- Our investigation found that NexTech, a company that proclaims to be a leader in augmented reality, has virtually no credible business prospects and appears to be focused almost entirely on promoting its stock, and insider self-dealing.

- The company is on a paid promotion spree, engaging at least 8 promotional outlets. It has pumped out 112 press releases over the past year – equating to a press release every ~2.2 trading days.

- Contrary to management’s claims that its customers “have nothing but rave reviews”, we spoke to customers and found that many of them – including ones featured by the company in its glowing press releases – were either entirely unaware they had a relationship with the company or had never actually implemented the product.

- We identified multiple brazen related party transactions, including one where the CEO and COO acquired a business personally, only to turn around and sell it to the public company months later, likely netting millions at the expense of shareholders.

- The company has a significant share lockup coming due next month from a recent toxic financing and has displayed multiple other red flags, such as recent CFO and COO departures.

- We think NexTech has been thoroughly “pumped”. We now expect a “dump”. We believe its equity is worthless.

Initial Disclosure: After extensive research, we have taken a short position in shares of NexTech AR. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Basics on the Company and the Bull Case

NexTech claims to be an “augmented reality” (AR) company that aims to use its technology to disrupt the markets for advertising, education, eCommerce, and entertainment. As of the time of this report, the stock trades at a fully diluted market cap of ~$150 million and has spiked about 900% since it came public via spin-off in mid-2018.

The stock’s explosive run looks largely due to promotion-driven excitement over its rapid revenue growth and aggressive projections. For example, one paid promotion site described the latest quarter’s results as “more than $2.5 million in revenue for the period, 44 times more than the same quarter last year.”

A recent presentation given by NexTech’s CEO on another paid promotion site similarly highlighted 4390% revenue growth and estimated over 3x revenue growth this year alone: [19:50 minute-mark]

According to the company, the product is working incredibly well. The CEO says in one webcast that his company sees “nothing but blue skies” for eCommerce and that it has been “signing up customers at a very rapid rate”. It is claimed that augmented reality provides up to 2,000% more product engagement, 400% more add to cart rates, and 50% fewer product returns than traditional eCommerce. (11:09-mark)

NexTech charges $79/month for the subscription to its AR advertising platform and claims it expects to hit breakeven cash flow imminently.

Introduction: Numerous Related-Party Transactions, Heavy Stock Promotion, Vaporware Products and Inorganic Revenue “Growth” Driven by Acquisition of 2 Websites that Sell Vacuum Cleaners and Pet Supplies

Despite the rosy picture painted by management, we find that reality looks quite different.

As part of our investigation, we spoke with over a dozen of NexTech’s customers and deal partners. Contrary to management’s claims that its customers “have nothing but rave reviews”, we found that many customers touted in the company’s glowing press releases were either entirely unaware they had a relationship with the company or had never actually implemented the product.

NexTech has been aggressively promotional, having issued 112 press releases in the past year, and has engaged at least 8 paid stock promotion sites that tout the stock.

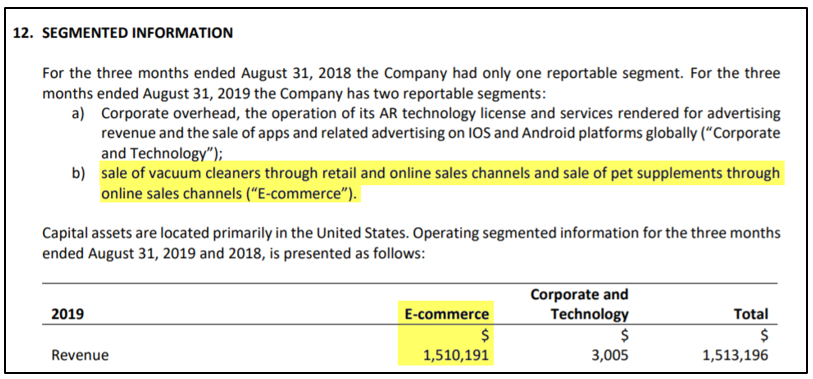

The company’s eye-popping revenue “growth” has almost entirely been the result of acquiring companies with pre-existing revenue. Last year, the company bought 2 small eCommerce sites that sell vacuum cleaners and pet supplements. As of last quarter, these eCommerce sales accounted for 99.8% of revenue [Pg. 16]

These acquisitions have allowed the company to report staggering (but essentially meaningless) year over year growth rates.

Meanwhile, we have also identified sketchy related-party transactions taking place at the company. For example, NexTech’s CEO and COO acquired the vacuum cleaner website into a newly-formed private entity, then almost immediately flipped the entity to the public company, likely pocketing millions at the expense of shareholders for simply stepping in the middle.

The company recently completed a financing round priced at an absurd ~70% discount to market prices. When factoring in the value of warrants, the round was essentially a “free money round” for the unnamed lucky beneficiaries. Those shares unlock next month, at which point we expect they will be aggressively dumped onto unsuspecting investors.

Overall, we think NexTech has been thoroughly pumped, and investors will soon experience the “dump”.

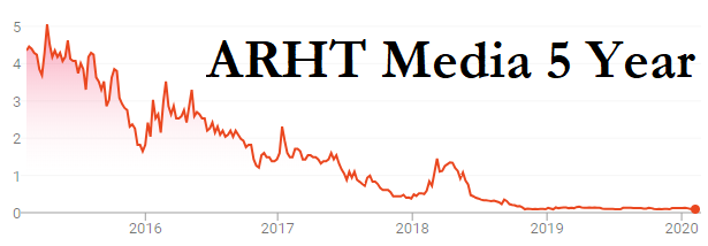

Background: NexTech AR was a Spin-Out from A Cannabis Penny Stock That Now Trades at ~$0.03, Down ~98% From its 5 Year Highs

NextTech spun out of a cannabis company (as all great technology companies do) called Future Farm Technologies (CSE:FFT), on August 31, 2018, and became a standalone public company.

Future Farm aspires to be a “leading supplier of pharma-grade health and wellness products, including those made from hemp”. It, too, is heavily promotional, having issued over 180 press releases in its short ~3-year tenure as a public company.

As one example, during the height of blockchain mania, Future Farm announced an agreement to purchase a “blockchain cryptocurrency application for cannabis payment platform”. The stock spiked to almost $1.40 on the buzzword-laden release, but now trades at ~3 cents, a near 98% collapse.

Background: NexTech’s CEO, Evan Gappelberg, Has a History of Stock Promotion and Business Failures, Including a Key Role in the Future Farm Debacle

NexTech’s CEO is Evan Gappelberg. Gappelberg owns a securities firm called Atlas Advisors, incorporated in 1999, which offers various services including paid stock research and promoted CEO interviews. Former members of the Atlas Advisory team now work at other stock promotion outfits such as:

- ProActive Investors (a stock promoter currently paid by NexTech)

- Investology (example)

- Venture Research, LLC (example)

- Investor relations firm Blueshirt Group

Prior to Atlas, Gappelberg’s biography mentions his early Wall Street experience at an unnamed firm, stating that he worked as “Senior Vice President of Finance where he underwrote Take Two Interactive Software, Inc.”.

