Summary: PharmaCielo (TSXV:PCLO / OTC:PCLOF)

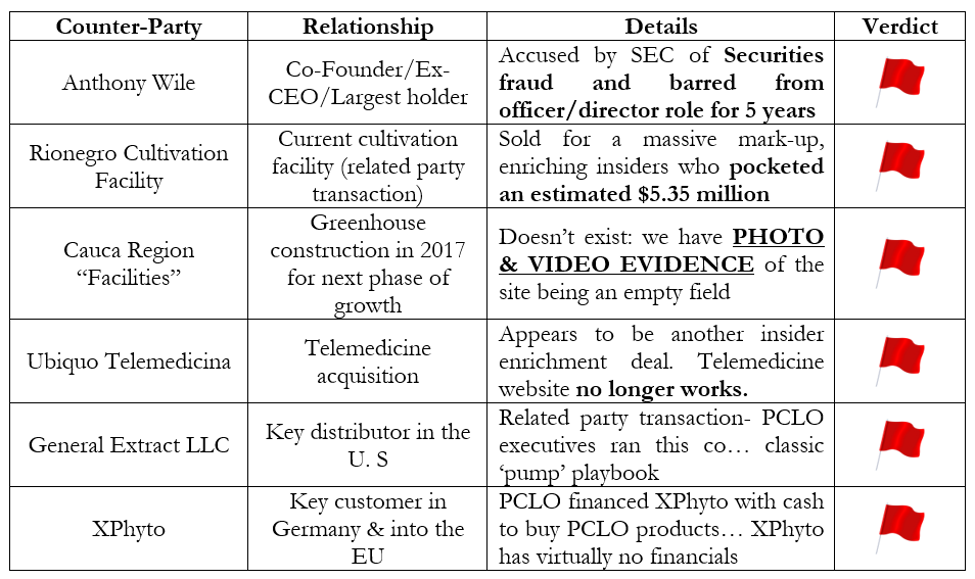

- We believe PharmaCielo is nothing more than the latest self-enrichment scheme drummed up by its co-founder Anthony Wile, who had been charged by the SEC over allegations of securities fraud, stock promotion and market manipulation in the past.

- Wile co-founded PharmaCielo just prior to finishing serving a 5-year officer and director bar that he consented to in 2010 as part of a settlement stemming from the SEC charges.

- Unbeknownst to investors, PharmaCielo’s key operating property in Rionegro, Colombia was purchased through a bankrupt company co-founder (Federico Cock-Correa) via a Panamanian entity linked to Anthony Wile. It was then sold to PharmaCielo at a massive markup, allowing insiders to enrich themselves by an estimated $5.35 million by stepping in the middle.

- The company announced it was building greenhouse facilities on newly-purchased land in Colombia’s Cauca region in 2017. We visited the land and found the greenhouses don’t exist. The site is nothing more than an empty field covered in weeds. (We have photos and video)

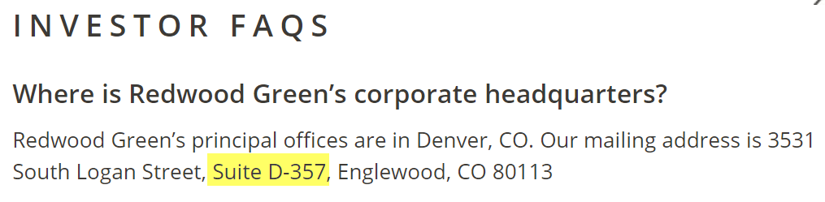

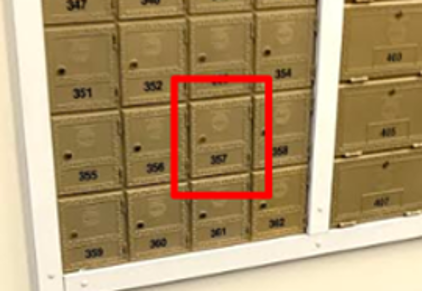

- PharmaCielo recently announced a U.S. distribution deal with an opaque company called General Extract LLC. We found that this is yet another undisclosed related party deal, involving PharmaCielo’s former COO. General Extract’s parent company corporate address (“Suite D-357”) was actually a mailbox at a Colorado UPS store.

- PharmaCielo’s other main partnership, a distribution deal with nanocap company XPhyto, appears to be little more than a shell game. PharmaCielo is supplying XPhyto with cash so XPhyto can turn around and buy PharmaCielo’s products.

