- SCWorx, a nanocap company headquartered in a Regus rental office in New York City, recently announced it had entered into massive $35 million per week deal to buy and re-sell Covid-19 tests, causing its stock to surge 434%.

- SCWorx’s CEO has a checkered past, including pleading guilty to felony tax evasion charges and paying a judgement in a lawsuit alleging he submitted fraudulent expense reports.

- The Covid-19 test supplier that SCWorx is buying from, Promedical, also is laden with red flags. Its CEO is a convicted rapist and formerly ran another business accused of defrauding its investors and customers. The CEO was also alleged to have falsified his medical credentials.

- Promedical claimed to the FDA and regulators in Australia to be offering COVID-19 test kits manufactured by large, well-respected Chinese firm Wondfo.

- Wondfo put out a press release days ago stating that Promedical “fraudulently mispresented themselves” as sellers of its Covid-19 tests and disavowed any relationship. We spoke with Wondfo and confirmed there was never any relationship.

- Meanwhile, the buyer that SCWorx has lined up for up to $840 million dollars in tests is a virtual healthcare company started by a 25-year-old in August 2018 that looks modestly sized, with only 3 employees and 3 consultants/advisors listed on its team page– hardly the major partner that we believe would be capable of handling hundreds of millions of dollars in orders.

- Obviously, we believe the Covid-19 hype surrounding SCWorx is completely bogus and we predict shares will soon return to the $2.25 price level they were at prior to the hype.

- We also think shares risk being halted and ultimately could move far lower than $2.25 if/when regulators investigate the company’s potentially nefarious business practices at a time when our country and its citizens are arguably at their most vulnerable. We’re offended by how egregious this appears, not only as investors, but as Americans.

On April 13th, SCWorx (NASDAQ:WORX), a nanocap company that lists its headquarters at a Regus Rental Office on the 21st Floor of 590 Madison Ave.,[1] took the market by storm.

That day, the company announced the first installment of an order for up to 48 million COVID-19 tests from an Australian manufacturer. Per the announcement, the deal represented $35 million in orders per week, for a potential total deal size of $840 million.

It was undoubtedly a monumental announcement for a company with a market cap of just $16 million at the time. The sheer size of the previously unannounced order had the potential to single-handedly alter the course of the ongoing national fight against the novel coronavirus.

The company’s stock skyrocketed on the announcement. The day before the announcement, shares of the relatively sleepy company had closed at $2.25 per share and had traded a total of just 21,400 shares.

On the day of the announcement, shares closed at $12.02, an increase of 434%, on 96,182,900 shares of volume, making it one of the most actively traded names on the NASDAQ.

The original announcement stated that the company would be receiving a go-forward provision for up to 2 million units per week. A subsequent 8-K filed yesterday provided additional detail, stating that the company would be paying a unit price of $13 per test, and would be required to pay 50% down and 50% due on completion of each order (amounting to an up-front payment of $13 million for the first week of units).

This sum may have come as a surprise to investors – it certainly did to us – given that as of its latest financials, the company only reported tangible assets of $2.6 million [Pg. 3] and a history of consistent net losses. [Pg. 5]

Beyond the seeming inability to actually fund such a massive deal, SCWorx’s business (up until the COVID-19 pandemic, apparently) was in developing healthcare management software, not medical products themselves.

Other surprises that may lie in store for investors are the numerous red flags we found that lead us to believe this announcement is completely bogus. Namely, our findings that:

- SCWorx’s CEO was convicted of felony tax evasion and sued over allegations of fraudulently submitting expense reports in the past.

- The company SCWorx is claiming to buy the tests from, Promedical, was recently denounced by a legitimate Covid-19 test manufacturer as “fraudulently misrepresenting” themselves as sellers of their product.

- Promedical’s CEO is a convicted rapist and has been accused in a media exposé of defrauding investors at his previous business.

- The purported purchaser of tests that SCWorx has lined up is a virtual health company that was started less than 2 years ago by a 25-year-old recent college graduate. Given that the purchaser is a virtual health company, and the tests must be administered in real life, the fit seems less than ideal.

