- We believe that China Metal Resources Utilization (“CMRU”) is nothing more than a ‘zombie company’; an entity technically alive, but under such severe financial distress and laden with so many red flags, that insolvency seems inevitable.

- We believe CMRU’s Chairman/CEO may have reached the same conclusion: he has disclosed agreements indicating his intention to offload his entire personal stake in the company, which currently represents about 29.65% of the company’s outstanding shares.

- The company’s Chairman/CEO has a history of allegations of inflating revenue and margins at his previous company, Gushan Environmental (古杉环保), which subsequently saw its valuation implode before it was taken private at a price 96% below its IPO price. CMRU was pieced together with the wreckage of Gushan. One media report called CMRU the “rebirth” of Gushan.

- CMRU’s financials paint a picture of a company in financial turmoil. Recent filings show the company has cash of RMB 64.7 million versus RMB 1,559 million in borrowings due “within one year or repayable on demand”, at an average interest rate of 13.72%.

- The company has not repaid loans that look to have matured in 2016 and appears to have also missed a bond payment due in August 2019 on another loan, before being granted a short-term extension late last month.

- The operating business seems wholly incapable of supporting the company’s debt load: the company has reported negative gross margins and has bolstered its reported metrics through questionable accounting maneuvers.

- The company says it “normally” settles payables on 30-day terms. As of now, 95% of the company’s payables are past 30 days due and 64% are over 180 days old. We question whether they will ever be paid.

- The company has engaged in an aggressive M&A spree, paying up to HK$1.56 billion on deals replete with hallmarks of undisclosed related party dealings.

- In one case, the company paid consideration of up to HK$741 million for a 4-month old entity that had just leased an apparently abandoned factory (we visited the site, and have pictures).

- In several disclosed and undisclosed related party transactions, there are clear links to CMRU’s Chairman/CEO’s family.

- CMRU’s stock appears to have had a suspicious constant bid at $3 for almost 4 straight years, despite numerous material news releases and high market volatility. During one 398 trading day period, the stock never once deviated by more than 5.75% from its average price of $3.05.

- All told, we think CMRU is an obvious near-term zero.

Initial Disclosure: After extensive research, we have taken a short position in shares of China Metal Resources Utilization. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction

We believe that China Metal Resources Utilization is nothing more than a “zombie company”; an entity under such severe financial distress that insolvency appears to be an inevitability, yet it nonetheless continues to lurch forward in the capital markets with a HK$7.6 billion market value (US$1 billion).

We also believe that the company’s Chairman/CEO may realize this, given that he has recently entered into agreements indicating his intention to sell his entire stake in the company, amounting to ~40% of the business at the time of the announcement.

Given the Chairman’s checkered history in public markets, this does not surprise us. CMRU’s Chairman/CEO has a history of fraud allegations and destroying shareholder value at his previous company, the formerly NYSE-listed Gushan Environmental Energy, which ultimately was “taken under” at a price ~96% lower than its split-adjusted IPO price.

CMRU is weighed down by a crippling debt load. As of year-end 2019, the company has cash on hand of just RMB 64.7 million versus borrowings of RMB 1,559 million due “within one year or repayable on demand”, at an average interest rate of 13.72%. [Pg. 25] The company also appears to have already missed a bond payment due in August 2019 that it has since received a brief extension on, and has not repaid a loan that looks to have matured in 2016. [Pg. 26, Pg. 1, Pg. 27]

The operating business looks wholly incapable of supporting this debt; the company has reported negative gross margins and has bolstered its reported metrics through questionable accounting maneuvers.

The company has raised over HK$2.5 billion in cash from IPO to present—so where did all the cash go?

The company has engaged in an aggressive M&A spree that strikes us as replete with hallmarks of undisclosed related party dealings. In particular, the company purchased multiple newly-formed entities with minimal assets, collectively paying up to HK$1.56 billion. In several undisclosed and disclosed related party transactions, there are clear links to CMRU’s Chairman’s daughters.

We believe these red flags put CMRU on track to suffer a similar fate to its predecessor, Gushan: a near-total annihilation of shareholder value.

Meanwhile, CMRU’s stock price has remained suspiciously stagnant, despite historic levels of volatility in global capital markets and numerous material news announcements from the company. The stock’s lack of price movement resembles a phenomenon we have witnessed at other questionable China-based companies that have subsequently and suddenly cratered.

We have a price target of $0 on shares of CMRU.

Background: Basics on the Business

China Metal Resources Utilization Limited was incorporated in the Cayman Islands on February 22, 2013 and its shares have been listed on the Main Board of The Stock Exchange of Hong Kong since February 21, 2014. The company is headquartered in Mianyang, China and was founded by Yu Jianqiu, who serves as Chairman, CEO and is the largest shareholder with ~29.65% of the outstanding equity. [Pg. 36]

The company’s main revenue drivers are trading of copper and sales of recycled copper products, which, combined, accounted for 99.5% of reported 2019 revenue [Pg. 11].

CMRU manufactures and sells copper and other metals-related products in the People’s Republic of China, operating in three segments: (1) recycled copper products; (2) power transmission and distribution cables; and (3) communication cables.

Background: CMRU’s Chairman, Yu Jianqiu, Has A History of Allegations of Inflating Revenue and Margins at His Preceding NYSE-Listed Disaster, Gushan Environmental

The legacy of CMRU Chairman/CEO Yu Jianqiu has not been favorable to shareholders to date.

CMRU was founded using assets of another Yu Jianqiu company, Gushan Environmental, that was alleged by a major media outlet to have engaged in brazen fraud. Yu Jianqiu is now board chairman and executive director of CMRU and currently controls ~29.65% of the company’s outstanding shares.

Before CMRU, Jianqiu was Founder, Chairman, and Principal Executive Officer of Gushan Environmental Energy Ltd. [Pg. 21], which was formed in 2001 and listed on the NYSE in 2007. The company began as a biodiesel firm and only later added the copper/metals business that became CMRU today, as we will show.

In September 2008, tipped by an insider, National Business Daily journalists revealed in an investigative report [1,2] that Gushan appeared to have rented oil container vehicles and hired drivers to go in and out of its factory repeatedly in order to present the false impression of a booming business. The article went into vivid detail on the key evidence and observations supporting the allegations. One excerpt stated:

“In the hour that the reporter observed Gushan, three tanker trucks in the group’s factory entered and exited nearly ten times, a busy scene. However, these tanker trucks did not load or unload any oil.”

Moreover, Gushan was alleged to have falsified the purchase price of raw materials and to have inflated its revenues, based on interviews with multiple employees and other sources, according to the National Business Daily exposé. One source stated:

“The only explanation is that they are listed companies, and they are very concerned. Even when the production is stopped, they must create the illusion of prosperity in production and sales to avoid the stock price falling.”

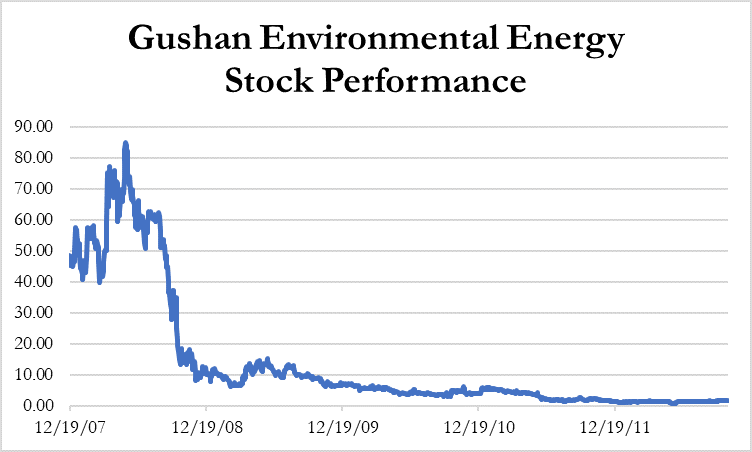

The company failed to address any of the specific allegations and simply declared the report to be “inaccurate”. The stock subsequently cratered, hastened by the financial crisis, and never recovered:

(Source: FactSet, split-adjusted prices)

In late-2010, with the biodiesel business faltering and with the stock battered, Gushan began purchasing interests in copper recycling businesses [Pg. 37]. These would later form the foundation for CMRU.