- The company is running low on cash, with an estimated $11.7 million remaining. We believe the company’s back is against the wall and, accordingly, expect a dilutive capital raise in the near future.

- The company’s Rionegro cannabis oil processing centre, a key element of its plan to export oils, remains unfinished after almost 6 months of delays.

- According to local sources, the Rionegro greenhouse facilities have issues with mold and residual pesticides from the flower-growing operation that preceded the company’s use of the facility.

- Co-founder Anthony Wile has been hitting the bid recently, dumping 200,000 shares of his then 13 million shares of the company just days before PCLO’s CEO issued a shareholder letter telling investors that insiders were “confident holders”.

- PharmaCielo has property, greenhouses, licenses, and some residual cash. But with essentially no revenue, continued cash burn, and management’s track record of self-enrichment and the co-founder/former CEO’s history of securities fraud charges, we believe PharmaCielo ends up as a total loss for investors.

Initial Disclosure: After extensive research, we have taken a short position in shares of PharmaCielo through PCLOF, its U.S. OTC ticker. This report represents our opinion, and we encourage every reader to do their own due diligence. Portions of our research for this report required on-the-ground conversations with locals in Colombia. Given the volatile nature of the political climate in the country, we have removed several source names from the report. However, those names can and will be made available to regulators and/or government entities upon request. Please see our full disclaimer at the bottom of the report.

Background: Basics on the Company and the Bull Thesis

PharmaCielo trades on the TSX Venture exchange and U.S. Over-the-Counter Market (“OTC”) under the symbols PCLO and PCLOF, with a market cap of roughly $200 million as of this writing.

The company describes itself as focused on cultivating, processing and supplying all-natural medicine-grade cannabis oil extracts to large channel distributors via its greenhouse facilities in Colombia.

PharmaCielo’s Colombian operating subsidiary owns 2 properties:

- 12 hectares of open-air greenhouses and a processing & extraction facility situated on a 27 hectare property in Rionegro.

- A 3.6 hectare property in Northeastern Cauca, where PharmaCielo has a contract-production partnership deal with a 63 person cooperative called “La Cooperativa Unidad del Norte” (aka Caucannabis)

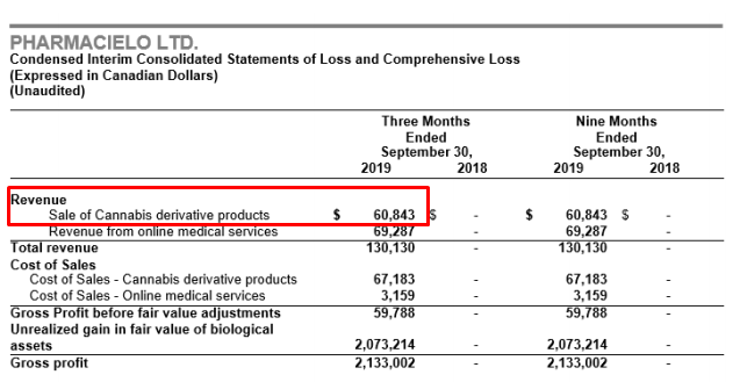

PharmaCielo has generated only $60,843 in cannabis revenue throughout the life of the company [Pg. 3], but the bull thesis seems to focus on:

- PharmaCielo’s first-mover advantage in Colombia;

- Its ability to eventually become a low-cost producer of cannabis; and

- Its ability to monetize both its existing facilities and expand through different cooperative farming deals.

The company has greenhouses that are currently growing cannabis in Rionegro, as corroborated by photographs taken last week as part of a touring of its facilities by the Colombian Justice Minister:

Sell side reports tout the company’s “multi-year supply agreements” in the U.S. and Europe as key selling channels.

Cormark Securities (which underwrote the company’s August 2018 financing and advised on a prospective acquisition) has consistently rated the company a “buy”. In Cormark’s research initiation, it specifically touted PharmaCielo’s management team as a key strength:

Reality Check: Multiple Undisclosed Related-Party Transactions with Insiders, Supply Agreements with Apparent Shell Companies, ‘Greenhouse’ in Cauca Region is an Empty Field, Co-Founder Previously Targeted by SEC and an Imminent Need for More Capital

Our research, which has included extensive, on-the-ground research in Colombia and in the U.S., has revealed to us that the company’s prospects differ sharply from management’s narrative. Through our research, we found:

- The co-founder and former CEO of PharmaCielo has a track record of securities fraud, according to SEC allegations. He settled the charges in 2010, agreeing to a 5-year ban from being an officer or director of a public company. He co-founded PharmaCielo while still barred as a public officer/director, then took it public shortly after the ban expired.

