges.

2022 (June): We wrote about $600 million Enochian Biosciences, describing the company as a “scam based on a lifetime of lies” run by founder Serhat Gumrukcu. We evidenced how Gumrukcu had faked his medical credentials and had practiced on patients, including terminally ill children, pretending to be a doctor. We traced his background and found that Gumrukcu was originally a Turkish magician who specialized in spoon bending before fleeing the country as a fugitive over allegations that he ran medical scams.

A week prior to publishing our report, Gumrukcu was charged in a murder for hire plot that had resulted in the killing of a Vermont man involved in one of his alleged scams.

In June 2022, the company falsely claimed it had responded to questions we had asked during our research process and that we ignored the responses. As a result, in August 2022, we sued the company. In September, the company filed an 8-K correcting its misstatement.

In October 2022, the company then sued its founder, Gumrukcu, alleging its “inventor”, founder and largest shareholder fabricated numerous scientific test results and even entire tests. The company also acknowledged it unknowingly submitted fabricated test results to the FDA.

Gumrukcu is currently in prison awaiting trial over the murder allegations.

2022 (June): We wrote about Ebix, Inc., a fintech company that we alleged displayed hallmarks of fake revenue at its key subsidiary, EbixCash. We also wrote about the company’s massive debt load and predicted it would face insolvency risks in roughly a year. In July 2023, the company announced that it needed to restate its subsidiary EbixCash’s financials, eliminating up to 62% of its earlier claimed revenue. In September 2023, the company announced a forbearance agreement with its creditors. In December 2023, Ebix filed for bankruptcy and its stock was delisted.

2022 (May): We wrote about Nasdaq-listed Singularity Future Technology whose CEO was a fugitive on the run for allegedly operating a massive ponzi scheme in China. We evidenced that the CEO had a “red notice” issued for his arrest. We also highlighted undisclosed related party transactions involving Singularity’s CFO.

In August 2022, the CEO was forced to resign by the board. In September 2022, the company’s CFO was terminated by the company’s board for cause. In November 2022, the company’s Chief Technology Officer resigned.

In March 2023, Singularity confirmed that its then-former CEO Yang Jie had a “red notice” issued for his arrest in China, as we reported. Jie had apparently provided forged documentation to the SEC that falsely claimed his criminal charges had been dropped.

2022 (March): We uncovered a $400 million ongoing ponzi scheme called J&J Purchasing and submitted our findings to the government. As part of our investigation, we obtained recordings of key J&J marketers by rigging a private jet with hidden surveillance equipment and inviting them to pitch the investment offering to a Hindenburg associate posing as a wealthy investor.

In March 2022, FBI agents showed up at the home of the lawyer alleged to be behind the scheme, resulting in a shootout followed by a four hour standoff during which the lawyer confessed repeatedly to having run J&J as a Ponzi scheme. The lawyer was taken into custody, recovered from his gunshot wounds and was later criminally indicted on charges of wire fraud and money laundering.

The Wall Street Journal broke the story. We published our full findings the following day.

In April 2022, the SEC filed a complaint against J&J Purchasing and its key principals and marketers, alleging fraud. It later amended its complaint, charging 15 individuals with fraud, along with multiple corporate entities.

