- Renovaro is a biotech company with several preclinical drug candidates that is “committed to curing people with cancers and infectious diseases”. Weeks ago, it voted to merge with “AI Health” company GEDi Cube, giving the company a pro-forma fully diluted market cap of ~$567 million.

- Current CEO Dr. Mark Dybul has a prestigious background (i) serving under Anthony Fauci at the National Institute of Health (NIH) (ii) as Executive Director of the Global Fund to Fight AIDS, Tuberculosis, and Malaria and (iii) as a tenured professor at Georgetown University.

- Dybul has been involved with the company since 2017, before it went public. The company went public in early 2018 under a predecessor name, Enochian BioSciences. Dybul stepped into the CEO role in 2021, where he remains today.

- Then known as Enochian, the company’s co-founder, “scientific founder”, “inventor”, and largest shareholder was an individual named Dr. Serhat Gumrukcu.

- CEO Dybul praised Gumrukcu as a “rare genius”, saying he could be “the most impactful scientist in generations”. In a now-deleted company video, Dybul praised Gumrukcu’s “brilliance” and said he created “some of the most innovative approaches to HIV and oncology” that he knew of.

- In May 2022, Gumrukcu, was charged by the Department of Justice over allegations that he conspired to hire a hitman to murder one of the victims of his many scams, a Vermont father of 6 who was taken from his home and executed in a snowbank.

- A week after the charges, we published a report on the company titled “Miracle Cures and Murder For Hire: How A Spoon-Bending Turkish Magician Built A $600 Million Nasdaq-Listed Scam Based On A Lifetime Of Lies”, which largely profiled the now-imprisoned Gumrukcu.

- In that report, we revealed Gumrukcu had faked his entire academic history, including forging his Russian medical degrees, and that he was a magician who had fled authorities in Turkey after being charged over allegations he faked being a doctor to steal money from a terminally ill cancer patient.

- We also revealed that as a fugitive in the United States, Gumrukcu continued his crime spree, culminating in 14 felony charges in 2017 relating to the fraudulent sale of a home he didn’t own, writing bad checks, and defrauding a businessman through a fake energy trading deal.

- The day after we published our report, CEO Dybul called it “misleading propaganda”, claiming the magician’s study results were still valid. “The science is the science, and the data are the data”.

- One month after the murder charges and our report, in July 2022, the company announced that Gumrukcu had faked clinical data relating to the company’s HBV and COVID-19 therapies. In October 2022, the company sued Gumrukcu, saying his conduct amounted to “brazen fraud”. The data was apparently not the data.

- The company claimed it had “no reason” to doubt Gumrukcu’s data. Dybul later admitted he and the company knew Gumrukcu had been arrested on 14 felony counts relating to fraud at the time they began working with him, but kept working with him anyway.

- Dybul ignored other obvious red flags including (i) in 2018 when the company’s CFO raised concerns of “serious financial improprieties” related to Gumrukcu (ii) when analysts in 2019 pointed out Gumrukcu’s suspicious medical credentials and criminal history and (iii) when Dybul was questioned in 2020 regarding a U.S. lawsuit alleging Gumrukcu practiced sham medicine on a terminally ill child and absconded with the parent’s $253,000.

- Enochian Chairman Rene Sindlev also knew of and ignored Gumrukcu’s felony fraud charges and previously compared Gumrukcu to Leonardo Da Vinci and Albert Einstein. No board members or key executives resigned despite their inexcusable governance failures.

- In late 2022, 6 months after the murder charges and 2 months after the company sued Gumrukcu for “brazen fraud”, the board of Renovaro elected to pay Dybul a $100,000 cash performance bonus on top of his $850,000 annual salary.

- In March and April 2023, with Enochian almost out of cash and its stock near lows, Chairman Sindlev “conducted multiple calls and in-person meetings” with representatives of GEDi Cube, an entity which didn’t even exist at the time, later company disclosures revealed.

- Also on the same day of the LOI and the name change, insiders including Chairman Sindlev quietly acquired millions of shares and warrants at effective prices ranging from $0.65 to $0.713 per share. Renovaro was trading at ~$0.65 at the time.

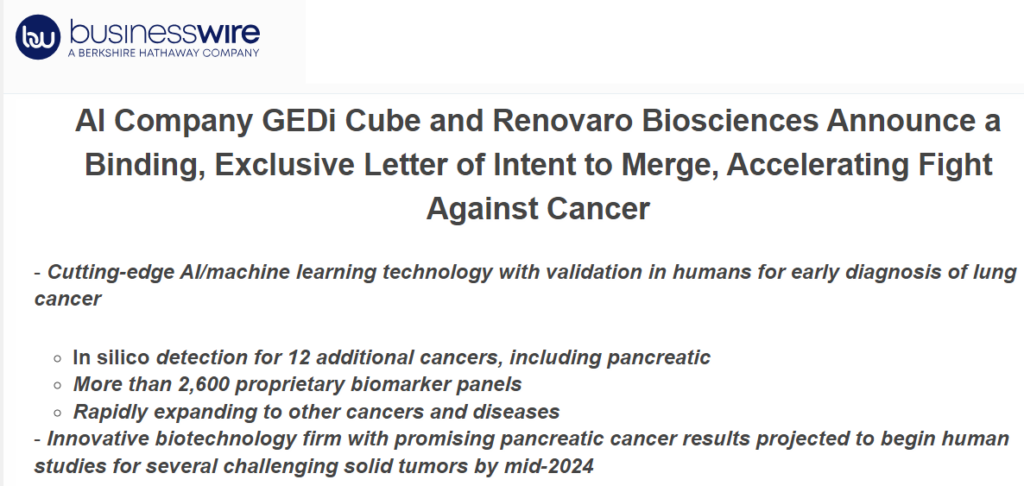

- 8 days later, Renovaro publicly announced the merger, calling GEDi Cube an “AI Company” using “cutting edge AI/machine learning technology”. Renovaro stock spiked 83% on the day, trading 78.5x its preceding 30-day average volume.

- At the time of the announcement, GEDi Cube was a 2-month-old entity with “no operational history”, no product, no revenue and virtually no assets, according to disclosures made months later. GEDi basically consisted of only a term sheet to acquire an entity called Grace Systems, which it claimed had AI technology.

- Grace Systems was a nearly insolvent tiny startup with no revenue and no commercial ready product after 10 years. It reported having $1,583 in cash on hand with ~$376,000 in liabilities at year end 2022. In April 2023, a Grace subsidiary filed for bankruptcy in the Netherlands.

- GEDi needed €1 million to own 51% of Grace, implying a ~$2.2 million valuation for Grace. But the newly formed GEDi entity had next to nothing, so Renovaro lent it the needed $1.05 million to close the deal.

- During merger negotiations to merge with Renovaro, GEDi then proposed a valuation of $225 million, which Renovaro rejected because GEDi “generated no revenue and had no projections”.