- The company’s key Rionegro Colombian facility appears to have been purchased in an undisclosed related party transaction though PharmaCielo’s bankrupt co-founder. Insiders enriched themselves by first purchasing the rights to the property into a newly-formed Panamanian entity (set up 3 DAYS prior to the deal), then re-sold it to the company at inflated prices, pocketing an estimated $5.35 million by stepping in the middle.

- The company’s key 3.6 hectare ‘operation’ in Colombia’s Cauca region is actually just an empty field (we have pictures and video). We confirmed this with local leaders of a farming co-op that struck a deal to grow cannabis with the company.

- PharmaCielo disclosed paying over $865,000 for the land in Cauca, including 201,000 shares. Yet local land records show that the Cauca land was sold for only ~$127,000. Co-op leaders confirmed the price and stated that they received no shares as part of the transaction. We hypothesize that the ‘missing’ money may have yet again found its way to insiders.

- The company’s odd acquisition of a telemedicine platform appears to have been part of a quid pro quo where (a) PharmaCielo bought the company from an investor in exchange for (b) the investor allocating money to a different company founded by a PharmaCielo co-founder.

- The company’s U.S. distribution partner is actually yet another undisclosed related-party deal with a company that appears to have limited to no credible operations.

- PharmaCielo has generated only $60,843 in cannabis-related revenue despite years of development.

- As it appears a large amount of money has gone to enrich insiders, the company likely needs cash imminently in order to maintain operations and complete its oil processing facility, a key component of its plan to export cannabis oils.

- The company’s main facility in Rionegro may be troubled with mold and pesticide contamination, likely originating from the flower-growing operation that preceded PharmaCielo’s assumption of the facilities, according to local sources we spoke with. In addition, Rionegro planning authorities say one-third of the land is unusable due to environmental restrictions and the risk of flooding.

We have a 1-year price target of $0 based on the company’s lack of meaningful revenue ($130k since inception), continued losses, whittling cash (estimated at $11.7 million as of this writing) [1] and incredibly questionable management behavior.

Leadership: PharmaCielo’s Co-Founder, Former CEO and “Backer” Anthony Wile Had Previously Been Accused by The SEC of Stock Manipulation. We Think He’s Back at It Again.

They say the tone is set at the top. PharmaCielo’s co-founder, largest shareholder, “backer” and former interim CEO/Director, Anthony Wile, has a history of stock manipulation and pump and dumps, according to SEC prosecutors.

Anthony Wile listed himself as co-founder of PharmaCielo Ltd. on his recently-deleted LinkedIn page (that disappeared during the course of our investigation, around February 24, 2020. We archived it on February 2, 2020.) On the same page, he stated that he had been involved in PharmaCielo’s operations since the company was established, which was in 2014.

He listed his work experiences dating back to 2007, but he left out this key detail from earlier in his career:

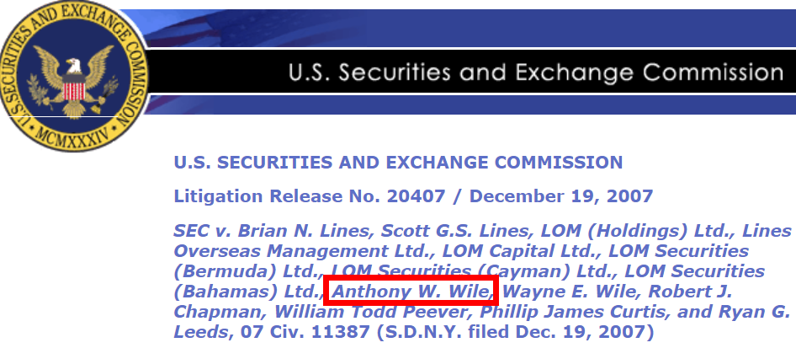

In 2007, Wile was listed as a defendant in a civil injunctive action filed by the Securities and Exchange Commission, which alleged that he issued deceptive press releases, promotional materials, and created a misleading website to tout a publicly-traded mining company. Wile was also accused by the SEC of “orchestrating touting”, a “manipulative stock trade on the open market to create an inflated market” and disseminating “materially false and misleading information to the market.”

