Background: Hindenburg’s Work On Exposing Alleged Ponzi Schemes

While most know Hindenburg for our coverage of public company shorts, our founder started in fraud research by uncovering suspected Ponzi schemes, including Platinum Partners, a $1.4 billion hedge fund, which culminated in criminal indictments for 7 individuals over allegations of fraud, with most pleading guilty or losing at trial.

Early last year, Hindenburg uncovered an ongoing $400 million Ponzi scheme largely affecting the Mormon community called J&J Purchasing. As part of our investigation into J&J, we obtained recordings of key J&J marketers by rigging a private jet with hidden surveillance equipment and inviting key individuals involved with the scheme to pitch the investment offering to a Hindenburg associate posing as a wealthy investor. We then submitted our findings to the government.

In March 2022, FBI agents showed up at the home of the lawyer alleged to be behind the scheme, resulting in a shootout and a four-hour standoff, during which the lawyer confessed repeatedly to having run J&J as a Ponzi scheme.

The lawyer was taken into custody, recovered from his gunshot wounds and was later indicted on charges of wire fraud and money laundering.

We Began Work On Nanban In February 2023 And Submitted Our Findings To The SEC Several Months Later

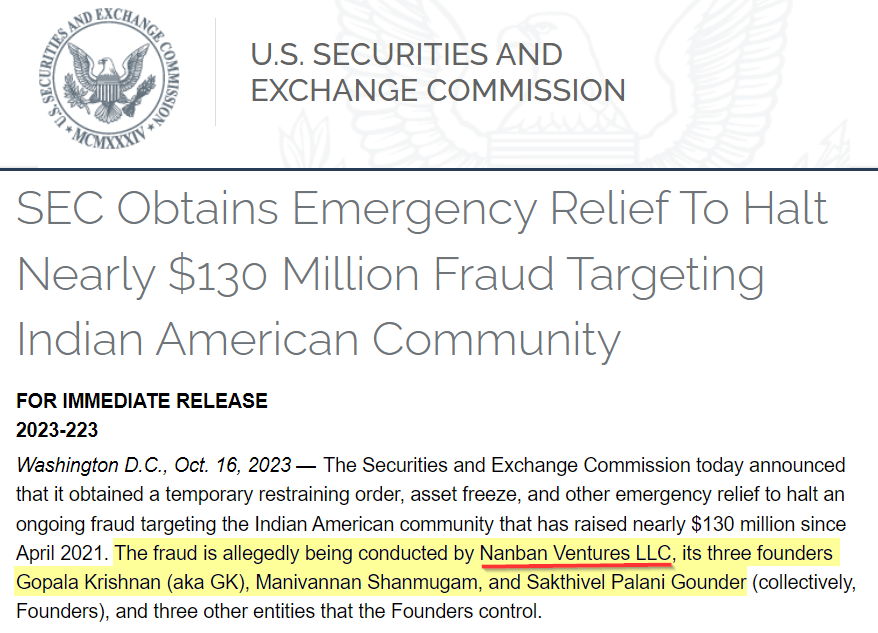

Yesterday, The SEC Froze The Assets of Nanban And Filed A Fraud Complaint Against Key Entities And Individuals

Following media coverage of our work on J&J Purchasing’s Ponzi scheme, we received a tip in February this year about a new “too good to be true” investment pitched largely to the Indian-American community.

After several months of research, we concluded that the Nanban group of companies was likely running an investment scheme and shared our findings with the government.

Yesterday, the SEC froze the assets of Nanban and filed a complaint alleging widespread fraud against key entities and individuals.

It is unclear from the court records thus far whether the SEC had been investigating Nanban prior to our work but, based on the agency’s rapid and thorough response, we suspect they were.

We believe the SEC’s quick response and detailed complaint, along with the asset freeze, is likely to help maximize recovery for victims of the alleged fraud.

Nanban Introduction: A Claimed Investment Opportunity Of A Lifetime Run By A “Rare Individual Whose Sole Purpose In Life Is To Help Other People Obtain Wealth Like He Has”

According to the initial tip we received, the investment promised 20% per month through “a rare individual whose sole purpose in life is to help other people obtain wealth like he has.” The ostensible billionaire runs a group of entities that share the name “Nanban.”

According to one of its websites,

“’Nanban’ means ‘friend.’ A person you can trust. Someone who desires to help without seeking anything in return.”

As with J&J, we posed as wealthy, yet inexperienced investors, recording hours of meetings with key Nanban figures promoting this “something for nothing” investment and gathering extensive documentation backing the offering.

Part I: Gopala Krishnan And The Origins Of The Nanban Group

Without Any Apparent Professional Experience In Finance, Gopala Krishnan (GK) Claims To Have Developed An Investment Strategy Called “GK Strategies” That “Works 100% Of The Time” And Can “Consistently Generate More Than 100%” With Full Principal Protection

Despite not having any apparent prior professional experience in finance, Nanban CEO Gopala Krishnan (GK) has said he “was always fascinated with the stock market”, saying in interviews that he started trading in 1997. [1] For years, he didn’t do “anything good” and couldn’t be consistent, he said.

In 2001, he experienced a self-proclaimed “nirvana moment” that allowed him to devise a strategy using stock indices and derivatives that “works 100% of the time”, according to a public interview aired on YouTube.

One of the Nanban websites associated with GK provides more details about his strategies:

“After extensive research, he [GK] formulated a simple success formula called GK Strategies™ that makes it possible to generate cash flow, regardless of market condition. (sic)”

GK claims he “copyrighted all my five strategies under GK Strategies copyright.” He has provided the expected returns for the GK strategies in public interviews:

“First two strategies, level 1, level 2 allow people to generate 18 to 30% on their own— from a cash flow perspective. My level 3, level 4, level 5, takes it to a completely different level— we consistently generate more than 100% in the higher-level strategies.” [10:14]

GK maintains that the strategy provides “principal protection and consistent positive returns in any market conditions.” Essentially, GK has claimed to have found the holy grail of finance—strategies that generate massive returns no matter what.

In 2019, GK Decided To Start A Foundation “Just To Teach People How To Make Money”

GK regularly discusses how charitable and altruistic he is.