In late 2012, Jianqiu took Gushan private for $1.65 per ADS, representing a ~96% decline from its split-adjusted IPO price. By 2013, local media reported that much of the Gushan biodiesel business had been shut down.

Background: CMRU Was Formed Out of the Wreckage of Gushan and Taken Public in Hong Kong 2 Years Later

In 2014, Jianqiu took the copper recycling segment of Gushan public on the Hong Kong exchange, where it trades as CMRU today. The South China Morning Post said:

“The bulk of China Metal’s operations were part of biodiesel maker Gushan Environmental Energy”.

Mainstream media outlet Zhitong Finance asserted at the time that CMRU was simply the “rebirth” of Gushan.

Along with the copper wiring subsidiaries of Gushan, CMRU also retained much of Gushan’s board and executive team. CMRU’s two executive directors, CFO, corporate Secretary and a board member all came from Gushan. [Pg. 3]

Jianqiu had privatized Gushan at a valuation of about US$31 million. Yet when it re-emerged as CMRU, just 2-years later, the company sported a market value of ~US$320 million. The market value has nearly tripled despite its worsened and distressed financial state.

Part I: CMRU’s Financial State of Disrepair

100% Fundamental Downside—CMRU Has Been Operating at Negative Gross Margins, Looks to be Unable to Meet its Near-Term Debt Obligations, Has a Spiking Debt Load and Other Signs of Severe Financial Stress

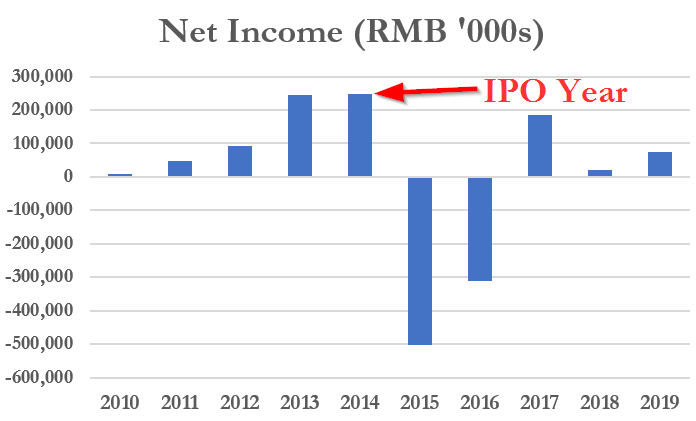

According to CMRU’s IPO prospectus, business was booming its early years. Since financials were first reported in 2010, the company increased its net income by a whopping 127% compound annual growth rate in the years leading up to its 2014 IPO. But performance suddenly and curiously fell off a cliff as soon as the company became public.

(Sources: Prospectus and annual reports [’12-’13, ’15-‘16, ‘17, ’18-‘19])

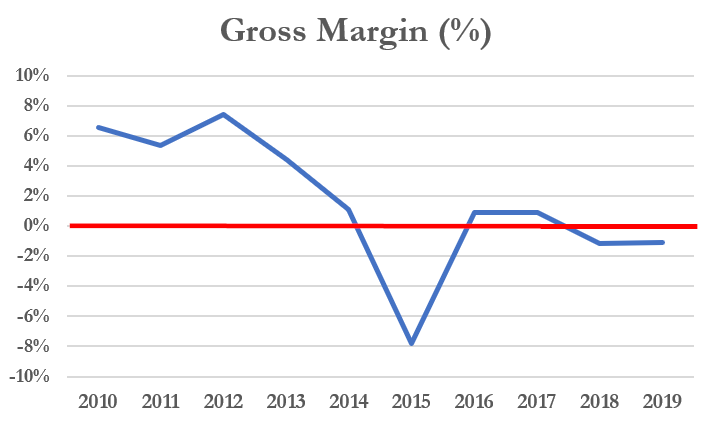

Gross margin, which at one point resembled that of a viable business, quickly sunk below zero, where it remains as of the company’s most recent annual financial reporting period. The reason for this collapse is largely why the metal recycling business tends to be unattractive to begin with: it is a highly competitive commodity business.

(Sources: Prospectus and annual reports [’12-’13, ’15-‘16, ‘17, ’18-‘19])

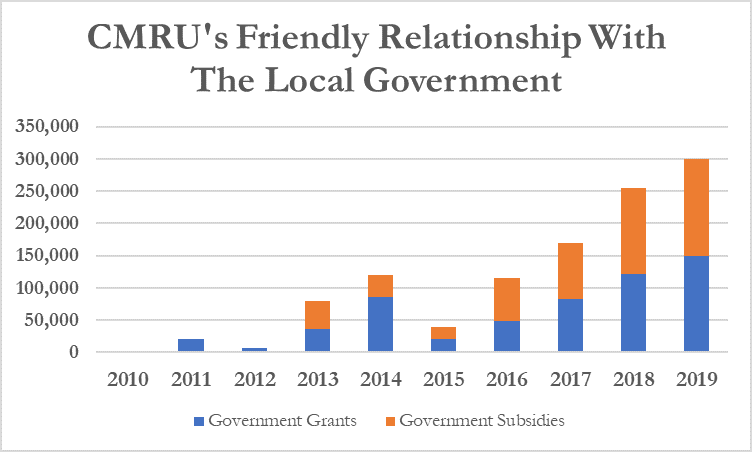

Despite the company’s negative gross margins, CMRU has managed in some years to eke out a small profit, largely through accounting alchemy related to the reversal of doubtful account allowances (which we detail further later) and government subsidies/VAT refunds.

Financial Stress: Cash of RMB 64.7 Million Versus Borrowings of RMB 1,559 Million Due “Within One Year or Repayable on Demand” At an Average Interest Rate Of 13.72%

The company’s poor operating performance seems to be exacting a serious toll on its balance sheet.

As of 2019 year-end, the company had cash of RMB 64.7 million, down from RMB 112.9 million the year prior. [Pg. 26] This compares to borrowings of RMB 1,699 million as of the same period, which had spiked almost 50% from the prior year. [Pg. 24] Of those borrowings, a crippling 92% were due within one year or repayable on demand (RMB 1,559 million). [Pg. 25]

The weighted average interest rate on the company’s borrowings is similarly crippling at 13.72%. [Pg. 24] Again, with the company operating at a negative gross margin, this situation strikes us as obviously untenable.

Financial Stress: The Company Appeared to Miss A Bond Payment Due in August 2019 And Has Not Repaid Loans That Look to Have Matured in 2016

Furthermore, the company appears to already have been late on multiple bond payments.

In 2017, the company issued HK$600 million in bonds due August 2019. The company apparently failed to pay back the bonds on time, stating in December 2019 that it was “still in negotiation in connection with the proposed extension of the instruments.” [Pg. 26]

Late last month, the company announced that it was able to negotiate a brief extension on the bonds until August 2020. Meanwhile, shareholders were left essentially guessing as to whether or not progress was being made behind the scenes for nearly 4 months, between December 2019 and April 2020, on a material amount of debt.

The company also appears to be nearly four years late on another set of loans, which have been due since 2016. The senior (or “entrusted”) loans total RMB 300 million and were issued by Mianyang Science Technology City Development Investment (Group) Co., Ltd, a state-owned enterprise:

“…the entrusted loans expired on 27 August 2016, 23 September 2016 and 18 November 2016 respectively. Mianyang Development Group, the entrusted bank and (CMRU’s subsidiary) have agreed that, the entrusted loan would not be repayable until further agreed otherwise. As at 31 December 2019 and up to the date of this report, the negotiation was still on going.” [Pg. 27]

In the interim, the company is attempting to issue 325 million shares for HK $871 million, which would plug up some of the hole. However, the critical share sale has been delayed by the COVID-19 outbreak. Should this share sale fail to consummate, or in the absence of further dilutive share sales, we expect CMRU will quickly become insolvent.

