Summary: Riot Blockchain (RIOT)

- Riot made a dramatic pivot from a “life science tools” business to a blockchain company mere months ago.

- The company paid approximately $12 million for a two-week-old crypo-mining entity that owned only about $1.9 million in crypto mining assets.

- A second acquisition raises additional red flags.

- Riot depleted an estimated 63% of company cash through a special dividend that appears to have disproportionately advantaged insiders.

- Regardless of one’s views on blockchain technology, we believe Riot is a name that should be avoided.

With “blockchain mania” in full swing, a new self-described leader has emerged. Riot Blockchain (NASDAQ:RIOT) purports to be “a Leading Blockchain Company & Only Nasdaq Listed Pure Play Blockchain Company.” With share prices nearly quadrupling in the past three months, we decided to examine the name more closely.

The company’s blockchain focus has come about through a series of rapid moves. Mere months ago, Riot was known as Bioptix, Inc. and operated “a life science tools company that provides an affordable solution for drug discovery scientists who require label-free, real-time detection of bio-molecular interactions.”

On October 4th of this year, Bioptix announced that it was changing its name and ticker from Bioptix. Inc. (BIOP) to Riot Blockchain (RIOT), and indicated that it would be pursuing a completely different business model focused on strategic investment and operations in the blockchain ecosystem.

We find such a dramatic pivot in business operations to be concerning in its own right, but we believe it is even more questionable given that the seismic shift has come about in conjunction with a series of dubious transactions. This is just one of the many reasons there needs to be crypto regulation, the market is too insecure and variable for anyone to consider any crypto to be reliable and secure.

Riot Paid Approximately $12 million To Acquire Kairos Global Technology – A Two-Week-Old Crypto-Mining Company That Owned Only About $1.9 Million in Crypto Mining Assets

On November 2, 2017, the company announced via press release that it had “entered into a definitive agreement to acquire cryptocurrency mining equipment consisting of 700 Antminer S9s and 500 Antminer L3s, all manufactured by industry leader Bitmain.” Upon closing of the purchase the company issued another press release on November 6, 2017, stating that “it has closed on its acquisition of cryptocurrency mining equipment”. A basic reading of the press releases might lead a reader to believe that the company had purchased the equipment directly.

However, a reading of the November 1, 2017, Form 8-K that described the transaction leaves us with a different impression. The 8-K clarified that Riot had actually acquired a corporate entity called Kairos Global Technology (“Kairos”) that held the cryptocurrency mining equipment described above.

The form 8-K described a share exchange agreement with Kairos whereby the company exchanged Convertible Preferred Stock (convertible into 1,750,001 common shares of Riot) for all outstanding shares of Kairos’s common stock. Given that Riot’s stock closed at $6.95 per share on November 1, 2017, we estimate the share transaction value at approximately $12.1 million (As of this writing those same shares would be worth an estimated $27 million.) In addition, Riot included a potential $1 million royalty sweetener for Kairos’s shareholders:

The shareholders of Kairos also will receive a royalty to be paid from cash flow generated from operations, which shall entitle such shareholders to receive 40% of the gross profits generated on a monthly basis until they have received a total of $1,000,000, at which point the royalty is extinguished.

All told, we estimate the transaction provided anywhere from $12-13 million in value to Kairos’s shareholders on the day of closing. Our belief is that Riot grossly overpaid. As above, Riot’s stated motive for the transaction was to acquire 700 Antminer S9s and 500 Antminer L3s used to mine cryptocurrency.

However, if Riot had simply purchased the above servers directly from Bitmain, we estimate that the price would have been $1,905,000. In order to arrive at this number, we checked a historical capture of the Bitmain website as of October 16th, 2017, and found that Antminer S9 servers were selling for $1,265 and that Antminer L3s were selling for $2,040.

We contacted Bitmain to see if it was experiencing massive backlogs or any other scenario that could justify an overpayment of roughly $10 million for $1.9 million of machines. We have not heard back from Bitmain as of this writing. The historical capture of the Bitmain website from October 16th shows that machines would have been expected to ship in just over one month from that date (November 21st-November 30th).

Adding to our skepticism of the Kairos deal is the fact that Kairos appears to have had no operations and/or website (despite registering a domain name) and that the entity was formed on October 19, 2017 – less than two weeks prior to its announced acquisition by Riot. We believe the fact pattern indicates that Riot’s acquisition of Kairos’s assets is highly irregular. Especially when you think about the consideration that should be used when registering a domain name for a new or existing website, look at how people and businesses go about registering domain names over on sites like makeawebsitehub.com, and it does seem nothing but irregular as to how Riot went about this.

