- Icahn Enterprises (IEP) is an ~$18 billion market cap holding company run by corporate raider and activist investor Carl Icahn, who, along with his son Brett, own approximately 85% of the company.

- Our research has found that IEP units are inflated by 75%+ due to 3 key reasons: (1) IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables (2) we’ve uncovered clear evidence of inflated valuation marks for IEP’s less liquid and private assets (3) the company has suffered additional performance losses year to date following its last disclosure.

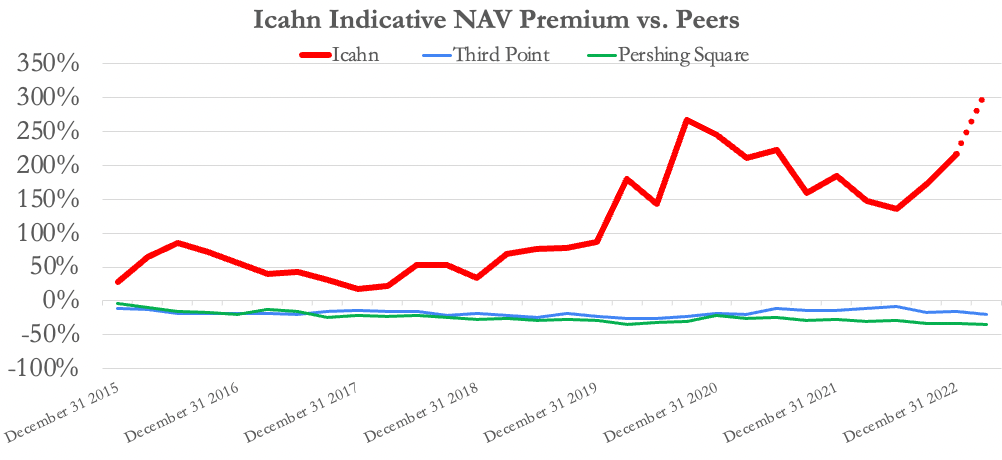

- Most closed-end holding companies trade around or at a discount to their NAVs. For comparison, vehicles run by other star managers, like Dan Loeb’s Third Point and Bill Ackman’s Pershing Square, trade at discounts of 14% and 35% to NAV, respectively.

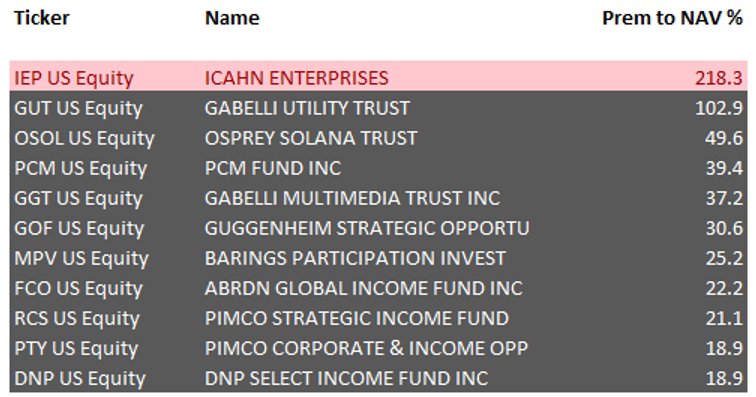

- We further compared IEP to all 526 U.S.-based closed end funds (CEFs) in Bloomberg’s database. Icahn Enterprises’ premium to NAV was higher than all of them and more than double the next highest we found.

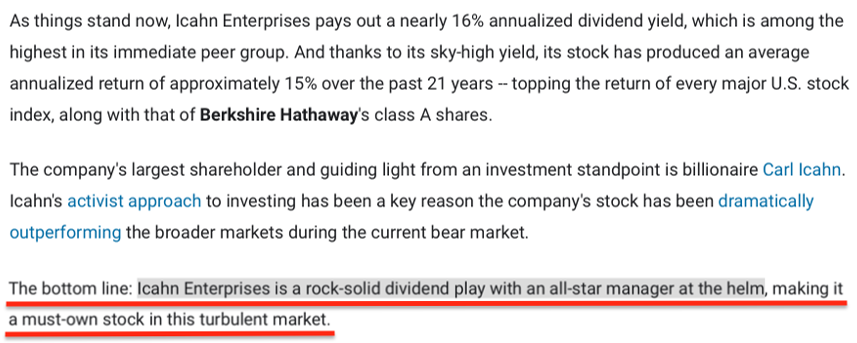

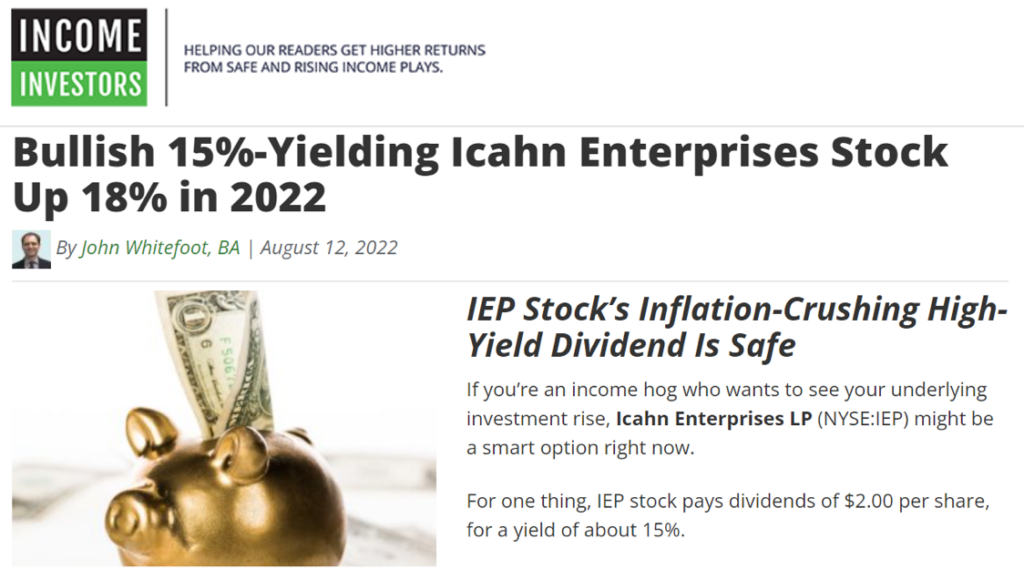

- A reason for IEP’s extreme premium to NAV, based on a review of retail investor-oriented media, is that average investors are attracted to (a) IEP’s large dividend yield and (b) the prospect of investing alongside Wall Street legend Carl Icahn. Institutional investors have virtually no ownership in IEP.

- Icahn Enterprises’ current dividend yield is ~15.8%, making it the highest dividend yield of any U.S. large cap company by far, with the next closest at ~9.9%.