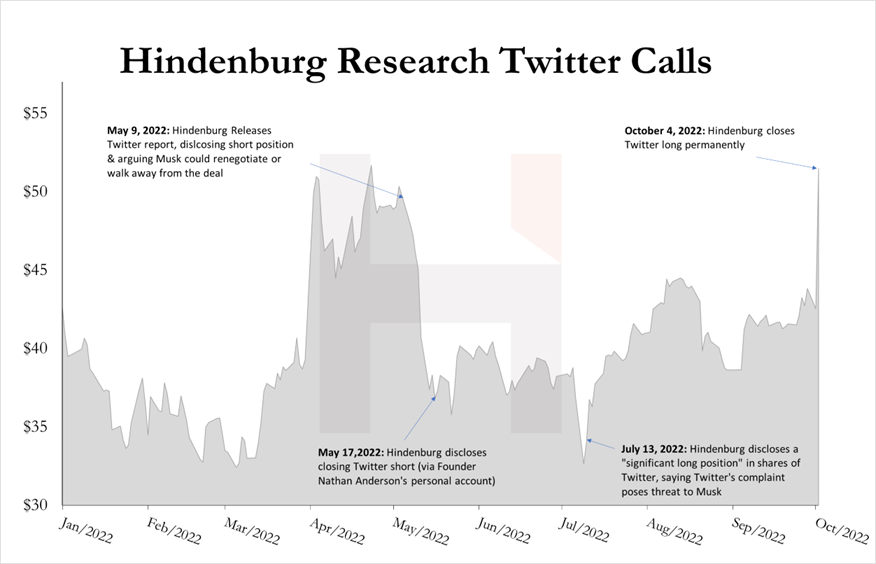

2022: In mid-2022, following Elon Musk’s agreement to buy Twitter, we announced a short position, betting that Musk, a notoriously impulsive individual, would either try to renegotiate or walk away from the deal.

Four days later, Musk attempted to walk away from the deal, sending Twitter’s stock lower. We covered our short and later went long, believing that Musk’s arguments for backing out were unlikely to prevail in court. Musk later closed the deal at the originally agreed upon price, resulting in investment gains in both directions.

2021 (May): We wrote about PureCycle, alleging the “green” recycling SPAC was an ESG charade sponsored by the worst of Wall Street.

Six months later, the company’s CFO resigned. In July 2022, the company announced the resignation of its Chairman/CEO Mike Otworth who, as we noted in our report, had previously run 6 failed public companies.

2021 (May): On May 12, 2021, we wrote about Lordstown Motors, alleging that the zero-revenue electric vehicle company was touting a “largely fictitious” pre-order book, which it used to raise capital and confer legitimacy. Almost one month later, on June 14, 2021, Lordstown announced that its Chairman & CEO Steve Burns and CFO Julio Rodriguez resigned from the company.

In June 2023, the Lordstown filed for Chapter 11 bankruptcy.

In February 2024, the SEC referenced our report in its announcement charging Lordstown with fraud, alleging the company misrepresented its order book and the timeline for delivering its flagship electric truck. The company agreed to $25.5 million in disgorgement. The SEC also charged its auditor with violating auditor independence standards.

In March 2024, the SEC referenced our report in charging Lordstown Chairman & CEO Steve Burns with fraud.

2021 (March): On March 1, 2021, we evidenced suspected acts of international corruption by ESG-darling Ormat, a developer and operator of geothermal power plants.

Eight hours after our report was published, Ormat announced that the company’s General Counsel and Chief Compliance Officer was relieved of his responsibilities by the company’s board and that a director would step down.

2020 (November): On November 30, 2020, we wrote about Kandi Automotive, evidencing suspected fake sales and misleading statements relating to the company’s U.S. electric vehicle launch.

In September 2023, the SEC charged Kandi with fraud over false statements & omissions relating to the company’s U.S. EV launch, including issues raised in our report. The company settled the charges.

2020 (October): On October 13, 2020, we wrote about Loop Industries, alleging the company was a “recycled” smoke and mirrors show. About four months later, the company’s CFO and COO resigned.

In October 2022, the SEC charged 4 individuals over an alleged deceptive scheme to promote and secretly dump shares of the company. Former Loop director Donald Danks, featured prominently in our report, was charged and CEO Daniel Solomita was named as a relief defendant.

In November 2022, the Department of Justice (DoJ) filed criminal charges against the same 4 individuals alleging securities fraud, with Danks additionally charged with money laundering.

2020 (September): We released a report titled “Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America” that, with the help of whistleblowers, called out a vast array of alleged lies and deceptions by Nikola in the years leading up to its proposed partnership with General Motors.

Among dozens of other issues, we pointed out that Nikola’s promotional video meant to highlight the capabilities of its Nikola One semi-truck was nothing more than the truck being towed to the top of a hill in the Utah desert then filmed rolling down, a claim the company later admitted.

Nikola Founder and Executive Chairman Trevor Milton resigned from the company 10 days later.

