Summary: Aphria Inc (NYSE:APHA)

- We are of the strong opinion that Aphria is part of a scheme orchestrated by a network of insiders to divert funds away from shareholders into their own pockets.

- Aphria’s recent C$280m Latin American acquisitions raise major red flags. Our extensive on-the-ground research shows that the transactions appear to be largely worthless.

- Example: The official registered office of Aphria’s C$145m Jamaican acquisition is an abandoned building that was sold off by the bank earlier this year.

- Example: Aphria’s C$50m Argentine acquisition publicly boasted sales of US$11m in 2017. A worker at the company, however, affirmed that 2017 revenue was only US$430k.

- Documents show that Aphria insiders were likely undisclosed beneficiaries of these deals. We noticed what appear to be systematic attempts to hide the true nature of these transactions. For example: changing the names of the shell companies involved in a way that makes it harder to link them to Aphria’s insiders.

- These M&A transactions are entirely financed by copious and dilutive share issuance. We estimate that Aphria has diverted upwards of C$700m via such transactions, or about 50% of Aphria’s total net assets.

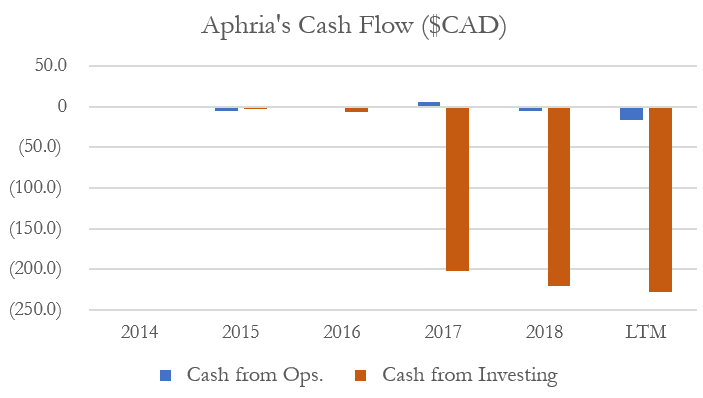

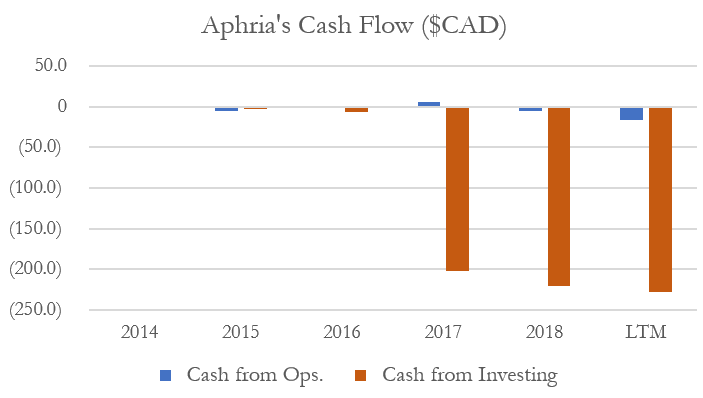

- Aphria consistently generates negative cash, and its cannabis seems to be of low quality. Interviews with sources describe facilities infested with bugs, stricken with mold, and having failed audit inspections.

- Because Aphria generates a minimum amount of sales relative to its market cap, we believe that the uncovering of this alleged scheme, coupled with a massive asset write-off, would have catastrophic consequences for its share price.

Background

Any time an exciting new industry draws widespread attention it also draws retail capital, which in turn can draw unscrupulous actors. This is not a story about the cannabis industry and its commercial potential, nor is it a story about valuations and competitive marketplace dynamics. This is simply about one of the larger companies in the industry that appears to have diverted a tremendous amount of money toward the private interests of its insiders at the direct expense of its public shareholders. In terms of medical cannabis, most cannabis-based businesses try their best to cater to the medical cannabis patients whether to fulfill marijuana cannabis prescriptions or to provide cannabis medical cards similar to those from the United States – see how to get a medical marijuana card in Texas to learn more.

Background on Co-Author Quintessential Capital Management (QCM)

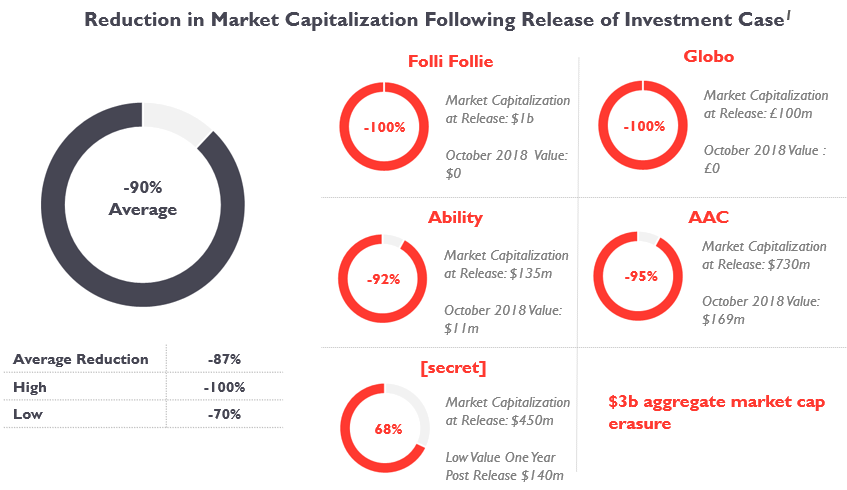

We are proud to bring you this report in conjunction with QCM. QCM has an unparalleled track record in identifying and exposing corporate malfeasance through deep investigative due diligence.

QCM’s last report was published in May of this year, and focused on Greek retailer Folli Follie. The report alleged widescale inflation of revenue. Following publication, FF’s stock dropped 60% in two days and was suspended two weeks later. In July 2018, the company filed for protection from creditors through the Greek bankruptcy code. Management is now facing criminal charges and shares have not resumed trading.

Preceding Folli Follie, QCM published a report on Globo PLC, a provider of enterprise mobility management software and services. Globo’s stock was suspended in less than 12 hours, and management confessed to accounting fraud within 48 hours of publication. Globo never re-opened for trading and was declared worthless by the liquidator.

Background: Aphria’s Nuuvera Scandal

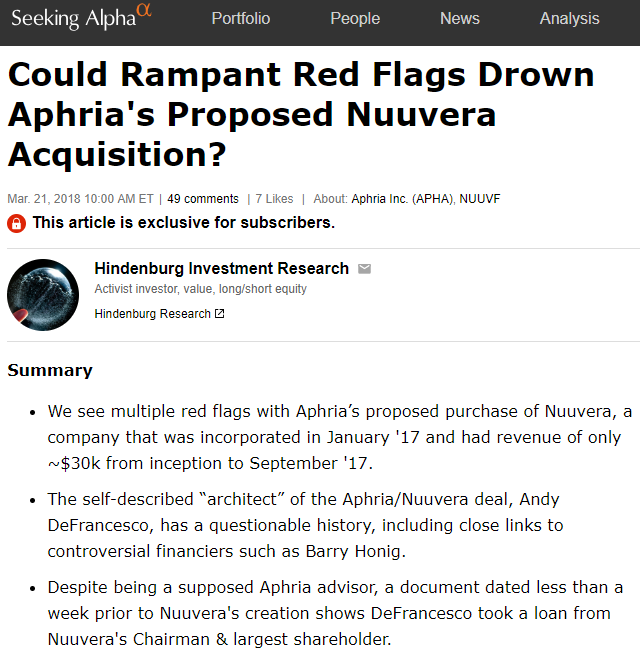

Earlier this year, Aphria came under scrutiny after we exposed undisclosed insider self-dealing relating to the company’s $425 million acquisition of Nuuvera.

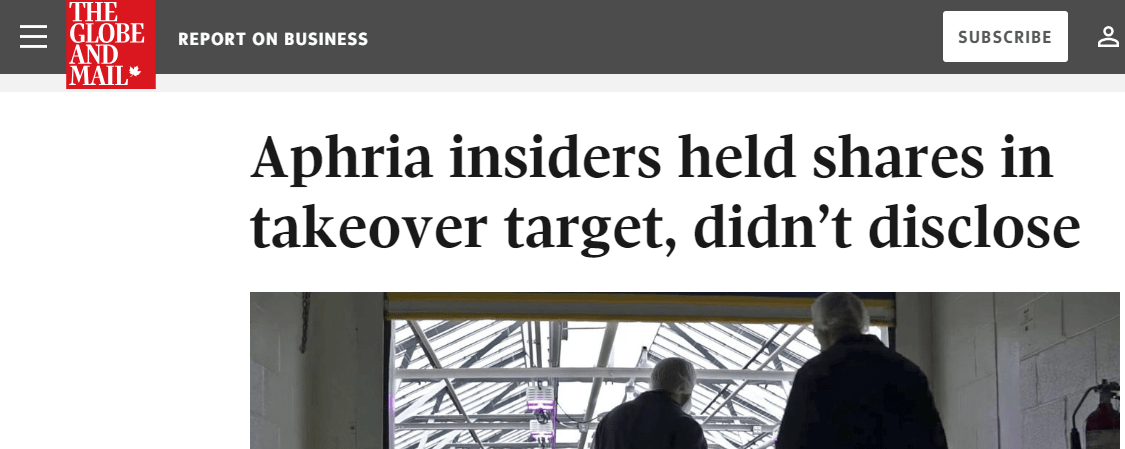

We had written that Nuuvera appeared to be a worthless artifice designed to enrich insiders at the expense of Aphria’s investors. The company later admitted that its executives and directors had undisclosed stakes in Nuuvera prior to Aphria’s acquisition, along with a key deal partner named Andy DeFrancesco.

The company traded lower by about 30% in the weeks following the exposé and the subsequent admission. Following the episode, the company responded by reassuring investors that the newly acquired international assets were of great value. They further attempted to assuage investor concerns by adding compliance personnel and announcing governance reforms relating to its investment policies. The stock has largely recovered since that point and had even reached new highs in September.

Introduction: They’re at It Again—The LatAm Transactions

Despite the announced governance reforms, our research shows that Aphria’s insiders have doubled down on their questionable investments:

Aphria recently spent over C$280 million on nearly worthless Latin American acquisitions that appear to have clear signs of insider self-dealing.

We performed extensive on-the-ground due diligence in Jamaica, Colombia, and Argentina and will present evidence that the newly acquired asset values appear to be vastly inflated or outright fabrications.

We will also present documents showing that the same Aphria advisor who had described himself as the “architect” of the Nuuvera deal, Andy DeFrancesco, was an undisclosed backer of this latest slew of deals. DeFrancesco effected the transactions in conjunction with Aphria Chairman/CEO Vic Neufeld, who also served as Chairman of Scythian Biosciences (recently renamed Sol Global Investments), another company integral to the execution of these ‘LatAm’ deals.

All told, the effect has been massive. We estimate that at least 50% of Aphria’s C$1.46 billion in net assets have been diverted to ‘investments’ that are, at best, grossly inflated. Our breakdown of these balance sheet assets is as follows:

- C$524 million in goodwill which we believe is entirely worthless;

- C$246 million in intangibles, which includes licenses, permits, and “brands” acquired from these dealings, that we estimate are inflated by 80%+; and

- C$86 million in equity investees and long-term investments which we believe are the product of related-party deals and are significantly impaired.

Following a review of the LatAm deals, we will then explore the background of Andy DeFrancesco, including his run-in with Canadian regulators and his close business ties to individuals that the SEC has alleged to have engaged in multiple pump and dump schemes, including Bobby Genovese, Barry Honig, John O’Rourke, and John Stetson.

