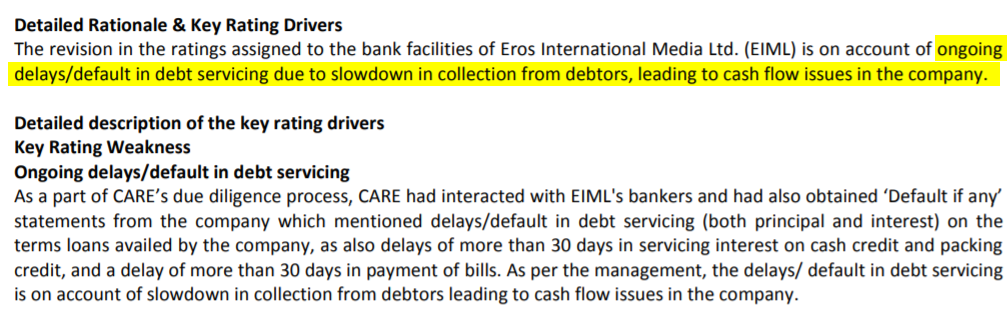

- Yesterday, Eros’s key Indian operating subsidiary had its credit rating lowered 10 notches to “default” by CARE ratings, the second largest Indian ratings agency. The issue, according to CARE was “a slowdown in collection from debtors”.

- The default occurred just as we were completing an investigation that sought to explain precisely why Eros has been persistently unable to collect receivables from its debtors.

- After extensive on-the-ground research in India, interviews with multiple former employees, and a detailed review of Indian private company filings, we believe the underlying problem is that a significant portion of Eros’s receivables don’t actually exist.

- We have uncovered details of highly irregular related-party transactions. For example, Eros has directed $153 million to a supposed production company based in tiny office located in what looks to be a rehabilitated Mumbai slum. The entity is operated by the brother-in-law of Eros’s Chairman and CEO.

- We have also documented what we believe to be multiple undisclosed related-party transactions that appear designed to hide receivables.

- It is hard to imagine Eros’s equity makes it out of this scenario intact. We expect the price of both the BSE and NYSE stock to end up worthless, barring some sort of bailout from a friend of Eros’s leadership.

- In our opinion, this situation has arisen due to a complete failure of Eros’s auditor, Grant Thornton, to apply even basic scrutiny to Eros’s financials.

Initial Disclosure: After extensive research, we have taken a short position in shares of EROS. We stand to benefit financially if the stock price declines. This report represents our opinion, and we encourage every reader to do their own due-diligence. Please see our full disclaimer at the bottom of the report.

Introduction: The Market Was Caught Off-Guard by the Sudden Credit Default of Eros’s Key Operating Subsidiary

The last couple of days has seen a dramatic series of events for Eros, a company that has been dogged by allegations of accounting irregularities for years (including in several articles written by us: 1, 2).

India’s second largest credit ratings agency, CARE ratings, suddenly lowered the rating on Eros’s key Indian operating subsidiary by 10 notches to “Default”, catalyzing a wave of intense selling pressure across Eros’s entire capital structure.

Eros’s Bombay Stock Exchange-listed subsidiary subsequently cratered limit-down, along with Eros’s unsecured bonds trading -43%, followed by its NYSE-listed stock which finished the day down about 50%.

Eros initially responded to the default news with a morning press release stating:

Eros International PLC and all of its subsidiaries have met and continue to meet all debt service commitments.

The story already shifted by mid-day however when a follow-up press release acknowledged that its subsidiary was actually late on two loan payments:

(the subsidiary) was late on two loan interest payments for April and May 2019. These interest payments total less than $2 million and are currently in process of remittance.

The release then reiterated the company’s strong cash and liquidity position, although this seemed to do little to allay investor concerns (the stock remained roughly flat from the time of announcement until end of day).

The implosion of Eros’s capital structure seems to have caught many market participants off-guard. Macquarie analysts covering the stock put out a research note entitled “Hard to Explain“, with their best guess being that Eros defaulted due to a “clerical error”.

Introduction: It’s Not Hard to Explain

For us, this unraveling couldn’t have been more expected. We have been tracking Eros’s rapidly deteriorating financial condition closely and were in the process of finalizing this investigation which sought to understand these very issues in more depth.

With Eros’s high short-term debt balance, its recent failure to raise an onshore bond, and its failure to collect on its suspiciously high receivables balance, a liquidity event seemed to border on inevitable.

The Reason Cited for Default: “A Slowdown in Collection from Debtors”. Our Explanation: We Think a Significant Portion of Eros’s Receivables Don’t Actually Exist

The reasoning cited by CARE for the default rating was a “slowdown in collection from debtors” which led to cash flow issues at the company. Per the report synopsis:

The “slowdown in collection” echoes the criticism of multiple short-sellers over the past several years (including us) who had identified patterns of suspicious related-party entities and large amounts of revenue that the company has had persistent difficulty in collecting.

Quite frankly, our belief is that Eros is having a hard time collecting on its receivables and advances because we think a significant portion of them do not actually exist.

When faced with past questions about revenue and receivables from skeptics Eros chose to sue them all, including us, alleging a massive “short and distort” conspiracy. The lawsuit was recently dismissed against all moving defendants.

About Our Investigation: On the Ground in India, And Multiple Interviews with Former Employees

Instead of cowering to Eros’s bullying tactics, we instead decided to take our research to the next level.