Months later, around December 2020, private investigators claiming to be journalists attempted to discern the identity of a key Nikola whistleblower, offering a meeting under false pretenses. The whistleblower worked with Hindenburg to turn the tables, with the founder of Hindenburg pretending to be the whistleblower and secretly recording the meeting with hidden camera and audio equipment, outing the investigators and the intended deception.

Nikola founder Trevor Milton was subsequently criminally indicted in July 2021 on charges of securities and wire fraud. In October 2022, a jury found Milton guilty on 3 counts of fraud and later sentenced him to 4 years in prison. The whistleblower’s identity was protected until trial, where he served as a key witness for the prosecution.

2020 (July): We wrote about Facedrive, calling the company a $1.4 billion ESG stock promotion, specifically flagging an irregular relationship with a stock promotion entity based in the British Virgin Islands (BVI).

In March 2023, the company settled Ontario Securities Commission (OSC) allegations including that it had issued misleading press releases and worked with the BVI stock promoter to issue overly promotional articles.

2020 (July): On July 10, 2020, we wrote why we thought shares of Workhorse had 50% downside, saying that the company’s chance of winning a much-hyped U.S. Postal Service contract was “virtually zero”.

~8 months later, on February 23, 2021, the US Postal Service announced it was awarding the multi-billion dollar contract in question to Oshkosh Defense, not Workhorse. On the news, Workhorse shares plunged by as much as 55%.

2020 (June): We announced we were short Ideanomics, a company with a torrid history of changing business models, then pumping and dumping on each new endeavor. We identified why we thought the company was engaging in egregious fraud.

In June 2022, the audit partner that had audited IDEX for the past 3 years was barred from the industry for audit failures.

In August 2024, the SEC charged Ideanomics and 3 senior executives with accounting and disclosure fraud.

2020 (June): We wrote about WINS Finance, highlighting that its Chinese operating subsidiary was subject to a RMB 350 million asset freeze which had not been disclosed to U.S. investors.

We also pointed out that WINS’ parent, which owned 67.7% of WINS’ equity, had already been declared insolvent in China with no disclosure to U.S. investors. About four months later, in October 2020, NASDAQ delisted WINS specifically due to the undisclosed asset freeze we identified.

2020 (May): We wrote that Sorrento Pharmaceuticals was engaging in pandemic profiteering, using sensational claims about a Covid “cure” to boost its stock. The company never commercialized its claimed “cure” and filed for Chapter 11 bankruptcy in February 2023.

2020 (May): We wrote about China Metal Resources Utilization, calling it a “zombie company”. We showed how the company was under severe financial distress and identified numerous accounting irregularities, including evidence of undisclosed related party transactions. Several weeks after our report, shares fell around 90% in a single day.

Several months later, Ernst and Young withdrew as auditor after refusing to issue an audit opinion due to accounting issues including undisclosed related party transactions. In June 2021, the Hong Kong Exchange formally sanctioned the Chairman for failing to disclose his disposition of almost 10% of the company’s shares. The company stopped reporting financials by 2022 year-end and its shares were suspended by the exchange.

2020 (May): We wrote about Co-Diagnostics (NASDAQ:CODX), raising questions about the quality and economics of its COVID-19 test kits as touted in company press releases, along with red flags around the regulatory history of its CFO. In July 2023, the SEC charged Co-Diagnostics with fraud over misleading COVID-19 press releases and undisclosed related-party dealings involving the company’s CEO and CFO.

2020 (April): We wrote about SC Worx (NASDAQ:WORX) and how the company’s sudden, massive COVID-19 testing deal looked to be “completely bogus”. We also raised questions about the CEO, a convicted felon, and the track record of the company’s claimed COVID-19 testing partner, which was run by a convicted rapist. SC Worx was halted by the SEC later that month. In March 2022, the SEC charged SC Worx and its former CEO with misleading investors about the Covid-19 test kit deal.

2020 (March): We wrote a second report on Predictive Technology Group (OTC:PRED), calling into question the company’s COVID-19 related press releases. The stock was halted the next month by the SEC in late April 2020 for “claims about COVID-19 tests”. When we first wrote about the company less than a year earlier, it had a market cap of ~$1 billion. It was subsequently delisted from two OTC exchanges and is now considered a “Dark or Defunct” issuer.

