- GrowGen is a roll-up of small mom and pop gardening shops. With the whole industry getting a financial temporary benefit from COVID-19, its stock has surged almost 108% in a week on the back of strong quarterly sales and retail investor enthusiasm.

- GrowGeneration’s management team is one of the most questionable we have ever seen at a public company. Top executives have extensive ties to alleged pump & dump schemes, organized crime and various acts of fraud.

- President & Co-Founder Michael Salaman was alleged by the FTC to have engaged in scheme to sell consumer credit card information without authorization. He has an extensive career in penny stock failures alongside his father, Abraham Salaman, a twice-convicted fraudster with ties to the mob.

- At Michael Salaman’s last public company, Skinny Nutritional Corp, he selected a CFO who had previously spent 3 years in prison for bank fraud. A key shareholder/landlord, known as “the Godfather of payday lending” was later sentenced to 14 years in prison in a massive racketeering case.

- All the Skinny Nutritional Corp directors resigned amidst securities fraud allegations and complaints that management failed to provide the board with basic financial information. The company eventually filed for bankruptcy.

- GrowGen CEO & Co-Founder Darren Lampert is a securities lawyer turned penny stock broker. Lampert spent the former half of his career defending several boiler room brokerages, including individuals with deep ties to the mob, and the second half operating at brokerages including several that came under scrutiny from regulators or prosecutors.

- For example, CEO Lampert has personal and business ties to Robert Cattogio, who was sentenced to 12 years in prison in 2001 in what the government at the time dubbed “the largest securities fraud ever prosecuted”.

- CEO Lampert later worked at several questionable trading operations including Hold Brothers (expelled by FINRA) and Incremental Capital (founders were arrested for insider trading).

- GrowGen CFO Monty Lamirato has previously been sanctioned by the SEC over allegations of professional misconduct. He had a history of working for failing penny stock companies prior to joining GrowGen.

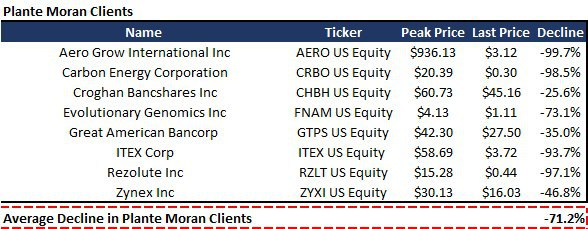

- GrowGen’s auditor Plante & Moran was reported to have missed major fraud at one of its key clients. Its latest PCAOB inspection report detailed a laundry list of audit failures and some of the firm’s clients consist of failing OTC companies.

- Purely on a fundamental/valuation basis, without the alarming warning signs above, we see 60% downside to shares of the company. The company trades at an extremely rich 60.5x adjusted estimated 2020 EBITDA and over 6.1x estimated 2020 sales.

- Management seems to agree with our valuation assessment. The company completed a financing at $5.60 per share, reflecting a 70% discount to current levels.

- Insiders and key holders, including the CEO, President & Co-Founder, and private equity backers have sold stock aggressively this year in the $4-$8 range.

Initial Disclosure: After extensive research, we have taken a short position in shares of GrowGeneration. This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Basics on the Business: An Acquirer & Operator of Grow Shops with A Stock That Has Recently Caught Fire Among Retail Investors

GrowGeneration Corp. is an operator of grow shops, which provide gardening supplies to both individuals and businesses focused largely on the cannabis niche.

The company was incorporated in Colorado in 2014 and subsequently acquired four existing hydroponic supply stores. [Pg. 1] It grew from there and now owns 28 locations with plans to continue acquiring and integrating new shops. The company uplisted to the NASDAQ in December 2019.

The Good News: Gardening Is One of the Few Brick & Mortar Businesses That Have Experienced a COVID Tailwind. Our Channel Checks Found That Sales at GrowGen’s Stores Have Indeed Increased Substantially But Some Caution May be Warranted

Starting with the good news, GrowGen reported an impressive quarter, showing year-over-year same-store-sales growth of 49% and strong revenue growth.

The gardening business has experienced a wave of renewed interest due to lockdown and isolation measures resulting from the global pandemic. We called all the stores in the locations where the company says it’s posting biggest growth in order to perform channel checks:

- A manager in West Lansing Michigan told us “we’ve been pretty much booming…the biggest challenge is getting people to wear their masks but otherwise its going pretty smooth for our industry.”

- An assistant manager in Livonia, Michigan told us: “Actually it’s kind of crazy ‘cuz since the beginning (of coronavirus) business went up, we’ve been significantly busier than we’ve ever been before.”

- A manager in the Brewer Maine location told us “I would say we’re up probably 40 percent. I guess that will drop off toward the winter.”

All the store managers and employees we spoke with provided similar positive feedback, confirming that business has increased substantially since COVID.

The Stock Has Run Well Past the Numbers: We See 60% Downside Purely on a Valuation Basis and Prior to our Findings on Management Detailed Below

The tailwinds have fueled an already surging stock. GrowGen’s stock has surged almost 108% in a week, helped by the quarterly numbers coupled with media appearances by a management team that has been active about telling the company’s story.

The stock now trades at over 60.5x adjusted estimated 2020 EBITDA and over 6.1x estimated 2020 sales.

We see 60% downside reflecting purely a rationalized valuation for the following reasons:

- The stock is priced absurdly rich even under a best-case scenario. This is clearly driven by retail momentum & euphoria.

- The COVID surge is not likely to be permanent. As the pandemic eases and people get back to work, we expect growth will ease.

Management appears to agree with us. On June 30th, less than two months ago, the company issued stock at $5.60 per share, a 70% discount to current levels. The initial deal was announced on June 10th and shortly thereafter GrowGen requested an exemption from the SEC to accelerate its registration to complete the financing. (On June 26th)

We can also take guidance from insiders and key holders including the CEO, President & Co-Founder, and private equity backers whom have sold aggressively this year in the $4-8 range (56-78% discount to current levels) for total proceeds of ~$14 million and a meaningful portion of their holdings. (Source: FactSet)

We note some caution on their growth by acquisition strategy here as although the company is tucking in one ‘mom and pops’ after another, it appears that social media reviews of stores deteriorate after acquisition.