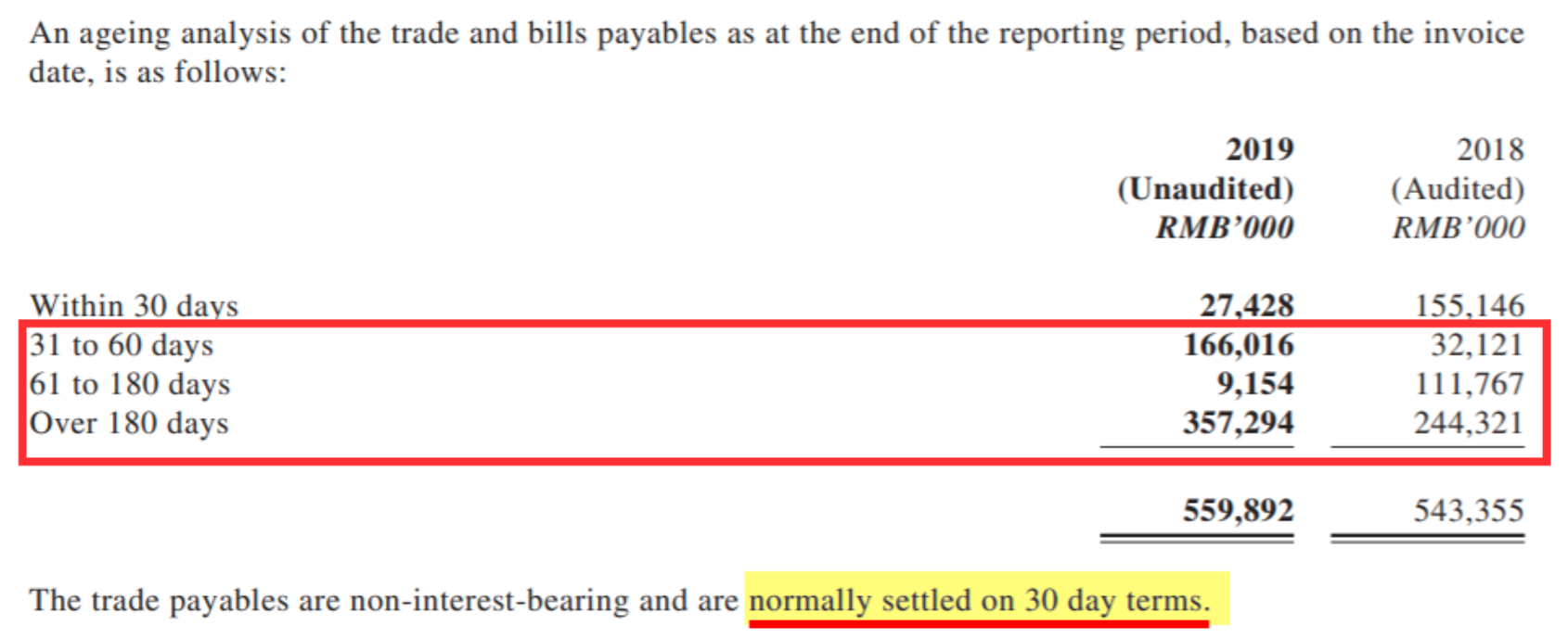

Financial Stress: The Company Says It “Normally Settles” Payables On 30 Day Terms.

95% Of Its Payables Are Past 30 Days Due And 64% Of the Company’s Payables Are Now Over 180 Days Old, Amounting to RMB 357 Million.

In addition to the company showing obvious stress from its traditional debt, its growing payables balances appear to be another looming threat.

Company filings state that its payables are typically settled on 30-day terms. Yet we see that in the past year, the vast majority of its trade and bills payable have shifted to being over 30 days due.

(Source: 2019 Annual Report, Pg. 19)

In particular, RMB 357 million of the company’s payables—64% of the total—are over 180 days old, and RMB 532 million – 95% of the company’s total payables – are past the “normal” 30 day threshold.

Signs of Accounting Alchemy: Reporting Net Income Through the Reversal of Doubtful Receivables

We have also seen signs of clever accounting being used to bolster the company’s reported performance.

For example, over the last 2 years, the company has added a total of RMB ~115 million to its reported profit from “Reversal of provision for doubtful debts”. [Pg. 3] Note that the company has reported total net income of RMB 95 million for the same 2 year period. [Pg. 3]

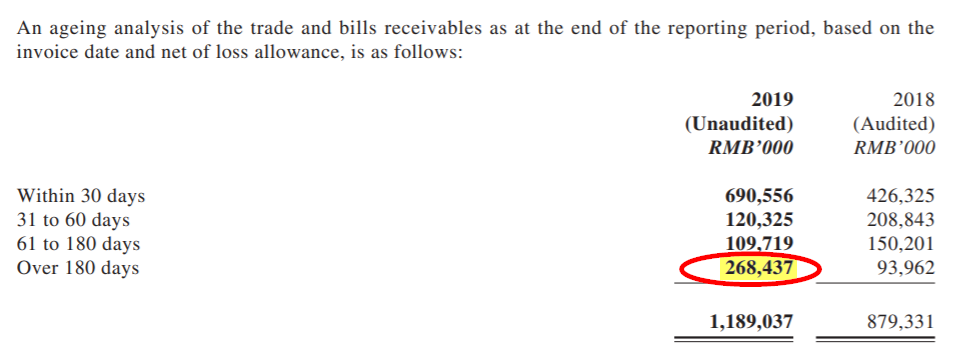

We checked see if these major reversals were warranted, given the rather tight terms the company has with customers:

“The Group’s trading terms with its customers are mainly on credit, except for new customers, where payment in advance is normally required. The credit period is generally 3 months.” [Pg. 18]

Despite those 0-3 month terms, there is a large, sudden spike in receivables that are now past 180 days. [Pg. 19]

To us, it looks as though the company should provision for even more doubtful accounts, instead of reversing these provisions. However, the decision to impair is apparently, at least in part, at the board’s discretion:

“The directors of the Company were of the opinion that no provision for impairment under IAS 39 was necessary in respect of these balances” [Pg. 189]

More Signs of Accounting Alchemy: Revenue ‘Growth’ Has Been Fueled by Trading of Copper “Through Online Copper Trading Platforms”

While reviewing CMRU’s financials, we saw one area of potential optimism: strong revenue growth.

But a basic review of the company’s revenue breakdown shows that essentially all of the growth is derived from the online trading of copper, an inherently low margin, low value-add business. As of year-end 2019, ~69.5% of 2019 revenue was from trading [pg. 11], allowing the company to report growing revenue. Here is a description of these activities from the company’s annual report:

“As part of its trading businesses, the Group purchases electrolytic copper and related products from suppliers through online copper trading platforms and the underlying goods are kept in independent warehouses before delivery to the customers.” [Pg. 77]

(Source: Annual reports/Hindenburg analysis)

Aside from online copper trading, revenue has also been bolstered by a slew of by highly questionable acquisitions, as we will detail shortly. Net of trading and acquisitions, the company’s organic revenue has been floundering.

Pushing the Eject Button: Chairman/CEO Yu Jianqiu Entered Into an Agreement to Sell ALL Of His Personal Holdings in CMRU (A ~40% Stake in the Company)

Meanwhile, with the company under significant financial distress, Chairman/CEO Yu Jianqiu entered into a framework agreement in November 2019 to sell ALL of his personal holdings in the company, which amounted to a ~40% stake at the time:

“Following the completion of the Disposals, Mr. Yu Jianqiu will cease to hold any Shares and will no longer be a controlling shareholder of the Company.”

It appears the Chairman/CEO has been partially successful so far, having reduced his stake to ~29.65% according to an announcement in late April 2020.

Part II: Where Did the Cash Go? Hallmarks of Insider Self-Dealing

CMRU has raised over HK$2.5 billion in cash from its IPO to present.[1] Virtually all of that cash is now gone, with the company drowning in debt. So where did the money go?