A quick search shows why the firm’s name was left unsaid. Take Two was one of the only success stories underwritten by Whale Securities, a bucket shop that racked up an impressive number of regulatory sanctions (1) – including allegations of transacting business as an unregistered broker dealer, failing to comply with NASDAQ trading rules and failing to supervise its employees.

The firm was also widely known for its small cap IPO failures.

Outside of his stock promotion and Wall Street experience, Gappelberg also ran a business called “Wand World”. There, he is credited with such inventions as the Taxi Wand, a “hand-held beacon uniquely suited for hailing taxicabs”, and the Britney Spears Concert Wand:

Wand World does not appear to have achieved commercial success.

A further review of Gappelberg’s history shows he played a key role in the Future Farm debacle (the entity that NexTech spun out of):

- Gappelberg helped raise an early round of financing through his firm, Atlas Advisors [Pg. 11]

- Gappelberg sold his personal portfolio of apps to Future Farm [Pg. 26] The same app portfolio ended up being resold to into NexTech and was summarily discontinued and written down to zero. (More on this, and selling private assets to one’s own public company, later.)

- In early May 2017, Gappelberg and his wife’s chocolate business announced a partnership with Future Farm, which outlined plans to launch a line of cannabis-infused chocolates. We called the chocolate business. The person who picked up the phone said they are closed until April and was “not sure” if they have a cannabis line.

NexTech Has Issued 112 Press Releases in The Last Year, Including Dozens of “Partnerships” and “Contracts” Without Reference to Actual Contract Economics

NexTech has been extraordinarily promotional in its short tenure as a public company, averaging one press release every ~2.25 trading days over the past year.

The company regularly issues press releases announcing new partnerships or contracts that discuss huge market opportunities without detailing any actual revenue metrics. Numerous examples: (1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23).

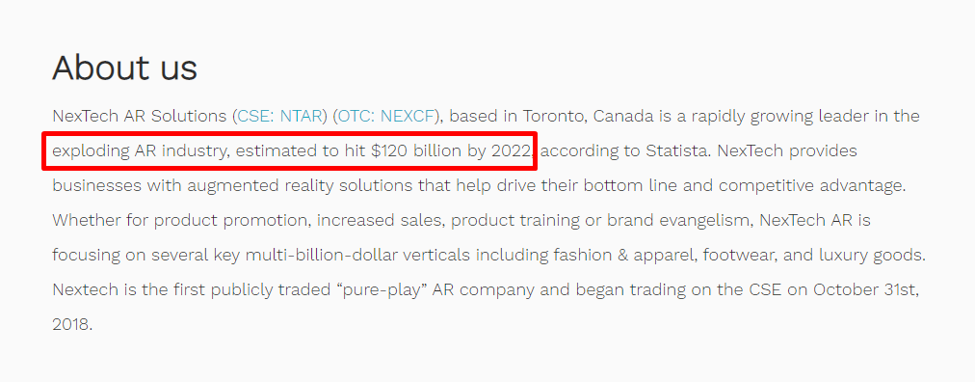

Gappelberg, in an interview, mentions the “emerging trillion-dollar mega-trend of Augmented Reality” as the answer as to why he established NexTech.

The company touts similar enormous market opportunities on its website, where it claims the industry is “exploding” and is estimated to “hit $120 billion by 2022”.

The Company Has Engaged in a Paid Promotion Spree, Pumping its Stock Through at Least 8 Promotion Outlets

In addition to its slew of press releases, the company has hyped its future prospects through aggressive paid-promotion campaigns. We’ve identified no fewer than 8 stock promotion outlets hired by the small company that have collectively issued a slew of positive articles, “research”, and CEO interviews:

- Starwood Research, which called NexTech and its CEO Evan Gappelberg the “Tesla and Elon Musk of Micro-Cap” was paid $30,000 and an option to purchase 150,000 shares of NexTech at C$2.00.

- Zacks Small Cap Research put out glowing reports and was compensated with “quarterly payments totaling a maximum fee of $40,000 annually”.

- ProActive Investors posted bullish videos and articles and is paid up to $25,000 cash annually.

- StockHouse was engaged by the company and paid an undisclosed sum.

- FinancialBuzz acknowledged it sponsored NexTech content, though it did not disclose payment amounts.

- StreetWise Reports acknowledged receiving compensation, which looks to be $10,000+.

- Octagon Media Corp. In a press release about a new client deal, the company slipped in that it paid Octagon 150,000 options and $60,000 for “investor relations services”, which includes promotional interviews with NexTech’s CEO.

- CFN Media, a cannabis media penny stock (OTC:CNFN) was paid $90,000 in cash for its promotion of the company.

Part I: NexTech’s Customers

We wanted to see whether there was any substance to the company’s promotional campaigns and press releases, so we spoke to over a dozen of NexTech’s customers and partners in order to see how its products were being received.

What we learned was rather startling: in several cases, representatives for NexTech’s customers and partners had no idea they even worked with NexTech or stated openly that they’d never actually worked on any projects with the company.

Other customers we spoke with acknowledged not even paying for the product. Of the few that did, most pay $30 to $79 per month, likely less than the cost for NexTech to put out the press release touting the relationship.

A Partnership with Budweiser May Sound Like a Big Deal…

…But it Was Actually Only a Contest Promotion for One Event at Budweiser Stage, a Local Music Venue in Toronto, and It Didn’t Work

Budweiser: “We Did It as a Test and Learn but It Didn’t Perform and We Would Not Repeat”

The most touted partnership by the company was a supposed deal with Budweiser. The headline of the press release claimed “NexTech Launches ARitize App with Budweiser” and described how Budweiser selected NexTech to launch an augmented reality contest to celebrate the 25th anniversary of the Bud Stage, which is actually a single music venue in Toronto.

The contest encouraged users to use the hashtag #BudAR on social media posts that were meant to include pictures of augmented reality features superimposed on Budweiser cans. In the end, we found only 2 social media posts hashtagging the contest, with both users sharing that the app didn’t work for them:

Despite NexTech repeatedly hyping the supposed collaboration, we saw no similar announcement by Budweiser or LiveNation (the operator of the venue). NexTech’s website for the contest is currently down.

We emailed a senior brand manager at Budweiser for feedback on the contest with NexTech and whether the relationship is ongoing. His reply:

“We did it as a test and learn but it didn’t perform and we would not repeat.”

Despite this, the company still claims Budweiser as one of its clients to this day.

