Summary: EHang (NASDAQ:EH)

- EHang is a $903 million market cap, China-based, Nasdaq-listed electric vertical take-off and landing (“eVTOL”) aircraft company.

- The company’s share price has surged more than 267% over the last year due to market excitement over eVTOL companies, a recently granted aircraft design certification from the Chinese government, and a 1,300+ unit pre-order book, suggesting imminent largescale revenue.

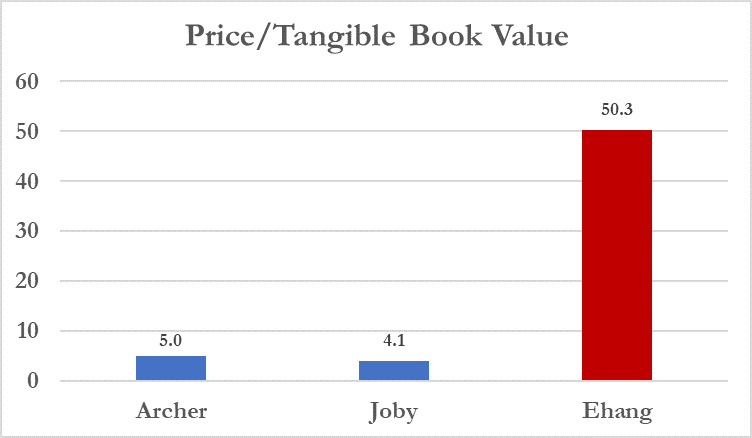

- EHang has generated net losses since inception and currently trades at ~50.3x its tangible book value, a significant premium to competitors Joby Aviation (4.1x) and Archer Aviation (5.0x). Despite its premium valuation, EHang’s flagship aircraft is outmatched by competitors on key performance metrics.

- Aircraft manufacturing is a matter of life and death. Yet EHang has operated on a shoestring budget relative to peers, investing just $97.4 million in cumulative R&D, while competitors Joby and Archer Aviation have invested $761.9 million and $381.1 million, respectively.

- EHang’s competitors have hundreds of millions in cash, while EHang has only $44.9 million left, representing limited runway in the capital-intensive aviation industry.

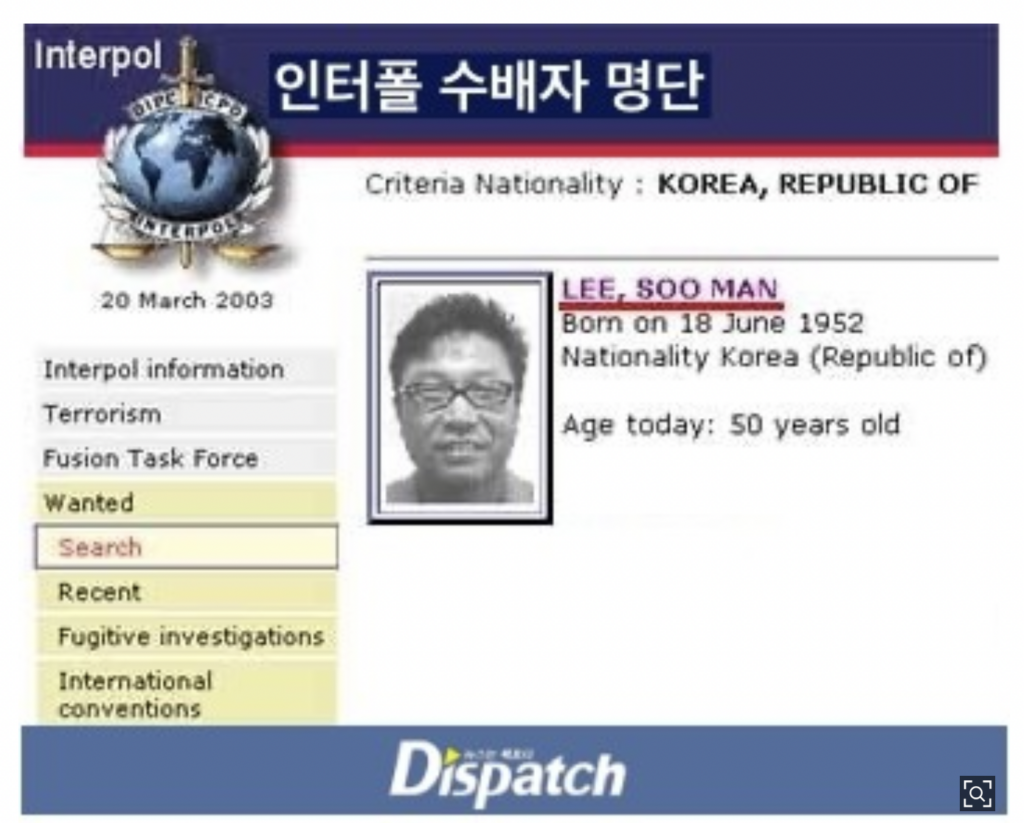

- Short on cash, in July 2023 EHang announced a $23 million capital raise led by a South Korean music producer who was previously put on an INTERPOL wanted list and sentenced to 2 years in prison for embezzling from a Korean company he founded, according to media reports.

- EHang’s much-touted, recently granted certification comes with numerous flight restrictions that it has failed to fully disclose to investors. The restrictions invalidate the bulk of its potential commercial use cases, including restrictions against flying in densely populated areas, in shared airspace, and out of sight of a ground crew.

- EHang claims restrictions will be progressively lifted, but according to China-based eVTOL experts, EHang’s flagship aircraft would need a billion-dollar redesign and an entirely different class of certification to avoid the limitations.

- We found that 92+% of EHang’s claimed 1,300+ unit preorder book is based on “dead” or “abandoned” deals, failed partnerships, and newly-formed customer entities with no discernible operations.

- EHang’s largest deal is a 1,000-unit preorder from one of its pre-IPO investors, a biotech company called United Therapeutics, which represents ~74% of EHang’s total preorders. The deal was initially signed in 2016.

- In 2020, the CEO of United Therapeutics said she was looking for a much longer-range aircraft than what EHang offered, saying, “250 nautical miles… is the sweet spot in terms of range,” while EHang’s EH216 offers a range of just 19 miles (30km).

- United Therapeutics quietly sold its entire $109 million stake in EHang by February 2021. In November 2021, in its last public comments on Ehang, the VP of Drone Delivery for United Therapeutics said, “I don’t think anyone could say right now that they [EHang] have a certifiable configuration in terms of aircraft design.”

- A former EHang employee said the deal was “dead”. We repeatedly inquired with United Therapeutics and rather than confirm the partnership, we were told by its PR rep: “We have no comment. We’re just not going to comment on this.” EHang continues to market the deal as active in its SEC filings and investor presentations.

- EHang’s second largest commitment is a 100-unit preorder, worth ~$30 million, from Prestige Aviation, an Indonesian entity that was formed with $34,000 in registered capital 1 day prior to its announced partnership with EHang.

