- Predictive’s key original holders and recent Chairman/director have previously been charged by regulators with securities fraud, including allegations of pump and dumps, boiler room sales, and false press releases.

- Predictive’s CEO Brad Robinson has a checkered history, including allegations of securities fraud and of non-compliant marketing of a medical product.

- Predictive has embarked on a flagrantly suspicious acquisition spree that displays hallmarks of insider self-dealing. Specifically, 4 of Predictive’s 7 acquisitions were entities based out of Predictive’s own address before they were acquired.

- Predictive’s revenue is derived almost entirely from sales of stem cell products, a business that appears to be predicated on (i) sourcing birthing tissue from pregnant women who wrongly believe they are donating it to purely non-profit causes, and (ii) aggressive “miracle cure” sales tactics targeted toward elderly customers suffering from chronic pain.

- We attended a sales seminar held by one of Predictive’s largest distributors, run by a doctor in Georgia. The pitch was targeted toward elderly customers and relied heavily on aggressive claims and celebrity testimonials.

- We also contacted multiple new moms who donated birthing tissue to Predictive’s thinly disclosed subsidiary under false impressions that their donations were going to be used for non-profit causes.

- We believe there is 80% downside to Predictive’s shares purely on valuation alone and 95%+ downside given the issues we have uncovered.

Initial Disclosure: After extensive research, we have taken a short position in shares of PRED (a really large short position, in fact). We stand to benefit financially if the stock price declines. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction: About Our Investigation

This report follows an extensive, months-long investigation, which included on-the-ground research at Predictive’s facilities in Utah, an undercover meeting with a key product distributor in Atlanta, and multiple conversations with former employees and industry experts. We also spoke with multiple new moms who wrongly believed they were donating their birthing tissue to purely non-profit causes such as research into how stem cells can treat deadly diseases.

We have investigated numerous companies and bad actors in our history, many of which have subsequently been charged by regulators with securities fraud, and we can’t recall examining a business with as many issues as Predictive. We think this company is rotten to its core.

Background: Basics About the Business and the Bull Thesis

Predictive went public on the OTC Market via a reverse merger in 2015. Originally, the public entity had been used by a company that sold vitamin-laced showerheads, then later reverse merged into a shoe company, which then reverse-merged into a housing company, before finally reverse merging into Predictive in 2015. It then applied to uplist onto NASDAQ about 2 months ago.

Predictive purports to be a life sciences company that primarily focuses on two lines of business:

- Procuring and selling regenerative medicine products (mainly stem cell products derived from placental/birthing tissue).

- Developing diagnostic tests to detect diseases (primarily an endometriosis test).

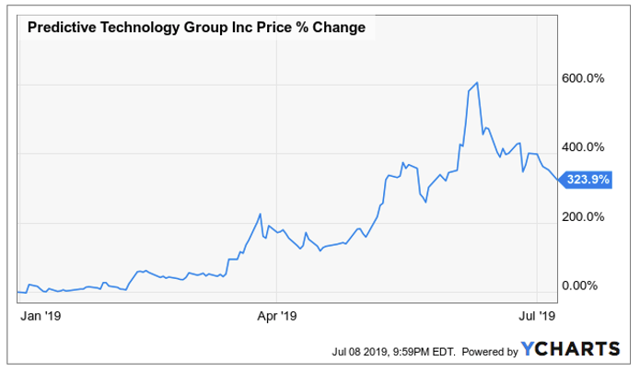

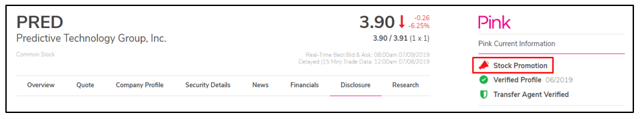

The stock has been on an absolute tear, up roughly 320% year-to-date, fueled by multiple paid promotion campaigns (1,2,3).

The company is presently flagged by the OTC Markets for undergoing current stock promotion efforts.

The bull thesis focuses mainly on:

- Growth in the company’s stem cell business

- Upside from the possible roll-out of the company’s endometriosis test, which has been touted as a potential game-changer in a large market

As we will show, we think the stem cell business is subject to major operational, legal, and regulatory risks that are likely to impede (if not totally eradicate) this source of revenue.

We will also show why we believe the company’s latest attempts to roll out its endometriosis test will sputter. Multiple industry experts have expressed doubts about the viability of the test and historical marketing materials from Predictive’s subsidiary show a history of delays-the endometriosis test was slated for a roll-out in Q1 of 2016, but was then tabled for years. We expect this latest attempt will result in similar delays.

Background: Predictive’s Stem Cell Business Accounts for Virtually All of its Revenue and Appears to be Predicated on 2 Key Falsehoods

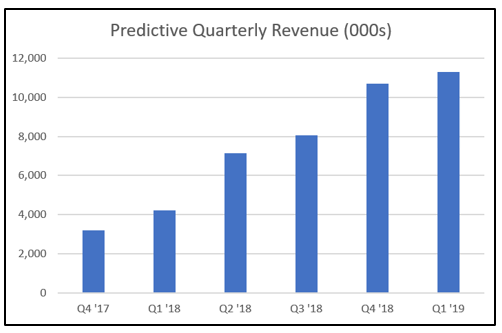

Thus far, virtually all Predictive’s revenue has come from sales of its regenerative medicine (i.e.: stem cell) products. [Pg. 5] The company’s quarterly revenue growth has been on a strong upward trajectory:

As we will show, this stem cell business model which accounts for almost all Predictive’s revenue appears predicated on two key falsehoods:

- Pregnant women donate their birthing tissue to a subsidiary of Predictive under the false notion that they are donating solely to research and other non-profit causes.

- The donated tissue is then sold to a network of pain management clinics that then use high-pressure sales tactics and make outlandish claims about the effectiveness of the product. The target audience for this appears to be the elderly and those suffering from chronic pain.

Background: Predictive’s Irregular Acquisition Spree Displays Hallmarks of Undisclosed Insider Self-dealing

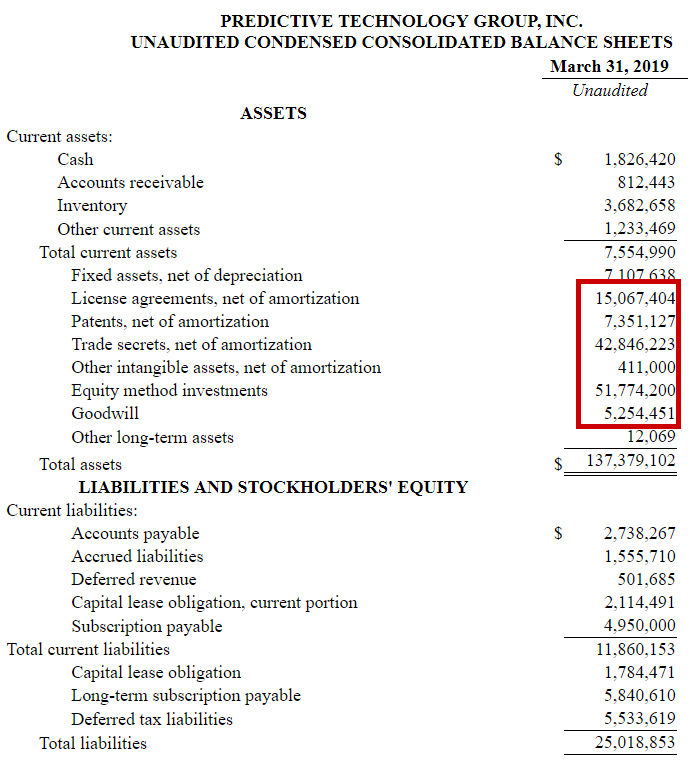

Beyond its core-revenue generating business, we will also explore Predictive’s $120 million+ acquisition spree.

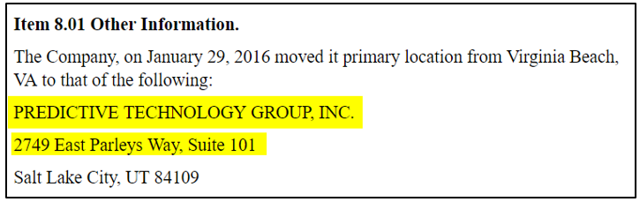

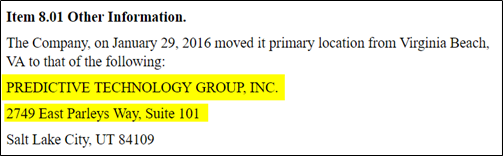

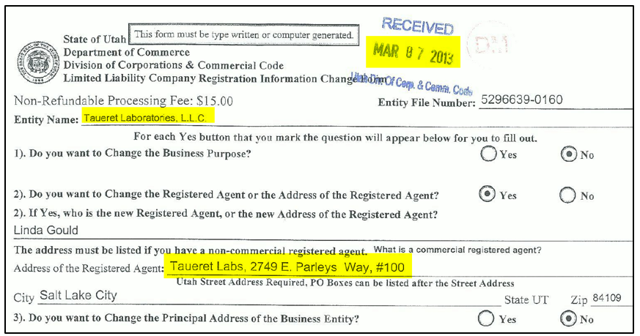

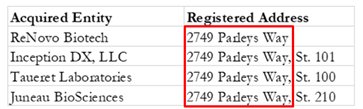

In particular, 4 out of 7 of Predictive’s recent acquisition targets were based out of the same address, which also happens to be Predictive’s old headquarters.[1] For context:

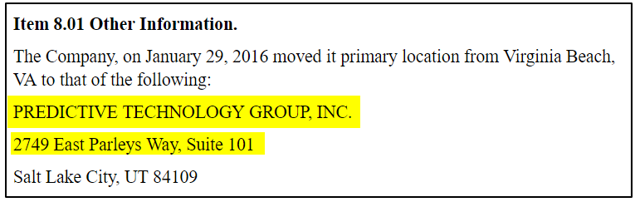

Predictive’s Headquarters: 2749 East Parleys Way

Registered Addresses of 4 of Predictive’s 7 Acquisitions Before They Were Acquired-The Same Address!