NexTech Announced a $60,000 Licensing Deal with Cannabis FN

…But Failed to Mention that It Pays Cannabis FN $90,000 For Stock Promotion Services

Cannabis FN is the only example we could find of NexTech reporting the revenue associated with a contract. Company filings show a $60,000 agreement as of May 28th 2018, seemingly providing early validation for the company’s technology [Pg. 8]:

“NexTech has agreed to create AR programming for CFN Media who intends to sell this programming as an additional service to existing and new customers. In consideration for a $60,000 payment, CFN Media will receive one year of exclusivity.”

Several months later, NexTech announced it was “to broadcast first ever cannabis augmented reality live streaming event in partnership with CFN media” at a cannabis conference.

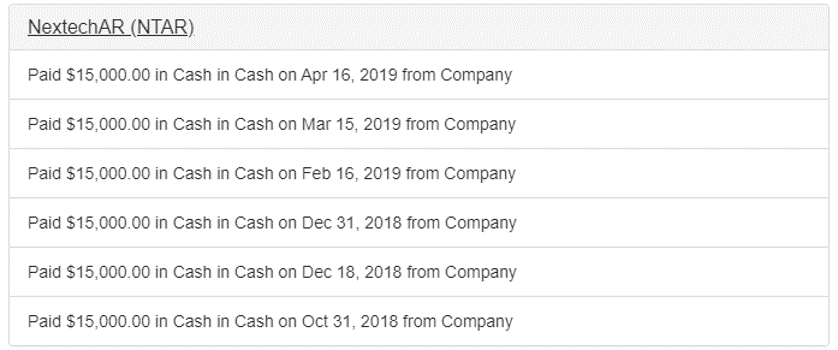

Both announcements gave the impression that NexTech was landing clients and getting its technology out there. Both also left out a key detail: NexTech pays Cannabis FN $90,000 for stock promotion, resulting in an overall net loss of $30,000 for NexTech in its dealings with Cannabis FN.

Per Cannabis FN’s disclosure page, under “Past Clients”, we see $90,000 in cash payments by NexTech to Cannabis FN, which temper the splashy headlines:

Our Calls with NexTech’s Clients Reveal the Reality of Its Products: Plenty of Hype with Little Substance

We noticed that actual customer feedback of NexTech’s products differed sharply from the narrative portrayed by the company. Here is a rundown of several of our calls with NexTech’s customers and deal partners:

Fish out of Water. NexTech announced a joint venture with local Toronto creative agency Fish out of Water in September 2018. The announcement suggested that the agency would contribute a range of expertise to the company:

“Fish out of Water will contribute its many years of industry expertise in brand building as well as access to its stable of traditional clients and emerging list of clients in the cannabis industry.”

This month (over a year after the announcement) we called the creative director of the agency for feedback on the progression of its joint venture with NexTech. She told us:

“We haven’t done any tangible projects with them so I don’t know. There’s nobody here that could tell you.”

Reef. We called and spoke with a customer service rep for the beachwear eCommerce site who was unaware that they were even a customer of NexTech: “I honestly don’t know.”

Weby. In December 2019, NexTech’s CEO announced an agreement with eCommerce site Weby. NexTech’s CEO Gappelberg describing the new customer relationship in glowing terms:

“Market leaders like Weby know the revenue positive impact that the adoption of next-generation technologies can have on driving an organization’s bottom line. By investing in superior online product experiences with NexTech AR’s eCommerce technology, Weby is offering its customers a better and more meaningful way to engage with and to purchase product brands that they represent.”

We called Weby and spoke with its CEO. He described the partnership quite differently:

“Yeah its far far periphery for us. I don’t think we’ve done much with it.”

“…it’s something a thousand miles away from center…”

“…One of the manufacturers was participating in it and we’re one of the retailers that’s selling the project…the importance of that vendor in terms of our website sales is like .000000000001%. So we kinda let the website team run with it. How far they’ve gotten with it? I don’t even know if they’ve got the code installed.” (Note: he verbalized each of those eleven zeroes)

He also described the conversation he had with NexTech and the terms he offered in order to “possibly” work with them:

“Guys if you offer it for free we’ll possibly plug it in but it’s definitely not at the forefront of what we’re working on.”

He confirmed that Weby indeed gets the product for free. One of its manufacturers (he believed Walther) pays for it instead.

Here it is in the CEO’s own words:

[Click HERE for Audio of the Call]

Foottraffik. NexTech announced a deal with cannabis marketing agency Foottraffik in April 2019. Despite appearing to be a small company, the VP of sales we spoke with was entirely unfamiliar with NexTech, and said he would “have to do some digging on that” and get back to us after researching it further. We have not heard back as of this writing.

Romios Gold. Two weeks ago, NexTech announced a deal with Romios Gold, a junior mining company. Despite the odd pairing of augmented reality and mining, the announcement touted how the deal opened up the door for NexTech to the $683 billion mining sector:

“The mining sector is certainly a new industry for us and we are the first companies to create 3D/AR core samples, which we believe could become a new industry standard for the entire mining industry.”

We called Romios and spoke with its CFO, who didn’t have a “clue” who NexTech was:

“I haven’t got a clue. The name is not familiar with me. I’m the CFO but uh, is it Ramios Gold you’re talking about?”

We assured him that we had called the right company and pointed him to the press release naming the Romios CEO. He replied:

“Quite frankly I’m not aware of it at all.”

We believe this bodes poorly for NexTech’s chances for becoming the new industry standard for the entire mining industry.

Hear it in the CFO’s own words:

[Click HERE for audio of the call]

GWN Events. In September 2018, NexTech announced a licensing agreement with GWN Events, a producer of live events. At the time of the announcement, NexTech Director Reuben Tozman gushed:

“We’re excited to see GWN leverage our technology to build a new channel of communication out to its loyal fanbase. GWN is showing true innovation in its category and we’re excited to be a part of it”

We called GWN to check how the NexTech agreement had progressed over the course of the year. The representative on the phone told us this:

“Honestly I’m not really familiar. I wouldn’t really know who to talk to about that…I can ask around but as far I’m aware no one really is involved with it.”

Davidson’s. In December, NexTech announced a deal with Davidson’s, a firearms distributor. We spoke with a Director of Web & eCommerce at Davidson’s, who led by telling us that setup and implementation of NexTech’s software was easy and straightforward:

“It was pretty effortless in terms of getting things set up. I mean it’s a pretty simple piece of tech. It’s javascript, plug it on a site, and you get augmented reality models for stuff.”

As far as return, he said it was too premature to tell, as the AR-enabled site with an add-to-cart function was still in a beta phase:

“In terms of like a return we haven’t seen anything yet but it’s still early days.”

As far as cost, Davidson’s is paying nothing. Once again, Walther (one of the manufacturers whose products is on the site), covered the costs:

“Walther had paid for the setup and everything. And then I had negotiated with them to put it on our sites for free. There’s no cost to us and we’ll see where it goes from there.”

AimCam. In November 2019 NexTech announced that it had “landed a deal” with AimCam, a provider of glasses for the sport and target shooting market. NexTech used the deal to tout the potential in the $131 billion global eyewear market.

