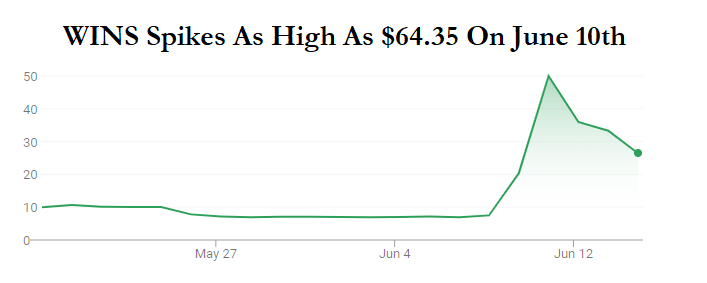

- On June 10th, Wins Finance, a China-based small business lender, mysteriously spiked 758% on 151x its previous day’s volume on absolutely no news whatsoever. The company disavowed involvement in the mystery surge in a press release.

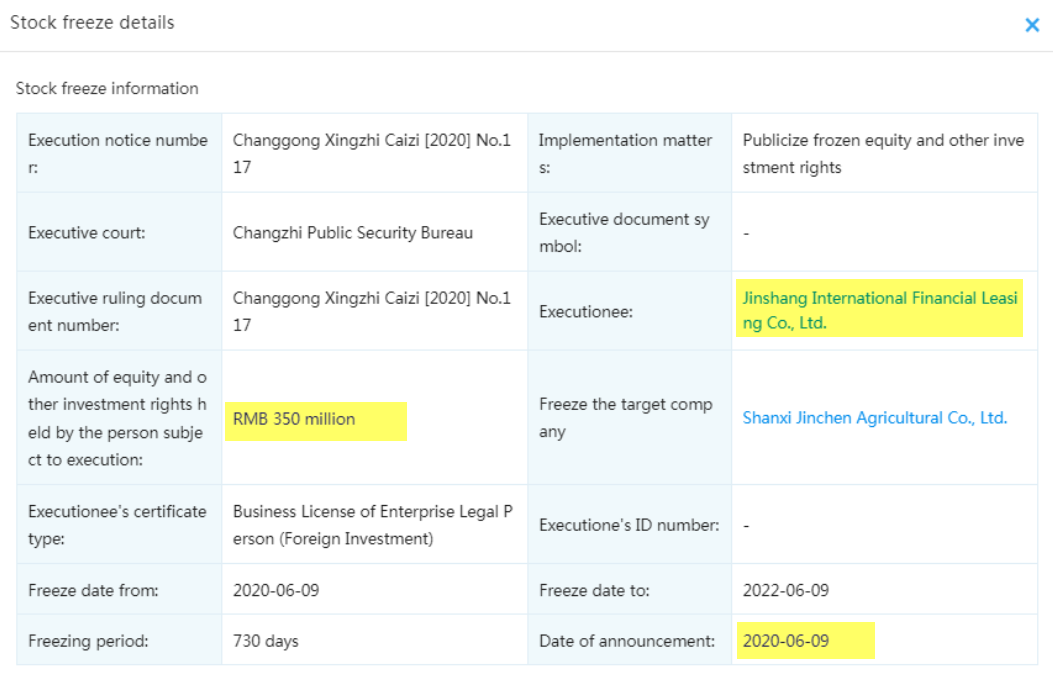

- The timing looks suspicious. The day before, on June 9th, Chinese courts rendered an RMB 350 million asset freeze on assets of Wins’ operating subsidiary. The same operating entity in China has two enforcement orders against it since November 2019. We think Wins is likely functionally insolvent.

- Wins’ parent, which owns 67.7% of Wins’ equity, has already been formally declared insolvent. A provisional liquidator was appointed to the parent company in February, and its equity (which was listed in Hong Kong) has been suspended from trading.

- Wins has a July 2nd hearing with NASDAQ to determine its listing status over its failure to file an annual report for the fiscal year ending June 30th, 2019. The last available financials for the company were as of 18 months ago (December 2018).

- We visited the company’s headquarters and found it mostly empty. We also visited the corporate address for Wins’ operating subsidiary and found it empty. Neighbors told us the office has been abandoned for a “year or two”.