- Outside of promotional events with EHang, we found no website and zero evidence of any aviation operations for Prestige Aviation except for a photoshoot where it appears to have photoshopped its logo onto a rented jet.

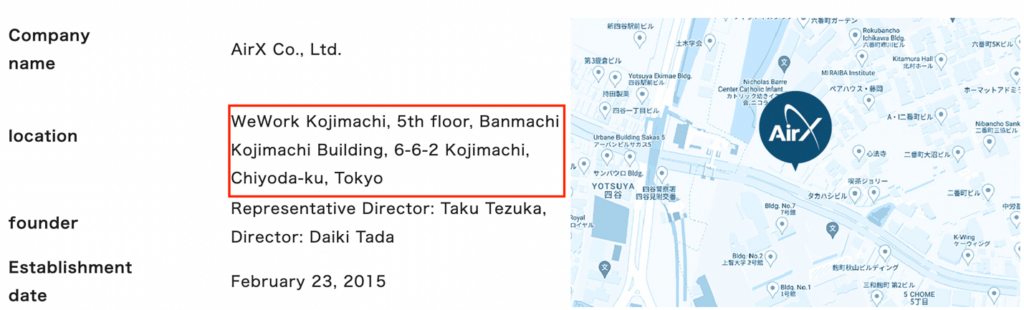

- In January 2022, EHang received a 50-unit preorder from AirX, valued at an estimated $15 million. AirX is a Japanese startup based out of a WeWork that reportedly raised around $1 million in capital, largely to scale its helicopter sightseeing booking website.

- AirX’s website indicates it merely intends to resell EHang products to buyers that don’t yet seem to exist, in a country (Japan) where EHang would need to complete a multi-year certification process.

- In September 2023, EHang announced an up to 100-unit order, representing an estimated $30 million in sales, from Shenzhen Boling Holdings Group, which was in the business of “Radio and Television” production up until 5 days before the Ehang deal announcement, when it added aviation-related terms to its official Chinese business description.

- Boling has virtually no web presence and has zero registered employees, according to QCC, a Chinese corporate database. Its corporate address leads to a residential apartment building.

- Beyond pre-orders, in 2019, EHang announced a major partnership with DHL-Sinotrans to develop a “fully automated and intelligent drone logistics solution.” EHang hasn’t provided an update on the project since August 2020. A former EHang employee told us the project was a “dead end,” saying, “…there were some problems in the integration, and they abandoned the project.”

- In 2021, a research firm alleged that one of EHang’s largest customers, Kunxiang, was secretly a pre-IPO investor that signed “sham sales contracts” so that EHang could report revenue growth as it approached its IPO. EHang’s CEO denied the allegations, calling its dealings “arm-length transactions.”

- Corporate records reveal that Kunxiang is in fact controlled by a sanctioned Chinese financier whose venture capital firm invested in EHang pre-IPO through an offshore shell company in 2017.

- An executive from the venture capital firm admitted in a 2018 interview to investing in EHang. Further confirming this, the same executive was photographed celebrating with EHang CEO Hu Huazhi at the company’s Nasdaq IPO bell-ringing ceremony.

- To summarize, when faced with allegations of suspicious product purchases by a conflicted party, EHang CEO Hu Huazhi seemingly chose to flagrantly mislead shareholders by claiming that the aircraft purchases were arm’s length.

- EHang never seemed to collect the suspect revenue and has instead been aggressively impairing its receivables since 2020, writing down $15.2 million in receivables during a period where it only reported $15.3 million in revenue.

- EHang’s insiders & key stakeholders haven’t reported a single stock purchase since inception. Instead they have reported selling more than 28 million shares, including share sales in September 2022 at prices as low as $4.21-$6.17, 59%-72% below current levels.

- Overall, EHang seems to have a major credibility issue—whether it be by fluffing up its preorder book (which looks to almost entirely be vapor) or by brazenly misleading about early sales that bear all the hallmarks of fake revenue.

- Trust is crucial in the aviation industry, both for investors and potential customers who are literally putting their lives at risk. We think the company is a fatal accident waiting to happen, both for investors and for passengers.

Initial Disclosure: After extensive research, we have taken a short position in shares of EHang Holdings Limited (NASDAQ:EH). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Background & Basics: A China-Based Electric Vertical Take-Off & Landing (eVTOL) Business

EHang is a China-based, electric vertical take-off and landing vehicle (“eVTOL”) manufacturer. The company was founded in 2014 and went public on NASDAQ in December 2019 with the goal of commercializing passenger-grade autonomous aircraft. [Pg. F-15]

EHang’s founder and current CEO, Hu Huazhi, once described his vision for EHang as a cross between Tesla and Uber:

“In the future, we will build EHang into a Tesla in the air, allowing people to use EHang’s air taxi services as easily as using Uber today and to enjoy the convenient door-to-door air transportation.” [Q4 2020 Earnings]

While commercializing an autonomous air taxi business is core to EHang’s vision, it also aims to use non-passenger aircraft for applications in aerial firefighting, organ transport, and last-mile delivery. [Pg. 12-13]

EHang’s ambitions in passenger transport rely on the commercialization of its two flagship models – the short-range EH216 and the long-range VT-30.[1] [Slide 7]

Bull Case: A Leading eVTOL Company With Chinese Regulatory Approval, A State-Of-The-Art Factory, And 1,300+ Preorders Ready To Convert Into Sales

On October 13th, Ehang reported that China’s aviation regulator, the Civil Aviation Administration of China (“CAAC”), issued a Type Certificate for the EH216-S, the passenger-grade version of the EH216, which means that the design of the EH216-S is compliant with safety conditions set by the CAAC. According to EHang, this certification represents a significant step toward commercial operations.

“This demonstrates that the EH216-S’s model design fully complies with CAAC’s safety standards and airworthiness requirements, and that the EH216-S is qualified for conducting passenger-carrying UAV commercial operations.” [Source]

EHang has already started manufacturing and selling its flagship EH216 model, pictured below.

EHang’s other prospective model is the VT-30, a longer range model initially announced in 2021 to compete with models developed by peers such as Archer and Joby.

The VT-30 will be capable of flying 300 km, according to EHang.

Unlike many other eVTOL rivals, EHang has been able to demonstrate significant demand for its vehicles, boasting over 1,200+ preorders globally and more than 100+ domestically in China. [Pg. 3]

With a challenging aspect of regulatory approval out of the way for the EH216-S, and a new factory capable of producing 600 aircraft annually, investors believe EHang is well-positioned to capitalize on its key Chinese customer base.

The combination of excitement in the eVTOL space, customer demand for EHang’s vehicles, and recent Chinese regulatory approval has propelled EHang’s stock up 267% over the last year to yesterday’s closing price of $14.96.

The spike has catapulted EHang’s market cap to ~$903 million.[2]

Fundamentals: EHang Trades For ~50.3x Its Tangible Book Value, Significantly Higher Than Better Capitalized Peers Such As Joby, Which Trades For ~4.1x

Despite The Premium Valuation, EHang’s Flagship Model EH216 Is Outmatched On Key Performance Specifications

Benchmarking EHang’s valuation against eVTOL peers with sales or earnings ratios is not possible since many eVTOL peers are pre-revenue and loss-generating. However, when comparing EHang’s valuation based on price-to-tangible book value, per FactSet, it trades at 50.3x tangible book, while larger peers such as Joby Aviation trade for only around 4.1x-5.0x.