We called AimCam and spoke with a representative who told us it has yet to be implemented:

“We haven’t implemented it yet…It has been developed we just need to basically plug it into our website really.”

When asked about cost, the individual we spoke with said he believed it cost $300 as a setup fee and then a monthly charge of $30 per month.

The NexTech announcement had touted its analytics platform, but the representative for AimCam contradicted this:

“There’s certain stuff they could probably improve on with regards to being able to track. Basically, there’s no way of tracking the effectiveness of this implementation of the website in the sense that there’s no analytics that come from it that would be very useful to have, especially on the eCom side.”

JumpBall. On November 26, 2019 NexTech announced that it had “enter(ed) the $1.5 trillion global clothing and apparel marketplace” with its deal with JumpBall.

We spoke with a JumpBall co-founder who had positive things to say about Paul Duffy and the company. He viewed it as a way to try to showcase products differently, but acknowledged they are still in the setup phase, haven’t implemented it, and are not yet paying for it. He is in the process of getting the apparel to the company over the next several weeks and then said it would be a paid subscription.

Tufner Weighing Systems. The rep we spoke with about NexTech’s Tufner deal said:

“I think we’re in the process yeah. We haven’t done anything yet.”

Wright Brothers. NexTech announced an agreement with Wright Brothers in May 2019.

We called Wright Brothers and the representative we spoke with informed us that they are in fact paying users (he believed $79 per month) and said that they have implemented it on the website. He said it has had a positive impact but “it hasn’t been that significant”, partly because website sales are a small part of the overall revenue (which is mostly comprised of licensing revenue). He expressed his interest in exploring the potential of using the technology in the education market, which may happen down the road.

Q: With All of These Low-Paying and Free Partnerships, What Has Driven NexTech’s ‘Revenue Growth’?

A: Two Acquired eCommerce Websites: One That Sells Vacuum Cleaners and Another That Sells Pet Supplies

In the absence of actual organic customer revenue, NexTech has grown its revenues inorganically through the acquisition of 2 small eCommerce sites. As stated above, these comprised 99.8% of sales last quarter.

Infinite Pet Life Acquisition

One of NexTech’s acquisitions was for a pet supplement website:

“The Company acquired Infinite Pet Life for US$1,850,000. Infinite Pet Life is a web site business selling health supplements for pets. The consideration was based on a multiple of Infinite Pet Life’s EBITDA” [Pg. 2]

The announcement stated that Infinite Pet Life generated about $1.6 million in revenue and $600,000 in EBTIDA, giving the acquisition a roughly 3x multiple.

Vacuum Cleaner Market Acquisition

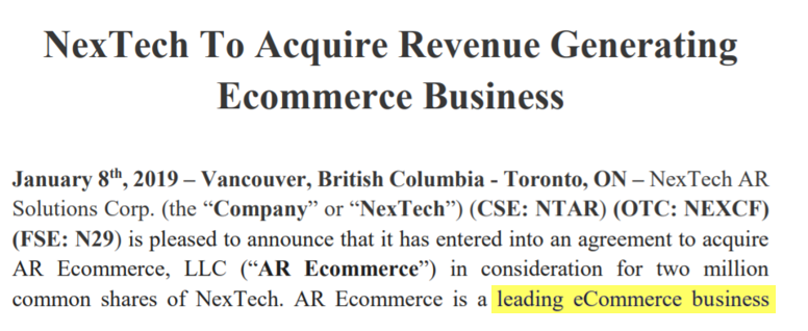

The other eCommerce site acquired by NexTech was a small vacuum cleaning supplies company called www.vacuumcleanermarket.com, though you wouldn’t know it from its press releases. The company’s announcements (1,2) on the acquisition vaguely refer to the vacuum cleaner site as “AR Ecommerce” and a “leading eCommerce business” with scant additional detail:

The Company Claims Its Augmented Reality Features Are Revolutionizing Its Vacuum Cleaner Website. We Tested the Features—They Didn’t Work.

Aside from giving it the ability to report surging revenue “growth”, the justification for the small eCommerce acquisitions is to ‘ARitize’ them, or to work augmented reality features into the sites. Weeks ago, the company described how AR is revolutionizing their pet and vacuum supplies websites [18:56 mark]:

“Those businesses are scaling bigtime. We’ve integrated augmented reality into those businesses and it’s showing up in the results.”

Around this time, Vacuum Cleaner Market announced it would be introducing augmented reality, complete with an image of a 3D hovering vacuum!

The website included a sample of how the technology worked. On desktop, it amounted to a 3D photograph that you can rotate when you hover over it (not an uncommon feature on eCommerce sites and a “technology” that was ubiquitous as early as Apple’s QuickTime VR, which was initially demoed and released in 1995, nearly 25 years ago).

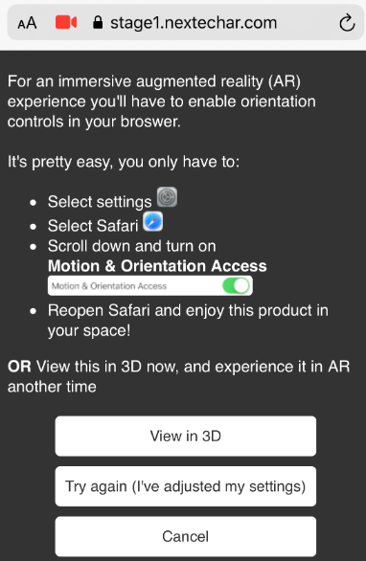

We then tested it on mobile and found that the augmented reality feature didn’t work. We were given a prompt asking us to toggle a setting in our phone:

But that phone setting doesn’t exist anymore. Apple removed the toggle for the setting in September of last year. We were then again left with just a regular 3D photograph of the vacuum. We called VacuumCleanerMarket and asked customer service about the feature. They described it in far less exhilarating terms than management:

“It’s just a 3D model of the vacuum cleaner – you can like spin it around see what it is underneath it, to the side of it…it’s just a software that our current company has.”

We find this important because not only did the key “feature” the company claims to be building not seem to work, but the company said that its non-working feature is “showing up in the results” for the business. How?

Part II: NexTech’s Slew of Highly Questionable Related-Party Transactions

While we didn’t find a lot of substance to NexTech’s technology or customer relationships, we did find one area where value is being delivered: management’s pockets.

We noticed a bevy of related party deals that seem to provide value to management while providing questionable benefit to shareholders.

NexTech’s CEO and COO Bought the Vacuum Cleaner Website Personally Before Turning Around and Selling it to the Public Company, Likely Pocketing Millions for Stepping in the Middle

As we showed above, one of NexTech’s key sources of revenue “growth” was its acquisition of an eCommerce vacuum cleaner company. For context, when most public companies make an acquisition, they just go out and buy the target company.