Nonetheless, bulls would likely argue that the business is positioned well to consolidate its industry niche and grow into its numbers with the backing of strong management.

And that brings us to what we view as the overriding problem with GrowGeneration.

GrowGeneration’s Management Team Is Poison: An Extensive History of Ties to Organized Crime, Penny Stock Bankruptcies and Failures, Fraud Allegations and Regulatory Infractions

In the remainder of the report, we examine GrowGeneration’s key management and board and show why we think that while the company has an interesting business model, the investment should be avoided at all costs.

Part I: President & Co-Founder Michael Salaman—Extensive Ties to Organized Crime, Fraud Charges by the FTC And A Career of Controversial Penny Stock Failures

Michael Salaman is credited on GrowGeneration’s website as being one of two company co-founders.

We did a thorough review of Salaman’s background and found that he has a storied career that includes, among other things:

- Extensive business dealings with his father Abe Salaman, a twice-convicted stock fraudster with ties to the mafia.

- Operating multiple now-bankrupt or defunct penny stocks that failed amid controversy.

- Allegations of fraud by the FTC.

- Allegations of fraud by shareholders and improprieties by the board of his previous public company.

- Association with the “Godfather of Payday Lending”, who is serving 14 years in prison after being found guilty of a massive racketeering scam.

Skinny Nutritional: A Public Company Run into the Ground by Michael Salaman

Bad Sign: The Company’s CFO Had Previously Served 3 Years in Jail for Bank Fraud. Salaman Hired Him Anyway

Prior to starting GrowGeneration, Salaman was CEO and founder of Skinny Nutritional, which sold fruit-flavored, zero calorie water.

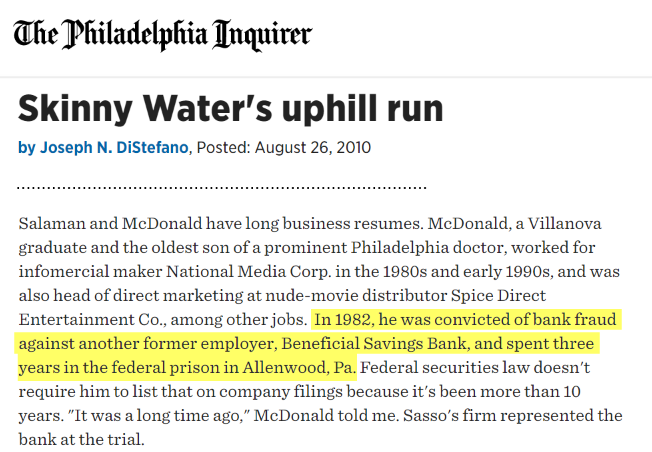

The company started in 2000 and traded on the pink sheets, experiencing a rocky path to eventual bankruptcy in 2013. One harbinger of the company’s eventual ruin could have been Salaman’s selection of a CFO, an individual that had previously served 3 years in jail for bank fraud.

That CFO, Donald McDonald, had prior overlapping work experience with Salaman. They both worked at infomercial maker National Media Corp, another penny stock that failed following the fraud charges against Salaman and others brought by the FTC (detailed further below).

The overlapping work history indicates to us that Salaman was familiar with McDonald’s imprisonment, but hired him anyway. Below is an excerpt from a media article on the subject:

Skinny Nutritional’s Key Shareholder and Landlord, Known as “The Godfather of Payday Lending”, Was Later Sentenced to 14 Years in Prison Over a Major Racketeering Scheme

Michael Salaman is Still Friends with the “Godfather” on Facebook

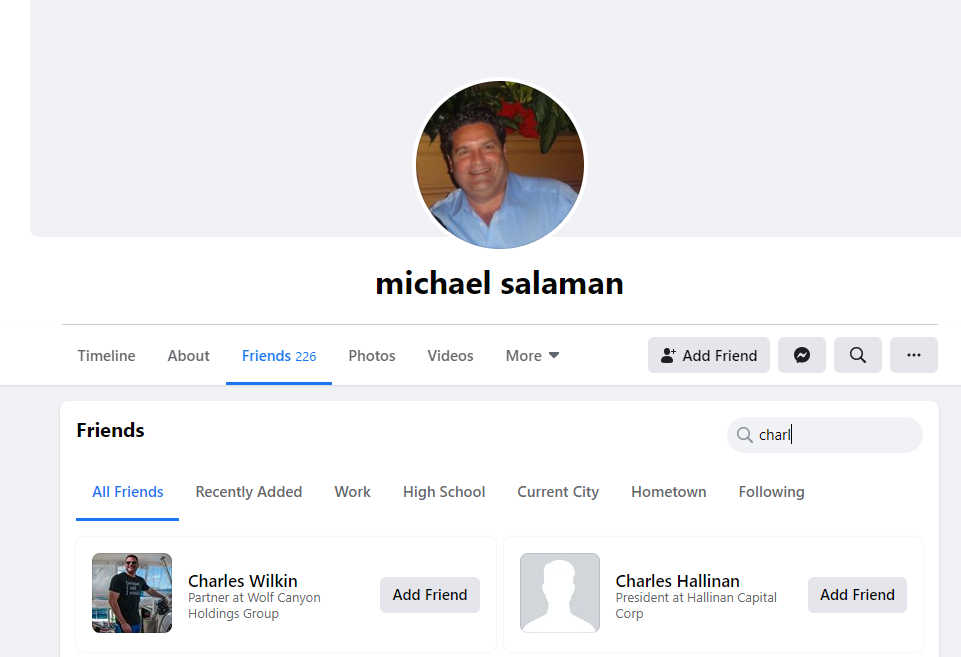

In addition to selecting a convicted felon as CFO, Skinny Nutritional made an unusual choice for its landlord. SEC filings show it leased office space from Hallinan Capital, run by Charles Hallinan. [Pg. F-36] Hallinan also owned a 5.3% stake in the firm, making him a key shareholder. [Pg. 46]

Hallinan was sentenced to 14 years in prison in 2018 and stripped of $64 million after a jury found he was the mastermind behind a major racketeering scheme to defraud borrowers through his payday loan empire. He was found guilty on 17 counts including fraud and international money laundering.