- Wins’ CFO Junfeng Zhao resigned from the company’s operating subsidiaries in November. We emailed the company yesterday asking about this and whether he was still CFO of the parent. The company didn’t respond to us directly, but issued a 6-K this morning announcing Zhao’s resignation as CFO. We think he may have actually resigned 7 months ago and the company simply didn’t disclose the departure until prompted by us.

- Wins’ (now-former) CFO’s immediate prior work history included serving as financial controller for Agria, a firm delisted by the NYSE and charged by the SEC over allegations of stock manipulation and accounting fraud.

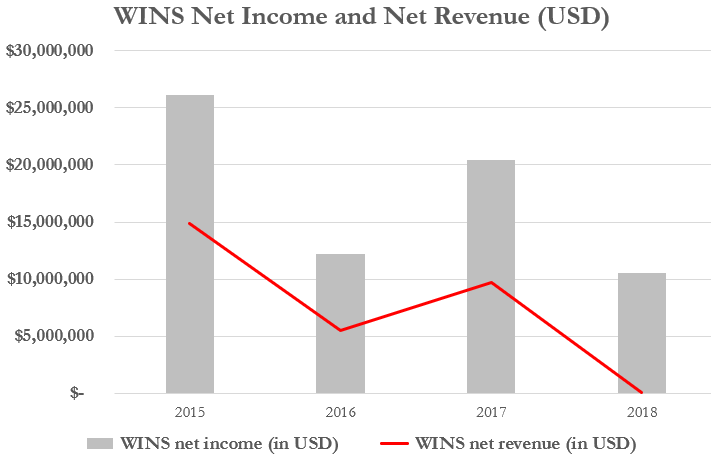

- Wins’ financial situation looks severely impaired. The company recently disclosed that $83 million disappeared in a deal with an opaque Chinese entity. Net revenue in the last available financials (for the six months ending December 2018) was negative. Net income declined 67% y/y.

- We view Wins’ auditor (Centurion ZD CPA) as a major red flag. Centurion merged with a firm that had absorbed an auditor banned by the PCAOB for audit failures relating to China-based companies. Centurion also served as auditor for Yangtze River Port & Logistics, a once $2 billion market cap company that lost 99% of its value and was delisted once its claimed key asset was identified (by us) as likely being a total fabrication.

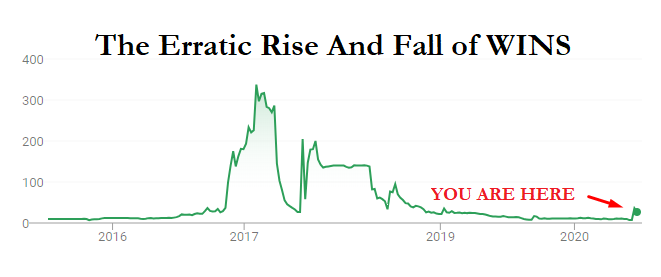

- Wins has a history of alleged stock manipulation, including a mysterious 4,555% spike in 2017 that gave the firm a temporary $9 billion market cap. That circus led to the company’s ejection from the Russell index, a shareholder lawsuit and a NASDAQ delisting threat.

- Wins strikes us as a company worth $0 trading at a current market cap of $700 million ($34 price as of this writing) due to its recent irregular trading spike. Frankly, we think the company is in the midst of one last pump and dump before it disappears for good.

- In our view, Wins never should have remained listed after its first fiasco in 2017. We encourage NASDAQ to implement stronger policies that prevent companies that repeatedly exhibit glaring red flags from trading on a premier national exchange.

Background on Wins’ Absurd 4,500% Spike in 2017 on No News, Leading to a Fraud Lawsuit Settlement And A Nasdaq Delisting Decision (That Was Reversed For Undisclosed Reasons)

We never expected to be talking about Wins Finance Holdings (NASDAQ:WINS) after its ridiculous debacle in 2017. That year, the tiny China-based small business lender spiked 4,500% on no news, leaving a wave of befuddled analysts and journalists trying to figure out what on earth had happened.

Multiple reporters (1,2,3,4,5) noted the irregular trading, including this example:

It was later discovered that WINS fraudulently claimed to own a U.S. office in order to qualify for FTSE/Russell index inclusion, according to a lawsuit filed in 2017 (Wins settled the complaint in 2018).

The stock had spiked on the inclusion, but FTSE/Russell ultimately removed WINS from its indices, sending it crashing back down.

