9/5/2023 Update: Further Response To Tingo’s Absurd Claims And Obfuscation From The Company’s September 1st Release

Once again, Tingo has continued to charge ahead with new, obvious lies in a statement it put out on Friday, September 1st. We have never seen a public company choose to forge forward with brazen and obvious fabrications in this manner. Tingo’s management, including Darren Mercer, Dozy Mmobuosi, Chris Cleverly and CFO Kevin Chen appear to all be betting that by the time they are forced to face the consequences of their choices, they will already be long gone with the money.

Our update from last week asked Tingo for the bare minimum that almost all public companies provide: specifics on its unnamed key customers, unnamed legal counsel, unnamed banks, unnamed vendors and its unnamed contacts at its newly-claimed key supplier. Once again, the company has failed to provide specifics on any of these while concocting new shape-shifting responses to the extensive and growing body of evidence that it is simply fabricating its business operations.

First, Tingo has still not named the banks it claims held $780+ million of its cash before nearly all of it mysteriously disappeared this quarter.

Additionally, Tingo once again provided no detail on its previously hyped relationship with law firm White & Case LLP, while continuing to let market participants believe the relationship is still active. It has not named the other law firms it is said to be working with, or in what capacity it is working with them.

Tingo has also failed to explain why the new “UGC” supplier entity it claims to now work with, essentially its sole claimed supplier of millions of mobile phones, doesn’t match the entity named in its own SEC filings.

The company also failed to explain why its new claimed contract start date with UGC contradicts the start date mentioned in its SEC filings.

When asked for specifics about its new claimed UGC supplier entity, such as the name of a key contact, a website, or any tangible evidence of its existence at all, Tingo provided none. Tingo now simply says the entity is based “in Africa”, without naming the country. Recall that Tingo just claimed it advanced this mystery entity a stunning $434 million in cash in the weeks after we questioned the company’s cash balance. (For more detail on Tingo’s absurd, shape-shifting responses to questions about UGC, see the appendix below.)

Revisionist history now seems to be the PR strategy for Tingo.

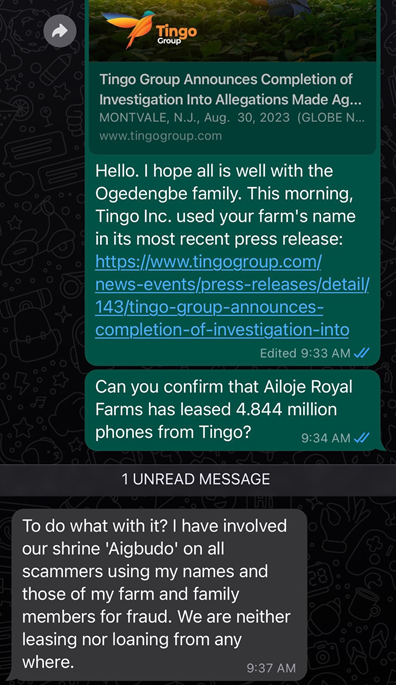

For example, days ago, the Ailoje Royal Farms cooperative, which Tingo claims accounts for 4.844 million customers, put out a public statement saying it has no business relationship with Tingo whatsoever, after previously telling us and media that it has fewer than 100 farmers total, and that Tingo was misusing its name as part of a scam.

Tingo’s response, incredibly, is that the cooperative is run by someone else, a head of a faction of a different farming cooperative called AFAN that was previously suspended and has faced controversy over its legitimacy (and which Tingo is funding and is closely tied to). Tingo also now claims that Ailoje Royal Farms is no longer a single cooperative—instead it is now a consortium, working with 1,100 smaller, unnamed cooperatives spread across every state in Nigeria.

Tingo also now claims that the Kebbi (Dala) Multi-Purpose Cooperative Society, which also has no website or apparent public signs of existence aside from its mention in Tingo press releases, is not actually based in the Kebbi state. The cooperative, which Tingo says accounts for 4.5 million customers, is now based 730km away in the Kano state and it, too, now works with unnamed partnerships and co-ops in 19 states in Northern Nigeria.

The claimed Kebbi partnership, which Tingo has ostensibly held as a key relationship since at least 2014, [Pg. 106] is now claimed to be headed by an individual named “Haib Umar”. Note that a Google search of the name “Haib Umar” displayed results showing Tingo’s press release and misspellings of individuals named “Habib Umar”.

