Summary: Eros International (NYSE:EROS)

- Eros claims to be “well-capitalized” yet plans a shelf offering. The company also sold shares of its key Indian operating subsidiary the very day of its earnings release.

- The company reiterated a claim from early April that it is in advanced stages of negotiations for a debt refinancing deal, yet it still has no deal in place.

- The company is facing spiking financing costs which are +463.6% q/q; Short-term debt and contractual obligations due within one year stand at $262 million.

- Past accounting questions appear to have intensified.

- Eros announced a near doubling of its content library, yet we find zero CY 2017 movies “Recently Added” to its ErosNow website.

Introduction

With this report, we intend to update the market on our findings following Eros’s (NYSE:EROS) latest annual results released on July 28th and the company’s 20-F filing released on July 31st. Much of the market seemed focused on Eros’s top line and bottom line miss and how the results tarnished the company’s growth story. Despite those important takeaways, we believe the full story is significantly worse.

Asset Sales and a Potential Shelf Offering Spell More Liquidity Issues

A key bullet point from the earnings release focused on Eros’s supposedly strong capitalization:

Not including the $40 million set aside for the (revolving credit facility), Eros has over $112 million of cash on balance sheet, availability under existing lines of credit and access to capital markets and the company remains well-capitalized and able to invest in future growth.

Despite the self-proclaimed clean bill of health, the company’s actions, subsequent statements, and reported debt and off-balance-sheet obligations seem to conflict with the notion that the company is adequately capitalized. In particular, the company suggested it is seeking more capitalization options. In the earnings release, it stated:

…we are in advanced stages of negotiations for a debt refinancing deal as well as expect to file a shelf for a potential capital raise soon after this earnings.

We can’t help but notice that in early April, the company similarly stated it was “in advanced stages of executing multiple long-term refinancing options” after a failed bond offering and a temporary extension of its revolving credit facility. With debt maturities looming and without a finalized deal in place, we believe the company is short on time and short on options.

Even more telling, the aforementioned equity and refinancing alternatives are being explored despite the company’s rapid selling of shares in its key Indian operating subsidiary, Eros International Media Limited (EIML). The most recent sale of EIML shares occurred the very same day of the annual release, July 28th, suggesting a current and ongoing need for liquidity.

Based on Eros’s recent share disposition filing with the BSE and recent sales reported to the NSE/BSE, Eros owns approximately 45.32% of unencumbered shares in EIML and has pledged but retained voting rights over another 16.20% of the company. This compares to the company’s last annual release where it reported a 74.4% unencumbered stake in the operating subsidiary. It is unclear whether these sales and share pledges are expected to continue.

If the above weren’t troubling enough, the maturity wall of debt and short-term contractual obligations suggests a high need for near-term capital:

- The company’s $85 million revolver is due September 30th. Eros stated that it has “set aside approximately $40 million to pay (the RCF) down further”.

- Eros’s total short-term debt stands at over $180 million.

- Eros’s unrecorded contractual obligations due in “less than 1 year” stand at $81.2 million, with total unrecorded contractual obligations of $292.9 million.

- Eros’s “trade and other payables” increased by over 84% to $120.1 million from $65.2 million in the preceding year, suggesting a significant near-term liquidity burden payable to the company’s suppliers.

In short, the company exhibits signs of an ever-tightening liquidity situation with no clear solution in hand.

Spiking Financing Costs

The effects of this liquidity situation have also seemed to manifest in the form of increased financing costs. From the company’s most recent filing:

For the three months ended March 31, 2017, net finance costs increased by 463.6% $6.2 million (sic), compared to $1.1 million in the three months ended March 31, 2017. In fiscal 2017, net finance costs increased by 115.0% to $17.2 million, compared to $8 million in fiscal 2016, mainly due to lower income from financing activities and increased borrowing costs.

Part of the increase in financing costs can be explained by new debt, such as a new senior Term Loan secured by a pledge of shares of EIML, carrying an interest rate of 13-14.25%. In other cases, we see that pre-existing debt has been renegotiated at higher rates. For example, in this release, we learned for the first time that the interest rate on the revolving credit facility has moved significantly higher to “LIBOR + 7.5% and Mandatory Cost” compared to a rate of “LIBOR + 1.90% – 2.90% and Mandatory Cost” in the previously reported period.

Such “tightening screws” are indicative of the rising costs and stricter covenant terms that generally result from pushing out maturities to try and buy a company more time to pay off its debts. We intend to carefully monitor for any new debt issuance or repayments at the company and its subsidiaries as the debt scenario evolves over time.