The 4,500% spike in WINS still serves as the classic example of a passive index forced-buying bonanza (followed by a passive index forced-selling bonanza), a process that played out several times over the history of Wins:

After FTSE/Russell removed WINS from its index, shares were halted for 6 months and then plummeted spectacularly.

Nasdaq moved to delist the company in 2017, but then reversed its own decision without providing a reason.

And Here We Are Again: WINS Mysteriously Spikes 758% Last Week on No News and Has Begun To Crash Once Again

On June 10th, WINS stock mysteriously spiked to as high as $64.35, a 758% gain from the prior day’s close, on absolutely no news whatsoever. On the day of the surge, the stock traded 428,000 shares, compared to 2,800 in the prior day, a 151x increase in volume.

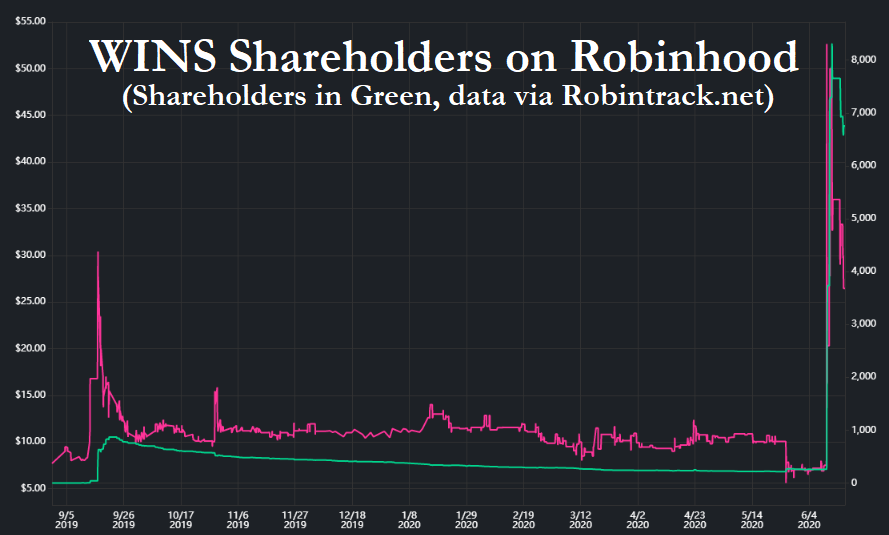

The sudden spike managed to draw in retail momentum traders. RobinHood account holders owning WINS increased to over 8,000 from only 259 prior to the spike, according to RobinTrack.

The company commented on the move publicly on June 11th, disavowing any role in the oddity and claiming to have no idea why the stock was up on such significant volume:

“…in view of the recent high trading volume and significant price increase of the Company’s ordinary shares, Wins Finance wanted to confirm to the market that it is not aware of any material corporate developments that could account for this unusual trading activity.”

Is the Spike Justified? A Panoply Of Material Issues Exposes WINS As A Clear Zero

1. Wins Operating Subsidiary Had Its Assets Frozen by the Chinese Courts the Day Before the Mysterious Stock Spike

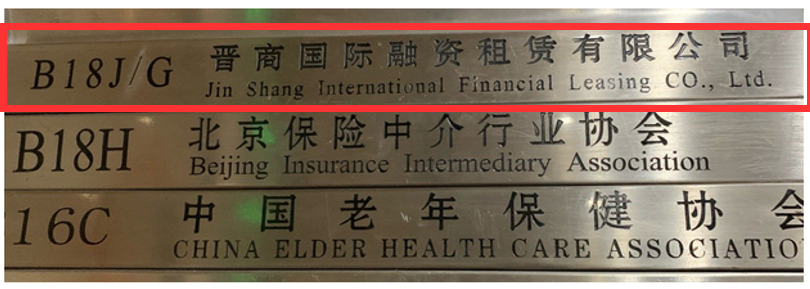

Wins Finance’s operating entity in mainland China is Jinshang International Financial Leasing Co., Ltd. 晋商国际融资租赁有限公司 (also referred to as “Jin Shang”), according to company filings. [Pg.29]

Following Wins’ massive stock move, we reviewed Chinese Court and legal filings to see if there was any local news that might have justified the spike.