In March 2022, just last year, a “Habib Umar” was named in an article about Tingo as heading a totally different and vastly smaller cooperative called the “Muryar Manoma Arewa Multi-purpose Association”, which counted only 600,000 members.

We are meant to believe that the Tingo article about Haib/Habib Umar and a totally other cooperative (the only public mention of its existence that we could find, by the way) left out that Umar was already heading a different and vastly larger cooperative that already had 4.5 million Tingo customers? As was the case with Tingo’s “rebuttal” about “UGC Technologies Company Limited” last week, Tingo seems to simply be slightly altering names of its claimed partners and associates to try to cover its tracks.

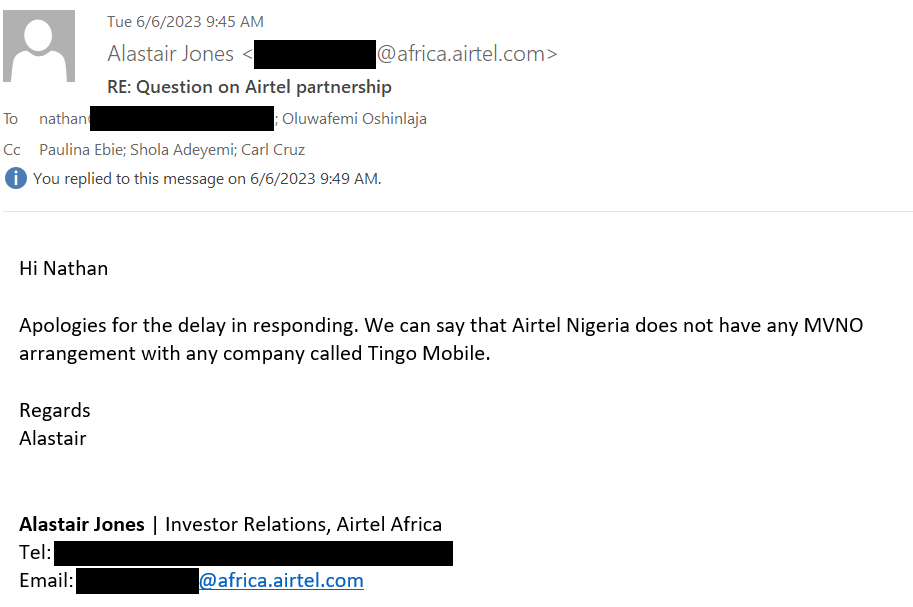

We also noted in our response that Tingo’s lone claimed telecommunications provider, Airtel, publicly denied it had a contract with Tingo following our report, despite Tingo’s claims for years to have had an agreement with Airtel.

Tingo had claimed this key Airtel relationship existed in relatively unchanged form as recently as a June 2nd 2023, in a prospectus amendment. But following our report on June 6th, and Airtel’s clear and public denial of the relationship, the company claimed in its response to us 3 months later that it suddenly no longer has an agreement with Airtel and now works with a 3rd party mystery vendor that it can’t name.

As to Tingo’s Nwassa platform, the company claims that it has managed to generate hundreds of millions in revenue in 6 months despite having no website and no app. This comes despite Tingo’s previous claims to have invested almost $200 million in infrastructure in support of these efforts. [Pg. F-80]

Again, the company has said it operates this mega-revenue generation through a system of text-to-order that local media has already debunked as non-functioning. Tingo expects investors to believe that many of Nigeria’s largely subsistence farmers are texting one entry at a time to “purchase items such as farming inputs, insurance, micro-loans, or additional airtime” to the tune of hundreds of millions in transaction volume.