- Renovaro and CEO Dybul then apparently negotiated against themselves, relying on a valuation opinion from an unnamed “AI expert” that ultimately resulted in Renovaro agreeing to pay $275 million in exchange consideration for GEDi.

- In brief, Renovaro and CEO Dybul lent GEDi the cash to close the Grace deal at a ~$2.2 million implied valuation, then turned around and merged with GEDi for $275 million in consideration after a hard-fought negotiation against himself.

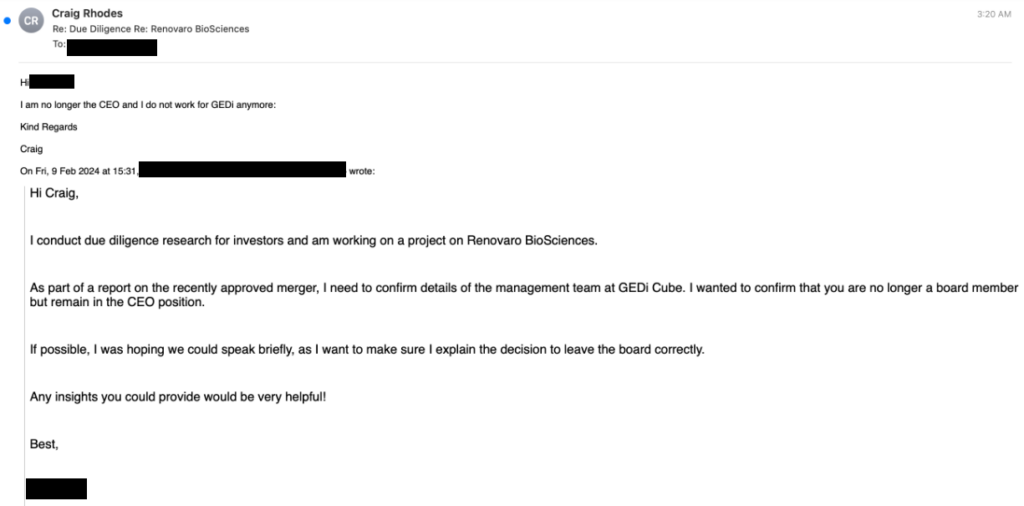

- Renovaro has repeatedly touted the importance of “visionary” former Intel/Nvidia executive Craig Rhodes as CEO of GEDi Cube. Shareholders likely voted for the deal in part due to Rhodes’ background. Rhodes confirmed to us in an email that he resigned in December 2023, a month before the vote, with no apparent disclosure of the key resignation to shareholders.

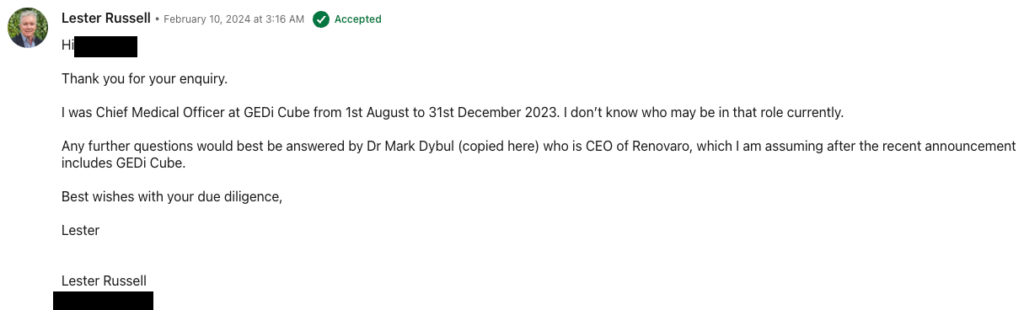

- Renovaro also touted the appointment of Lester Russell, GEDi’s Chief Medical Officer, in an August 2023 press release. Russell also resigned in December 2023, also without disclosure to shareholders.

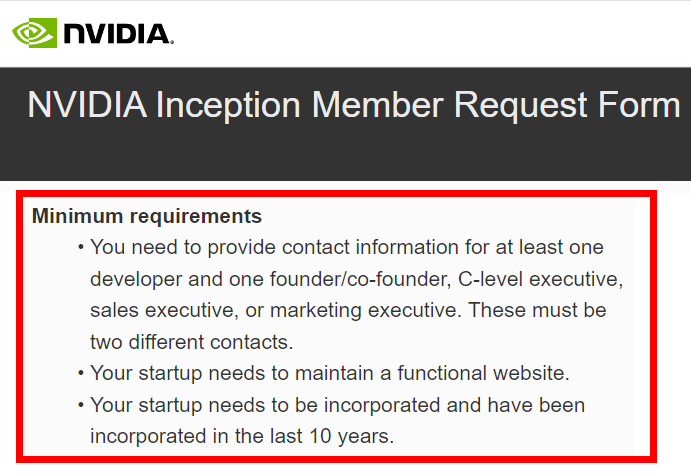

- Renovaro and Dybul also repeatedly highlighted GEDi’s “strategic partnership” with Nvidia as a key justification for the merger. But the Nvidia “partnership” is a free program that over 17,000 companies have joined.

- In the months leading up to the merger vote, Renovaro enlisted stock promoters, including one previously sanctioned by the SEC, to hype up the GEDi deal and pump shares to retail investors.

- Dybul now claims that GEDi can provide a “multiplier effect” that will enhance Renovaro’s pipeline.

- However, the company’s lead candidate remains Gumrukcu’s cancer therapy. Dybul still touts the jailed magician’s treatment, referring to it in January 2024 as “the holy grail of cancer research” and hopes to begin human trials later this year.

- In an ironic twist, Gumrukcu’s husband sued Renovaro’s key executives and financiers in January 2024, alleging a range of securities law violations by Dybul and Sindlev, among others. The complaint alleges Sindlev purchased significant Renovaro stock while in possession of material nonpublic information relating to the merger.

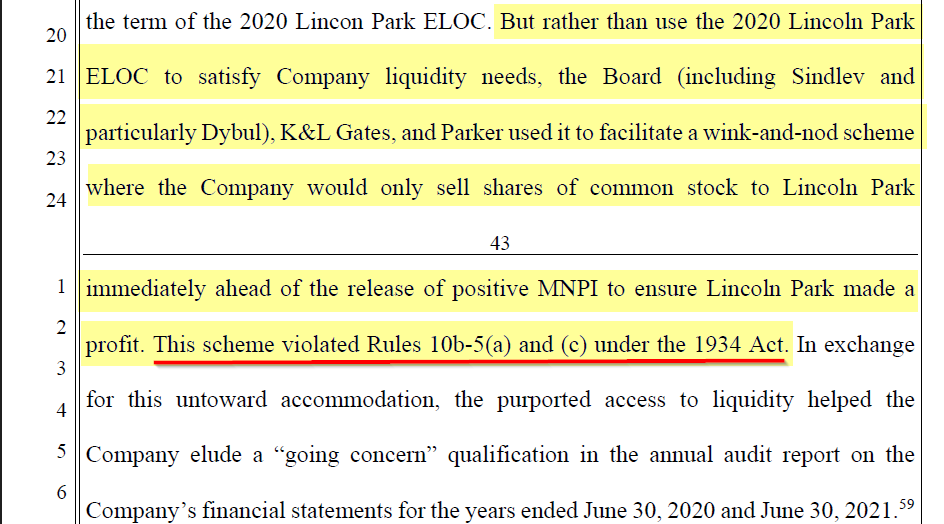

- The complaint also cites damning internal emails to allege Dybul is engaged in a “wink and nod scheme” with Renovaro’s financier Lincoln Park Capital, whereby Renovaro provides them with non-public information ahead of key company news to help Lincoln Park trade against Renovaro’s own shareholders.