Aircraft manufacturing is a matter of life and death for passengers and pedestrians below, making R&D investment critical to ensure safety. EHang has operated on a shoestring budget relative to peers. From 2017 to the last reported period, EHang invested just ~$97.4 million in cumulative R&D, according to FactSet. Competitors Joby Aviation and Archer Aviation, which only began reporting as of 2020, have already invested ~$761.9 million and ~$381.1 million, respectively.

EHang’s industry low R&D investment has resulted in its aircraft being outmatched by urban air mobility competitors in key performance metrics like range, flight time and charging speed.[3] While some of these competitors utilize different aircraft designs, all are targeting a similar use case.

| Model | Range (KM)[4] | Max Payload (KG) | Flight Time (Min) | |

| EHang, EH216 | 30 | 220 | 25 | |

| Archer, Midnight | 161 | 453 | 10-20+ | |

| Joby, S4 | 241 | 453 | 77 | |

| Volocopter, Volocity | 35 | 200 | 20+ | |

| Xpeng, Aeroht X2 | 75 | 200 | 35 | |

EHang’s Competitors Have Hundreds Of Millions In Cash And Are Backed By Multi-Billion Dollar Auto And Aircraft OEMs, While EHang Has Only $44.9 Million Left, Representing Limited Runway In The Capital Intensive Aviation Industry

Competitors with better performance specs are making significant progress toward commercial operations in China, EHang’s beachhead market, including through significant capital raises and partnerships with established multi-billion-dollar vehicle manufacturers.

For example, XPeng Aeroht, an affiliate of $14.8 billion market cap auto manufacturer XPeng, raised $500 million in 2021 and established an $800 million credit line in 2022 with the aim of commercializing eVTOLs in China.

While not as significant as EHang’s recently granted Type Certification, XPeng Aeroht obtained a special flight permit from the CAAC for its X2 eVTOL in February 2023, and it has since announced two additional models. It plans to enter commercial operations in 2024 with its flagship X2 model, expected to be priced ~50% lower than EHang’s EH216. [1, 2]

Volocopter, a German eVTOL competitor, announced a joint-venture with China-based auto manufacturer Geely in April 2021, which later placed a preorder for 150 aircraft in September 2021, comparable to EHang’s entire domestic preorder book.

In November 2022, Volocopter announced it raised $182 million in its Series E round, partly backed by a subsidiary of major Chinese automaker Geely. Volocopter is also aiming for a 2024 commercial launch.

As of July 2023, EHang had just $44.9 million in cash, representing approximately 18 months of runway at the time, based on EHang’s historical burn rate. That runway will likely become significantly shorter as the company aims to expand production.[5] EHang’s competitors Joby and Archer have 9x and 27x the amount of cash that EHang has on hand, respectively.[6]

Background: Short On Cash, In July 2023 EHang Announced A $23 Million Capital Raise Led By Lee Soo Man, A “Renowned South Korean Music Producer”

Lee Soo Man Was Previously Put On An INTERPOL Wanted List And Sentenced To 2 Years In Prison For Embezzling From A Korean Company He Founded, According To Media Reports

EHang competitors Joby, Archer, XPeng, and Volocopter have all raised hundreds of millions in cash from experienced manufacturers and sophisticated investors such as United Airlines, Mercedes-Benz, Geely, and Toyota Ventures, to name a few.

EHang’s capital has been derived from less strategic investors. In July 2023, EHang announced it had entered a share subscription agreement to raise $23 million in funds led by “renowned South Korean music producer” Lee Soo Man. The total number of shares sold to Soo Man in the private placement was not disclosed.

Lee Soo Man was put on an INTERPOL wanted list in 2003 for embezzling 1.15 billion Korean won (~U.S. $1.3 million) from a company he founded, SM Entertainment, according to Korean news site Dispatch. Soo Man later returned to Korea to serve two years in prison and three years of probation. [1] He was pardoned by South Korean president Roh Moo-Hyun in 2007 before his sentence was enforced, according to media reports. [1,2,3,4]

Background: EHang’s Insiders & Key Stakeholders Have Sold More Than 28 Million Shares, Including Share Sales In September 2022 At Prices As Low As $4.21-$6.17

With so many ostensibly bullish catalysts in EHang’s immediate future, and with the stock hitting an all-time low of $3.32 in late October 2022,[7] one might expect management to show faith in the company by purchasing shares at what bulls perceive as a discount.

However, EHang hasn’t reported a single insider purchase since going public, according to a review of SEC insider holding forms.[8] Instead, insiders and key stakeholders subject to reporting requirements have dumped more than 28 million shares since the December 2019 IPO, while others resigned after the lock-up, avoiding reporting requirements altogether.

| Insider | Initial Holdings | Current Holdings | Reduction In Holdings |

| CEO & Founder – Hu Huazhi | 46,222,663 | 39,946,818 | -14% |

| Co-Founder – Shang Hsiao | 7,056,077 | 2,355,136 | -67% |

| Pre-IPO Investor – United Therapeutics[9] | 2,888,537 | 0 | -100% |

| Pre-IPO Investor – GGV Capital | 11,099,686 | 0 | -100% |

| Pre-IPO Investor – Zhen Fund | 7,556,187 | 4,327,865 | -43% |

| CSO – Edward Xu[10] | 462,500 | 0 | -100% |

| CFO – Richard Liu | 1,300,000 | Resigned – No Reporting Requirements | |

| CMO- Derrick Xiong | 3,365,313 | Resigned – No Reporting Requirements | |

| Total Shares Disposed | 28,655,831 | ||

Other insiders have obfuscated the specific details of EHang share sales by taking advantage of a prior reporting loophole whereby share sale disclosure forms were submitted manually over email, instead of electronically. This made them invisible for users of the SEC’s public EDGAR filings system.[11]

For example, a paper Form 144 share sale filing by former Chief Strategy Officer Edward Xu shows that he dumped shares in September 2022 on dates when closing share prices ranged from $4.21 to $6.17, 59%-72% below current levels.

Background: EHang Received An Industry-First eVTOL Type Certification, But It Failed To Disclose The Numerous Flight Restrictions Included With The Certification

We Spoke With Two China-Based Aviation Experts, Including One Who Worked For The CAAC For Nearly A Decade, Who Said EHang’s Aircraft Will Be Limited To Aerial Sightseeing In Rural Areas, Seemingly Invalidating The Bulk Of EHang’s “Urban” Air Mobility Use Cases

EHang has touted its recent Type Certification approval as being a key advantage ahead of eVTOL competitors, but the certification comes with significant restrictions that EHang hasn’t fully disclosed to shareholders.