An Alarming M&A History: Numerous Questionable Related Party Transactions With The Chairman’s Daughters

A review of the company’s deals shows that its M&A history is rife with red flags. Several transactions show hallmark signs of insider self-enrichment, such as undisclosed ties to insiders of CMRU or the Chairman/CEO’s family. In other cases, the company acquired newly formed BVI-based entities with minimal assets at massive price tags:

- In December 2017, CMRU announced an agreement to indirectly purchase a newly-formed entity that had leased a copper factory and equipment less than 3 months earlier. CMRU paid maximum consideration of HK$317.6 million for the entity, or 4,217x its net assets and net profit. We found clear ties between the entity and the Chairman/CEO’s daughters and CMRU employees, despite CMRU describing the deal as “arm’s length” and the sellers as being “independent third parties”.

- In February 2018, CMRU announced an agreement to indirectly purchase a 4-month old entity that had just leased equipment and an apparently abandoned factory (we visited the site, and have pictures). The company paid maximum consideration of HK$741 million for the entity, or 138x its net assets and 438x its earnings.

- In October 2018, CMRU announced an agreement to indirectly purchase a year-old profitless copper manufacturer for maximum consideration of HK$509 million, or 16x its net assets.

Beyond questionable M&A transactions that we believe could involve undisclosed related-parties, the company has also disclosed multiple related party deals that have directed resources to insiders.

- On April 13th 2015, the company announced it had raised RMB 200 million in a convertible bond offering. A week later, the company agreed to pay approximately RMB 135 million to buy a 30% interest in a recycling company from the Chairman/CEO’s daughters and independent third parties. [ 43-44]

- In August/December 2015, the company announced the multi-part purchase of an aluminum trading business owned by JX-Ecommerce, a company controlled by the CMRU Chairman/CEO’s daughters. [ 44-45]

- On October 25th 2017, CMRU invested RMB 125 million into JX E-commerce, a company controlled by the Chairman/CEO’s daughters. [ 33, Pg. 45] On March 27th 2020, CMRU then received a short-term loan of RMB 125 million from the same entity it had acquired the shares from earlier. [Pg. 33]

- CMRU also contracts with a subsidiary of JX E-commerce for delivery services. It has paid the entity about RMB 30 million in the past 3 years. [ 3]

When aggregating these deals together, we find that a significant portion of the company’s raised capital has gone toward highly suspicious M&A transactions or related party deals. In the end we think shareholders will be left bearing the full cost of this rapid capital dissipation.

Signs of Undisclosed Related-Party Dealings: CMRU Paid HK$317.6 Million to Acquire a Newly-Formed Entity with Clear Links to the Chairman’s Daughters and Other CMRU Employees

Acquisition target: Mianyang Zhaofeng Copper Co., Ltd/ Silver Eminent Group (绵阳兆丰铜业有限公司)

On December 15th 2017, CMRU entered into an agreement to purchase 100% of Silver Eminent Group Limited, which owned a 100% equity interest in Mianyang Zhaofeng Copper Co., Ltd (“Mianyang Copper”) through its wholly owned subsidiaries. The maximum consideration was HK$317.6 million. [Pg. 13] The rationale for the acquisition was that Silver Eminent was in the copper production business, with a factory and equipment.

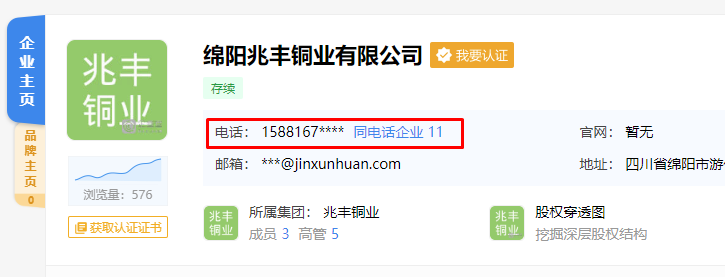

We found glaring red flags with the deal, namely that Mianyang Copper/Silver Eminent appeared to have been shell companies formed just months before the acquisition. We also found signs that the deal may have been a related-party transaction, contrary to company disclosures.

Silver Eminent Group Limited was incorporated in the British Virgin Islands on August 28, 2017. [Pg. 6] Its wholly owned China-based subsidiary, Mianyang Copper, was formed 2 weeks later on September 5th, 2017, according to Chinese corporate records through QCC.com.

About a month after the formation of the entities, on September 30, 2017 Mianyang Copper signed a lease agreement to use a factory and equipment for the production of copper. [Pg.6]

Two and a half months later, CMRU acquired the newly-formed entity for the startling sum of HK $317.6 million. In describing the deal, CMRU Chairman/CEO Yu Jianqiu stated:

“…we expect the acquisition to have immediate synergy effect, enabling us to diversify and strengthen our revenue sources and accelerate our growth”

According to the financials for Silver Eminent just prior to the acquisition, the entity had total net assets of just RMB 69,000 and unaudited net profit of only RMB 69,000. [Pg. 6] In other words, CMRU acquired the target at 4,217x its net assets and net profit.

We found it hard to imagine that acquiring a newly-formed entity with newly-signed factory and equipment leases at a massive price tag made any sort of economic sense for shareholders. When we examined further, we found signs of undisclosed ties between the entity and CMRU’s Chairman/CEO.

Signs of Undisclosed Related-Party Dealings: Why Did 4 Entities Owned by or Tied to the Chairman/CEO’s Daughters Share a Phone Number with an ‘Arms-Length’ Acquisition Target?

The company’s disclosures of the Mianyang Copper acquisition stressed that the deal was arms-length:

“The consideration was determined by the parties on an arm’s length basis…”

“To the best of the directors’ knowledge, information and belief having made all reasonable enquiries, the Seller and its ultimate beneficial owners are Independent Third Parties.”

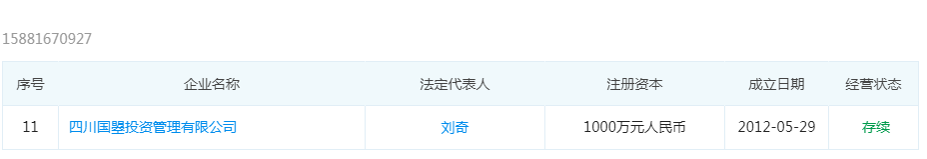

Upon further examination of Mianyang Copper, we found evidence to the contrary. The entity shared a phone number with 11 different enterprises, many of which are clearly linked to CMRU’s Chairman’s daughters’ companies and to CMRU employees.[2]

(Source: QCC.com [full number behind paywall])

At least 4 of the entities that shared a phone number with Mianyang Copper have obvious ties to CMRU employees or its Chairman/CEO Yu Jianqiu:

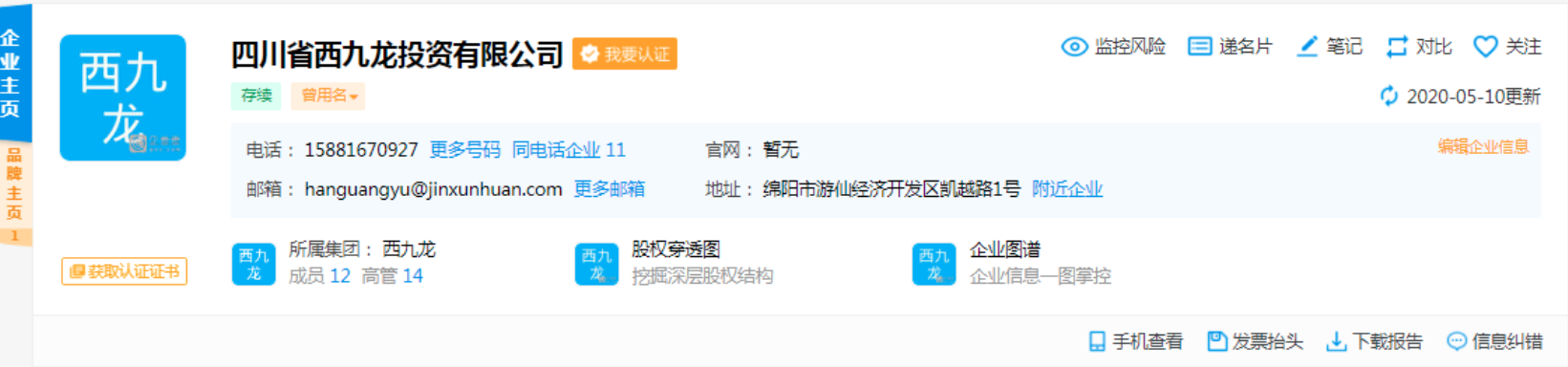

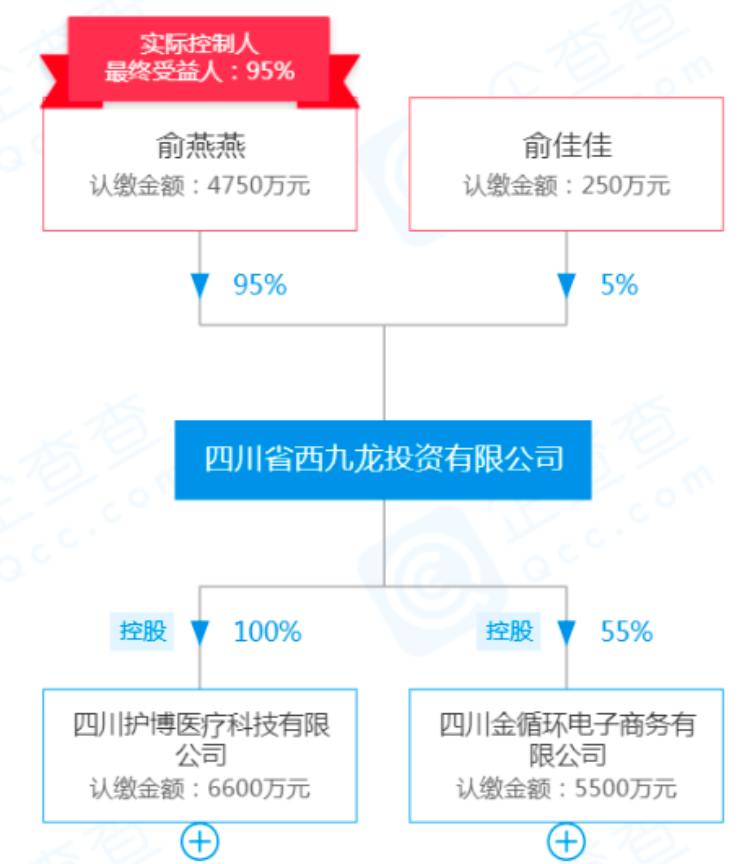

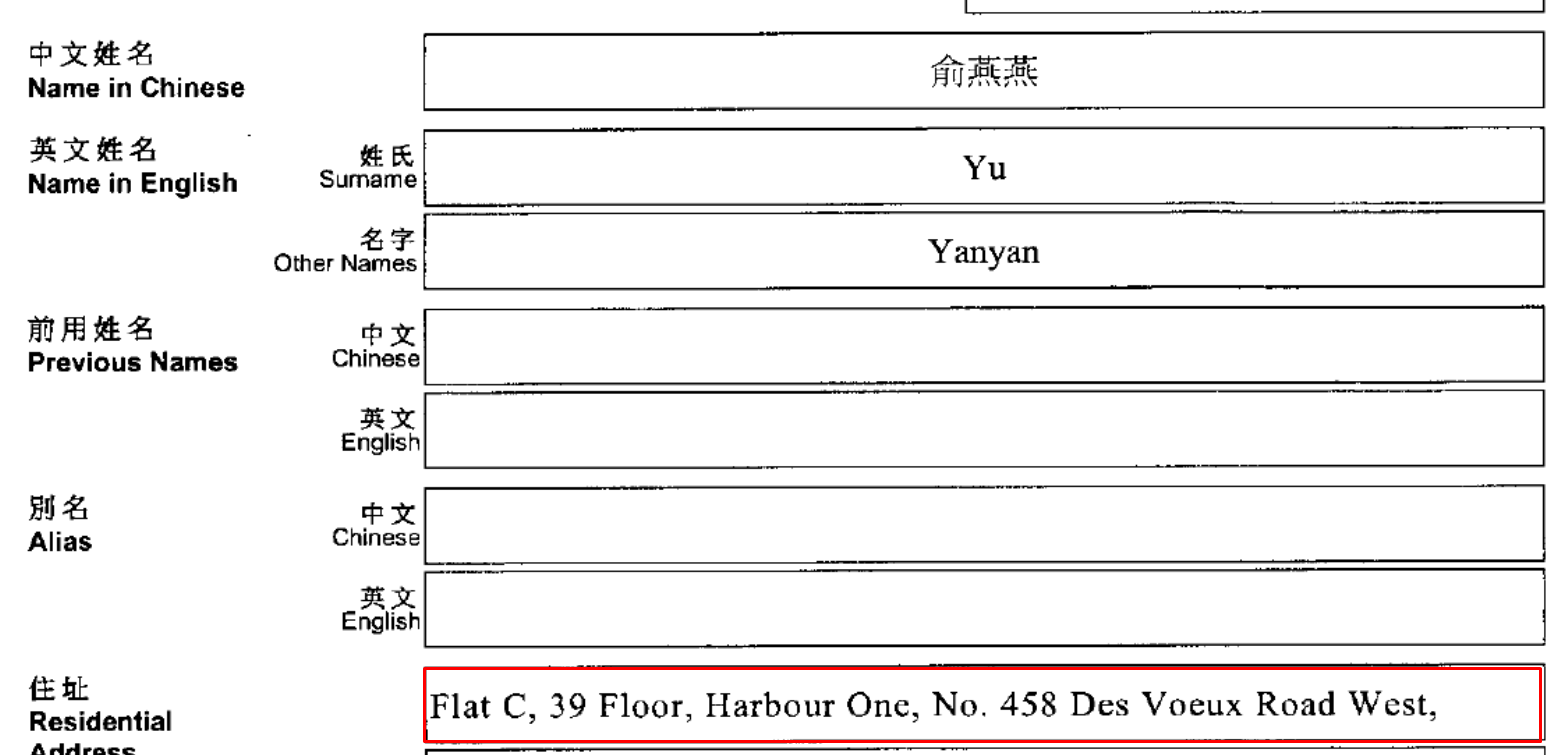

- Sichuan West Kowloon Investment Co., Ltd. (四川省西九龙投资有限公司), a company owned by Yu Jianqiu’s daughters, shared a registration address, email and phone number with Mianyang Copper.[3]

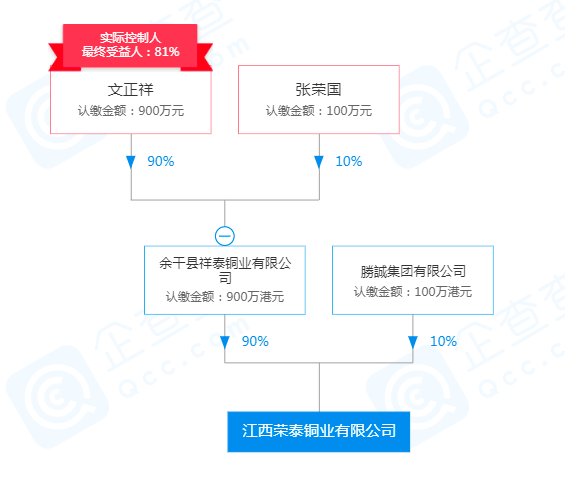

- Jiangxi Rongtai Copper Co., Ltd. (江西荣泰铜业有限公司) is 10% owned by Alpha Universe Group Limited (勝誠集团有限公司), indirectly 10% owned by CMRU, and 90% by a separate company.[4]

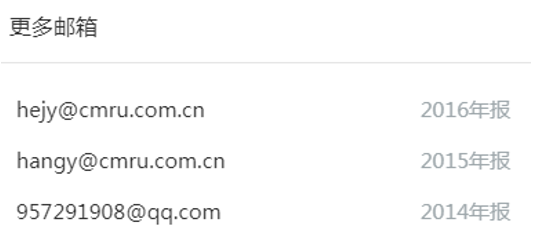

- Sichuan Guozhao Investment Management Co., Ltd. (四川国曌投资管理有限公司) is ~16% owned by Liu Qi, who we believe is CMRU “Planning Director” Liu Qi, based on a LinkedIn profile with a matching name and location.