SCWorx’s CEO Has A Checkered Past That Includes Felony Tax Evasion And Allegations Of Submitting Fraudulent Expense Reports

Marc Schessel serves as both CEO and interim CFO of SCWorx. (The company’s earlier CFO was terminated in October and was paid cash and shares as part of a settlement agreement.)

Schessel has a checkered history. A lawsuit by a former employer detailed how Schessel pled guilty to felony tax evasion in 2003. That conviction was described as having been the result of failing to pay income taxes on illicit proceeds from a bribery scheme that led to the indictment of two other individuals.

Previously, another former employer sued Schessel for submitting fraudulent expense reports, which resulted in a judgement against him.

SCWorx Says They’re Buying Tests From Promedical.

Promedical’s Name Mysteriously Disappeared From FDA Test Provider Lists In The U.S. And Australia After Falsely Claiming To Work With Wondfo, A Large Chinese Manufacturer.

The supplier for SCWorx has a mysterious history when it comes to coronavirus testing kits in the U.S. and Australia.

The 8-K filed on Thursday after hours by SCWorx identified the manufacturer of its test kits as Australia-based Promedical:

“On April 10, 2020, concurrently with its acceptance of the Purchase Order, the Company entered into a Supply Agreement (“Supply Agreement”) with Promedical Equipment Pty Ltd. (“Supplier”) pursuant to which the Company agreed to purchase and the Supplier agreed to supply an aggregate of 52 million COVID-19 Rapid Testing Units over a six month period…”

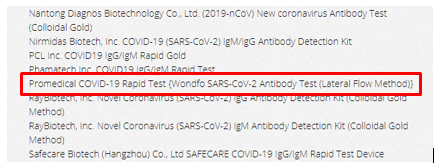

In late March, Promedical’s name appeared multiple lists showing current COVID-19 diagnostic devices listed with the FDA (1,2,3). In each instance it claimed to be offering tests made by Wondfo, a large, well-known biotech company.

See one example below originally posted on a microbiology site:

But, as of 4/16/2020, it is not listed on the FDA’s list of test providers permitted under an Emergency Use Authorization nor permitted by its more general standards.

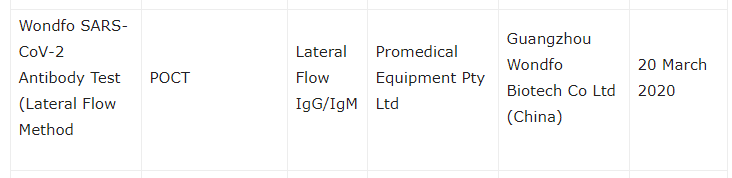

A similar phenomenon seems to have also taken place in Promedical’s native Australia. In a March 23 article on MILNZ.co.nz that listed COVID-19 diagnostic tests for legal supply in Australia, Wondfo’s test is again listed under “Name of Test” with Promedical as the “Australian Sponsor”.

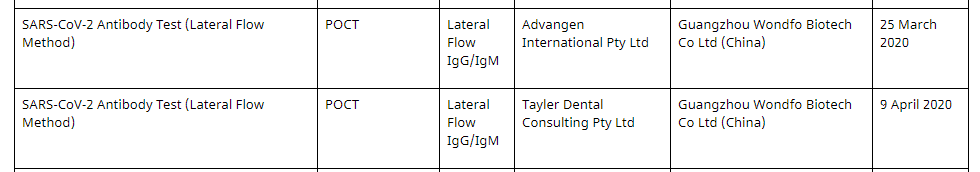

But again – just like in the U.S. – when we check the updated list on the official Australia Department of Health website, we find that Promedical has mysteriously disappeared and that Wondfo’s name now appears next to two totally different Australian sponsors:

But again – just like in the U.S. – when we check the updated list on the official Australia Department of Health website, we find that Promedical has mysteriously disappeared and that Wondfo’s name now appears next to two totally different Australian sponsors:

We called the Therapeutic Goods Administration (“TGA”) in Australia (similar to the U.S. FDA) and they told us that Promedical requested to have its name removed from the list, which is why they are no longer on it.

We contacted the FDA who wrote back, somewhat vaguely:

“While I cannot speak to details of this specific case, we’ve been notified by several organizations that were not the original manufacturers.”

What could have prompted these mysterious disappearances and the request for removal?