According to GK, in 2019, he met Mani Shanmugam and Sakthivel Palani Gounder, who both shared GK’s philosophy “of giving back to the community with no strings attached.” The trio decided to start Nanban Foundation, a 501(c)(3) non-profit organization, “just to teach people how to make money.” [Min 5:58]

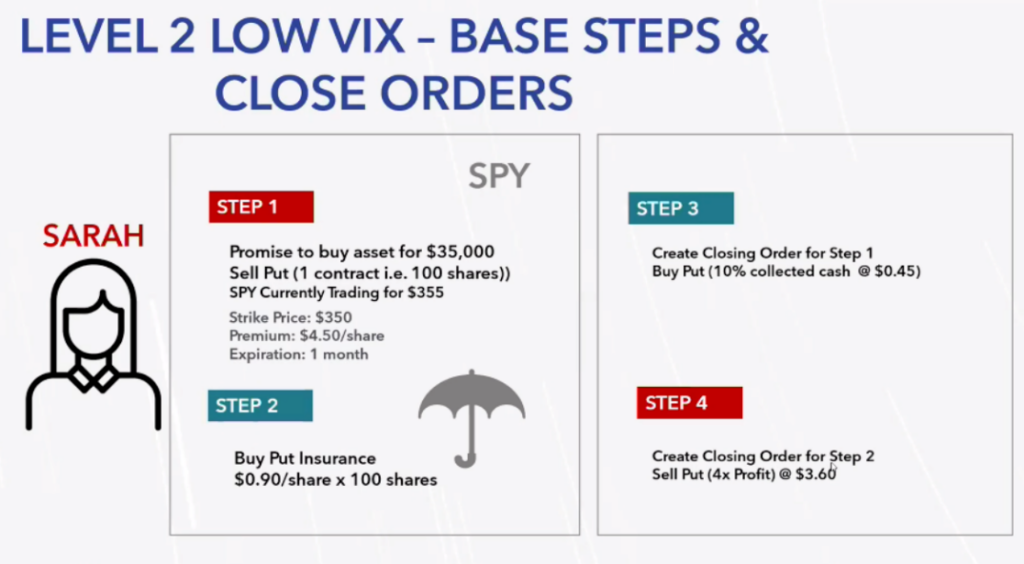

Per the Nanban Foundation website, anyone can register for a free webinar to learn “GK Strategies” Levels 1 & 2 for free.[2] The webinar invites users to learn a “comprehensive Investment Strategy used by Hedge Fund managers.”

Referring to his strategies, GK said:

“It’s all proprietary, I own the IP, so I am also under fiduciary responsibility of my big investors who have invested in the IP … but I have donated level 1 & 2”

GK claims “after 10 hours, you have the entire strategy, and you can do it yourself [Min 8:26] … we are just giving you the knowledge so that you generate passive income.” [Min 12:49] He also explains his motivation:

“Now, why are we doing this? It all goes back. It all goes back to the Nanban philosophy. As I said, Nanban means a true friend who does the right thing without expecting anything in return. So if we charge anything, that means we have some expectations. We just let people know that ‘hey, we conduct this extensive webinar 4 times a year.’” [Min 8:40]

After Declining Requests From Rich Individuals To Manage Money, GK Said He Had A Change Of Heart And Decided To Launch For-Profit Investment Offerings When A Widow And Several Single Moms Asked For Help

The For-Profit Business Line Began With “Nanban Hedge Fund” And Evolved Into Real Estate and Venture Investments

After the success of teaching GK Strategies through Nanban Foundation’s webinars, GK claims he rejected “a lot of high-net-worth people, rich people” that contacted him to manage their money, saying “we have enough wealth to last for generations … money was not the driver for us.” [Min 19:10]

However, GK changed his mind after “3, 4 ladies—they were single moms … they went through divorces, or I think one husband died … they said ‘we are very busy taking care of our kids … could you please help us?’” [Min 19:42]

After those pleas for help, Nanban says it launched the Nanban Hedge Fund and the for-profit side of Nanban Group. [Min 20:20]

The launch of the hedge fund happened despite GK having “no idea what a fund was” before 2019, as he claimed on December 28, 2022 in a public interview on YouTube:

“I was not a fund manager 3 years ago. I had no idea what a fund was. I had heard about Goldman Sachs and BlackRock, and all big companies. Ray Dalio— great fund manager. But I had no idea how that worked.”

According to GK, clients “loved what Nanban was doing” and eventually asked for a real estate alternative, resulting in the launch of a Nanban Realty fund in March 2021. [Min 22:21] This is despite GK claiming that “I was not very fascinated with real estate, it is too much work involved … and at the end of the year you make low single digits.”

After a few months, Nanban expanded the offering further and created a third division called Nanban Venture, launched in May 2021. [Min 22:53]