Furthermore, it is unclear to us who ultimately benefited from the apparent generous payment terms for Kairos. The entity was registered to the address of a believed one-man law firm called Laxague Law, Inc. (“Laxague Law”). Its officers consisted of a Dubai resident and its directors consisted of two Floridians, though the underlying shareholder structure was not publicly disclosed.

Riot’s Acquisition of a Majority Stake in Another Blockchain Technology Company Raises Additional Questions

Riot’s acquisition of newly-established Tess, Inc. raises additional red flags. On October 20, 2017, Riot announced that it had acquired a majority (52%) stake in Tess, which Riot described as a company that was “developing blockchain solutions for telecommunications companies.” A “whois” search of the Tesspay.io website shows that it was initially registered on July 18, 2017. Tess then released a seven-page whitepaper in August 2017 describing (i) its plans for an initial coin offering (“ICO”); and (ii) the role its coins intend to play in telecommunications transactions. Those representations aside, the resumes of Tess’s principals leave us skeptical of Tess’s odds of success:

- Tess’s CEO, Jeff Mason, concurrently holds the same CEO position at two other companies, according to his LinkedIn profile: PowerCases and Wiztel;

- Tess’s CFO, Fraser Mason, concurrently hold the position of Senior Vice President of PowerCases, according to his LinkedIn profile; and

- Tess’s Chief Software Architect, Sorin Tanasescu, concurrently holds various senior roles at other companies, including: (A) Managing Director of VoiceWay; (B) Director of Middleware Integration for Rogers Communications; and (C) Director of an entity called Ingenium IT Compusoft (“Ingenium”).

Tanasescu’s other companies give us additional cause for concern. Namely, VoiceWay appears to have been associated with a Bitcoin phishing website.

On a Bitcoin forum called BitcoinTalk, one user conveyed that Google was displaying advertisements for “mt-qox.com,” a clever misspelling of the then-popular Mount Gox bitcoin trading website. That same user noted that the “mt-qox.com” website completely duplicated the real Mount Gox website. This is why it is important to do your research on bitcoin trading websites and bitcoin traders. Some people decide to do research at websites similar to https://cryptoevent.io/review/bitcoin-revolution/ to learn more about bitcoin bot trading.

Are you new to the world of Bitcoin? If so you might have questions relating to how Bitcoin is taxed. Correspondingly, if you live in Canada and you have concerns about how you should be reporting income you have earned in Bitcoins, or want to learn more about how to report profits on the sale of Bitcoins, you should seek the advice of an experienced Canadian Tax Lawyer to avoid future problems with the Canada Revenue Agency. For more information, head to taxpage.com.

The apparent imposter site was registered to Cristian Talle at the address 196 Judith Ave., Toronto, Canada. It also appears to be a residence, based on a Google Maps search. That same address houses Tanasescu’s other businesses including VoiceWay and Ingenium. In addition, Talle used a VoiceWay email address to register the mt-qox.com site. Reddit users also noticed the site and started a thread entitled “[SCAM] watch out for mt-qox.com“. The users reported the site to Mount Gox and Google. Google subsequently took action and blocked it as a phishing website, according to the thread. (Note that the VoiceWay website itself was also registered by an individual named Cristian Talle – under a Rogers Communications email address).

Furthermore on the subject of Tess: On the same day that Laxague Law set up Kairos (October 19, 2017), the same law firm also set up an entity called Ingenium Global, Inc., which has a unique name that is similar to an entity in which Tanasescu manages (Ingenium IT Compusoft). Even more interestingly, Ingenium Global, Inc. listed the exact same officers/directors as Kairos (an individual in Dubai and two from Florida) and registered the exact same par value and share count. Given that Riot announced the acquisition of Tess the very next day (October 20, 2017), we cannot help but wonder whether the selling parties in the Kairos transactions were in any way related to the shareholders of Ingenium, and ultimately to the selling parties in the Tess transaction.

Riot Depleted An Estimated 63% of the Company’s Cash Through a Special Dividend That Appears To Have Disproportionately Advantaged Company Insiders

Bioptix/Riot recently engineered a “special cash dividend” that stripped the fledgling company of approximately 63% of its cash, seemingly handing a significant portion of those funds to company insiders. That kind of cash giveaway – announced one day ahead of a shift to a new, speculative business model – gives us significant concerns. The sequence of events was as follows:

In March 2017, Bioptix announced the completion of private placements that included a convertible note financing and also included warrants to purchase 1,900,000 shares of common stock.

On September 25, 2017, Bioptix made the following disclosures:

- Bioptix filed a Form 8-K stating, in part, that notes from the March 2017 Offerings had been exchanged for shares of Series A Convertible Preferred Stock.