In this report, we will share findings from our on-the-ground investigation to Mumbai, and from interviews conducted with multiple former employees globally.

Our primary goal was to learn more about Eros’s mysterious and growing uncollected receivables balance, which appears to be at the core of its current liquidity situation.

As we will show, we think Eros’s collapse is an egregious failure of its auditors, Grant Thornton, to apply even basic scrutiny to the company’s financial condition. This comes as no surprise: In the wake of another ‘mysterious’ financial collapse at one of its other clients last year, the CEO of Grant Thornton said (quite infamously):

We are not doing what the market thinks. We are not looking for fraud and we are not looking at the future and we are not giving a statement that the accounts are correct…we are not set up to look for fraud.

You can say that again Grant Thornton.

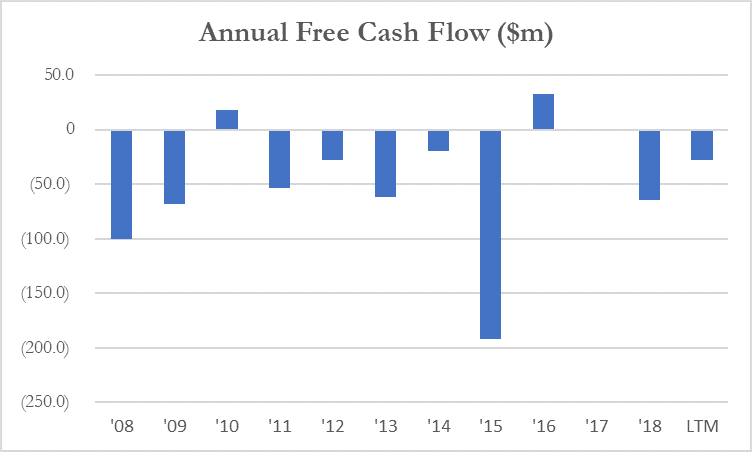

Liquidity Basics: Consistently Negative Free Cash Flow, Low $88m Cash and Equivalents Balance And $211m of Short-Term Debt

We will dive into what we believe are accounting irregularities in the reported financials, but a quick analysis of Eros’s reported numbers showed a poor liquidity position as-is:

- Cash and equivalents of $88 million as of last quarter [Pg. 3]

- Short term debt of $211m (total debt of $294m). [Pg. 3]

- Weighted average debt yield of ~10.9% (despite about half of the debt being secured.) [Pg. 20]

- Historical free cash flow has generally been negative, owing largely to expenditures on content outpacing reported net profit.

At a glance, a company with high short-term debt, historically negative free cash flow, and low available liquidity represents an obvious credit risk. It is for these reasons that a large number of companies decide to get supply chain financial risk mitigation. Ultimately, mitigating financial risk is all about lowering the level of risk by eliminating or reducing risk factors that could leave a business in financial ruin.

The Reported Financials Don’t Tell the Full Story. Eros Has A Long History of Accounting Red Flags

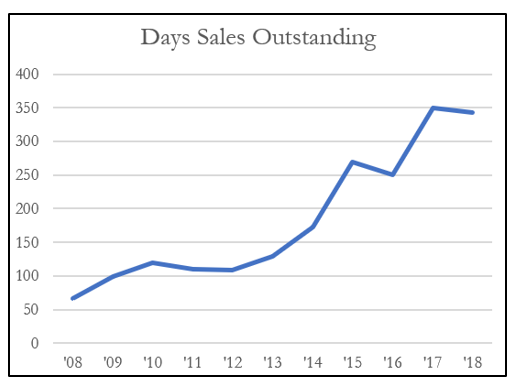

Going one level deeper, Eros has been the subject of multiple historical articles identifying accounting irregularities (1,2,3,4,5,6,7,8). Many of these articles have focused on red flags like Eros’s large uncollected receivables balance and consistent lack of positive free cash flow.

Eros’s days sales outstanding (DSO) indicate that almost a year’s worth of revenue has been booked but never collected. It is this lack of collection that seems to be contributing to Eros’s current liquidity meltdown.

(Note that large, growing receivables balances and a consistent lack of positive free cash flow generation are two common red flags often associated with revenue falsification):

We will next explore Eros’s relationship with a variety of questionable entities that we believe are contributing to its current situation.

Exhibit A: Next Gen-Eros Has Made $153 Million Worth of Net Payments & Advances to This Small Related Party Entity

Next Gen is one example of a related-party entity that we think Eros may have trouble “collecting” from.

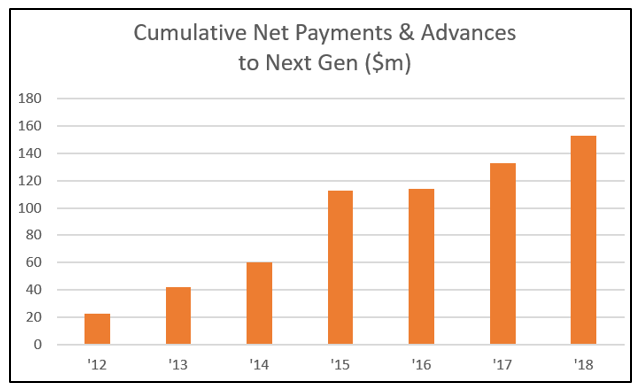

Next Gen is a film production company owned by the brother-in-law of Sunil and Kishore Lulla, Eros’s Chairman & CEO respectively. [Pg. 98] The entity has received $153 million in net payments and advances since 2012 (the earliest year reported in Eros’s SEC filings.)