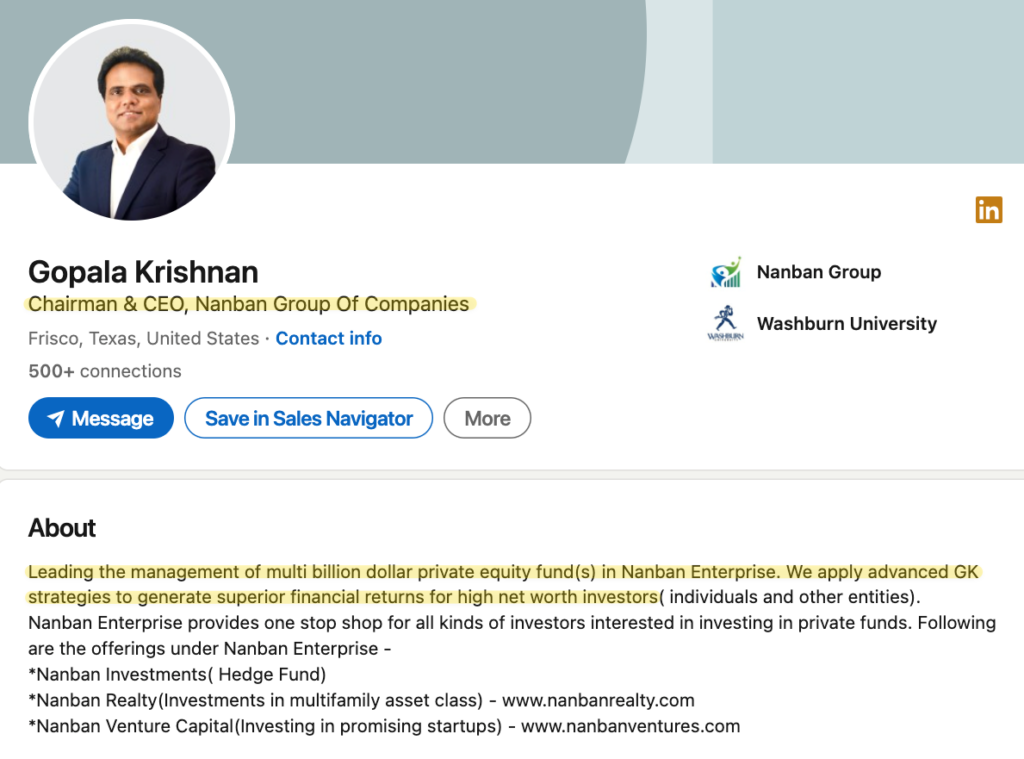

Today, according to his LinkedIn profile, GK acts as Chairman & CEO of Nanban Group of Companies, where he claims to manage “multi billion dollar private equity fund(s)” by applying “GK Strategies to generate superior financial returns.”

Part 2: The Nanban Group of Companies

Since 2020, Nanban Entities Has Offered Securities, And Nanban Investments Has Registered As An Investment Advisor With The SEC

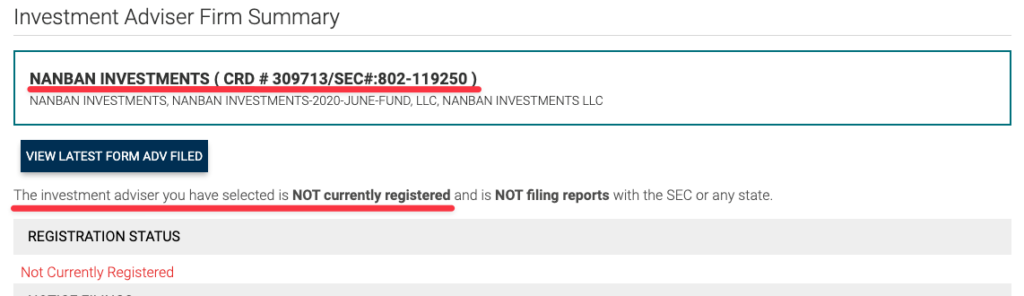

Now, Despite Claiming Billions In AUM, Nanban Investments Is Inexplicably No Longer Registered With The SEC, A Legal Requirement

Since June 2020, a series of entities associated with Nanban Investments began to offer securities of pooled investment funds.[3] Initially, the investment manager of these funds was Nanban Investments, LLC. [1, 2, 3, 4]

Per Form Ds filed with the SEC, the Nanban funds, collectively, have raised at least $115 million from 1,003 investors through these offerings, since 2020.

As required for an investment manager with at least $110 million in AUM, Nanban Investments registered as an investment advisor with the SEC. In October 2022, GK claimed that “Nanban will not take any shortcut … we follow rules and regulations in every country.”

But despite claiming billions of dollars in AUM (as discussed later), Nanban Investments withdrew its registration as an Investment Advisor with the SEC, effective around March 2023, seemingly in contravention of the rules.[4]

3 Years After Inception, Nanban Has 8 Business Divisions, Including Real Estate, ESG Solutions, Zero-Cost Healthcare, Venture Capital, and Entertainment

During the early stages of our research, we found several websites using the Nanban image but promoting investments under different names and entirely different business descriptions—often vague in substance. [1, 2, 3, 4, 5]

When we interacted with one Nanban marketer, introduced to us by GK, he explained that “today Nanban has 8 business divisions.” The marketer named the divisions and provided some details about each, claiming the collective organization to be a massive empire:

- Nanban Hedge Fund: “completely a cash flow fund … the minimum is a 100 million dollars for single participation.”

- Nanban Realty: “started in late 2020, which currently has $1 billion of assets under management, and it also has close to 4,000 acres of land under management.”

- Nanban Ventures: “so Nanban Growth Fund is part of that. And Nanban Ventures started in June 2021, and as of December 2022, for 19 months, we had launched 6 funds, one after another. And as of December 2022, the Nanban Ventures managed $100 million of capital, which is invested into cash flow strategies, real estate and start-ups.”

- Nanban Chola: “is into primarily land holdings, which currently holds close to 35,000 acres of land in the country [US].”

- Nanban Gulf: “wherein we offer the hedge fund, the venture capital and the Nanban Chola … All the three under one roof, but for Middle East.”

- Nanban ESG Solutions: “which primarily is into acquiring, promoting, and sometimes just investing in ESG products and technologies.”

- Nanban Cares: “Where we are getting into healthcare, and we are starting in India. And the intent is that we leverage our business model, our balance sheet to get into very, very cost-effective, in some cases zero cost for the needy patients.”

- Nanban Entertainment: “we are going to produce movies, create a lot of content.”