Eros Television: A New Related Party Emerges

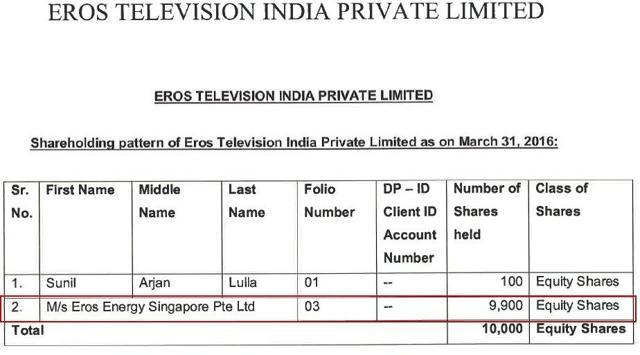

The latest filing discloses that Eros received a $6.4m short-term loan from Eros Television, which is cited as a “related party”. We find it odd that Eros Television sits outside the Eros corporate structure. Per Indian filings, Eros Television is a subsidiary of Eros Energy Singapore Pte Ltd:

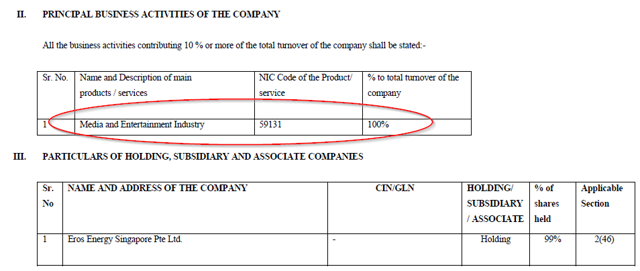

Eros Energy Singapore has multiple subsidiaries that all appear to be related to the energy space, except for Eros Television. Per Eros Television’s Directors Report dated November 2016, we see that the entity generates 100% of its sales from the “Media and Entertainment Industry”, making it an apparent anomaly in the Eros Energy corporate structure:

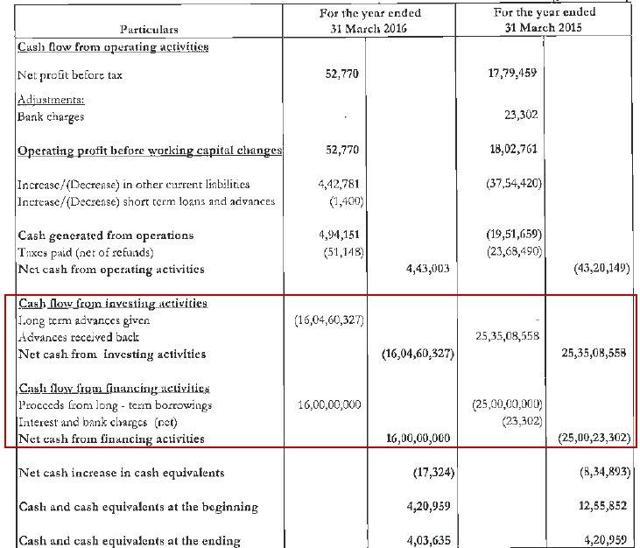

Furthering our suspicion, the entity appears to record little financial activity with the exception of large cash transfers through a series of borrowings and advances, per the Eros Television audit report filed November 2016:

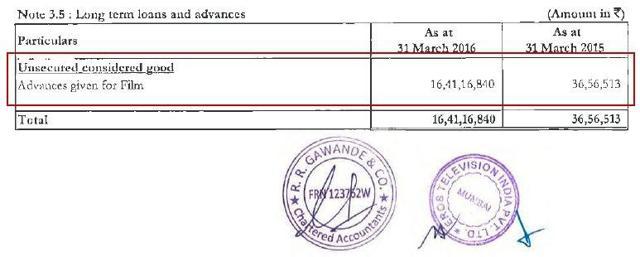

In the same audit report, we see a note showing that the advances were “advances given for film”:

If the above wasn’t odd enough, perhaps the greatest indication of potential irregularity is that Eros derives a substantial portion of its revenue through television syndication. Per the annual release, revenues from television syndication were a rare bright spot in the company’s results, representing a year-over-year increase of 22.1% to $88.0 million from $72.1 million from the year prior.