- Gumrukcu and his husband are a key holder of Renovaro, with ~19 million shares, or ~28% of the company. The family of Gumrukcu’s murder victim sued him for wrongful death and courts have frozen 12.8 million of his Enochian shares to cover potential damages.

- Gumrukcu’s husband still owns 3.6 million free-trading shares which we expect will hit the market soon to cover litigation costs and defense costs for the upcoming murder conspiracy trial, slated for later this year.

- In conclusion, if your company co-founder and key inventor turns out to be a con artist magician who (allegedly) murdered someone and faked his scientific data, you can’t just change your company name and pivot to AI and hope no one notices.

- CEO Mark Dybul appears set on trying to run the same shameless scam with a new name. We think he is in a league of his own as far as poor judgment and governance and see inevitable massive downside in shares of Renovaro.

Initial Disclosure: After extensive research, we have taken a short position in shares of Renovaro Biosciences, Inc. (NASDAQ:RENB). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

This report follows our June 1, 2022 report, “Miracle Cures and Murder For Hire: How A Spoon-Bending Turkish Magician Built A $600 Million Nasdaq-Listed Scam Based On A Lifetime Of Lies”, which largely profiled the now-imprisoned company scientific founder, Serhat Gumrukcu.

The story of Gumrukcu’s rise and fall, where he now sits in prison awaiting trial for a murder conspiracy, has recently been chronicled in a podcast produced by Amazon’s Wondery. (Spotify, Apple)

Renovaro CEO Mark Dybul Had An Illustrious Reputation When He Joined The Company, Originally Named Enochian Biosciences, In Early 2018

Mark Dybul’s path to being Renovaro’s CEO started as early as August 2017, when he was awarded shares in the company when it was still private and went under a predecessor name, Enochian.

In early 2018, the company went public as Enochian Biosciences by merging with an OTC-listed company where Gumrukcu had been a consultant. [Pg. 7]

Following the merger, Mark Dybul joined the board. In January 2019 he became Executive Vice Chair, and in July 2021, he officially stepped into the CEO role, where he remains today.

Dybul, who refers to himself as “The Honorable” Mark Dybul in his biography and company press releases, is a tenured Georgetown professor of medicine with a prestigious career that has included working under Anthony Fauci at the National Institute Of Health (NIH) and serving as the Executive Director of the Global Fund to Fight AIDS, Tuberculosis, and Malaria.

His work in public health has led to brushes with heads of state such as President George W. Bush, Justin Trudeau, billionaire philanthropists such as Bill Gates, and testifying in front of both the Senate and the House of Representatives.

Part I: Mark Dybul Turns A Blind Eye To Outrageous Fraud For Nearly Half A Decade

Dybul Had Praised The Now-Imprisoned Scientific Founder Of Renovaro (Then Called Enochian) As A “Rare Genius”, Saying He Could Be “The Most Impactful Scientist In Generations”

When Dybul joined Renovaro, then known as Enochian, it was viewed as a promising biotech company that had come up with prospective cures or treatments for many of the world’s most complex diseases such as HIV, cancer, Hepatitis B and others.

At the time, the company’s scientific founder, Serhat Gumrukcu, was praised by Dybul as being a “rare genius”, with Dybul writing in November 2019:

“Dr. Gümrükcü is one of those rare geniuses that is not bound by scientific discipline or dogma. He sees connections and opportunities often missed. His ideas are the purest kind: those that seem so obvious and simple once he has conceived of, and explained them.”

Turkish court documents include a character reference for Gumrukcu provided by Dybul in a letter from September 2020 which included this glowing statement:

”….It is not an overstatement to say he might be the most productive and impactful scientist in generations.” [Pg. 22]

Current Renovaro Chairman, Rene Sindlev, went a step further, comparing Gumrukcu to the greatest business leaders and thinkers of all time:

“Hold on tight to your shares. Our researcher and inventor is the biotech world’s answer to Zuckerberg, Bill Gates and Larry Page. People close to him compare him to Leonardo Da Vinci, Nikola Tesla and Einstein in one and the same person.”

Quarter after quarter, Dybul promoted how the company, then called Enochian, was going to harness Gumrukcu’s genius to revolutionize the world of medicine, including in a corporate video subsequently deleted by the company:

“Enochian’s inventor, Doctor Serhat, has the type of brilliance that has the capacity to see across discipline in science and connect things that others don’t see. And that’s exactly what he’s done to create some of the most innovative approaches to HIV and oncology that I know of.”[1]

In May 2022, The Claimed Once-In-A-Generation Scientist, Serhat Gumrukcu, Was Charged By The Department Of Justice Over Allegations That He Paid A Hitman To Execute One Of The Victims Of His Many Scams

A Week Later, We Published A Report Showing That “Doctor” Serhat Gumrukcu Had Forged His Russian Medical Degrees And Fabricated His Background

Our Research Showed He Was Actually A Turkish Magician, International Fugitive And Lifelong Con Artist

On May 25th, 2022, Gumrukcu was charged by the Department of Justice with a murder-for-hire conspiracy where he was alleged by the authorities to have plotted the execution of a victim of one of his many scams.[2]

A week after the indictment, on June 1st, 2022, we released a report showing how “Doctor” Gumrukcu had faked his entire academic history, including forging his Russian medical degrees. In reality, Gumrukcu was a Turkish magician who had fled Turkish authorities after being charged over allegations that he faked being a doctor to steal money from a terminally ill cancer patient.

Our Report Showed That After Fleeing To The U.S., Gumrukcu Embarked On A Fraud Spree, Culminating In His Arrest In California And 14 Felony Charges

As a fugitive in the United States, Gumrukcu continued his crime spree, culminating in his arrest and 14 felony charges in 2017 relating to the fraudulent sale of a home he didn’t even own, writing bad checks, and defrauding a businessman through a fake energy trading deal.

Gumrukcu’s jilted business partner on the fake energy trading deal, Greg Davis, threatened to turn him into authorities, which risked de-railing Gumrukcu’s biggest scam yet: co-founding the then $600m publicly traded biotech company Enochian BioSciences.

Shortly before the Enochian deal closed, someone posing as a U.S. Marshall appeared at the home of Davis, a father of 6, claiming he was under arrest. The man took Davis out to a snowbank in Vermont and shot him to death.