According to its website, Next Gen has produced only 5 films since 2012, all of which were co-produced and/or distributed with Eros. We find this odd: Why fund Next Gen with hundreds of millions of dollars only to then co-produce/distribute all of their films?

Next Gen: The TOTAL Budget for Films Next Gen Has Produced in That Same Time Period Was Only $19.3 Million. Where’d the Rest of the Money Go?

Oddly enough, the total budget of the 5 films produced in that timeframe amounted to only about $19.3 million, according to Box Office India. (1,2,3,4,5)

Again, these films were largely co-produced by Eros which means that Next Gen likely hadn’t even shouldered all of these production costs itself:

| Film | Year | Budget $USD |

| Table No.21 | 2013 | 1,275,000 |

| 3G | 2013 | 1,950,000 |

| R… Rajkumar | 2013 | 8,700,000 |

| Phobia | 2016 | 1,275,000 |

| Munna Micheal | 2017 | 6,150,000 |

| Total | 19,350,000 |

If production costs totaled only $19.3 million, where did the other $133+ million go?

Next Gen also claims to buy and sell catalogue film rights, yet its website shows no films purchased or distributed. This doesn’t seem to explain the massive amount of money sent into the entity either. It also raises the same question-why would Eros send money to Next Gen only to buy catalogue films from it?

Next Gen: A High-End Office Fit for a Major Bollywood Production Studio? No-A Small Office Based in a Mumbai Rehabilitated Slum?

We visited Next Gen’s offices and found it to be far from what you would expect out of a supposed high-end Bollywood production company allocating hundreds of millions of dollars to movie projects.

Next Gen’s website doesn’t list an address, so we had to dig through the entity’s Indian private company filings to find its headquarters. The address is listed as ‘6-A/10, Junu Sangeeta Apartment, Santacruz (West), Mumbai.’

The offices are located in the Juhu Beach area and, more precisely, in a small enclosed area called “Sangeeta Apartments”. As the name suggests, and unsurprisingly for the location of a suspected shell company, the area is largely residential. Here we are at the Sangeeta Apartment complex on May 4th of this year:

And here is the Indian investigator in front of Next Gen’s offices (you can see the Next Gen sign in the background)[1]:

The company is located on the ground floor of what has been identified by one of our Indian advisors as an SRA building. SRA stands for “slum rehabilitation authority”, a government institution in charge of taking slum constructions and, with minimal modifications, turning them into buildings safe for living. This is clear from the photograph, which shows metal bars at the exterior of the building — typical signs of SRA intervention.

Our Indian consultant explained that many “dodgy” businesses tend to be located in slums or former slum locations because the authorities are less likely to check the premises and interfere with their activities.

We were able to briefly enter the Next Gen offices and accessed what seemed to be the main area. It was a small room with a desk and a couple of posters. We saw little to no commercial activity going on at the premises.

Immediately upon entrance, a middle-aged man with a mustache approached us with a worried and suspicious disposition. This person, as far as we could tell, was the only employee present during our three visits to the premises, and was unable to communicate in English.

The impression we got from this visit is that of a sham office where little to no real activity is going on at a location totally unsuitable for movie production; an industry most would associate with a nice building, well-stocked offices, and plenty of high-level employees.

Next Gen: Former Employee Claimed That Next Gen Channels Money to Lulla Family Members Through Dummy Production Deals

A 2016 class action lawsuit against Eros included witness testimony alleging that Eros uses Next Gen as a means of funneling money to the company’s insiders. Per the amended complaint [Pg. 22]:

Confidential Witness (“CW”) 2 is an Indian film producer with personal knowledge of the Company’s business practices in the period immediately leading up to the Class Period, as a result of his work co-producing films with Eros, including at least one film released in 2011. According to CW2, Eros channels money to family members through dummy production deals.

According to CW2, 30-40% of Eros’s acquisition and production occurs through Next Gen, owned by Kishore Lulla’s brother-in-law Puja Rajami. Further, according to CW2, NextGen signs the co-production agreements with EIM, and Eros makes payments to EIM, which, in turn, makes payments to NextGen to produce the films.

Thus, NextGen collects money on films but provides no added value, according to CW2. CW2 also avers that NextGen employees use Eros’s offices and do little other than make a margin on the film. CW2 also avers that Lulla’s wife also receives advances as a producer.

The lawsuit was dismissed, likely due to a lack of additional evidence. In light of our latest findings on Next Gen, however, we view the witness testimony as highly prescient.

Next Gen: How Much of These Advances/Payments Are Now Suddenly Hard to Collect?

We think investors deserve to know:

- How much of these advances and payments to Next Gen are now uncollectable and contributing to Eros’s liquidity situation?

- What did Eros get in exchange for these transfers?

- What steps has Eros’s auditor, Grant Thornton, taken to validate that the transactions were appropriate, if any?

A Pattern Emerges: Indian Private Company Audits Show Multiple Undisclosed Related-Party Transactions

Aside from Next Gen, and guided by our interviews with former employees, we explored other entities related to Eros’s Lulla family for clues to what is happening with Eros’s receivables balance. As alluded to earlier, we think the reason Eros has been unable to collect on its receivables is because it may be circulating them through its myriad related-party entities.