- As a result of the company’s elevated unit price, its annual dividend rate equates to an absurd 50.5% of last reported indicative net asset value.

- The company’s outlier dividend is made possible (for now) because Carl Icahn owns roughly 85% of IEP and has been largely taking dividends in units (instead of cash), reducing the overall cash outlay required to meet the dividend payment for remaining unitholders.

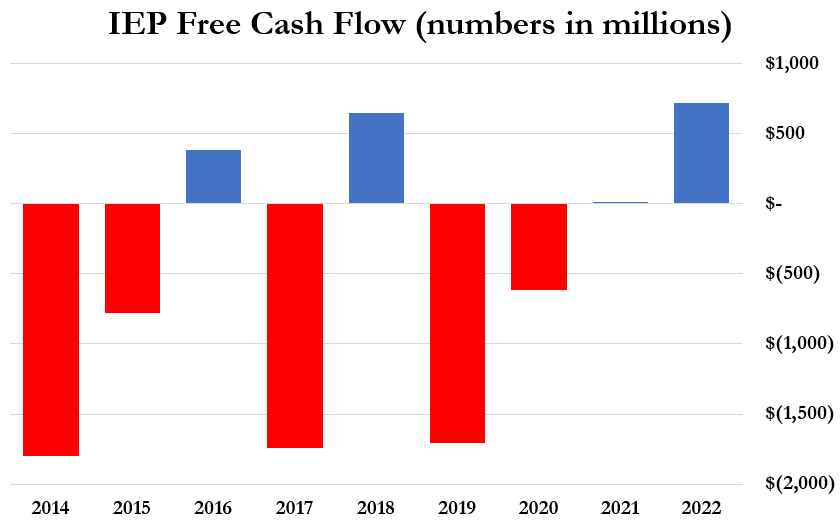

- The dividend is entirely unsupported by IEP’s cash flow and investment performance, which has been negative for years. IEP’s investment portfolio has lost ~53% since 2014. The company’s free cash flow figures show IEP has cumulatively burned ~$4.9 billion over the same period.

- Despite its negative financial performance, IEP has raised its dividend 3 times since 2014. IEP’s most recent dividend increase came in 2019, when it raised quarterly distributions from $1.75 to $2.00 per unit. IEP’s free cash flow was negative $1.7 billion in the same year.

- Given that the investment and operating performance of IEP has burned billions in capital, the company has been forced to support its dividend using regular open market sales of IEP units through at-the-market (ATM) offerings, totaling $1.7 billion since 2019.

- In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors. Such ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one “holding the bag”.

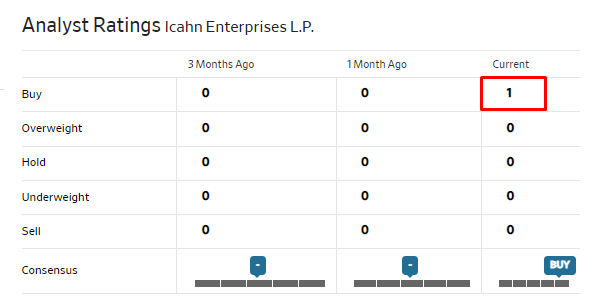

- Supporting this structure is Jefferies, the only large investment bank with research coverage on IEP. It has continuously placed a “buy” rating on IEP units. In one of the worst cases of sell-side research malpractice we’ve seen, Jefferies’ research assumes in all cases, even in its bear case, that IEP’s dividend will be safe “into perpetuity”, despite providing no support for that assumption.

- Since 2019, one bank has run all of IEP’s $1.7 billion in ATM offerings: Jefferies. In essence, Jefferies is luring in retail investors through its research arm under the guise of IEP’s ‘safe’ dividend, while also selling billions in IEP units through its investment banking arm to support the very same dividend.

- Adding to evidence of IEP’s unsustainability, we estimate that IEP’s last reported indicative year-end NAV of $5.6 billion is inflated by at least 22%, due to a combination of overly aggressive marks on IEP’s less liquid/private investments and continued year to date underperformance.

- In one example, IEP owns 90% of a publicly traded meat packaging business that it valued at $243 million at year-end. The company had a market value of only $89 million at the time. In other words, IEP marked the value of its public company equity holdings 204% above the prevailing public market price.

- The mark is even more irregular given that IEP bought over a million shares of the company in December before immediately writing up the value of those shares by ~194% in the same month.

- In another instance, IEP marked its “Automotive Parts” division at $381 million in December 2022. Its key subsidiary declared bankruptcy a month later.

- IEP reported $455 million in “real estate holdings” in its most recent quarter. The reported values in this segment have been remarkably stable for years despite declining net income and despite including (i) the Trump Plaza in Atlantic City, which was razed to the ground in 2021; (ii) a country club that became nearly insolvent in 2020 before ownership reverted to its members in 2021; and (iii) a lack of transparency on other assets and valuations.

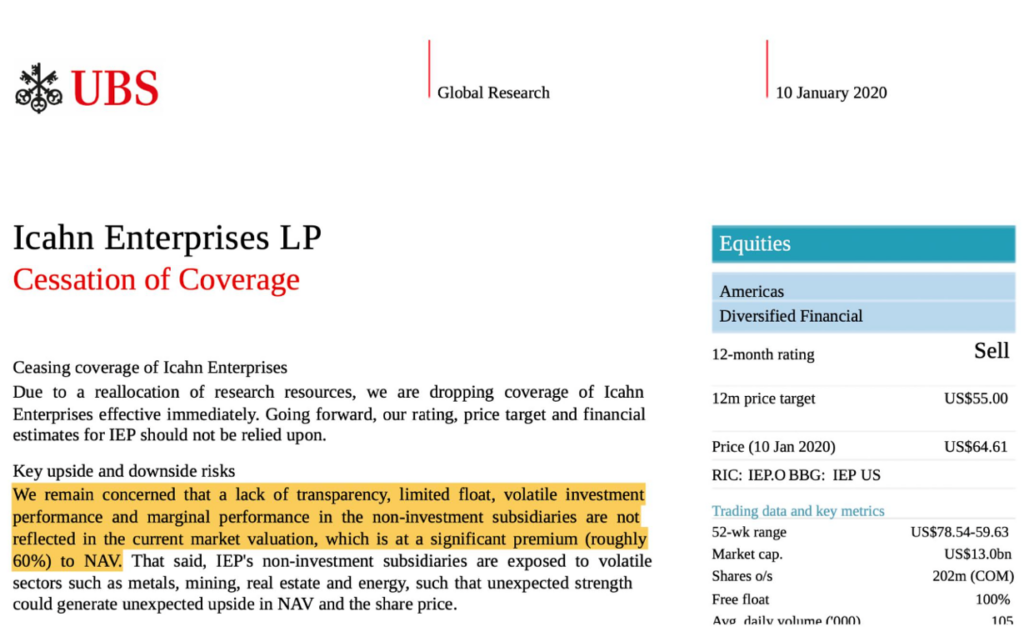

- The irregular valuation marks fit a pattern: In January of 2020, UBS dropped coverage of IEP citing a “lack of transparency” following its research showing marks that were “divergent from their public market values”, among other issues.