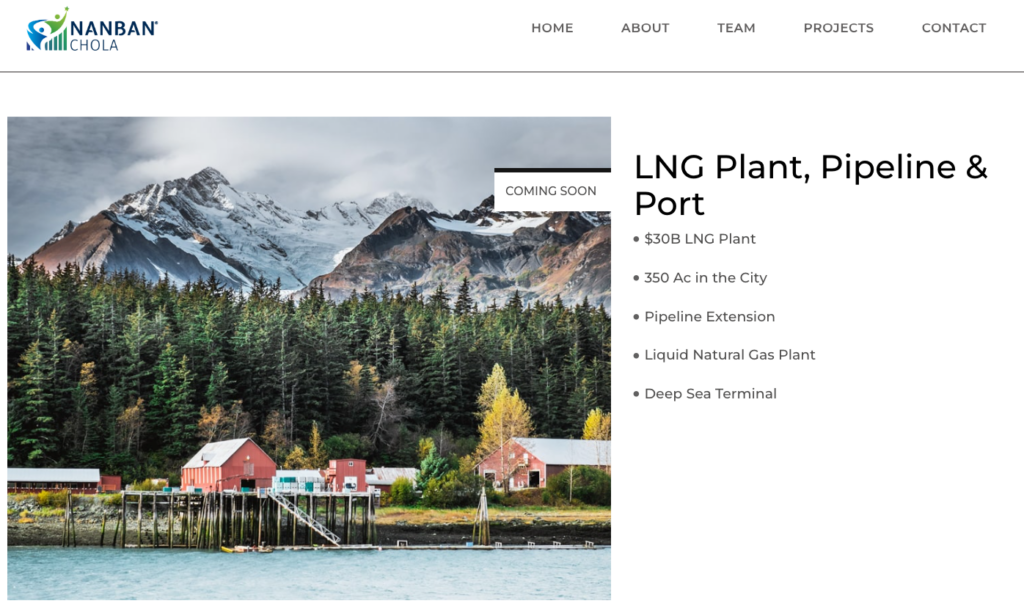

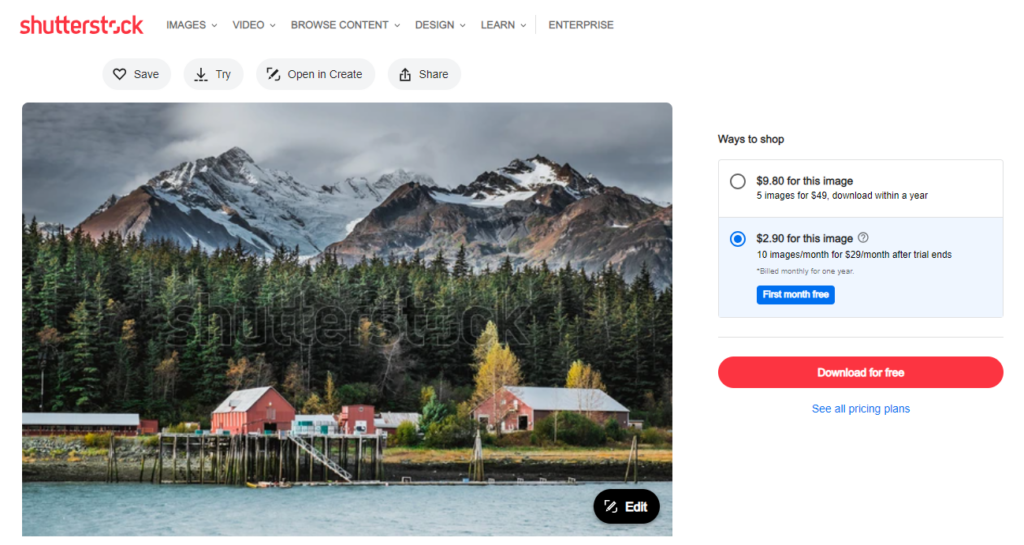

One Claimed Strategy, Nanban Chola, Says It Has $72.2 Billion in “Total Project Pipeline Value”, Including a Massive $30 Billion Proposed Liquid Natural Gas (LNG) Plant, Pipeline, and Deep Sea Terminal That It Says Is “Coming Soon”

The Picture Of The Project, Which Would Be One Of The Largest In The World (If It Were Real), Is A Stock Photo Of An Alaskan Fishing Village

Among Nanban’s divisions is Nanban Chola. According to its website, Nanban Chola has $72.2 billion in “total project pipeline value” for the 35,000 acres it allegedly owns in the US.

We found 4 entities with the name of Nanban Chola. A property search on each of the entities did not identify any real estate or property ownership.[5]

Nonetheless, its slate of projects includes a $30 billion proposed liquid natural gas plant, pipeline, and deep-sea terminal. The project, if it were real, would likely be one of the largest of its kind in the world and would take decades of permitting and permission across multiple levels of government, along with extensive planning and construction.

We found no news articles, permitting, or any other evidence that the megaproject exists except for the claims on Nanban’s website.

Nanban provides no details other than to say the megaproject is “coming soon”. The picture of the supposed project matches a stock picture on Shutterstock, on sale for $2.90, of a “famous fishing village” in Alaska.[6]

Despite Claiming To Oversee Diverse Business Lines Such As Public Market Investing, Private Infrastructure Development, Venture Capital, And Real Estate, Nanban’s Principals Lack Virtually Any Relevant Experience

Key Individuals Overlap Across The Entirely Different Business Lines

To run such different business divisions, one would expect to see a diverse group of senior executives and employees with different skill sets and relevant experience in each industry.

However, according to Nanban entity websites, the C-suites of these vastly different business lines almost completely overlap with one another.[7]

| LinkedIn Profile/Entity | Nanban Enterprises | Nanban ESG Solutions | Nanban Ventures | Nanban Chola |

| Gopala Krishnan (“GK”) | Chairman & CEO | CEO & Managing Partner | CEO & Managing Partner | General Partner/Advisor |

| Sakthivel Palani Gounder | CIO & Managing Partner | CIO & Managing Partner | CIO & Managing Partner | General Partner/Advisor |

| Mani Shanmugam | COO & Managing Partner | COO & Managing Partner | COO & Managing Partner | General Partner/Advisor |

Per their LinkedIn profiles, these C-Suite executives lack relevant experience in venture capital, ESG, and infrastructure development. As mentioned before, GK’s only apparent prior experience is in IT. According to their LinkedIn profiles, Sakthivel and Mani spent the last years of their corporate careers in roles related to data analytics.

In Public Interviews Since February 2021, GK Has Represented Having Billions In Assets Under Management (AUM)

Despite These Claims, Nanban Only Reported $75.8 Million In Gross Assets To The SEC in March 2022

Assets Under Management (AUM) is a critical metric that provides investors insight into the size, scope, and capabilities of an investment manager. Investment managers engaging in fraud often make inflated claims of AUM to give prospective investors the sense that the manager is trusted by others with large amounts of capital, and therefore must be trustworthy.

In December 2020, an interviewer commented, “with less than a year, you guys have raised over $950 million dollars,” while GK nodded.

In February 2021, a year after the Nanban Group of Companies came into existence, GK claimed in another public interview that Nanban was “almost a 1.2 billion dollar company.”

In 2021, referring to its AUM, GK claimed that “we have gone from zero to $2.5 billion in 17 months.”

By October 2022, GK maintained that “all the six divisions that we have is worth INR 96,000 crores,” equivalent to $11.5 billion.[8]

On June 2023, GK claimed on a call with us to have influence on assets of close to $100 billion, including the $72 billion in “total project pipeline value” from Nanban Chola.