As a result, the SEC sought a permanent bar to prevent Wile from serving as an officer or director of any public company, but Wile settled the SEC charges in 2010 for a 5-year ban and a civil penalty of $35,000.

Before the ban ended in 2015, however, Wile was already on to his next project, co-founding PharmaCielo in 2014.

Leadership: PharmaCielo’s Other Co-Founder and Former CEO/Director Federico Cock-Correa Was in the Midst of Bankruptcy Proceedings Upon His Recruitment to The Company

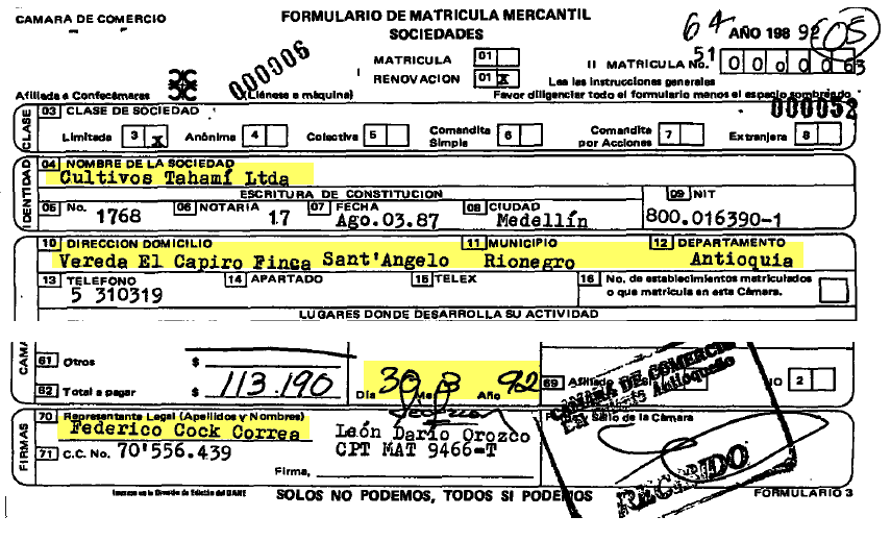

Aside from Wile, Federico Cock-Correa is a company co-founder, former CEO of PharmaCielo Holdings (the Colombian operating entity) and current board member of PharmaCielo Colombia. Cock-Correa has a background in horticulture and has previously owned and operated flower and greenhouse businesses in Colombia’s northwest Antioquia province.

According to our research, Cock-Correa was experiencing a period of severe financial distress during the time he linked up with Anthony Wile. One local source told us the following:

“At PharmaCielo one of the founders brought in a bankrupt flower grower. That was the first mistake. They also made a mistake in the area they chose.”

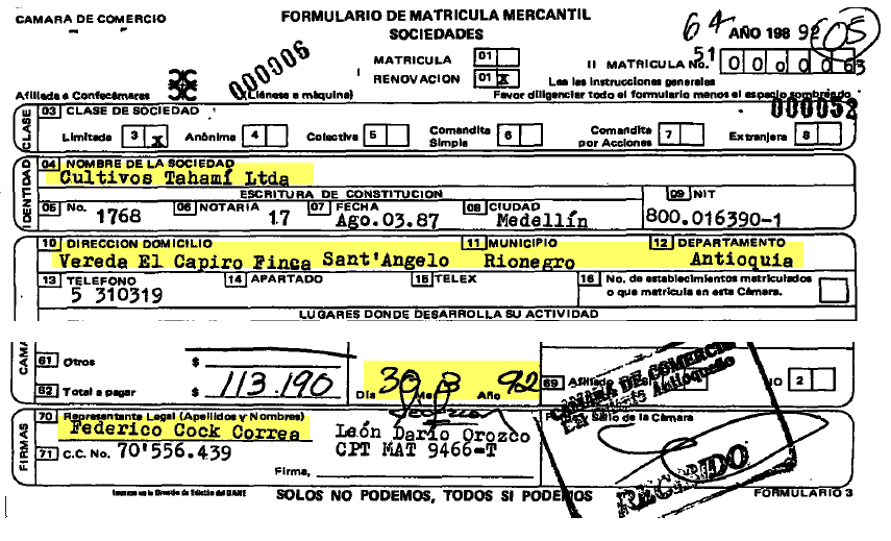

Colombian corporate records corroborate this. The current name for Cock-Correa’s key flower growing business on its incorporation certificate is “Tahami y Cultiflores SA En Reorganizacion” [In Reorganization]. The certificate shows the company formally agreed to a restructuring deal (broadly equivalent to U.S. Chapter 11 Bankruptcy proceedings) on June 6, 2014.