- Beyond aggressive marks, Icahn’s liquid portfolio has continued to generate losses. Our analysis of Icahn’s latest December 2022 13-F filing indicates that IEP’s long holdings have lost ~$471 million in value year to date, despite the S&P gaining ~9.2% in the same time frame.

- IEP disclosed that its investment fund had a 47% notional short bet in its December 2022 filings. Given the positive market performance, we estimate this short bet has contributed at least a further $272 million in year-to-date losses.

- Overall, we estimate IEP’s current NAV as being closer to $4.4 billion, or 22% lower than its disclosed year-end indicative NAV of $5.6 billion. The analysis suggests that units currently trade at a 310% premium to NAV, with an annual dividend rate of 64% of NAV.

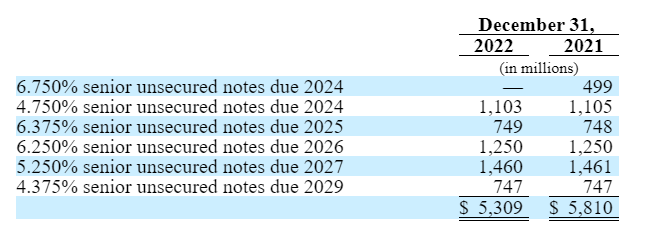

- Tightening matters further, IEP is highly levered, with $5.3 billion in Holdco debt and maturities of $1.1 billion, $1.36 billion, and $1.35 billion due in 2024, 2025, and 2026, respectively.

- IEP’s debt covenants limit the company’s financial flexibility: IEP is not permitted to incur additional indebtedness and is only allowed to refinance old debt. With interest rates having increased, IEP will need to pay significantly higher interest expenses on future refinancings.

- Carl Icahn’s ownership in IEP comprises about 85% of his overall net worth, according to Forbes, giving him limited room to maneuver with his own outside capital. We have assessed that Icahn has little ability or reason to bail out IEP with a capital injection, particularly at such elevated unit prices.

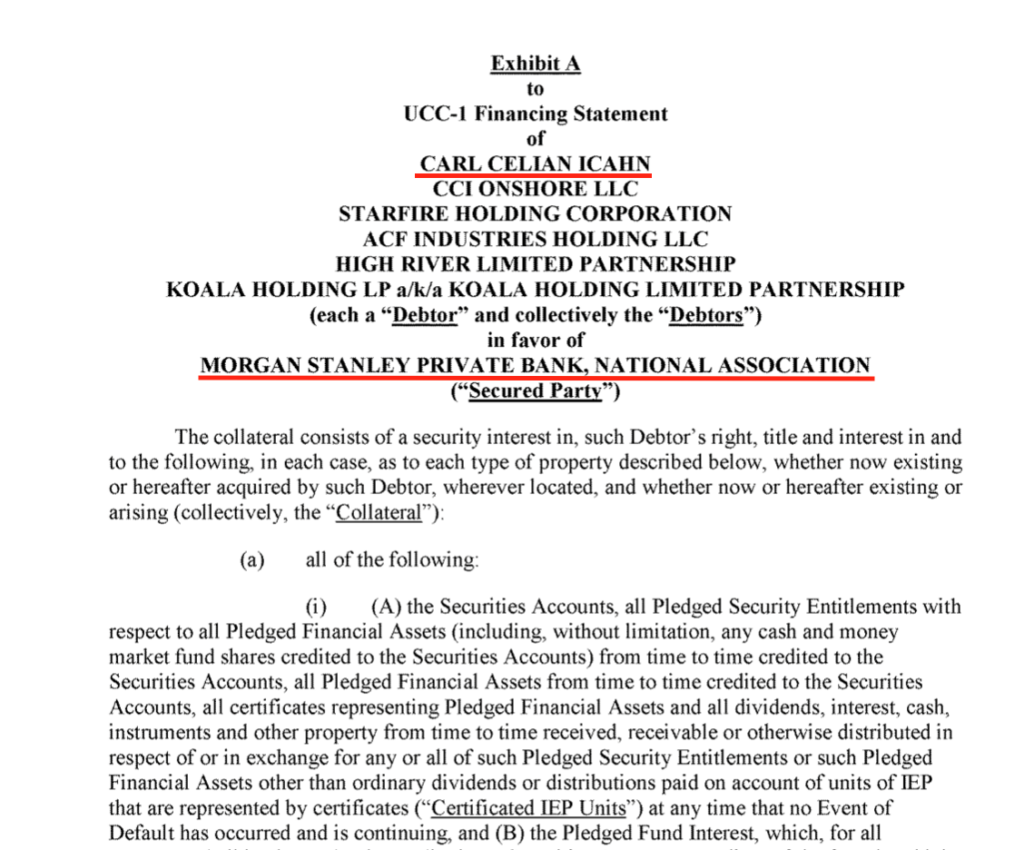

- Further underscoring Icahn’s limited financial flexibility, he has pledged 181.4 million units, ~60% of his IEP holdings, for personal margin loans. Margin loans are a risky form of debt often reliant on high share (or unit) prices.

- Icahn has not disclosed basic metrics around his margin loans like loan to value (LTV), maintenance thresholds, principal amount, or interest rates. We think unitholders deserve this information in order to understand the risk of margin calls should IEP unit prices revert toward NAV, a reality we see as inevitable.

- Given limited financial flexibility and worsening liquidity, we expect Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance.

- Overall, we think Icahn, a legend of Wall Street, has made a classic mistake of taking on too much leverage in the face of sustained losses: a combination that rarely ends well.

Initial Disclosure: After extensive research, we have taken a short position in units of Icahn Enterprises L.P. (NASDAQ:IEP). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report. Figures current as of market close on April 28, 2023.

Background And Bull Case: Collect A 15.8% Dividend While Investing Alongside Legendary Corporate Raider Carl Icahn

Carl Icahn is an iconic and legendary activist investor with a reputation for taking stakes in companies and then unlocking shareholder value, usually by accusing corporate executives of mismanagement or malfeasance and claiming to act in the interests of regular investors.

