(NASDAQ:SKYS)

- A key lender recently noted SKYS to be in default, but shares spiked on a company press release indicating that the lender proposed to buy SKYS for $2.15-2.25 per share.

- Retail investors seem to have taken the release at face value, but court filings show that those proposals were actually withdrawn after the lender learned of a new $121m liability.

- Instead, the lender has begun to seize SKYS assets, including a significant Luxembourg subsidiary which it has now fully appropriated.

- The company’s financial state was weak prior to the new $121m liability and the recent note default. SKYS has had 3 CFOs within the span of 6 months.

- We expect the stock to dive as retail investors realize what’s actually going on. SKYS looks to be approaching insolvency and we do not anticipate the equity will survive.

Introduction

An interesting thing has happened with Sky Solar Holdings (SKYS), a small, troubled company that develops and operates international solar projects.

One of SKYS’ key lenders, Hudson Solar, recently declared SKYS to be in default on its notes and has begun taking action to enforce its interests. Hudson has sued the company looking to force repayment on the notes and has seized some of SKYS assets, including a significant operating subsidiary.

That all seems quite bad for equity holders of SKYS. But despite that, investors have bid up the stock dramatically based on what appears to be a mistaken reference to a buy-out proposal made in a company press release.

Following the filing of Hudson’s litigation against the company, a SKYS press release seemed to imply that there are proposed deals on the table, including one where Hudson would acquire SKYS for between $2.15 to $2.25 per share. Per the press release:

“In a series of letters, Hudson alleged that Events of Default (as defined in the Note Purchase Agreement) under the Note Purchase Agreement had occurred and proposed to resolve the issue with an offer to either (I) purchase of the equity in certain projects of the Company at a purchase price of US$240 million, and (II) acquire the Company through merger at $2.15 to $2.25 per ADS (the “Proposals”).”

SKYS had closed at $0.56 per share the day prior to the announcement. But following the press release with news of the proposals, the stock surged over 100% within days. It now trades around $1.20 per share.

But there is one major problem!

The Hudson Proposals Had Already Been Withdrawn Prior to The SKYS Press Release

A review of the court docket shows that while Hudson had previously made several proposals on dates as late as December 24th (see ex. 20 [1]) subsequent events seem to quite clearly render those old proposals moot.

In particular, on December 26th (two days after the last reference we find to Hudson’s proposals), Hudson became aware of an agreement made with a party SKYS had been in litigation with. The agreement requires subsidiary Sky Solar Japan to pay $121 million to the other party “on or before April 1, 2019”.

As made clear in Hudson’s complaint, this new liability changed everything:

“…the discovery of a material new debt of this magnitude raised the specter that the Guarantors and, indeed, the corporate group as a whole, would be insolvent and lack sufficient liquidity to fully satisfy the Obligations under the Note Purchase Documents, the Notes, and the Guaranty.”

Hudson highlighted that as a result of this and other factors, the earlier proposals had been withdrawn:

“Prior to the December 26, 2018 Letter, Hudson Solar (and its affiliates) had previously attempted to engage with the Guarantors, as parent holding companies of the Obligors, on numerous occasions by making a series of proposals to address the liquidity issues of the group. However, these offers were not given serious consideration by the directors and management of the Guarantors and have since been withdrawn.”

At some point, Hudson looks to have decided that just seizing the assets as a creditor was a better approach than paying for equity.

Hudson went ahead and appropriated 100% of one of Sky Solar’s subsidiaries in January. The subsidiary, Energy Capital Investment S.a.r.l, was classified as a “significant” subsidiary on SKYS annual 20-F filing (pg. 81) and holds (or held rather) Sky Solar’s 84mw of solar projects in Uruguay.

Hudson now controls this subsidiary and has made it clear that they’re not done. Hudson subsequently served demands in multiple jurisdictions to secure payment from SKYS and its various international interests, per a press release of their own.

It would seem therefore that while the SKYS press release mentioned proposals that genuinely had been made by Hudson at one point, it failed to mention that those proposals had already been withdrawn.

We reached out to SKYS investor relations to ask whether they had any reason to believe that the proposals are still active and to clarify some of the items above. We haven’t heard a response as of this writing but we will surely update this piece if we hear back from them. We also reached out to Hudson which declined to comment due to the ongoing litigation.

In short, we don’t think there are any active proposals from Hudson to acquire the company. On the contrary, Hudson appears to be in the midst of seizing as many of SKYS assets as possible and forcing repayment or liquidation if necessary.

SKYS Balance Sheet Looked Pretty Ugly Before the Added/Accelerated Liabilities

SKYS looks to have already been financially troubled prior to the new $121 million liability due on April 1st and prior to the accelerated demand for about $96 million on the defaulted Hudson note (pg. 15).