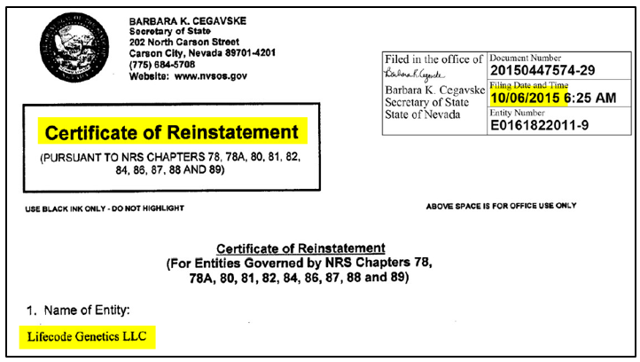

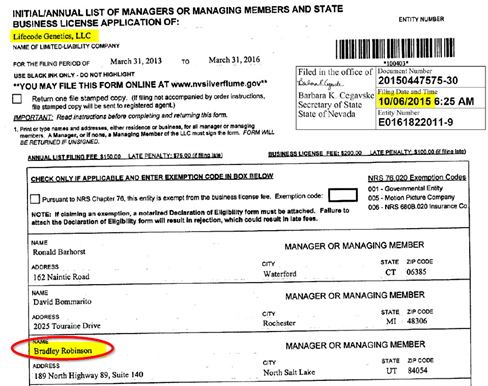

Corporate records from another acquisition target, LifeCode Genetics, show that Predictive’s CEO/President Bradley Robinson had a managing role just prior to the entity being acquired by Predictive. We found no disclosure about Robinson having any stake in the acquisition target.

Predictive has shoveled $120m in cash and stock in what we believe are questionable acquisitions that are unlikely to generate shareholder value. Predictive is also slated to pay an additional $12 million in cash installments that extend until 2021 for another questionable acquisition, based out of the same address, that we will detail further in this report. We expect this obligation will vampirically drain Predictive’s already-low cash balance for the foreseeable future.

Background: Three of Predictive’s Key Backers (Who at One Point Held ~90% of its Shares) Have Previously Been Alleged by the SEC or State Regulators to Have Committed Securities Fraud

Lastly, we will explore the background of Predictive’s former Chairman/Director, its key early backers, its CEO, and its auditor.

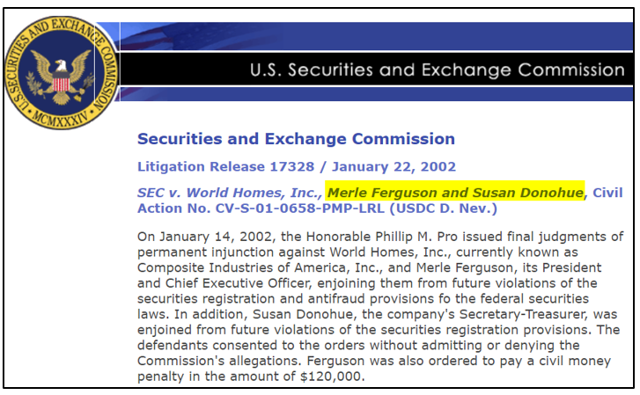

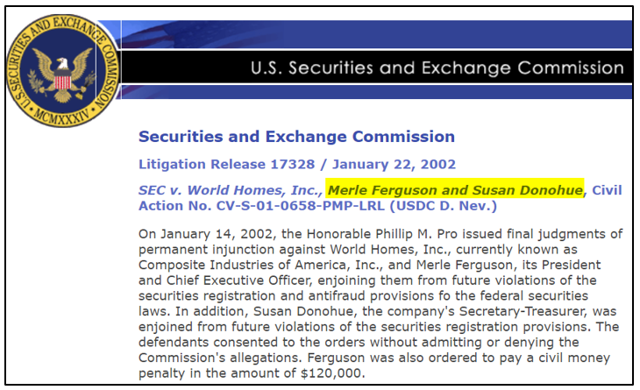

Merle Ferguson served as Chairman of the Board of Predictive since its outset as a public company [Pg. 43] and continued serving in that capacity until his replacement in October 2018. Ferguson then served as a director until March 18th of this year, when he was replaced by none other than former Senator Orrin Hatch.

Ferguson was previously charged by the SEC with fraud relating to allegations that he filed false press releases as an executive of a public company. Ferguson and another key Predictive holder, Susan Donohue, later settled the charges.

We will show that along with Ferguson/Donohue, almost 90% of Predictive’s shares were controlled by 3 individuals that had previously been charged with securities fraud either by the SEC or state regulators. The charges ranged from allegations of engaging in boiler-room-fueled pump and dumps to issuing false press releases.

In addition to key holders, we also review the biography of Predictive’s CEO/President Brad Robinson. We found that Robinson’s official biography omits several of his professional missteps, including running a failed company that attempted to commercialize cholesterol-lowering algae water. That venture ended up mired in litigation, where Robinson was sued over allegations of securities fraud and allegations of improper marketing of a medical product.

Lastly, we explore Predictive’s auditor, BF Borgers. The auditor operates a small business out of Colorado whose clients mainly consist of tiny companies trading on the OTC. One example is The Lingerie Fighting Championships (Pink:BOTY), which sports a market cap of $200 thousand as of the time of this writing. We do not view BF Borgers as an auditor credible or capable enough to handle the size and complexity of Predictive’s acquisition-laden entity structure.

All told, we think key people and service providers surrounding Predictive are major warning signs.

Background: Priced Beyond Perfection-80% Downside Purely on Valuation Alone

Given the issues with its core business model, its irregular acquisition spree, and management’s suspect bios, we view Predictive as totally uninvestable.

But putting all that aside for the moment, with a market cap of $1.1 billion, Predictive is currently priced beyond perfection, purely on valuation alone:

- Price to sales of 24x using Q1‘s run-rate ($45m run rate). (P/S of 29x on a last-twelve-months basis.)

- Consistent net losses and an accumulated deficit of ~$34 million as of Q1.

- Tangible book value (net of equity method investments) of -$3 million as of Q1.

- Dangerous current ratios of 0.63 and a quick ratio of 0.33. With cash of only $1.8 million the company has limited short-term liquidity.

Note Predictive’s high intangible asset balances, owing largely to assets acquired through the company’s acquisition spree:

In addition to the above, Predictive has an agreement with one questionable entity to make monthly cash payments until 2021 – a setup that we believe will vampirically drain up to $12 million in cash going forward.

We also looked at the company’s acquired intellectual property portfolio, which largely consists of patents/pending patents and early-stage initiatives that would require substantial new investment in order to even assess its viability. We harbor doubts about whether there is any meaningful value in its IP portfolio, given the questionable nature of the acquisitions.

Given the company’s absence of net income, negative tangible book value, and spotty operating cash flow, we are left with a revenue multiple analysis.

When applying an extremely generous 5x revenue multiple to Q1’s run-rate, we arrive at a market cap of $225 million, or roughly $0.78 per share, implying downside of at least 80%, using a highly optimistic valuation basis. However, given the additional red flags we have unearthed, we see 95%+ downside for Predictive’s shares.

Part I: Predictive’s Stem Cell Business-Misled Pregnant Women and Elderly Patients Suffering from Chronic Pain

As noted above, virtually all of Predictive’s revenue comes from sales of its stem cell product, which is derived from birthing tissue from new mothers. The tissue is donated to a subsidiary of Predictive, where, based on our research, it is then stored and then sold to a network of distributors nationwide. These tissues are said to be rich in stem cells and other growth factors and form the foundation of the company’s current product offering.

In reviewing Predictive’s financials, we noticed that the company had incredibly impressive gross margins, ranging from 55%-94%:

This would prompt any person to wonder: how is the company procuring its birthing tissue product so cheaply?