2020 (March): We wrote about HF Foods (NASDAQ:HFFG), specifically calling out the company’s misallocation of shareholder capital and massive undisclosed related party transactions, including a $509 million merger. In May of 2020, HFFG recognized a $338.2 million goodwill impairment, resulting in a $339.9 million quarterly loss relating to the deal. The company had a market cap of just ~$400 million at the time.

In February 2021, HF Foods’ co-CEO, featured prominently in our report, resigned. In 2022, HF Foods disclosed its CFO and a director resigned and reported a delisting notice.

In September 2022, the SEC issued a cease and desist, as well as levying $1.6m in fines, to HF Foods’ auditor Friedman LLP for failing to find numerous audit issues with issuers that, according to our analysis, included HF Foods.

In June 2024, the SEC filed a complaint against the former Chairman/CEO and CFO of HF Foods, alleging that they hid millions in liabilities and misappropriated company funds. The complaint referenced our original report and the company’s misleading response to our report. [Pg. 32]

Later that month, the SEC charged the company with fraud over similar allegations, also referencing our report and the company’s misleading response in its allegations.

2019 (October): We wrote an article warning customers of SmileDirectClub’s questionable business practices and warning investors that negative press of the company could spread as a result of poor customer reviews, lawsuits, various regulatory investigations and allegations of practicing dentistry without proper licensing. Following our report, exposés were written by the Boston Globe, the New York Times, and NBC News that supported red flags we originally raised in our report.

The company filed for bankruptcy in September 2023 and was shut down months later.

2019 (September): We wrote an article detailing why we thought Bloom Energy (NASDAQ:BE) had billions of dollars in undisclosed off-balance sheet liabilities. We specifically pointed out issues relating to the company’s accounting around its service agreements. About 5 months after our article, Bloom announced a massive restatement of nearly four years of its financials due to “material” accounting errors relating to its service agreements involving every quarter since it went public. Forbes published a corresponding exposé on the company.

2018 (December): We wrote an article about Yangtze River Port & Logistics (NASDAQ:YRIV), a $2 billion market cap China-based logistics company. Our investigation found that the company’s key asset didn’t appear to exist, among other major anomalies. The company sued us, alleging defamation, so we redoubled our efforts and uncovered numerous additional findings.

Multiple independent media outlets and a law firm corroborated our reporting (1, 2, 3). The company was delisted from NASDAQ 6 months later, lost over 99% of its market cap, and now has gone “dark or defunct”. The lawsuit against us was dismissed.

2018 (December): We wrote an article about irregular acquisitions and dealings between Liberty Health Sciences (CSE:LHS) and Aphria. Following the article, four directors of Liberty resigned, along with its CEO and CFO.

2018 (December): We wrote a second article on Aphria (NYSE:APHA) detailing how the company made a second series of highly irregular, overvalued acquisitions that had hallmarks of insider self-dealing (see below for the first example). Insiders later admitted to having undisclosed stakes in its own acquisitions, leading to the resignation of the company’s Chairman/CEO, a co-founder, and an executive/board shake-up. The company later wrote down the value of the questioned acquisitions 6 months later.

2018 (March): We wrote an article showing that $2 billion market cap cannabis company Aphria (NYSE:APHA) made a highly irregular, overvalued acquisition that had hallmarks of insider self-dealing. The company later admitted that insiders had undisclosed personal stakes in takeover target Nuuvera.

2017 (December): We wrote a series of articles about Riot Blockchain’s (NASDAQ:RIOT) suspicious acquisitions that appeared designed to benefit insiders.

Riot’s then-CEO was later charged with fraud by the SEC over allegations of participating in multiple pump and dump schemes.

2017 (December): We wrote an article about PolarityTE’s (NASDAQ:PTE) sketchy origin story and irregular financial disclosures. The company’s CFO later resigned and was charged by the SEC in 2018 for allegedly participating in pump & dump schemes.