The Mystery Solved: Wondfo Publicly and Strongly Disavowed Any Relationship with Promedical, Stating It “Fraudulently Misrepresented Itself”

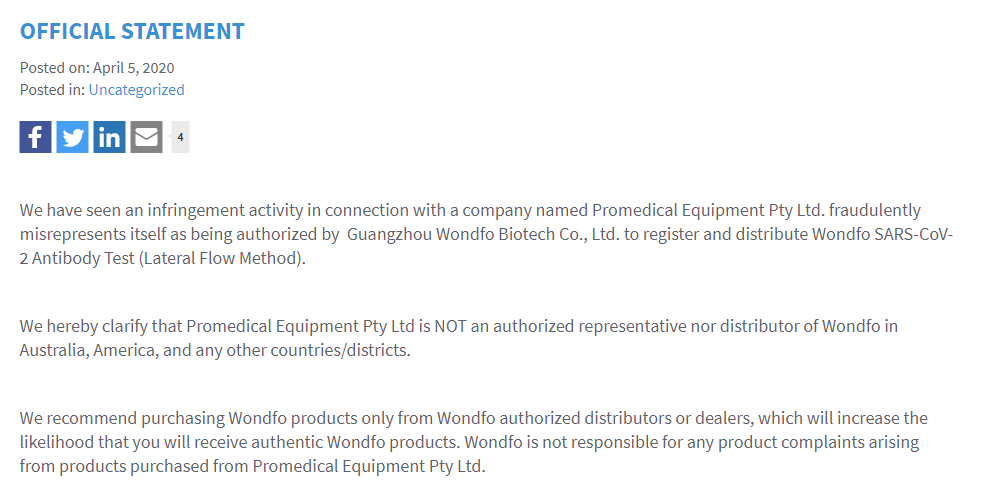

Wondfo seemingly solved the mystery of Promedical disappearing off the U.S. and Australian FDA sites when it publicly disavowed Promedical as misusing its name, via an official press release.

On April 5, 2020, Wondfo issued an official statement distancing themselves from Promedical:

“We hereby clarify that now Promedical Equipment Pty Ltd is NOT an authorized representative nor distributor of in Australia, America, and any other countries/districts. We recommend purchasing products only from authorized distributors or dealers, which will increase the likelihood that you will receive authentic products. is not responsible for any product complaints arising from products purchased from Promedical Equipment Pty Ltd.”

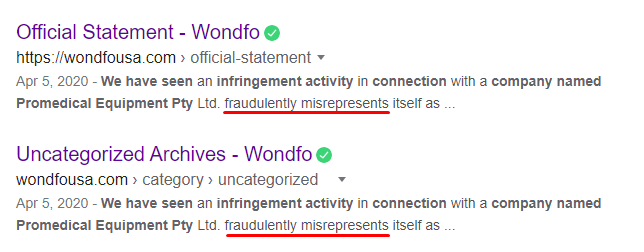

Additionally, Google’s cache shows an earlier statement, where Wondfo publicly said that Promedical was “fraudulently misrepresenting” itself as being authorized by Wondfo to distribute its products:

And a cached version of the statement still comes up when you Google the above text (as of 4/16/2020):

Promedical then issued a statement on April 8, 2020 claiming that Wondfo had previously authorized them to sell their kits, but that they are no longer selling or marketing them:

“On the 7th of March 2020 Wondfo authorized Promedical to sell their Rapid Test Kits in Australia and North America. However, as of the 3rd April 2020, Promedical will no longer be selling or marketing any Wondfo products. We have recalled all marketing material related to Wondfo created by Promedical as it is no longer valid.”

We called Wondfo on April 15, 2020 to try and understand what relationship it had with Promedical in the past, if any. We asked if the company used to have a relationship with Promedical and we were told by a Wondfo representative:

“As far as I know we never had any deal in place with Promedical Equipment,” we were told.

We asked the person to double check, so they put us on hold for two minutes. When they came back, they confirmed:

“We’ve never had any kind of relationship with them at all. Ever.”

We reached out to SCWorx to discuss this and other issues but the representative repeatedly insisted that he could not provide any information beyond the company press releases.

Another Wondfo Seller Told Us That Promedical’s Test Offering Was A Fake: “This Is Very Serious and Could Have Resulted in Hundreds Of Deaths”

We were also told by another seller of Wondfo’s products that Wondfo had Promedical removed from the Australian TGA website.