Local media dubbed him the “Godfather of payday lending”.

In case there is question of whether it was merely a relationship of landlord and tenant, Michael Salaman’s Facebook account (which we expect may soon become private) lists Hallinan as a friend:

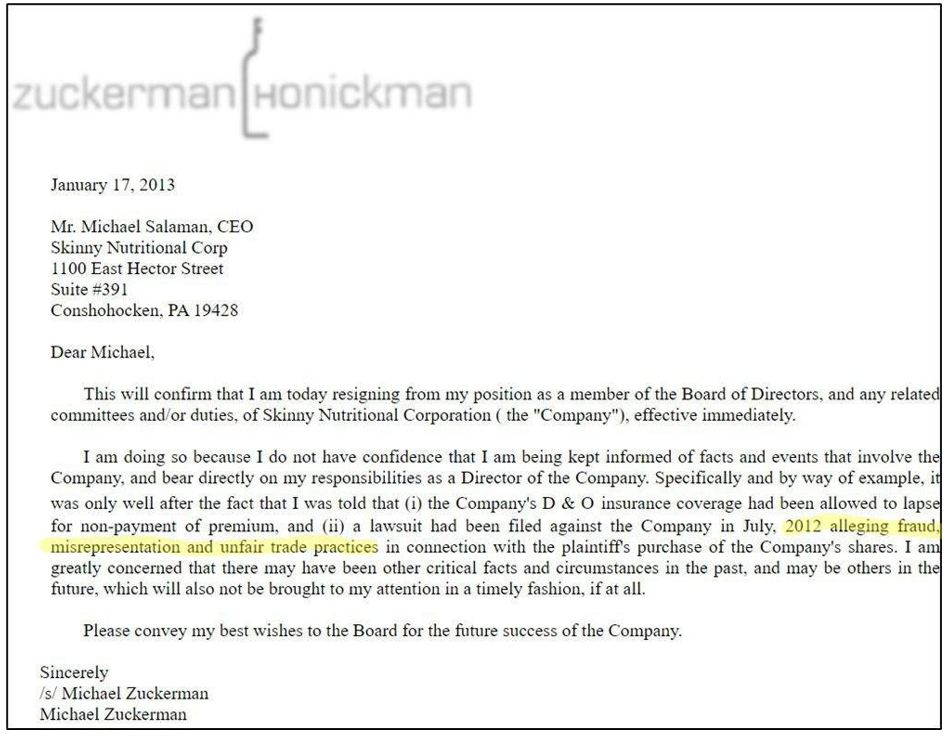

Skinny Nutritional Declared Bankruptcy Following Mass Director Resignations Over (a) Failure to Provide Financials and (b) Undisclosed Lawsuits Alleging Securities Fraud, Among Other Issues

In 2013, all board members except for Salaman resigned amidst securities fraud allegations and allegations that management had failed to provide board members with basic information to perform their oversight roles.

The three resignation letters were scathing. See one resignation letter below:

A second board member wrote the following in their resignation letter:

“Although it has been clear for some time that the Company has not been willing to freely provide to Board members (i) basic, essential, financial, production and sales information, and (ii) forecasting for internal and investor purposes, I had remained patient, hoping that these institutional problems would be addressed, due to the repeated assurances from management that the solutions being suggested by various Directors would be put into place. Ultimately, I have had to recognize that, for whatever the reasons, the Company will not correct these serious problems.”

A third board member wrote the following in their resignation letter:

“This has been a difficult decision for me, as I have been working hard for quite some time to improve the Company’s (i) ability and willingness to provide basic, essential, financial, production and sales information to the Board, and (ii) forecasting for internal and investor purposes. Among the various ways I tried to resolve these institutional problems, I brought in a former CFO at MBNA at my own expense to work with the Company, but ultimately was forced to recognize that, despite repeated assurances from management that the suggested solutions and inter-company communications were necessary, appropriate and would be implemented, the Company was unwilling to correct these serious problems.”

Unsurprisingly, Skinny Nutritional’s serious problems landed it in Chapter 11 bankruptcy shortly thereafter.

To reiterate, Salaman hired a CFO with a questionable background and the company failed after the company failed to provide financials to its own board– this is not a nuance to ignore given that Salaman has a key role at GrowGen both on the management team and the board.

Michael Salaman’s Early Investment Career Involved Acquiring/Running Penny Stock Shells with Father Abe Salaman

Abe is a Twice-Convicted Fraudster with Extensive Ties to Organized Crime

The sins of a father aren’t always attributable to a son. But as we will show, Michael’s father has an extensive background in fraud, and Michael’s business dealings with his father have been deeply intertwined.

Abe Salaman has been convicted of fraud twice. The first involved a guilty plea in the 1970’s to an indictment alleging he helped rig the price of a stock on the Philadelphia exchange.

In the early 90’s, a company Abe Salaman worked for, National Media, had accused him of insider trading. In 1992, a jury found in Salaman’s favor in that case. Son Michael was working at the same company during this period, according to his SEC biography which placed him at National Media from 1985-1993. [Pg. 22]

Abe Salaman’s second conviction came as part of a wide-sweeping probe into organized crime on Wall Street around 2000. According to the New York Times, a pre-dawn raid involving nearly 100 federal agents arrested 11 people charged in the stock scheme.