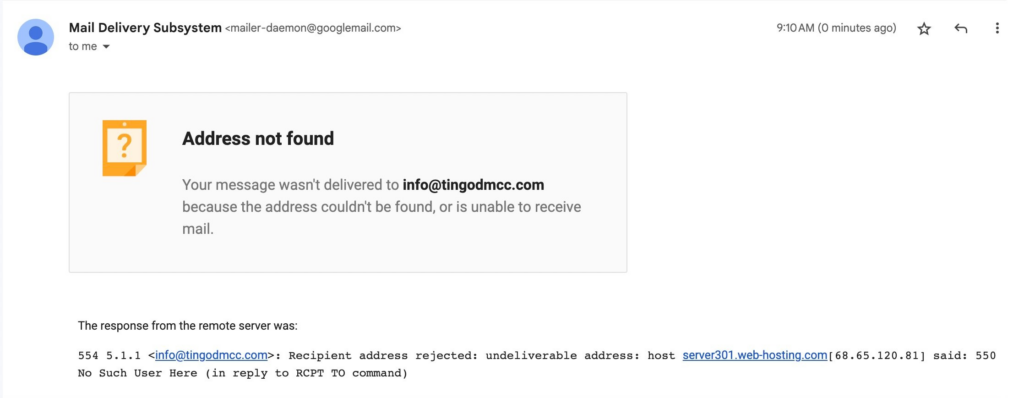

As to Tingo DMCC, the company’s claimed export platform that is, according to the company, somehow magically on track to export more agricultural products than the entire nation of Nigeria, Tingo has claimed that its sales do not show up on export records because of the nature of how they are shipped: on land versus marine. The company has once again provided zero documentation to substantiate its claimed exports in any transportation medium.

Overall, it has become clear that Tingo has chosen to brazenly lie until it is all over, legal consequences be damned. Worse, the company hasn’t even made an effort to come up with credible lies. When faced with direct evidence contradicting their claims, they simply revise history, or change the story to make everything more nebulous and opaque.

And here’s the rub: Tingo will continue to successfully rope in retail investors who trust that SEC filings have meaning, who trust that a Nasdaq listing has meaning, who trust that a Deloitte audit client means something, and who trust that the existence of a board with independent directors has meaning. Those retail investors will be taken for a ride as the company announces new glowing fake numbers and other grandiose claims as insiders cash out at their expense.

Sadly, those retail investors will be mistaken, and it will not be their fault. Tingo is a stock market embarrassment at a level that we have never seen.

Appendix: Tingo’s Absurd, Shape-Shifting Contradictions About Its Claimed Key Mobile Phone Supplier

Note that Tingo’s SEC filings at various times contradict themselves about the name of the UGC entity that it claims is responsible for supplying “almost all its mobile phones”:

- Tingo Group’s 2022 10-K refers to the entity as “UGC Technologies Company Limited”. [Pg. 10]

- Tingo Inc.’s 2021 10-K refers to the entity as “UGC Technologies Group”. [Pg. 15]

Both of those entity names found in Tingo’s SEC filings match names used by the entity we contacted, while neither match the new claimed entity name from Tingo’s recent ‘rebuttal’ press release, “UGC Technologies Limited”. This discrepancy is of course massive and Tingo has made no effort at all to explain it.

Note another key discrepancy: Tingo Group’s 2022 10-K filed in March 2023 says the UGC entity is based in “Shenze Town, China” [Pg. 10] while its proxy statement filed just 2 months later in May 2023 says the UGC entity is based in the sort of similarly-named but very different “Shenzhen City, China”. [Pg. 10] The latter is a full 2,000km away in a completely different province.

A thorough search of Chinese corporate records revealed no entity starting with “UGC Technologies” at all, anywhere in China.

The only entity we found with a somewhat similar name was “UGC Technology Limited” (not the plural “Technologies”). The entity is based in a different location (Hong Kong) and formed at a different time (October 2010) than the various entity names/locations claimed in Tingo’s press release. In short, it is not a match.

Tingo could clear all this up by simply providing a company code for its claimed China-based entity, and the actual country in Africa where its claimed supplier entity exists, or any of the corporate records for the entity or other specific information we asked for. It has not done so despite having ample opportunity

Our Response From August 31st

Yesterday morning, August 30, 2023, Tingo Group issued a press release announcing it had completed an investigation into the issues we raised about the company in our June 6, 2023 report entitled “Tingo Group: Fake Farmers, Phones, and Financials – The Nigerian Empire That Isn’t.”

Given the nearly 3-month gap since our report, and after multiple delays, Tingo’s largely retail investor base euphorically welcomed the news, which essentially announced a clean bill of health. The stock spiked by 65% on 7x normal volume for the day.

This morning, the company released its quarterly report, once again claiming blockbuster quarterly revenue of $977 million along with earnings of $96 million. It also promised a $20 million dividend, contingent on the company receiving approval from the Nigerian government to convert the money. On this morning’s subsequent conference call, the company confidently indicated to investors that its revenue, earnings, customer base and cash position, among numerous other metrics, were all poised to spike massively.