But the problems stretch back much earlier, to at least 2011, with court insolvency rulings, and bank embargos on Tahami’s greenhouse facilities.

Cock-Correa and his family continue to run Tahami and are still paying off their debts. Under the terms of the insolvency deal, the debt repayments run for a 10-year period (2014-2024). Creditors include two banks, pension funds and the government tax agency.

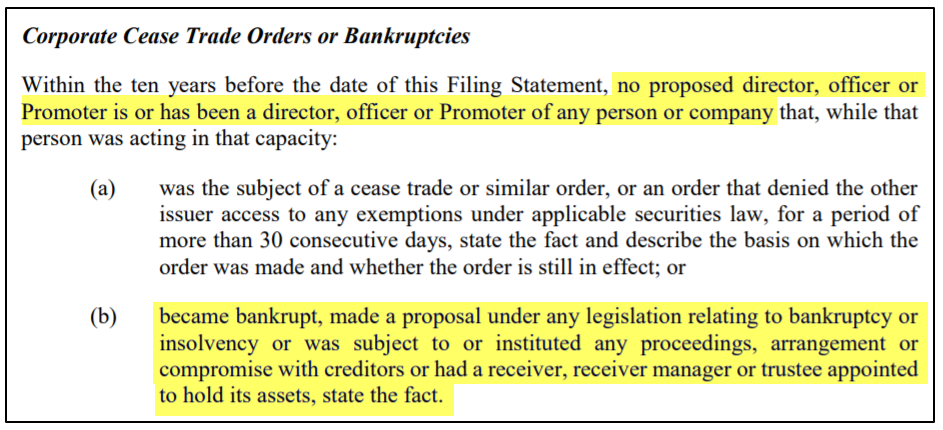

Critically, none of this seems to have been disclosed to investors. On the contrary, PharmaCielo’s filing statement from January 2019, the foundational document detailing the business and its risks, states unequivocally that no director or officer of the Resulting Issuer (PharmaCielo), had been acting as the representative of any company that had become bankrupt or subject to any insolvency proceedings within the past 10 years: [Pg. 76-77]

This appears to be a major misrepresentation. Cock-Correa had a company that became insolvent and had been in reorganization prior to the filing, during the date of the filing, and is still to this very day.

Furthermore, the bankruptcy is inexorably linked to PharmaCielo. Prior to PharmaCielo’s purchase of the Rionegro property, Tahami had operated the very same property since as early as 1992, per this filing we pulled from the Rionegro Chamber of Commerce:

Both companies even operated side-by-side on the same premises during 2016, according to company registration documents. [1,2]

A local source confirmed to us that Wile helped financially support Cock-Correa during his insolvency period. The financial support does not appear to have been an act of charity, however.

Undisclosed Related Party Transactions: The Company’s Key Property in Rionegro, Colombia Was Bought Through PharmaCielo’s Co-Founders

When looking into the company’s key greenhouse facility in Rionegro, we came across the first of several instances of apparent insider self-dealing involving either Anthony Wile or Federico Cock-Correa, the company’s co-founders.

Central to almost all of PharmaCielo’s business ambitions is the company’s “headquarters and principal cultivating facility” in Rionegro, Colombia which the company touts on its website, in press releases and is often referenced in analyst reports about the company.

The company announced the purchase of the site in July of 2016, per this press release, which called it a “significant milestone”, and disclosed that the company paid $5.02 million in cash and 1.7 million in equity shares for the purchase, equating to a total estimated purchase price of $8.85 million.[2] The deed was signed on June 1, 2016, one month earlier.

We checked local land registry documents and found that the total land sale (which consisted of two parcels, with the second sold on August 30, 2017) cost only about $3.5 million USD. [Plot 1, Plot 2] This was a wide discrepancy from the value that PharmaCielo had announced in its press release ($5.02 million in cash and 1.7 million equity shares).

We had our Colombian investigator look into the deal further. What we found was that the property was bought in what appeared to be an undisclosed related party transaction through PharmaCielo’s co-founder, Federico Cock-Correa.

