Summary: Eros International (NYSE:EROS)

- An entity outside Eros’s corporate structure both receives short term loans from Eros and simultaneously records large payables to an Eros related party.

- The entity, Ayngaran International Films Private Limited (“AIFPL”) appears to report very little other financial activity.

- AIFPL’s short-term loans & advances represent 249x its annual revenue, and trade payables represent 289x its annual revenue.

- We believe the above raises new red flags relating to Eros’s receivables accounting.

Today we intend to provide support for longstanding questions posed by short sellers relating to Eros’s potentially misleading accounts receivables. Eros has consistently maintained a large uncollected accounts receivables balance which has indicated at the very least that the company has unusual difficulty in collecting its revenue. At worst, the balance could be indicative of illegitimate revenue transactions or ‘round tripping,’ a means of boosting the operating metrics of a company without ultimately providing any real economic benefit.

Accounting Questions

In an earlier report on Eros (NYSE:EROS), we had outlined suspicions relating to Eros Television Private Limited, an entity that appears to sit outside of the Eros corporate structure and records little financial activity with the exception of a series of advances and payables.

Recently, we learned of yet another entity, Ayngaran International Films Private Limited (“AIFPL”) that demonstrates a similar pattern: it appears to sit outside the Eros corporate structure and shows little financial activity with the exception of a series of large advances and payables. The added insight gleaned from this example is that (i) a recent annual Director’s Report filing clearly identifies Eros as the key lender to AIFPL; and (ii) the filing clearly identifies “related party” as the primary benefactor of AIFPL’s payables. (as presented in detail below). Related party entities are later defined in the filing and consist of Eros subsidiaries or related entities/individuals.

In short, the filing seems to show that Eros lends to AIFPL which then simultaneously owes large payables to Eros controlled or related parties. AIFPL records little other financial activity. We believe this evidence renews questions relating to Eros’s receivables accounting practices.

Who Owns AIFPL?

In order to demonstrate that AIFPL sits outside the Eros corporate structure, we pulled the full equity ownership of the entity from the Indian corporate filings database. AIFPL is shown as having 3 owner/directors who collectively own 100% of the equity in the entity.

Neither Eros nor any of Eros’s corporate entities own any equity in AIFPL, as shown in the linked ownership table above.

AIFPL’s 2016 Directors Report

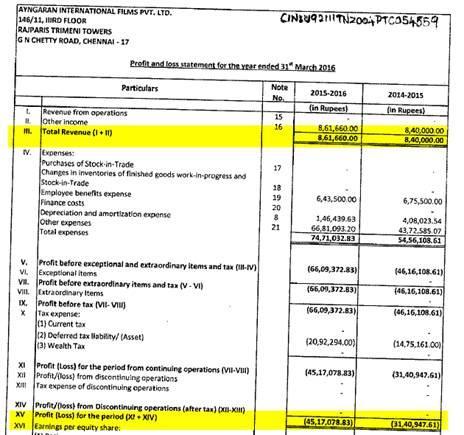

The 2016 annual directors report for AIFPL came out in early August in the Indian Ministry of Corporate Affairs filings database. As per page 2 of the report, the entity recorded revenue of only INR 861,660 and a modest loss of INR 4,517,078.

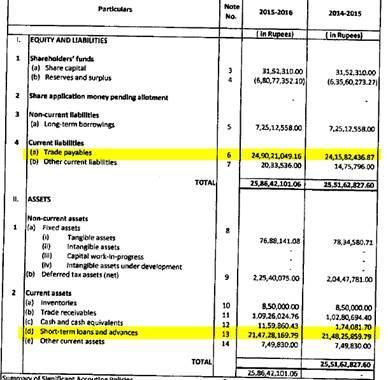

Despite the minimal top line and bottom line activity, on page 1 of the report we see that the entity recorded a whopping INR 249,021,049 in trade payables and INR 214,728,169 in short term loans and advances, as shown below:

We find the above to be a jarring fact pattern. We simply cannot envision a reasonable scenario where a company’s trade payables are 289x larger than its annual revenue. Similarly, we believe it is odd that a lender would extend a short term loan representing 249x the borrower’s annual revenue.

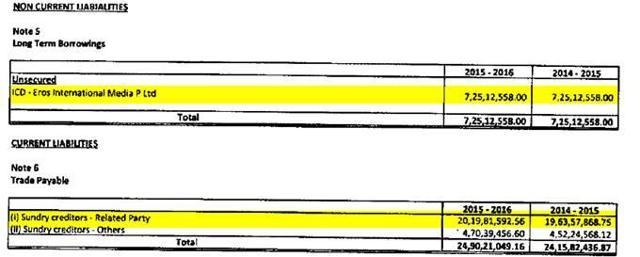

As shown in later notes in the Director’s Report on page 6, the loan is explicitly mentioned as originating from “ICD – Eros International Media P Ltd”. ICD stands for inter-corporate deposit, a form of company to company loan that is prevalent in India. Similarly, the majority of trade payables are shown as being to a related party:

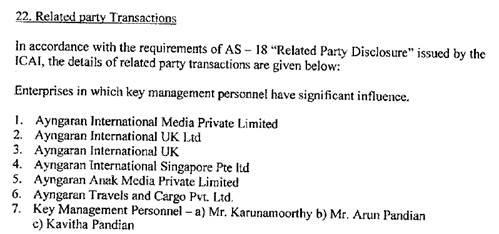

As defined later in the report, related party entities consist of 4 Eros subsidiaries (per Eros’s 20-F filing) or related parties of those subsidiaries connected through key management personnel of AIFPL:

The two entities not owned by Eros in the list above (Ayngaran International Singapore Pte ltd and Ayngaran Travels and Cargo Pvt. Ltd) are connected to Eros through AIFPL’s key management personnel:

- Kumarasamy Karunamoorthy is listed as a key management person of the AIFPL entity. He is also a current director of Eros-owned Ayngaran International UK Ltd; and

- Arun Pandian, listed as a key management person of AIFPL, is a producer associated with the same Eros-owned Ayngaran International UK Ltd. Kavitha Pandian (the other listed key management person) is his daughter.

What Now?

We have reached out to Eros’s investor relations contact and to CEO Jyoti Deshpande last week seeking comment on the economic rationale for the business purposes behind the AIFPL transactions. As of this writing, we have not heard back, but will update this should we hear clarification from the company.

We have also written to the SEC on this matter and will likely write to Eros’s auditors, Grant Thornton India LLP. In the meantime, we urge caution to investors in Eros.

Disclosure: I am/we are short EROS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

2 thoughts on “Eros International: New Receivables Accounting Red Flags”

Comments are closed.