According to the CAAC, EHang’s EH216-S Type Certification lists numerous flight restrictions, including restrictions against flying at night, in inclement weather, above water, in densely populated areas, in the same airspace as other aircraft, and out of sight of the ground crew. (For more, see Appendix A)

EHang’s investor presentation includes commercial applications that seem to be prohibited by these restrictions, including intracity air travel, intercity air travel, airport shuttling, and others.

We hired a China-based eVTOL expert who spent nearly a decade certifying aircraft for the CAAC, and asked how EHang’s potential restrictions would impact its commercial launch, including the use cases highlighted above. The expert told us that he didn’t think the EH216 would be able to be used as an urban air taxi, and that the primary application would be aerial sightseeing and theme park shuttling.

“You have showed me about 6 scenarios, so from my point of view that, EHang’s use case will be the first 3, maybe… for the third one, between ground transportation hubs, maybe, maybe it can be successful for some ground transportation hub…For the fourth to the sixth [scenario], I don’t suppose so.”

We hired a second expert, a China-based aviation consultant with experience developing CAAC Type Certification applications, who also said that the EH216 won’t be able to operate as an air taxi, but that it can be operated in rural areas for aerial sightseeing tours.

“Generally, the application scenario of EHang 216-S is for the tourism, for the tourism and air sight and flight experience. It can’t operate as an air taxi. It can’t to operate, to transport, a lot of people…”

While EHang recently claimed in a press release that it would “gradually lift” the restrictions, which it hadn’t mentioned to shareholders until October 30th, the second expert told us that EHang would have to redesign its aircraft to qualify as a “transport” class aircraft. This would allow it to fly in urban areas and in the same airspace as other aircraft.

“EHang 216-S apply the TC [Type Certification] as the Normal category aircraft… If they operate a passenger transport business in urban areas (as an air taxi), they have to apply [for] the TC [Type Certification] as the Transport class category aircraft…”

“That [transport class] is the same safety level as Boeing 737… an aircraft [to] reach that safety level will cost at least one billion USD for the development and certification. That is impossible for EHang.”

As detailed in Part 1 of this report, many of EHang’s preorders are based on applications in urban areas, over water, or applications that would require nighttime flying, such as emergency transport, or other use cases that are seemingly prohibited by the restrictions highlighted in EHang’s Type Certification.

Part 1: 92+% Of EHang’s Claimed 1,300+ Unit Preorder Book Is Based On “Dead” Or “Abandoned” Deals, Failed Partnerships, And Newly Formed Customer Entities With No Discernible Operations

EHang claims in its 2022 annual report and most recent investor presentation that it has customers lined up to purchase its vehicles, demonstrated by 1,200+ preorders overseas and 100+ preorders in China. [Slide 3]

EHang’s 1,300+ unit preorder book suggests solid demand and serves as the most critical metric for quantifying future revenue potential.

After examining every preorder and partnership, itemized below, our research indicates that over 92% of EHang’s preorder book is based on deals that were later “abandoned” or came from customers in no financial position to purchase EHang’s aircraft in volume, or at all.[12]

2016: An Established U.S. Biotech Company Called United Therapeutics Placed A 1,000-Unit Preorder (Representing ~74% Of Today’s Preorder Book) And Invested $17 Million Into EHang, Pre-IPO

2020: United’s CEO Stated in 2020 That “250 Nautical Miles… Is The Sweet Spot In Terms Of Range,” While EHang’s EH216’s Max Range Is 19 Miles

2021: United Therapeutics Dumped Its Entire $109 Million Stake In EHang, And Hasn’t Commented On The Partnership In 2 Years

In May 2016, EHang announced an up to 1,000-unit conditional preorder with a subsidiary of United Therapeutics (NASDAQ:UTHR), a U.S. biotech company that intended to use EHang’s aircraft to develop an organ delivery network.

It was, by far, the largest deal in EHang’s history as a company, representing ~74% of today’s total estimated preorder book of 1,300+ units. In addition to the preorder, United Therapeutics invested $17 million into EHang across two transactions in 2016 and 2019.[13] [Pg. 156]

Later, in 2020, the CEO of United Therapeutics described the agreement with EHang as one of “three shots on goal”, along with its financial support of two other aviation startups developing organ delivery solutions.

In December 2020, the United Therapeutics CEO reportedly said that the preorder with EHang was for a longer range fixed-wing aircraft, saying that the “sweet spot” would be a range of 250 nautical miles (~287 miles), more than 10x the range of EHang’s recently-certified EH216.

“EHang is now working on a longer-range version of its 116 and 216 AAVs that will be able to fly up to around 250 nautical miles. This, said Rothblatt, is the sweet spot in terms of the range (plus emergency reserves) it needs to expand its organ transportation network across North America.” [1]

“United Therapeutics has committed to buying up to 1,000 of the longer-range aircraft and is willing to help the Chinese company achieve type certification in the U.S. and Canada.” [1]

Two months after those supportive comments, in February 2021, United Therapeutics quietly dumped its entire stake in EHang, netting a $91.9 million gain on its original $17 million investment.[14] [Pg. F-19]

November 2021: United’s VP Of Organ Delivery Told An eVTOL Focused News Site “I Don’t Think Anyone Could Say Right Now That They [EHang] Have A Certifiable Configuration In Terms Of Aircraft Design”

In a November 2021 interview with VerticalMag, the VP of Organ Delivery Systems for United Therapeutics said United was still working with EHang, but acknowledged that EHang didn’t offer an aircraft that met its needs.

“The nature of our business, we cannot of course commit to a large number of aircraft without them [EHang] being compliant to what we need… there is definitely a lot of work to be done with EHang… I don’t think anyone could say right now that they have a certifiable configuration in terms of aircraft design.” [Vertical]

Aside from pictures in its corporate presentations, these 2-year-old comments represent the last public discussion we could find where United Therapeutics mentioned EHang.

EHang is developing a longer range aircraft, the VT-30, but even this model is limited to a maximum range of 300 kilometers, or ~186 miles, which is still a long way off from United Therapeutics’ target of 287 miles.

United Therapeutics Seems To Have A Far More Active Partnership With eVTOL Company Tier 1 Engineering, Which Conducted A Test Flight With United’s CEO In October 2022

United seems to have moved on. In October 2022, eVTOL company Tier 1 Engineering successfully transported a simulated organ in its retrofitted, all-electric helicopter on behalf of United Therapeutics.

The United Therapeutics CEO, pictured below with the Tier 1 team, said that the flight proved that it is “practical to deliver transplantable organs by electric helicopters from hospital to hospital.”

A Former EHang Employee Told Us That The United Therapeutics Deal Was “Dead”

They Added That EHang Has Not Removed Several Names From Its Investor Presentation, Despite No Longer Working With The Companies, Because It Would Be “Admitting it Failed”

EHang Still Counts The 1,000 Units In Its 1,200+ International Pre-Order Book And Displays United’s Logo In A “Customers And Partners” Section Of Its October 2023 Investor Presentation

According to EHang’s annual report, the deal with United was still active as of December 31st 2022, despite EHang meeting none of the milestones set out in the agreement.