These reported numbers and stated guidance would of course be exciting, were it anywhere close to reality. However, a careful review of the company’s recent releases indicate Tingo has done little but continue to lie about every key aspect of its business – all while failing to address every question we’ve raised.

It bears repeating: we have never seen a scam so thorough, obvious and brazen as Tingo – a true outlier, even in a market rife with fraud.

Tingo Initially Claimed It Would Release Findings Of An Independent Investigation From Law Firm White & Case LLP

Yesterday’s Release Made No Mention Of White & Case

Instead, The “Investigation” Amounted To The Company Investigating Itself, With Help From Its Own Non-Independent, Outside Counsel

On June 8th, Tingo announced it had hired respected law firm White & Case, LLP to conduct an independent review to be reported to the company’s independent directors.

But yesterday’s release made clear that those goal posts had moved, with Tingo’s investigation now “based on the Company’s outside counsel’s investigation and further investigative work of its own”. Essentially, Tingo investigated itself with help from its own outside (non-independent) counsel, after receiving an “interim report” from an unnamed independent law firm.

Notably, yesterday’s release made no mention of White & Case, which reportedly ended its engagement with Tingo in July, despite the company offering no update or disclosure about the status of the relationship, which the market likely assumed was ongoing.

Unsurprisingly, Tingo’s Investigation Into Itself Was Filled With Inconsistencies And Fresh Evidence That It Continues To Outright Lie To Investors

Tingo’s release yesterday failed to distinguish who investigated which allegations, leaving investors in the dark about how much of Tingo’s “investigation” was simply management giving itself a clean bill of health. The release also failed to detail its investigative methodology and provided no evidence or basis for any of its claimed confirmations.

Instead, the company declared that its stunning financial results were delivered by generating revenue through unnamed vendors and payment providers, processing its food through unnamed outsourced third parties, selling to unnamed key customers, then depositing the cash in unnamed banks.

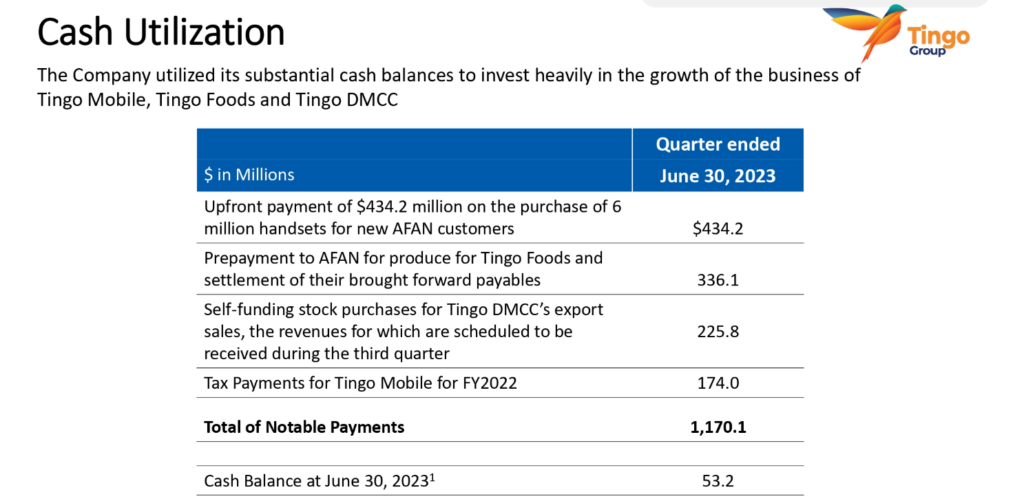

All the while, the cash seems to have vanished. As of its latest quarterly results, ~$1.2 billion of Tingo’s claimed cash has disappeared through a series of advances and payments, including some to suppliers that don’t seem to exist.

We Asked Tingo A Simple Question: Which Banks Hold Tingo’s Claimed $780 Million In Cash?

The Company Failed To Answer, Instead Reporting That Its Cash Balances Had Dropped By $725 Million In The Quarter, In Large Part Due To A Claimed $434 Million Advance To An Imaginary Phone Supplier

In our initial report, we documented evidence showing that virtually every aspect of Tingo’s operations were fabricated or exaggerated.