Local real estate records [1,2] show that the property was owned by four siblings with the surname Uribe Villegas. Our investigator consulted two of the prior sibling owners by phone, in February 2020. Neither would confirm the purchase price, but one (Pedro Javier Uribe) directly contradicted the PharmaCielo press release that indicated the purchase included 1.7 million in shares:

“We received payment in cash. Maybe we got something like 3 percent of the value of the farm we got in shares. But 1.7 million shares? No, no no, no. That’s a lot. No we got much less.” (Note that we have this conversation on audio.)

Undisclosed Related Party Transactions: PharmaCielo Purchased the Land from a Panamanian Entity Connected to Anthony Wile That Had Been Formed a Mere 3 Days Before the Deal

It struck us as odd that PharmaCielo announced paying millions more for the land than the actual owners seemed to receive, according to both real estate records and our conversation with an owner.

In the available public documents [1,2], the deal appeared to be a basic transaction between PharmaCielo and the Uribe Villegas siblings.

But in Colombia, we learned, it is very common to sign purchase option agreements known as “promesas de compraventa” (translated as ‘promises of sale’) prior to the official signing of deeds or payment for the property. These are documents, usually but not always notarized, that are legally binding but are considered private documents and not available in the land registries.

In our conversation with prior owner Pedro Javier Uribe, he confirmed that the sale had taken place in this manner (we also have this conversation on audio):

“Before the sale, maybe six months, I don’t really remember well, we had drawn up a purchase option (promesa de compraventa). Here in Colombia that means you sign a paper saying you’d sell your property in a certain amount of time at a certain price.”

When asked specifically the name of the other party of the purchase option, he said:

“I don’t remember exactly who it was but it was another company of theirs. Part of PharmaCielo…I don’t know what the internal workings were.”

So, instead of an outright sale, the owners sold an irrevocable option to buy the land – but we found they didn’t actually sign it with PharmaCielo.

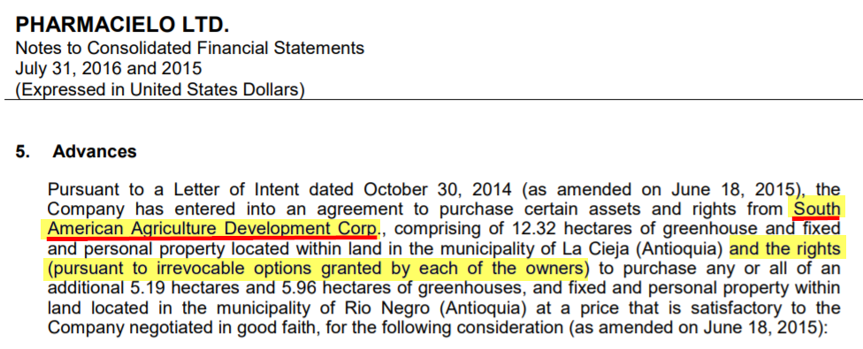

When we checked PharmaCielo’s filing statement, we found that rather than purchasing the property directly from its prior owners, the property and irrevocable purchase options were acquired through an entity called South American Agriculture Development Corp (“SAADC”). This is the only time the SAADC entity is mentioned in any of PharmaCielo’s filings: an audit on page 187:

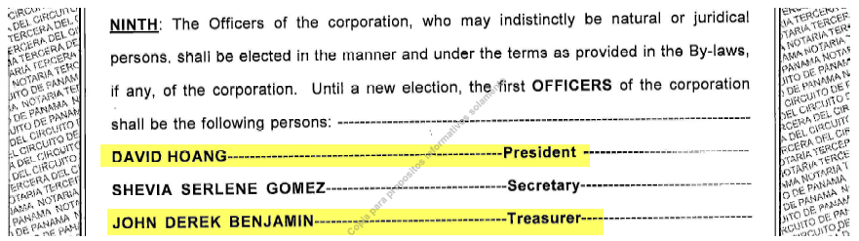

South American Agriculture Development Corp. (“SAADC”) is a Panamanian entity formed on October 27, 2014, per Panamanian corporate records. That date is just 3 days before PharmaCielo entered into a letter of intent to purchase its property and other assets on October 30, 2014. [Note 5]