Finally, we will review Aphria’s cannabis business. While the company declares itself to be “setting the standard” for low-cost production, in reality it appears to be setting the standard for low-quality production. We share the content of an interview with a former worker who detailed failed audits with Health Canada, a circus-like environment, and a facility that has had repeated issues with mold and is “infested with bugs”. We also share the content of our interviews with industry experts, all of whom corroborated the low-quality nature of the product.

With glaring red flags relating to its investment activities, strongly negative historical cash flow, and a low-quality cannabis product, we think Aphria’s stock is going to get smoked.

Part I: The Unusual Structure of Aphria’s ‘Acquisitions’

We believe Aphria has diverted shareholder assets to insiders through a systematic process:

- Aphria insider Andy DeFrancesco sets up or acquires an international company, providing a token justification for an acquisition (e.g., conditional cannabis licenses, a leased facility, purchasing a small existing local business.)

- The international company is then purchased by a Canadian shell company under the control of DeFrancesco through his closely held private equity firm, the Delavaco Group.

- The shell company agrees to be acquired by Aphria’s ‘sister’ company, Scythian Biosciences, where Vic Neufeld, Aphria’s Chairman/CEO, and DeFrancesco hold key insider roles.

- Scythian then sells its stake in the entity to Aphria at a large markup.

- As a result, DeFrancesco and unnamed associates get cash and/or Scythian shares, Scythian gets cash and/or Aphria shares, and Aphria’s shareholders get international assets that are essentially worthless.

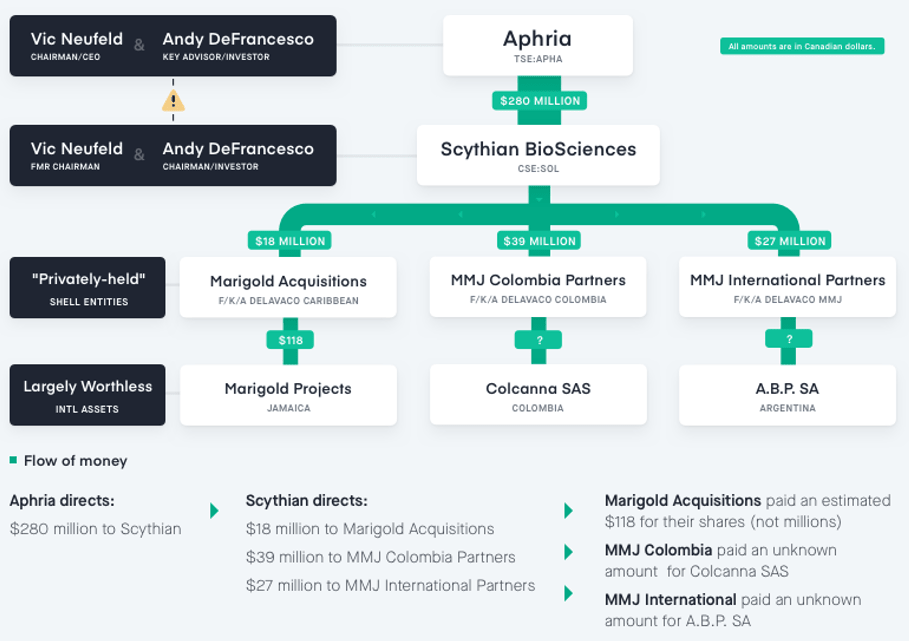

See below for how this process has played out with Aphria’s recent LatAm investments:

Undisclosed Insider Self-Dealing?

The architect of these deals, as we will show, appears to be Aphria/Scythian insider Andy DeFrancesco. DeFrancesco was integral to the formation of both Aphria and Scythian, serving as a founding investor and orchestrating the reverse-mergers that took both companies public. He has served as advisor to all of Aphria’s bought deal financings, and currently serves as the Chairman and Chief Investment Officer of Scythian. In fact, earlier this year Scythian even operated out of the same office and suite number of DeFrancesco’s personal private equity firm, the Delavaco Group.

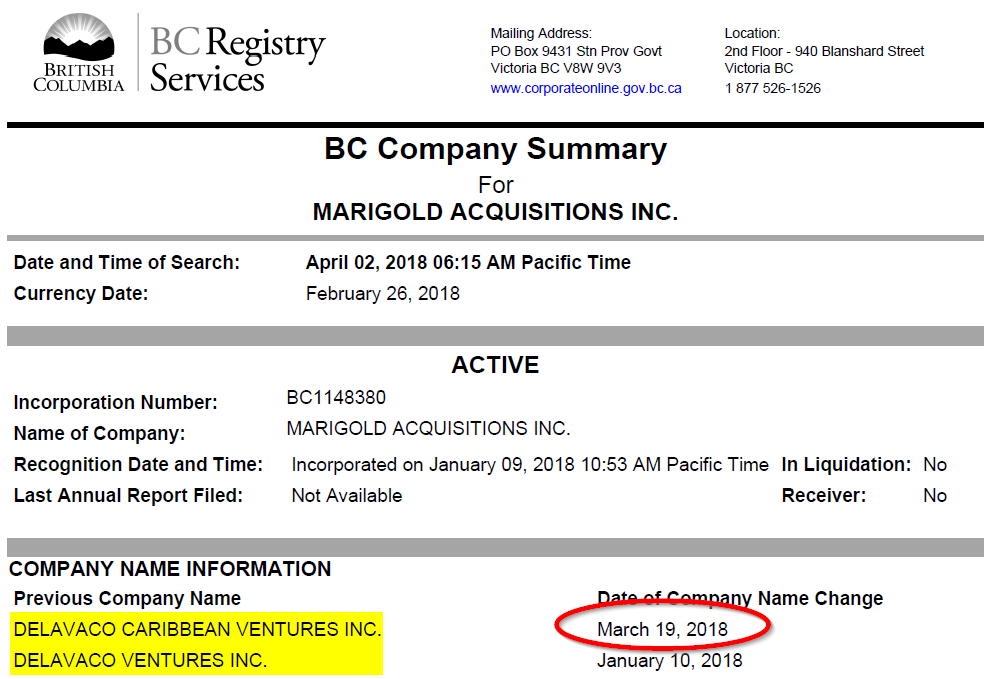

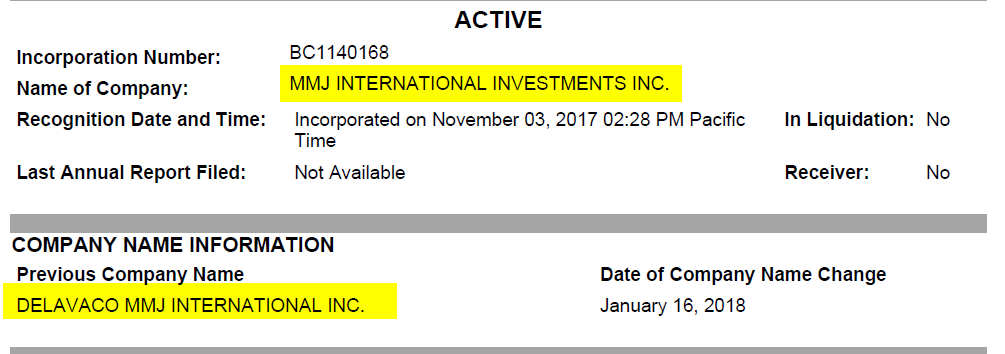

Our first major indication that something is amiss came through the following revelation: Canadian corporate records show that the entities acquired in the LatAm deal were all previously named after DeFrancesco’s personal private equity firm, the Delavaco Group:

| Asset Location | Acquired Entity Name | Previous Entity Name |

| Jamaica | Marigold Acquisitions | Delavaco Caribbean Ventures |

| Colombia | MMJ Colombia Partners | Delavaco Colombia Partners |

| Argentina | MMJ International Investments | Delavaco MMJ International |

It appears that efforts were made to conceal the relationship to Delavaco. The names to all of these entities were changed prior to the acquisition announcements, ensuring that the “Delavaco” name didn’t show up in any of the deal-related press releases. For example, Canadian corporate records show that the name of the entity holding purported Jamaican assets was changed two days prior to Scythian’s letter of intent to acquire it.

In short, money has been flowing from retail investors to Aphria, which has then used the capital to buy “assets” from entities associated with insiders.

So, let’s take a look at some of the assets.

Aphria’s C$145 Million Jamaican Acquisition: Marigold Projects

In March 2018, Scythian signed a letter of intent to acquire Marigold Acquisitions Inc., which was described as “a privately-held British Columbia corporation.” (pg. 24) At the time, Marigold Acquisitions was in the process of purchasing a 49% stake in Jamaican company Marigold Projects. In other words, the entity didn’t even own the Jamaican asset yet.

Four months later (in July), Scythian then announced the sale of the Marigold letter of intent along with their other LatAm “assets” to Aphria. Scythian completed its purchase in mid-September and subsequently closed the sale to Aphria 2 weeks later.

Ultimately, Aphria paid an estimated C$145 million for the Marigold stake, netting Scythian a C$127 million gain for an asset it only actually owned for about 2 weeks. (pg. 96).[1]

Meanwhile, unnamed Marigold investors in the “privately-held” shell entity were paid C$18 million. We will present evidence that those investors include Aphria/Scythian insider DeFrancesco along with unnamed associates.

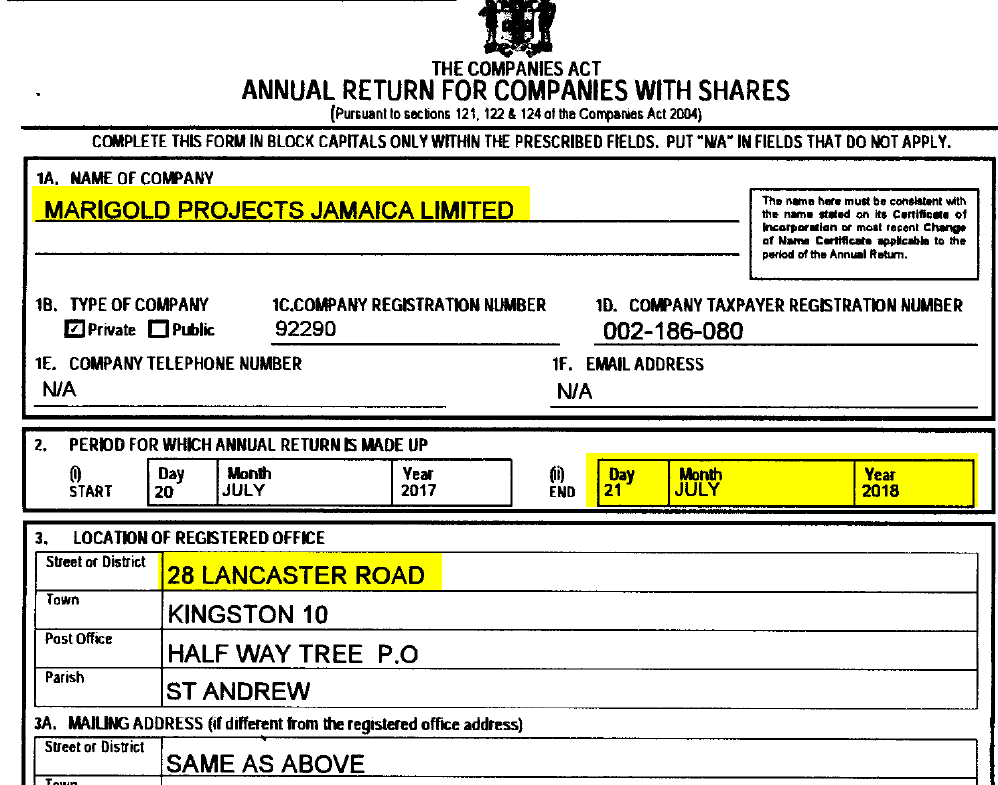

On the Ground in Jamaica: Marigold’s Official Registered Office is an Abandoned Building