Consequently, we questioned the company’s claimed industry-leading financial margins and ultimately its cash balance of $780 million as of Q1 2023. [Pg. 1] In our series of follow-up questions, we asked simple questions, such as which banks Tingo uses to hold its cash balances. These questions were also asked by the Financial Times and have thus far gone unanswered.

In yesterday’s release, the company continued to avoid naming its banks, declaring simply that:

“Bank statements were obtained directly from the banks used by Tingo Mobile and Tingo Foods, and interviews with the banks were conducted over video conference calls. The bank balances of each company were confirmed at several dates”.

The company made no effort to share who performed these claimed checks and there was no mention of the involvement of auditors or independent legal counsel.

Following these and other questions we asked, the company reported today that its cash had dropped by a stunning $725 million over the course of one quarter. In total, the company reported $1.17 billion in depleted cash, which included last quarter’s claimed cash and new claimed cash from the recent quarter:

The largest outlay of $434.2 million went to an up-front payment to Tingo’s mobile phone supplier which doesn’t seem to exist, as we detail below. Other outlays went to claimed prepayments of product not-yet-received and tax payments to the government.[1]

Our Report: We Reached Out To “UGC Technologies Company Limited”, Tingo’s Key Claimed Supplier Of Millions Of Phones Since 2020, Per Company SEC Filings

UGC’s CEO Went On The Record Saying It Had No Relationship At All With Tingo, Despite Having Preliminary Discussions With Tingo In 2020

Tingo Responded By Claiming That Its Supplier Relationship Is Actually With A Different (But Similarly-Named) Entity, Contradicting Its Own SEC Filings

Tingo’s 2022 annual report said that “UGC Technologies Company Limited” and another company called Bullit Mobile Limited were sole suppliers of its mobile phones. [Pg. 10] Tingo’s response yesterday noted that “Tingo Mobile has purchased almost all its mobile phones from UGC Technologies Limited to date”, identifying UGC as its sole key supplier.

As detailed in our June report, we reached out to both. The CEO of UGC Technologies Company Limited, Busty Okundaye, told us that his company had bid on a Tingo contract 3 years ago but never heard back from the company.

In yesterday’s press release, Tingo now claims its earlier SEC filings were incorrect and that it purchased almost all of its phones to date from a similarly-named but different entity called “UGC Technologies Limited” (rather than UGC Technologies Company Limited). Tingo also wrongly claimed:

“Hindenburg contacted a company called UGC Mobile Technologies in the U.S., not Tingo Mobile’s supplier, UGC Technologies Limited, which has offices in Africa and China.”

Note that the company we reached out to does match the name from Tingo’s SEC filings and does have offices in the U.S., China and Africa.

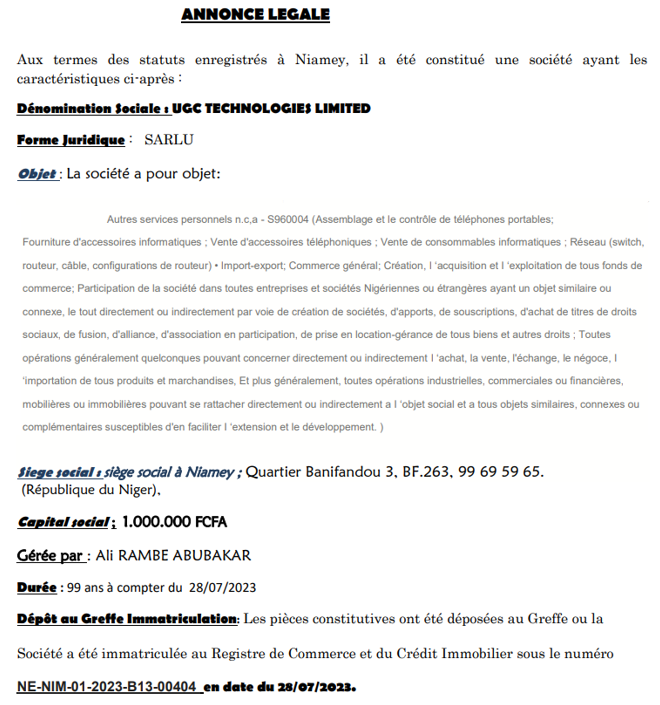

Tingo’s New Claimed “Supplier” Corresponds With An Entity Set Up In Niger A Month After Our Report, In July 2023

It Obviously Has Not Been Supplying Millions Of Phones To Tingo Since 2020

One would expect a sweeping presence for a company that, according to Tingo’s press release yesterday, had sold millions of phones and has been around for at least 2 years with “offices in Africa and China.”