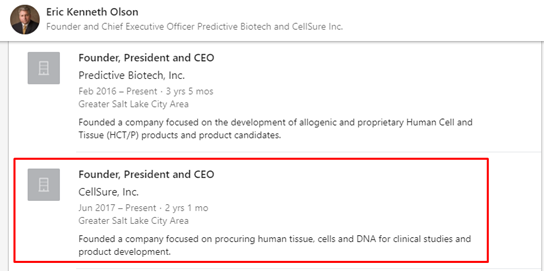

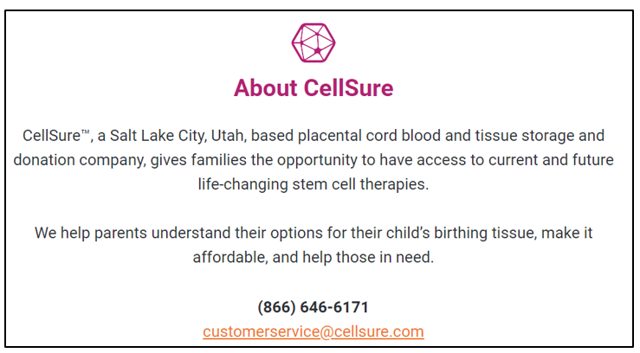

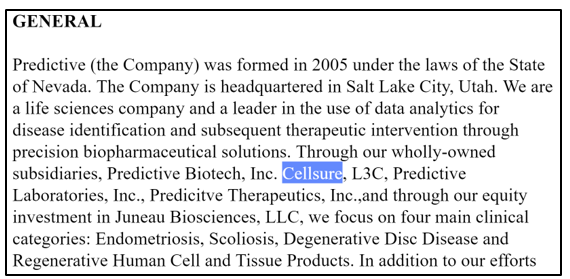

Predictive Has a Thinly-Disclosed Subsidiary Named CellSure That Encourages Pregnant Women to Donate Birthing Tissue to a ‘Good Cause’

As we researched Predictive’s employee backgrounds, we noticed that the head of a key Predictive subsidiary listed another company on his Linkedin profile called CellSure.

On CellSure’s website, it describes itself as a “placental cord blood and tissue storage and donation company” which gives families the option to pay for storage for their own use or to donate to a good cause.

Curiously, the “About” page for CellSure makes no references to Predictive and only recently began listing an address.

Similarly, we were unable to find any reference on Predictive’s website to CellSure.

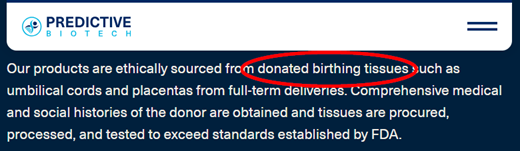

On Predictive Biotech’s website, all we see is the company say that its products are sourced (“ethically”) from donated birthing tissue, although the source of the donations is not disclosed.

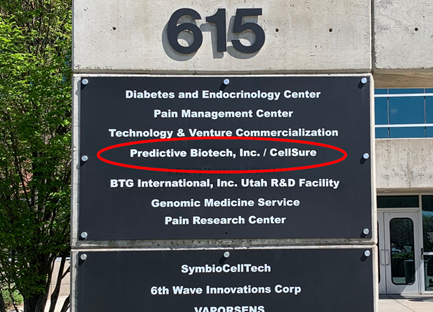

However, when we visited Predictive’s offices in Utah, we found that the building signage describes them as “Predictive Biotech, Inc. / CellSure”:

CellSure had likely been operating as an undisclosed related entity until about a month ago on May 22nd 2019, when its name was mentioned once in an amended prospectus as a wholly owned subsidiary of Predictive.

The True Purpose of the Tissue Donated to CellSure/Predictive Is Obfuscated

CellSure’s website says that it gives parents the option to “help those in need“, and describes research being done using stem cells. The implication from this description is that donations go to critical research for autism, diabetes, Alzheimer’s, Parkinson’s, and other deadly diseases.

CellSure’s website implies that its mission is charitable, claiming that the donor’s child will become a “hero the day they are born.”

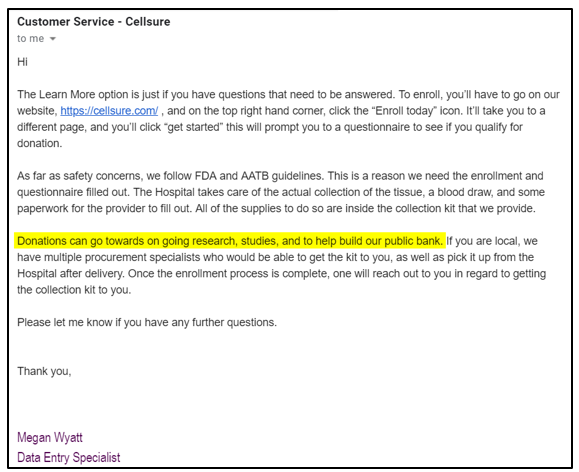

We contacted CellSure support and asked about where the donations go. Their response was:

Donations can go towards ongoing research, studies, and to help build our public bank.

(A public bank is typically a non-profit charitable bank that can be used by members of the community to help treat life-threatening diseases).

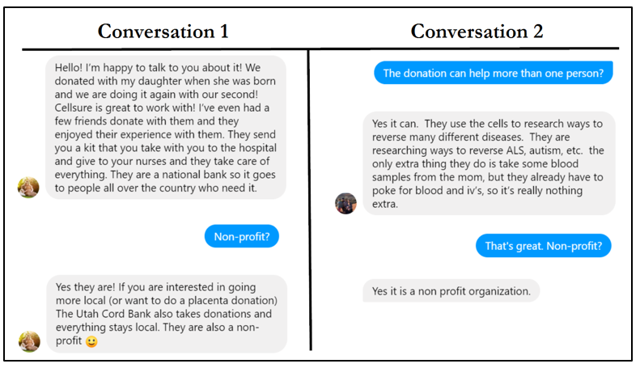

The donors seem to believe this as well. We were able to contact 4 new moms who had donated to CellSure, per the company’s Facebook page. We approached them on the grounds of wanting to learn more about the donation process.

Three of the four unequivocally believed that CellSure was a non-profit that would use the tissue for things like “(treating) people who are very ill” or “to research ways to reverse many different diseases”.

The fourth donor we contacted actually worked at Predictive Biotech as a lab manager, per her LinkedIn profile. During our conversation, she mentioned that she worked for a “sister company” of CellSure. When asked if CellSure was a non-profit, she said “I think so” but then claimed not to remember, despite having left Predictive only 3 months earlier.

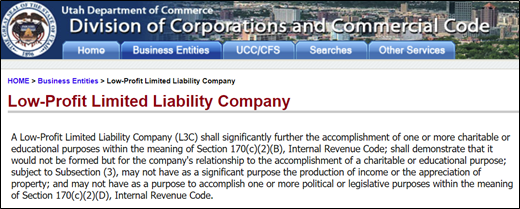

CellSure is actually registered as a “low-profit limited liability company”, which Utah defines as a company meant to “significantly further the accomplishment of one or more charitable or educational purposes” and “would not be formed but for the company’s relationship to the accomplishment of a charitable or educational purpose”.

In other words, low profit organizations are supposed to exist primarily to advance a charitable or educational purpose.

The Real ‘Good Cause’: Predictive’s Bottom Line

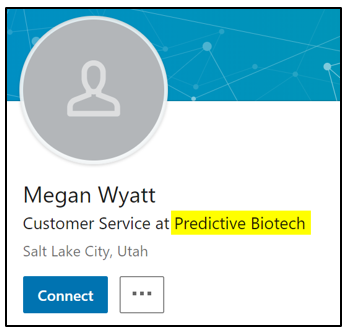

Recall from our customer service interaction above that we had communicated with Megan Wyatt from CellSure about all the good causes the donated tissue goes towards. But, from Ms. Wyatt’s LinkedIn profile we see that she actually works at Predictive!

We found other LinkedIn profiles showing that key employees worked concurrently at both Predictive and CellSure (1,2,3).

All told, pregnant women falsely believe they are donating their birthing tissue to purely non-profit causes, when in fact it is going to a subsidiary of a public company and then sold for profit.

We emailed the company IR asking whether they make it clear to women that their birthing tissue goes to a public company rather than non-profit causes and have not heard back as of this writing.

Does it Work? It is Unclear Whether the Stem Cells are Even Alive, Let Alone Functional

Given that Predictive’s stem cell products have not been FDA approved or cleared, they are offered only as FDA registered tissue products. What this means is that it was registered using an online form through the FDA’s website, without the thorough independent vetting of an FDA testing process.

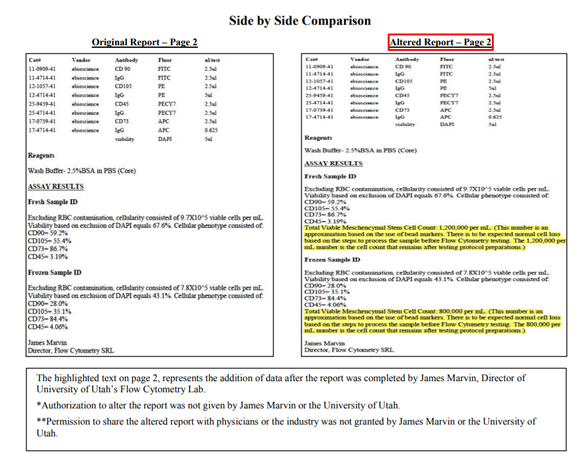

At one point, Predictive apparently portrayed that its product had a large number of viable stem cells based on a report from a University of Utah lab. However, it turned out that Predictive had altered the report to include conclusions about the number of viable cells which were never actually in the original.

A competitor did an analysis of the unaltered lab work, declaring that “these cells have been through the proverbial wringer.” He couldn’t conclude that there were any live stem cells in the company’s products.

Doubts about the live cell count of stem cell products are not exclusive to Predictive. ProPublica recently wrote an investigative piece on aggressive profiteering in the world of stem cells. The piece found that products often had little evidence to back up claims of efficacy and even that many had no live cells at all.