Those arrested included the brother of famous mafia hitman Sammy Gravano, a captain in the Bonnano crime family, and two members of the Russian mafia. The scheme involved multiple pump and dump stock frauds, which collectively roped in thousands of victims.

Michael Salaman’s father, Abe Salaman, was indicted on three counts of racketeering conspiracy and securities fraud, according to court records and media reports. He pleaded guilty in 2001.

Michael Salaman: Previously Charged by the FTC Over Selling Credit Card Numbers as Part of a Telemarketing Scheme at a Company Vice-Chaired by his Father

According to Salaman’s biography filed with the SEC, he began his career as VP of business development for National Media Corp, an infomercial marketing company. [Pg. 22] His father Abraham Salaman had served as Vice Chairman of the board of the same company during part of Michael’s employment and was later accused of insider trading in stock of the company, as referenced above.

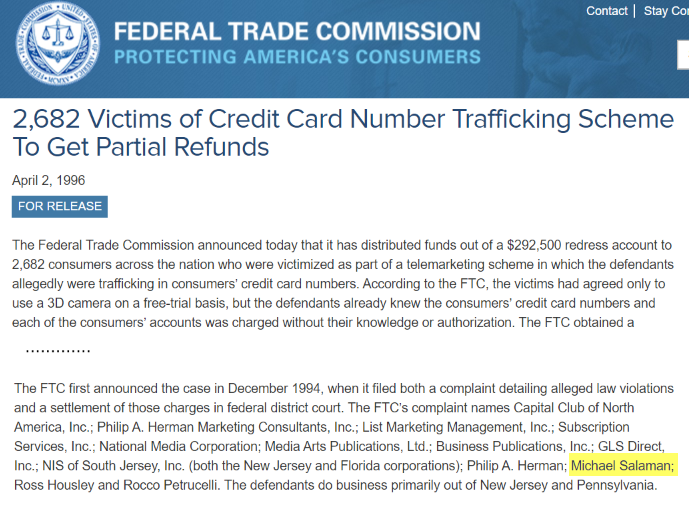

In 1996, Michael Salaman, along with others and the company, were charged by the FTC with victimizing 2,682 consumers across the nation as part of a telemarketing scheme in which the defendants allegedly trafficked consumers’ credit card numbers without their consent.Below are excerpts from the FTC release on the charges.

Later in 2001, National Media Corp filed for bankruptcy following a name change.

Michael Salaman’s Slew of Questionable Deals with Father Abe, Resulting in Numerous Penny Stock Failures

Salaman and father Abe went on a spree of deals throughout the 1990’s and 2000’s that regularly ended in ruin for shareholders.

American Interactive Media (“AIME”): A Company Run by Michael Salaman With the Quiet Backing of His Father, Which Cratered and Deregistered its Securities Following a Stock Promotion Run

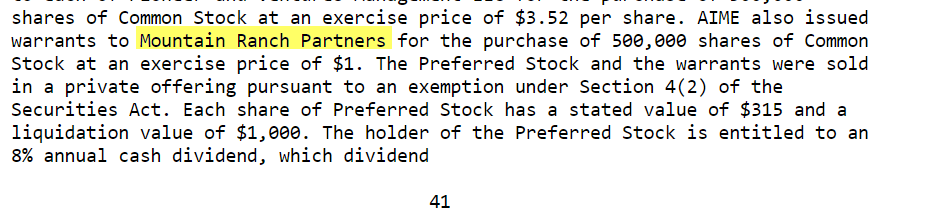

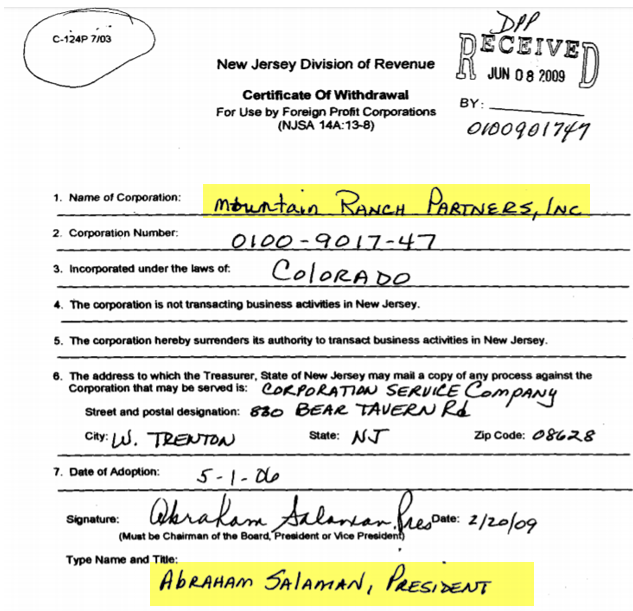

According to Michael Salaman’s biography filed with the SEC, following his stint at National Media Corp, he then started a digital media company called American Interactive Media, Inc. (“AIME”). [Pg. 22] Michael’s name shows up on the company’s SEC filings, but father Abraham Salaman masked his ownership in the enterprise through an entity called Mountain Ranch Partners.

SEC filings show that the Mountain Ranch entity, with its unstated owners, received discounted shares and warrants in the company through a private offering. [Pg. 41]

According to New Jersey corporate records, Mountain Ranch Partners was controlled by Abe Salaman.

We saw no disclosure stating that Mountain Ranch was a related party. According to a New York Post article, now available in web archives, Abe hired a Florida penny stock promoter to hype shares in the company, which subsequently cratered.

SEC records show that AIME later had its securities registration revoked after failing to file timely periodic reports.

Americas Shopping Mall: Michael and Abe Were Both Involved in this Near Total Investment Loss and a Scandal that Resulted in Connecticut’s State Treasurer Requesting a Federal Probe

In 1999 Abe Salaman also turned up alongside son Michael in a scandal that drew the scrutiny of the Treasurer of Connecticut. Approximately $9 million in state pension money was invested into a company called Americas Shopping Mall as both Michael and his father, along with other stockholders, registered to sell their stakes.