Much to our surprise, we found that Chinese Courts had frozen assets of Wins’ operating subsidiary the day prior to the spike. Per QCC and court records, two judgments were rendered against Wins’ subsidiaries as part of the same case:

As we can see, the date of the freeze was June 9th, 2020:

Beyond the above, in November 2019, two enforcement orders totaling RMB 35 million (USD 4.9 million) were filed against Jinshang, according to court records. One month later, the creditor agreed to extend the payment deadline to December 2021, according to the same records. It is unclear how Jinshang has handled these enforcement orders yet.

We have seen no disclosure from the company on any of these court ordered judgments. We have asked the company for more information and have not yet received a reply.

Given the above, we think the company is likely functionally insolvent.

2. Wins Has Failed to Disclose That Its Parent Entity, Which Owns 67.7% of Its Equity, Is Insolvent, Has Ceased Trading in Hong Kong, and Is in Liquidation

In mid-2017, Wins announced that Hong Kong Exchange-listed Freeman FinTech acquired ~67% of its shares. An announcement from last week affirms that the parent has maintained its ownership stake.

Recent Hong Kong filings that show that Freeman FinTech was suspended from trading and entered into liquidation on February 28th 2020, according to a court order. This followed almost a year of insolvency petitions and creditors declaring the company to have been in default. [1,2]

Freeman Fintech’s financials also show that substantially all of its WINS stake had been pledged to creditors in advance of the liquidation, suggesting that the ownership of the company had been in precarious hands well before recent events. [Pg. 46-47]

3. We Visited Wins’ Headquarters in China and Found it Mostly Empty

Our investigator visited Wins’ headquarters during working hours and reported to us that the building seemed mostly empty. There was no one at the front desk, so the investigator continued into the main working area.

In total, our investigator saw about 30 cubicles and numerous offices, which were almost entirely empty. They counted 4 individuals in the facility that did not appear to be doing much.

Our investigator approached one of the individuals under the grounds of seeking a loan (the business Wins purportedly operates in.)

When asked about the company and whether it was still engaged in business and to what extent, the woman simply stated “we do professional work” repeatedly. She had no business card and provided no contact information for her or anyone else at the company.

She seemed to provide no insight on the purported business at Wins and our investigator viewed her answers as highly evasive. The stance was not one would not expect for an active business seeking new customers, but is fitting with a company facing an asset freeze and potential insolvency.

We emailed the company to ask whether COVID has impacted its employee’s ability to show up to its headquarters, and have not heard back as of this writing. We also asked about the judgments in an effort to understand whether the business is still operating as a going concern, and have not heard back thus far.

4. We Visited Wins’ Operating Entity’s Listed Address and Found it Empty—Neighbors Said the Location Had Been Abandoned for a “Year or Two”

In addition to WINS headquarters, we also found a location listed on the operating entity’s corporate records through its QCC profile:

Jin Shang International Financial Leasing Co., Ltd. 晋商国际融资租赁有限公司

Address: 北京市西城区西直门南大街2号B2-18G

Our investigators took the following photographs from our visit to this address. Here are several photos of the building from the outside:

Here is a photograph of the B2 entrance, which is listed on the entity’s address:

Here are some photos of the signage in the lobby, which still lists the operating entity for Wins, Jin Shang International Financial Leasing Co. (alternately spelled Jinshang International Financial Leasing Co., Ltd. in company filings):

Our investigators took photos of the hallway where the offices are located. It is not what we would expect from a $600 million NASDAQ-listed company, but rather perhaps a low budget motel:

There were two doors listed on the address, “B18G” and “B18J”, both shown side by side in the photograph below (and corroborated by the lobby signage).

We knocked on the door for “B18G” at 11AM local time during a normal June workday and no one answered. Neighbors told us that no one had been seen there for “maybe a year or two”. The second door appeared to our investigator to now belong to a different business altogether (as marked).

5. We Emailed Wins Last Night Inquiring as To Whether The CFO Was Still Active, Given That He Resigned From Wins Subsidiaries in November. This Morning the Company Announced the CFO Had Resigned

We found that Wins’ (now-former) CFO Junfeng Zhao had previously been appointed a board director of two of Wins’ operating subsidiaries in China, but found that he resigned from those directorship roles in November 2019, according to Chinese online corporate records. We also noticed that he disappeared from the company’s website.