The ProPublica article focused largely on the Utah Cord Bank, a competing manufacturer of Predictive which processes similar types of stem cell product. (In fact, Predictive’s Chief Laboratory officer was one of 2 key employees at the Utah Cord Bank before defecting to Predictive).

Per the ProPublica article:

For most of these products, there’s not many healthy cells left,” Daniel Kuebler, the dean of the School of Natural and Applied Sciences at Franciscan University of Steubenville, Ohio, said

…Even if there are some cells that are still alive post-thaw, “I have a hard time getting them to grow,” Kuebler said. “Just because they’re alive doesn’t mean they’re not in the process of dying.

Lisa Fortier, a researcher at Cornell University and a consultant for a company that sells birth-tissue products, tested nine (products) from four manufacturers-[Predictive was not one of them]-and also found no live cells. It is ‘very unlikely’ that the amniotic membrane “works as a stem-cell product,” she said.

Beyond ProPublica, fifteen doctors from institutions such as Stanford, Cornell, the Mayo Clinic, and others recently signed a consensus statement warning about the aggressive marketing of non-viable birth tissues as live “stem cell” products.

In short, we believe that Predictive’s products have a lack of scientific support, and without FDA testing cannot make claims that the cells are even alive, let alone make any clear claims of efficacy.

However, this hasn’t stopped Predictive’s products from being aggressively pushed forward through distributor sales channels.

Once Predictive Procures the Tissue, Distributors Use Aggressive Sales Tactics to Sell it to Patients Suffering from Chronic Pain

Once the tissue is donated to CellSure, based on our research, it is then processed and sold through Predictive to a network of distributors across the country. We found no examples of the procedures being covered by insurance, owing to the fact that the stem cell procedures are not FDA tested.

Instead, patients pay in cash. Prices range anywhere from $5,000 to as high as $25,000 per treatment, based on our conversations with multiple patients and distributors. These treatments can quickly add up to big income for practitioners.

Many use high-pressure sales tactics, including holding seminars that preach stem cell therapy as a sort of miracle cure for a wide array of ailments.

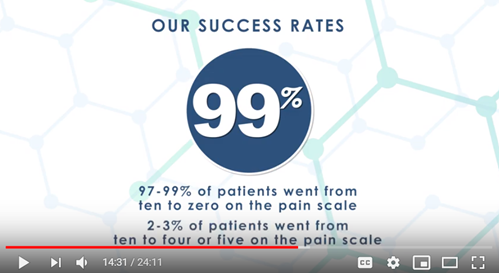

Key Distributor Southern Stem Cell Institute: “97%-99% of Patients Went from Ten to Zero on the Pain Scale”

In Atlanta, Dr. Richard Ambrozic of the Southern Stem Cell Institute (SSCI) is a Predictive distributor who has claimed to perform “thousands” of procedures nationwide.

We initially found Dr. Ambrozic through a competitor who identified his affiliation with Predictive. We then confirmed that he uses Predictive products from his marketing materials.

Dr. Ambrozic regularly holds seminars for prospective customers and claims that he can use stem cells to treat nearly any kind of orthopedic condition (along with fibromyalgia, erectile dysfunction ( is the main solution), neuropathy, and a host of other issues) with success rates that completely defy medical convention.

CLICK HERE TO WATCH SSCI’S WEBINAR (minute 14:20 for the success rate)

Key Distributor Southern Stem Cell Institute: Our Experience Attending a Stem Cell Seminar at a Hampton Inn in Newnan, Georgia

We signed up for one of Dr. Ambrozic’s stem cell seminars to get a sense of the experience. It was held in a small breakout room at the Hampton Inn in Newnan, Georgia, about 45 minutes outside of Atlanta.

Dr. Ambrozic arrived in a Mercedes SUV covered in stem cell logos. As the participants watched testimonial videos, Dr. Ambrozic put a lab coat over his surgical scrubs and got down to business.

Key Distributor Southern Stem Cell Institute: Targeting the Elderly

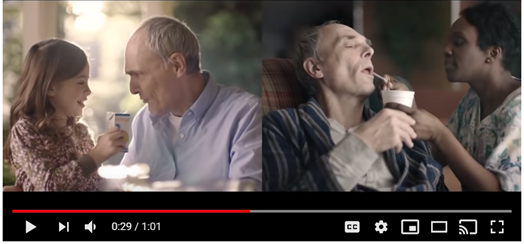

The audience at the seminar consisted of about 20 elderly individuals, some with walkers or canes, and another with a shoulder sling. All were suffering from localized or general chronic pain and seemed to be desperate for solutions.

At one point, Dr. Ambrozic played a video titled “What will your last 10 years look like” which juxtaposed the lifestyle of a healthy older man against that of a man in a vegetative state in a nursing home.

At the end of the video, Dr. Ambrozic asked the crowd:

Now, does anyone want to be that guy on the right?

Key Distributor Southern Stem Cell Institute: Aggressive Claims

Throughout the seminar, Dr. Ambrozic made other aggressive claims that were potentially outright false.

Claim #1. Dr. Ambrozic said that the product — which is sourced from Predictive Biotech — comes from “one of the best [labs] in the world and its actually got awards from the FDA.” (We have this claim captured on audio)

Reality: We could find no record of the FDA handing out awards to any lab, let alone Predictive’s. The closest we could find was an FDA award for ‘Excellence in Laboratory Science‘ which awards groups or individual researchers, but Predictive was not on those lists either. We reached out to the FDA and Predictive for clarification and have not heard back from either as of this writing.

Claim #2. Dr. Ambrozic claims on his website that the average live stem cells in their product range from 1.1 million to 4.4 million cells.

Reality: We believe this claim cannot be made legally without rigorous independent testing, which was not presented, nor discussed, at the seminar.

We have emailed the SSCI asking for clarification on these claims and have not heard back as of this writing. Should we hear back we will update this accordingly.

Distributor Neo Matrix Medical: “You Are Not Invincible…But You Can Be!”

Another Predictive distributor, Neo Matrix Medical, operates a pain management clinic in Florida. We found Neo Matrix’s affiliation with Predictive through its marketing materials, which acknowledge using Predictive’s products.

The proprietor, Mike Van Thielen, holds a PhD in Holistic nutrition from the University of Natural Health, an online program that charges about $7,500 per degree, where there’s “no time limits for completing courses.”

Van Thielen refers to himself as “Dr. Mike” and holds regular seminars catered toward those suffering from chronic pain. Here is an image from one such seminar, held by Neo Matrix Medical. Note again that the audience largely consists of elderly individuals:

We’ve obtained video footage of “Dr. Mike” making aggressive claims to prospective patients. In the video you will see claims that the stem cell treatments can help any muscular/skeletal disorder and can even offer an alternative to facelifts and skin treatments.

This really turns back time 10, 20 years…

Walking without a cane, walking without a walker…

In one video, to a backdrop of heavy techno music, Dr. Mike claims “You are not invincible, but you can be!”

Predictive Distributor Southwest Spine and Pain Care (“SSPC”): An Unusual Relationship Involving a Suspicious Acquisition

In Utah, we found that the SSPC clinics distribute Predictive’s products through what appears to be an extra-special relationship.

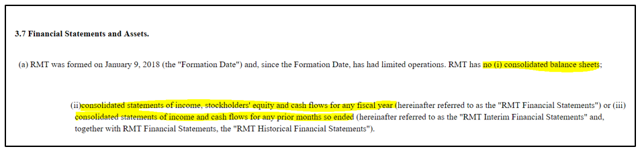

In October 2018, Predictive acquired an entity called Regenerative Medical Technologies Inc (“RMT”) for 10 million shares, valued at $9.2 million at time (and valued at over $39 million as of this writing). (pg. 15).

Utah corporate documents show that RMT was founded by Dr. Rick Obray. Dr. Obray is a founding partner of the SSPC clinics, which operate over a dozen pain management clinics.

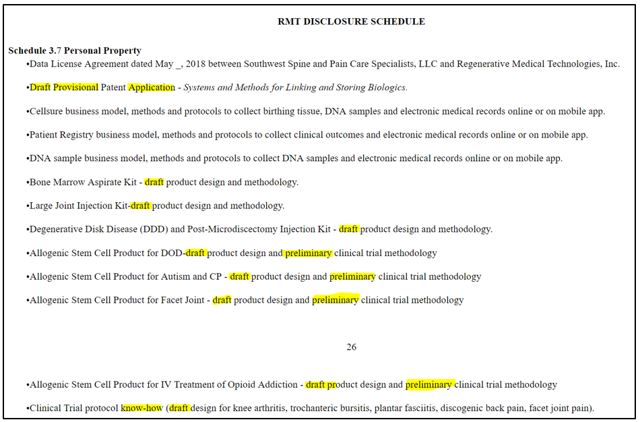

A review of the RMT acquisition agreement [pg. 9] showed that the entity had been formed on January 9th, 2018, only about 7 months prior to the agreement, and was described in the purchase agreement as having “limited operations”. The filings further show that RMT didn’t even have financials (balance sheet, income statement, or cash flow statement) when it was acquired.

Predictive claimed to be acquiring RMT for its intellectual property in the regenerative medicine field. But in the same agreement [pgs. 26-27] we see that the acquired “property” consisted mostly of highly preliminary assets and drafts, including:

- Draft product designs;

- Preliminary clinical trial methodologies;

- One draft provisional patent application

- Several early-stage business models

In addition to the above ‘assets’ the acquisition also included “A license agreement for data from Southwest Spine and Pain Care Specialists, LLC”. Per a press release that accompanied the acquisition, we see that the licensed data includes “access to data and medical records from patients in 13 clinics.”