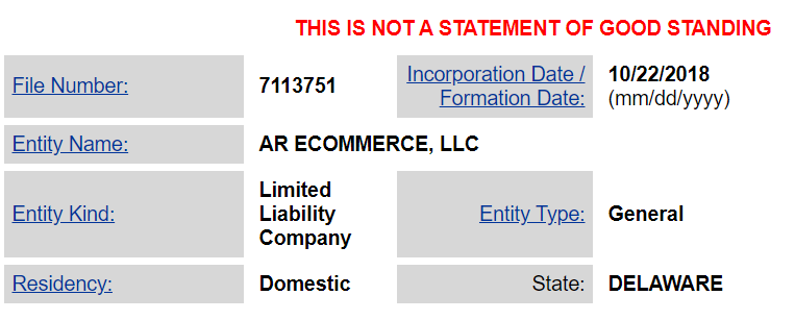

Contrary to that normal approach, NexTech’s CEO and COO instead set up a new private entity, acquired the vacuum company personally, then almost immediately re-sold it to the public company. Here’s the step by step:

1. On October 22nd 2018, CEO Evan Gappelberg and COO Reuben Tozman formed AR Ecommerce, LLC in Delaware:

2. A week later, (October 31st, 2018) they used the entity to acquire vacuumcleanermarket.com, a seller of vacuums with a warehouse near San Jose, California. [Pg. 16]

3. Two months later, on January 8th 2019, Gappelberg and Tozman flipped the AR Ecommerce entity to the public company, pocketing 2 million shares.

We spoke with the former CEO of Vacuum Cleaner Market and asked what kind of multiple eCommerce sites sell for. He told us the standard is 3x EBITDA, suggesting a sale price of roughly C$1 million based on Vacuum Cleaner Market’s reported EBITDA at the time of announcement.

Based on the value of NexTech’s shares at the time, a 3x multiple suggests Gappelberg and Tozman pocketed at least $600,000 by stepping in the middle of NexTech’s transaction. At current share prices, Gappelberg and Tozman’s take amounts to almost $2.3 million.

We reached out to Gappelberg directly and asked him specifically how much he paid for the vacuum cleaner site when he bought it into his private entity:

Our question: “How much did you originally pay for VCM when it was purchased by AR Ecommerce?”

Rather than answer the question, Gappelberg deflected and answered how much the company later paid for the website (which had already been disclosed).

His answer: “NexTech paid 2 million shares at a price that was in the .80 cent range, so valued at about $1.6 mill.”

We hope he provides an answer to the question of how much he bought it for just months earlier.

edCetra Acquisition: The Company Bought an eLearning Platform from its Own COO in 2018, Apparently CHOOSING to Pay More Than Required

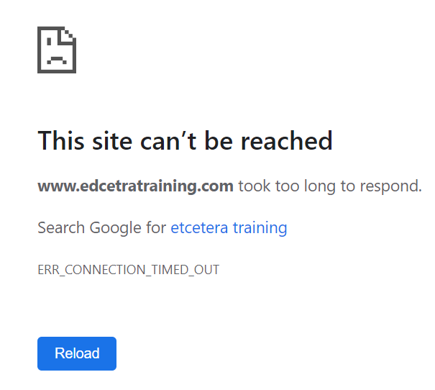

The Website for the Platform Is Currently Dead

In May 2018, NexTech purchased an exclusive license to the intellectual property of edCetra, which purports to offer an “eLearning education and training platform”. [Pg. 5]

The company paid 100,000 shares to its own newly appointed COO, Reuben Tozman, for the license. The deal also came with a 1-year option to buy edCetra outright for another 100,000 shares.

NexTech had big plans for the technology:

“By licensing the technology, NexTech can accelerate its business plan and will spend the next few months customizing it to create an augmented reality (“AR”) training and education platform for the cannabis industry”.

NexTech expected it would take 90 days to launch the new augmented reality cannabis eLearning platform. (Yes, an augmented reality cannabis eLearning platform.)

That didn’t happen (color us shocked) but in December the company exercised its option to buy the whole company. However, rather than paying 100,000 shares for the company, as the option allowed, NexTech inexplicably chose instead to pay 300,000 shares for the entity.

The December 2018 press release announcing the purchase again set high hopes for edCetra:

“The company is preparing the eLearning platform for a re-launch in January 2019, with the added augmented reality feature”

Those plans appear to be abandoned, as the edCetra website is dead as of this writing:

edCetra’s Assets Were Sold 7 Years Ago and it Appears to Have Been Defunct Since Then…So What Did NexTech Buy?

NexTech’s COO Tozman received 400,000 shares from the sale of edCetra, but what exactly did shareholders get for that dilution?

Tozman’s biography in another of his ventures shows that edCetra had already sold its assets years before the sale to NexTech:

“Reuben (Tozman) was the founder and former CLO of edCetra Training Inc, which successfully sold its assets in May 2013.”

We also see that:

- The last post on edCetra’s Facebook page was in 2013

- LinkedIn profiles of former edCetra’s executives (1,2,3) and employees (1,2,3,4,5,6,7) show them departing around 2013 or earlier.

In 2017, the Canadian government moved to dissolve the apparently defunct entity, but it was revived and sold to NexTech the next year.

NTAR Bought an App Portfolio Created by Its CEO with a “Consistent History of Generating a Gross Profit” and “Established Relationships with Apple and Google” Then Summarily Wrote it Down to Zero

In another example, NexTech acquired an app portfolio created by its CEO as part of the spinout that took NexTech public in early 2018.

The portfolio consisted of apps that allowed “readers to connect with authors and other fans of bestselling self-help books”.

The app portfolio had originally been sold to the predecessor company for a total of 15,000,000 shares (1,2), with the intention of positioning the company “for rapid rollout of a suite of marijuana centric apps.”

The nonsensical pivot from self-help to marijuana never happened.

When NexTech later acquired the app portfolio, it claimed it would enhance its value by infusing the portfolio with augmented reality features. Per a filing in late October 2018:

“NexTech is confident that upgrading the App Portfolio with new 3D AR features and functionality will generate an increase in user engagement thereby increasing the advertising revenue as well as the in app purchase revenue from the App Portfolio.” [Pg 8]

Management repeatedly described the acquisition in accretive terms, also in late October 2018:

“The App Portfolio has a consistent history of generating a gross profit, as well as established relationships with Apple and Google, which has the potential to accelerate the scaling of the NexTech Business as well as to help fund ongoing development work for NexTech’s AR 3D-based advertising.” [Pg 8]

“The App portfolio should also generate a modest cash flow and provide an additional source of capital.” [Pg. 5]

Those hopeful prospects flittered away almost immediately. By February 28th 2019, the company wrote the value of the app portfolio down to zero. [Pg. 11]

“The Company reviewed its intangible assets for impairment as at February 28, 2019 and determined that the App portfolio was impaired and wrote off the remaining unamortized value.”