We connected with Cellmid, an actual provider of Wondfo Covid-19 tests that had identified irregularities with Promedical’s advertised test offering. The CEO of Cellmid told us:

“(Promedical’s) website was a cut and paste from different tests and then posted pictures of the product.”

She explained to us that Promedical attempted to market a product different than the one originally listed with the TGA (the Australian regulator). The different product happened to be Cellmid’s:

“The product they promoted here was not the product they listed with the TGA. They just happened to be unlucky and used our product to fake it.”

She stressed that the offering of bogus tests had the potential to put lives at risk:

“This is very serious and could have resulted in hundreds of deaths.”

She also explained how Promedical was able to, at least temporarily, get on the TGA website as a test provider:

“Promedical got the required docs from Wondfo’s agent under the representation that they have a major government contract…They filed these otherwise confidential docs with the TGA”

And they also commented on how Promedical was ultimately removed:

“We noted (to Wondfo) that (Promedical’s) website information did not match the Wondfo test info. Ultimately Wondfo contacted the TGA and had Promedical removed from the list.”

Promedical’s CEO Is A Convicted Rapist Who Has Been Accused of Running Another Business That Defrauded Its Investors and Customers

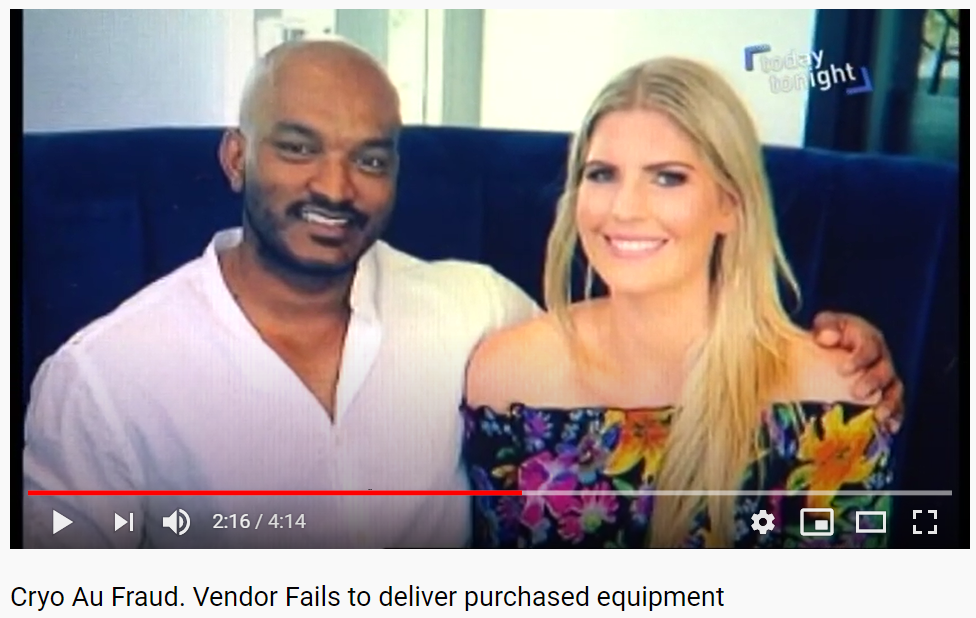

Promedical is run by CEO Neran De Silva and Managing Director Cassandra Auty, who are engaged, according to media reports. The couple has a checkered history, to put it mildly.

De Silva is a convicted rapist. According to media reports and court records he had been found guilty and sentenced in the Queensland district court for sexually assaulting a woman who had been sleeping on the couch of a mutual friend’s house.

At the time, De Silva and Auty managed a cryotherapy business called Cryo Australia that lured investments from prominent individuals, including Australia’s Assistant Treasurer. The controversy around the rape led to a minor political scandal in the country:

In addition to the rape controversy, the Cryo Australia business itself was accused of defrauding both its customers and investors.

A local media expose detailed how Cryo Australia accepted over a million dollars from a variety of customers and investors but then Neran “suddenly disappeared” around the time of the rape conviction. Within months the company went into liquidation.