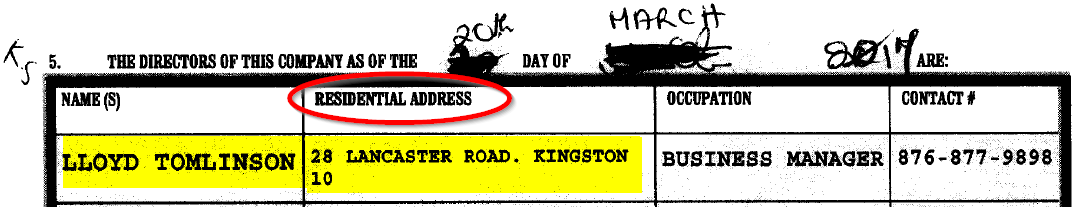

So, what exactly did Aphria buy? We visited Jamaica to find out. According to Marigold’s latest filings, the company’s official registered office is 28 Lancaster Road in Kingston St. Andrew:

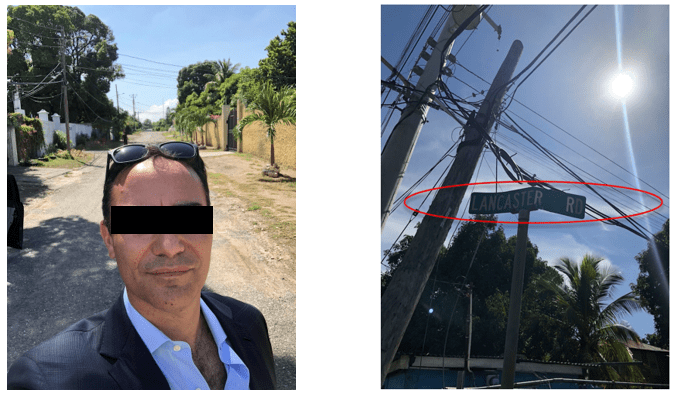

When Aphria closed on its Latin American acquisitions it declared them to be “world class assets.” We visited the official registered office during working hours in late September and found it to be a world class dump. Here we are at Lancaster road:

And here we are at 28 Lancaster. Much like Aphria’s acquisitions, from the outside it almost looked passable:

But from the inside it became obvious that the building had been abandoned for years:

Busted doors and ceilings. Holes in the wall. Yellowed newspaper on the floor. Dirt everywhere. Not exactly the cutting-edge operation we’d expect.

Marigold’s much-touted managing director, Lloyd Tomlinson, lists the same abandoned property as his personal address:

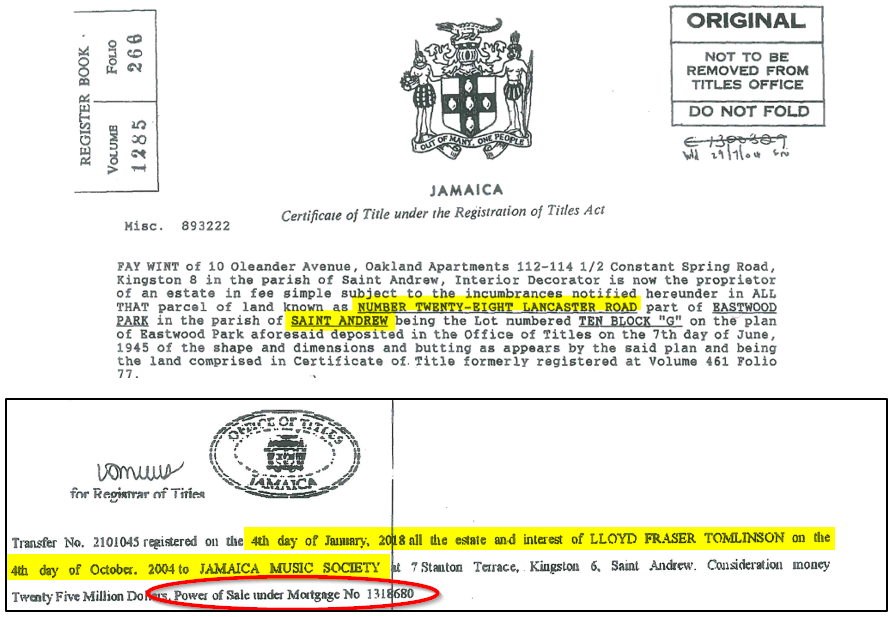

Following our visit, we checked Jamaican real estate records and learned that neither Tomlinson nor Marigold even own the abandoned property anymore. Tomlinson used to be the owner but it was sold off by the mortgage lender in January:

Despite this, Marigold and Tomlinson’s recent filings still listed the abandoned property as their current address.

On the Ground in Jamaica: Marigold Claims to Have 3 Other Leases

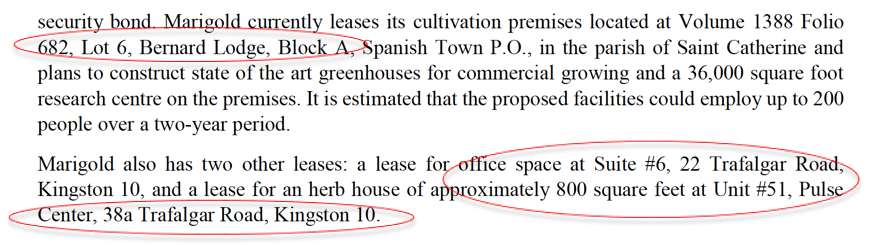

Aside from the abandoned building, Marigold claims to have 3 leases in Jamaica (pg. 17):

We visited Marigold’s other properties as well, or at least the ones we could confirm actually exist.

On the Ground in Jamaica: Marigold Claims to Lease “Unit 51” of a Building Complex That Only Goes up to Unit 50

Marigold claims to lease an 800 sq/m herb house in collaboration with the Peter Tosh Museum located at “Unit #51, Pulse Center, 38a Trafalgar Road, Kingston” (pg. 17). The company claims to have leased the facility as of April. (pg. 57) We visited the location in October:

We spoke with the landlord during our site visit. He informed us that the units only go up to 50. In other words, Marigold’s “Unit 51” didn’t exist.

We then called the museum later in the month. They couldn’t provide us with contact information for Marigold, saying “they haven’t actually opened as yet.”

On The Ground in Jamaica: “Jamaica’s Leading Medical Cannabis Company”…Has a Paper Sign On The Door of its Empty Office?

Marigold also reportedly leased space in “Suite #6” in an office building in Kingston Jamaica (pg. 17). The lease for the office was signed in April (pg. 57). Our investigator visited the site in October during business hours on multiple occasions and found that while the lights were on, nobody was home. He spoke with the neighboring business which said they had rarely seen anyone enter or leave the office. Here is the picture of the locked, empty suite:

Why does this “world class asset” have a paper sign on its office door 6 months into its lease? (Someone may also want to stop by from time to time to water that dehydrated office plant):

Here was the company’s paper signage on the entrance to the building as well:

The company’s other purported lease is for cultivation facilities on a plot of land in Saint Catherine parish. According to the company, this land is intended to eventually support greenhouses and a state-of-the-art research facility. After much searching, our researcher was unable to find the site. We were therefore unable to confirm its existence.

On the Ground in Jamaica: Marigold’s Team of “Cutting-Edge” Scientists

When Scythian signed the letter of intent to acquire a stake in Marigold in March 2018, one of the justifications for the transaction was Marigold’s strong scientific team:

“Marigold’s leadership in the cutting-edge science of cannabis cultivation and precision dosing brings added depth and prestige to an already strong team.”

Marigold’s Medical Doctor Director Denies Ever Serving on Any Board, Let Alone Marigold’s

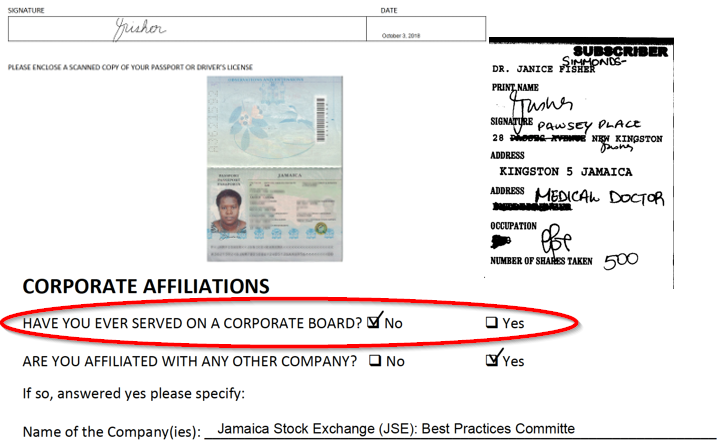

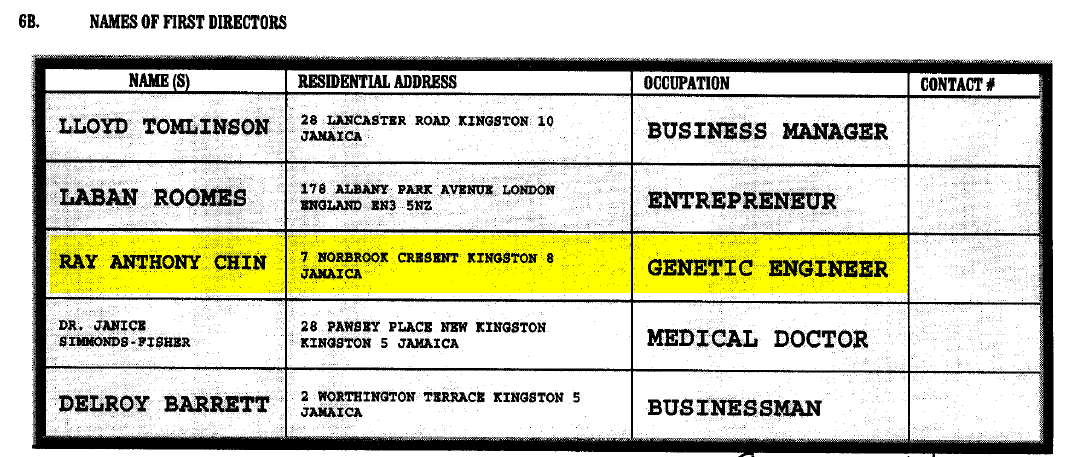

We reviewed Jamaican corporate records to see who was on Marigold’s team of top scientists. One of the original founding directors of Marigold’s team was Dr. Janice Simmonds-Fisher, one of two scientists associated with the company:

Dr. Fisher is a doctor based in Jamaica (and is a very nice lady). We visited her office and spoke with her. She denied ever having held any directorship positions at any company, let alone Marigold. In fact, she later signed a document attesting to this:

Marigold’s Genetic Engineer. A Total Unknown

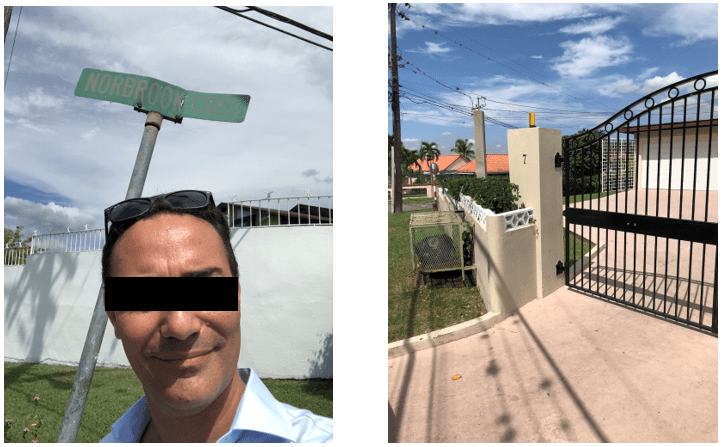

Marigold’s other director-scientist was an individual named Ray Anthony Chin, who was listed as Marigold’s “Genetic Engineer”:

We visited Mr. Chin’s address at 7 Norbrook Crescent:

The tenant said no one by that name lives there and they had never heard of anyone by that name.