Despite the billion-dollar claims, Form Ds filed by Nanban-associated entities with the SEC disclose having sold only $115 million in securities to investors, a massive discrepancy. Moreover, according to a Form ADV filed by Nanban Investments with the SEC on March 24, 2022, the company disclosed managing 2 private funds with $75.8 million in gross asset value.

This amount is a fraction of the multi-billion dollar figures GK claimed to have raised before filing the Form ADV.

Nanban Growth Fund Doesn’t Have An Independent Auditor

Instead, We Were Told The Auditing Was Done “In House”, A Massive Red Flag For Any Investment Firm, Let Alone One That Claims To Manage $11+ Billion

One would expect that an investment fund launched by a firm that claims to manage $11+ billion would have relationships with well-established auditors. However, when we asked who audited the fund, he said, “that is in house. So we have in-house team to do all the work.”

We see the lack of an independent auditor, particularly in light of the claimed returns, as a bright, flaming red flag.

SEC: Affinity Frauds Enlist Respected People From A Community To Spread The Word

Those People May Not Realize They Are Promoting A Scam And Become Unwitting Victims Of The Fraud Themselves

GK has regularly appeared beside Indian spiritual leaders like Dallas-based Swami Mukundananda, associated with the Radha Krishna Temple, where GK Strategies hosted GK trainings.

According to the SEC, affinity frauds often target ethnic groups or immigrant communities. Fraudsters “enlist respected leaders from within the group to spread the word about the scheme. Those leaders may not realize the ‘investment’ is actually a scam, and they may become unwitting victims of the fraud themselves.”

During the December 28, 2022, interview, GK stated that Nanban has 95+ employees. However, he also said that these people first became investors and then became employees.

“So we grew from 3 owners to 95 plus employees now … people came forward and said ‘how can we be part of Nanban’s philosophy?’ So they became investors and they are also employees.

We believe that many of the “employees” that GK refers to, which first “became investors and they are also employees,” may be members of GK’s community that are currently victims of affinity fraud.

SEC: “Unregistered Persons Who Sell Securities Perpetrate Many Of The Securities Frauds That Target Retail Investors”

Despite Acting As Brokers, Per SEC Definitions, Nanban Marketers Are Not Registered With The SEC As Required

The SEC explicitly mentions that brokers must register before selling unregistered securities (such as the Nanban Funds):

“A person who sells securities that are exempt from registration under Regulation D of the 1933 Act must nevertheless register as a broker-dealer.”

While posing as potential investors, we engaged with two different marketers from Nanban. Each pitched us a different fund and sent us all the paperwork so we could sign up as investors. One confirmed that his compensation was linked to “profit sharing, but as a GP [general partner]” of the fund he was pitching.

We checked the SEC’s registration database and could not find any of their names or a Nanban-named registered broker, indicating that the sales agents may have been acting as unlicensed brokers, a common red flag of fraud, according to the SEC. [9]

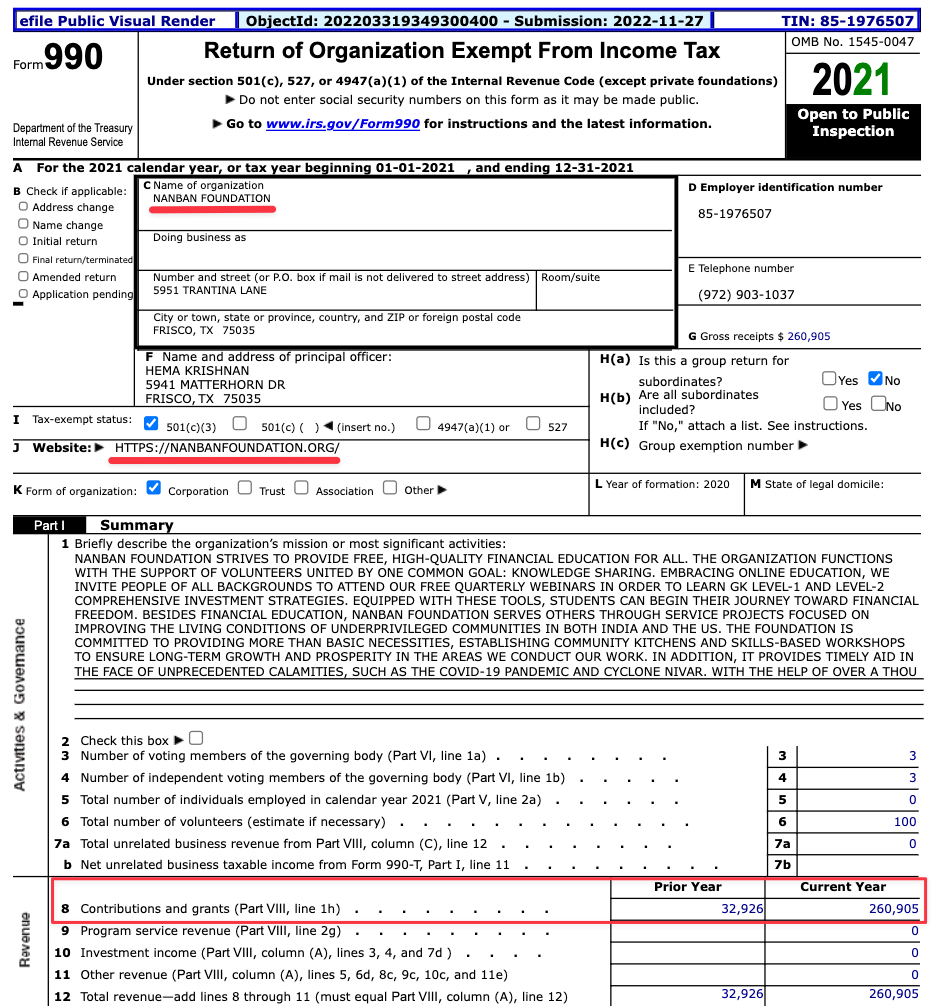

GK Claims That Nanban Owners Donate A Minimum of 30% Of Their Profits To The Nanban Foundation. He Claimed To Have Committed $100 Million to His Foundation In 2021

Public Fillings Show That The Nanban Foundation Received Only $226,355 In Total Contributions During 2021

In a November 2021 interview, GK claimed, “as owners of the company, we donate minimum 30% of our profits to the foundation. So then our Nanban Foundation, which is 501(c)3 non-profit, can conduct charitable projects at scale.”