Icahn has used his reputation to fuel Icahn Enterprises, an ~$18 billion market cap NASDAQ-listed investment vehicle offering exposure to Icahn’s personal portfolio, including a mix of public and private companies such as petroleum refiners, auto parts distributors, food packaging companies and real estate. [Pg. 6]

The company began as American Real Estate Partners L.P., a publicly traded master limited partnership formed in 1987. [Pgs. 1-3] In 2007, the name was changed to Icahn Enterprises after it purchased Icahn’s private asset management business for $810 million. [1]

Carl Icahn and his son Brett manage the company and are its largest holders, with 85% of the company. Bulls believe this stake aligns Icahn’s incentives with public investors, as Icahn’s holdings in IEP comprise ~85% of his net worth, based on Forbes data.

Beyond the allure of investing with one of the most well-known names on Wall Street, the other key draw to Icahn Enterprises units has been the company’s consistent $2 per quarter cash dividend, amounting to an annualized yield of about 15.8%, giving IEP the highest dividend yield of any large cap (>$10 billion) company by far, with the next closest being a 9.9% yield, according to FactSet screening.[2]

IEP’s dividend – paid consistently for 71 quarters straight – has been the key allure for IEP’s retail investor base. [Pg. 4] The company has a history of increasing its dividends, with the current dividend of $2.00 per unit per quarter in place since Q1 2019. [Slide 4][3]

Background And Bull Case: Investment Bank Jefferies, The Only Major Sell-Side Firm Covering IEP, Has Consistently Given It A “Buy” Rating and Has Indicated To Retail Investors That The Dividend Is Safe “Into Perpetuity”

Other Retail Investor-Focused Media Outlets Have Also Focused On IEP’s Dividend Yield And Icahn’s Star Status

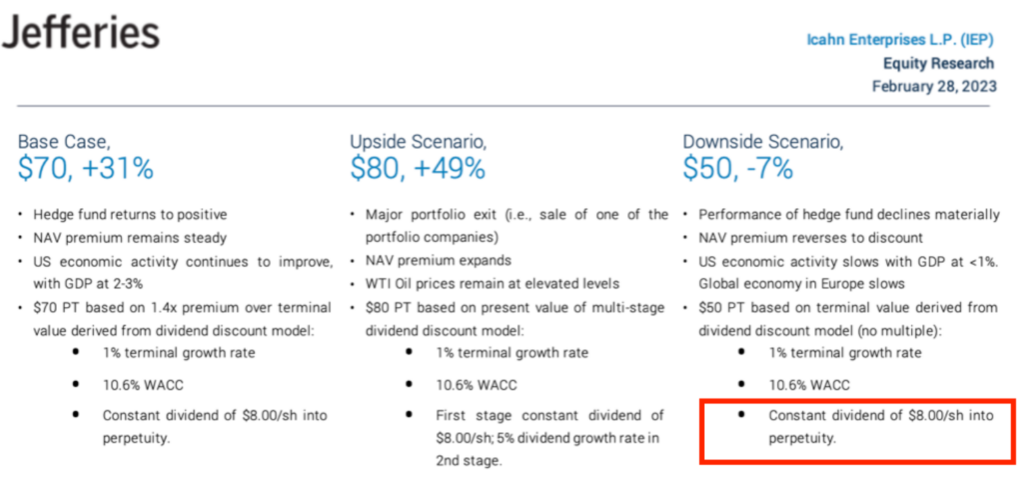

Jefferies, the only large bank covering IEP, has consistently given it a “buy” rating. It reiterated its “buy” rating in a February 2023 fourth quarter recap report.

To arrive at price targets for its “Base Case”, “Upside Scenario” and “Downside Scenario”, the bank assumed in all cases that IEP’s generous dividend would be paid in perpetuity, giving investors the impression that the yield is extremely safe. [1, 2]

(Source: Jefferies research)

In July 2022, retail investor-focused news outlet Motley Fool wrote that Icahn’s ~16% dividend had “room to grow” and the company was a “rock-solid dividend play”, owing to Icahn’s star status.

A similar October 2022 piece by Motley Fool said that IEP sported “ultra-high dividend yields, fundamentally strong businesses, and a proven ability to generate healthy levels of free cash flows in an uncertain economic environment.”

In an October 2022 article by InvestorPlace, IEP was listed among the three stocks to buy “with your social security increase” because of its 14.8% dividend at the time.

Similar articles have appeared in other retail outlets focused on the safety of the dividend.

Overall, regular investors have been led to believe that IEP’s dividend is safe, despite being abnormally high.

Background: IEP Trades At An Absurd 218% Premium To Its Last Reported Indicative NAV

By Comparison, Most Peers Trade Around Or At A Discount To NAV

Before examining the sustainability of IEP’s dividend, we first compared the company’s valuation to peers on a fundamental basis.

We assessed Icahn Enterprises compared to similar celebrity investor-controlled investment vehicles, such as Dan Loeb’s Third Point and Bill Ackman’s Pershing Square. Third Point and Pershing Square investment vehicles both trade at discounts to NAV, likely due to the investments being closed-end (i.e. investors can’t redeem) and high fees paid to the sponsors.

By comparison, Icahn’s vehicle, similar to other closed-end funds, does not provide redemptions, and while it may charge lower fees than its peers, Icahn’s vehicle trades at about a 218% premium to its December 2022 reported “indicative net asset value”.[4]

| Icahn Enterprises (NASDAQ: IEP) | Third Point (LSE: TPOU) | Pershing Square (OTC:PSHZF) | |

| Net Asset Value | $5,643,000,000 | ~$700,000,000 | $10,100,000,000 |

| NAV per Share (Unit) | $15.96 | $23.06 | $53.88 |

| Price per Share (Unit) | $50.82 | $19.83 | $34.75 |

| Premium (discount) to NAV per share (Unit) | 218% | -14% | -35% |

Background: We Further Compared Icahn Enterprises To All 526 U.S.-Based Closed-End Funds In Bloomberg’s Database And Found It Trades At A Higher Premium To NAV Than All Of Them

As a further check, we compared IEP’s premium to NAV against all 526 U.S. based closed end funds (CEFs) and their respective premiums to NAV in Bloomberg’s database.

We found that IEP’s premium to NAV is the highest among every fund on the list and more than twice as high as the next closest fund.[5]

Icahn’s Last Year Of Significant Outperformance Was 2013, Coinciding With The Beginning of His Successful Herbalife Campaign

Icahn’s Investment Portfolio Has Lost 53% Since 2014. This Compares To S&P 500 Performance of 147% In The Same Period

Despite Icahn’s career of heavily publicized activist wins, his recent performance has suffered. Icahn’s last year of significant outperformance was in 2013, when Icahn’s investment fund returned 30.8%, coinciding with the beginning of his successful Herbalife campaign. [Pgs. 1 and 95]

Since 2014, Icahn’s public market investment portfolio, which comprises 45% of IEP’s gross indicative assets (i.e., excluding holding company cash & debt) has lost 53%. In the same period, the S&P returned 147%. [Slide 20]

Icahn’s Dividends Are Mathematically Unsustainable: Since 2014, $1.5 Billion In Cash Dividends Were Paid Despite Negative Free Cash Flow of $4.9 Billion, Owing To Poor Performance

Overall, IEP has posted negative $4.9 billion in free cash flow since 2014, according to FactSet data, fueled by portfolio losses and declines in IEP’s operating investments. [Pg. 46, Pg. 41, Pg. 116]

Despite its extended period of losses and negative cash flow, IEP has paid unitholders cash dividends of almost $1.5 billion during the period. [1,2,3,4,5,6,7,8,9]

During that same time frame, IEP raised its quarterly dividend 3 times, from $1.25/unit in 2013 to $2/unit starting in 2019 (a year when IEP posted negative $1.7 billion in free cash flow.)