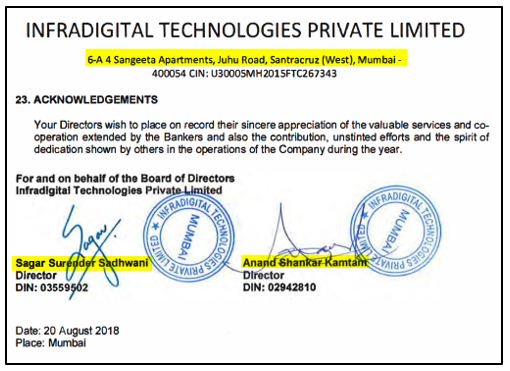

Example #1: InfraDigital Technologies-An Undisclosed Eros Related-Party Entity That Operates Out of the Same Address as Next Gen

Our research led us to an entity called InfraDigital Technologies that operates out of a different suite at the same address as Next Gen.

The entity is clearly a related party of Eros. Its two directors are (1) Anand Shankar, Eros’s finance controller and (2) Sagar Surender Sadhwani. (Surender Sadhwani is Eros’s director of Middle East operations and the cousin of Eros’s Chairman and CEO, Kishore Lulla and Sunil Lulla.)

Per the latest director’s report we can see both the directors and the address:

InfraDigital Technologies: Suspicious Financials- Barely Any Operating Revenue but Large Borrowings and Receivables To/From Related Parties

From the latest financials for the entity we see that it generated only about $90,000 USD in operating revenue yet had “Long term borrowings” and “Long term advances” of about 5x that amount, $427,000 and $482,000 respectively.

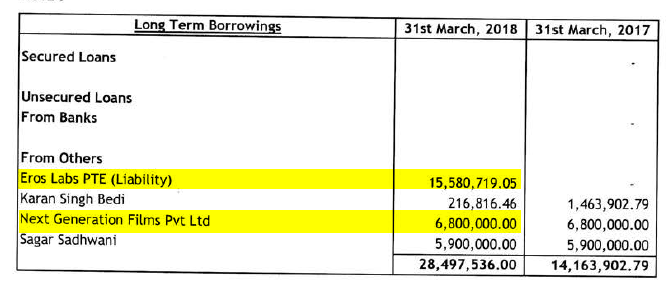

The borrowings come from related-parties Next Gen and Eros Labs:

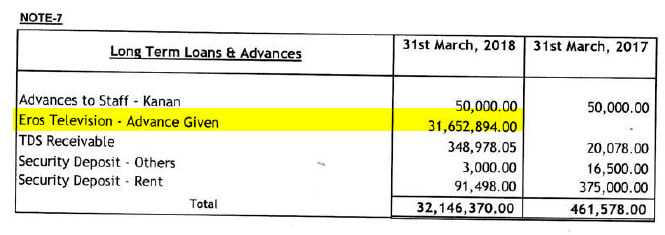

And the advances go right out to related-party Eros Television:

If this is all starting to look very circular it’s likely because it is all very circular.

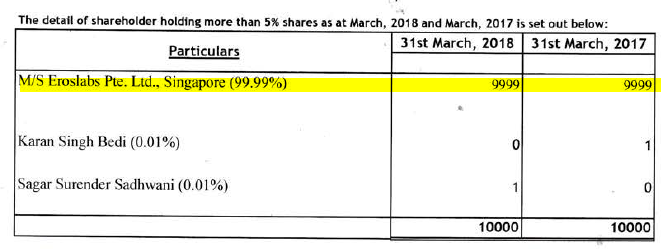

From the same audit we see that 99.99% of the shares of Infradigital are held by a Singaporean entity called Eroslabs Pte, revealing that the entity is not part of Eros’s corporate structure:

Singaporean records show that Eroslabs PTE is directed by the husband of Rishika Lulla, who registered his address as a PO Box based in Dubai.

We wonder, why do Eros’s principles have multiple entities engaging in numerous related party transactions based out of a small apartment in what appears to be a rehabilitated Mumbai slum? What legitimate business could be taking place here?

InfraDigital looks to be just one of multiple entities that exhibit similar characteristics.

Example #2: Eros Television-An Entity Based Out of The Same Registered Office as Eros’s Indian Subsidiary, Yet NOT a Part of Eros’s Corporate Structure.

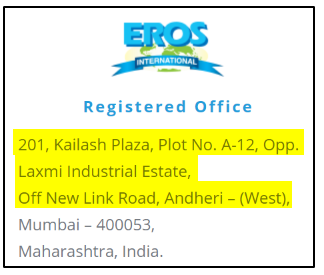

Eros Television is an entity based out of the same address as Eros’s Indian registered office, yet which falls outside of Eros’s corporate structure. From the entity’s recent directors report we see its address:

And from the Eros website we see the registered office matches:

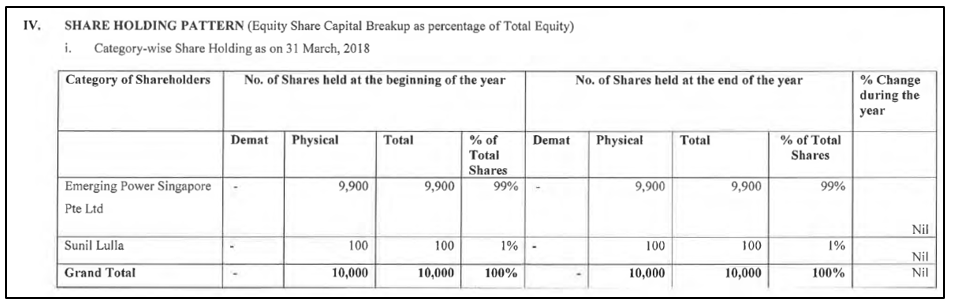

Per the same director’s report we see that 99% of Eros Television is owned by Emerging Power Singapore, another entity directed by the husband of Rishika Lulla. The other 1% is owned by Sunil Lulla.