During another interview, in January 2022, GK stated that he had committed $100 million “last year [2021].”

As a 501(c)3 organization, Nanban Foundation must file a public IRS Form 990. The form contains the financial information of a non-profit organization.

Nanban Foundation’s Form 990 for 2021 shows that the organization received $260,905 in total contributions and had $50,788 in total assets by the end of 2021.

If GK had committed $100 million during 2021 and he and his partners were donating 30% of Nanban’s profits, we would have expected a more meaningful contribution to Nanban Foundation during 2021, or a larger asset base than just ~$50,000.

GK told us that during 2022 “we donated [$]300 million.” Nanban Foundation’s 2022 Form 990 hasn’t been filed yet.

Part 3: Nanban’s Investment Offering

According To GK, GK Strategies Are “Patented In The US.”

According To The USPTO Database, There Is No Record Of A Patent For GK Strategies

GK claims that his investment processes are so incredible that he sought intellectual property protection to ensure they could not be replicated. In October 2022, GK claimed his GK Strategies are “copyrighted and patented in the US.”

According to the United States Patent and Trademark Office (USPTO), Nanban Enterprise, LLC registered a trademark on the word mark “GK Strategies” on April 27, 2021. However, a trademark is not the same as a patent.

We reviewed the USPTO Patent Public Search. We couldn’t find any patents involving Gopala Krishnan as an inventor let alone any referring to a trading method.

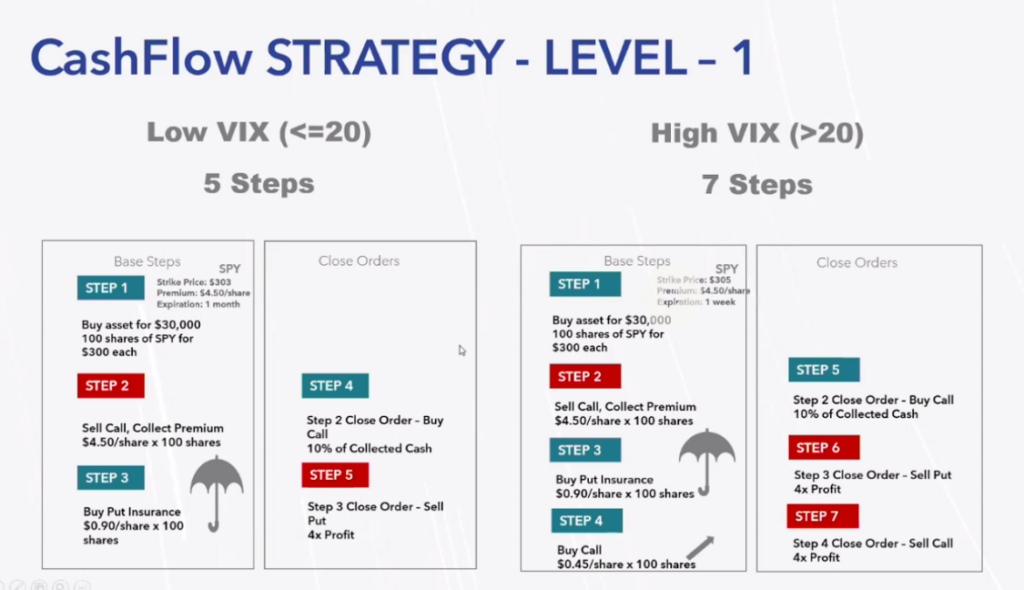

Contrary to GK’s claims, we reviewed GK’s strategies and found them to be routine, run of the mill, beginner options strategies.

Nanban Hedge Fund: “Where We Apply From Level 1 To Level 5 All The [GK] Strategies”

GK Claims That His Trading Strategies Allowed Him To Generate 1,800% Return In 2008

As mentioned before, GK claims that his 5 proprietary strategies can generate up to 100% returns. When we asked how we could have exposure to those strategies, GK said:

“If you only want to participate in GK Strategies, that is our Nanban Hedge Fund where minimum now is $100 million … that is where we apply from level 1 to level 5 all the strategies to generate around 30% minimum every year that is what our goal is through our Nanban Hedge Fund”

In one of our conversations, GK provided an analogy between owning a multi-family property and implementing his strategies. He said that the asset he owned was the S&P 500 because it could never go to zero. Then, he claimed “renting out this asset [S&P 500] to generate income every week.” As with a real estate property, GK alleges that he carries insurance on it, but “not to protect the asset, but, to put us also in a great position to generate amazing cash flow when there is so much fear in the market.”

Based on this strategy, GK claimed that during the global financial crisis in 2008, he was able to generate a 4-figure return:

“I only share this in personal relationships like this. In 2008, when the market went down 58% my cash flow was 1,800% that year.”

According to one of the marketers, Nanban Hedge Fund delivered a 48% return in 2022, a year that the S&P 500 lost 19% and the hedge fund industry posted its worst performance since 2018, as reported by Reuters.

GK Claims That His Trading Strategies Are Based On Buying Shares Of SPY, Renting Them To Speculators For 2% A Month, And Using Proceeds From The “Rent” To Buy Insurance To Protect For A Market Crash

In a 2020 interview, GK provided an example of how he executed his trading. According to GK:

“[The strategy] allows people to sleep well in the night because they know if anything happens in the market, I’m protected, the market goes up I’m sure to make 2% if market doesn’t go anywhere I still make 2% so in all 3 situations you are covered, and cash flow is king.”

The “beautiful thing” of his strategy, GK claims, is that “when markets go down, there is something called volatility that increases big time in the markets, so instead of 2% if volatility increases, you get 6%, 7%, 8% a month on the same asset … when volatility increases option premiums increase big time and if you’re on the right side of the options you generate great income and that’s what we do.”

GK maintains that “you spend $35,000, but you make $700 to $1000 consistently 100% of the time every month.”

GK’s claimed strategy simply doesn’t exist as described. There is no way to generate 2% per month (24% per annum) by simply renting out major indices, while retaining the potential for upside.

As a reference point, borrowing rates for index ETFs, such as SPY, have been historically low. During the last year, the maximum rate has been 2% annually. According to these rates, the “rental income” that GK could have been able to generate annually would be just $20,000 on a $1 million “property.”