2017 (November): We wrote an article about $3 billion market cap Opko Health’s (NASDAQ:OPK) nefarious criminal connections as well as its slate of product failures and irregular disclosures. In late 2018 the company’s Chairman/CEO and the company itself were all charged with fraud by the SEC. They later settled the charges.

2017 (November): We wrote an article about Pershing Gold (NASDAQ:PGLC) and identified a key individual behind a series of irregular company disclosures. That individual was later charged by the SEC as the “primary strategist” of a group alleged to have run multiple pump and dump schemes.

2017 (August): At the inception of Hindenburg Research, our firm’s first two critical research reports centered on then-U.S. listed Indian film company Eros International. [1,2] Our reports alleged major accounting irregularities, including suspected undisclosed related party transactions, asset inflation and falsified revenue, among other issues. The company sued us, but the lawsuit was dismissed. We followed up with a third report in 2019 alleging “egregious accounting irregularities”. In January 2023, the company was delisted by the NYSE. Almost 8 years after our initial reports, Indian securities regulator SEBI corroborated many of our findings, identifying multiple illicit related party transactions involving the same entities and people. SEBI orders from June 2023 and October 2024 detailed evidence that “prima-facie indicated possible siphoning of funds and manipulation of books of accounts”. The regulator fined and barred Eros promoter and managing director Sunil Lulla.

2017 (March): Hindenburg founder Nate Anderson submitted a whistleblower report relating to suspected fraud at West Mountain Partners, an Atlanta-based hedge fund, outlining the suspected overvaluation of key fund assets.

In 2019, the SEC charged West Mountain and its principal with fraud relating to the overvaluation of assets and false statements.

2016: Hindenburg founder Nate Anderson, together with Bernie Madoff whistleblower Harry Markopolos, submitted a whistleblower report relating to suspected fraud at Platinum Partners, a $1.4 billion hedge fund. Subsequent to their work, in late 2016, 7 individuals at the fund were criminally indicted over allegations of fraud, with most pleading guilty or losing at trial.

In August 2023, the SEC settled fraud charges against a related reinsurance company called Beechwood Re which had been cited extensively in whistleblower materials as an offshore haven for Platinum’s illicit proceeds.

2016: Hindenburg founder Nate Anderson submitted a whistleblower report to the SEC related to Statim Holdings, an Atlanta-based hedge fund. The report detailed suspected misrepresentations and misleading statements by the fund and its principal. The firm was subsequently charged with fraud by the SEC in 2019.

2015: Hindenburg founder Nate Anderson submitted a whistleblower report to the SEC related to TCA Global, a Florida-based hedge fund. The report detailed numerous suspected misrepresentations, including asset inflation, by the fund and its principals.

In 2021, the SEC charged TCA’s two top principals with fraud, alleging the pair had artificially inflated net asset values and performance. They settled the charges.

2014: Hindenburg founder Nate Anderson submitted a whistleblower report to the SEC relating to RD Legal, a hedge fund that was later charged by the commission for allegedly making material misstatements to its investors. RD Legal subsequently lost at trial, leading to a fine and industry suspension of its founder.

Honors

2024: Top Short Seller, Activist Insight’s (now Insightia) 2024 Investing Annual Review – link

2023: Top Short Seller, Activist Insight’s 2023 Investing Annual Review – link

2022: Top Short Seller, Activist Insight’s 2022 Investing Annual Review – link

2021: Top Short Seller, Activist Insight’s 2021 Investing Annual Review – link

2020: Top Short Seller, Activist Insight’s 2020 Investing Annual Review – link

Why “Hindenburg”?

We view the Hindenburg as the epitome of a totally man-made, totally avoidable disaster. Almost 100 people were loaded onto a balloon filled with the most flammable element in the universe. This was despite dozens of earlier hydrogen-based aircraft meeting with similar fates. Nonetheless, the operators of the Hindenburg forged ahead, adopting the oft-cited Wall Street maxim of “this time is different”.

We look for similar man-made disasters floating around in the market and aim to shed light on them before they lure in more unsuspecting victims.

Please send tips, feedback, or questions to info@hindenburgresearch.com