“In April 2016, the Group entered into a development and purchase cooperative arrangement with a U.S. biotechnology company (“Biotech Customer”) to design, develop, test-run and manufacture an organ transport e-helicopter system… As of December 31, 2022, none of the milestones have been achieved and the agreement, as amend [sic], remains in effect.” [Pg. F-38]

EHang’s October 2023 presentation similarly featured the United Therapeutics logo. [Pg. 19]

Despite EHang’s claim that this agreement “remains in effect,” a former EHang employee called the deal “dead”.

The same former employee added that EHang’s partnerships with Vodafone, Ambular, DHL-Sinotrans, and Heli-Eastern had also failed, explaining that EHang doesn’t “take out” these initiatives from its investor materials when they don’t work out, because doing so would be an admission of failure.[15]

“EHang partnered with Vodafone for communications, they partnered with Heli-East for helicopter operations, to use heliports in China and Asia-Pacific, they partner with DHL for doing local logistical drones, but also, this is, the same as the United Therapeutics [deal]. It’s dead—it’s a dead end.”

“EHang, they enter the Ambular project… for them, it’s a catchy idea, you know, to transport organs and liver, [or] heart, whatever, and say we’re going to save lives. For them it was an ice breaker or promotion, marketing. Then these things failed, they lose their power, and what they don’t do in China is take it out from the videos or the article[s] in their web[site] because they think that taking it out is like admitting it failed.”

We Contacted United Therapeutics To Inquire Directly About Its Deal With EHang

Rather Than Confirming Its Partnership, We Were Told “We Have No Comment. We’re Just Not Going To Comment On This”

Typically, companies with active, thriving partnerships are happy to confirm as much. We put in multiple calls and emails to United’s investor relations department and the head of its drone program to inquire about the status of its partnership with EHang, but heard nothing.

After a week, we finally received a response from the company´s PR spokesman Elliot Sloane:

“You’ve called 20 people, and it’s like, obsessive, and it’s too much… You know, we have no comment. We’re just not going to comment on this. So, I hope you can take that for an answer.”

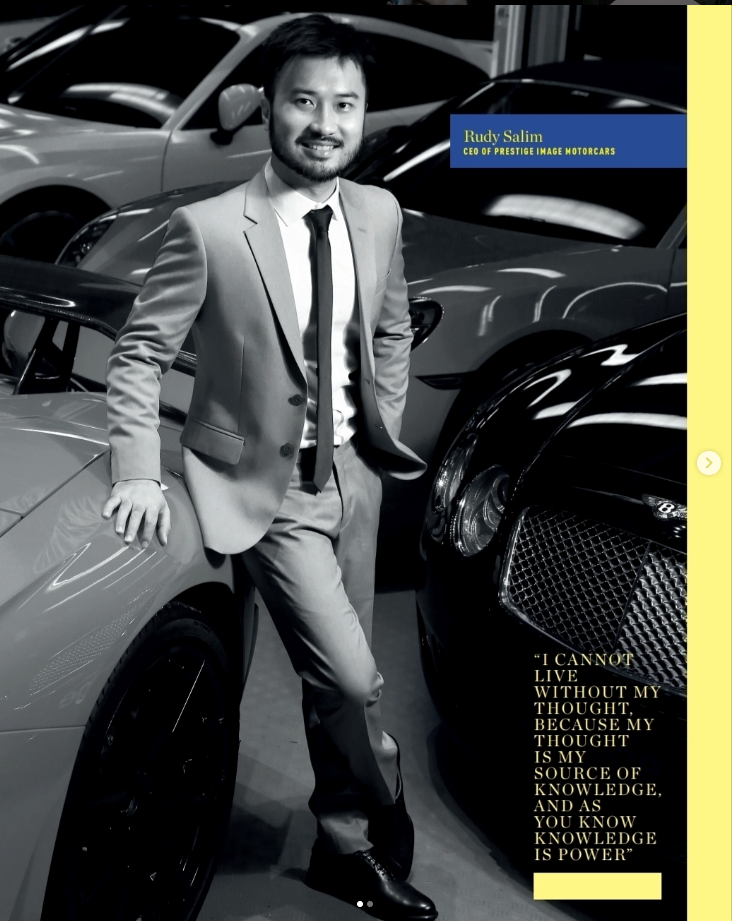

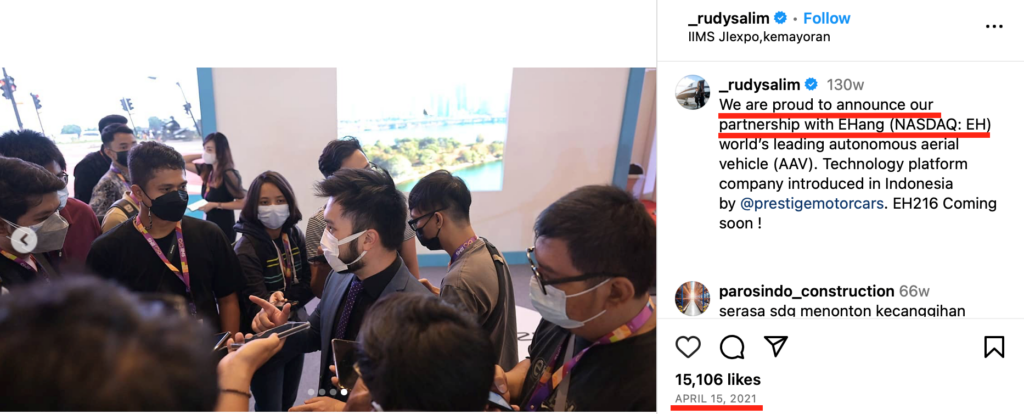

EHang’s Second Largest Commitment Is A 100-Unit Preorder, Worth An Estimated $30 Million, From An “Indonesian Aviation Company” Called Prestige Aviation

EHang’s second largest preorder comes from Prestige Aviation, an Indonesian company owned by Rudy Salim, a 36-year old social media influencer and luxury car dealer.[16]

In April 2022, EHang announced that Prestige Aviation had placed a 100-unit preorder for its EH216, worth an estimated $30 million based on the reported price of $300,000. The press release described Prestige Aviation as a business that provided “aviation services that includes the sale and acquisition of aerial vehicles and private jet lease.”

EHang’s press release quotes Rudy Salim, the executive chairman of Prestige Aviation, saying that Prestige is a “forerunner of Indonesia’s sustainable transportation.”

One would expect that a $30 million preorder might come from an established aviation company with aircraft, pilots, or any observable aviation-related operations. On the contrary, we couldn’t even find a website for Prestige Aviation, much less an active aviation-related business. The company shows just 2 employees on LinkedIn.

Salim, who has no discernible aviation experience, spends much of his time producing self-promotional social media content, including short films where he can be seen racing supercars and engaging in gun fights with animated villains.

Outside Of Promotional Events With EHang, The Only Evidence We Could Find Of Prestige’s Aviation Operation Was A Few Instagram Photos Featuring Prestige Aviation Branded Airplanes

A Related Instagram Reel Shows That Prestige Photoshopped Its Logo Onto Rented Jets

The only evidence we could find that Prestige had an aviation business were several early photos of Prestige Aviation’s planes on social media, but they appear to be photoshopped.

