This morning, Bloom Energy issued a press release responding to some of the issues that we raised yesterday in our report “Bloom Energy: A ‘Clean’ Energy Darling Wilting To Its Demise”.

We appreciate the company’s response, but find that its press release does nothing to refute the findings of our research or our conclusion that the company could be a bankruptcy candidate as its debt approaches maturity.

In fact, we believe that as readers carefully compare Bloom’s responses to our research, it becomes clear that the company instead largely confirmed our concerns.

Sometimes the Things Left Unsaid Echo the Loudest. Here Are the Issues That Bloom Failed to Address Entirely.

Right off the bat, we note that there were multiple key items in our report that the company failed to address. In particular:

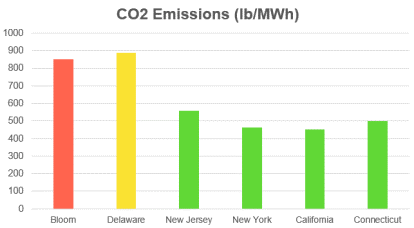

- Our report: Bloom’s carbon emissions are comparable to that of a modern natural gas power plant.

Bloom’s response: None.

- Our report: Bloom’s tricky accounting allows it to only record one year of servicing liabilities despite contracts that last up to 25 years.

Bloom’s response: None.

- Our report: Subsidies are being pulled or stepped down, which would have a material effect on Bloom’s financials.

Bloom’s Response: None.

- Our report: Bloom has been ‘selling’ replacement servers to the same projects and booking it as NEW revenue. The impact of these deals has been material; last quarter alone, server replacements accounted for ~40% of Bloom’s revenue.

Bloom’s Response: None

Of the items Bloom did respond to, we find their responses to be woefully inadequate.

Our Report: Bloom Should Not Compare Its Emissions to the Marginal Grid

Bloom’s Response: Here’s a Chart of Our Emissions Versus the Marginal Grid

One key issue we highlighted was how, contrary to the company’s clean energy narrative, Bloom’s CO2 emissions are far DIRTIER than the electric grid in most key states in which it operates:

(Source: 2016 EPA eGRID summary tables, table #3)

We specifically noted that Bloom attempts to sidestep this reality by wrongly comparing its emissions to the “marginal grid”. As we detailed, the marginal grid largely consists of the dirtiest “peak” power sources available, and is not comparable to Bloom’s servers, which run continuously.

Bloom’s “marginal” comparison was the same argument that was roundly (and rightly) rejected by Santa Clara, California, when Bloom sought to fight the city’s renewable energy legislation.

In the city counsel meeting, Santa Clara’s resident environmental analyst and engineer Suds Jain did not mince words when Bloom attempted to use its “marginal” emissions argument:

“They’re cherry picking facts. Bloom boxes are less efficient than our Donald Von Raesfeld power plant which is 60% efficient…They compare Bloom boxes to our dirtiest oldest generators. They’re not comparing to Donald Von Raesfeld which is combined-cycle.…They compare their plants to our ageing plants. The last thing is they’re comparing to marginal emissions. Those marginal emissions are peaker plants. Bloom boxes are [not] peaker plants. They’re not as cost effective as peakers.” (See video at 3:20:35 mark)

Bloom obviously doesn’t like comparing itself to the actual electric grid (we wonder why). And so, the first chart that Bloom placed at the top of its press release is that of its “marginal output emission rate”, and cited a paper that sought to justify the comparison:

We find Bloom’s marginal grid comparison to be further evidence that its “clean” narrative has already collapsed.