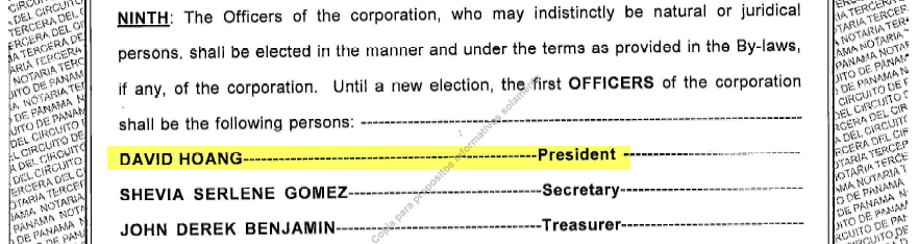

Critically, SAADC’s Panamanian corporate records also show a clear link to Anthony Wile. The entity lists David Hoang as its President and Director:

Hoang worked as Chief Trading Officer of High Alert Capital, a private investment firm where Anthony Wile served as Chairman & CEO, according to Canadian corporate records. High Alert was also linked to PharmaCielo in this 2016 British Columbia regulatory filing that shows it was the company’s largest shareholder, owning 11.6 million shares.

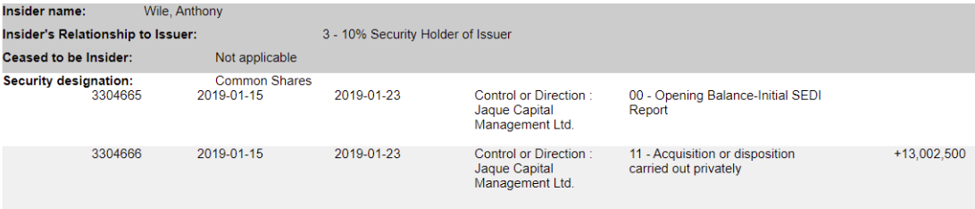

Later, Anthony Wile’s SEDI disclosures show that his private equity firm (Jaque Capital Management) had acquired 13 million shares in an acquisition “carried out privately”, which were likely ported over from High Alert.

One source in Colombia, who, when asked about the South American Agriculture Development Corp., told our investigator:

“I think that’s the company Tony and Cock (Correa) had together. I couldn’t swear to it but I heard them talking about it once that’s why it rings a bell.”

Per the audit notes in PharmaCielo’s filing statement, we see that the company advanced SAADC $2.8 million. [Pg. 187] That number matches the purchase price of the first Rionegro parcel, estimated at U.S. $2.88 million according to land registry records, almost to the dollar.[3]

In other words, PharmaCielo lent the money to SAADC to buy the property, then SAADC flipped the property right back to PharmaCielo at a mark-up.

Opaque disclosure records make it difficult to calculate the exact mark-up but we estimate Wile (and potentially Cock-Correa) pocketed an estimated $5.35 million in cash and shares by stepping in the middle of the company’s land deal.

We encourage Wile to release the exact figures SAADC paid to the original owners and specifically how much was netted in the short-term windfall.

“There’s Nothing There, Just Weeds”: PharmaCielo’s ‘Greenhouse Facility’ in Cauca Doesn’t Exist

In addition to obvious signs of insider self-enrichment at the company’s primary Rionegro facility, we found a similar pattern at the company’s second property in Colombia’s Cauca province.

By way of background, in 2017 PharmaCielo purchased a 3.6 hectare plot of land in the Cauca region, which for years has been plagued by civil discord fueled by the drug trade.

PharmaCielo came in and struck a partnership with a cooperative of Cauca indigenous and peasant farmers to help them transition from black market crops to legal crops. The company was hailed as a trailblazer, and the deal resulted in PharmaCielo being featured in a front page article in the New York Times:

PharmaCielo’s contract-production deal is with “La Cooperativa Unidad del Norte” (Caucannabis), a small farmers’ cooperative with about 63 members as of the time of the deal’s announcement.

In May 2017, PharmaCielo issued a press release with a headline that touted both its socially inclusive mission and a major step in that mission, establishing a greenhouse:

“PharmaCielo Encourages Social Inclusiveness of Colombian Cannabis Industry Strategy with Establishment of Greenhouse Facility in Cauca Department”

The same press release stated:

“The land purchase agreement is expected to be finalized and closed in the next month, with construction of the new greenhouse facility commencing immediately thereafter.”

The land purchase did close, per local land records. And in July, the company declared that it had already “established a 3.6-hectare cultivation operation” in the area.