In the past 4 years alone, IEP has paid out $980 million in cash dividends, despite cumulatively burning almost $1.6 billion in free cash flow.

The Company Has Supported Its Dividend And Declining Asset Values By Selling $1.7 Billion Through At The Market (ATM) Unit Sales Over The Past 4 Years

The Bookrunner For Unit Sales Is Jefferies, The Sole Sell Side Analyst That Covers IEP, Which Has Assumed In Its Research Notes That IEP’s Dividend Is Safe In Perpetuity

In Short, Icahn Has Been Using Money From New Investors To Pay Out Dividends To Old Investors

With a name as well-known as Icahn, one would think sell side analysts would line up to offer their unique take on publicly traded Icahn Enterprises. Instead, Jefferies is the sole sell side analyst covering the company.

Jefferies analyst Daniel T. Fannon initiated the firm’s research on IEP in April 2013 with a “buy” rating and has touted the company ever since. In Fannon’s February 28, 2023 research note, he placed a $70 price target on Icahn Enterprises, saying:

“IEP represents one of the few public vehicles for investors to access the activist investor style”.

As noted earlier, Jefferies’ research notes assume that Icahn’s dividends will be paid out in perpetuity even in a worst case scenario, despite free cash flow and investment losses that clearly evidence that the dividend is high risk.

To sustain its dividend, IEP has sold units over the last 4 years, totaling over $1.7 billion in at-the-market (ATM) offerings. [Pg. 47, Pg. 98] The sole agent of all of IEP’s offerings has been Jefferies. [1,2,3,4,5]

Once again, the very investment bank selling IEP units to investors is simultaneously drawing in additional retail investors with its “buy” rating and its unsupported assumption that IEP’s dividend is safe forever.[6]

Carl Icahn’s relationship with Jefferies & Co (“Jefferies”) goes back to the corporate raider leveraged buy-out days of the 1980’s. Several articles from the time noted Icahn’s ties to the founder of Jefferies, Boyd Jefferies, who eventually pleaded guilty to two felony counts of securities fraud and resigned from the firm he founded.

Jefferies current CEO, Richard Handler, has maintained a close relationship with Carl Icahn over the years. A 2014 article reported that Icahn helped bail out Jefferies during the global financial crisis. Jefferies now appears to be returning the favor (and collecting fees along the way through its ATM unit sales).

As Detailed Above, Icahn Enterprises Is Significantly Overvalued Relative to Its Last Reported NAV

Our Review Also Shows That Icahn’s Latest Reported NAV is Further Inflated By An Estimated 22% Due To (i) Continuing 2023 Year To Date Investment Losses And (ii) Overstated Valuation Marks On Less Liquid Investments

We reviewed IEP’s investment portfolio to understand why it was trading at a massive premium to its stated NAV, attempting to discern whether year to date performance improvement or highly conservative investment marks may have explained the aberration.

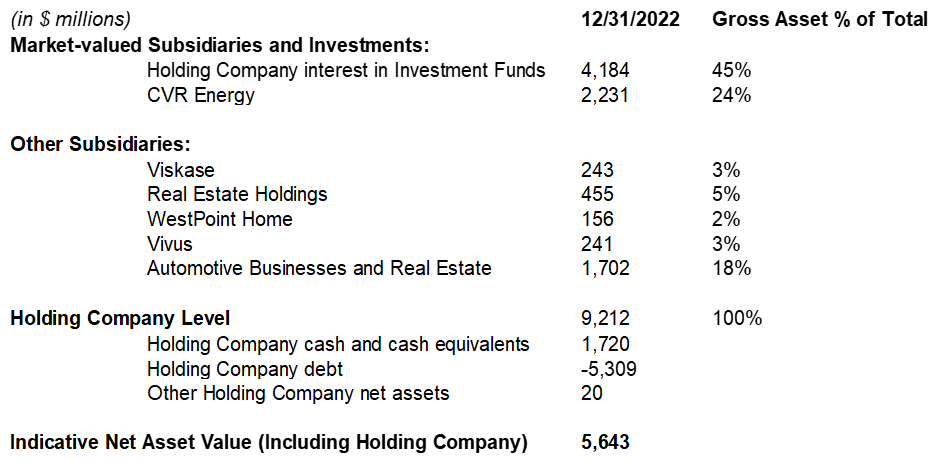

Icahn Enterprises provides a breakdown of its indicative net asset value in its quarterly investor presentations. The latest, from December 2022, is below:

After a review of the largest 5 components of Icahn’s portfolio, comprising ~95% of its gross investment value, we found that reported values were either clearly overstated due to (i) pro forma losses not yet reflected in the most recent 2022 year-end NAV calculation or (ii) blatant overvaluation of less liquid valuation marks.

A $4.2 Billion Stake In Icahn’s Investment Fund, Which Has Severely Underperformed For Years, Makes Up Over 45% Of IEP’s Gross Indicative Assets

The Underperformance Seems To Be Continuing: Icahn Started The Year With a 47% Net Short Position That We Estimated Has Contributed $272 Million In Year To Date Losses Due To Broad-Mark Gains

Icahn’s Disclosed Longs Also Declined, Contributing An Estimated $151 Million In Year To Date Losses

The largest component of Icahn’s reported NAV is a stake in Icahn’s private investment fund valued at almost $4.2 billion, or 45.4% of IEP’s gross indicative assets. [Slides 20][7] The investment fund invests in public equities and debt, employing an activist strategy. [Slide 11]

Icahn disclosed that on December 31, 2022, the investment fund had net short notional exposure of 47% and 71% short equity. [Pg. 43] Given the S&P’s return of about 9.2% year-to-date, we estimate the non-notionalized short equity book has lost at least $272 million year to date.[8]

Beyond the presumed drag from his net short exposure, our analysis of Icahn’s long positions disclosed in his latest personal 13F filing and in IEP’s SEC filings show that they have also generated negative returns, despite broader market gains.