For example, in January 2021, one Instagram user, likely a Prestige employee or partner, posted a photo of himself stepping out of a Prestige Aviation Jet. [1,2,3]

The same user posted a video that same week on Instagram reels, featuring what looks to be the same exact jet, but without the Prestige Aviation name and logo photoshopped onto it. Instead, it featured the name of the real owner, Elang Indonesia (no relation to EHang).[17]

On April 14, 2021, Three Months After The Above Photoshoot, Prestige CEO Rudy Salim Incorporated Prestige Aviation With ~$34,000 In Registered Capital

The Next Day, Salim Announced A Partnership With EHang On His Instagram Account

Prestige’s EHang Pre-Order Came The Following Year, In April 2022

Salim incorporated Prestige Aviation on April 14th, 2021, with ~$34,000 in registered capital, based out of an address that matches Salim’s car dealership, according to its corporate profile and Google Maps.

The next day, Salim announced its first partnership with EHang on his Instagram account. The partnership was not an order, but instead focused on the general promotion of EHang in Indonesia.[18]

Prestige’s 100 unit EHang pre-order was placed the following year, in April 2022.[19]

In January 2022, EHang Received A 50-Unit Preorder From AirX, Valued At An Estimated $15 Million

AirX Is An Early Stage Startup That Has Reportedly Raised ~$1 Million In Venture Capital To Scale Its Helicopter Sightseeing Booking Platform

AirX’s Website Indicates That It Merely Intends To Resell EHang Products To Buyers That Don’t Yet Seem To Exist

In January 2022, EHang announced a 50-unit preorder from AirX, which at the reported price of $300,000 per EH216, would represent an estimated $15 million in revenue – nearly equivalent to EHang’s total reported revenue for the last 2 years combined.[20]

While EHang described AirX as a “leading Japanese air mobility digital platform company,” we found no indication that AirX has any physical aviation assets of its own.

AirX’s website shows that it is a 20-employee company based out of a WeWork office. It has raised U.S. ~$900,000 total since inception, according to Crunchbase. AirX’s website advertises “Capital” of 149 million yen, or approximately $993k USD.

The company’s eVTOL ‘offering’ consists of trying to resell EHang’s products, according to its website. The website states that orders will be fulfilled by importing from EHang, indicating that AirX hopes to act as a middleman for 50 EHang units that don’t yet seem to have actual buyers.

As opposed to an aviation company capable of purchasing $15 million worth of eVTOL’s, AirX appears to be a startup focused on scaling its digital marketplace for booking helicopter sightseeing tours with third-party operators.

AirX claims the EH216 will be ready for commercial flight in Japan by 2024, which we see as impossible given that EHang must apply for a Type Certification in Japan. The process reportedly takes years, though there is some local government support for the technology.

In September 2023, EHang Announced It Delivered 5 Units To Shenzhen Boling Holding Group, Which It Says Plans To Purchase Up To 100 Units, Representing ~$30 Million In Sales

Prior To The Deal, Shenzhen Boling Was In The Business of “Radio And Television Program Production,” But 5 Days Before The EHang Announcement, It Added Aviation To Its Business Registry Description

QCC Data Shows Zero Registered Employees For The Company, Which Was Set Up Only 2 Years Ago

On September 29th, 2023, EHang announced it had delivered 5 units to a new customer, Shenzhen Boling Holding Group Co., Ltd (“Boling”), which plans to purchase up to 100 units for aerial sightseeing applications.

According to the press release, Boling is a diverse conglomerate with businesses across 8 different sectors.

“Shenzhen Boling Holding Group Co., Ltd. Is a comprehensive integrated company that combines various businesses, including the cultural and tourism, international education, research and development of smart city technologies, cultural and technology, exhibition services, international trade, hotel management and operation, as well as cross-border e-commerce.”

Despite its claimed broad operations, Boling has no staff or registered insured employees according to QCC, a Chinese business data aggregator.

On September 24, 2023, just 5 days before EHang issued its press release announcing that the units would be delivered, the entity changed the scope of its business, adding various aviation segments, as well as tourism, according to QCC.

We Visited Boling’s Address And Found A Residential Apartment Building With No Signs Of A Real Business

In EHang’s press release, the chairman of Boling is listed as Xu Guanshen, who has minimal business presence online. A Google search of Boling’s business name in Chinese (“深圳博领控股集团”) excluding EHang (“-亿航智能”) yielded just 5 results on Google, none of which suggested any business operations for the company.

To try and learn more about Boling, we visited its registered address and found it to be a residential building with no outward facing signs of any business.[21]

We were unable to confirm any business operations for Boling, much less an active aviation business with the capital and experience to acquire and operate 100+ autonomous aircraft from EHang.

EHang Signed A Partnership With Blue Chip Delivery Giant DHL In 2019

A Former EHang Employee Claimed That EHang’s Partnership With DHL-Sinotrans, Was Also A “Dead End” And That They Had “Abandoned The Project”

DHL Is Still Highlighted In EHang’s October 2023 Investor Presentation

Beyond issues in its preorder book, we have also identified red flags with EHang’s claimed partnerships.

For example, in 2019, EHang announced a strategic partnership with shipping giant DHL to develop an urban drone delivery business is China. The CEO of DHL Express China was quoted at the time giving high praise to the fledgling drone company:

“We are delighted to be partnering with EHang to set a new innovation milestone with this new fully-automated and intelligent drone logistics solution”.

EHang held a press ceremony commemorating the event.

In EHang’s October 2023 investor presentation, it included a photo of a DHL-branded drone delivery under its “Urban Air Mobility Use Cases” slide, and it included DHL on its list of customers and partners.

The only update that we could find on its partnership with DHL-Sinotrans since May 2019 trial deliveries was in an August 2020 earnings call, where the company said that EHang was in “good cooperation with them [DHL]”, but that it was still “early stage”. [Pg. 78]

When we asked a former EHang employee about the status of the deal, we were told the project had been “abandoned.”

“So, you don’t hear any more about the DHL-Sinotrans company in China working with EHang. Why? Because there were some problems in the integration and then they abandoned the project, but they don’t claim, nobody says ‘we closed the project’… they never admit any failure or any dead ends.”

Rather than communicate its missteps to the market, EHang seems to prefer the approach of just faking it forward indefinitely.

Part 2: Signs Of Fake Revenue – Undisclosed Related Party Transactions, $15+ Million In Impaired Receivables

Typically, companies gain required product certifications before producing and selling products for customer end-use, particularly in aviation settings where safety is paramount.

Bucking this norm, EHang sold 3 aircraft in 2018, a full 5 years ahead of its recent certification. Its sales volume skyrocketed to 61 units in 2019 and 70 units in 2020, despite being 3-4 years away from certification. [Pg. 48]

We found major red flags with these claimed sales indicating that they were fake.