We Attended Nanban Foundation’s 4-Day Webinar To Learn GK Strategies Levels 1 & 2

We Found A Different Strategy To What GK Pitched In 2020, And Nothing Unique Or Proprietary

In early June 2023, we signed up for the webinar of “GK Strategies Level 1 & 2” through Nanban Foundation website. We attended the 4-day, 12-hour-long webinar.

While we found some similarities to GK’s pitch as previously described, there was no mention of renting the shares to speculators. Instead, the strategy relies on selling options to generate “cash flow.”

GK Strategies’ Claims Of Consistently Generating Returns Are Actually Just Basic Options Strategies Such As “Collar” Or “Put Bull Spread” Transactions

The Strategies Are Subject To High Levels Of Risk, Despite GK’s Claims

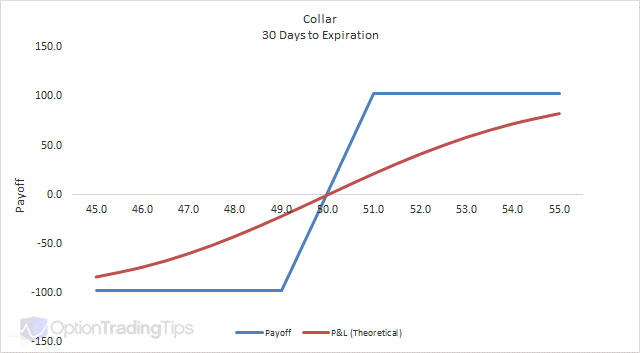

GK’s claimed “Level 1” strategy is the equivalent of writing a collar, a basic options strategy generally used for hedging (and thereby limiting) profits, not generating outsized returns.

As with any option strategy, there is a cost associated with placing the trade, and there is no guarantee that executing a collar will result in a profitable transaction. As seen in a collar payoff structure, this strategy can (and regularly does) yield negative results, as can all options strategies.

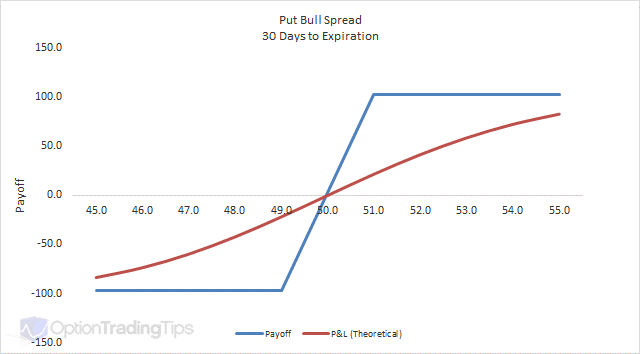

GK’s “Level 2” strategy, as shown in the following slide, amounts to what is known as a “put bull spread”:

A put bull spread is a strategy used to place bullish bets on an underlying asset with a desire to limit risks.

As with the Level 1 proposition, there is no guarantee of generating a profit by executing this strategy. Moreover, if the underlying asset falls below the strike price of the put initially sold, the investor will start facing mark-to-market losses on their portfolio.

While these options strategies likely seem complex and impressive-sounding to a layperson, any financial professional (and many retail traders) would instantly be able to identify these as often-used strategies that do not confer any unique advantage.

The options market is highly competitive and highly efficient, with numerous quantitative research and algorithmic trading firms scanning the market for minor pricing inefficiencies. For Nanban to claim runaway profitability from strategies that amount to ‘Options 101’ is a clear sign that GK is simply making up his claims of high, consistent returns.

Nanban Realty: A Proprietary Real Estate Underwritten Methodology That Targets 16%-45% Average Annual Returns Where Investors “Will Never Lose Their Capital”

As mentioned earlier, Nanban Realty was launched in late 2020, according to one of Nanban’s marketers. Per its website, Nanban Realty is a strategy “utilizing moderate leverage and focused asset management allows us to generate superior returns.” Those returns are advertised as “16% – 45% targeted average annual return with 8% preferred rate.”

According to their LinkedIn profiles, Nanban’s founders don’t have obvious relevant prior experience in real estate investing.[10]

After showing our interest of investing millions of dollars into real estate, GK introduced us to Prassana Kumar, manager of Nanban Realty MGR, LLC and CEO of Orion RE Capital.

Per our conversation with Prassana, he told us the origins of Nanban Realty.

“About 6, 7 years ago, we started Orion Real Estate. And then 3 years ago we met the Nanban … we said, let’s offer real estate investments under one platform, so that investors will have choices to invest. Not just hedge funds, they love real estate … so we launched one single platform, we call it as Orion & Nanban. But for all simplicity, we also use Nanban Realty.”

According to the initial Nanban marketer we talked to, Nanban Realty has $1 billion in AUM. This figure is confirmed by Nanban Realty’s website, which claims a “$1 B Multifamily & Land Real Estate Portfolio.”

(Source: Nanban Realty)

However, in our May 2023 conversation with Prassana, he seemingly contradicted previous claims.

Q: “How much assets under management do you guys have?”

Prasanna Kumar: “Right now, half a billion.”

Prassana claimed to “have some proprietary underwriting” that results in no losses:

“When we are buying an asset, we know that tomorrow if we sell, we should be able to recover that. At least at the minimum. So, that’s our criteria. So from that perspective, when I liquidate, investors will never lose their capital.”

When we pushed for more details of Nanban Realty’s proprietary underwriting model, Prassana told us that he “was planning to patent it.” He described 3 main features of their model:

- “The model will… It’ll adjust the whole cash flow and the overall IRR based on the current SOFR’s [rates] projections.”

- “We come up with a couple more interesting metrics when we buy the property, I look at it, in 10 seconds, I can make a decision … So, we have similar metric [to a P/E ratio] that nobody uses in the market that we have pioneered in using those metrics in our underwriting.”

- “And then lastly, creative financial management. Financial engineering is extremely important. Let’s say if we buy a property, a $100 million property, we need $20 million to do all the CapEx work. We don’t front-load the $20 million in day one … So, we kind of actively manage that capital as well to improve IRR.”

There is nothing proprietary about Nanban Realty’s underwriting model as described, which we see as likely nothing more than a basic spreadsheet that incorporates today’s forecast of variable rates.

We don’t believe that a similar metric to a P/E ratio that “nobody uses” could provide an edge to any real estate investors. One of the most used metrics in the real estate industry is the cap rate, which is an inverse function of a property’s profitability, similar to a P/E ratio.