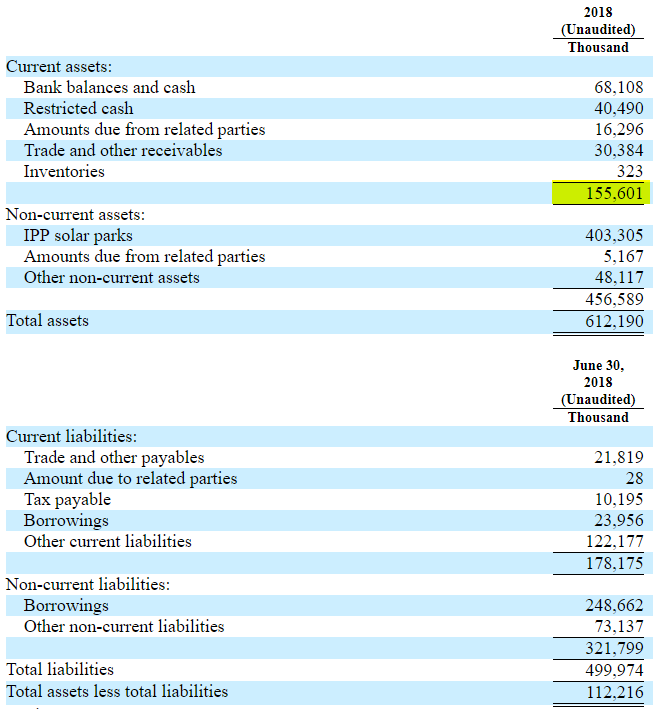

Given the latest reported financials as of June 30, 2018, the company had total current assets of only $155.6 million and current liabilities of $178 million. The company reported shareholder equity of $112 million in that period. Again, all of this was prior to the new $121 million liability.

It is therefore hard to imagine a scenario where Sky Solar’s equity makes it out of this situation intact:

SKYS Just Appointed Its 3rd CFO in 6 Months

SKYS looks to have experienced some very recent tumult in its key financial ranks, which further indicate signs of stress.

The company announced on August 31, 2018, that long-time CFO Andrew Wang resigned and that Sanjay Shrestha would assume the role.

Then on January 28, 2019, the company abruptly terminated the new CFO. Shrestha resigned as director shortly thereafter, on February 1, 2019.

The company has appointed Julie Zhu as the acting CFO, marking the third person to fill the CFO shoes within 6 months.

The quick turnover at such a key oversight role indicates that the company could be experiencing issues with its internal controls. The Hudson complaint seemed to underscore this point as well:

“Sky Solar Holdings is listed on the NASDAQ as a foreign issuer and, as such, is subject to various reporting obligations. Notwithstanding these obligations, the Sky Solar Holdings board of directors has failed to disclose numerous material events that would be relevant to shareholders, including, but not limited to:

1. Hudson Solar’s (and its affiliates’) proposals to address the group’s serious liquidity issues;

2. the ongoing Events of Default under the Note Purchase Agreement;

3. the receipt of numerous notices regarding such Events of Default;

4. the acceleration of the Notes;

5. the Demand on Guaranty; and

6. the exercise of appropriation rights against Sky International under Luxembourg law, resulting in the assignment of the shares of ECI to Hudson Global Finance DE, LLC.”

As a parting shot, Hudson said the following of SKYS:

“(Hudson Solar) believe(s) that it is dealing with a severely mismanaged company that does not operate in a candid manner and that is unable to meet its obligations, both monetary and nonmonetary, to its various stakeholders.”

Questions around internal controls are not entirely new for SKYS. In late 2017 the company’s former Chairman/CEO was found to have made unauthorized transfers to entities under his control. An internal investigation later found that the transfers “appeared to lack proper board and audit committee authorization”. A settlement with the company required the former executive to pay back $15 million to the Company, among other conditions.

To their credit, at least the internal investigation led to the executive’s ouster and uncovered the alleged wrongdoing. Nonetheless, for a company to experience such executive tumult in such a short period of time does not inspire confidence.

Conclusion: We Would Be Surprised If Sky Solar’s Equity Makes It Out of This Alive. We Are Short.

We think Sky Solar’s press release gave investors the mistaken impression that there’s an active proposal on the table to buy the company. We don’t see any evidence of that and we don’t see the recent rally holding up once investors piece together what is happening here.

Best of luck to all!

[1] The court filing shows that Lumens Holdings, an entity that held a portfolio of Sky Solar’s projects sent a letter to Hudson in relation to a an agreement breach. In that letter, Lumens indicated that Hudson looks to have made the proposals to purchase Sky Solar or the certain projects on December 24th. This is the last reference we were able to find in relation to any proposals. Thereafter Hudson indicated that it had withdrawn those proposals and has given no public indication that it has changed its stance. Per the lawsuit exhibit 20:

“With respect to the proposals set forth in the December 24th Letter, we take the view that this strategic opportunity is completely separate from the issue of finding a mutually agreeable alternative to the Security Provision, and that without reaching an agreement in respect of the Security Provision it is impossible to value the company Sky Solar or SIE properly and fairly, therefore, we are not prepared to consider or have any discussion of the proposals set forth in the December 24th Letter until an agreement is reached in respect of the Security Provision.”

Disclosure: I am/we are short SKYS.

Additional disclosure: Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

One thought on “Sky Solar: Court Records Show That Lender Already Withdrew Buyout Proposal But Retail Investors Don’t Seem To Realize It Yet”

Comments are closed.

bonjour….merci…