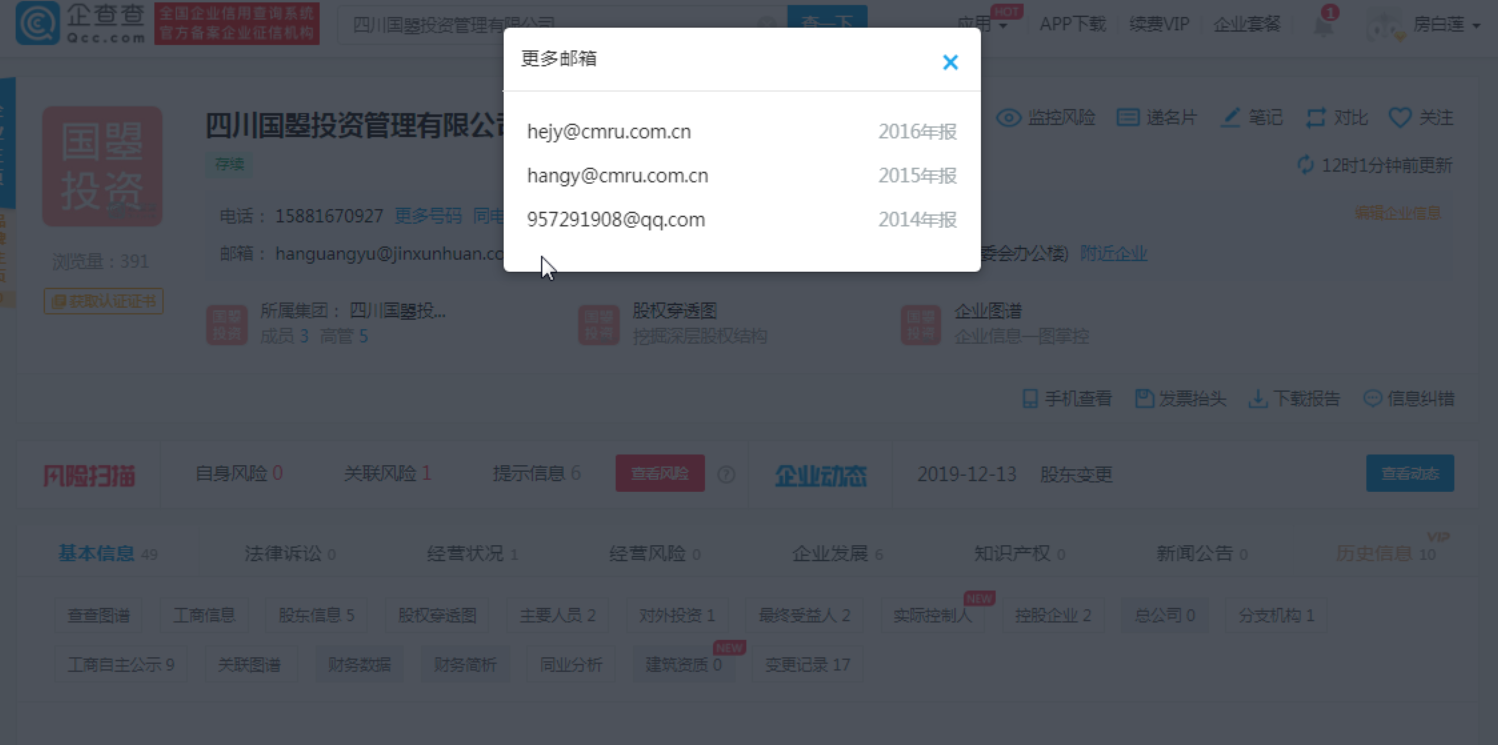

Additionally, Sichuan Guozhao Investment Management Co., Ltd. previously used e-mail addresses from a “@cmru.com.cn” domain name, further linking the phone number used by Mianyang Copper to China Metal Resources Utilization.

(Source: Link & See Appendix D)

- Sichuan Baohe Supply Chain Management Co., Ltd. (四川保和供应链管理有限公司). This entity is owned by an HK company called Hong Kong Baohe Resources Limited. Yu Lili, believed to be the Chairman’s daughter or close relative,[5] is a director at Hong Kong Baohe. The entity’s secretary, Cheung Ying Kwan, is the same secretary for CMRU [77].

We do not think it is a coincidence that a multitude of entities associated with CMRU and its Chairman were tied to Mianyang Copper.

In sum, we think insiders at CMRU were likely the ultimate beneficiaries of the Mianyang Copper acquisition, contrary to company disclosures.

More Questionable M&A: CMRU Paid HK$741 Million to Acquire a Newly Formed Entity That Had Leased an Abandoned Factory Months Earlier

Acquisition Target: Hubei Rongsheng Copper Co., Ltd. (湖北融晟金属 制品有限公司)

Mianyang Copper is not the only newly-formed entity acquired by CMRU for astronomical prices.

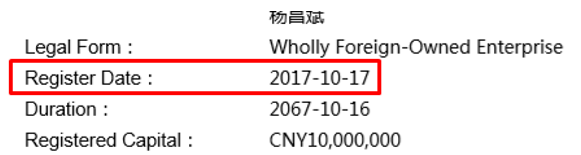

On February 7, 2018, CMRU entered into an agreement to purchase 100% of the issued share capital of Value Link Developments Limited for an aggregate maximum consideration of HK$741,175,000.

Value Link indirectly owned a 100% equity interest in Hubei Rongsheng Copper Co., Ltd. (“Rongsheng”). Both were formed less than 4 months prior to the acquisition agreement. Value Link was formed on October 27, 2017 [Pg. 6] and Rongsheng was formed days earlier on October 17, 2017, according to Chinese Corporate Filings.

(Source: Hubei Rongsheng Copper Co., Ltd. SAIC filing)

Rongsheng seemed to have little in the way of assets at the time. The entity leased a factory and equipment less than a month following its formation and leading up to the acquisition. [Pg. 6-7]

According to the financials for Value Link at year-end 2017, just prior to the acquisition announcement, the entity had total net assets of RMB 4.9 million and unaudited net profit of RMB 1.55 million. [Pg. 7] In other words, CMRU was acquiring a target at 138x net assets and 438x earnings.

Signs of undisclosed related party dealings

Rongsheng owns a 100% stake in an entity called Hubei Pangxin Nonferrous Metal Co., Ltd. (湖北省庞鑫有色金属有限公司), according to Chinese corporate records from QCC.com. The same records show that an individual named Yu Dongdong is listed as a supervisor of that subsidiary. Given the matching surname and similar naming convention to the CMRU Chairman/CEO’s other offspring, we suspect Yu Dongdong is a family member. The subsidiary was created after the acquisition, suggesting that the company may be paying salary or other compensation to a family member without disclosure.

Our visit to the factory

Our investigators visited Hubei Rongsheng Copper Co’s address, which is on Buyun Road, Economic Development Zone, Yunmeng County in Hubei province, per the company’s SAIC filings.

They visited during working hours within the past month. Here is a photo of the gate of the factory:

Local residents told our investigator that the factory used to belong to a company called Yunmeng Xinshengyuan Copper. They were also told that the building was later abandoned, but Rongsheng Copper inspected it and decided that it could be used, before signing a lease in October 2017, right around the time of its formation.

Our investigators were told that production began in November 2017, but during the visit they did not witness any freight trucks around the two entrances to the factory despite it being working hours. (It is unclear whether the lack of activity was COVID-19 related or otherwise).

Here is a side view of the same factory:

All told, we find it highly suspicious that the company paid HK$741 million to acquire a newly-formed company with minimal assets that had just assumed a lease for an abandoned factory.

More Questionable M&A: Acquiring a Newly-Formed Profitless Copper Producer for 16x Net Assets

Acquisition Target: (Kaifeng) Chengxin Copper Co., Ltd. (开封市晟鑫铜业有限公司)

On October 19, 2018, CMRU entered into an agreement to purchase 100% of the issued share capital of Sky Harvest Global Limited for aggregate maximum consideration of HK$509,164,969. The transaction closed in November 2018. [Pg. 14]

Sky Harvest indirectly owned a 100% equity interest in Chengxin Copper Co., Ltd. [Pg.12]

The purchase price was determined after an “arms length” negotiation. [Pg. 6] The owners were all described as being “independent third parties”.