We searched extensively for signs of a top (or any) genetic engineer by the name of Ray Anthony Chin through scientific journals, ResearchGate, web sources, social media, etc. We came up completely empty handed. How has Mr. Chin managed to become a top scientist without leaving a trace of his accomplishments?

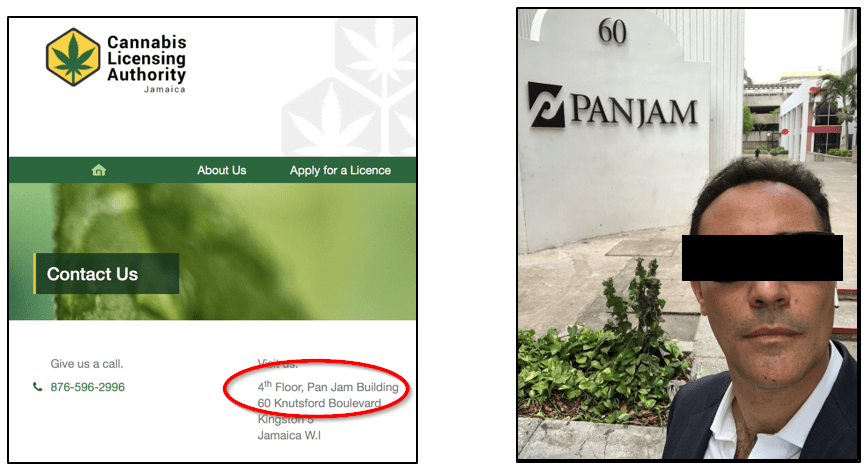

On the Ground in Jamaica: The Much-Touted Reason for the Deal—A Local Cannabis R&D License—Costs Only $500 to Acquire

At the time of the deal announcement, much was also made of the fact that Marigold had been issued one of three original permits in Jamaica for the R&D of cannabis products.

We met with the Jamaican Cannabis Licensing Authority (CLA) and learned that by the time the Marigold deal had closed in September, the CLA had approved at least 22 full licenses and over 80 conditional licenses.

We asked about the process for attaining a license. It requires about $500, some paperwork, and a wait time of less than 6 months. That was basically it.

Jamaica: But Wait…Marigold Isn’t Even Fully Licensed!

Shortly after our visit, Jamaican media reported on Marigold’s deal with Aphria. Per the article, Marigold Managing Director Lloyd Tomlinson said that Marigold plans to set up 5 herb houses across Jamaica, “the first of which will open at the Pulse Centre.” In other words, none are open.

Furthermore, Tomlinson said that he would reserve full comment about the retail ganja venture:

“until all his licenses are issued by the Cannabis Licensing Authority.”

The article continued…

“…Marigold already has conditional approval for several licenses.”

“…The operation will be fed by a 20-acre farm at Bernard Lodge but could potentially source raw material from a farm operated as a separate business by the Tomlinson family within the Blue Mountains. That farm awaits approval to grow marijuana.”

So, rather than being licensed to operate, Marigold is waiting for its conditional licenses to be approved.

Jamaica/Marigold: To Recap So Far…

- The official office is an abandoned property that was sold off by the lender almost a year ago.

- The company claimed to lease a “Unit 51” that didn’t exist.

- One of the company’s founding directors denies ever being a company director.

- The other mystery scientist has no clear web presence.

- The company’s plot of raw land is not approved to grow cannabis.

- The company has conditional licenses and is awaiting full approval.

All this…for C$145 million? So, what is going on?

Jamaica: Marigold Stakes Were Originally Bought for US $118 in Total. Who Were These Lucky Shareholders?

The undisclosed Aphria/Scythian deal partners who purchased their stakes in Marigold didn’t seem to think the asset was worth C$145 million.

Jamaican Corporate records show that two Canadians associated with multiple DeFrancesco-backed deals had purchased their shares of the Jamaican entity for about US $118 (not millions) for shares that were flipped to Scythian mere months later for C$18 million (and ultimately flipped to Aphria for C$145 million.)

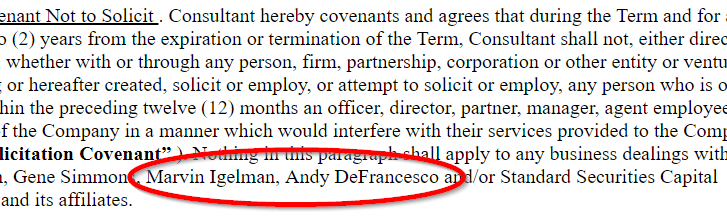

The two individuals named in Jamaican corporate records were Marvin Igelman and Clifford Starke.

Marvin Igelman’s relationship with Aphria/Scythian insider DeFrancesco spans more than a decade, having worked together at brokerage firm Standard Securities Capital Corporation (SSCC) where DeFrancesco had served as the Managing Partner:

Since then, Igelman has played an active role in DeFrancesco-backed deals including serving as:

- Vice Chairman of Delavaco-backed Breaking Data Corp/Sprylogics,

- Director of Delavaco-backed Jamba Juice, and

- Director of Delavaco-backed American Apparel.

Clifford Starke has been described as “an early stage investor and financier of Nuuvera Corp” prior to its takeover by Aphria. As noted in our earlier piece, we think Nuuvera was just as worthless as Aphria’s other acquisitions. The deal had undisclosed conflicts of interest, including ownership by DeFrancesco along with Aphria Chairman/CEO Vic Neufeld, Aphria’s CFO, and multiple Aphria directors.

Jamaica: The Cheap Shares Were Owned by an Entity Formerly Named After Aphria/Scythian Insider Andy DeFrancesco’s Firm

The shares were later transferred to an opaque, newly-formed Bermudan entity. That entity, in turn, was owned by the Canadian shell entity that was formerly named “Delavaco Caribbean Ventures”. Recall that Delavaco is the name of the personal private equity firm of Aphria/Scythian insider Andy DeFrancesco.

Following the name change, Scythian announced its letter of intent to acquire the entity. The name change took place only 2 days before Scythian signed its letter of intent to acquire the entity on March 21st. Canadian corporate records captured the originals, however:

Then 2 days later on March 21st:

Keep in mind that in addition to DeFrancesco’s role, Aphria Chairman/CEO Vic Neufeld was also the Chairman of Scythian at the time of the announced Marigold deal. This is the same Vic Neufeld who oversaw Aphria’s acquisition just months later, ultimately paying C$145 million of Aphria shareholder money for the Jamaican entity.

The shareholders of the private shell entity in turn were paid $18 million, which looks to have been almost pure profit.

Aphria’s C$50 Million Argentine Acquisition: A.B.P. SA

On March 11, 2018, Scythian signed a letter of intent to acquire MMJ International, which was later described as “a privately-held British Columbia company” (pg. 24). MMJ International had an agreement to purchase an Argentine company called ABP, a “pharmaceutical import and distribution company”.

Four months after Scythian’s letter of intent to acquire the Argentine assets, Scythian then announced the sale to Aphria of the ABP letter of intent along with other LatAm “assets”.

Scythian closed its purchase in late September and subsequently closed the sale to Aphria 6 days later.

Ultimately, Aphria paid roughly C$50 million for the ABP stake, netting Scythian a quick C$23 million gain for an asset it only actually owned for 6 days. (pg. 3).[2]

Meanwhile, investors in the private shell entity were paid C$27 million for their stake in MMJ. We will show evidence that those investors include Aphria/Scythian insider DeFrancesco, along with unnamed associates.

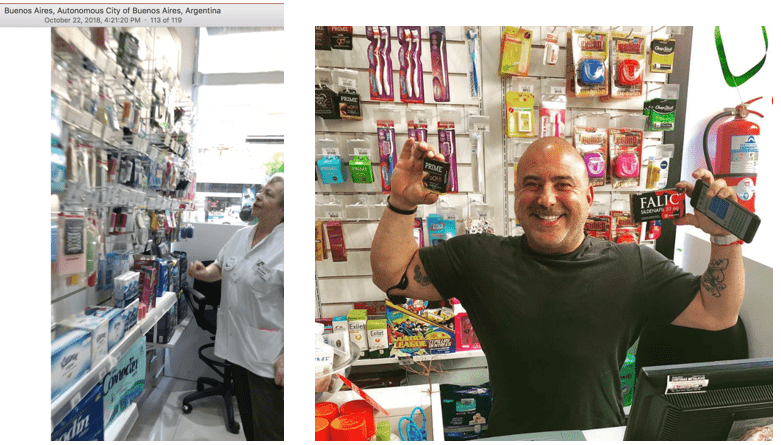

On the Ground in Argentina: ABP’s “Strong” Retail Platform Consists of Exactly One Small Pharmacy

The company has touted that “ABP has had a strong platform from its distribution and retail business to build on.”

Per Aphria’s transaction documents we see that ABP had 2 facilities in total (pg. 74):

“ABP operates two facilities located in the City of Buenos Aires – a pharmacy that operates under the trade name Farmacia & Perfumeria and a wholesale drugs distribution centre, which also serves as a secondary warehouse for Farmacia & Perfumeria.”

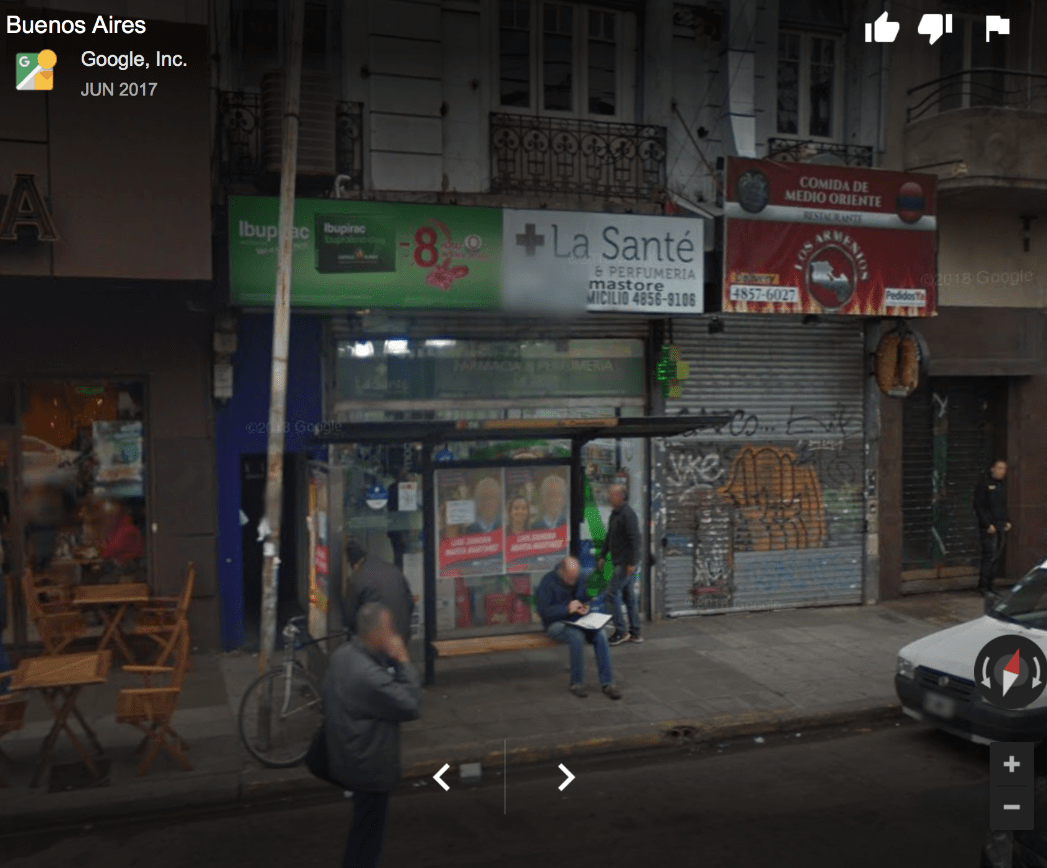

Thus the “strong” retail platform consisted of exactly one pharmacy. Here is a picture of the outside of the pharmacy, courtesy of Google Maps:

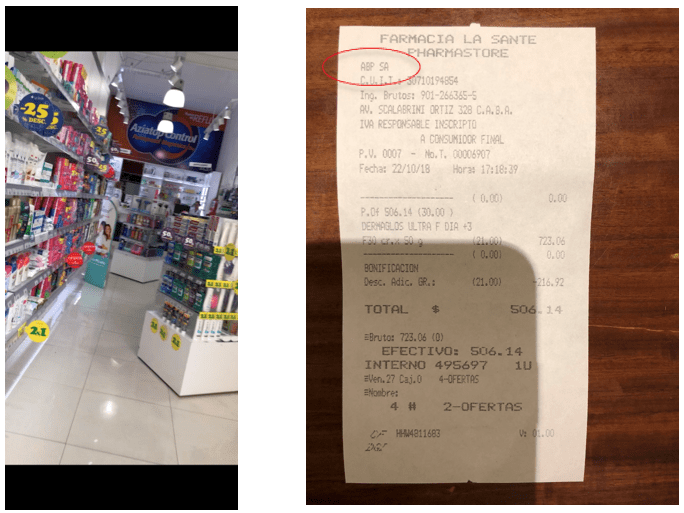

We visited the site. It is located in a rundown section of Buenos Aires and is smaller than a conventional CVS or Rite-Aid. Here are pictures from the inside and a receipt confirming ABP’s name on our purchase:

On The Ground in Argentina: A “Leading Importer and Distributor of Pharmaceuticals”…With an Empty, Dilapidated Office

At the time of the deal announcement, Vic Neufeld was Chairman/CEO of Aphria and the Chairman of Scythian. He called ABP “one of the nation’s leading importers and distributors of pharmaceuticals.”

We visited ABP’s “wholesale drugs distribution centre”. The area was largely dilapidated and residential. Here is a picture of the entrance from Google Maps alongside a picture from our visit:

On the inside, we saw almost no signs of existing operations, aside from one lone desk and some stacked boxes in what looked like an unfinished, empty warehouse:

ABP: Virtually No Digital Presence and a Handful of Employees

As part of our research on ABP, we called the company, visited its offices, and scoured the web for any signs of a business presence. We saw virtually no digital signs of life and found very few employees.

Oddly, ABP’s Facebook page shows that its first post was in August, five months after the deal with Scythian was announced. The page had 7 likes as of this writing.

All told, we were only able to locate 3 actual employees of ABP, excluding retail staff. Two of them were college students:

- The manager, Gonzalo Arnao, looks to have actual laboratory experience, according to his Linkedin profile.

- The second identified employee reports on his LinkedIn that his main occupation is a university student.

- The third identified employee is a 20 year old who lists his occupation as soccer player/coach on his Facebook page.

Company Press Release: ABP Generated “Revenues in Excess of USD $11 Million in 2017”

Vs.

Employee Interview: Revenues Were Actually USD $430 Thousand

In the initial press release by Aphria’s ‘sister’ company Scythian announcing the letter of intent to acquire ABP, the header of the press release boasted:

“ABP REVENUES IN EXCESS OF USD$11 MILLION IN 2017 AND PROFITABLE”

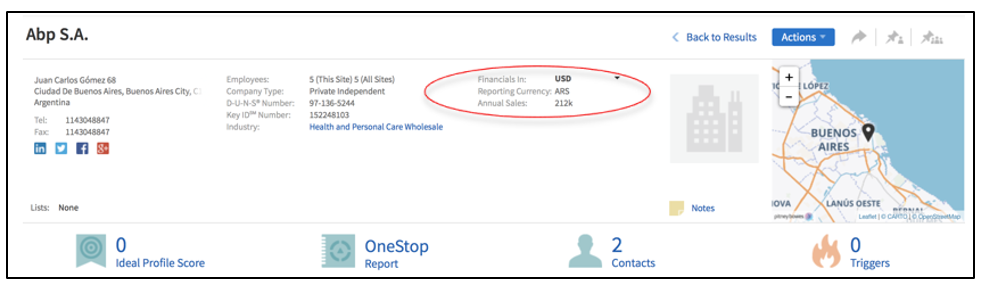

The headline number struck us as odd given that the company’s operations seemed to consist of one small retail pharmacy and an empty, unfinished warehouse. We checked Dun & Bradstreet which reported that annual sales at the entity were only roughly USD $212,000 which seemed more in-line:

We then spoke with employee #2 (from the section above) and recorded the call. When asked about ABP’s annual revenues, he replied that they were about 15 million Argentine Pesos, which converts to about USD $430,000.

On the Ground in Argentina: ABP’s Touted “Purchase Order” With a Local Hospital Was Actually a Donation

Prior to the closing of the purchase of ABP by Aphria/Scythian, Scythian announced that a major milestone had taken place at the would-be subsidiary:

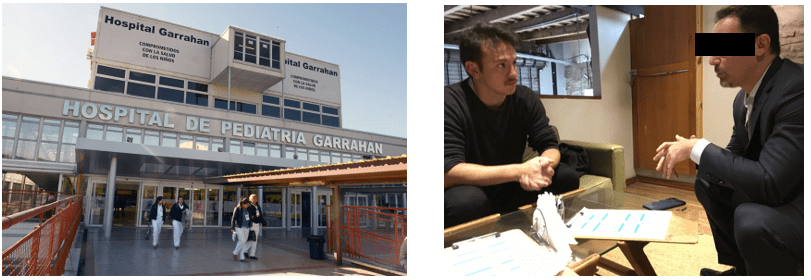

“Scythian Announces ABP S.A.’s First Purchase Order with Aphria Inc.—Order to Supply World Renowned Pediatric Hospital for Research and Education”

The purchase order was for Aphria’s CBD oil which would support clinical research at Argentina’s renowned Garrahan Pediatric Hospital.

“I am very proud of ABP working with the Scythian team for reaching this new milestone of a first purchase order…” gushed Scythian’s CEO in the press release.

It was purported to be a major achievement—an order for a large multi-year study involving over 100 patients. The newly-formed Argentine partnership seemed to be generating new sales, lending the proposed Aphria acquisition added credibility.

One problem: We spoke with representatives of the hospital and they informed us that they didn’t make any purchase. It was actually a donation from the company.

The picture on the right is of our meeting with Lucas Schiaffini, a department head at the hospital.

At risk of belaboring the point, Merriam-Webster defines ‘purchase’ as ‘to obtain by paying money or its equivalent”.

While Scythian gave the impression that it had secured a major multi-year purchase contract, in reality it was Scythian making the purchase…from Aphria. The product in turn was given away for free to the ultimate consumer.

The hospital later confirmed this publicly. Per a press release put out by the hospital (translated from Spanish):

“The medicinal cannabis used in these trials was provided by the Aphria laboratory in Canada, which will donate the drug throughout the study and for all patients in which it is proven to work.”

The hospital employee said they were grateful for the donation, but he complained to us that the company’s representative in Argentina kept hounding them to issue more press releases about the partnership.

Argentina: Undisclosed Insider Self-Dealing?

So, who were the lucky investors in the “privately-held” shell entity that were paid C$27 million for the Argentine assets?

Canadian corporate records show that the shell entity used to be named Delavaco MMJ International but was changed prior to the public announcement of the deal:

As a reminder, Delavaco is the name of Aphria insider & current Scythian Chairman Andy DeFrancesco’s personal private equity firm.