In other words, this entity falls outside of the Eros corporate structure but is clearly a related party that exists at Eros’s own address.

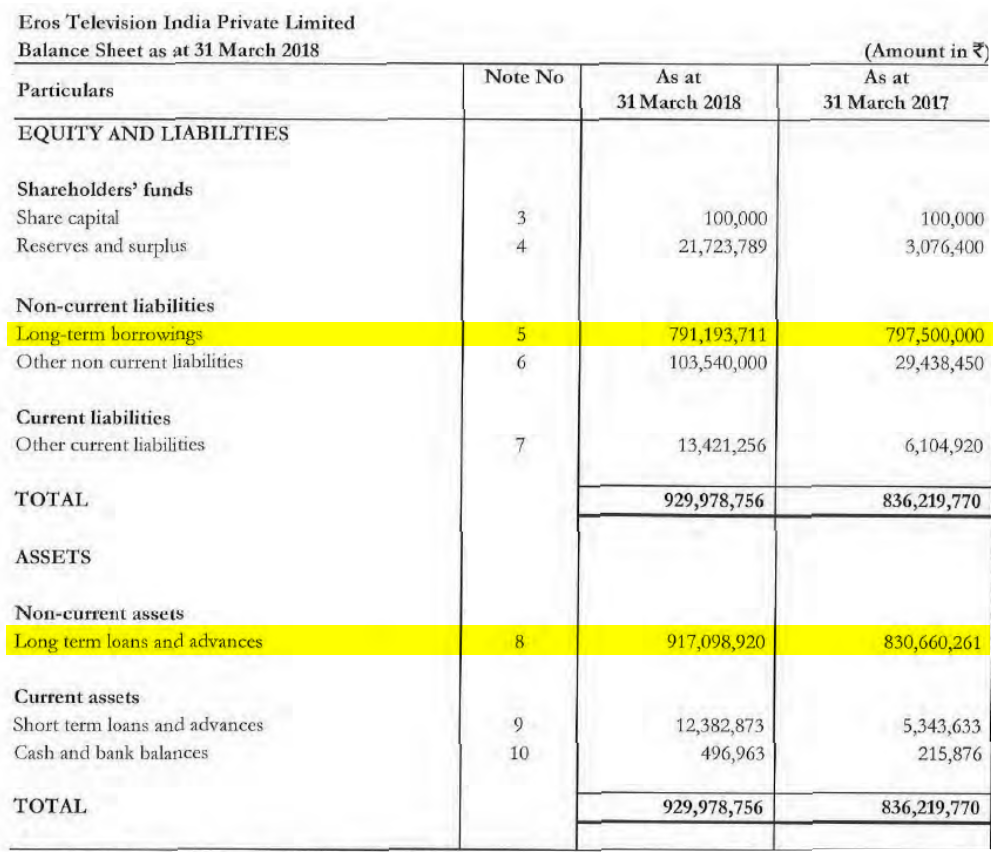

Eros Television: Suspicious Financials-Zero Operating Revenue, Zero Inventory, No Fixed Assets, No Investments, Yet a Balance Sheet Laden with Large “Advances” and “Payables” to Related Parties

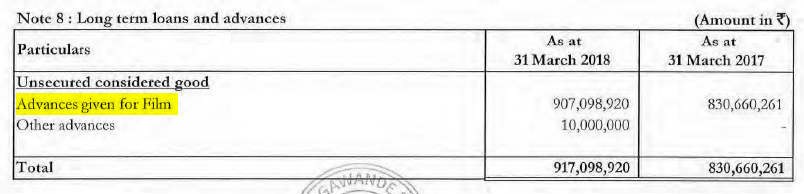

As we see from its latest audit, Eros Television has generated zero operating revenue for the prior 2 years, had zero inventory, no fixed assets, and no investments, yet its balance sheet is laden with large, suspicious advances and payables:

We see that the advances largely consist of “advances given for film”, suggesting that the entity lends out a massive amount of capital to procure films.

Eros Television: Did Eros Fail to Disclose Related Party Transactions with This Entity… Again?

As we had noted earlier, Eros sued us in 2017 after we had identified that the company appeared to be engaging in undisclosed related-party transactions. We had initially emailed Eros to ask about such transactions, but rather than respond to our questions they instead filed a lawsuit against us and dozens of others in an effort to silence criticism.