CEO Dybul And The Company Later Admitted They Knew Gumrukcu Had Been Arrested on 14 Felony Counts Relating To Fraud

But They Kept It Quiet And Continued With The Merger, Hailing Gumrukcu As A Genius Anyway

Prosecutors Would Later Argue That A Key Motivation For the Murder Was To Prevent One Of Gumrukcu’s Fraud Victims From Derailing the Merger

Federal prosecutors made clear that a key motive for the alleged murder plot was that Gumrukcu was in the midst of closing the merger with Enochian, and that Davis’s testimony may have threatened the deal. Per the indictment on Gumrukcu’s conspirator:

“That same year, 2017, Serhat Gumrukcu was putting together a successful deal that came together soon after the murder, namely, his significant ownership stake in a biotech company, Enochian Bioscience. Gumrukcu therefore had a strong motive to prevent Davis from reporting yet another fraud, and likely threatening the Enochian deal.” [Pg. 3]

CEO Dybul would later admit that he and the company knew Gumrukcu had been arrested on 14 felony counts relating to fraud at the time they began working with him, but they kept working with him and hailing him as a genius anyway.

According to our findings, Gumrukcu would have needed permission from his parole officer to attend Enochian’s Nasdaq bell-ringing ceremony, marking the start of its public trading on the premier national exchange, due to the felony counts he faced around that time.

1 Day After We Published Our Report, Enochian CEO Mark Dybul Called It “Misleading Propaganda” Claiming The Magician’s Study Results Were Still Valid

“The Science Is The Science, And The Data Are The Data”

A week after Gumrukcu was arrested on murder-for-hire allegations, and 1 day after we published our report, Enochian CEO Mark Dybul published a letter to shareholders dismissing our work and reaffirming the value of Enochian’s therapeutic pipeline:

“Enochian’s rigorous foundation is rooted in independently conducted science, and our commitment to the promise of our potential therapies remains strong. Enochian’s value as a company is derived from scientific patents that we own or license and the potential these ideas carry to cure or treat some of the world’s most widespread, deadly, and intractable diseases…Shorters of Enochian stock have released misleading propaganda about the company in a thinly veiled attempt to smear its reputation”.

While Dybul’s letter criticized our findings, signs of doubt began to emerge. The letter quietly stopped referring to Gumrukcu as “Doctor” for the first time.

Dybul’s letter ended by distancing the company’s future from the fraud and murder allegations of its scientific founder, saying Gumrukcu’s findings were still valid:

“The science is the science, and the data are the data.”

1 Month Later, On July 1st, Enochian Announced That Gumrukcu Had Forged Clinical Data Related To His HBV And COVID-19 Therapies

In October 2022, Enochian Sued Gumrukcu, Saying His Conduct Amounted To “Nothing Short Of Brazen Fraud”

The Data Was Apparently Not The Data

Just one month later, on July 1st, 2022, despite Dybul’s earlier assurances, the company announced that Gumrukcu had faked clinical data related to Enochian’s HBV and COVID-19 therapies:

“…former scientific advisor Serhat Gumrukçu altered two different sets of animal data generated by third-party research institutions before Enochian’s scientists had a chance to review. One data set was for an inhaled COVID-19 treatment study while the other was for an HBV therapy study.”

In October 2022, Enochian sued Gumrukcu, claiming he engaged in a “concerted, deliberate scheme to alter, falsify, and misrepresent to [the Company] the results of multiple studies supporting its [Hepatitis B] and SARS-CoV-2/influenza pipelines.” [Pg. 3]

According to the lawsuit, Enochian used Gumrukcu’s forged study results as part of its pre-IND submission to the FDA:

“Enochian relied upon Defendants’ fabricated ENOB-CV-01 AAV study— including the results presented by Defendants above—in preparing and submitting its pre-IND meeting request and submission package for ENOB-CV-01 to the FDA on September 7, 2021.

Enochian would not have submitted a pre-IND meeting request to the FDA had it known that Defendants fabricated the ENOB-CV-01 AAV study.” [Pg. 33]

The company alleged Gumrukcu’s conduct amounted “to nothing short of brazen fraud, which has caused Enochian substantial harm.” The litigation is still ongoing as Gumrukcu sits in a Vermont prison awaiting trial for murder. [Pg. 3]

Enochian Later Claimed It Had “No Reason” To Doubt Gumrukcu’s Data, But CEO Dybul Had Innumerable Reasons To Doubt Gumrukcu While At Enochian, Including Felony Charges, A History Of Fraud Allegations And Conflicting Professional Biographies

CEO Mark Dybul, has repeatedly claimed he was either unaware of the various red flags surrounding Gumrukcu, or that the company had “no reason” to doubt Gumrukcu’s therapeutic data. [Pg. 17]

However, Dybul has had ample reason to doubt Gumrukcu’s alleged therapeutic breakthroughs during his ~6-year tenure at the company, including ~3 as CEO:

- In December 2018, Enochian CFO Robert Wolfe was terminated for raising concerns of “serious financial improprieties” related to the hiring and compensation of Gumrukcu, who Wolfe noted was a convicted felon. Mark Dybul was on the board of directors at this time.

- In 2019, a series of articles was published on Seeking Alpha highlighting Gumrukcu’s questionable medical credentials and criminal history. Dybul was Executive Vice Chair of Enochian around the time.

- In January 2020, Dybul was questioned during an interview about a lawsuit in which Serhat illegally practiced sham medicine on a child who subsequently died, and absconded with the parent’s $253,000. Dybul refused to comment.

- During our initial investigation, we called then and current Chairman Rene Sindlev and asked if he knew of the history of felony charges against Gumrukcu. He responded, “We did.”

Dybul repeatedly failed to protect shareholders by ignoring this astonishing series of red flags relating to his prized scientist.

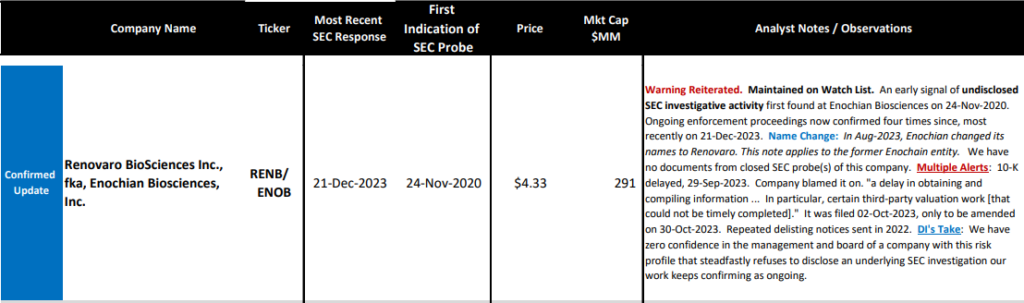

Renovaro Is The Focus Of An SEC Investigation Since November 2020 That Hasn’t Been Disclosed To Shareholders, According To Freedom Of Information Act (FOIA) Request Data From Research Firm ‘Disclosure Insight’

In a December 2023 interview, when asked about how he has dealt with the “drama” around Renovaro, “the Honorable” Mark Dybul stressed the importance of transparency during times of crises:

“In crises the most important thing is to stay focused on what your mission is, to remain humble and learn …and be very transparent…Be honest about what your problems are and what you’re trying to do, what your solutions are, and be transparent about them. And that’s precisely what we’ve done.”