In other words, it appears Dr. Obray sold his confidential patients’ medical records as part of the deal.

Concurrent with the deal closing, Dr. Obray joined as Chairman of Predictive’s Clinical Advisory Board. The press release crowed over Dr. Obray’s resume and credentials, yet oddly left out his role at SSPC, which appeared to be his primary occupation.

An obvious question emerges: why would Predictive pay over $9 million for a newly-formed entity with no financials and little in the way of developed intellectual property?

The value of confidential patient records alone would not seem to explain the large purchase price for RMT.

In what is unlikely to be a coincidence, we noticed that the SSPC clinics began offering placental stem cell therapy around the formation of RMT in early 2018. (Placental stem cells are the precise type of stem cell that Predictive offers.) Per SSPC’s Spring 2018 newsletter, we see that they featured the treatment:

When we saw this, we reached out to Predictive asking about clinics that offer their services in the area. Sure enough, their response volunteered that they do offer products through SSPC:

In short, Dr. Obray looks to have sold Predictive his patient’s medical records and started marketing and selling Predictive’s products right around the time he formed, and later sold, an entity to Predictive for $9.2 million. We believe this is all an extremely odd acquisition.

Part I Conclusion: We Believe Predictive’s Stem Cell Product is Sourced from Misled Pregnant Women and Then Aggressively Sold to Those Suffering from Chronic Pain

In addition to the horrifying ethical implications of Predictive’s apparent business model, we believe the approach exposes stockholders to a range of risks:

- Regulatory. The FDA is looking more closely at aggressive stem cell operators, and Predictive’s size and public profile makes it a potential target.

- Liability. Patient liability is a real issue, especially for a manufacturer or distributors making aggressive or potentially misleading claims about the viability and efficacy of its products.

- Opacity. The more exposure mothers and potential patients have to the true nature of these businesses, the more informed their decisions will be. In this case, it appears a better-informed consumer would be severely detrimental to Predictive’s bottom line.

Part II: Predictive’s Acquisition Spree: Hallmarks of Insider Self-Dealing

Since its 2015 reverse merger, Predictive has paid over $120 million in cash and stock to acquire 7 companies (including its 49% minority stake in an entity called Juneau). We believe every single one of these acquisitions have irregularities.

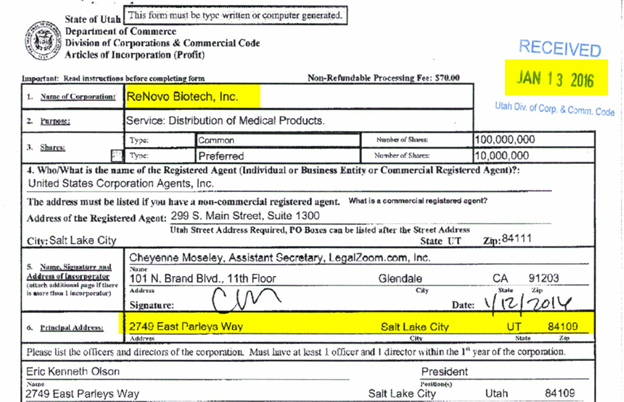

Four of the entities were registered to a handful of different suites at the exact same address where Predictive had its headquarters. For context, this is the address that was listed as Predictive’s headquarters:

And here are the registered addresses of 4 of the 7 acquisitions before they were acquired by Predictive:

From the list above, ReNovo Biotech was formed at Predictive’s address less than 2 months before being acquired for over $14 million. Inception DX existed for only about a year before also being acquired for over $14 million. In both instances the vast majority of the purchase price allocation was for “trade secrets.”

We think the real “trade secret” is who benefited from these transactions.

In some cases, the answer seems rather apparent. We found that Predictive’s CEO and President Brad Robinson was listed as a manager/managing member of LifeCode Genetics just prior to its acquisition by Predictive. We found no Predictive filing disclosing any stake held by Robinson in the entity.

We also see that CEO/President Brad Robinson and his brother Eric Robinson had played key roles in Juneau BioSciences prior to its minority acquisition by Predictive. Brad Robinson served as a VP of Juneau in 2010, where he was “responsible for developing strategic partnerships and the company’s capitalization” [Pg. 43]. Robinson’s brother, Eric, worked at Juneau from 2018-2015, serving as CFO, General Counsel, and director. Robinson did not disclose any beneficial stake in any of Predictive’s Juneau share acquisitions on behalf of himself or his brother.

Lastly, the company’s most recent acquisition, the FlagShipHealth Group, was an entity that Predictive BioTech President Tim Lacy had disclosed partial ownership in. [Pg 55] This entity is largely a sales and marketing organization. It is unclear what the final purchase price was, but Predictive has issued Flagship 12 million warrants at a $0.50 strike price, along with cash payments of $2.5 million, for its services. [Pg. 15] Today, these warrants are worth over $40 million.

None of Predictive’s acquisitions seem normal to us.

LifeCode Genetics Acquisition: Insider Self-Dealing?

On January 26th 2016, Predictive announced the acquisition of LifeCode Genetics, ultimately paying about $30 million for the entity. [Pg. 34] The press release described LifeCode in a way that made it seem like an operating business:

LifeCode, a Nevada corporation established in 2011, develops and commercializes gene-based diagnostics.

LifeCode holds strategic gene-based diagnostic assets, which can assist mothers in having healthier pregnancies and, ultimately, healthier babies.

Bradley Robinson, President, Predictive Technology Group, Inc., states, “This acquisition complements the business strategy at PRED. We look for novel assets which can improve quality of human life.”

Despite presenting LifeCode as being a company that “develops and commercializes gene-based diagnostics”, we were unable to find a website or even web mentions of LifeCode.

When searching for LifeCode on Google, limiting the date range from its formation until the day prior to the acquisition we found only one hit…where it was briefly named as a client of another related-party business that Predictive recently acquired:

We couldn’t even find a formal address from LifeCode’s Nevada corporate records. Instead, it appeared to have listed its registered agent’s office.

Nevada corporate records also show that the entity’s corporate registration had apparently lapsed up until just prior to the acquisition. On October 6th, 2015, the entity was reinstated before ultimately being acquired several months later:

Predictive’s prospectus shows that LifeCode’s sole asset looked to be a 10.169% stake in a separate entity, Juneau BioSciences, LLC [Pg. 34]. Juneau, in turn, had generated a total of zero non-related party revenue at the time (in 2016) and had total assets of only about $213,393 at the end of the year, per Predictive’s filings. [Pg. 35] (We will dive further into Juneau later.)

Predictive’s purchase price for LifeCode valued Juneau at roughly $301.9 million.

So, why would Predictive pay over $30 million for a neglected corporate entity that appeared to have no website, no formal address, no operations of its own, and only held a small stake in a money-losing enterprise with almost no assets?

On the same date of its corporate reinstatement in late 2015, Nevada corporate records listed the managing members of LifeCode. On that list is none other than Predictive CEO and President Brad Robinson:

Per a review of CEO Brad Robinson’s biography, he was listed as being a “founding member of LifeCode Genetics, LLC in 2011” [Pg. 48] but that was it. Nowhere do we see a disclosure that Robinson held a stake in Predictive’s own acquisition.

Ronald Barhorst, a current Predictive Director, also shows up as a manager of LifeCode. Barhorst joined as a Predictive director in March 2019 [Pg. 47] and therefore wasn’t an insider at the time of the acquisition. Nonetheless, the collective irregularities around this acquisition make us wonder about Barhorst’s board stewardship at the company as well.

ReNovo Biotech Acquisition: A 2-Month-Old Entity Formed at Predictive’s Own Headquarters Acquired for $14 Million Worth of “Trade Secrets”. Insider Self-Dealing?

Sometimes you find a red flag so bright that it can be seen with the naked eye from another galaxy.

On March 2nd 2016, Predictive announced its intent to acquire ReNovo Biotech, ultimately paying over $14 million for the company [Pg. F-40]. Predictive’s filings indicate more than 85% of the purchase price was allocated to “trade secrets” [Pg. 37]. From the press release, the justification for the acquisition was as follows:

PRED through this acquisition gains access to ReNovo Biotech’s cellular, tissue, biomaterial and regenerative medicine products, R&D, sales/marketing expertise, distribution channels and product candidates.

Despite the seeming broad variety of “trade secrets” gained from the acquisition, Utah corporate records show that ReNovo was formed on January 13, 2016, less than 2 months earlier.

Utah corporate records also show that ReNovo’s address was 2749 East Parleys Way – the same address as Predictive’s headquarters.

We find it immensely irregular that Predictive paid $14 million to unnamed shareholders, mostly to acquire “trade secrets”, via an entity formed less than 2 months earlier at its own address.