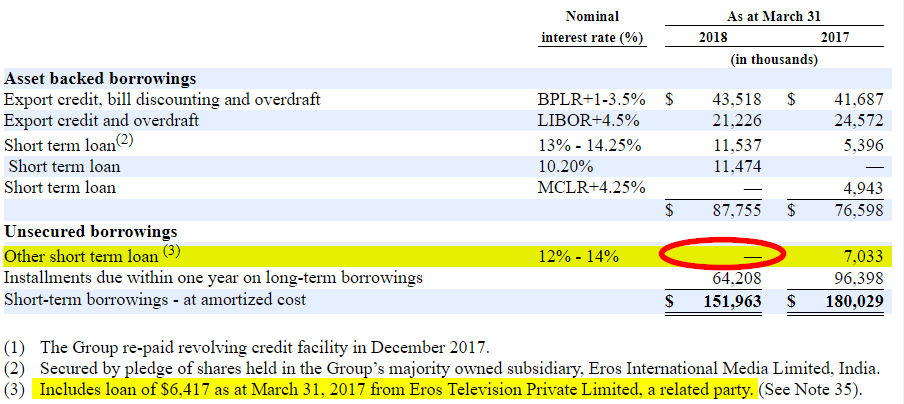

Despite the lawsuit, Eros eventually admitted in its 2017 financials that it had taken a $6.4 million loan from Eros Television, one of the very entities we had identified as suspicious. [Pg. 98]

While we were pleased to see that Eros eventually disclosed its dealings with Eros Television in its 2017 financials, we see that no related party transactions with Eros Television were disclosed in 2018:

(Note that Eros Television was mentioned 3 other times in the 2018 financials, but similarly disclosed no other transactions aside from the 2017 transaction.)

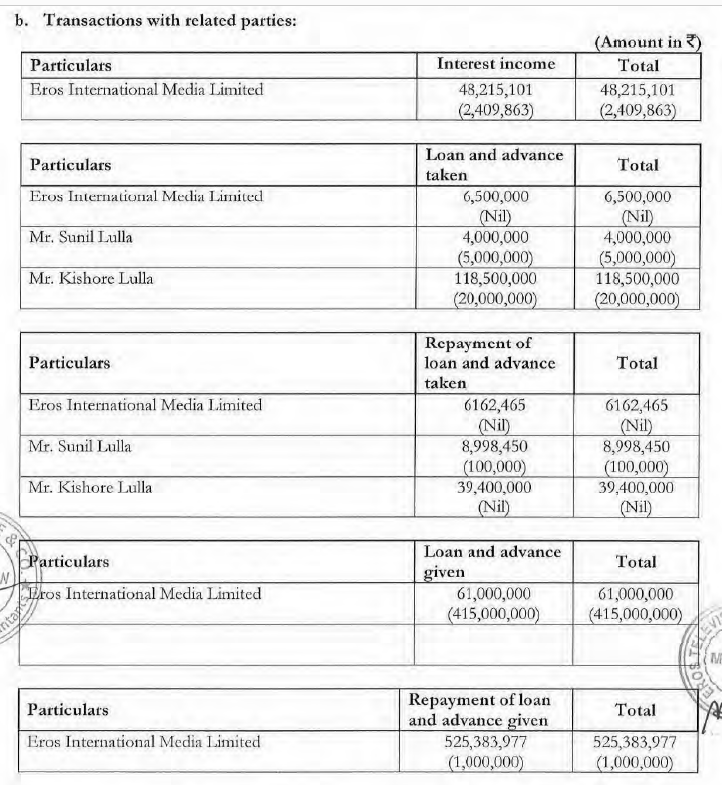

We found this incredibly surprising. We see that Eros Television in fact engaged in plenty of related party transactions in 2018 according to the entity’s own audit:

As you can see from the above, the large transfers have gone through this entity both to and from Eros’s subsidiaries and its key individuals. Aside from this apparent system of advances and payables we were unable to identify any other operations or purpose for this entity.

We view this as another major failure of Eros’s auditor, Grant Thornton, to monitor an entity with a documented history of engaging in undisclosed related-party transactions. There is simply no excuse for this repeated failure.

Eros Television: Our Visit to The Entity’s Auditor, Based Out of a Tiny Office in A Dilapidated Building

Given that Grant Thornton seems to have exercised virtually zero oversight over Eros’s financial controls we sought to see if anyone else was monitoring the situation.

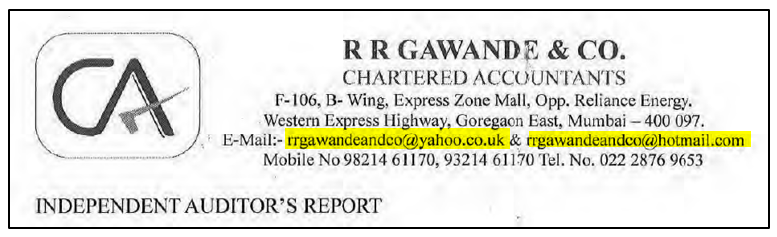

We see from Eros Television’s latest audit that the entity is audited by a firm called R.R. Gawande & Co. The proprietor can be reached by email at either his Hotmail account or his Yahoo account:

We visited Gawande’s offices in May 2019. The office is located in a humble neighborhood in Mumbai called Goregaon and within a commercial building called “Express Zone”. To enter we first walked past a few cows lounging under a tent at the gate:

On the inside, the facility was poorly-lit and run-down. Most of the commercial space looked vacant.