We found that tremendously odd, and e-mailed Wins yesterday to inquire whether its CFO was still in fact its CFO. Our e-mail to the company asked:

“I saw that your CFO withdrew from Wins’ Chinese operating entities. Can you please share the reason for that and confirm whether he still currently the acting CFO of the company?”

The company did not e-mail us back but appears to have responded this morning with a 6-K announcing that its CFO resigned, claiming he resigned two days ago on June 15th. We think there is a chance he may have actually resigned in November but the company simply didn’t disclose it until prompted.

Regardless, the company did not announce a replacement for Zhao. What are the odds that Wins files an annual report and maintains NASDAQ compliance now that it has no CFO?

The release this morning also announced the resignation of a board member with no replacement.

6. Wins’ (Now Former) CFO’s Immediate Work History Prior to Wins Including Financial Controller at Agria, Which Later was Delisted by the NYSE and Settled Charges with the SEC Over Alleged Stock Manipulation and Accounting Fraud

WINS former CFO, Junfeng Zhao, previously served as financial controller at Agria Corporation immediately prior to joining WINS in 2010.

Agria was investigated by the NYSE in 2016 for alleged stock manipulation. The NYSE had “identified evidence indicating that the Company (i) through a top executive and other intermediaries engaged in trading intended to artificially inflate Agria’s stock price.”

It was charged by the SEC in 2019 over allegations of accounting fraud and manipulative trading. Agria was delisted by the NYSE, settled the SEC charges, and eventually terminated its securities registration.

Though the unraveling of Agria took place after Zhao’s departure, we found it an alarming resume item to immediately precede his assumption of the CFO role of a different public company.

7. Wins’ Auditor Has a Storied History of Auditing U.S. Listed Chinese Firms That Have Imploded Amidst Accounting Irregularities

Wins doesn’t have a great track record with regard to its financial reporting.

The company has disclosed a material weakness in its financial controls for the past 2 annual reports it filed in 2017 and 2018. Namely, the weakness was that the company had a lack of qualified accounting personnel. [Pg. 6, Pg. 6] The SEC noted this weakness in a letter to the company on May 2nd, 2019, and it has clearly not been remediated (given the lack of financials). Nonetheless, Wins remains listed (for the time being.)

As of the 2018 annual report, WINS’ auditor was a firm called Centurion ZD CPA.

Centurion recently merged with Dominic KF Chan & Co. [Pg. 1] The last Public Company Accounting Oversight Board (PCAOB) report we could find for Dominic KF Chan was from 2011 and it did not inspire our confidence. Per the report:

“The inspection team identified what it considered to be audit deficiencies. The deficiencies identified in two of the audits reviewed included deficiencies of such significance that it appeared to the inspection team that the Firm did not obtain sufficient competent evidential matter to support its opinion on the issuer’s financial statements.”

Another Hong Kong auditor called Albert Wong & Company (AWC) was banned by the PCAOB for ignoring flagrant red flags among China-based companies listed on U.S. exchanges. Prior to the PCAOB handing down its ban however, AWC merged with Dominic KF Chan, in early 2016.

We view this is a red flag bordering on absurdity.

Centurion may be known to some of our readers, given that it was also auditor of Yangtze River Port & Logistics, a once $2 billion market cap NASDAQ-listed firm that we wrote about in late 2018. We found that the company’s key asset didn’t appear to exist and seemed to be a total fabrication.

That company was later delisted by NASDAQ and has since lost 99% of its value following an investigation by both NASDAQ and FINRA that found signs of manipulative trading and other irregularities.

8. Even Wins’ Outdated, Year and a Half Old Financials Show an Organization Crumbling. Recent Disclosures Show $83 Million Has Gone Missing into an Opaque Chinese Entity

While WINS stock was spiking, its financials were disintegrating spectacularly. The company saw its net revenue crash from $9,726,685 in 2017 to just $102,763 in 2018.