Until recently it was not even clear to us that Eros insiders controlled a related-party television business that sits outside the Eros corporate structure. We would be very interested to know the amount, if any, of the television syndication revenue that Eros generates from dealings with related-party Eros Television.

Questionable Revenue, Again

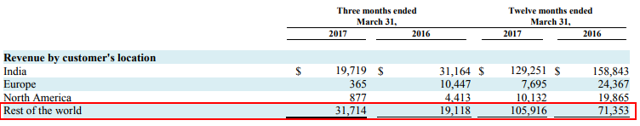

The company reported a severe drop in revenues in India, Europe, and North America. Despite these across-the-board declines, the “Rest of the World” segment revenues increased substantially; an increase of over 56% on a year-over-year basis:

The explanation provided by the company for the leap in RoW revenues is as follows:

…mainly due to decreased theatrical revenues from the film mix offset by increased catalogue revenues and accelerated catching up on sales held back in the second half of fiscal 2016.

For some context, the company was previously faced with questions about its historically large Days Sales Outstanding (DSO) metric that, in part, stemmed from uncollected “high margin” catalogue revenue. The company responded in FY 2016 by deciding to “forego a portion of its potential catalogue revenues that have relatively longer payment cycles, in order to improve days’ sales outstanding.”

As noted by research boutique GeoInvesting, that explanation appears to defy common sense. High margin sales are the best kind of sales. Choosing to forego high margin business as a means of temporarily improving a balance sheet metric seems to be nonsensical.

We find the language in this release on “accelerated catching up on sales held back” to be similarly bizarre. It appears as if the company can simply turn on and off its “high margin” catalogue sales at will. We find it curious that these sales seem to take place with such fluidity and that they appear heavily in the “Rest of the World” segment; the least specific customer category consisting of largely opaque jurisdictions.

Notably, the company also claims in the most recent March quarter to have generated over 60% of its total revenue in “Rest of the world”.

Again, as noted by the folks at GeoInvesting, India has 1.25 billion citizens while there are only an estimated 16 million total Indian ex-pats living abroad across all regions. While Bollywood entertainment can certainly have appeal with anyone, one would think that such appeal may apply at least somewhat proportionately across one or several other regions of the world such as Europe and North America. Instead, we are led to believe that growth is shrinking in India, Europe, and North America, while exploding elsewhere.

Questionable Receivables, Again

The company’s trade receivables balance increased to $226.8 million from $169.3 million from a year ago, again due largely to “significantly higher catalogue sales”.

Using the updated trade receivables balance and the annual revenue number, we calculate a DSO of 327 days. That metric is extremely high by any measure, but we believe the ex-India DSO to actually be much worse.

Eros’s key Indian subsidiary (EIML) had a DSO of approximately 97 days in its last fully reported fiscal year. Given that India accounts for a substantial proportion of the company’s total revenue and has skewed the overall DSO downward, we can surmise that the DSO on revenue coming from outside India is likely significantly higher than 327 days. The implication is that Rest of the World sales seem to be particularly troublesome to collect on. We wonder why.

The company’s release added that it collected over $25 million of fiscal 2017 trade receivables post balance sheet. While this was touted as an accomplishment, we view collection of only 11% of the previously outstanding trade receivables in the roughly four-month interim period as a reinforcement of the company’s continued collection issues.

Eros’s Movie Library

In the annual release filed on Friday, the company announced that “Eros’ library for digital film rights stands at over 10,000 films.” According to conference call transcripts, CFO Prem Parameswaran stated, “By the end of the fiscal year we had added 5,000 digital titles to the roster of films available on ErosNow.”

We find the new 10,000 metric to be somewhat confounding. On the ErosNow website, there are zero “Recently Added” movies for calendar year 2017 and only 22 movies for calendar year 2016 as of this writing. Similarly, we checked every genre category and found zero movies for calendar year 2017 and only 36 movies for calendar year 2016. We wonder, how old are the 5,000 additional digital titles and where can they be found?

The apparent doubling of the company’s film library also occurred despite its “intangible asset-content” line item only increasing by 13.8% from the previous year ($904.6m from $795.1m). Similarly, the company’s cash flow line item for “Purchase of intangible film rights and content rights” dropped 17.8% on a y/y basis, to $173.5 million from $211.3 million.

We have a hard time understanding how the company nearly doubled its library while seemingly failing to update its ErosNow offering with meaningful 2017 and 2016 content, failing to record a significant increase in the value of content assets, and failing to spend a commensurate amount on the new library titles. We seek clarification on specifically what was purchased.