Icahn’s disclosed long positions as of 2022 year-end indicate that they collectively lost an estimated $151 million on a year to date basis.[9]

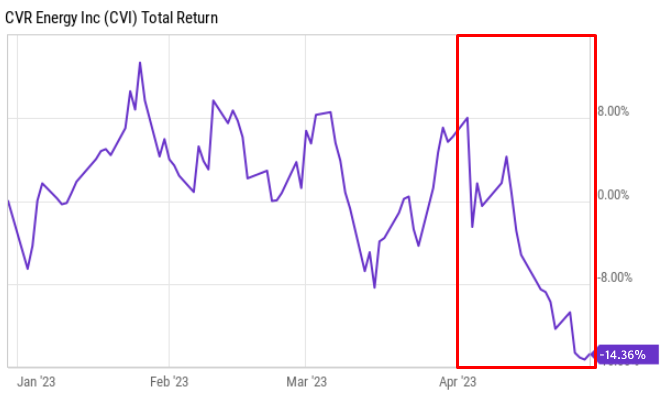

IEP’s 2nd Largest Component, Comprising 24% of NAV: CVR Energy, A Public Company Down ~14.4% YTD, Representing ~$320 Million in Pro Forma NAV Decline

Declining Profitability Indicators For CVR, Such As Shrinking Refinery Margins and Falling Fertilizer Prices, Are Likely To Pressure Its Profitability And Cash Flow Going Forward

IEP’s second largest component of its indicative NAV is a 71% stake in publicly-listed CVR Energy, valued at $2.2 billion at year-end, making it roughly 24% of IEP’s reported gross indicative assets. [Slide 20]

IEP’s mark for its CVR position is appropriately based on the publicly listed price of CVR’s equity. However, the public company has lost around 14.4% YTD, representing ~$320 million in pro forma NAV decline year to date (and $471 million in total year to date losses in the long book).

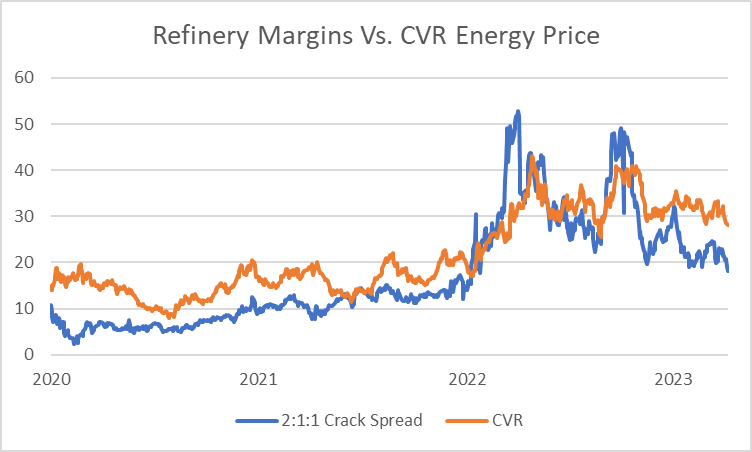

CVR’s petroleum segment, representing 77% of its 2022 operating income, consists of 2 petroleum refiners. [Pgs. 54, 9] Refiners are cyclical businesses, with profitability subject to refinery margins, often measured by “crack spreads”, as disclosed by CVR as part of its risk factors. [Pg. 40]

In recent years, petroleum refineries have benefitted from industry-high crack spreads, which have declined by ~34% year to date, according to FactSet data. US energy analysts see refiners’ crack spreads declining by as much as 50% by 2024, according to forward estimates for monthly crack spreads.[10]

CVR’s fertilizer segment, representing 19.3% of 2022 operating income, is in part dependent on fertilizer prices, which are down 20%+ from decade-highs seen last year. [Pg. 54][11]

Note that CVR was +6% by March quarter-end, which will likely be reflected in IEP’s next quarterly earnings release as adding ~$138 million to March-end NAV. These numbers do not reflect a significant decline nearly immediately after the quarter ended (see below chart), likely due to declining crack spreads and fertilizer prices.

Overall, CVR’s year to date price decline represents another hit to pro forma NAV, with further forward-looking risks.

IEP’s Third Largest Component To NAV: A Non-Public Automotive Segment That Burned $207 Million In Operating Cash Flow In The Past 2 Years, Valued At Over $1.5 Billion

Icahn’s third largest reported component of indicative NAV is its automotive segment, valued at $1.7 billion dollars, comprising approximately 18% of IEP’s gross indicative assets. [Slide 20] According to SEC filings, the Automotive segment lost $88 million and $119 million in operating cash flow in 2022 and 2021, respectively. [Pg. 46]

Suspicious Marks In Less Liquid Assets Example #1: Icahn Has 90% Equity Ownership In A Publicly-Listed Meat Packaging Business

The Company Had A Market Cap Of $89 Million At Year-End, But Icahn Enterprises Marked Its Position At $243 Million, Instantly Applying a 204% Premium To Its Public Share Price

Beyond year to date mark to market declines and reported losses, we have identified signs that IEP’s marks in less liquid and private investments may be severely overinflated. Less liquid and private assets collectively comprised ~31% of IEP’s gross indicative assets, or ~$2.8 billion as of 2022 year-end.

As one example, as of December 2022, IEP reported 90% ownership in shares of Viskase, a publicly traded meat packaging business.

Typically, publicly traded companies are marked at their share price for NAV purposes. In the case of Viskase, IEP valued its 90% stake at $243 million. [Slide 20] At the time of its valuation in December 2022, Viskase’s entire market value was only ~$88.7 million, 67% lower than IEP’s valuation.

These marks are made more abnormal given that in the same month, December 2022, Icahn Enterprises paid about $0.89 per share for 1,123,363 shares of the company. [Pg. 7] He then apparently immediately marked those shares up almost 194% despite the public market pricing remaining relatively flat.

Example #2 Cont’d: The Meat Packaging Business Is Highly Illiquid, Trading Only About 129 Shares ($143 Per Day) On The Over The Counter (OTC) Pink Sheets

Generally, One Would Apply A Significant Illiquidity Discount In Such A Circumstance—Icahn Apparently Chose A Massive Illiquidity Premium

Viskase trades on the over-the-counter (OTC) pink sheets with volume of only about 129 shares ($143) per day. At this volume rate, with IEP owning about 90% of Viskase’s 103.2 million shares outstanding, it would take Icahn approximately 720,000 days (~2,880 years) to unload his stake on the open market.

Generally, one would apply a significant liquidity discount in such a circumstance. However, a footnote on IEP’s investor presentation discloses that it marked the value up because of the illiquidity.