In the 6-month period ending December 31st 2018, the company reported net revenue of negative $916,671 and net income of $2,985,734, a 67% year over year decline for the same 6-month period. [Pg. 6]

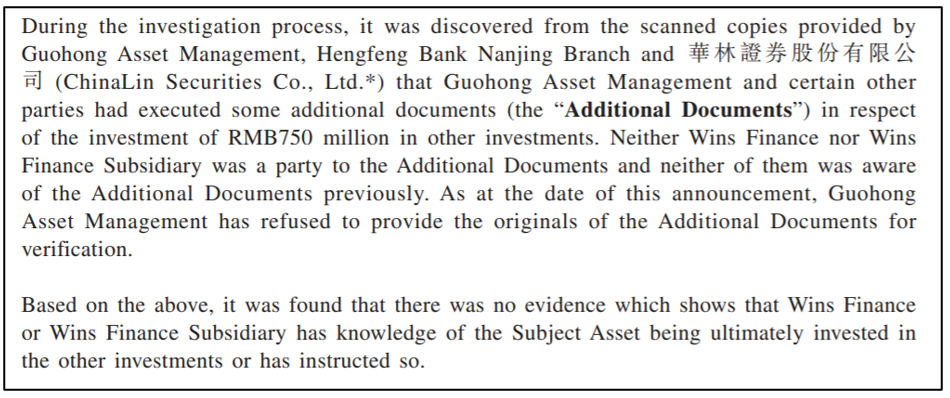

The company disclosed in January 2020 that it is late to file its annual report in part due to uncertain treatment of $83 million in missing assets entrusted to an opaque Chinese entity that the company is no longer certain it can recover.

Wins’ parent entity stated that it hired an independent firm to assess whether the money was siphoned out by a related party and unsurprisingly found that the company was unaware of the circumstances around the missing funds.

The company provided an almost comically brief summary of the independent findings, stating that there were “some additional documents” that led to the disappearing funds, and declared the company absolved of responsibility.

9. We Expect WINS Will be Delisted Due to Failure to File Financials. This View Is Reinforced By The Company’s Lack of A CFO, Per Its Announcement This Morning.

Wins announced it received a delisting notice from NASDAQ on November 18th 2019 for failure to file a timely 2019 annual report for its fiscal year ending June 2019. The company submitted a plan to file its report and regain compliance, which bought it another 180 days, until May 13, 2020. In the same announcement, the company announced the appointment of a new Chairman and a new Chief Operating Officer.

The May 13th deadline passed with no financial report, and on May 22nd, the company announced it had received another delisting notice from NASDAQ. The same announcement disclosed at the newly appointed Chairman and Chief Operating Officer both resigned.

The company requested a hearing with the listing panel, which will allow the company to remain listed until July 2nd while the panel makes its determination.

Conclusion: Wins Is Truly The Worst Of NASDAQ—We Think It is a Zero In Short Order

Investors often view a listing on NASDAQ, one of the U.S.’s most prestigious exchanges, as a sign of legitimacy.

Despite this perception, Wins is currently listed on NASDAQ despite having (1) no current financials (2) no CFO (3) undisclosed legal judgments (4) a headquarters that is almost entirely empty (5) a history of major trading irregularities and alleged fraud (6) an auditor that has a history of ‘auditing’ China-based total blow ups, and (7) a parent in undisclosed insolvency.

Meanwhile, as the company with no CFO’s July 2 deadline to file financials approaches, we believe it is simply putting off the inevitable – disclosing the precarious position it is in – while the stock pumps one last time to perhaps help stakeholders exit on the way out.

In sum, we think WINS is a company that is already worthless and the market will soon figure that out.

Disclosure: We are short shares of Wins Finance Holdings (NASDAQ:WINS)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

18 thoughts on “Losing With WINS: NASDAQ’s Latest Disgrace Has No Financials, An Insolvent Parent Entity and Is Embroiled in What Appears to Be an Obvious Pump and Dump”

Comments are closed.

You GD kikes. Making false news to tank a stock. I hope you all get Covid and choke to death slowly like the gas chambers, remember those?. You have no morals and think you’re tricky. You’ll get yours. You have my email address, let’s chat. Anytime anywhere you frauds.

Are you an idiot?

To the people of Hidenburg, could you please comment on the risk of getting wiped out if another pump & dump occurs while shorting the company?

It might eventually go to zero, but in the past it has gone up immensely for no particular reason. If that happens while shorting the stock the margin calls would become unbearable and most likely your short positions would be closed. The stock might fall afterwards, but by then you will be wiped out.

Don’t you think that risk outweighs the potential benefit? If there were only put options available…

Thanks a lot!

Well, I was clearly right about the risk of shorting stocks that can be pumped. If you dont believe me just go read any newspaper and see what is happening with WSB.