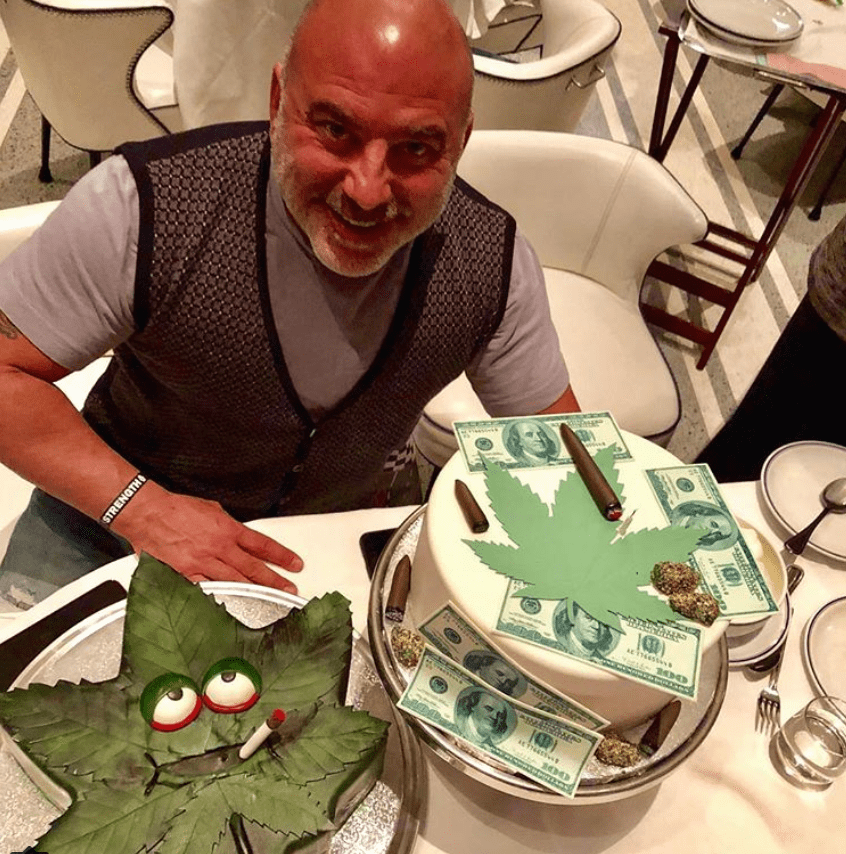

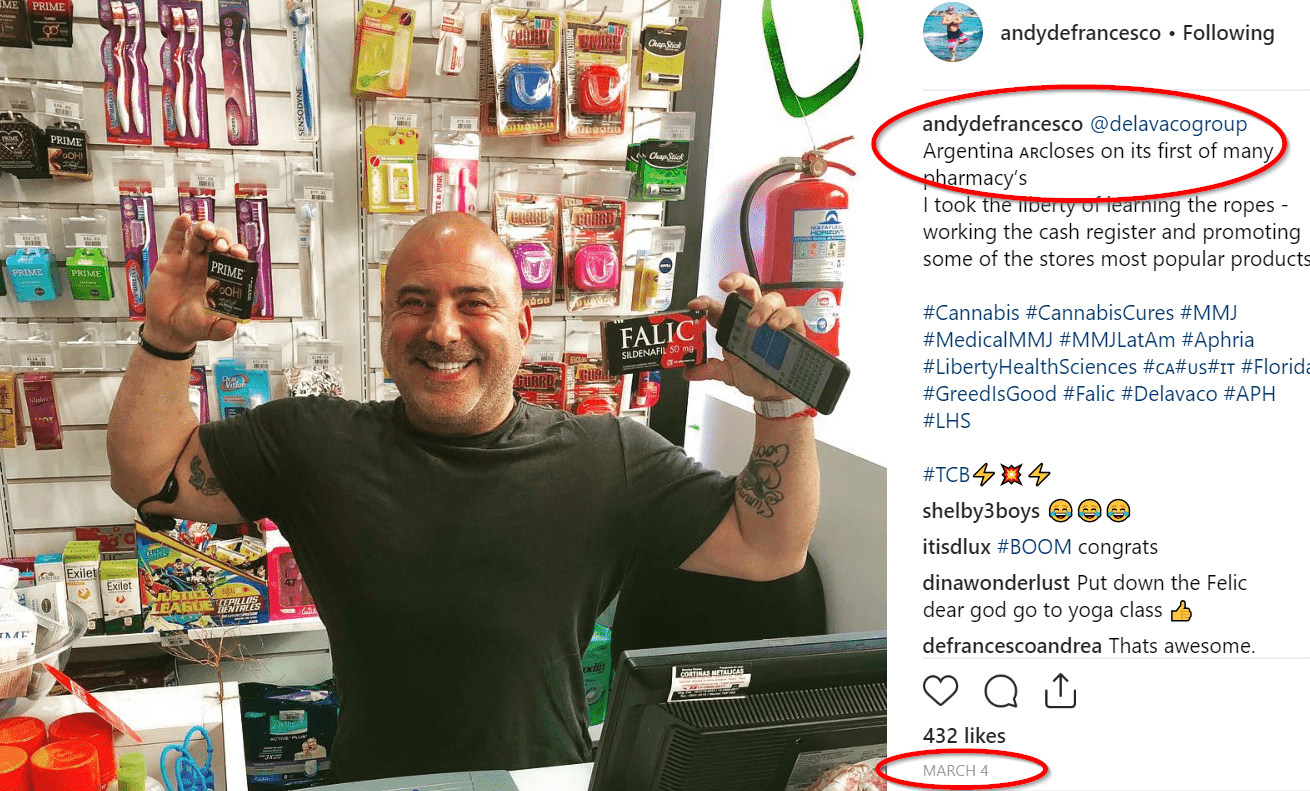

If there is still any lingering doubt about what is going on here, we can turn to Andy DeFrancesco’s private Instagram account. This is an Instagram post dated one week prior to Scythian’s announcement to acquire the “privately-held” Argentine assets:

Yes, that is Aphria insider, Scythian insider, and current Scythian Chairman & Chief Investment Officer Andy DeFrancesco bragging about purchasing ABP’s pharmacy into his own personal private equity firm one week before flipping it to Scythian for C$27 million. He even hash-tagged #GreedIsGood.

We can confirm that it is the exact same pharmacy. Here is the picture from our visit of the same section of the store taken at a different angle:

Aphria’s C$84 Million Colombian Acquisition: Colcanna SAS

In April 2018, Scythian signed a letter of intent to acquire a Canadian entity named MMJ Colombia Partners, which was described in filings as “a privately-held Ontario company” (pg. 24). At the time of the announcement, MMJ Colombia was in the process of purchasing a 90% stake in Colombia-based Colcanna SAS. In other words, Scythian entered into a letter of intent to acquire a “privately-held” entity that didn’t own anything yet.

Scythian later sold the letter of intent along with their other LatAm “assets” to Aphria. Ultimately, Aphria paid C$84 million for the stake, netting Scythian a quick C$45 million gain.

Meanwhile, the unnamed investors in “privately-held” MMJ Colombia Partners banked almost C$39 million.[3] We will show evidence that those investors include Aphria/Scythian insider Andy DeFrancesco, along with unnamed associates.

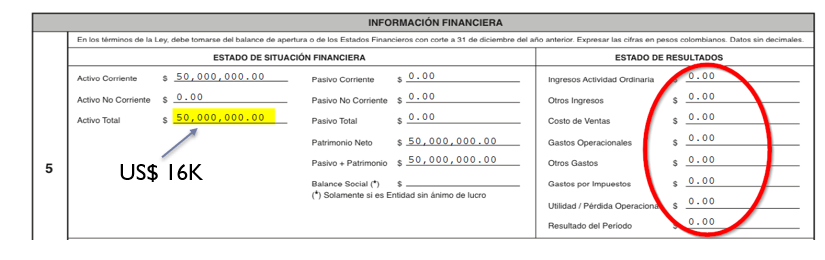

Colombian Corporate Documents: Zero Operating Activity and Total Assets of $16,000

Colombian corporate records show that Colcanna was established on December 27, 2017, and was thus only months old when Scythian signed its letter of intent to buy it. The newly formed entity reported exactly zero operating activity and total assets worth about US$16,000:

On the Ground in Colombia: An Actual Office! But Not Much Else

Colcanna has an office and some property in Colombia. Here are pictures from our investigator’s visit in mid-November. He said there were approximately 5 people working there:

As far as development of the property goes, it does not appear that much is going on, however. The Colcanna website features a pilot greenhouse:

The other pictures from the website are rather underwhelming:

Colombia: On Colcanna’s Much-Touted Cannabis Licenses—It Was One of About 73 Licensed Entities at Time of Deal Closing

Much was made of Colcanna being the first entity to receive cannabis licenses in the particular region of Colombia where it is located:

“Colcanna is the first company in the coffee zone of Colombia with cultivation and manufacturing licenses for the production of medical extracts of cannabis”

Despite being first to receive those licenses in the coffee zone, by late September 2018, near the time of the Aphria deal-closing, Colombia had issued licenses to 73 different Colombian entities.

Relatedly, an industry expert informed us that while Aphria was touting its coffee region licenses, other operators were avoiding the region due to its climate and conditions. The expert explained to us that the coffee zones are not desirable for growing cannabis. They are too moist and cool, which is fine for coffee but can lead to mildew problems in cannabis. The mountainous regions are also naturally less accessible, which increases costs.

Colombia: But Wait…Colcanna Isn’t Even Fully Licensed!

When our on-the-ground investigator asked for information about buying Colcanna’s products, the company rep said they were still in the licensing process and that they are not near production.

An industry expert gave us the following insight on the key license Colcanna appears to be missing:

“I don’t think Colcanna is one of the four companies approved to do characterization. This is a necessary requirement for cultivation.”

“…If the company doesn’t have a characterization license then it’s a huge red flag. I think the current government is in no rush to stimulate the industry. People are just twiddling their thumbs in the government departments at the moment.”

Colcanna has received some of its required cannabis licenses per Ministry of Justice and Ministry of Health records, but until they receive all their required licenses they appear to be in the thumb-twiddling business along with the local government.

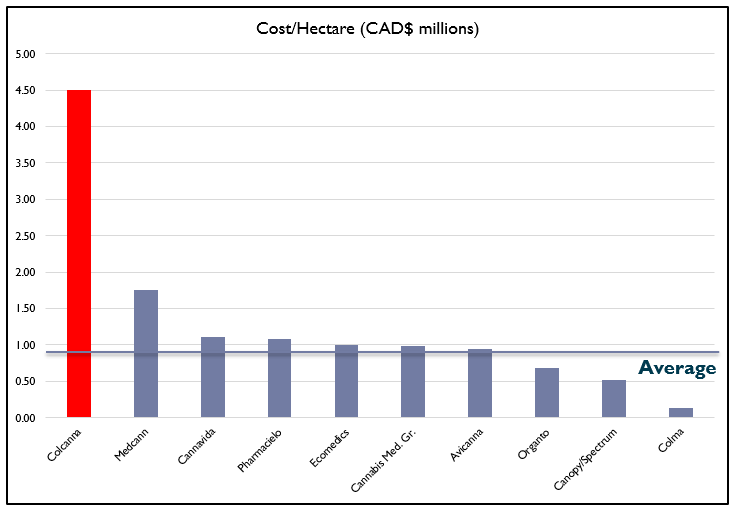

Colombian Comparable Transactions: Aphria Overpaid Relative to Peers for Land/Licenses

When comparing the purchase price of Aphria’s acquisition relative to other Colombian cannabis producers we see that they stand out:

The cannabis space is replete with debates about valuation, but putting that aside, the fact that Aphria’s purchase stands head and shoulders above the rest of the industry speaks for itself.

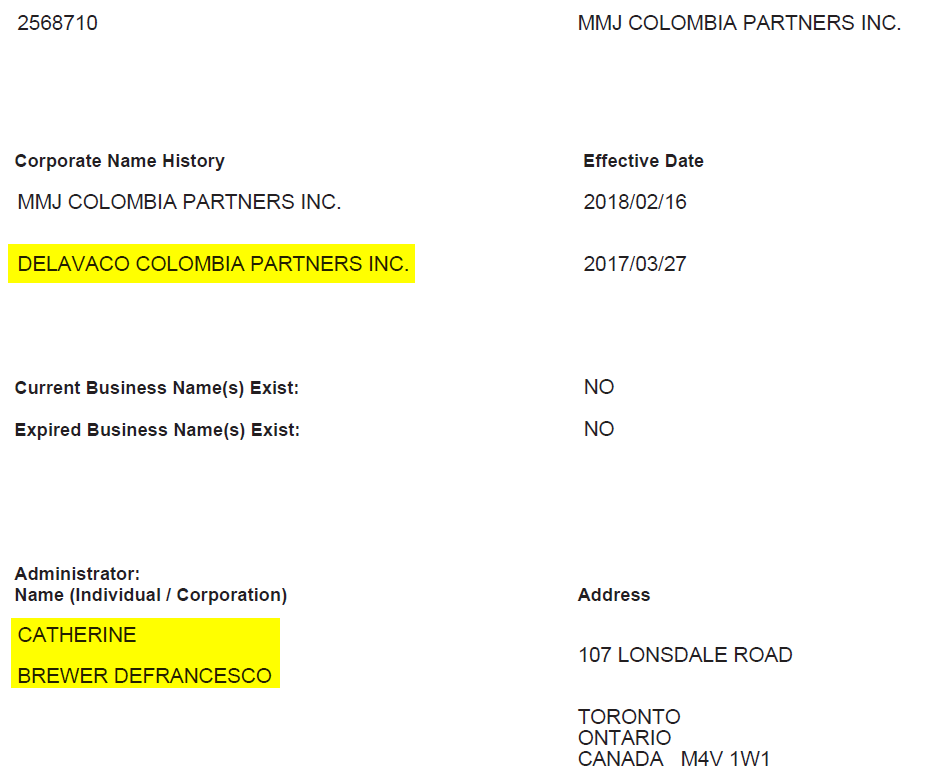

Colombia: Undisclosed Insider Self-Dealing?

Who were the shareholders in the privately-held shell entity that banked C$39 million for selling a newly-formed, stalled Colombian operation?

Canadian corporate records show that two months prior to the Scythian announcement MMJ Colombia had a different name: Delavaco Colombia Partners. Recall that Delavaco is the name of Andrew DeFrancesco’s personal private equity firm. Also recall that DeFrancesco is the current Chairman of Scythian and a key insider of both Scythian and Aphria. The entity was registered in the name of DeFrancesco’s spouse:

The timing of the name change looks prescient. Delavaco Colombia’s name was changed on February 16, 2018—the very day that Colcanna received its first license for cannabis R&D from the Colombian government, suggesting that the acquisition plan may have been set in motion upon receipt of the license (pg. 54).