Disclosure Insight (DI) is an investigative organization that uses Freedom of Information Act requests to discover whether companies are the subject of undisclosed SEC investigations.

According to DI, Renovaro has been the subject of an undisclosed SEC investigation since November 2020, which it confirmed as still ongoing as of December 21st, 2023. DI summed up their take on Renovaro as follows:

“We have zero confidence in the management and board of a company with this risk profile that steadfastly refuses to disclose an underlying SEC investigation our work keeps confirming as ongoing.”

CEO Dybul’s Leadership At Enochian Represents One Of The Most Incredible Failures Of Corporate Governance We Have Ever Seen

Yet, Despite The Circumstances, Not One Of The Company’s Executives Or Directors Resigned

Instead, 6 Months After The Murder Charges And 2 Months After Suing Gumrukcu For “Brazen Fraud”, The Board Elected To Pay Dybul A $100,000 Cash Bonus In 2022 On Top Of His $850,000 Annual Salary

The Enochian saga was one of the most bizarre and outrageous downfalls of a public company we had ever seen.

With virtually no remaining tangible assets, massive legal liabilities, and its co-founder and one of its largest shareholders in jail, one might have expected Mark Dybul and the board to have resigned in shame, dissolved the company or – at the very least – express contrition at the inexcusable lack of judgment in supporting one of the great con artists of our time.

Instead, the board and executive team seemed to just move on as though nothing happened. Nobody resigned and company officers began talking about the company’s origins – based squarely on a foundation of fraudulent conduct and faked data – as though it was a distant memory.

Just 6 months after the arrest of Gumrukcu, the company awarded Dybul a bonus of $100,000 for his “performance” during the catastrophic year, in addition to his annual salary of $850,000.

Part II: When All Else Fails, Change The Company Name, Pivot To “AI”, And Hope No One Notices

As of its March 2023 financials, Enochian was almost out of money, with just ~$3 million in cash compared to over $11.7 million in current liabilities. [Pg. 2]

With its largest shareholder in jail over allegations of murder for hire and wire fraud, the admission that much of its research was fake, a (still-undisclosed) regulatory investigation and with its reputation in tatters, Enochian as a company appeared to be a near-insolvent husk, consisting of little aside from a pile of legal liabilities.

In March And April 2023, Enochian’s Chairman Rene Sindlev Held Talks To Merge Enochian With A Company Called GEDi Cube

GEDi Cube Didn’t Even Exist At The Time. It Was Formed Months Later, In June

Forging forward with an upside down balance sheet, no revenue stream, and seemingly little to no business operations, the company’s management began seeking other “options to strengthen [the company’s] ability to advance its existing product pipeline and enhance stockholder value.”

Starting in April and May 2023, Chairman Rene Sindlev “conducted multiple calls and in-person meetings” with representatives of a company called GEDi Cube, which didn’t exist at the time, according to later company disclosures.

About a month later, on June 14th, 2023, GEDi Cube was incorporated in the UK, according to corporate records.[3]

On August 1st, 2023, Enochian BioSciences Filed To Change Its Name To Renovaro, Meaning “Renewal”, Signifying A Fresh Start

That Same Day, Renovaro Quietly Signed A Letter Of Intent To Merge With GEDi Cube

Rather than taking ownership over his haunting leadership failure, Dybul, along with the rest of the board, simply changed the name of the company.

On August 1st, 2023 the company reported filing a corporate amendment to change its name from Enochian BioSciences to Renovaro BioSciences. The word is a Latin variant for “renewal,” which Dybul says represents the company’s mission.

That same day, Renovaro CEO Mark Dybul and a director of GEDi Cube executed a letter of intent to merge the entities.

Also On August 1st, Insiders Including Chairman Rene Sindlev Quietly Acquired Millions Of Shares And Warrants At Effective Prices Ranging From $0.65 To $0.713 Per Share

To Profit Off The Deal, The Insiders Would Need The Stock To Rise On Significantly Higher Trading Volume

Enochian’s stock had languished following the unraveling of its dealings with Serhat Gumrukcu. By August 1st, 2023, its stock was ~$0.65, up slightly from June lows of ~$0.40.

On August 1st, Chairman and longtime shareholder Rene Sindlev participated in a financing with a $500,000 investment, per a Form 4 filed later, over 1 month past the legally required deadline. Sindlev received 70,126 preferred shares, convertible to 701,260 shares of common stock at $0.713 per share. Sindlev also received 350,630 warrants to acquire common stock at $0.65 per share.[4] [Pg. 1]

On the same day, another longtime shareholder, Dutch financier Ole Abildgaard, effectively acquired the rights to 3,436,190 shares of common stock for ~$0.713 per share and warrants to purchase an additional 1,718,095 shares of common stock at $0.65 per share, per a Form 3 filed almost 2 months past the legally required deadline.

For Sindlev and Abildgaard to profit off their August 1st stock acquisitions, they would need the stock to rise on significantly higher trading volume.

8 Days Later, Renovaro Finally Publicly Announced The Merger, Describing GEDi Cube As An “AI Company” Using “Cutting-Edge AI/Machine Learning Technology”

The Stock Spiked 83% On The Day, Trading Almost 34 Million Shares of Volume, 78.5x Higher Than The Preceding 30 Day Average Volume

Insiders Had Unrealized Gains As High As ~$27.8 Million On An Investment Of Less Than $3 Million, Based On Price Highs In October

On August 8th, Renovaro Chairman Rene Sindlev, CEO Mark Dybul and other representatives from both Renovaro and GEDi Cube met in Cannes, France, to discuss the merger.

Even though Renovaro CEO Mark Dybul had signed a letter of intent (LOI) to merge with GEDi Cube 8 days earlier on August 1st, they did not publicly announce the deal until August 9th:

The buzzword-laden press release, which mentioned AI five times, along with “machine learning” and AI industry heavyweight “NVIDIA”, had the desired effect—the stock spiked as much as 175% on the day, closing +83% after trading almost 34 million shares, 78.5x its average volume over the preceding 30 days.

Renovaro’s stock continued to climb in the following months on the hype and excitement of merging with a supposed cutting-edge AI company. By mid-October, it had risen as high as $5.18, up 1,195% from its June lows of ~$0.40 prior to the announcement.