Despite reportedly only earning 2.2 million in 2022 and net losses of 3.3 million in 2021, with relatively flat revenue, Icahn Enterprises decided to value its stake on a 9x adjusted EBITDA number. [Pg. 7]

“Amounts based on market comparables due to lack of material trading volume, valued at 9.0x Adjusted EBITDA for the twelve months ended December 31, 2022 and December 31, 2021.” [Slide 21]

Suspicious Marks In Less Liquid Assets Example #2: Icahn’s Auto Parts Division Was Valued At $381 Million In December 2022

One Month Later Its Key Subsidiary Filed For Bankruptcy

Icahn’s Automotive segment is composed of three divisions: (1) auto parts (2) auto services and (3) automotive owned real estate assets.[12] [Slide 20]

IEP valued the “auto parts” division at $381 million in December 2022. [Slide 20 and Pg. 46] The division owns Auto Plus, which IEP describes on a website as a “leading after-market parts distributor”.

In January, one month after IEP’s $381 million mark, IEH Auto Parts Holding LLC and its subsidiaries including Auto Plus, filed for bankruptcy.[13] A search through the bankruptcy administrator showed $238 million in creditor claims, suggesting significant indebtedness. Given this, we suspect IEP’s $381 million mark will be written down significantly further.

Suspicious Marks In Less Liquid Assets Example #3: Marks In IEP’s “Real Estate” Holdings, Valued At $455 Million, Have Remained Remarkably Stable Over The Past 4 Years

This Is Despite The Portfolio Including (i) The Trump Plaza, Which Was Razed to the Ground In 2021 (ii) A Country Club That Nearly Went Insolvent Before Being Taken Over By Members; And (iii) Lack Of Transparency On Assets And Valuations

Icahn Enterprises reported a “Real Estate Holdings” segment with a NAV of $455 million at 2022 year-end, representing 5% of gross indicative assets. [Pg. 20] IEP’s NAV calculation for the segment has remained remarkably stable from 2019 to 2022 despite an overall decline in net income in the segment.

| 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | |

| Real Estate NAV | 474 | 440 | 472 | 455 |

| Real Estate Segment Net Income (Loss) | 16 | -16 | -8 | 7 |

(Source: Icahn Presentations Slide 11, and 11, 14)

Disclosures around the segment provide little clarity on the individual assets and their marks, but we can derive some clues from IEP’s investor presentations and SEC filings.

For example, IEP’s most recent 2022 year-end investment presentation vaguely reports that its real estate holdings include ownership of “a property in Atlantic City”. [Pg. 14]

A previous September 2020 presentation identified the property as the Trump Plaza Hotel and Casino, which ceased operations in 2014. [Pg. 11] That same year, in 2014, an investor group offered to pay $20 million for Trump Plaza, but Icahn rejected the price as too low, according to media reports.

It is unclear what the property was or is marked at on IEP’s books, owing to a lack of detailed disclosure.

The casino sat closed until it was finally demolished in 2021.

IEP presentations also reference an Aruban resort that disclosed a severe pandemic occupancy drop, followed by a post-pandemic recovery, but provided little clarity on the implications for its financial state. [Slide 8]

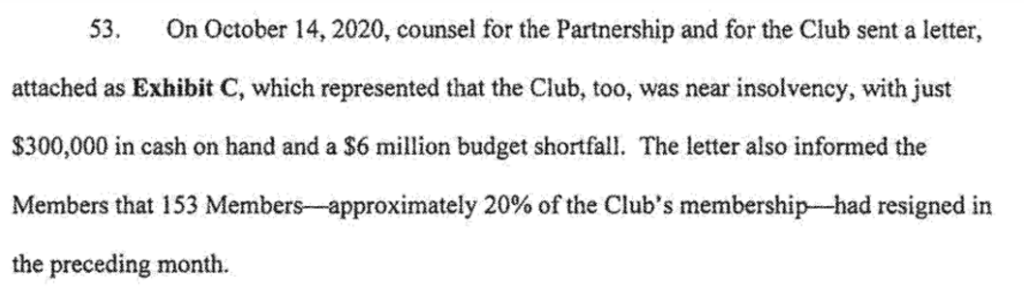

In another example, IEP’s investor presentation from September 2020 listed the operation of 2 country clubs, including the Grand Harbor club in Vero Beach, Florida. [Pg. 11] Around October 2020, the club became borderline insolvent, according to subsequent litigation records.

In December 2020, the members took the club over from Icahn and subsequently sued, alleging that Icahn had failed to maintain the facilities to the tune of $14 million. [Pg. 6]

Rather than detail these issues to IEP’s investors, subsequent IEP investor presentations and investor communications appeared to simply drop mention of the Grand Harbor club operations without further detail. [Pg. 11] The Grand Harbor case is slated for trial in the upcoming weeks, but Icahn Enterprises does not specifically report the case in the “legal proceedings” section of its annual report. [Pg. 31]

In all the above instances, we are expected to simply trust IEP’s process for marking its various troubled positions despite an absence of detailed disclosure on valuation or individual properties.

The Irregular Valuation Marks Fit A Pattern: In January Of 2020, UBS Dropped Coverage Of IEP Following Notes That Cited A “Lack Of Transparency” And Marks That Are “Divergent From Their Public Market Values”, Among Other Issues Like Investment Underperformance And A 60% Premium to NAV

Up until January 2020, the only other large bank aside from Jefferies covering Icahn Enterprises was UBS. Prior to dropping coverage in 2020, UBS analyst Brennan Hawken had a sell rating on the units, owing to its lack of transparency.

Earlier in 2017, UBS noted irregularly high marks for IEP’s Tropicana and Viskase holdings due to IEP’s failure to use public market prices. Hawken wrote at the time:

“IEP’s reported NAV dropped 4.6% q/q to $36.83/unit despite the company marking its Tropicana (TPCA) stake up 13.8% when the public market value only increased 5.4%. As a result, the carrying values of Tropicana and Viskase, which also is publicly traded, remain divergent from their public market values (by $3.31/unit) so we continue to compute our NAV estimate using the public marks for those two holdings rather than the EBITDA multiple comps that IEP uses.”

Hawken noted the lack of “appropriate” marks on Icahn’s reported NAV:

“We remain concerned that weak investment fund returns, a limited float, and marginal performance in the non-investment subsidiaries are not reflected in the current market valuation, which is at a significant premium to NAV (particularly when adjusted for what we view as appropriate marks).”

In January 2020, Hawken cited Icahn’s lack of transparency, marginal private subsidiary performance and a 60% premium to NAV as reasons for dropping coverage.

IEP’s Loan Covenants Limit Financial Flexibility By Restricting IEP From Issuing New Debt, Only Permitting Refinancing

IEP’s weakening performance seems to have caused concern among creditors. The company has disclosed since 2015 that “we are not permitted to incur additional indebtedness”. [Pg. 193] IEP’s recent 2022 annual report included similar language and noted that it is only able to refinance existing debt. [Pg. 89]

The leverage is substantial. As of December 2022, IEP reported $5.3 billion of Holdco debt, supported by $1.7 billion in Holdco cash and IEP’s investment assets. [Pgs. 41, 88]

IEP’s current debt was issued between 2017 and 2021, when interest rates were around historic lows.