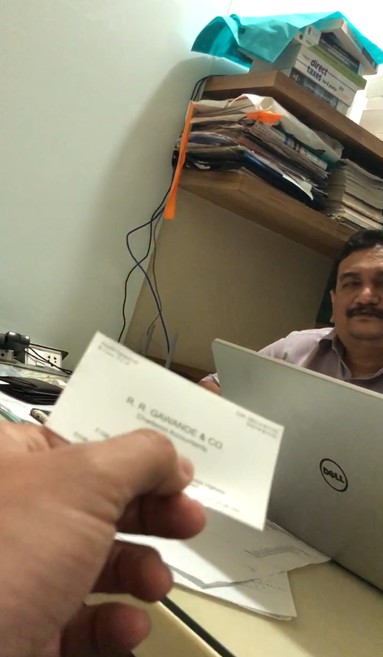

Gawande’s office was clearly marked with a sign on the second floor. The office was tiny, barely enough for a single desk and a table with a mug of coffee.

When we entered, Mr. Gawande was sitting with a younger co-worker. Although we entered the office on the pretense of being a potential client, the staff was clearly suspicious (they probably do not get many walk-ins).

Needless to say, the staff’s disposition and the lack of office infrastructure is not what we would have expected for an establishment that audits entities associated with Eros and the Lulla family.

Shortly after our meeting, Mr. Gawande, possibly advised by Eros to behave cautiously with curious strangers, discontinued all communications with us despite our repeated attempts to contact him again.

All told, we do not think Gawande is a credible auditor, though he strikes us as a perfect auditor for an entity with virtually no operations aside from suspect receivables and payables.

The Signs Were There All Along

As early as 2009, Eros’s principles had been credibly accused of engaging in related-party transactions to help a company inflate revenue and earnings following an investigation by audit firm BDO.

From the article:

A probe has discovered Eros has been used in an apparent effort by a Soho-based special effects group to embellish its financial results.

Senior company insiders say a confidential report two years ago by BDO, the accountant, found a pair of questionable transactions between Eros and Prime Focus, which is run by Namit Malhotra and best known for its special effects work on Avatar.

Prime Focus’ independent auditor disputes BDO’s findings.

Insiders at Prime Focus claim the deals artificially inflated the turnover of its London subsidiary, helping the loss-making operation return to profit.

There should be no surprises about what is happening now.

What About ErosNow? Usage Metrics Show That the Product is a Dud

Speaking of ‘now’, the equity bull case for Eros has generally relied on a belief that ErosNow would be a massive success. In a liquidation scenario, creditors would also want to know what the value of the platform could be.

In its last earnings release, Eros touted that ErosNow reached 15.9 million paying subscribers, an impressive milestone.

Despite the rosy headline, Eros’s accounting around ErosNow revenue looks muddled. Rather than simply reporting revenue from the platform, last quarter’s release (for example) just vaguely declared that revenue growth was “fueled primarily by Eros Now” without stating clearly how much was generated from the platform.

Understanding true usage and adoption is also a challenge based on Eros’s reported numbers. The “paying subscribers” metric, for example, seems to consist largely of users that have simply bought new phones that come with pre-paid content bundles. Such numbers say nothing about usage or user engagement.

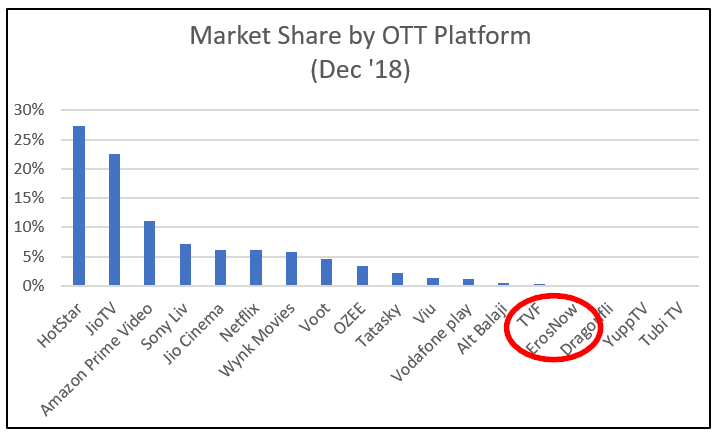

The platform’s active users are minimal, according to independent metrics provided by KalaGato, a service regularly cited by Indian media that tracks over-the-top (OTT) content app usage and downloads.

According to KalaGato, ErosNow barely registers as a player in the space, ranking 15th with a market share of about 0.16% as of December 2018.

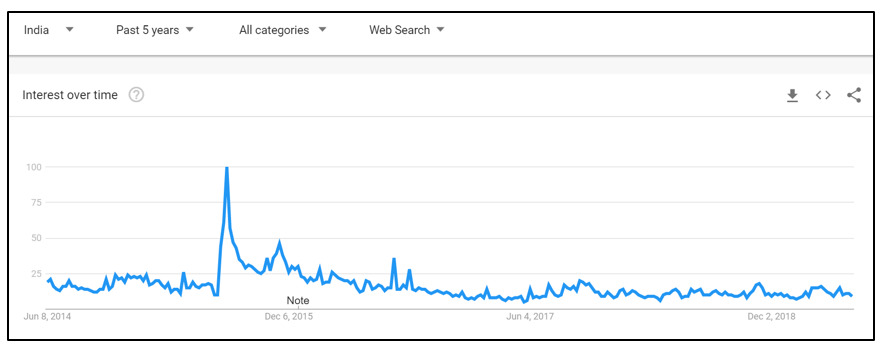

Google Trends similarly shows that the ErosNow topic has basically flatlined in India since mid-2015, a time period that corresponds to their initial marketing campaign to roll out the platform:

By all measures ErosNow’s usage seems minimal, despite years of company suggestions that the platform represents the future of Eros.