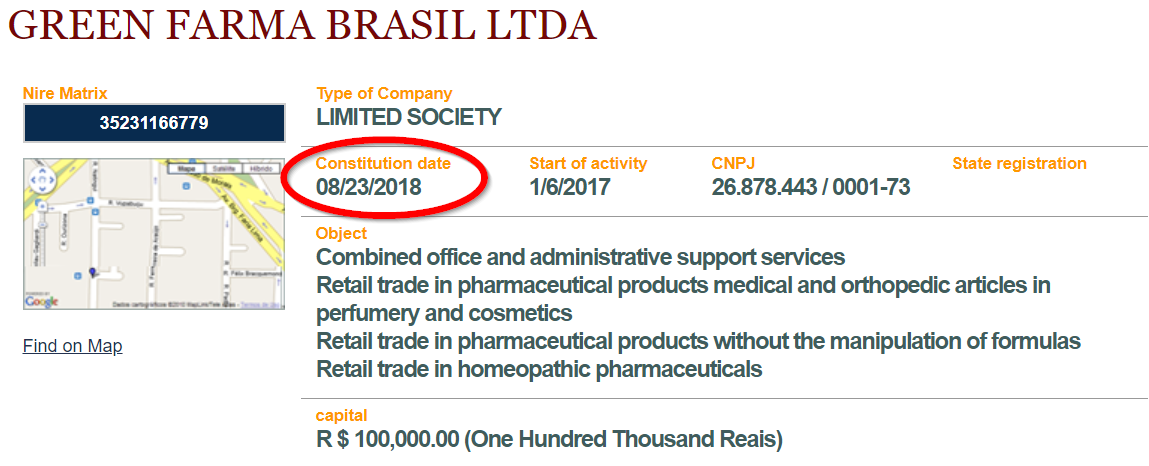

Aphria’s “Option” to Pay $24 Million+ for a Newly-Formed Brazilian Entity Which Appears to Own Nothing but a Pending License

On July 23, 2018, Scythian announced a letter of intent to acquire a stake in “Brazilian Investments Inc”, a private British Columbia-based entity.

Canadian corporate records show that “Brazil Investments” had also undergone a name change. It was originally named “MMJ Brazil Investments” and was incorporated only on March 14, 2018. The name was changed to the nebulous “Brazil Investments Inc” on June 15, 2018, about a month before the announced deal:

“The acquisition of LATAM provides the Company with an option to purchase 50.1% of a Brazilian entity for $24 million (USD), once it secures a medical cannabis licence from the Brazilian government and a right of first offer and refusal on another 20-39% of the Brazilian entity.” (Pg. 23)

Brazilian corporate records show that the ultimate target, “Green Farma Brasil”, had informally operated as of early 2017 but had only taken the step of legally constituting months after the announced deal, on August 23, 2018:

The company was formed with capital worth only about US$27,000.

Thus, it seems that Aphria purchased an option to buy a recently formed entity with no known operations except a pending Brazilian cannabis license. For the sake of their investors, we sincerely hope they don’t choose to exercise this option and shovel $24 million (or more) into this new shell.

From the prior name “MMJ Brazil Investments”, it appears to us that the company under option by Scythian is also related to Delavaco based on the naming convention used in the Colombian acquisition, which was named “MMJ Colombia Partners Inc” immediately prior to its acquisition.

Part II: Who is Andy DeFrancesco?

Andrew DeFrancesco is the Founder of the Delavaco Group, a private equity and advisory firm based in Toronto and Florida. His biography was recently removed from the Delavaco site and his spouse is currently listed as the Chairman and CEO of the firm.

Andy DeFrancesco’s Deep Relationship with Aphria

As described briefly above, Andy DeFrancesco has been a key figure with Aphria from the beginning.

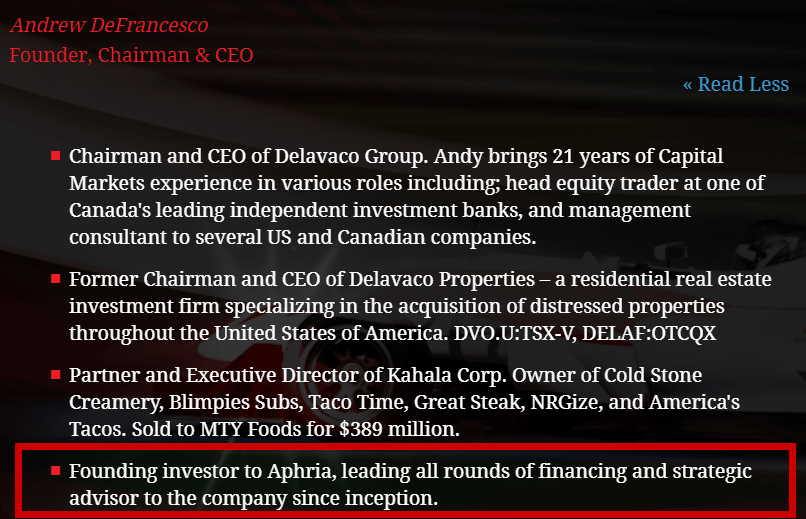

DeFrancesco’s biography on the Delavaco website stated that he was “founding investor to Aphria, leading all rounds of financing and strategic advisor to the company since inception.” Despite the recent removal of his biography, we can still see the original through Web Archives, which also shows that he was formerly listed as “Founder, Chairman & CEO” of the firm:

Additional links to Aphria include:

- DeFrancesco’s Delavaco Group is named as a “special advisor” to Aphria in the company’s press releases relating to all of their bought-deal financings (1,2,3,4,5,6,7).

- DeFrancesco’s private equity firm, the Delavaco Group, was the advisor in Aphria’s reverse-merger into a shell entity named Black Sparrow Capital Corp. That transaction took Aphria public.

- The COO of Delavaco Capital was the CEO and CFO of the Black Sparrow shell.

- DeFrancesco was the self-described “architect” of the Aphria/Nuuvera deal which we previously identified as being laden with undisclosed related party conflicts.

Andy DeFrancesco’s Deep Relationship with Scythian BioSciences (Now Renamed Sol Global Investments)

DeFrancesco also has a close relationship with Aphria’s ‘sister’ company, Scythian BioSciences/Sol Global Investments:

- Going back to the beginning, the “finder” of Scythian’s reverse-merger deal to take the company public was the COO of the Delavaco Group. The Delavaco Group is DeFrancesco’s personal private equity firm.

- Until recently, Scythian’s head office was listed as 366 Bay Street, Suite 200, Toronto, the very same address and suite number of DeFrancesco’s Delavaco Group Toronto office ( v).

- Scythian’s former CFO, Jonathan Held, served in the role until late September. Held operates his consulting firm ALOE Finance out of the exact same address and suite number as the Delavaco Group’s Toronto office.

- In September, DeFrancesco was named Scythian’s Chairman of the Board and Chief Investment Officer. He is now in charge of allocating Scythian’s fresh batch of money received from Aphria through the LatAm deals.

In short, DeFrancesco has played an integral role with Aphria, Scythian, and the LatAm transactions as outlined above. We view him as the architect of these questionable transactions.

Now, we will explore his background and associations.

Canadian Regulators: DeFrancesco Has “Little Regard for the Truth”

A 2009 IIROC complaint mentioned Andy DeFrancesco’s prominent role in a scheme that led to the subsequent industry ban of a broker. For context, IIROC is the national self-regulatory association for Canadian investment dealers, similar to FINRA in the U.S.

IIROC’s complaint made several conclusions about Andy DeFrancesco and the broker, who both worked at Standard Securities Capital Corporation (SSCC):

“Both the respondent’s and Andy DeFrancesco’s conduct in this matter showed they have little regard for the truth.”

“Andy DeFrancesco was deceptive in his conduct with respect to his wife.”

“He was deceitful to his employer, SSCC, in managing (a client’s) account by placing his own assets in her account.”

“Both the respondent and Andy DeFrancesco were involved with the SSCC new account application form of (the client) which contained the false signature of (the client).”

Per earlier SEC filings, DeFrancesco had served as the Managing Partner at SSCC, a firm that was the recipient of multiple regulatory sanctions (1,2,3,4). SSCC was eventually absorbed by another brokerage firm.

DeFrancesco’s Business Ties to Barry Honig, Who SEC Prosecutors Allege to Have Engaged in Multiple Pump and Dump Stock Schemes

DeFrancesco has several close business interests with Barry Honig, a controversial financier who was recently alleged by SEC prosecutors to have orchestrated multiple pump and dump schemes.

SEC and Canadian records show that Honig and Andrew DeFrancesco (along with family accounts) have cooperated on a slew of deals, including:

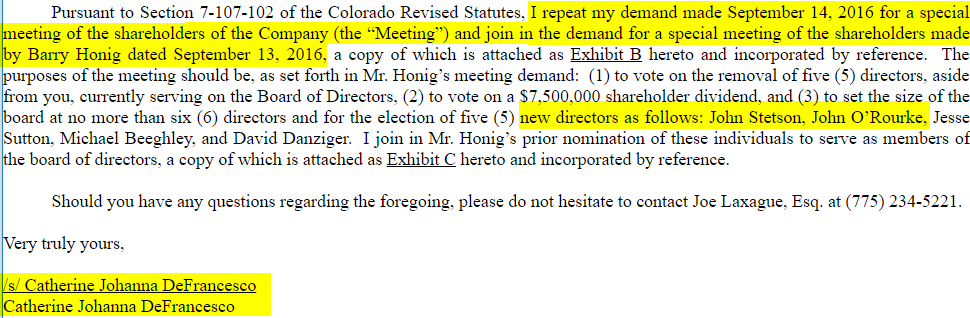

Riot Blockchain (formerly named Venaxis Inc.): DeFrancesco’s spouse reported a key ownership stake in Venaxis Inc. and even joined Barry Honig in an activist campaign to oust the prior board of directors.

DeFrancesco advocated for Honig’s new director slate, which included John Stetson and John O’Rourke, two individuals who were later alleged by the SEC to have participated in multiple pump and dump schemes along with Honig.

Venaxis later “pivoted” business models several times, ultimately becoming Riot Blockchain. Documents show that DeFrancesco had a key role in Riot as well…

As we alleged in an earlier report, Riot at one point made an irregular acquisition that is reminiscent of Aphria’s LatAm transactions: the company bought equipment by purchasing it through a newly-formed privately-held shell entity rather than just buying it on the open market. The equipment cost ~$2 million, but Riot paid ~$12 million for the entity, netting holders of the shell a roughly $10 million gain in about 2 weeks.

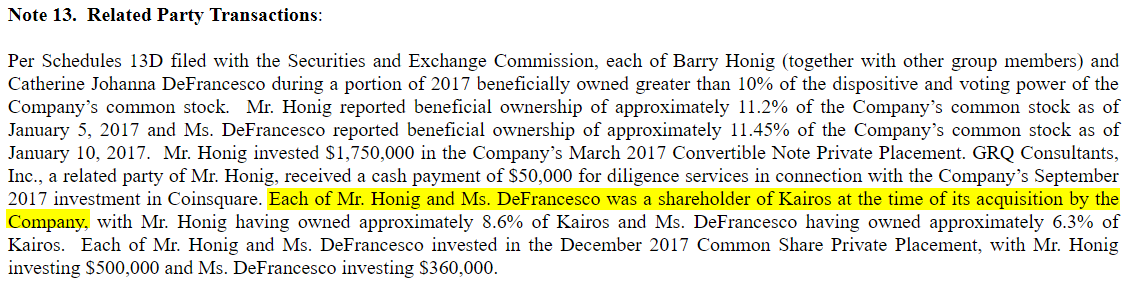

So, who owned the shell? None other than DeFrancesco’s spouse together with Barry Honig (pg. 23).