Managing the timing of your cash disbursement associated with any project is the least you can expect from any real estate promoter. Yet again, Nanban is trying to pass off ‘101’ level financial analysis – this time in the world of real estate – as some type of breakthrough.

Nanban Growth Fund (Part Of Nanban Ventures): In 2022, “We Made 22.6% Positive Cash Flow”

Nanban Growth Fund Claims To Be Able To Outperform Because Of Its Asset Allocation: 60% Goes Into A Vague Bucket Called “Cash Flow”, 20% Into Real Estate, And The Rest Into “Moon Shots”

GK also introduced us to another marketer named Bala Shanmugam, who pitched us Nanban Growth Fund LP. According to the fund Form D, Bala is the fund manager.

Bala claimed that the Nanban Growth Fund strategy “generated 22.6% cash flow” in 2022, a year when the S&P 500 lost 19.4%. Bala attributed the fund’s success to its asset allocation. He claimed that 60% of the fund is invested into “cash flow,” the remaining allocation goes 20% into real estate, and 20% into “moon-shoots” which were described as “promising start-up companies.”

The “Cash Flow” Asset Class Produces Minimum 20% And It Is “Risk-Free”

The Marketer Claimed That The “Cash Flow” Strategy Invests In Private Companies And Proprietary Strategies Applied On SPY

Describing the vague category of “cash flow,” Bala alleged that the “cash flow” allocation was “risk-free because we have consistently generated this cash flows.” (Fund managers promising “risk free” returns is a classic hallmark sign of a scam—all investments have risk.)

We asked for more details, and he said they had “two models” to generate cash flow. One by having “access a lot to private companies, which generate cash flow … and which produces cash flow for us.” In another call, Bala provided more details about this claimed model:

“So we use our property strategies and access to some of the most private and mature companies which produce cash flow … so we invest roughly 60% of the fund into these strategies, and they produce minimum 20% cash flow on a annual basis at the fund level.”

Unlike every other investment fund that shares basic information on its investments, Bala told us that “because these are private companies … they’re not comfortable us sharing it with our investors.”

In other words, Bala claimed it needed to remain totally opaque on its risk-free portfolio in order to protect these secret, consistent, private, cash-flow generating machines.

Bala shared with us a Webinar about the Nanban Growth Fund featuring GK. During the presentation, GK provided more vague details about these private companies.

“The money raised in this fund is going to be invested in some really strategic private companies that are already producing cash flows … they don’t want to be public, but they have been generating really good cash flow, they are allowing us to participate in their companies.”

Private companies with the characteristics described by Nanban should have no problem accessing capital through traditional avenues like going to a bank, which will cost less than half of what they are paying Nanban. For example, today, Wells Fargo offers unsecured loans to businesses with rates starting at 10.00%.

It is unclear why private companies that steadily generate positive cash flows and would be perceived as low risk by lenders, would be willing to pay Nanban a 20% rate.

Regarding the second model used to generate cash flow, Bala claimed, “we also have some proprietary strategies which we apply on SPY … And that produces, again, cash flow.” In another conversation, Bala implied that the “cash flow strategy[11]” is the same as applied in the Nanban hedge fund, which we previously discussed.

“The only difference if you will, between hedge fund and ventures is that in hedge fund, 100% went into cash flow. Here at any point of time, at the minimum, 60% is into cash flow strategies.”

Once again, Nanban’s claims appear to be non-sequiturs and nonsense, and we obviously don’t believe that Nanban Growth Fund can achieve superior returns by merely investing in “cash flow.”

Conclusion: When It sounds Too Good To Be True

One of GK’s associates, Prassana Kumar, told us “One thing we can guarantee you is the trust and honesty, integrity and hard work, that we can guarantee any day everything, the books are open. That’s why we’ve been successful.”

Despite Kumar’s claim, we think Nanban attempted to take advantage of its community, roping investors into an affinity fraud.

A note to victims of Nanban: This is undoubtedly a painful situation. Being victim of an (alleged) investment scam can make us question our judgement and our assumptions about everyone. It makes us feel foolish, or pained to have inadvertently hurt someone we care about. Just know that mistakes happen (and it is rather common, unfortunately). Things will get better after the initial shock wears off. And fortunately, most people are good—it’s really just a handful of people that try to ruin it for everyone.

Note also that your investment is very unlikely to be a total loss (which is often the assumption when first hearing such news.) The SEC acted early and effectively to freeze assets, which should maximize recovery. It will take time, but hopefully the recoveries are substantial.

Feel free to reach out if you have any questions that we might be able to help with or even if you just want to vent or discuss: info@hindenburgresearch.com.

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] According to his LinkedIn profile, GK has more than 22 years of experience in IT roles at companies such as Verizon, Hewlett Packard and DXC Technologies.

[2] The current version of the Nanban Foundation website refers to “Cash Flow Strategies” Levels 1 & 2. Through a Nanban Foundation Telegram group we joined, we received a flyer saying that “Nanban Foundation is sunsetting the name GK Strategies and renaming our path to financial freedom to Cash Flow Strategy.”

[3] Beyond the Nanban name, the Form Ds we refer to either include Nanban’s principal place of business address or list related persons with profiles on Nanban websites.

[4] We also checked for registrations for any other Nanban-named entity and for Gopala Krishnan, and didn’t find any other registered investment advisor.

[5] Nanban Chola Main LLC, Nanban Chola Land Holdings LLC, Nanban Chola Global PE LLC, Nanban Chola PE Main LLC

[6] Similarly, at least one other billion-dollar project, the Georgetown Oasis, also uses stock images.

[7] The divisions not shown in the table didn’t have a website or their website doesn’t mention the team behind the company.

[8] 96,000 crores = 960,000,000,000 INR. 1 USD = 82.82 INR (Oct 20, 2022, FX Rate)

[9] We searched BrokerCheck and the Investment Adviser Public Disclosure’s database for Balamurugan Shanmugam, Prasanna Kumar and “Nanban” under the firm search feature in both databases (or just 1?). Both marketers are disclosed as related persons in Forms D associated with Nanban. [1, 2]

[10] Gopala Krishnan (“GK”), Sakthivel Palani Gounder, Mani Shanmugam

[11] As mentioned before, GK Strategies have recently been renamed “Cash Flow Strategies.”