Conclusion: Eros’s Unraveling Is Like the Obvious Ending to a Cliché Movie

For those who have followed the Eros saga closely, the latest news looks to be the culmination of the inevitable:

- The auditors clearly looked the other way despite years of warning signs.

- The bankers seemed more interested in generating fees through debt & equity offerings than in performing credible underwriting.

- The complex international structure made it too challenging for regulators to enforce.

Our prediction is that the company will repeatedly attempt to re-assure bond and equity holders that ‘everything will be fine and we are well-capitalized’ all the way down.

Good luck and safe investing to all.

Disclosure: I am/we are short EROS.

Additional disclaimer: Use of Hindenburg Research’s research is

at your own risk. In no event should Hindenburg Research or any affiliated

party be liable for any direct or indirect trading losses caused by any

information in this report. You further agree to do your own research and due

diligence, consult your own financial, legal, and tax advisors before making

any investment decision with respect to transacting in any securities covered

herein. You should assume that as of the publication date of any short-biased

report or letter, Hindenburg Research (possibly along with or through our

members, partners, affiliates, employees, and/or consultants) along with our

clients and/or investors has a short position in all stocks (and/or options of

the stock) covered herein, and therefore stands to realize significant gains in

the event that the price of any stock covered herein declines. Following

publication of any report or letter, we intend to continue transacting in the

securities covered herein, and we may be long, short, or neutral at any time

hereafter regardless of our initial recommendation, conclusions, or opinions.

This is not an offer to sell or a solicitation of an offer to buy any security,

nor shall any security be offered or sold to any person, in any jurisdiction in

which such offer would be unlawful under the securities laws of such

jurisdiction. Hindenburg Research is not registered as an investment advisor in

the United States or have similar registration in any other jurisdiction. To

the best of our ability and belief, all information contained herein is

accurate and reliable, and has been obtained from public sources we believe to

be accurate and reliable, and who are not insiders or connected persons of the

stock covered herein or who may otherwise owe any fiduciary duty or duty of

confidentiality to the issuer. However, such information is presented “as is,”

without warranty of any kind – whether express or implied. Hindenburg Research

makes no representation, express or implied, as to the accuracy, timeliness, or

completeness of any such information or with regard to the results to be

obtained from its use. All expressions of opinion are subject to change without

notice, and Hindenburg Research does not undertake to update or supplement this

report or any of the information contained herein.

[1] The first 5 people who are able to positively identify the Indian investigator will win a free Hindenburg mug, a quintessential addition to any kitchen cabinet.

20 thoughts on “Eros International: On-The-Ground Research, Employee Interviews, and Private Company Documents Expose Egregious Accounting Irregularities”

Comments are closed.

Very thorough work. I will have to read it again to make sense. I have recommended Eros stock as investment to my family and dearly regret it now.

1) U have not detailed about the library EROS, claims to own..is it for real or this also fudged..??

2) Is it a genuine working company..??

3) How valuable its library is..??

4) Why this company cant be a potential take over target, at present valuations, even if entire story as narrated out to be true and assume all receivable and advances are zero

LOL!

– The editorial lists the unethical & outright criminal behavior of Eros as a corporate entity. It is not concerned with Eros’ library of content.

– It is a “genuine working company.” How do you think it got listed on commercial Stock Exchanges?

But a “genuine working company” does not give you an indication if it functions within legal framework of corporate law and ethics or NOT.

– How valuable its library is? Who cares? If the company is rotten to the core no one will bother touching it with a barge pole.

– Why this company cant be a potential take-over target? Because it stinks. And only an ignorant fool of epic proportions will even bother to look at the catalogue, which being Bollywood is pretty much borderline Bullshit anyways.

Hi,

Really great research.

But just want to understand more about your thoughts on Eros Now.

Is there any data point to support that most of its paying subscribers consist largely of users that have simply bought new phones that come with pre-paid content bundles ?

I go through there FY2019 annual report and they define paying subscribers as:

“any subscriber who has made a valid payment to subscribe to a service that includes Eros Now

services as part of a bundle or on a standalone basis, either directly or indirectly through an OEM or mobile telecom provider in any given month, be it

through a daily, weekly or monthly billing pack, as long as the validity of the pack is for at least one month.”

And it also mentioned its partnership with OEM as:

“Our OEM partners also include major mobile device manufacturers such as the LG

Corporation and Micromax. Typically, a limited amount of Eros Now’s content library is available for free, with users able to watch additional content by

paying a subscription fee either directly to us or through the OEM or mobile telecom provider or by paying a per-use fee for individual movies and programs.”

So my understanding is that people still need to pay to be paying subscriber instead of coming with new phones?

And I checked Eros Now Youtube channel….there’s ~20mn followers. https://www.youtube.com/user/erosentertainment/videos

I agree the company has lots of issues. But maybe there’s still potential in Eros Now?

intuitive

revolutionary

world-class

Common

red

Soft

Kentucky

Security

gold

Does anybody know how the class-action case in the U.S.A against EROS is proceeding?