Cumulatively, at the mid-October high of $5.18, Sindlev and Abildgaard’s opportunistic share purchases represented $27.8 million in paper gains in a matter of months.[5]

At The Time Of The Announcement, GEDi Cube Was A 2-Month-Old Entity With “No Operational History”, No Product, No Revenue And Virtually No Assets, According to Disclosures That Came 5 Months Later

GEDi Cube Basically Consisted Of A Term Sheet To Acquire An Entity Called Grace Systems, Which It Claimed Had AI Technology, According To The Later Disclosures

Investors buying into the claims from Renovaro’s merger press release were likely unaware that the company’s statements weren’t strictly accurate.

At the time, GEDi Cube apparently consisted of almost nothing at all, according to Renovaro’s disclosures months later in late December 2023. These disclosures acknowledged that GEDi Cube had “no operational history” at the time it was incorporated in June 2023. The same disclosures reported that GEDi Cube had no meaningful assets and could present no prior period financial statements.

The only key ‘asset’ it seemed to have was a “Binding Head of Terms” it had signed in June to acquire a tiny, nearly insolvent startup called Grace Systems.

Grace Systems Was A Tiny Startup With No Revenue, No Commercial-Ready Product After 10 Years, And Was Nearly Insolvent, Reporting $1,583 In Cash With ~$376,000 In Liabilities At Year-End 2022

In March 2023, Grace’s Co-Founder Announced He Was “Looking For A New Role”

In April 2023, A Grace Systems Subsidiary Filed For Bankruptcy In The Netherlands

Founded in 2013, Grace Systems was a Dutch data science startup that had “primarily incurred net losses since its inception” and had “never generated any revenue relating to its cancer diagnostics AI platform”, according to later Renovaro proxy filings.

Based on its financial statements, Grace Systems was borderline insolvent by mid-2023:

- As of December 2022, Grace Systems reported zero revenue and ~$376,000 in liabilities with just $1,583 of cash on hand. It had incurred ~$468,000 in reported losses in the first 9 months of the year. [Pgs. 137-8]

- In March 2023, the co-founder of Grace Systems, Frank Van Asch, posted on LinkedIn that he was “looking for a new role” and “#OpenToWork”.

- In April 2023, a Grace Systems’ subsidiary filed for bankruptcy in the Netherlands. [Pg. 146]

Grace Systems was unable to commercialize its technology over the last decade. According to Renovaro’s later disclosures detailing merger risks, it still hasn’t done so and may never be able to.

GEDi Cube Needed To Infuse €1 Million In Capital To Close The Deal To Own 51% Of Grace, According To Its Deal Terms, Implying A ~$2.2 Million Valuation Of Grace

But GEDi Cube Had Almost Nothing, So Renovaro Lent It $1.05 Million In Mid-August

Days Later, GEDi Cube Closed Its Deal With Grace Systems By Infusing Renovaro’s Cash Into The Nearly-Insolvent Grace Entity

Per its term sheet, GEDi Cube needed to provide €1 million to own 51% of Grace, implying a ~€1.96 million (U.S. ~$2.2 million) valuation of Grace.

But GEDi Cube apparently didn’t have the money because it, too, had almost no assets. As a result, days after GEDi Cube signed the August 8th letter of intent to merge with Renovaro, Renovaro made two loans to GEDi Cube that totaled $1.05 million (~€1 million) on August 11th and 18th.

Just 5 days after those loans, on August 23rd, GEDi Cube merged with Grace Systems, infusing Renovaro’s money into the deal – the combination of a decade-old, nearly insolvent and failed data science company with a newly incorporated shell.

The August merger with GEDi Cube, and simultaneous cash infusion, appears to have staved off Grace Systems’ failure, but the newly formed combined company was in an equally precarious financial position.

As of September 30th, 2023, GEDi Cube (then consolidated with Grace Systems) reported just €1,094,077 in assets and €2,247,165 in liabilities. [Pg. 137]

During Merger Negotiations, GEDi Cube Claimed A Valuation Of $225 Million, But Renovaro Rejected This As Meaningless Because GEDi Cube “Generated No Revenue And Had No Projections”

Renovaro Instead Relied On A “Due Diligence Report” From An Unnamed “AI Expert” “Consultant”

Renovaro Seemingly Used The Report To Negotiate Against Itself, Ultimately Agreeing To $275 Million In Consideration For GEDi Cube

During merger negotiations, GEDi Cube claimed a self-assessed valuation of $225 million. Given its history the proposed valuation was clearly absurd. Renovaro rightly “did not give any weight to the valuation” because GEDi Cube “generated no revenue and had no projections”.

Then things got weirder.

One closing condition of the deal was that Renovaro hire an investment bank to provide a fairness opinion on the value of GEDi Cube. However, Renovaro discarded this condition, meant to protect its own shareholders, based on GEDi Cube’s “lack of financial projections” which it claimed would render a fairness opinion not meaningful. (Note that investment banks regularly provide fairness opinions on pre-revenue technology and biotech companies.)

Instead, Renovaro enlisted an unnamed “AI Expert” to provide a due diligence report. [Pg. 57]

The unnamed AI Expert expressed “confidence in the viability and the potential for commercialization of GEDi Cube’s technology and platform.”

Based on the “confidence” of the unnamed consultant, CEO Mark Dybul seemingly negotiated against himself, settling on “exchange consideration,” of $275 million in shares for the transaction.

On January 25th, 2024, shareholders voted in favor of the GEDi Cube merger.

Effectively, Renovaro has nearly completed the most bizarre merger we have ever seen, whereby Renovaro lent $1.05 million to a newly-formed GEDi Cube entity for GEDi Cube to buy a stake in a nearly-insolvent data science company at a mere ~€1.96 million implied valuation, only to have GEDi Cube then flip it to Renovaro for $275 million after CEO Dybul engaged in an apparently hard-fought negotiation against himself.

Despite The Company’s Eventual Admission That Much Of The Research By Its Magician Co-Founder And (Alleged) Murderer Was Faked, His Cancer Therapy Is Still The Company’s Lead Therapeutic Candidate

CEO Dybul Referred To The Therapy As “The Holy Grail Of Cancer Research” In A January 2024 Letter To Shareholders

Dybul Now Claims That GEDi Cube’s AI Can Provide A “Multiplier Effect,” Helping Enhance The Company’s Upcoming Human Clinical Trials

Despite the company’s claim that Gumrukcu had engaged in “brazen fraud” by faking scientific data, Mark Dybul remarkably still expects shareholders to believe in the storyline that Gumrukcu’s work on cancer was legitimate.

The former magician’s cancer therapy, RENB-DC-11, is still the company’s lead therapeutic candidate.[6] Dybul cited another doctor and referred to it as “the holy grail of cancer research” in a January 16, 2024, shareholder letter.[7]

In the same letter, Dybul referenced how AI can help revolutionize and accelerate the commercialization of “AI-powered products,” writing that the combination of Renovaro and GEDi Cube could have a “potential multiplier effect.”