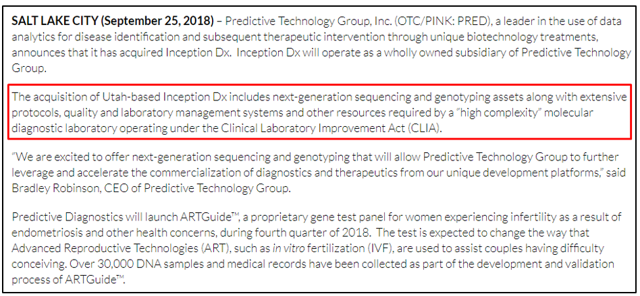

Inception DX Acquisition: Predictive Paid ~$14.2 for Another Newly Formed Entity Based Out of Its Own Address That Mainly Held “Trade Secrets”

On August 22, 2018, Predictive paid $14.2 million for Inception DX [Pg. F-14], an entity that had been formed only about a year earlier, in June 2017, at the same address as Predictive’s headquarters, per Utah Corporate records.

The assets acquired included [I] $12.3 million in “trade secrets” along with [II] $800k in cash [III] 6 pieces of lab equipment worth ~$700k, and [IV] about $440k worth of Juneau BioSciences shares that Inception DX had been given on the same day of the acquisition as part of an ‘unrelated’ agreement between Predictive and Juneau. (We’ll explain.)

A web capture of the InceptionDX website from August 6th 2018, just weeks prior to Predictive’s acquisition, shows that it was just an undeveloped template. The website consisted of nothing more than boilerplate Latin ‘placeholder’ text that is common on brand new, undeveloped website templates. Example from the web capture:

The press release announcing the acquisition was thin on details, but seemed to focus on the importance of having a CLIA lab.

Instead of buying an actual CLIA lab, the acquisition agreement shows that Inception DX only had “an initial CLIA registration and CLIA lab protocols based on modifications from those used by Taueret Laboratories.”

This was odd for 2 reasons:

- Predictive had already paid for CLIA lab protocols through an earlier deal. In July 2016, 2 years prior to the Inception DX acquisition, Predictive paid 300,000 shares to unspecified recipients for “protocols related to the operation and management of a CLIA lab and related genetic tests.”

- Predictive ended up acquiring Taueret, the company that the CLIA protocols were based on, just months later. This acquisition included a CLIA lab, rendering the CLIA protocols purchased from Inception DX seemingly useless.

We find it suspicious that Predictive paid unnamed recipients twice for mere CLIA lab protocols, only to end up buying the very lab that the CLIA protocols were based on months later anyway.

The remaining “trade secrets” detailed in the purchase agreement consisted of “Gen DB records- birth, death, or marriage records for over 31,900,000 individuals.” This asset also looks to have been moved into Inception DX from Taueret Laboratories, given that the database was proprietary to Taueret Laboratories prior to the formation of Inception DX.

As noted above, the Inception DX deal also included 400,000 shares of Juneau BioSciences. Inception DX acquired these shares on the exact date of the acquisition as part of an ‘unrelated’ agreement struck between Predictive and Juneau.

That agreement called for Juneau to use Inception DX’s CLIA lab in exchange for an immediate payment of 400,000 shares to Inception DX. Again, Inception didn’t have a CLIA-certified lab, nor ever ended up getting one as far as we can tell.

In other words, Predictive negotiated a deal with Juneau to have Juneau give Inception DX 400,000 shares of Juneau to use a lab that didn’t exist, and then acquired Inception DX later that day, using the 400,000 shares as a partial rationale for the acquisition. (To pose an obvious question: why wouldn’t Predictive just have negotiated to be paid the Juneau shares directly?)

Our suspicions are punctuated by the fact that every one of these entities (Predictive, Inception DX, Juneau, and Taueret) shared the same address: 2749 Parleys Way, Salt Lake City, Utah. Talk about circular dealing!

Inception DX Acquisition: 90% of the Purchase Price Went to Unnamed Individuals in the Caymans

This all begs the question, why would Predictive pay over $14 million for a newly-formed entity with only [A] cash and lab equipment worth $1.5 million, and [B] some assets apparently shuffled in from other entities based out of Predictive’s same address?

Deal records show that 90% of the acquisition value went to an entity in the Caymans with unnamed owners.

(Image by author, sourced from Pg. A-1)

We reached out to Predictive’s investor relations to gain more clarity on who the shareholders of Inception DX Cayman were, but the IR rep was unable to provide them.

We also reached out to the company to ask whether all of its acquisitions were truly arms-length, and have not heard back as of this writing. We will update this if we receive a response.

We encourage the company to provide the investing public with details of the shareholders of this Cayman entity (and of the company’s other acquisitions), as such information could easily clarify whether any related party dealings took place in these transactions.

Juneau BioSciences Acquisition: A Tiny Company with Deep Connections to Predictive’s CEO And His Brother

Next let’s turn to Juneau Biosciences, a company that develops genetic tests related to women’s healthcare. [Pg. 48] In particular, Juneau has been developing a test for endometriosis called the ArtGuide, which it hopes to commercialize this year.

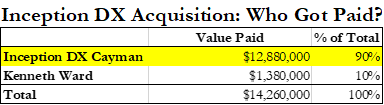

Juneau was formed in 2006 and is a small company with limited financials. The 2017 balance sheet reported total assets of just $183,190 and liabilities of $2.647 million. [Pg. 35]

Predictive’s filings include Juneau’s 2016 and 2017 financials, which show that all revenue was related-party. The company reported a loss in each year: [Pg 36]

Predictive’s auditor recently noted Juneau’s troubled financial state [Pg. 1]:

The Company’s lack of liquidity and recurring operating losses raise substantial doubt about its ability to continue as a going concern.

We contacted a former employee who worked with a related company via LinkedIn, asking to speak as part of our due-diligence. He said that Juneau had about 5-6 dedicated employees by 2013, focused primarily on endometriosis research. By all measures, it was a modest organization.

Despite its small size, the company seems to have been significantly influenced by Predictive CEO/President Brad Robinson and his brother Eric Robinson.

Per Brad Robinson’s bio we see that he previously served as the VP of Business Development for Juneau starting in 2010, and “was responsible for developing strategic partnerships and the company’s capitalization.” [Pg. 43]

We also found that Eric Robinson had served as Juneau’s General Counsel, Chief Financial Officer, and director from 2008 to 2015.

Juneau BioSciences Acquisition: Predictive Has Paid Over $50 Million For Its Minority Ownership in Juneau, and is Expected to Make Another $12 Million in Cash Payments By 2021

Despite its modest size and apparent precarious financial state, Predictive has directed a tremendous amount of money toward Juneau, starting as early as 2013. [Pg. F-18] Since that time, we calculate that Predictive has paid over $22 million in cash and stock to purchase shares from unnamed shareholders and debtholders of Juneau and to support Juneau’s various obligations.

Predictive has also added to its Juneau stake by acquiring 2 other companies that held shares of Juneau, including a ~$30 million purchase of LifeCode Genetics, an entity whose apparent sole asset was a stake in Juneau.

Finally, Predictive’s minority 49% stake in Juneau hasn’t even been fully paid. The company is slated to pay roughly $12 million in monthly cash payments between now and 2021 in order to purchase additional Juneau shares. [Pg. 1]

Despite all the cash and stock that has been directed into modestly-sized Juneau, Predictive’s economics on the deal leave something to be desired. It is expected to split net profits that come out of the Juneau relationship 50/50 [Pg. 8], and is obligated to pay another $2.5 million worth of stock if there is ever a commercial first sale of Juneau’s endometriosis test, along with other milestone payments. [Pg. 8]

Juneau BioSciences: Did Predictive Buy A Potential Game Changer in Endometriosis Diagnostics Testing – or a Dud?

So, what has Predictive purchased using all that cash and stock?

Juneau is hoping that its ArtGuide test, which is currently in development, will revolutionize diagnostic testing for endometriosis, a painful disorder that affects millions of women and can be associated with infertility. Currently, there is no blood test that can identify endometriosis through DNA biomarkers.

The ArtGuide test would be considered a Laboratory Developed Test which will not undergo FDA testing. This will make reimbursement a challenge, leaving the company to target self-pay markets [Pg. 9 & Pg. 6].

In October 2018, Predictive announced that it is beta testing its ArtGuide test and hopes to launch it in Q2 of this year. Despite these forward moving signs, industry experts and the company’s own missed historical milestones give us strong doubts about whether this latest announcement truly represents a leap forward toward rapid commercialization.

Juneau BioSciences: Proposed Endometriosis Test Already Being Met with Industry Skepticism

When we saw Juneau’s October announcement about the ArtGuide test’s imminent commercialization pathway, we reached out to several endometriosis experts to get their take. They were unanimously skeptical.

This is what the CEO of the World Endometriosis Society (operators of Endometriosis.org) told us:

We did see the press release from Juneau BioSciences last year.

However, there has been no peer reviewed publication in the scientific literature about this ‘discovery’, its methodology, population(s) tested, sensitivity/specificity of the test, types of endometriosis detected, etc.

Nor is there any evidence/basis to the claim that ‘27 million women in the United States are symptomatic of endometriosis’.

This joint statement from the World Endometriosis Society and the World Endometriosis Research Foundation remains status quo.

The ‘joint statement’ is referring to a March 2018 a consensus statement put out by both the World Endometriosis Research Foundation (WERF) and the World Endometriosis Society (WES), two of the largest endometriosis research organizations. The statement looks to have been aimed at debunking a slew of claims by various proprietors to have ‘solved’ the endometriosis biomarker conundrum (the very type of claim being made by Juneau). From the statement:

To date there are no data that definitively support any claims of a validated diagnostic test – or any combinations of tests – to accurately diagnose endometriosis or provide monitoring of disease progression/regression… There are presently no endometriosis diagnostic or treatment biomarkers that have been demonstrated to have the validity and reliability necessary to be used in routine clinical diagnosis or care.