De Silva had described himself as a “doctor” on his former business website, but The Guardian reported that there was no reference to him on the Australian Health Practitioner Regulation Agency’s register of medical practitioners in the country. He also didn’t appear in the graduate verification systems of the University of Queensland, Griffith University and Queensland University of Technology, where he had listed his medical qualifications.

We called Promedical to ask about this and other issues but the call went to a virtual answering service.

ReThink My Healthcare Appears to Be A Tiny, Newly Formed Operation. Should We ReThink Them as A Multi-Million Dollar Customer of SCWorx?

We also looked into the customer that would purportedly be buying tests from SCWorx, a company called Rethink My Healthcare.

Rethink My Healthcare was founded in August 2018 by Connor Gallic, a then 25-year-old who didn’t have health insurance and wanted to start his own company to solve the problem of low-cost mental healthcare.

We could find little information on the company except some articles around its founding. Connor is listed as President of the company and “Chief Healthcare Hero” on his LinkedIn page. We found only 2 employees on LinkedIn, consisting of Connor and his Chief Revenue Officer.

The company’s team page on its website lists 6 people, including the 3 executive team members and 3 consultants/advisors.

ReThink charges $60 per month for “virtual healthcare” focused on mental health issues and also offers one-time virtual doctors visits for $24.99.

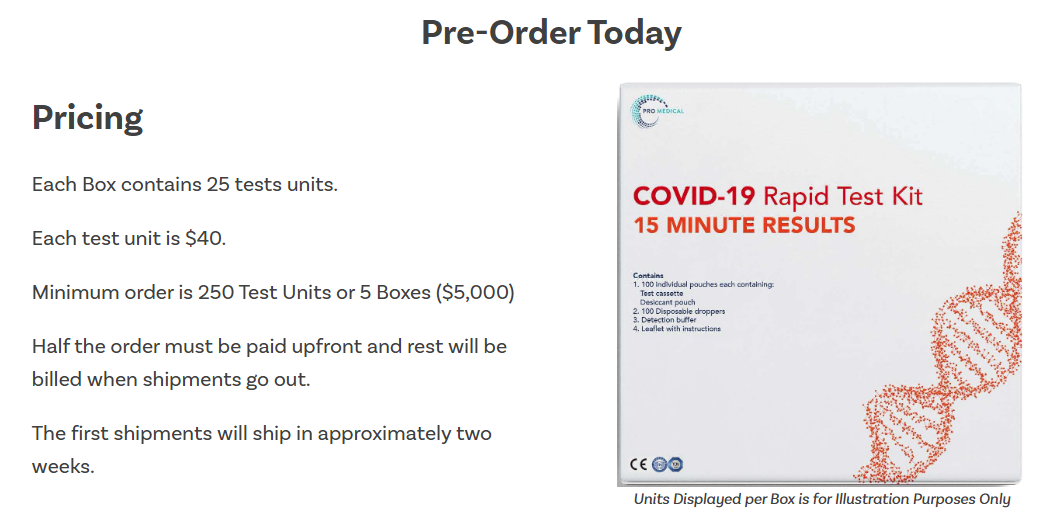

The front page of Rethinkmyhealthcare.com boasts that Covid-19 rapid tests are now available for pre-order and, when the link is clicked through, it redirects a site where it says tests will be sold for $40:

(Source: ReThinkMyHealthcare.com)

While there are no publicly available financials for ReThink, we find it difficult to believe that the relatively unknown company – founded less than 2 years ago and offering $60 per month virtual doctors visits – is going to be able to come up with upwards of the $35 million per week it has committed to purchasing from SCWorx.

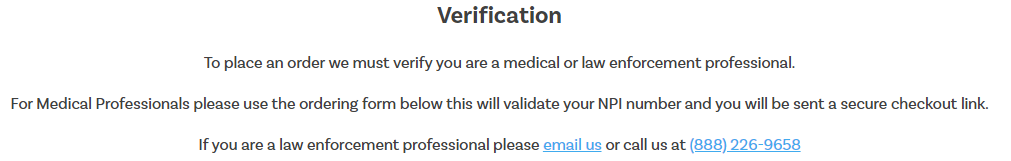

Further, we can’t figure out what the synergies are between a virtual healthcare company offering a test that needs to be physically administered to people. ReThink’s website also notes that you must be a medical or law enforcement professional to purchase a test, narrowing the funnel of those who can place orders from the company.