The investment ultimately went bust, resulting in Connecticut’s State Treasurer requesting a Federal probe into the suspicious connections.

Neurocorp: Another Salaman Shell Company Involving Michael and Abe That Later Collapsed

Around 1996, Abe Salaman took a company public called Neurocorp that eventually ran treatment centers for people with dementia, schizophrenia, depression, and other mental health disorders. [Pg. 38]

Michael also held a stake in the business, along with two brothers. [Pg. 20, Pg. 38]

The entity appears to be defunct, as its last SEC filing is a notice that it’s annual report would be late, followed by nothing.

Collectively, the extensive ties between Michael Salaman and numerous penny stock failures and individuals associated with fraud should be alarming, given his role in GrowGen’s management and the board.

Part II: CEO & Co-Founder Darren Lampert’s Professional and Personal Dealings with Individuals Associated With Organized Crime and Sanctioned Brokerage Firms

Darren Lampert has been GrowGen’s Chief Executive Officer and a Director of the company since its founding in 2014.

Lampert is an attorney by trade. According to the company’s most recent 10-K, Lampert “began his career in 1986 as a founding member of the law firm of Lampert and Lampert (1986-1999), where he concentrated on securities litigation, NASD [now FINRA] compliance and arbitration and corporate finance matters.”

His bio in the annual report also discloses that he “has represented clients in actions and investigations brought before government agencies and self-regulatory bodies.”

What his bio doesn’t note, however, is that as an attorney and as a broker, he has a long history of involvement with individuals associated with organized crime and penny stock boiler rooms.

Lampert’s Time at Hold Brothers Between 2005 and 2007 Has Been Omitted From His GRWG And LinkedIn Biographies. We Think We Know Why.

GrowGen’s bio for Lampert details his time before 2005 and after 2007, stating:

“…15 years working as a portfolio manager and proprietary trader at Schonfeld Securities (1999-2005), Schottenfeld Group (2007) and Incremental Capital (2008-2010).” [Pg. 22]

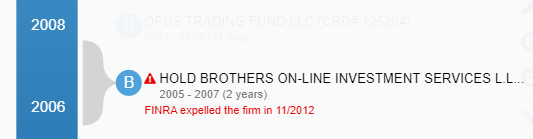

Absent from Lampert’s bio in GrowGen’s annual report (but visible on his FINRA Broker Check record) is his time working at Hold Brothers Online Investment Services between 2005 and 2007.

Lampert’s LinkedIn also fails to mention his time at Hold Brothers and conflicts with his official bio, stating that he was at Schonfeld Securities through January 2007. His FINRA Broker Check file says he was only at Schonfeld Securities through 2004 – a three-year difference.

FINRA now lists Hold Brothers as having been “expelled” in November 2012.

Prior to that, Hold Brothers was a firm that was “censured and fined…$3.4 million for manipulative trading activities, anti-money laundering (AML), and other violations,” according to a September 2012 FINRA press release:

The press release notes that:

“Between Jan. 1, 2009 through Dec. 31, 2011, Hold Brothers’ largest account and an affiliate were day-trading firms wholly owned and funded by Hold Brothers’ principals” and that these entities “engaged traders and trading groups in various foreign countries, primarily China, to trade its capital.”

These foreign entities “used sponsored access relationships with Hold Brothers to connect to U.S. securities exchanges to manipulate the prices of multiple securities” including “hundreds of instances where the foreign day traders used spoofing and layering activities to induce the trading algorithms of unwitting market participants to provide the traders with favorable execution pricing that would not otherwise have been available to them in the absence of the day traders’ illicit spoofing and layering activities.”

Lampert’s Time at Hanover & Company, Circa 2002, a Brokerage Firm With Extensive Ties to the Mob

Hold Brothers is not the only portion of Lampert’s work history that appears to have been omitted from his GrowGen and Linkedin biographies. Both also fail to mention his time at Hanover & Company.

A bankruptcy case filed in March 2002 revealed that Lampert was an attorney for Hanover & Company, a brokerage firm that had extensive ties to the mob.

The defendant in the case, Anthony Siclari, “testified that Darren Lampert, attorney for Hanover, prepared the loan documentation” for a transaction highlighted in the lawsuit.

Siclari was a former account holder at Hanover and “profited from Hanover fraudulent activity,” the case reads, “and then engaged in transactions to take those gains out of his Hanover account, both for his own benefit and to pass them on to Hanover personnel or Hanover itself.”

Siclari’s account was alleged to have been the “beneficiary of violations of securities laws perpetrated by Hanover officials — most significantly, Robert Catoggio, (“Catoggio”), the trader for Mr. Siclari’s account and Mr. Siclari’s friend since boyhood, who pleaded guilty to securities fraud.”

In 1997, Catoggio had been arrested for conspiring to manipulate the market alongside two other individuals, one of whom, Louis Malpeso was alleged to be an associate of the Colombo Crime Family.

Then, in 1999, Catoggio was charged as part of a group of 85 individuals for a “Mob Connected” $100 million stock scam. He was, at the time, already serving 18 months in prison for another stock fraud scheme.

Alongside Catoggio, Hanover was run by Roy Ageloff, who was “already infamous on Wall Street for running high-pressure boiler rooms that touted obscure stock offerings,” according to a 2017 Variety article:

“In July 1996, Fortune called Hanover a ‘lowlife brokerage firm,’ and noted that the FBI was looking into questionable IPOs,” the article reads.

According to the article, Catoggio allegedly funnelled money to the Genovese crime family and that Ageloff was sent to prison in 2001:

“Ageloff and his associates were indicted in June 1999, and accused of swindling investors out of $150 million in a series of ‘pump and dump’ schemes” and “prosecutors alleged that Catoggio funneled millions of dollars in proceeds to a captain in the Genovese crime family, whose stepson was one of the brokers who pleaded guilty. Ageloff pleaded guilty in 2000 and was sent to a medium-security prison in Florida in 2001.”