We also contacted the Endometriosis Research Center (endocenter.org) and received this response:

Thanks for reaching out to the ERC. We are aware of blood tests for diagnosing endometriosis. Although they provide a good step towards learning more about this disease, there are concerns. We continue to monitor the research.

The Feinstein Center for Medical research wrote the following to us:

The short answer is due to the complexity of the genetics involved in endometriosis (based on VERY large studies) – it seems unlikely genetics alone will successfully diagnose this complex condition.

Juneau BioSciences: Lackluster Product Development Track Record Thus Far

Several historical false starts by Juneau lead us to believe that the skepticism expressed by the experts we contacted is likely to be well-founded.

2013: The company announced, “After five years in research and development, Juneau is now poised to launch their novel EndoRisk test for women experiencing infertility.” Nearly six years later, the test still has not launched.

2015: Juneau representatives participated in a webinar describing the difficulties associated with coming up with a test and suggested that they were at least a couple of years out from identifying a gene.

2016 (January): Predictive put out marketing materials indicating that Juneau’s EndoRisk test would be commercialized imminently, with an “initial launch to fertility clinics” slated for that same quarter. They also targeted a launch to the “general primary care provider and OB/GYN market” slated for later in the year. Again, the EndoRisk test has still yet to be released.

(Note that the marketing materials show the company targeted launching 4 other tests that same year, none of which look to have been released.)

2016 (April): The company’s corporate entity apparently lapsed, as a reinstatement filing was made.

2017 (October): A Facebook post apologizes for going dormant and then says the company needs more study participants.

2018 (February): Predictive announces a “crucial milestone” in the development and commercialization of ARTGuide:

After testing thousands of women as part of the development program, the Company now expects commercial launch of the ARTGuide™ infertility test in the United States during Q3 2018.

2018 (October): Press release: ArtGuide is being beta tested and company claims it “will be made available to the entire US infertility market in the second quarter of 2019.”

All told, we are highly doubtful that this test will represent a near-term commercial success for the company.

Taueret Laboratories Acquisition: Yes, This Was Also Based Out of the Same Address (But, at Least This Acquisition Had a CLIA Lab, Equipment, and its Beneficiaries are Disclosed)

On August 22, 2018, Predictive acquired “DNA and Ancestry Assets” from Taueret Laboratories, LLC for over $15 million. [Pg. 38] The press release announcing the acquisition seemed to acknowledge that the acquisition was slightly off-center from Predictive’s business strategy:

Although our focus remains on endometriosis, the acquisition of these key DNA and ancestry assets significantly strengthens our development platforms to commercialize gene-based diagnostics and biotechnology treatments for other debilitating diseases

The DNA biobank was described in the purchase agreement in less-than-exhilarating terms [Pg. 20]

These samples were all collected more than 15 years ago. A precise inventory of samples is not feasible, and some samples have been consumed or have become degraded…The collection is useful for pilot studies and confirmatory studies, but no warranty is made as to their relevance or usefulness for any particular disease discovery target.

Corporate filings as far back as 2008 show that Taueret’s official address was 2749 East Parley’s Way, Suite 100, Salt Lake City, Utah. The address was the same address of Predictive. Here is a filing from 2013 showing this as well:

And again, here is an SEC filing showing Predictive operating out of the same address a year and a half PRIOR to the acquisition of Taueret’s DNA assets:

Following the purchase of DNA assets, Predictive later paid another $9.7 million in cash to purchase the Taueret entity, [Pg. 1] with about $8.5 million of that amount deferred until 2020. [Pg. 5] The remaining purchased assets largely consist of lab equipment, lab certifications, 3 provisional patents and 1 utility patent relating to preeclampsia, and 452,000 shares of Juneau BioSciences.

We spoke with several former Taueret employees that we contacted through LinkedIn who said the business had about 15 employees around 2012-2013. The company primarily processed DNA micro-array samples for Ancestry.com, but then lost the business and was forced to lay off much of its workforce.

The company also had later performed testing for several clients, but that line of revenue became impaired due to changes in reimbursement for its main test.

Note that Taueret was the only transaction where we were able to see who received proceeds from the transactions (in Exhibit B of the acquisition agreement and Exhibit A of the intellectual property agreement) and the beneficiaries look to be the stated owners/operators of the business.

Part III: The People Behind Predictive

Predictive’s Chairman (Until Late 2018) and Two Other Key Early Backers Had Previously Been Charged with Securities Fraud

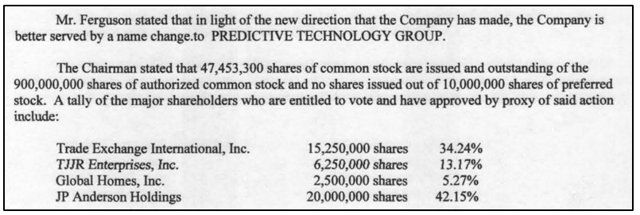

Nevada corporate records show the early holders of Predictive from its outset as a public company in 2015. Based on that list, we found that 89.56% of Predictive’s early shares were held by entities run by 3 individuals that had been previously charged with securities fraud.

Merle Ferguson/Susan Donohue. The top two entities from the above (Trade Exchange International and TJJR Enterprises) collectively held 47.41% of Predictive at the time. The entities were registered to Ferguson and Donohue, per Nevada Corporate records.

Ferguson served as Chairman of the board of Predictive, and continued serving in that capacity until his replacement as Chairman in October 2018. Ferguson then served as a director until March 18th of this year, when he was replaced by former Senator Orrin Hatch.

In 2001, both Ferguson and Donahue were charged by the SEC with securities fraud. SEC prosecutors alleged that the pair had issued multiple false and misleading press releases about a company where they served as President/CEO and treasurer respectively. Both were ultimately fined and/or enjoined from future violations.

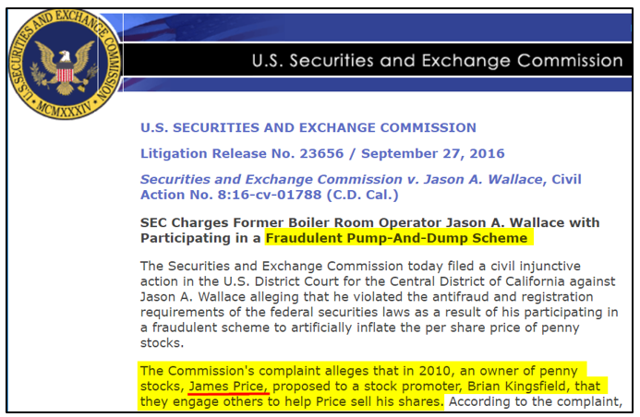

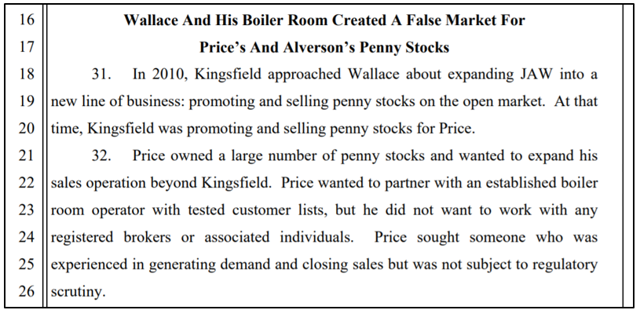

James Price was another key early holder of Predictive, controlling 42.15% of the company through the entity JP Anderson Holdings.

In 2016, not long after Predictive became public on the OTC markets via reverse merger, the SEC charged a boiler room operator for allegedly using illegal tactics to help Price unload shares of his other penny stocks.

The boiler room operator was also charged criminally and pled guilty.

As shown above, Price was featured prominently in the SEC boiler room complaint but was not charged directly. He was charged by the Illinois Securities Department however, for similar allegations of securities fraud in relation to selling of penny stocks. Price ultimately settled those charges.

We find it immensely disconcerting that the vast majority of Predictive shares were controlled by individuals alleged by various regulators to have been engaged in pump and dump schemes, issuing false press releases, or boiler room sales, including Predictive’s Chairman.

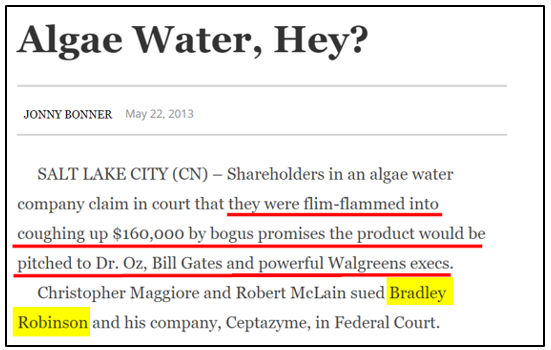

Predictive’s CEO/President Bradley C. Robinson Left Some Things Off His Official Biography, Including Allegations of Securities Fraud and Allegations of Non-Compliant Marketing of a Medical Product

Beyond its key backers, we explored Predictive CEO/President Bradley Robinson’s track record in more detail and discovered several red flags and omissions.

Around 2010, Robinson led a company called Ceptazyme (and a related company called Zus Health) which sought to market an algae water product grown in distilled water that the company claimed could lower cholesterol.