Sky Harvest Global was another BVI-based entity formed one year prior to the acquisition, on August 28th 2017. [Pg. 7] It had minimal assets, with net assets of only RMB 1.44 million at the time of announcement, and had generated a loss of RMB 64,000 from the date of its incorporation prior to the acquisition. The sellers agreed to assume some of the liabilities of the entity, resulting in CMRU paying 16x net assets for the newly-formed loss generating enterprise.

Part III: Other Oddities Such as A Stock Price That Seems To Suspiciously Stick To the $3 Level Even Amidst Historic Volatility

Questionable Trading: CMRU’s Stock Appears To Have Had A Bid At The ~$3 Level for Almost 4 Straight Years

Typically, stocks go up and down. That’s just what happens—stocks naturally have some volatility.

But contrary to the normal machinations of the stock market, CMRU’s equity at times has seemed about as smooth as a ball bearing.

(Source: Historical stock price data from FactSet)

For example, for the 398 trading day period between April 22nd 2016 to November 29th 2017:

- The stock averaged $3.05, and never went above $3.22 or below $2.94.

- The stock never once deviated by more than 5.75% from its average price of $3.05 in the period.

- The stock never had a daily gain of more than 5%, or a daily loss of more than 2.92%.

We believe that such a lack of price discovery is beyond improbable – especially when we consider that during that 398 trading day span, numerous material events occurred that would normally have a meaningful impact on even the most illiquid company’s stock price:

- 4/28/2016: The company released its annual report, which detailed a 53% y/y decline in revenue, and an RMB 751 million swing from profitability of RMB 248 million to a loss of RMB 503 million.

- 8/11/2016: The company announced an offering of 135 million shares after hours, diluting existing shareholders by 6.41%. The closing price finished up 1.97% the following day.

- 8/31/2016: The company announced interim results showing further losses after hours. The stock finished the next day up a penny, or 0.31%.

- 11/24/2016: The company announced an intention to issue HK$200 million in convertible bonds after hours. The stock finished down just 0.66% the next day.

- 03/30/2017: The company announced its annual results after hours, showing a 175% revenue increase and a loss of RMB 310.8 million. The stock closed unchanged the following day.

- 06/01/2017: The company announced an equity offering of 74 million shares after hours, diluting existing shareholders by 3.1%. The stock finished the following day down just 2 cents, or 0.66%.

- 7/21/2017: The company issued a surprise announcement after hours that it expected it would report a profit, compared to the losses in the previous period. The stock finished the day up three cents, or 1.01%.

- 8/31/2017: The company announced interim results after hours showing a 187% surge in revenue from the prior comparable period, and a swing to profitability. The stock finished the following day up 6 cents, or 2%.

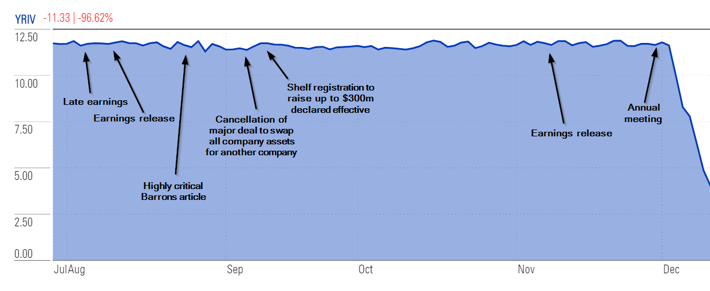

The price movement (or lack thereof) reminds us of the trading in another company we recently wrote about for its questionable business practices, Yangtze River Port and Logistics.

In that instance, we had identified a period of four months where the stock appeared to have non-stop support, despite (i) the company delaying its earnings (ii) the release of a critical Barron’s article (iii) the cancellation of a major deal and (iv) an earnings announcement, among other developments.

Yangtze River ultimately plummeted 99% and was de-listed after FINRA alleged that the Company was involved in an effort to artificially support its stock price with three brokerage accounts registered in the names of individuals who appeared to be neighbors of the company’s CEO.

We have seen a parallel lack of price movement in other companies, primarily China-based, that eventuate a complete collapse in the stock (e.g.: Deer Consumer Products, Tech Pro Technologies, et al.)

CMRU exhibits this same pattern, and we expect it will result in the same fate for shareholders. Since early February, the stock has mysteriously found a floor around the same $3 price level.

After all, what are the odds that a copper recycling business is somehow “immune” to the global recession that has shocked markets and the global economy over the last 3 months as a result of the coronavirus?

CMRU’s Friendly Relationship with The Provincial Government Has Kept it (Barely) Afloat

Chairman/CEO Yu Jianqiu has been the recipient of a remarkable amount of government support since launching CMRU, which has historically enabled this zombie company to continue lurching along.

Recently, Jianqiu agreed to sell his personal shares of the company to state-owned enterprise Sichuan Provincial Investment Group Co., Ltd. at a price tag amounting to HK$2 billion. This is a remarkable sum of money for shares that in our view seem quite obviously worthless.

Beyond the government directly enriching the company’s founder, CMRU has received RMB 1.1 billion in subsidies and grants since 2010, when it began reporting financials, according to its annual filings. In 2019 alone, the company received RMB 299.7 million of local government subsidies and grants that were described as being “unconditional” or with “no specific conditions”.[6] [Pg. 15] This essentially amounts to free money:

Beyond the local government’s annual free-money giveaway to CMRU, it also held a significant equity stake in the company. Per the 2019 interim report, state-owned enterprise Mianyang Science Technology City Development Investment Group (绵阳科技城发展投资(集团)有限公司) held 11.87% of the outstanding equity of CMRU. [Pg. 20][7]

Lastly, as noted above, the same Mianyang state-owned investment group loaned the company RMB 300 million that has apparently been due since 2016. [Pg. 27]

Governments make lousy capital allocation decisions all the time, but this strikes us as next-level. Why would the government pay HK $2 billion to buy the equity from a founder that is already late on his government debt after burning through his annual free cash windfalls from the government?

Note that CMRU only employs 847 people, per its latest annual report, suggesting that the issue is beyond just mere job protection. [Pg. 33]

We can only wonder.

Conclusion: 100% Downside

We believe that China Metal Resources Utilization will suffer a similar fate to its predecessor, Gushan: a near-total annihilation of shareholder value. We have a price target of zero.

Disclosure: We are short shares of CMRU (1636.HK)

Appendix A: 11 Companies That Share Phone Numbers With Mianyang Zhaofeng Copper

The eleven companies that share the same phone number (numbers are behind a paywall at QCC.com):

Appendix B: Sichuan West Kowloon Investment Co., Ltd

The Sichuan West Kowloon Investment Co. e-mail and addresses are shared with Mianyang Zhaofeng:

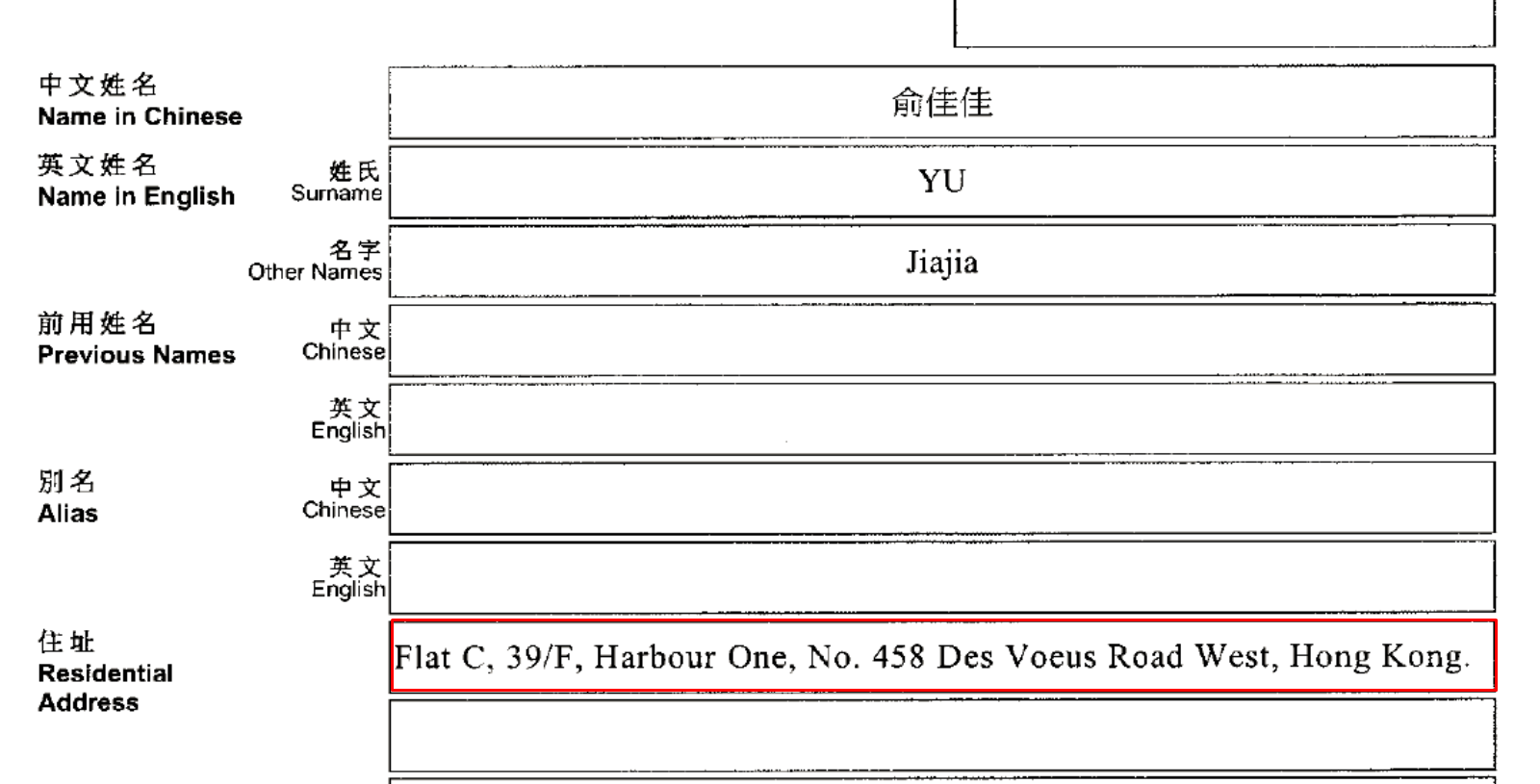

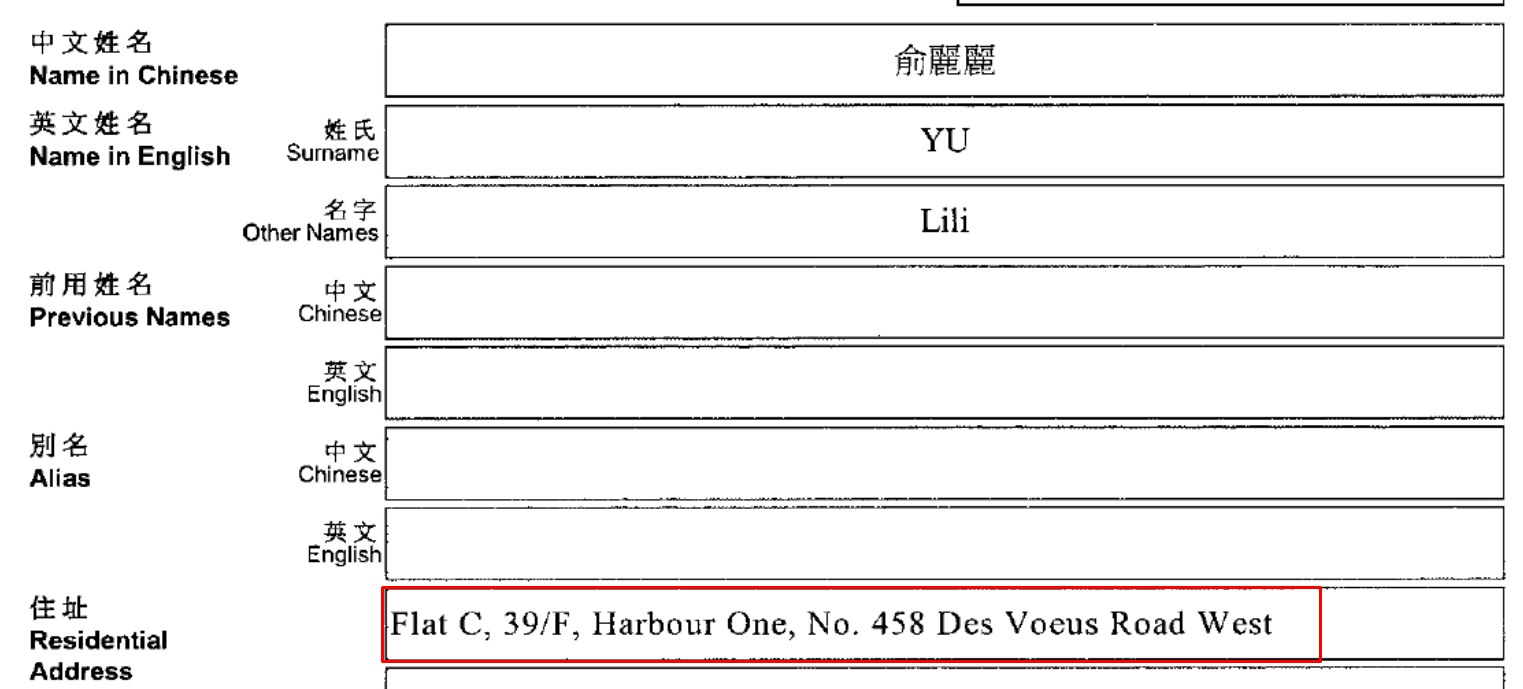

Sichuan West Kowloon Investment Co., Ltd is owned by Yu Yanyan (95%) and Yu Jiajia (5%), CMRU’s Chairman/CEO’s daughters:

(Source: QCC.com)

Appendix C: Jiangxi Rongtai Copper Co., Ltd. (江西荣泰铜业有限公司) Ownership Chart

(Source: QCC corporate records)

Appendix D: CMRU E-mail Addresses Associated with Sichuan Guozhao Investment Management Co., Ltd.

(Source: QCC corporate records)

Appendix E: Yu Lili Shared a Residential Address With CMRU’s Chairman’s Daughters, Yu Yanyan and Yu Jiajia

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] HK$539 million IPO [Pg. 318] + HK$252.7 million convertible bond + HK$348 million secondary [1,2] + HK$250 million convertible bond + HK$194 million secondary [1,2] + HK$600 million convertible bonds [1,2] + HK$365 million secondary + HK$19.5 million warrant exercise.

[2] See Appendix A for a list of all 11 organizations

[3] See Appendix B for screenshots

[4] See Appendix C for organization chart

[5] Yu Lili shares the same surname as the Chairman and shares a residential address with the chairman’s daughters, Yu Jiajia and Yu Yanyan. See Appendix E.

[6] The subsidies are provided annually by the Youxian District Finance Bureau in Mianyang City, Sichuan Province and grants were described as “local government grants received by operating subsidiaries” of the company.

[7] It is unclear whether the equity holding has changed given that the latest fully audited annual report has yet to be released.

4 thoughts on “China Metal Resources Utilization: 100% Downside to This Zombie Company”

Comments are closed.

Hi, thank you for the intensive research and great writeup! I have a question regarding the sale of the founder’s stake to Sichuan Provincial Investment Group.

Do you know the motives behind the sale? Are they acquiring more shares and do they have a desire to become a majority owner? They seem to be concerned with developing the Sichuan economy, in which case profit might not be a motive for them, and they might financially support the company.

Having direct state backing also makes it much easier much easier to raise funds- their cost of bank/other borrowings fell from 8.7% to 7.2%. While they do have extremely high debt load, having state support might mean they continue perpetually as a zombie company.