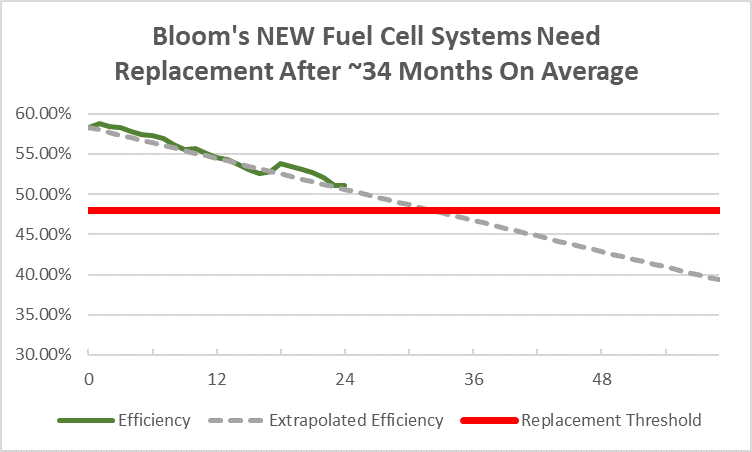

Our Report: Here Is Tangible Raw Data Showing Bloom’s 5th Generation Fuel Cells Won’t Last 5 Years

Bloom’s Response: Please Allow Us to Repeat Our Claim That 5th Generation Fuel Cells Last 4.8 to 5.2 Years Without Offering Any Supporting Data

On the financial side, Bloom’s response largely side-stepped our analysis of its undisclosed service replacement liabilities.

Our report analyzed granular monthly data on dozens of actual Bloom projects and found the company’s estimates for the useful life of its fuel cells to be widely overstated.

We disclosed our entire collection methodology and the raw data that we used to draw estimates, specifically for two reasons:

- We wanted readers to have a clear understanding of the data we were using to draw our estimates.

- We wanted to give the company as much detail as possible so it could refute, with specificity, any claims it would like.

Instead, the company provided a response that simply rehashed its old claim that new fuel cells last 4.8 to 5.2 years without providing data. Again, the data we presented specifically refutes this claim.

This chart, based on data from California and New York, shows how rapidly Bloom’s newer post-2016 installed servers are declining by month, on average. It also shows how the trend continues:

Our findings were also corroborated by multiple experts in the field who were highly skeptical of Bloom’s claim that solid oxide fuel cells could last 5 years or longer.

We encourage the company to provide actual granular data to the market to give investors a thorough understanding of the life of its products.

Our Report: Bloom Has $432 Million in Recourse Debt and $296.2 Million in Convertible Notes Will Come Due in 2020

Bloom’s Response: That Is “Erroneous and Misleading”. We Have $432 Million in Recourse Debt and $296.2 Million in Convertible Notes Will Come Due in 2020

With regard to the company’s precarious debt situation, Bloom calls our assertions “erroneous and misleading” – before then confirming exactly what we said in our report.

For instance, Bloom confirmed in its response that it has approximately $432 million in recourse debt on its balance sheet and that $296.2 million in convertible notes will be due at the end of 2020.

Bloom did not mention in its response that the conversion price for the $296.2 million tranche of debt is now far out of the money, at $11.25 per share. This likely means that, upon maturity, Bloom will have to put up the cash.

The company stated that it could refinance its existing debt, issue new debt or equity to help deal with its liabilities.

As we stated yesterday, we believe a refinancing would likely be on toxic terms. We don’t believe the company will be able to tap the debt markets or issue equity without materially and negatively impacting its capital structure. New debt would likely come with aggressive covenants and a large coupon, given the company’s financial position. Issuance of new equity (as the company nears 52 week and all-time lows) could be extremely dilutive to existing shareholders.

Conclusion: We Remain Short and Believe the Company Should Provide Further Transparency to Investors

Disclosure: We are short shares of Bloom Energy

Additional disclaimer: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

2 thoughts on “Our Reply to Bloom’s Woefully Inadequate Response”

Comments are closed.

Did you guys review the latest Bloom Energy 10Q? They’ve made significant changes to accounting policies based on some reviews. With a just a very quick late glance I noticed that it showed that their accumulate shareholder deficit was double what had previously been reported. And that they had actually recognized higher losses than previously reported.