In an investor deck published on December 1st, 2023, Renovaro wrote, in a slide titled “what makes our combination so compelling?”:

“We will have the ability to inform and design clinical trials with insights from the deep learning of GEDiCube. We expect this will enable Renovaro to make adjustments for their upcoming human clinical trials”. [Slide 6]

Note that Dybul and the company hope to begin human trials for this cancer treatment later this year:

“The company expects to begin human Phase 1/2 clinical trials of its leading candidate for pancreatic cancer and other solid tumors with poor life expectancy by the second half of 2024.”

Renovaro Repeatedly Touted The Hiring Of “Visionary” Former Intel/Nvidia Executive, Craig Rhodes, As CEO Of GEDi Cube

Many Shareholders Undoubtedly Voted In Favor Of The Deal Based On Rhodes’ Background And Involvement

But Craig Rhodes Resigned In December 2023, A Month Before The Vote, According To A Direct Email Confirmation From Rhodes

We Found No Disclosure Of The Key Resignation To Shareholders

Renovaro has also repeatedly highlighted the experience of Craig Rhodes, CEO of GEDi Cube, as key to the credibility of the transaction.

In Renovaro’s August 9th announcement of its intent to merge with GEDi Cube, Rhodes was hailed as having led “life sciences groups at Intel, Oracle, and most recently, NVIDIA”.

On October 2nd 2023, Renovaro’s SEC filing announcing the signing of the definitive agreement to merge was even more lavish with its praise of Rhodes, calling him a “visionary” inventor who would lead the company’s AI efforts:

“Visionary Craig Rhodes, CEO of GEDiCube, former head of Life Sciences for Europe, the Middle East, and North Africa at NVIDIA, and before that, the leader for the AI divisions of Intel and Oracle. His pioneering partnership brings AI to frontline cancer diagnosis and treatment. Craig’s team has already developed proprietary, award-winning technology that can detect lung cancer early with remarkable accuracy. He will lead Renovaro.AI.”

However, on January 8th, 2 weeks before shareholders voted on the merger, corporate filings in the UK show that Craig Rhodes resigned as director from GEDi Cube.

We emailed Rhodes to ask whether he was still CEO, despite the director resignation filing. He confirmed unequivocally that he is no longer involved in the company at all, writing “I am no longer the CEO and I do not work for GEDi anymore”.

When we followed up asking when he left the board and CEO roles, he replied “end of December on both accounts”.

Shareholders who voted in favor of the merger based on his involvement likely would have been unaware of this critical departure.

Renovaro Also Hailed The Appointment Of Lester Russell As GEDi Cube’s Chief Medical Officer In An August 2023 Press Release

Russell Also Resigned In December 2023, Also With No Apparent Disclosure To Renovaro Shareholders, According To A Written Confirmation From Russell

On August 21, 2023, weeks after announcing its intent to merge with GEDi Cube, Renovaro issued a press release announcing its excitement over the appointment of Lester Russell, a “seasoned expert in clinical medicine and digital health” according to Mark Dybul’s quote in the release.

We reached out to Russell to learn the status of his role. He responded via LinkedIn message saying that he left the company on December 31st, 2023, and referred us to Dybul for any further questions.

Renovaro And Dybul Repeatedly Highlighted GEDi Cube’s “Strategic Partnership” With Nvidia As A Key Justification For The Merger Transaction

Reality: The Nvidia “Partnership” Is A Free Program Over 17,000 Companies Have Joined

Like many stock market scams, Renovaro’s seemingly exciting growth initiatives contain half-truths, at best, that fall apart under even basic critical analysis.

For example, following Renovaro’s signing of a definitive merger agreement with GEDi Cube, ‘the honorable’ Mark Dybul penned a shareholder letter on October 2nd 2023. The letter referenced GEDi Cube’s relationship with Nvidia as a key justification for the transaction, saying that the merger:

“…resulted from a carefully considered strategy to combine strengths and synergize work to elevate patient care by harnessing GEDiCube’s AI technology and its strategic partnerships, including with NVIDIA’s inception platform”.

Other communications such as Dybul’s January 16th, 2024, letter similarly highlighted how GEDi Cube had become a “formal inception partner” of Nvidia.

The company’s communications, however, failed to mention that the “partnership” is a free program for startups that virtually any company can sign up for. As highlighted on Nvidia’s website, over 17,000 companies have joined the same program.

The requirements of the program aren’t exactly rigorous. Companies must have at least 2 people, “a functional website”, and have been incorporated sometime within the past 10 years, per the Nvidia membership form.

In The Months Leading Up To The Close Of The Merger, Renovaro Enlisted Stock Promoters, Including One Previously Sanctioned By The SEC, To Help Hype Up The GEDi Cube Deal And Pump Its Shares To Retail Investors

Over the last several months, Renovaro and Dybul have been featured in a series of YouTube videos, podcasts, and other financial media.

While this attention may seem like organic “buzz” driven by Renovaro’s GEDi Cube merger, a closer analysis reveals that almost all the content has been published by paid stock promoters, some of whom have been sanctioned by regulators such as the SEC.

For example, on November 21st, 2023, Renovaro was featured in an article from InvestorBrandNetwork (IBN).

IBN is controlled by a stock promoter named Michael McCarthy, who was sanctioned by the SEC in 2017 for the fraudulent promotion of two biopharma companies, both of which collapsed after also being charged by the SEC.

IBN discloses that Renovaro is currently paying $39,000 per quarter for its “investor relations” services.

Another bullish article on Renovaro was published on Nasdaq.com by “investor relations exec” Ari Zoldan.

While novice investors may at first glance believe the article is endorsed by the Nasdaq exchange, the article discloses that contributor Ari Zoldan is the CEO of Quantum Media Group. Renovaro is a client of Quantum’s, according to the article’s disclaimer, indicating that the eye-catching title is simply the beginning of another paid puff piece for Renovaro.

In November 2023, a YouTube interview with Mark Dybul was published highlighting Renovaro’s cancer pipeline and pending AI merger.

The publisher was Proactive Investors, a well-known paid stock promotion outfit that discloses Renovaro as a client.[8]

Renovaro’s slew of paid stock promoters are associated with the worst of wall street- often promoting worthless penny stock scams to retail investors who hope to get in on the next big trend.

Part III: Transparency From An Unlikely Source

Serhat Gumrukcu’s Husband Sued Renovaro’s Key Executives And Financiers In January 2024, Alleging A Range Of Securities Law Violations By CEO Mark Dybul, Chairman Rene Sindlev, And Others

On January 16th, 2024, in the run-up to the merger vote, Renovaro filed a bizarre amendment to its proxy statement in response to a legal threat and “demand letters” sent to the company by unnamed stockholders.

The company said it believed the allegations in the letters were “meritless” but decided to provide more disclosures around the transaction anyway, including a critical disclosure describing the bizarre valuation process that resulted in the exorbitant merger consideration.[9]

The company failed to disclose that the demand letters and legal threat had apparently been sent by none other than the husband of jailed former magician and key Renovaro shareholder Serhat Gumrukcu.