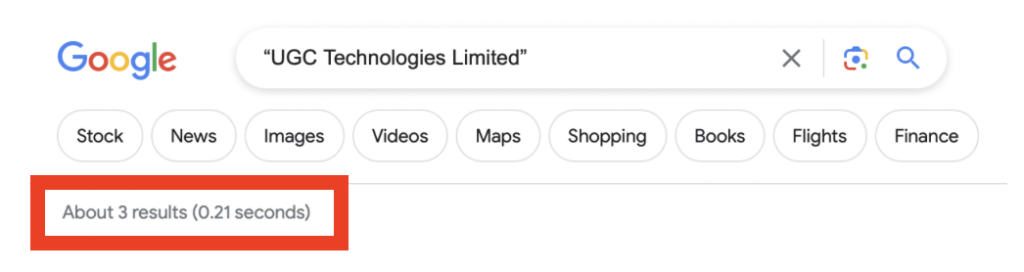

We found almost no evidence that Tingo’s new claimed supplier entity “UGC Technologies Limited” exists. We found no website or contact information. A Google search for the entity revealed only 3 results, the first 2 of which were from Tingo’s press release yesterday.

The third and final Google search result was from a Niger entity registry showing that an entity “UGC Technologies Limited” was registered in July 2023, one month after our report and almost three years after Tingo claims to have begun a contractual relationship with the company.

The Niger entity filings, translated from French to English with Google translate, state that UGC Technologies Limited filed its trade and credit number registration on 07/28/2023.[2]

Other Obvious Inconsistencies: In Tingo’s SEC Filings, It Claimed Its Contract With Supplier UGC Technologies Was Entered Into In March 2020

In Its Release Yesterday, Tingo Claims The Relationship Started 9 Months Later, In December 2020

Such Shape-Shifting Key Details Further Indicate That Tingo Has Simply Made Up The Existence Of The Relationship

The likelihood that there were two similarly named UGC’s with identical business offerings located in identical jurisdictions is highly unlikely. The notion that one of those entities (which actually has a website and public presence) happened to bid on a Tingo contract and never heard back and the other one (with no public presence at all) actually won the contract, is essentially impossible.

Other obvious inconsistencies indicate that Tingo is simply making the story up as it goes along. Tingo’s SEC filings say “In March 2020, Tingo Mobile entered into a mobile phone procurement contract with UGC Technologies Company Limited.” [Pg. 10] Yet Tingo’s release from yesterday now says the contractual relationship started 9 months after this, in December 2020.

Tingo should share basic details about its claimed relationship with UGC—how did the company even find this entity that has no website and no public presence? Who are its main contacts? Where are the manufacturing facilities? Where are the import or export records for its previously claimed purchased phones, which also don’t exist? Who is listed as signatory on the contracts?

In short, Tingo appears to be once again fabricating the existence of a supplier relationship and making very little effort to mask the deception.

Tingo Claims It Advanced $434.2 Million In Cash To Its New Supplier This Quarter, Conveniently Wiping Out Much Of Its Suspect Balance Sheet Cash To An Entity That Appears Brazenly Fictitious

Normal supplier relationships require payment over time as product is produced and shipped, particularly for a supplier that has supposedly worked with a company for years.

Despite evidence that the entity has existed for only a month, Tingo reported in its latest results that it advanced a whopping $434.2 million to UGC to produce 6 million mobile phones. [Pg. 38]

There is no evidence in any of Tingo’s past filings that it made large advances to its claimed mobile phone supplier. There is simply no rational explanation for why a genuine supplier would require almost half a billion dollars up-front to continue producing phones.

The reality, it seems, is that Tingo is simply attempting to paper over its fake cash and fake supplier relationship with a new, incredibly obvious lie to explain why it can’t confirm the existence of cash in its bank accounts.