Conclusion: This Strikes Us as an Obvious Scam. Price Target: $2.25 Or Less

Regulators like the DOJ and SEC have recently disclosed that they are specifically looking into business practices that take advantage of people during this time of crisis for our nation. We can’t help but wonder if SCWorx will wind up on the desk of one of those agencies. Certainly, we believe that this deal – and especially any ensuing stock sales that may take place – need to be carefully examined.

Obviously, given the information we’ve disclosed in this report, we believe the Covid-19 hype surrounding SCWorx is completely bogus and we predict shares will soon return to the $2.25 price level they were at prior to the hype.

We also think shares could ultimately move far lower than $2.25 if/when regulators look into the company’s potentially nefarious business practices at a time when our country and its citizens are arguably at their most vulnerable.

Disclosure: We are short shares of SCWorx (NASDAQ:WORX)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] We reached building security on 4/16/2020 at 212-888-5900 who told us the entire floor belonged to Regus, which had “subsidiaries”, which we understood to be rental tenants.

45 thoughts on “SCWorx: Evidence Points to its Massive COVID-19 Test Deal Being Completely Bogus, Price Target Back to $2.25 Or Lower”

Comments are closed.

Awesome article! Here is another reason why this whole SCWorxs thing is absurd. So Rethink My Healthcare is selling their kits at $40 per test. If you check out other companies that also sell the rapid test kit, they offer it at a fraction of the price. Other companies charge between $7-$15 per test. Just google “rapid tests covid-19” and you can find at least 4 companies selling kits for way less than Rethink My Healthcare. Let’s say hypothetically Rethink did have this kits for sale (they wont), no sane health care facility will buy a kit at their inflated price.

Well, let me know where you can find those. I have been trying to get hold of a large quantity of tests for over a week now and I haven’t succeeded yet. So, please share your findings, much appreciated.

Hold up…so WORX (a software company) decided to jump in on the action and basically try their hand at dropshipping. They buy kits at $13 and sell at $17, a 30% markup for ZERO value add! No wonder they can’t find legitimate buyers or suppliers, they probably don’t know the first thing about logistics.

Well Rethink My Healthcare seems to be working with MDLIVE (30 million) clients:

https://members.mdlive.com/rethinkmyhealthcare/landing_home

They must be doing something well?

LOL there is so much lies here lololol first you start with NERAJAN DE SILVA who is a scammer and maybe rapist and putting his as CEO NERAN DE SILVA ?? LOL .. I hope he will sue your ass for this 🙂

than you referring at chinese company who doesn’t have any relations with whole deal .. and kits doesn’t come from them at all …and its go on and on ..but you keep in mind one thing.. there is only 3.5 million WORX shares in floating and you and your employer shorted 30 millions of them ROTFL .. I will be glad to make a profit on your buy back cover…

and last thing 2,5 $ calling level from you is a proof that all of this is just scam BUT YOUR SCAM .. because if this what you write is a truth… than shares would drop to 0.01 $ ,, no company would survive that scam….. and trading would be halted for good…but WORX is legit Nasdaq member and their shares are in trading ..so no problem,, you just do your staff until somebody press charges ..and your disclaimer will not save you from those 🙂

Please have respect for us that were scammed or are you part of the scam. Think about it!

Conartists removing comments that don’t soot them

I hope you report this to the SEC this is a total scam and I had validated much of what you said. This company should be halted Monday morning before the open. This is serious and they are pumping more and more fraud into this until it’s shutdown.

I hope you report this to the SEC this is a total scam and I had validated much of what you said. This company should be halted Monday morning before the open. This is serious and they are pumping more and more fraud into this until it’s shutdown.

You guys are a bunch of scam artists. Go fuck off bitch as bitch ass

Pour les investisseurs qui ont acheté des actions SCWORX à 10 dollars et qui n’ont pas pu les revendre suite à la suspension du cours depuis quelques jours par la SEC seront-ils remboursés ?

A qui doivent ils s’adresser pour récupérer leur investissement ?..

Merci de m’apporter une réponse appropriée.

Cordialement.

PAYET.