On January 23rd, 2024, Gumrukcu’s husband filed a shareholder lawsuit in the Central District of California against several of Renovaro’s executives, stockholders, and partners including CEO Mark Dybul and Chairman Rene Sindlev.

The lawsuit includes allegations of corporate waste, breach of fiduciary duty, and unjust enrichment by Renovaro insiders. [Pgs. 4-5]

According To The Complaint, Chairman Rene Sindlev Purchased Significant Renovaro Stock While In Possession Of Material Non-Public Information Relating To The Merger

Perhaps most alarmingly, the lawsuit alleges that Renovaro insiders “continue to unlawfully profit off material nonpublic information related to Renovaro” and highlights several well-documented examples to support the claim. [Pg. 6]

The suit highlights two individuals – longtime shareholders Rene Sindlev and Ole Abildgaard– who purchased Renovaro stock and options before the release of material nonpublic information related to the GEDi Cube merger. It also identifies Lincoln Park Capital, a financier:

“Renovaro’s [Board] has engaged in a troubling pattern of authorizing transactions with insiders …on terms grossly unfair to Renovaro and its stockholders. In most instances, these transactions were effective just ahead of Renovaro’s release of positive material non-public information (MNPI).” [Pg. 9]

The lawsuit called the purchases a “manipulative scheme”, evidencing how insiders like Chairman Rene Sindlev helped orchestrate the GEDi Cube transaction while also buying cheap shares of Renovaro just ahead of the public announcement of the deal. [Pg. 27]

According To The Complaint, Mark Dybul Is Engaged In A “Wink And Nod Scheme” With Renovaro Financier Lincoln Park Capital, Whereby Renovaro Provides Non-Public Information To Lincoln Park Ahead of Key Company News To Help Lincoln Park Trade Against Renovaro’s Own Shareholders

In July 2020 and June 2023, Renovaro entered into two Equity Line Of Credit (ELOC) agreements with financier Lincoln Park Capital whereby Renovaro could require Lincoln Park to buy Renovaro stock. [Pg. 15, Pg.]

According to the complaint by Gumrukcu’s husband, Renovaro and Lincoln Park were engaged in a “wink and nod scheme” whereby Renovaro sells shares to Lincoln Park at “spring-loaded prices” shortly before positive news.

The complaint highlights that in June 2021, Renovaro sold shares to financier Lincoln Park immediately prior to a June 14th announcement of a Pre-IND submission to the FDA and a $29 million stock offering that caused shares to more than double to an intraday high of $12.99.

In another example, the complaint alleged that CEO Dybul coordinated with financier Lincoln Park to immediately begin dumping shares to investors should the stock pump on a positive news release:

To date, Renovaro has paid 835,588 shares to Lincoln Park as a fee for the two agreements, worth approximately $2.8 million at yesterday’s closing price of $3.36.

Gumrukcu And His Husband Are Still The Largest Holders of Renovaro (Formerly Enochian), Owning Nearly 19 Million Shares Or ~28% Of the Company

The Family Of Gumrukcu’s Murder Victim Sued Him For Wrongful Death, And The Court Froze 12.8 Million Of His Enochian Shares To Cover The Potential Damages

Gumrukcu’s Husband Still Controls 3.6 Million Shares That Are Free To Trade, As Of An Order In Late October 2023

With Gumrukcu’s Murder Trial Scheduled For Later This Year And With Mounting Civil Litigation Costs, We Expect His Husband Will Dump This Stock Imminently

Meanwhile, following the Department of Justice indictment against Gumrukcu, the family of the murder victim has sued, alleging wrongful death. The court froze 12.8 million of Gumrukcu’s shares, approximately 19% of Renovaro’s outstanding stock, as potential compensation should he lose the case.[10] [Pg. 6]

Gumrukcu’s husband controls 3.6 million shares which are not subject to the freeze, as of a court order on October 27th, 2023. [Pgs. 7, 9]

Given Gumrukcu’s upcoming criminal trial scheduled for October 2024, along with legal costs due to lawsuits from both Renovaro and the family of the murder victim, we expect Gumrukcu’s husband will seek to liquidate this stock at the earliest possible opportunity.

Conclusion: There’s No Magic Here—Just A New Name And The Same Shameless Scammers, In Our View

Disclosure: We are short shares of Renovaro Biosciences, Inc. (NASDAQ: RENB)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Anticipating that the company would attempt to remove evidence of its deep connection with Serhat Gumrukcu, we saved the video and re-uploaded it.

[2] The Department of Justice alleged that Gumrukcu conspired with Berk Eratay, another Turkish magician, to help arrange the murder. Eratay specializes in a form of illusion he calls “Biokinesis”, or the ability to edit ones own genes with your mind.

[3] GEDi Cube Intl. Ltd., was “initially incorporated in June 2023”. Note that post-acquisition of Grace Systems in August 2023, the entity then assumed the corporate history of Grace Systems which dates to 2013.

[4] Per the SEC requirements, “Form 4 must be filed within two business days following the transaction date.” Given the transaction date of August 1, 2023, Sindlev’s filing of the form on September 10th, 2023 was well past the statutory deadline, depriving investors of the knowledge that the Chairman bought securities mere days ahead of a material, non-public deal transforming the entire the company.

Abildgaard’s form 3 was filed even later, on October 6, 2023. Per the SEC requirements, “Form 3 must be filed within 10 days after the person becomes an insider”

[5] Calculated based on Sindlev and Abildgaard acquiring the rights to 4,137,450 shares of common stock at $0.713 and 2,068,725 warrants with a strike price of $0.65 for a total of for $2,950,000, and then subtracting this amount from the total value of these shares and warrants at the October 10th closing high price of $5.18.

[6] The “DC” in the treatment name refers to dendritic cells. Gumrukcu holds a patent for dendritic cell cancer therapy. The treatment was previously referred to as ENOB-DC-11 when the company was named Enochian and was later renamed RENB-DC-11.

[7] The company still reported $54 million in assets and goodwill related to Gumrukcu’s therapies, which are featured in the therapeutic pipeline, and which represented 94% of the company’s total assets, as of its last reported September 2023 financials.

[8] Per the ProActive Terms & Conditions, “In exchange for publishing services rendered by the Company on behalf of any issuer named on the Site, including the promotion by the Company of the issuer in any Content on the Site, the Company receives from said issuer annual aggregate cash compensation in an amount equal to Twenty Five Thousand dollars ($25,000).” Renovaro appears on that list.

[9] Days later, on January 24th, clearly in response to the demand letters, Chairman Rene Sindlev filed 10 ownership disclosure updates nearly simultaneously, amending prior shareholding disclosures from 2016 to 2023. [1,2,3,4,5,6,7,8,9,10]

[10] Based on Renovaro’s outstanding shares totaling 66,698,144 as of 11/14/2023 which does not factor in the pro-forma issuances implied by the merger. Note that while the court references the 12.8 million shares controlled by Gumrukcu several times in the order, the court later references “13.8 Enochian shares” which appears to be a typo.