Our Report Showed Tingo’s Two Claimed Farmers Cooperatives, Which Supplied Virtually All Of Its 9.3 Million Mobile Customers, Had Fewer Than 100 Farmers Each

When Contacted, Both Said They Had Never Heard of Tingo

Tingo Responded By Saying It Had “Confirmed” Its Obviously Fictitious Relationships With The Cooperatives, Without Providing Further Detail

In yesterday’s release, Tingo claimed:

“The two farming cooperatives referenced in the Hindenburg report were Kebbi and Ailoje, to which Tingo Mobile has leased 4.5 million and 4.844 million phones respectively. The relationships with all the co-operatives and farming organizations have been confirmed.”

As Recently As Yesterday, One Of The Cooperatives (Accounting For a Claimed 4.844 Million Mobile Customers) Again Confirmed To Us That The Relationship With Tingo Has Never Existed

Following Tingo’s release, we once again reached out to the Ailoje Royal Farms cooperative. As of yesterday, the head of the cooperative once again denied having any phones, leases or any relationship at all with Tingo.

Tingo Claims The Other Cooperative In Kebbi Is Responsible For 4.5 Million Leased Phones

The Partnership Told Local Media That It Had Fewer Than 100 Farmers Total

Kebbi’s Adult Population Is Only 2.7 Million People, Suggesting That If The Company’s Claims Were True, Each Adult In Kebbi Has 1.6 Tingo Phones Each

As to the other key claimed cooperative relationship with Kebbi, local media outlet WeeTracker earlier reported that it had reach out to the Kebbi Multi Purpose Co-operative Society. They were told that they too had no relationship with Tingo, no leased phones, and had very few members.

Notably, the entire population of Kebbi is projected at 5.5 million as of 2022, with only approximately 2.7 million people in Kebbi between the ages of 15-64. Tingo’s claims of 4.5 million leased phones would mean that 82% of the population, including babies and the elderly, are farmers leasing Tingo phones.

Furthermore, cell service coverage from all carriers reaches less than 10% of Kebbi by area, rendering the use of such phones nearly impossible.

We Asked Why $204 Million In Food Inventory Completely Vanished From Tingo’s Financial Statements

The Company Claimed It Was Purchased By An Unnamed Customer, Which Doesn’t Explain Why It Still Didn’t Appear In The Company’s Cash Flow Statement

Our report raised questions about numerous obvious errors in Tingo’s financial statements. The company brushed these aside, saying that errors amounting to hundreds of millions of dollars in misreported financials were merely “typographical”.

One such item related to $204 million in food inventory that completely vanished from Tingo’s financials without explanation.

In its response, the company wrote that the inventory was sold to an unnamed customer. The claimed sale was nowhere to be found in Tingo’s filings, including its cash flow statements, which should have registered the decrease in inventory as a source of cash.

Investors are simply meant to accept that the disappearance of $204 million from financial statements is somehow legitimate. Until this quarter’s vaporization of over $725 million in cash from the balance sheet, it was one of the largest disappearing acts of a substantial claim of value we had ever seen.

Tingo’s SEC Filings Have Claimed To Date That It Has A Contract With A Single Telecommunications Provider Named Airtel

Airtel Wrote To Us That It Has No Relationship At All With Tingo

Tingo Responded By Now Claiming That Its Services Are Provided Through An Unnamed Third-Party Vendor That Works With 4 Different Providers, Once Again Contradicting Its Own SEC Filings

Tingo’s historical SEC filings clearly indicate that Tingo Mobile has an agreement with Airtel, a major Nigerian telecommunications provider:

“Through a Mobile Virtual Network agreement with Airtel, Tingo Mobile provides its customers in Nigeria with voice and data services.” [Pg. 8]

The filings go so far as to detail the terms of the services (how much data and minutes are provided and for what price, along with the split received by Tingo Mobile). But as reported in our original piece, Airtel expressly denied all of this, saying it had no relationship with Tingo Mobile:

In yesterday’s release, Tingo completely contradicted its own SEC filings, now conveniently claiming the relationship has suddenly and dramatically changed and that it instead operates through an unnamed third-party vendor:

“Tingo Mobile does not directly provide airtime and data services on the phones it leases to customers…Such services are currently provided by a third-party vendor. Tingo Mobile therefore does not require a Mobile License from the Nigerian Communications Commission. This arrangement allows Tingo Mobile’s customers to choose the best network provider for their location from Airtel, MTN, 9 Mobile and Globacom.”

Tingo further claims, without stating when the change took place, that it now “earns a commission on the airtime and data services purchased by its customers, which it receives from its vendor, and which were previously received from Airtel.”