By May 2019, it acknowledged completely discontinuing its app portfolio business. [Pg. 2]

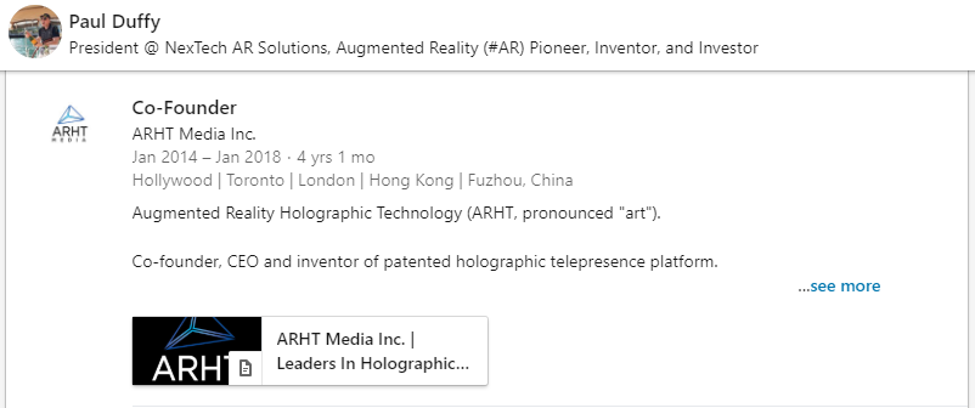

Another Related-Party Deal: NTAR Licensed Hologram Technology from A Penny Stock Company Affiliated with its President

In July 2018, NTAR announced a 5-year worldwide exclusive license agreement with ARHT Media (TSXV: ART; market cap $7m). The agreement would supposedly bring ARHT’s patented holographic display to the cannabis industry.

ARHT Media is a related party, given that NTAR’s President (who joined February 2018), is the Co-Founder of ARHT Media, per his LinkedIn bio.

ARHT Media rallied 12.5% on the news and is since down ~71% (currently trading at roughly .10 per share).

The agreement included purchasing a minimum of 12 holographic displays, per year, for the next five years, but no pricing information for the displays was given.

We reached out to NexTech CEO Evan Gappelberg directly to ask how much the displays cost. Again, he didn’t answer directly but admitted the technology is obsolete:

“ARHT contract is inactive as technology has obsoleted what they offer.”

And A Related-Party Partnership: NexTech Touted its Partnership With LivePerson (NASDAQ:LPSN) Without Mentioning Its Advisory Board Member Works At the Company

In one recent press release, NexTech touted a partnership with LivePerson (NASDAQ:LPSN) without mentioning any economics. The press release quoted Scott Starr, LivePerson’s AVP of retail issuing glowing praise:

“Providing augmented reality experiences and one-touch purchase transactions within messaging makes eCommerce interactions seamless for consumers – and changes the retail landscape forever.”

The press release failed to mention that Starr is actually a related party of NexTech—he had been appointed to NexTech’s board of advisors just 6 months earlier.

Part III: NexTech’s Questionable Intellectual Property Portfolio, Our Expectations of (Another) Capital Raise and A Slew of Upcoming Shares Unlocking That We Anticipate Will Flood the Market

Beyond the above, we found significant irregularities and deficiencies with NexTech’s intellectual property portfolio and its cap structure.

NexTech’s IP Portfolio: 2 Patents from Over 12 Years Ago Focused on Putting Infomercials in Games, and 3 Recently-Filed Patent Applications

NexTech has promoted its “valuable portfolio of patents around augmented reality” as a key component of its case to shareholders.

We reviewed the company’s IP portfolio [Pg. 2] and found that it consists of 2 old, largely irrelevant patents, and several augmented reality patent applications.

NexTech owns the following patents: #7,054,831 (filed in 2003) and #7,266,509 (an associated patent filed in 2006) which focus on “combining interactive game with infomercial” or with an advertisement. These seem largely irrelevant to NexTech’s supposed focus on augmented reality in advertising and eCommerce.

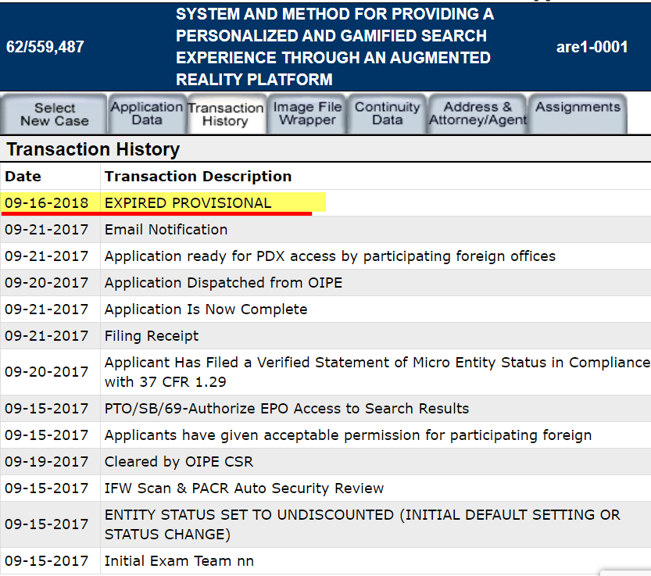

NexTech also owns the following patent applications: #15351508, #62559487, and #62457136 related to interactive gaming, interactive advertising, and augmented reality (“AR”) technology.

(Note that of these applications we were unable to find the last one [#62457136] after a search through the U.S. Patent and Trademark Database. We emailed NexTech’s CEO and asked him about it. He replied “I’ll do some research”. We have not heard back as of this writing.)

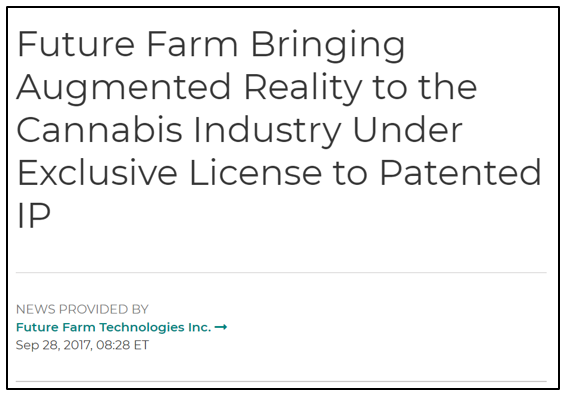

NexTech (And Earlier Future Farm) Touted a Core “Patented” Augmented Reality Technology it Had Licensed for Millions of Dollars

…Except The Technology Looks to Have Been Just a Patent Application (Now Expired) Filed By an Entity That Had Only Existed for a Month. Where Did the Money Go?

When NexTech spun out from Future Farm, it took Future Farms’ “intellectual property” licenses with it as part of the deal. [Pg. 5] We see that at the bottom of NexTech’s website, it claims that its platform “ARitize is a patented omni-channel augmented reality platform technology created by NexTech AR Solutions Inc.”