In an investor lawsuit, Robinson was alleged to have engaged in securities fraud relating to the business. The complaint alleged that Robinson made grandiose claims about the product’s efficacy and claimed that it would be pitched by Dr. Oz, the Gates Foundation, and others. None of the claims ever materialized. Per a local news article that covered the story:

We presume the lawsuit settled, as the last court document we found indicated that a resolution was pending.

The algae company had also struck a partnership with a public company to market the product, but the deal quickly fell apart, with the public company also suing Robinson over allegations that his company:

Failed to market the Registrant’s product in a manner compliant with state and federal regulations, and allowed its distributors to make claims and representations that were not in compliance with applicable regulations, among many other breaches.

Those allegations strike us as extremely prescient given Predictive’s current business.

The charges between the two companies were ultimately settled without any admission of wrongdoing.

Aside from the Ceptazyme debacle, Robinson also left his role at ActiveCare off his official biography. ActiveCare was a public company focused on diabetes management. Robinson and his brother Eric served at ActiveCare as Director and CFO/General Counsel/Director respectively. They resigned simultaneously about 8 months before the company declared bankruptcy in 2018.

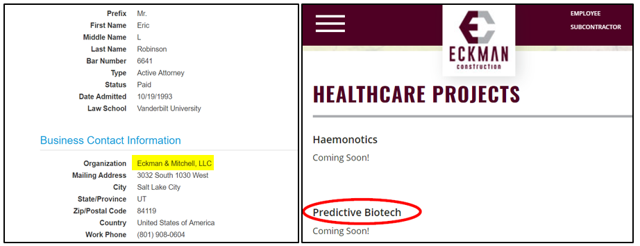

All in the Family: The CEO’s Brother Represents a Construction Company Hired By Predictive

Speaking of brotherly affiliations, Predictive CEO/President Brad Robinson and his brother Eric have been involved in multiple business interests. As we noted earlier, both Brad and Eric had key roles a Juneau, a company that Predictive has had deep business ties with. Both brothers also had brief roles at public company ActiveCare (which went bankrupt), and both were involved in Specialized Health Products, Inc., led by their uncle and Father.

When we see family members that regularly engage in business with one another, especially when those businesses overlap with public company interests, we look for potential undisclosed related-party transactions.

Eric Robinson is an attorney by trade. A check of his Utah bar profile shows that he currently works at Eckman & Mitchell, a construction firm. On the Eckman Construction website, we see that an upcoming project is planned for…Predictive Biotech

We find it rather odd that Robinson’s diverse interests — ranging from construction to laboratory science — overlap with a public company run by his brother. Nonetheless, if Eckman has launched this project (or does in the future) we hope the company will disclose the compensation paid on this deal.

Predictive’s CEO/President Bradley C. Robinson: Official Biography Doesn’t Tell the Full Story

Much like the details omitted from CEO Brad Robinson’s official bio, the items included also raise questions. For instance, here are several claims that we have taken the “shine” off of and “un-spun”:

Claim: Robinson’s official biography states he “was the CEO and co-founder of Infusive Technologies, LLC from November, 2004 until September, 2008 when it was acquired by Sagent Pharmaceuticals, Inc.”

Un-Spun: Sagent acquired Infusive’s key assets relating to a new syringe technology (not the whole company.) Sagent paid $1.25 million up-front for the technology, then was slated to pay additional amounts upon achievements of certain milestones, including upon receipt of an FDA 510K device approval.

The Sagent deal ended in litigation, however. According to a 2011 lawsuit filed by Robinson’s entity, Sagent failed to advance the commercialization of the technology.

Sagent countersued, detailing how the device was rejected by the FDA with a deficiency letter. Sagent alleged that Robinson botched the 510k application, and that he also concealed material facts from Sagent including [I] knowledge that former employees did not properly assign their patents to Infusive, and [II] knowledge that international patent applications had been botched as well.

The parties ultimately settled on undisclosed terms. Robinson’s entity, Infusive, was apparently allowed to keep the FDA-rejected syringe technology, because Infusive later took the technology public via reverse-merger in the entity that ultimately became Predictive! [Pg. 20]

(Merle Ferguson, the SEC-alleged securities fraudster who became Predictive’s Chairman, was CEO of the entity at the time in 2014.)

Claim: Robinson’s official biography states that he “studied accounting at the University of Utah and received a Masters of International Management from the Thunderbird”.

Un-Spun: This is true, but while Robinson studied at the University of Utah, he never actually graduated. He later received an executive MBA at Thunderbird, which doesn’t require an undergraduate degree. A Thunderbird admissions officer told us that the undergraduate degree requirement can be “surpassed by the quality and quantity of professional work experience a student had at that time.”

Claim: Robinson’s official biography states that he was a “Director/Co-Founder of Specialized Health Products, Inc. (“SHPI”), acquired by C.R. Bard, Inc.”

Un-Spun: This is also true, but SHPI was actually run by Robinson’s uncle, who served as Chairman and CEO. Robinson’s Dad served as the CFO. SEC filings show that Robinson was around 24 years old when he joined, an apparent fresh college drop-out at the time, yet was given a board seat at the family business.

And that pretty much brings us full circle.

So who audits this total gem of a company?

Predictive’s Auditor: Have You Ever Heard of BF Borgers? Neither Had We

Predictive has gone through several auditors in recent years, which we generally find to be a red flag. On February 28th 2017, the company announced that it was appointing Sadler, Gibb & Associates, LLC (“Sadler”) as its auditor, replacing Stevenson & Company CPAS.

Predictive switched to BF Borgers around 2018. BF Borgers is a roughly 25-person firm based in Colorado and can be found through the website www.denveraudit.com. If you’ve never heard of BF Borgers, we won’t hold it against you – neither had we. You are unlikely to find their clients anywhere on the S&P 500 (or any major national exchange for that matter).

Most of BF Borgers’ clients are sub $20 million market cap companies that are listed on the pink sheets, including esteemed firms such as:

- Kisses From Italy, a restaurant chain based in Fort Lauderdale, Florida that aspires to list on the OTC market if approved to do so. [Pg. 1]

- The Lingerie Fighting Championships (Pink:BOTY), with a market cap of $200 thousand as of this writing, and which is exactly what it sounds like. (Video Link)

Here is a picture of BF Borgers’ headquarters, courtesy of Google Maps:

We do not believe BF Borgers is adequately suited to effectively audit Predictive’s fairly complex entity structure, which includes its multiple acquired subsidiaries.

Conclusion: Our Predictions for Predictive

As one former employee of a subsidiary wrote us about Predictive’s management:

I don’t trust them implicitly, their motives never seem entirely open, there’s always a ‘play’ in everything they do.

We couldn’t have said it better ourselves. A company displaying hallmarks of insider self-dealing that also seems to be taking advantage of vulnerable pregnant women and elderly patients suffering from chronic pain strikes us as a terrible investment opportunity. We have some predictions for how things will play out next:

- We think Senator Orrin Hatch may resign. We have seen no indication that he is aware of any of the business issues here. (As a recently retired member of the Senate, we figure he may have thought he was just getting paid for some pretty light board work at an interesting local company.)

- We predict the company will issue some sort of threatening press release that dodges most of the substance of this report.

- We expect the company to be slated for a massive repricing of its stock in the near-term and potential regulatory intervention over time.

Safe investing to all.

[1] Predictive later changed its address from 2749 Parleys Way, Salt Lake City, Utah to 2735 Parleys Way, Salt Lake City, Utah sometime between June 8, 2017 and June 29, 2018, per SEC/OTC filings.

Corrections: A previous version of this report stated that Dr. Mike Van Thielen operated a series of pain management clinics and had a PhD in holistic medicine. Dr. Van Thielen operates 1 pain management clinic and has a PhD in holistic nutrition.

Disclosure: We are short shares of Predictive

Additional disclaimer: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

14 thoughts on “Predictive Technology: 95%+ Downside on CEO and Former Chairman’s Past Securities Fraud Allegations, Acquisitions That Reek of Insider Self-Dealing and Dubious “Miracle Cure” Sales Tactics”

Comments are closed.

SSCI no longer uses predictive. Its great to warn others about their bad practices!!!

This was terrific reporting. I would like talk about how I got introduced to this company and some of the red flags I found along the way when I was conducting research. I work at a shipping company that goes to predictive biotech. I noticed an uptick in the volume of packages that they were shipping. I also noticed that they were expanding their operation by taking over the whole floor that their office operated in. Those factors led me think that this could be a good investment. However, I noticed some red flags as well. I too noticed the large assets on their balance sheet like Trade secrets, and equity method investments which when I went through their 10-Q I didn’t get much explanation for what these assets were. Another red flag was when I tried to call them to get information about where they get their stem cells. I was unable to get ahold of anyone at their office and when I left a message no one contacted me back.

However, besides the red flags i picked up on my naivete and my lure of their optimistic press releases led me to invest anyways. I got lucky and still made a healthy return on my investment. I got out when their EV/Revenue multiple far exceeded their peers. I was looking to get back in when the price came down but thank goodness I read this report before that happened. Thank you again for your excellent reporting.

P.S. I am a finance student whom has been inspired by this report and would love to learn more about you guys.

BIG NEWS!

https://www.preeclampsia.org/

Bill Gates behind this, too—> scroll down to Scientific Advisory Council

https://www.preeclampsiaregistry.org/about-us

SHAREHOLDER REBUTTAL TO HINDENBURG!

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=150224513