- Bioptix filed an amended Registration Statement Form S-3 which described how holders of Series A Convertible Preferred Stock “are entitled to receive dividends if and when declared by the Company’s board of directors. The Series A Preferred Stock will participate on an ‘as converted’ basis, with all dividends declared on the Company’s Common Stock.”

Then on October 4, 2017, the newly-named Riot filed a Form 8-K stating that the company had approved a cash dividend:

Pursuant to which, the holders of the Company’s common stock, no par value per share (the ‘Common Stock’), and Series A Convertible Preferred Stock, no par value per share (the ‘Series A Preferred Stock’), as of the close of business on October 13, 2017, shall receive $1.00 for each share of Common Stock, including each share of Common Stock that would be issuable upon conversion of the Series A Preferred Stock, on an as converted basis.

The magnitude of the dividend is significant. The payout “totaled approximately $9,562,000” whereas Riot’s financial statements reflected that at the close of Q3 2017 – two days before the October 2017 dividend was approved – the company had only $13,139,722 in cash and cash equivalents. When factoring in an added $1.86 million in cash proceeds from warrant conversion, the October 2017 dividend depleted an estimated 63% of the company’s cash and cash equivalents balance. Consequently, we find its size relative to Riot’s available cash to be troubling.

The timing of related warrant conversions is similarly concerning. Riot’s quarterly filing prior to the October 2017 dividend indicates that 2,060,000 warrants from the March offering were converted into 1,228,690 common shares on a cashless basis. In addition, 620,000 warrants were exercised for cash during a period where Riot’s board of directors authorized on October 10th a “temporary reduction in exercise price” of convertible securities from the March 2017 private offerings. Given that the record date of the October 2017 dividend was October 13, 2017 (with a payment date of October 18, 2017), both the cashless warrant conversion and the conversion from the reduction in exercise price of the March 2017 securities appear to have conspicuously occurred just prior to the payment of the October 2017 dividend.

Who Benefited From the Special Dividend?

In the press release announcing the special dividend, the company’s CEO stated: “This special dividend is a positive step to return value to all Bioptix shareholders.” Despite this pronouncement, we believe Riot insiders and participants in the March 2017 private placements benefited disproportionately.

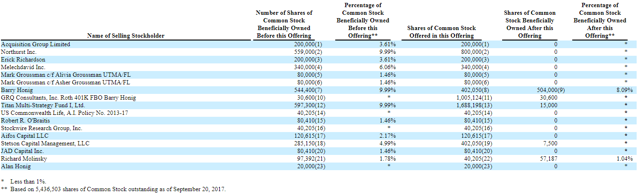

The amended Form S-3 detailing the convertible and warrant offerings prominently mentioned one individual in particular. Per the filing, “The Lead Investor is Barry Honig who is also a selling stockholder.” Moreover, Honig-related entities, as well as Honig’s family members including brother Jonathan and father Alan, also participated in the transactions.

Later, in two Schedule 13G filings filed as of an event date of October 10th – just days prior to the dividend ex-date – Jonathan Honig and an individual named Mark Groussman reported common stock ownership stakes of 9.51% and 5.93% respectively. Jonathan Honig’s filing also mentioned that the 9.51% figure “does not include 808,198 shares of common stock issuable upon conversion of Series A Preferred Stock.” it is unclear from the filings where Barry Honig’s ownership on a common stock and on a convertible/exercised basis stands currently.

Note that the same filing mentioned that there were only 5,436,503 shares of common stock outstanding as of September 20th. By November 13th, the number of common shares had spiked up to 8,321,137, a roughly 53% increase in common shares in less than two months. Such a jump indicates that a significant amount of dilution has affected common stockholders in a short amount of time.

Conclusion

We have no strong bearish or bullish view on the future of blockchain. We genuinely hope the technology is implemented broadly and that currency and information can be effectively decentralized through its use. Regardless of one’s views on blockchain technology however, we think Riot is a name that investors should avoid. We urge cautious investing to all.

Disclosure: I am/we are short RIOT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein. Hindenburg Research and the terms, logos and marks included on this report are proprietary materials. Copyright in the pages and in the screens of this report, and in the information and material therein, is proprietary material owned by Hindenburg Research unless otherwise indicated. Unless otherwise noted, all information provided in this report is subject to copyright and trademark laws. Logos and marks contained in links to third party sites belong to their respective owners. All users may not reproduce, modify, copy, alter in any way, distribute, sell, resell, transmit, transfer, license, assign or publish such information.

2 thoughts on “Riot Blockchain: Sudden Business Pivot, Suspicious Acquisitions, Questionable Special Dividend Riot Blockchain (RIOT)”

Comments are closed.