What is the Story with the Movie Slate?

The MD&A section of the earnings release attempted to address various liquidity-related concerns by discussing the financial strength of the company. One statement in that section suggested that a large amount of money had been invested in the film slate. Specifically:

Over $200 million is already invested in the ongoing slate.

The implication seemed to be that the initial outlay could mitigate the company’s near-term cash demands and give the company a chance to harvest its past investment.

Despite the stated $200 million past investment, the conference call transcript sent a potentially conflicting message; the company acknowledged that the film slate would be “quieter” for the next two quarters and that it had not “thrown money to buy” an external slate. Rather, it claimed to be developing movies in-house, which would take longer:

The first two quarters will be quieter, because this is a self built up slate and not really something that we have just thrown money to buy. So the first two quarters will be quieter than the – it will be more back ended.

On the same call, the company suggested that the slate was not fully funded and still ramping up:

We are targeting pending $200 million to $225 million this year on new contents as we ramp the slate and continue to bulk up our digital content offering.

In other words, although a supposed $200 million had already invested in the ongoing slate, the company expects to put another $200 million to $225 million in this year. Given all of the past and planned investment, one might expect the outcome to be an aggressive roll-out of a large slate. Instead, we are told the outcome is a quiet couple of quarters and promises of a full slate in the latter half of the year and in the future.

ErosNow or ErosNever?

We are placing ErosNow at the bottom of this piece because we believe that placement corresponds most accurately to its relevance at this time. ErosNow’s paying subscribers were announced as being “tripled” over the course of the year; a sensational headline. When pressed for specifics on revenue and cash flow on the conference call, however, CFO Parameswaran noted that ErosNow had generated only $14 million in revenue for the entire FY 2017. ErosNow, therefore, represents only about 5.5% of reported FY 2017 revenue.

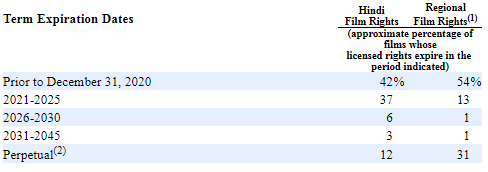

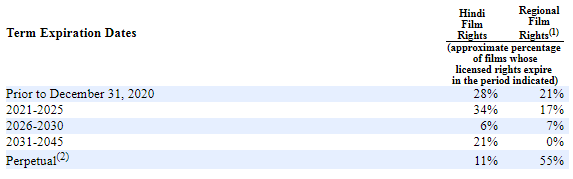

Despite the limited top-line contribution, the company noted that “nearly 50%” of the digital film rights are owned in perpetuity, in an apparent effort to reinforce the long-term value of ErosNow and the content library. In the company’s 20-F filing, we find a more optimistic version, that “over 50%” of the library is held in perpetuity. We seek clarification on exactly what proportion of the company’s digital rights are owned in perpetuity.

Perhaps the confusion arises due to the recent large increase in the company’s perpetual library. From the company’s 20-F filing, the company states:

We have acquired most of our film content through fixed term contracts with third parties, which may be subject to expiration or early termination. We own the rights to the rest of our film content as co-producers or sole producer of those films.

In other words, if Eros produced or co-produced the film, it owns the rights in perpetuity. Otherwise, the rights may expire on a fixed term. The acquired content accounts for “most” of its film content.

From the company’s previous 2016 20-F filing, we see that a substantial proportion of the content expired prior to 2020:

From the company’s latest 2017 20-F filing, we see a very different picture:

Now, we find that Eros’s perpetual film content has increased markedly in the “Regional Language Films” category, jumping from 31% last year to 55% this year. Regional films also comprised a greater proportion of the total library, increasing to 65% from 57% a year earlier. We would be interested to hear from management how the stated addition of 5,000 titles at seemingly low relative cost managed to achieve such a substantial altering of the library expiration dates.

Conclusion

We have numerous accumulated questions about Eros, and frankly, we are past the point of having confidence that they will be adequately answered. We believe Eros’s issues could be terminal for the public listed company within 3-6 months, if not sooner. We believe the combination of (i) hard-to-explain accounting questions (ii) short-term borrowings coming due (iii) spiking financing costs (iv) sales of key assets (v) worsening top and bottom line metrics, and (vi) a tarnished story all continue to make Eros a ticking time bomb for investors.

Disclosure: I am/we are short EROS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

3 thoughts on “Eros Earnings Review: An Abundance Of Red Flags”

Comments are closed.