We Wrote That Tingo’s Nwassa Platform, Which Accounted For $125.3 Million of Claimed Revenue in Q1 2023, Had No Functional Website. Local Media Reported That Its ‘Text To Order’ System Also Didn’t Function At All

Yesterday, The Company Reiterated That Its Platform Works, Without Providing A Shred Of Evidence To Back Up Its Claim

Tingo Further Claimed That Transactions Are Processed By An Unnamed Payment Processing Company And Declared That Its Revenue Is “Confirmed” Without Further Explanation

In our August 9th release of ‘Questions for Tingo’, we asked about the company’s Nwassa platform, a claimed ‘seed to sale’ marketplace that exhibited no independently verifiable signs of existing:

“The NWASSA website still says ‘under maintenance’, as it has for months. How does Tingo expect investors to believe hundreds of millions of dollars in transactions are happening through an entity whose website doesn’t exist? We have also raised questions about Tingo’s claim that the Nwassa system uses USSD codes, a system of text messaging orders. Local reporting by Weetracker showed that when they tried the claimed Tingo USSD codes, they didn’t work. How does the company explain this?”

In yesterday’s release, the company answered no questions on the functionality of the platform and provided no evidence that it generates the revenue it claims from the platform. Rather, the company simply concluded that it works and that it “confirmed” its own revenue.

The company also claimed for the first time that an unnamed Fintech partner processes the Nwassa payments and remits them to Tingo’s unnamed banking provider:

“The transactions made through Nwassa are processed by a third-party payment processing company owned by an American multi-national Fintech company, which collects a commission payment on behalf of Tingo Mobile on each transaction and remits the commissions to its bank account.”

Finally, the company said it “confirmed” its reported Nwassa revenue without detailing whether such confirmation was done internally or through an outside independent body. In other words, we are once again meant to just trust that a platform with no website and no online presence has taken over the Nigerian agriculture industry.

Our Report Showed That Tingo Claims Its ‘DMCC’ Platform Projects It Will Export More Food From Nigeria Than The Entire Nation’s Agricultural Exports, An Obvious Impossibility

There Are Zero Import/Export Records Indicating The Company Has Exported Anything

Tingo’s Response: None

Our report highlighted that Tingo claims to be on track to export more than Nigeria’s entire 2022 agricultural exports, despite not producing, harvesting, or processing any agricultural goods of its own, and despite no export records indicating it has exported anything at all.

In its release yesterday, the company made no effort to address these issues, claiming simply that it sold $348 million worth of product through direct contacts with unnamed customers.

We sought to learn more about this obviously ridiculous notion, emailing Tingo DMCC through the email address from its website.

The email instantly bounced back, with Google servers citing an “undeliverable address.”

Tingo’s lack of response follows a pattern of not answering any key, direct questions.

We Released 38 Questions To The Company On August 9th. The Company Has Failed To Adequately Address Any Of Them

On August 9, 2023, we released 38 questions to the company that we hoped it would address on its conference call. The company never took our questions on its conference call this morning, despite saying it was open to questions.

Thus far, the company has failed to adequately address any of the questions contained in our letter. The lack of response to each of them speaks volumes.

Conclusion: We Have Never Seen A Scam More Brazen And More Obvious Than Tingo

We strongly suspect that virtually all of Tingo’s rosy claims and financials are fake. We also strongly believe that its previously claimed cash balance, which conveniently disappeared when we raised questions about it, never existed at all.

The company has repeatedly misled investors about the nature of its claimed independent review and its relationship with White & Case, which we suspect no longer exists. The fact that the company has avoided answering all questions and has simply blazed forward with more absurd claims shows that it has zero regard for potential consequences.

Thus far, NASDAQ and the company’s independent directors have tacitly blessed the situation with their silence, as has Deloitte, the company’s current auditor of record.

We do not expect it will end well.

.

Disclosure: We Are Short Shares of Tingo Group, Inc. (NASDAQ: TIO)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Note that while the 2022 figures are not yet available, Tingo’s claimed tax payment would rank it among the highest corporate tax payors in Nigeria in 2021.

[2] Readers can replicate this search by navigating to https://www.mde.ne/annonces-lgales and filtering the search to July 2023. UGC Technologies Limited appears as the fourth company listed.