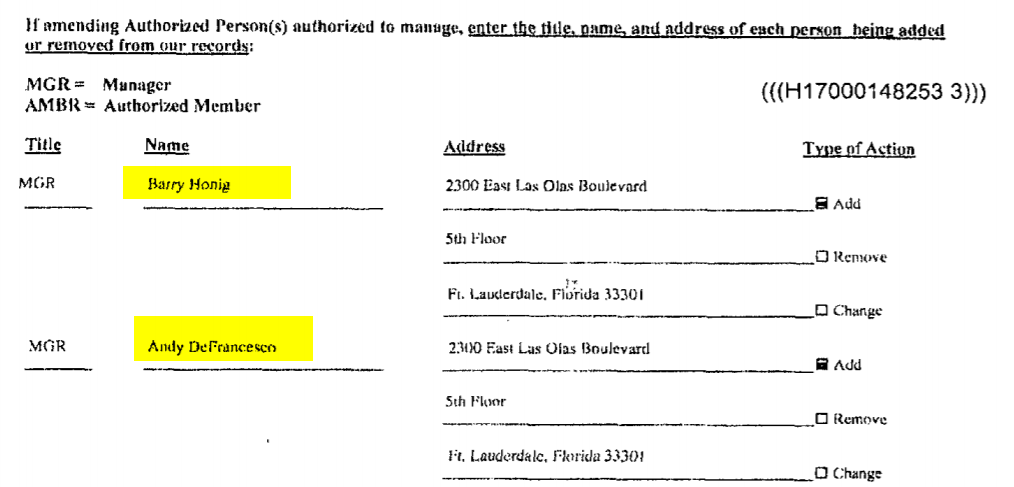

Real estate: According to Florida corporate records and real estate records, the pair also invested together in the very building where Delavaco Holdings Florida office is headquartered:

DeFrancesco / Delavaco’s Ties to a Stealth Stock Promotion Ring

Delavaco was recently named in an exposé by investigative reporter Chris Carey relating to an “army of writers, both real and imaginary” that have produced hundreds of bullish articles on clients of investor relations firm IRTH and about companies backed by Barry Honig. The article is entitled “Pretenders And Ghosts: Stealth Promotion Network Exploits Financial Sites To Tout Stocks.” Per the article:

“The stealth promotion ring began posting stories last year about companies with financial ties to The Delavaco Group… The touting ring has spotlighted at least four companies in The Delavaco Group’s investment portfolio: MassRoots, Aphria Inc., Liberty Health Sciences Inc., and Breaking Data Corp.”

DeFrancesco’s Business Ties to Bobby Genovese, Who SEC Prosecutors Allege to Have Engaged in a Manipulative Penny Stock Scheme

An SEC complaint filed August 2017 accused an individual named Bobby Genovese of “a penny stock promotion, manipulation and unlawful distribution scheme”. The complaint was related to an Ontario-headquartered and TSX-listed company called Liberty Silver Corporation.

The IIROC complaint mentioned earlier provided insight into DeFrancesco’s business relationship with Bobby Genovese. Per the complaint, DeFrancesco had apparently illicitly deposited shares into a fake client account as payment for “services rendered from past transactions” that he had done with Bobby Genovese.

According to a 2010 deposition of Andy DeFrancesco in an unrelated matter, he similarly referenced his business relationship to both Bobby Genovese (and the banned broker, Phil Vitug) (Pg. 27).

In sum, when reviewing DeFrancesco’s past associations and regulatory run-ins, we view his role in Aphria’s irregular acquisitions as totally unsurprising.

Part III—Aphria’s Side Business: Low-Cost Low-Quality Cannabis

As shown in our introduction, Aphria has dedicated much of its cash to international ‘investments’

Aside from its questionable acquisitions, however, the firm has also made investments into its greenhouse operations in Canada which produce a variety of cannabis products. This would make it easier to distribute to cannabis business startups who are looking to get a foot on the cannabis business ladder under the private label CBD umbrella. However, there are still laws and regulations that cannabis start-up companies have to follow if they want to stay in operations. There is software similar to this cannabis compliance software by companies like Green Bits that could assist cannabis businesses and ensure they are up to date.

The firm believes it has an edge in the competitive production space. They have repeatedly touted their ability to produce cannabis at lower cash costs than competitors, which enables them to deliver “one of the highest adjusted gross margin levels in the industry”.

We spoke with a former worker at Aphria’s facility which described the Aphria approach in rather different terms:

“The motto should be quality over quantity, but it’s probably the other way around. It’s more quantity over quality.”

As far as management:

“A lot of the people who are running the show are young, possibly not very experienced in what they are doing”

This has led to issues such as audit failures, mold, and bug infestations:

“We were constantly running into errors and not passing audits with Health Canada and having issues with bugs…it kind of became a bit of a circus.”

“We had a lot of issues with mold and right now the facility is infested with bugs.”

“Every single room that has product in it in that (Leamington) facility right now has bug problems.”

Another source with experience in Canadian and Colombian cannabis companies said the following:

‘Aphria is a big company but is yet to deliver product. There is huge customer turnover. They get a lot of newbies to get prescriptions and get signed up, but first orders receive 3 times market value for low grade.’

It seems that Aphria could be sacrificing quality and its long-term brand in order to generate temporary high margins. Regardless, the strategy appears to be failing as Aphria is not generating positive cash flow from operations. A money-losing, poor-quality, low-cost operation does not strike us as a winning formula.

Additionally, competition is only intensifying as more producers come on-line. Aphria had an early-mover advantage with its licensing and facilities, but that advantage dissipates with every new entrant. With their best times behind them we don’t think Aphria will ever generate meaningful positive cash flow from its Canadian growing operation.

The ‘Blunt’ Truth: Aphria is Uninvestable

All told, Aphria’s international deal spree has resulted in over C$700 million being deployed to its questionable “investments”. Including the Brazilian purchase option this total could reach over C$736 million:

We hope this information has been informative and has given readers a sense of what is going on at Aphria. We believe the conduct of Aphria’s executives and deal partners has been deeply unethical and possibly criminal. With a slew of highly questionable transactions, negative operating cash flow, and a low-quality product, we ultimately see no credible path forward for this company.

We’ll leave it at that (for now).

Disclosure: We are short APHA.

Full Disclaimer: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein. Hindenburg Research and the terms, logos and marks included on this report are proprietary materials. Copyright in the pages and in the screens of this report, and in the information and material therein, is proprietary material owned by Hindenburg Research unless otherwise indicated. Unless otherwise noted, all information provided in this report is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

[1] Note: To arrive at this number we apply the final deal value (based on Aphria’s share price at closing) to the percentage allocated to Marigold per the transaction’s formal valuation opinion

[2] Scythian purchased MMJ International for 6,176,320 shares of Scythian as of the closing price on the date immediately prior to the closing date of September 21, 2018 Scythian’s closing price on September 20, 2018 was 4.35, hence the transaction value of 6,176,320 * 4.35 = C$26,866,992

[3] See Scythian Biosciences Closes Acquisition of MMJ Colombia Partners which includes US$6,200,000 in cash advanced prior to deal closing, US$5,000,000 in assumed debt (both converted to CAD at an exchange rate of 1.3 CAD/USD, and C$24 million in Scythian shares.

131 thoughts on “Aphria: A Shell Game with a Cannabis Business on the Side”

Comments are closed.

Any facts tho ?

that was the biggest scam presentation iv seen in a while

I hope this was made in bad faith and you get criminal charges made against you.

You lying pieces of shit lol.

I owned APHA too, but sold it right away after this came out. I think you’re in denial Go……

Regardless, good luck to you and your APHA stock.

Fantastic piece. It’s refreshing to see some quality, in-depth research being done. This screams fraud.

totally agree with this article. I did my own research and much of the same information checks out. This is basically a pump and dump scheme comingled with false advertising and marketing..

Hey Criminal skank

I warned everyone years ago that the whole Cannabis stock “Sector” is criminal, and full of money laundering, tax evasion, and fat wallet criminals.

Tax havens fund Canadian pot companies

https://translate.google.com/translate?act=url&depth=1&hl=en&ie=UTF8&nv=1&prev=_t&rurl=translate.google.ca&sl=auto&sp=nmt4&tl=en&u=http://www.journaldequebec.com/2018/01/22/les-paradis-fiscaux-financent-les-firmes-de-pot-canadiennes …

The fact that you spent so much time and effort on this research is outstanding.

Although I’m not long/short Aphria, this information is going to help investors steer clear of this mess. Unfortunately, a lot of investors will lose a lot of money, but you releasing this detailed report is going to prevent further loss from new investors.

Bravo

Interesting.

ouch , should have listened to the first warning

“Lavar” is spanish “to wash”, a “machina de lavar” is a “washing machine”.

DeLavaCo?

It would appear this guy has some big huevos.

Aka ‘laundering’.

You missed the 3 boys farm connection, who owned it, who it was registered to, and who then bought it and who is ceo of new owner company…. Also check whataw firm represents apha….

Keep me informed

PENIS

In April of 2017I contacted Dave Smiley of the Miami Herald and sent him material on Andy’s firm stating this guy and company Aphria were frauds. There were people on the ground in Columbia that tipped Andy off.

I can send you what I have if you want it. Glad I can feel vindicated.

THANKS

Fine print at end of Hindenburg Research>>>You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions.

great exposition!!

I sold my small portion of shares today which I lost money on. I am done wirh investing in cannabis companies and small stocks. I sincerely hope that this unethical fraud Andy defrancesco will face criminal charges and jail time. I hope there will be a lawsuit on behalf of investors.

Scythian BioSciences?

The mans sense of humor here is not to be underestimated.

Symbolism and the Scythe: “the Grim Reaper carries a scythe because it reflects the roots of the character in agrarian society … it is said that Death uses a scythe to separate a person from their soul when they die. It’s symbolic on several levels.”

Your comment tells me that you never read any APHRIA’s SEC filings, MD. I don’t think you’ll be laughing if you are still holding APHA shares. Good Luck!!!

Amigo, thinking you got me a bit off here. A) I’m not holding (long) any shares, nor making any calls for higher or lower price. B) You seem to be bearish on the name (I will neither contest nor affirm support for this because I dont know who to believe yet). C) Look at my previous reply and you will see my comments on the DeLavaCO.

All I’m doing is pointing out what appears to be a brazen pattern of thinly disguised efforts to name companies in a cryptic yet amusing fashion. The amusement in this instance comes from a (spanish) laundry company and an entity to reaps (the interpretation of who’s reaping and what is open to dispute).

There’s ALOT to laugh at here.

This is just the beginning. Look at Canopy’s buyout of Hiku earlier this year.

You guys are about to get fucked hard lol.

Enjoy getting fucked in the ass by big bubba when you’re in jail you white collar beta cuck faggots.

Bow down to your king plebs.

Lol incomming sentencing and prosecution. Get rekt.

that was the biggest scam presentation iv seen in a while

I live down the road from aphria and nobody I have met buy there product…of course they are goin to be greedy ….they dont care about quality cause they prob dont even smoke…n if they do im sure they have there own cronic personal plants to enjoy …..u want good weed fukin buy it somewhere different and mind your fukin business like fuk wat satifaction do you get by wasting your time busting balls…let them grow shit weed if they want all investors take a risk when investing.

Just try and enjoy it finally being legal go smoke a spliff of fire bud eat something n shut the fuck up and mind your business fukin nothin better to do eh…

Exactly what I was looking for, appreciate it for posting .

Almost everyone has missed this key idea. these writing are supporting me in discovering some required pieces of information. I hope for an additional post around these topics soon!

Thanks for that magnificent write-up, great site to! It makes be want to get a weblog. What software do you have to get started? I hear a good deal about this WordPress?!!

I gotta favorite this internet site it seems handy very useful

Hello there, I discovered your web site by way of Google whilst looking for a related topic, your site got here up, it seems to be good. I have bookmarked it in my google bookmarks.

This is amazing!! Thnks