Lampert’s Ties with Convicted Mob-Associated Stock Fraudster Robert Catoggio Appear to Continue to this Day

The CEO and the Catoggios are Facebook Friends. In April This Year Lampert “Liked” a Photo of Ronald Catoggio’s Homemade Pasta

We wondered exactly how deep Lampert’s ties with Catoggio run. We figured that if they had a purely business relationship as peers at Hanover, both would have likely moved on once the brokerage firm imploded.

After examining Darren Lampert’s social media posts, it appears their relationship is still relatively close.

For starters, on his Facebook profile, Lampert is friends with Robert Catoggio.

Robert Catoggio has also engaged with Darren over the years (Darren’s profile is private so his posts are sparse). The last post we could find where Robert engaged with Darren is from November 2018. It is a picture of the GrowGeneration team.

Robert Catoggio is also connected with Mitchell Lampert, Darren’s brother and GrowGen’s legal counsel, on Facebook.

Lastly, Darren is connected to Ronald Catoggio, also named as a defendant alongside Roy Ageloff and Robert, who is believed to be a relative.

As of April 11, 2020 of this year, Darren Lampert liked that Ronald Catoggio was making some fresh pasta for dinner:

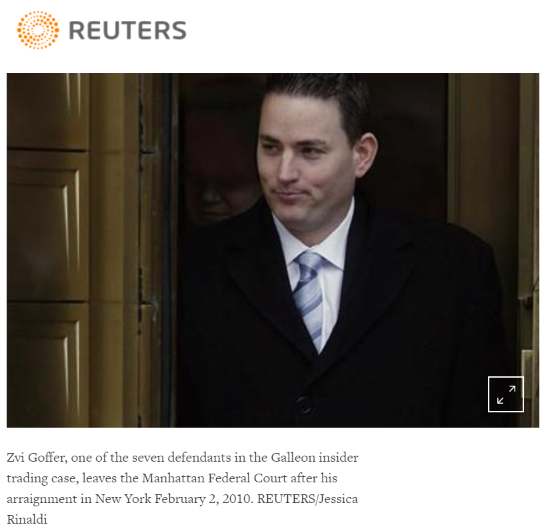

Lampert Also Spent Time at Incremental Capital, Whose Founders Were Arrested as Part of the Sweeping Insider Trading Probe That Took Down Raj Rajaratnam

Lampert’s bio also notes that between 2008 and 2010, he worked at Incremental Capital in an unspecified role. Incremental Capital was a company founded in 2008 by the Goffer Brothers, who were part of a group arrested in 2009 as part of the infamous Raj Rajaratnam insider trading probe:

“The men were arrested and charged in November 2009, weeks after Rajaratnam’s arrest in an investigation that extensively used FBI phone taps for the first time in an insider trading probe. Up to 60 recordings could be played at the trial.”

The Goffer brothers were also “accused of bribing two lawyers at the prominent law firm Ropes & Gray with tens of thousands of dollars for secret information on takeover targets.”

Zvi Goffer went on to be a trader at Galleon Group, the firm founded in 1997 by Raj Rajartnam that was closed in October 2009 after an insider trading scandal that led to Rajaratnam being sentenced to 11 years in prison.

Zvi was found guilty on 14 counts of conspiracy and securities fraud and was sentenced to 10 years in prison. He was also ordered to forfeit $10 million.

Lampert Had A History of Defending Boiler Rooms And Stock Scams At His Law Practice

During Lampert’s time as an attorney, he took on multiple cases involving boiler rooms and mob-associated individuals, which raises troubling questions in light of the above.

In Bondi v. Blinder-Robinson, et al, filed 5/3/1989 in New York Western District Court (6:1989cv00530), Lampert represented Blinder-Robinson and Co.

Blinder-Robinson was a penny stock brokerage firm that was charged by the SEC for overcharging its investors by more than $20 million over the course of 21 months. The company “marked up prices as high as 140 percent on penny stocks when selling them to investors.”

Ultimately, the SEC “suspended Blinder Robinson from trading in penny stocks for 45 days and from underwriting such offerings for two years”.

Lampert’s father, Irwin Lampert – who was also former CFO of GrowGen, also appears to have been involved in Blinder Robinson.

He was originally named on the SEC’s complaint against the company:

“In addition to Blinder-Robinson and Blinder, the SEC originally named the following corporations and individuals as defendants in this action: American Leisure, Cavanagh Communities Corp., Scope, Inc., Nathan S. Jacobson, Irwin S. Lampert, Joseph Klein, and Leon Joseph. These defendants all have entered into consent decrees with the SEC, and no longer are active parties in this litigation”

His father was described as being close to the firm’s founder and worked as counsel for the firm:

“Irwin Lampert, an attorney, has had a close personal relationship with Meyer Blinder since they met in Florida in 1972. Mr. Lampert was counsel for Blinder and Blinder-Robinson in an earlier securities case.”

Blinder, who was dubbed by media as the “Penny Stock King”, had been sentenced to 46 months in prison in a fraud case.

All in the Family: Darren Lampert’s Brother Mitchell, Who Serves as GrowGen’s Legal Counsel, Also Has A History of Working With Boiler Rooms

Darren Lampert’s brother, Mitchell, with whom he worked with at Lampert and Lampert, also has a history of defending companies alleged to be penny stock boiler rooms.

Mitchell Lampert now works at Robinson+Cole, is listed as GrowGeneration Corp’s counsel of record on the company website:

Interestingly, Mitchell’s biography also doesn’t mention his former firm “Lampert and Lampert” by name. Rather, it vaguely says “prior to joining Robinson+Cole, he was a partner in a mid-sized New York City-based law firm.”