But what do these patents actually consist of?

Our research found that NexTech’s IP was originally purchased from an entity that existed for only a month and had filed its key augmented reality patent application and trademark application the week prior to being purchased for millions of shares.

Both the patent and trademark applications, which NexTech still touts as part of its “IP portfolio”, were never pursued and have since expired.

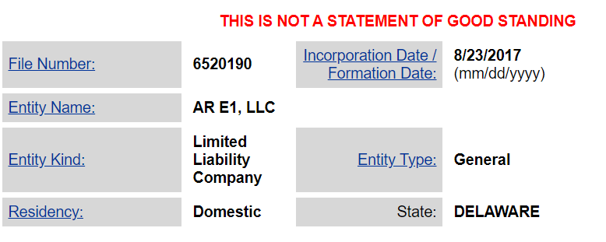

NexTech’s IP Entity AR E1, LLC was Formed Just One Month Before Its Original Acquisition

NexTech acquired its intellectual property from an entity called AR E1, LLC as part of its spin-out from Future Farm. The entity was formed in Delaware on August 23rd, 2017, presumably by founder Eric Koenig:

Koenig looks to have been the original creator of NexTech’s IP, based on a search of the patent portfolio.

By the time the above entity had been incorporated, Koenig only owned the 2 old gaming patents referenced above, and another patent application that tangentially mentioned AR technology.

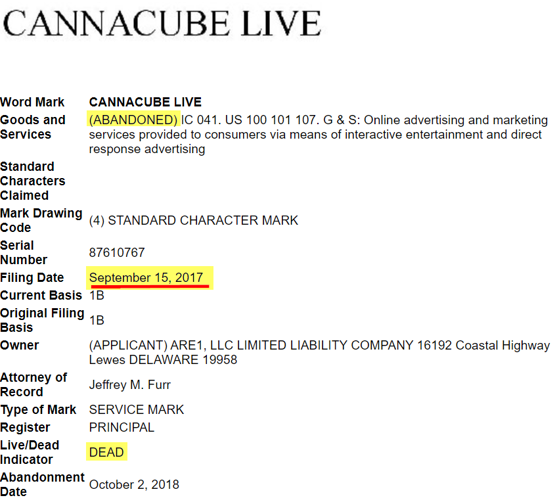

One month after forming the entity, on September 15th 2017, Koenig filed a patent application (application # 62/559,487) for a “system and method for providing a personalized and gamified search experience through an augmented reality platform”. This was the first explicit “augmented reality” application filed by Koenig. That same day, a trademark application was filed for “CannaCube Live”:

One week later, Future Farm issued a press release declaring that it had entered into an agreement for an exclusive license to patented augmented reality IP with the new AR E1 entity and the “CannaCube Live™ platform”:

The release failed to clarify that the entity had only what appears to be a mere AR patent application and that CannaCube Live was likely just in the concept stage:

“Future Farm and ARE1 will work together to merge augmented reality (AR) and ad-tech with the cannabis industry through the CannaCube Live™ platform.”

AR E1, LLC was paid 5,000,000 shares of Future Farm for what was described as its “impressive portfolio of intellectual property.” It appears that zero action was subsequently taken to pursue the augmented reality patent application or the trademark, which both expired automatically a year later by September 16th 2018.

NexTech Has Been Touting Its Augmented Reality Provisional Patent Despite Its Expiration Over a Year Ago

NexTech is now the owner of this expired provisional patent and expired trademark application:

But that hasn’t stopped the company from promoting the abandoned patent as part of its IP portfolio. Press releases and filings as recent as July and August still reference the patent, despite it expiring over a year ago.

NexTech’s Most Meaningful Intellectual Property: A 3D and 360-Degree Photography Company it Bought For Only $65,000

Based on NexTech’s actual delivered products, which largely rely on its ability to take 3D photographs and superimpose it on objects, it seems that its acquisition of HootView is the most important piece of IP in its portfolio.

On February 6, 2019, the Company acquired 100% of HootView.com (the “HootView”) for CDN$85,664 (US$65,000). Hootview provides 3D and 360-degree product photography, in conjunction with spin and zoom technology to online retailers through their website. [Pg. 17]

This technology also seems to be the foundation of ARitize, the company’s app that users are required to download in order to view augmented reality ads. (How many consumers would download a specific app just to view ads?)

The app has 4 reviews on the app store as of this writing. The only reviewer we could identify went by the username chipMONKgrafx, who it turns out to be NexTech’s creative director. He wrote “The Future is Here Now!” and gave his own app 5/5 stars.

NexTech’s Recent Capital Raise Was Completed At a Toxic 70%+ Discount (!) To Market Prices. We Expect the Stock Will Crater When These Shares Are Soon Unlocked

We think NexTech’s recent financing round foretells the pain that retail investors will soon suffer.

NexTech raised $3 million in November via a private placement. The stock closed at $2.30 around the time the deal was announced, but the private placement priced at $0.75 per share, a ~70% discount to market prices. The placement also included full warrant coverage, with 4,000,000 warrants priced at $0.93 per share. When adding the value of the warrants using a Black-Scholes calculation, the discount received by private buyers was greater than 100% of the offering price.

In other words, this private round was essentially ‘free money’ for the participants, at the expense of public shareholders.

Those shares unlock on March 23, 2020 and we fully expect NexTech’s share price will tank to at least $0.75 when private investors are given the opportunity to unload.

Investors in the Dark: Financial Reporting Gap Due to Company Switching Its Fiscal Year End

The company recently changed its fiscal year from May to December, resulting in a reporting gap for the September to December period. The company is expected to release these results by April 20th, marking a long gap of silence for investors.

Management has released revenue and gross profit numbers in the interim, largely driven by its eCommerce sales. The numbers so far put the company far off from its goal of $20 million in revenue this year and we have serious doubts that its augmented reality endeavors have contributed to any meaningful revenue.

When full financials are reported we will be keeping an eye out for the cash balance. Operating cash burn was $1.2 million as of last quarter and has been accelerating. The company had cash of about $1.4 million as of August 2019 [Pg. 4] and then raised $3 million through its November private placement round. We estimate cash will be depleted by June if not earlier, necessitating another infusion.

Classic Red Flags: The Sudden Departure of NexTech’s CFO and COO

Beyond the above, key insiders have recently jumped ship. On October 10, 2019, the company announced that Dave Miles and Reuben Tozman had resigned as CFO and COO/director, respectively, without explanation.

Conclusion: Actual Reality Is Quickly Approaching for Shareholders

We hope management responds to our research and, in doing so, clears up several mysteries:

- How much did CEO Gappelberg pay for the vacuum cleaner website when he bought it 2 months before flipping it to public shareholders?

- Who participated in the recent private placement rounds, receiving shares at a 70%+ discount to market prices? Did this include friends of management?