EHang Sold 24 Units To A Claimed “Arm[s] Length” Customer Called Kunxiang

In 2021, A Research Firm Alleged That (1) Kunxiang Was Secretly A Pre-IPO Investor In EHang And (2) The Orders Were A Sham In Order To Report Revenue Growth Around EHang’s Critical IPO Period

EHang CEO Hu Huazhi Denied Both Allegations

The 2020 uptick in orders was based in part on a new customer called Kunxiang Intelligent Technology, which ordered 23 units in 2019 and committed to buy another 105 units in 2020.[22]

In February 2021, short seller Wolfpack Research published a report alleging that Kunxiang was an undisclosed related party to EHang.

Specifically, it alleged that Kunxiang was one of EHang’s pre-IPO investors that had signed “sham sales contracts” with EHang to benefit its investment as EHang approached its IPO.

The day after the allegations, EHang CEO Hu Huazhi promptly refuted them, stating that Kunxiang was not a pre-IPO investor, and that EHang’s contracts with Kunxiang were arm’s length.

“The truth is that Kunxiang has never been a shareholder of EHang prior to our IPO, and to the best of our knowledge, after our IPO either… all contracts with Kunxiang are based on arm-length transactions.”

As detailed below, Chinese corporate records and recent litigation proceedings show that Kunxiang is in fact controlled by one of EHang’s pre-IPO investors, refuting Ehang’s claim.

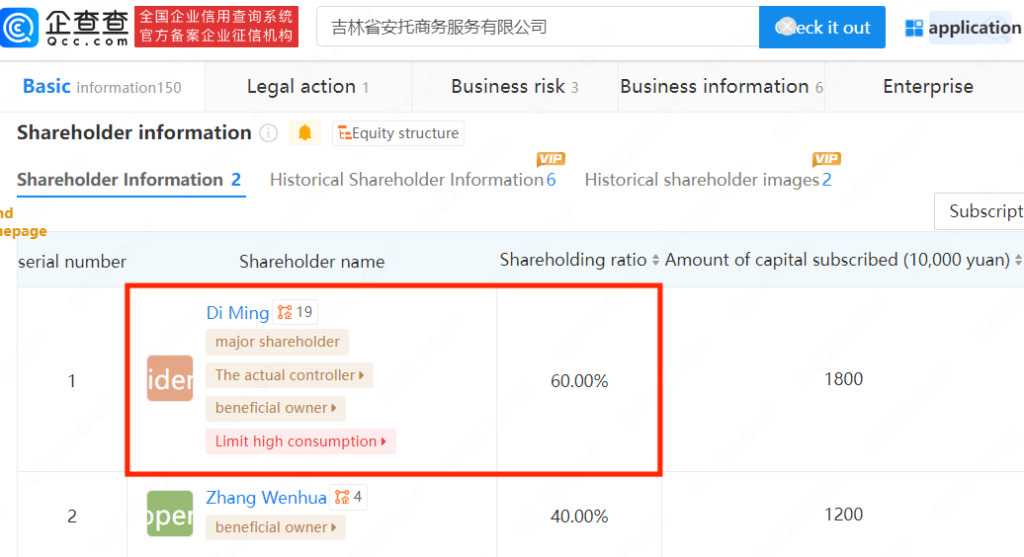

Chinese Corporate Records Reveal That Kunxiang Is Controlled By A Chinese Financier Who Did Invest In EHang’s Series C Fundraising Round Through An Offshore Shell Company

EHang’s sales contract with Kunxiang was signed by Di Ming. Ming is listed as the entity’s beneficial owner and controller, according to QCC, a database of Chinese corporate data.

QCC shows that Di Ming is also the controlling shareholder of venture capital firm Antuo Capital (referred to as Atop Capital in English, according to its website). [23]

During a 2018 interview, an Antuo executive named Yifei Zhang confirmed Antuo’s investment in EHang.

Further confirming the investment, Antuo Capital’s website listed EHang as a portfolio company at least as far back as January 2019, according to website archives.

Both the interview and the website archive were from prior to EHang’s December 2019 IPO, clearly demonstrating that a related party of EHang’s key customer was also a key pre-IPO investor, contradicting EHang’s earlier claims of the deal being arm’s length.

Beyond corporate records, we’ve also located a photograph of EHang’s CEO with Antuo Capital’s executive Yifei Zhang, celebrating EHang’s NASDAQ bell-ringing ceremony.

To summarize, when faced with allegations of suspicious product purchases by a conflicted party, EHang CEO Hu Huazhi seemingly chose to flagrantly mislead shareholders by claiming that the aircraft purchases were arm’s length. In reality, the aircraft purchases were made through the same individual controlling a key EHang pre-IPO investment, representing a clear undisclosed conflict of interest.[24]

Tell-Tale Signs Of Fake Revenue: EHang Never Seemed To Collect The Suspect Revenue, And Has Instead Been Aggressively Impairing Its Receivables Since 2020

For Example, EHang Wrote Down $15.2 Million In Receivables During 2021-2022, A Period Where It Only Reported $15.3 Million In Revenue

A telltale sign of companies reporting fabricated revenue is uncollectible receivables, indicating that booked revenue is never actually converted to cash.

From 2021 to 2022, EHang reported $15.3 million in sales. Yet almost as quickly as it was booking sales, it was writing down sales as uncollectible bad receivables. From 2021 to 2022, EHang wrote down $15.2 million in accounts receivables. [Pgs. F-43, F-40, F-36]

At the end of 2022, EHang’s allowance for doubtful accounts sat at 85% of its accounts receivables balance. [Pg. F-43]

While EHang does not break down a doubtful accounts allowance in quarterly filings, it disclosed more provisions for several long-aging accounts receivables in its Q2 2023 report. [Pg. 4]

Conclusion

EHang seems to have a major credibility issue—whether it be by fluffing up its supposedly massive 1,300+ unit preorder book (which looks to almost entirely be vapor) or seemingly brazenly misleading about early sales that bear all the hallmarks of fake revenue.

With its consistent underinvestment in R&D, EHang would need to rework its entire design to satisfy the safety needs for the use cases to which it aspires.

Trust is crucial in the aviation industry, both for investors and potential customers who are literally putting their lives at risk. We think the company is a fatal accident waiting to happen, both for investors and for passengers.

Appendix A: EHang’s Type Certification Has Numerous Flight Restrictions That Weren’t Disclosed To Shareholders

According to the CAAC, EHang’s 216-S Type Certification lists numerous flight restrictions, including restrictions against flying at night, in inclement weather, above water, in densely populated areas, in the same airspace as other aircraft, and out of sight of a ground crew. [Pg. 4, Section F]

We obtained the Type Certification from the CAAC website and have translated the restrictions below.

EH216 Type Certification: Pg. 4, Section F – Unmanned Aircraft System Operational Limitations

- It is prohibited to operate under known or forecast weather conditions such as rain, snow, thunderstorms, icing, sandstorms, fog or other meteorological conditions.

- Operation is limited to daytime only.

- The aircraft can only fly in segregated airspace.

- The aircraft can only fly in sparsely populated areas.