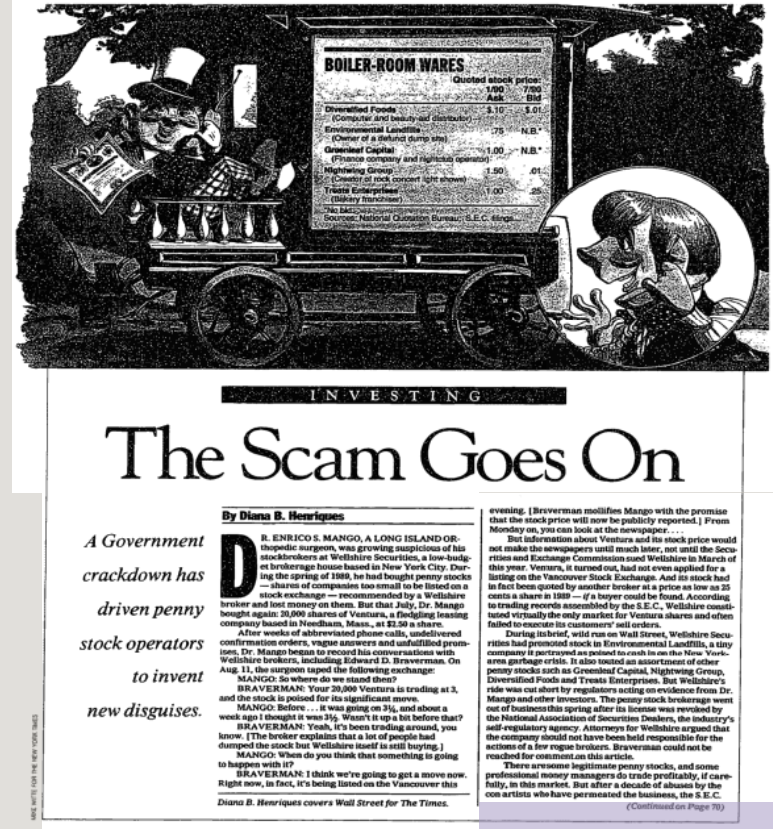

Previously, Mitchell Lampert was listed as defense counsel for Wellshire Securities when it was sued by the Securities and Exchange Commission in March of 1990.

According to the New York Times, “The S.E.C. charged that since July 1988, the ‘normal business’ of Wellshire has been to operate ‘as a penny-stock ‘boiler room,’’ selling speculative over-the-counter securities of unseasoned companies to the investing public through the use of various abusive sales practices.”

The article continued:

“Mitchell Lampert, the lawyer for the brokerage firm and its two top executives, said, ‘Our position is that nothing has been done wrong by Wellshire or Mr. Cohen and Ms. Martino.’”

On Sunday, September 23, 1990, the New York Times published a follow up piece on Wellshire called “The Scam Goes On”.

The article notes that Wellshire was offering quotes for stocks where they “constituted virtually the only market” and they “often failed to execute its customers’ sell orders”.

It continues:

“During its brief, wild run on Wall Street, Wellshire Securities had promoted stock in Environmental Landfills, a tiny company it portrayed as poised to cash in on the New York-area garbage crisis. It also touted an assortment of other penny stocks such as Greenleaf Capital, Nightwing Group, Diversified Foods and Treats Enterprises. But Wellshire’s ride was cut short by regulators acting on evidence from Dr. Mango and other investors. The penny stock brokerage went out of business this spring after its license was revoked by the National Association of Securities Dealers, the industry’s self-regulatory agency.”

While we believe everyone deserves to be represented by adequate counsel, the sheer number of associations with penny stock fraud cases, boiler rooms, and mob-related individuals is quite startling.

Part III: GrowGen CFO Monty Lamirato’s Background Includes an SEC Order Alleging Three Years of Improper Professional Conduct and Working for Languishing Penny Stocks

GrowGen appointed Monty Lamirato as CFO in mid-2017 when he replaced Irwin Lampert, the father of CEO Darren Lampert.

Lamirato Left His Partner Position at an Audit Firm Just Before an SEC Order Alleging Improper Conduct

While a partner at auditing firm Mitchell Finley & Company, the SEC alleged that Lamirato had engaged in improper conduct on an audit over a 3-year period. The order stated that Lamirato issued unqualified opinions for financial statements violating GAAP standards by failing to exercise due professional care.

He ended up settling the allegations in 1994:

In the following years, according to his official bio and Linkedin profile, Lamirato appears to have worked in consulting roles, as well as serving as CFO to various penny stocks such as Strategic Environmental & Energy Resources and Arc Group Worldwide.

Strategic Environmental trades on the pink sheets with a market cap of about $8 million as of this writing.

Arc Group went into freefall during Lamirato’s tenure and later voluntarily delisted itself from NASDAQ.

GrowGen’s Auditor: An Extensive List of Failed Clients and A Track Record of Audit Deficiencies

Given the questionable background of GrowGen’s CFO, the role of auditor should play an even more important role than otherwise. Rather than working with a well-known firm, the company instead has chosen a firm not widely known for its public company accounting.

In early 2019, GrowGen transitioned from small auditor Connolly Grady & Cha, P.C. to Plante & Moran, PLLC.

Plante & Moran has been involved with an accounting malpractice case called “modern day grave robbery”, when it was sued for failing to detect a $60 million theft during an audit.

Plante & Moran’s most recent inspection by the Public Company Accounting Oversight Board (“PCAOB”) was issued in 2018. The PCAOB found a laundry list of audit failures, including among many others:

- Failure to perform sufficient procedures to test the occurrence and valuation of revenue

- Failure…to perform sufficient procedures to test the design and operating effectiveness of controls over revenue

Here is a list of several of Plante & Moran’s clients on the OTC and their outcomes:

All told, no auditor is perfect, but we view the selection of a lesser-known firm as another warning sign.