As these maturities approach, any refinancings are likely to add significant interest expense to the enterprise.

Carl Icahn Has Pledged 60% Of His IEP Units For Margin Loans, A Risky Form of Financing That Could Result In Margin Calls Should Unit Prices Decline

Icahn Has Not Disclosed Key Terms of His Margin Loans Such As Loan To Value (LTV) Or Other Key Criteria That Would Give Unitholders A Full Understanding Of This Risk

According to its 2022 annual report, Icahn pledged 181 million units, worth over $9 billion, to secure his own “personal indebtedness”. IEP’s SEC filings provide no information on key terms like loan to value (LTV), maintenance thresholds, the principal amount or interest rates on his margin loans.

We checked Uniform Commercial Code (UCC) filings and located filings in Florida and Delaware that detailed how Icahn’s IEP assets had been pledged to Morgan Stanley, a counterparty to his margin loans.

We view it as critical that Icahn disclose the key terms of these margin loans so that investors can understand the potential risk of a margin call and forced asset sale should IEP units eventually trade around or at a discount to NAV, like virtually all of its peers.

Conclusion

“He was a great strategist, no question. But then, he lost it all because of his arrogance. That’s one thing you have to remember. It doesn’t stay forever if you’re not careful.”

– Carl Icahn describing Napoleon (5:13)

Carl Icahn has built an aura of invincibility around himself—a titan of Wall Street with a knack for coming out on top. But while the focus has always been on his grand public activist campaigns, quieter long-term investment losses, along with the substantial use of leverage, have whittled away his empire.

At this stage, Icahn’s net worth is reliant on selling overpriced IEP units to retail investors while convincing them that they will be rewarded with a consistent, safe dividend in perpetuity, despite extensive evidence to the contrary.

Confidence games never last forever—we expect Icahn Enterprises will be no different.

Disclosure: We Are Short Units of Icahn Enterprises L.P. (NASDAQ: IEP)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks or units (and/or options of the stocks or units) covered herein, and therefore stands to realize significant gains in the event that the price of any unit covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the units covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein. If you steal enough bricks eventually someone notices.

[1] In 2008, Icahn announced he was returning outside capital, and Icahn Enterprises has since managed its own proprietary capital through an internal investment fund. [Pg. 35 and Pg. 81]

[2] Large cap is defined as greater than $10 billion market cap. Coterra Energy had a dividend yield of ~9.9% and a market cap of ~$19 billion as of this writing.

[3] The company’s dividend was between $0.10 and $0.25 from 2005 to 2011. In 2013, the dividend was raised to $1.25 per unit. The current dividend has been $2.00 per unit since Q1 2019.

[4] Pershing Square charges a 1.5% management fee and 16% performance fee. [Pg. 100] Third Point charges a 1.25% management and 20% performance fee. We were unable to locate granular disclosure on Icahn’s investment fund fees but we reached out to the company for clarification. [Pgs. 36, 75, and 94]

[5] Screening criteria used: Market Status: Active, Fund Primary Share Class = Yes, Fund Type: Closed-End Fund, Country/Territory of Domicile: United States

[6] Icahn’s strong relationship with Jefferies is further evidenced by IEP board member Michael Nevin, who previously worked at Jefferies as a research analyst from 2014 to 2015, before joining IEP. He has been a director since December 2018. [Pg. 113]. Nevin is married to Icahn’s daughter. Furthermore, Jefferies led or helped lead bond sales of $3.7 billion in 2014 and $2 billion in 2010 for Icahn Enterprises, and has provided financing or assurances on major Icahn deals like Clorox in 2011. Jefferies has also advised on Icahn’s portfolio companies such as its 2012 advisory work to pursue a sale of CVR, and has heralded other investments like Crown Holdings in November 2022.

[7] Gross indicative asset values are derived by excluding holding company cash and debt. All prices derived as of 4/30/2023.

[8] Note that Icahn’s disclosures are as of year-end, are not static positions, and are not itemized by instrument. Icahn reported 71% gross exposure to “short positions” which equates to ~$2.97 billion. [Pg. 43] Icahn also reported 69% gross exposure to short broad market index swap derivative contracts and short credit default swap contracts, valued at $2.89 billion. [Pg. 43] When estimating the former part of the short book we use negative S&P 500 performance as broad-market based indicator, arriving at an estimated loss of ~$272 million. Given the opacity of the latter 69% exposure it is difficult to estimate marks, but we suspect they may have served as additional detractors to performance. Icahn’s filings suggest that there may be additional hedges on credit or energy and while the S&P 500 Energy Index is down 2.76% year to date, possibly contributing gains on the short side, the S&P Investment Grade Corporate Bond Index was up 4.3% during the period. These offsetting moves would not make up for the losses from the broad market move up of ~9.2%. [Pg. 36]

[9] Note that Icahn’s longs have lost only $26 million by the quarter ending March 2023, which are likely to be reflected in the upcoming earnings release. Analysis includes longs listed on Icahn’s recent personal 13-F as of 2022 year-end, excluding IEP longs and excluding CVR energy (which is detailed in the section below) and excludes Occidental warrants due to lack of clarity on whether they are in the IEP portfolio (though Occidental is also down ~3.5% YTD). Note that 13-F’s by their nature are a static point in time, and do not account for any purchases or sales made in the interim, resulting in estimated performance based on the last known collective holdings of the individual.

[10] Per RBN Energy, a 2-2-1 crack spread is the difference between the cost of 2 barrels of crude and the sum of one barrel of gasoline plus one barrel of diesel.

[11] CVR Partners, a fertilizer focused public company (NYSE: UAN), is 37% owned by CVR energy. [Pg. 58] It is roughly flat year to date, inclusive of dividends.

[12] IEP also owns real estate as part of its Automotive segment, which it valued at $831 million in December 2022. With the declining values in the automotive segment, the illiquid real estate may also be under threat. Real estate associated with auto service businesses are often discounted due to environmental liabilities, including being “held liable for spills and releases of spent solvents, used oil, gasoline, or other pollutants or contaminants into soil, surface water, or groundwater that occur when the owner is in control of the property”. We have applied no discount to these assets but suspect they may be impaired.

[13] While Icahn’s disclosures lack granularity on IEH Auto Parts Holding and its affiliates, it appears to represent all or most of the Automotive Parts division. [Pg. 6] IEP’s press release indicated that it “invested” and “loaned” significant amounts to Auto Plus. It is unclear what share of IEP’s ownership is loans versus equity from its disclosures or from our review of the creditor list in bankruptcy filings. We have reached out to IEP for clarification but have not yet heard back as of this writing. We expect IEP will provide its updated mark on the division in its upcoming earnings release scheduled for May 5, 2023.