- The aircraft must fly within the line of sight of the remote crew.

- The aircraft is prohibited from operating over water, including takeoff, landing, and forced landing.

Appendix B: EHang’s Reported Preorder Book

Calculating the size of EHang’s claimed preorder book is an imprecise task, as many of EHang’s customer relationships are labeled “conditional” or “indicative,” while others appear to denote vague “plans to purchase”.

EHang’s investor presentation claims 1200+ international preorders and 100+ domestic orders. Based on EHang’s disclosures and press releases, the company claims 1,475 units at various levels of commitment, including 120 units that a company called Xiyu Tourism “intends to sign” (which we suspect is not counted in the company’s pre-orders).

Based on a review of EHang’s filings, we estimate that the company has around 1,355 pre-orders broken down in the following table:

| Customer | Preorder Volume | Notes |

| United Therapeutics | 1000 | “Conditional Purchase Agreement” |

| Prestige Aviation | 100 | “Pre-order” |

| AirX | 50 | “Pre-order” |

| Aerotree | 60 | “Pre-order” |

| Total Estimated International Pre-Orders | 1210 | |

| Boling Holdings Group | 100 | “Plan To Purchase” |

| Xi’an Aerospace Investment Company | 20 | “Indicative Purchase Order” |

| Tianxingjian Cultural Tourism Investment and Development LLC | 25 | “Plans To Purchase” |

| Total Estimated Domestic Pre-Orders | 145 | |

| Total Domestic & International Orders | 1355 |

Disclosure: We Are Short Shares of EHang Holdings Limited (NASDAQ: EH)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] In 2016, the company announced the launch of its first autonomous aerial vehicle, the 184.

[2] Market cap based on an outstanding ordinary share count of 120,784,901 with each ADS share representing 2 ordinary shares. [Pg. 134]

[3] EHang is also significantly outmatched on charging speed, with the EH216 requiring 2 hours for a full charge, which provides a range of 30km, or approximately 19 miles. [Pg. 72] The Archer Midnight eVTOL, on the other hand, requires just 10-12 minutes of charging time to travel the same distance.

[4] Range with max payload.

[5]$10 million of EHang’s cash came from a December 2022 private placement in which EHang sold 1,733,102 American Depository Shares (3,466,204 Class A shares) at a price of $5.77 per share, a 61% discount from yesterday’s close. [Pg. 10]

[6] Last year, EHang disclosed in its Q2 update that it had reached an agreement with the Agricultural Bank of China for “indicative credit facilities of RMB 1 billion,” or approximately U.S. $137 million based on exchange rates for 11/2/2023. While the loan would have provided significant runway for EHang, management disclosed on the accompanying earnings call that the actual credit facility was just RMB 30 million, or approximately U.S. $4.1 million at exchange rates as of the same date. EHang’s is also increasing relying on debt. Total liabilities have increased by 35% from $35 million to $47.5 million, driven partially by an increase of $5.2 million in short-term bank loans, indicating that unless EHang’s credit facility has been extended, it may already be tapped out.

[7] Source: FactSet

[8] We located no Form 4s for insider share sales/purchases. Therefore, a precise breakdown of insider transactions is not available based on the available filings. However, insiders have reported form 13Gs that show initial holdings followed by lower share ownership, indicating that insiders have consistently sold.

[9] United Therapeutics’ divestiture of its EHang holdings is covered in detail in Part 1 of this report.

[10] EHang does not disclose how many shares Edward Xu initially owned, but a series of paper Form 144s reveal that he sold 462,500 shares between September 2021 and September 2022. It is unclear how many shares he owns today.

[11] In order to identify these forms, investors would have needed to be aware of the SEC’s “Paper Forms 144” website, and either use a third party aggregator of this data or download the full files for each day and search through to find EHang executive & key stakeholder submissions.

[12] For the full estimated list of EHang’s pre-order book, see Appendix B.

[13] United Therapeutics invested $10 million in EHang on 12/27/2016 through its subsidiary, Lung Biotechnology PBC, and invested another $7 million in EHang on 2/11/2019 directly. [Pg. 156]

[14] While United doesn’t explicitly mention EHang, it disclosed selling its entire stake in an unnamed publicly traded company for a $91.9 million gain in February 2021. United Therapeutics indirectly disclosed through a fair value calculation ($30.5 million fair value – $13.5 million unrealized gain) that the cost basis for that investment was $17 million, the amount that United Therapeutics invested into EHang’s Series C round.

United’s next largest public investment at the time was TransMedics (NASDAQ:TMDX), but United’s stake in TransMedics would have had a maximum value of only ~$60 million in February 2021, based on its holdings of 1,458,413 shares and a peak Transmedics share price of ~$41.20 that month, per FactSet.

[15] EHang established a “strategic partnership” with Vodafone in October 2019 to “provide 5G connectivity” to EHang’s aircraft in Europe, but EHang hasn’t provided an update on the deal in its SEC filings or earnings calls in more than 3 years.

EHang was selected to join Ambular, an international project to develop a flying ambulance, in August 2020. EHang hasn’t provided an update on the project in its SEC filings or earnings calls since December 2020.

EHang established its partnership with Heli-Eastern in September 2021 with the aim of establishing aerial sightseeing operations, but EHang hasn’t provided an update on the partnership since the initial announcement. Heli-Eastern is reportedly working with Lilium, an EHang competitor, to acquire and operate over 100 aircraft, according to media reports from June 2023.

[16] On a subsequent earnings call, EHang’s management referred to the deal as the “largest preorder we have received in Asia so far.” [Q2 2022]

[17] Elang Indonesia is a local charter company that features this exact same aircraft on its homepage.

[18] In November 2021, EHang announced that it had worked with Prestige Aviation to conduct its first test flight in Indonesia.

[19] Rudy Salim has continued to tout the EHang relationship on his social media accounts as recently as September 2023.

[20] EHang generated $8.9 million in revenue in 2021 and $6.4 million in revenue in 2022.

[21] Boling’s address is Unit 109, Building 1, No. 38 Hongbao Road, Hongcun Community, Guiyuan Street, Luohu District, Shenzhen. When we visited, we saw that there were no units on the first floor and that Unit 109 didn’t seem to exist.

[22] Kunxiang placed two orders in 2019 and signed a 2020 distribution agreement for an additional 105 units, although it is unclear how many units Kunxiang actually bought in 2020. [Order 1, Order 2, Distribution Agreement]

[23] Antuo Capital has reportedly received multiple fines from Chinese regulators, while many of its funds have been deregistered, according to local media.

[24] EHang’s SEC filings include a list of every entity or individual who invested in the 3 years preceding its IPO. Antuo Capital was not listed. However, we were able to easily identify each investor except for one opaque entity “Dragon Chariot Limited”, which acquired ~860,000 shares in 2017. [Pg. II-1] We suspect that “Dragon Chariot Limited” was the offshore entity that Antuo Capital used to invest in EHang, as Dragon Chariot Limited and an affiliate of Antuo were listed as co-defendants in a 2018 lawsuit in China, according to Qixin.com.