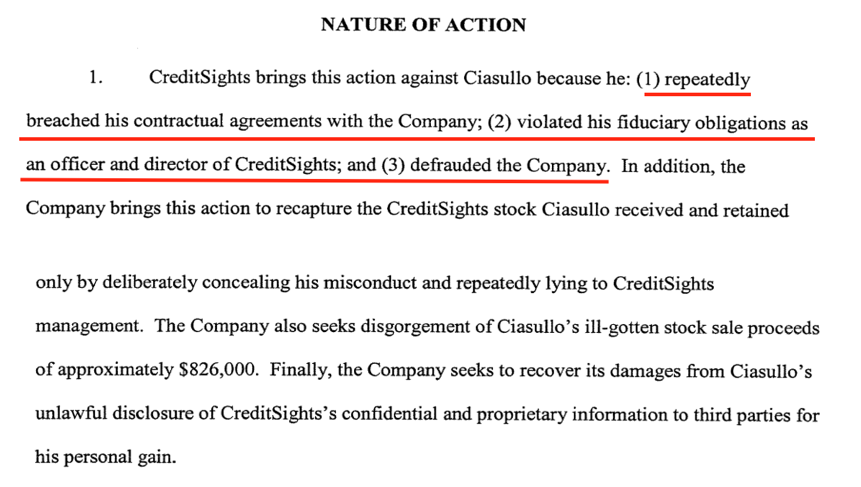

Director Paul Ciasullo Was Sued by the Company he Founded Over Allegations of Fraud. The Case Was Settled Privately

Beyond management, we examined a company director and found a pretty clear red flag.

Paul Ciasullo joined GrowGeneration’s board in the first half of 2020. Ciasullo’s biography filed by GrowGen in a proxy statement, says that in 2000, he founded and was President of a company called CreditSight Inc. [Pg. 10]

Ciasullo left on highly contentious terms, with the company filing a lawsuit alleging fraud, breach of contract, and violating fiduciary obligations. The claim stated as follows:

The company also accused Ciasullo of pledging his shares for personal loans in violation of his written and verbal confirmations to the contrary.

The claim also stated that he sent confidential business documents in order to get lenders to agree to pledges without the company’s knowledge or permission.

The allegations in the complaint were highly specific, but the case was later settled quietly.

Conclusion: Is This a Management Team That is Likely to Look Out for the Best Interest of Shareholders or for Themselves? We Think the Answer is Obvious—GrowGen Is Uninvestable.

We live in extraordinary times, where a company like GrowGen can spike to almost a billion-dollar market cap largely on hype and pure retail momentum while major warning signs go largely unnoticed.

In our view, GrowGen has an interesting business model, and it got a solid boost from COVID. That’s great. It’s the type of business that could be a decent model under the right management team.

The stock has to run to levels that render it obviously overvalued, but the clear elephant in the room is a management team that has a storied history of destroying shareholder value under extremely questionable circumstances.

We view this as a major buyer beware situation. Best of luck to all.

Disclosure: We are short shares of GrowGeneration (NASDAQ:GRWG)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

40 thoughts on “GrowGeneration: This Latest Euphoric Retail Stock Has The Brightest Management Red Flags We’ve Ever Seen—70%+ Downside”

Comments are closed.

Does your company have short positions, or advise clients to short GrowGeneration Corp?

If so, were the positions purchased before publishing this report, or were you advising clients to short GrowGeneration Corp before this report came out?

that is stated in the article, maybe try reading it before commenting next time

I don’t think it matters. If your investing, an individual should be considering all aspects before going short or long.

Very well done.

Great DD.

A thorough article, however, the company concept is sound and they will be the picks and shovels of the cannabis business similar to Scotts Miracle Grow.

Not sure what this company has to offer that Home Depot or Amazon can’t. They didn’t reinvent retail or anything special

Great article

Excellent report… the company’s management is nominated to the “Crooked Craig Shatto” award of the decade.

It’s a short on valuation w the shady stuff more so. Roll ups never end well charges and such expect at best 2x sales this should be single digits looking for 10 below.

Same wine different bottle. New dangled twist on the old roll up scam.

I knew of one in South Florida where we were acquiring mom and pop nutrition stores and kiosks in gyms. It was irrelevant what kind of cash flow/value they were worth as the numbers would be “made to work”

Package it all in a fancy new bow add some stupid made up valuation backed up by paid 3rd parties, put some “reputable names” on the board Of directors that have the panache – paid for of course with $ and/or shares.

Pump it and dump shares on naive idiots who buy the hype. Interesting to see the Tokyo Joe’s of the dotcom era are back in full swing on fintwit.

Instructing the sheep to buy. Hey look at the shiny new toy and here is my “detailed write up” lmao

Idiots don’t even know the game. The insiders at grwg know the game. They have already won.

Great job?

Certainly an eventual short, but could we see $24.61 area first? One more hurrah of excess?

Fib fractals warn possible.

Go in with a defined risk. After appreciation take out your cost. Generate cash from selling covered calls. Be careful and pay attention.

I hope it goes down in flames, hot hard flames. Get rekt!!!

https://www.reddit.com/r/OKmarijuana/comments/j00mhi/a_warning_to_shoppers_of_growgeneration_stores/

Seems like it’s all starting

NAILED IT!

Today the share price is higher than the one at your report date and almost 4 months passed. When you guys will throw white towel? Looking forward.

Dear,,, (1.) My website (All the Best Images) is of all types of images, photos, wallpapers. In this, you will get all kinds of wishes, which you can download and send to friends and relatives. All The Best Images

GREAT ARTICLE, with lots of detail.

Stock price has fought the gravity of these facts (so far).

Any insight on what kind of PUT options we should be looking at?

Time table for pump/dump?

Thanks

sold this stock after reading your report, its up 100% since my sell , did you guys get this one wrong?

I am going to short the stock as of today 4th February

This is not financial advice

Room for $70ish

25 puts 2022

Is your Short Thesis still valid guys?

Recently COO Sullivan sold of his outright position.

Hence financal results look good, they did raise capital and seem to deploy it in a consistent manner.