- What is the point of press releasing every new customer relationship, when many of these customers pay nothing or close to nothing?

We have seen this story play out before. We expect retail investors will end up holding the bag when all is said and done and we believe NexTech’s shares will eventually be rendered worthless.

Disclosure: We are short shares of NEXCF

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

20 thoughts on “NexTech AR: Relentless Stock Promotion, Sketchy Related Party Transactions and a Vaporware Product—Price Target: $0”

Comments are closed.

What are the next steps?

Great detective work.

You make a lot of claims, but I don’t see any actual evidence. Where’s the Beef? I would like to see facts backed up by facts. Post your sources, evidence, not just speculation and innuendo.

Companies simular to yours tout themselves as a magnifying glass look at a company, like Nextech AR Solutions, and how they are so great to inform investors about how badly a busines is behaving, not to protect investors, ” only to plunge their stock price into the ground, leaving them with nothing, so they can make MILLIONS OF DOLLARS FROM INNOCENT INVESTORS , and also openning the doors for multiple lawsuits, which they will have to endure years of ongoing LITIGATION, sacrificing most of their settlement to pay the lawyers.

Could you imagine if they let investors know all this when they placed their short position and before they displayed a report.

I am hoping reports like these are wrong, so investors can carry on. I believe, Evan Gappleberg, will pull through with honesty and humility through this situation.

If nothing is illegal, small things don’t concern me, because nothing is perfect.

The business is making money, and it will make tons of money in the near future, in my humble opinion.

With all do respect and kindness to everyone involed. Corey

Hello, Nathan.

I wrote a comment which was displayed on your website for half a day.

It did not reflect well on businesses similar to yours.

Was it removed because it was a negative view on reports like yours?

Are only mildly negative comments allowed on this site?

Or is freedom of speach not ok here?

Kindest regrds, Corey Horth

Amazing, I cannot wait for Part 2 of this report!

How about part three when the short sellers have to buy back the shares at a hire price!

That would be hillarious!

Evan Gappelberg is a criminal that’s clear. But also some smart moves on their side. Changing the fiscal year end so they don’t have to report their financials until april 2020 is good for the people who got the pp shares priced at 0,75. These people will get time to dump those shares. Anyway who got those super cheap shares? Coincidentally Dave Miles and Reuben Tozman resigned in October 2019 and the pp was in November. That’s just an other move to make money and then Nextech will go down.

Maybe Evan will try to press some more money out of it but now that he is exposed it will get even harder. I guess regulators will get him thanks to Hindenburg Research.

MORE NINSENSE FROM SHORT AND DISTORT SELLERS, INFLUENCERS AND SUPPORTERS.

IF THIS SO CALLED REPORT WAS SO REVEALING AND DAMAGING, WHY IS NTAR STOCK HOLDING AT $1.59 WITH A 20% REDUCTION DUE TO THE CORONAVIRUS PANIC?

EVAN DIDN’T HIDE HIS FACE AFTER THIS, SO CALLED REPORT. HE SHUT DOWN TRADING ON HIS STOCK SO HE COULD RESPOND AND INFORM HIS INVESTORS, WHO HE CARES ABOUT, TO LET THEM KNOW THAT, NATHAN HAD DISTORTED INFORMATION ABOUT NTAR.

THIS IS AN OPINION OF NATHAN, THE AUTHOR OF THE REPORT. COINSIDENTLY, THE RUMORS ABOUT LAWSUITS, WERE NOTHING BUT SPAM CONNECTED TO NTAR. EVAN CONTACTED THE OTC TO LET THEM KNOW THAT THESE SPAM FALSE LAWSUITS WERE DIRECTED TOWARDS HIS COMPANY. THERE ARE ZERO, ZERO, ZERO, ZERO, LAWSUITS AGAINST NTAR!

EVAN ALSO CONTACED THE TSX.V, OTC, IIROC TO INFORM THEM THAT SUSPICIOUS TRADING ACTIVITY WAS OCCURRING BEFORE THE REPORT CAME OUT.

DID, NATHAN WITH HIS HINDENBERG REPORT, CONTACT THE TSX.V, OTC, IIROC, TO LET THEM KNOW ABOUT HIS REPORT. HAS HE GONE ON TELEVISION, NEWS, ELLEN DEGENEROUS, IF I SPELLED THAT CORRECTLY, 20/20, 60 MINUTES.

I HAVE SCENE PROFESSIONAL SHORTERS, WHO INVEST BILLIONS, WITH CONCRETE EVEIDENCE, GO ON TELEVISION AND EXPISE EXTREME FRAUD, THE COMPANY STOCK GOES TO ZERO, AND THEY MAKE SO MUCH MONEY. GOOD FOR THEM

BUT WHEN YOU HAVE A HEALTHY, HONEST COMPANY LIKE, NTAR, I DON’T SEE NATHAN DOING THIS.

WHY IS THAT. WHY ARE WE ONLY ON THIS WEBSITE. WHAT GIVES? I WILL TELL YOU THAT THERE IS ZERO CREDIBILITY, THATS WHY.

THE ANSWER IS NO. BECAUSE IT IS A DISTORTED VIEW OF INFORMATION ABOUT NTAR AND EVAN.

THE ONLY CRIMINALS, ARE THE FRUSTRATED SHORT AND DISTORT SELLERS, WHO ARE HOLDING ONTO THEIR SHARES, HOPING NTAR STOCK PRICE WILL FALL TO ZERO, SO THEY CAN BUY THEM BACK, AND MAKE A HUGE PROFIT

FORTUNATELY, EVAN TOLD ALL OF HIS INVESTORS TO TELL THEIR BROKERS TO FORBID SHORT SELLING OF THEIR STOCKS, AND OR PUT A BUY BACK OF $5.00 ON THEM.

NOW, NATHAN IS ALLOWED HIS OPINION. NO PROBLEM THERE. BUT, HE TOOK A SHORT POSITION ON A BAD BET.

EVAN IS A STRONG PLAYER. HE WAS ON WALL STREET FOR 30 YEARS.

I HAVE TAKEN A PICTURE OF THIS, SO IF IT DOES NOT GET POSTED, I WILL MAKE SURE PEOPLE KNOW

KIND REGARDS, NO DISRESPECT TO, NATHAN.

LIKE HIM, I CAN HAVE MY OPINION.

COREY HORTH

Would you have the same statements today regarding NextechAR?

Their revenues look pretty good…maybe they will prove you wrong in the near future?

If so can we believe your claims about other companies??

They have consistently had more operating expenses than revenue, since company inception.

Quite a feather in Evans cap ?

https://www.globenewswire.com/news-release/2020/11/12/2125975/0/en/NexTech-AR-Solutions-Reports-Record-Third-Quarter-2020-Results.html

Unless you own equity in this dumpster fire of a company I don’t know why anyone would not appreciate this report.