Our investigator visited the Cauca property in February 2020, led by a senior member of the cooperative. He saw that PharmaCielo’s greenhouse facility in Cauca, first touted 2 years ago, simply doesn’t exist. Here is a picture of the location, and a video with a full panorama of the site:

[Click here to see the video of PharmaCielo’s Cauca ‘operation’]

Our investigator also spoke by phone with a senior member of the Caucannabis Cooperative. The senior member told us that Caucannabis had a five-year contract (2017-2022) with PharmaCielo under which the company purchased a 3.6 hectare plot near Corinto, Cauca, and agreed to cover the costs of organizing the plot and setting up a greenhouse facility according to the strict specifications of the Colombian Agrarian Institute (ICA), part of the Agriculture Ministry.

The license application was also made and paid for by PharmaCielo, the person said. They said that the cooperative, in alliance with PharmaCielo, planned to set up additional production facilities in the neighboring municipalities of Toribio and Jambalo. This was all to be part of the corporate strategy to create an ambitious network of hundreds of hectares of contract-grower capacity.

Since the cultivation license was issued in November 2017, the person said there has been no further investment, no greenhouse has been built and not a single cannabis plant has been sown.

The senior leader of the co-op who spoke with our investigator said:

“It’s been a long process because the law was modified and then the government changed. So far, we have not planted a single cannabis seed. PharmaCielo bought the plot and right now there’s nothing there. Just weeds.”

We emailed PharmaCielo’s investor relations asking about the current state of its operations in Cauca and have not heard back as of this writing.

Another Discrepancy Between the Price Indigenous Farmers Reportedly Received and the Price PharmaCielo Paid. Did Someone Step in the Middle?

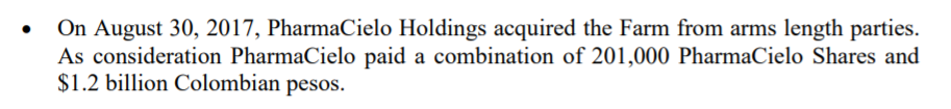

PharmaCielo paid a steep price for its now seemingly abandoned Cauca property. The company’s filing statement shows that it paid about US$875,000 in cash and shares for the land from “arms length parties”: [Pg. 39]

We asked a senior leader of the cooperative about the money PharmaCielo paid for the land, which had been bought from a sugar-cane farmer. We were told that they paid about 368 million pesos (or U.S. $127,250 at prevailing exchange rates) a difference of about U.S. $747,000 from the $875,000 price claimed in PharmaCielo’s filings.

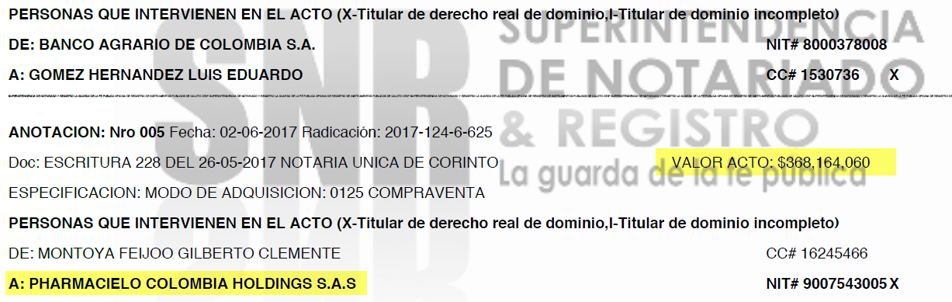

The 368 million peso number is corroborated by local land sale records pulled by our on-site investigator:

When asked whether the deal included shares, the same person told us:

“That was cash. Shares, never.”

The senior leader also confirmed the Cooperative – some of whose senior members witnessed the transaction—never heard any mention of shares as part of the deal, contrary to PharmaCielo’s disclosure of paying 201,000 shares.

We find these discrepancies troubling, and believe they could yet again be due to another intermediary stepping in the middle of the transaction.

When told of the price discrepancy, a senior cooperative leader said:

“That is a big, big difference. I can’t understand it. What would anybody do with all that money. Today I went out of my house with only 2,500 pesos in my pocket…less than a dollar. Just imagine what I could do if I had two dollars a day. And then just one person has all that money. 1.2 billion pesos you say? Just imagine if the cooperative had those funds. We could have got on and grown the cannabis ourselves by now.”

The Cauca Deal Was Touted as a Way to Help Local Farmers While Also Expanding PharmaCielo’s Operations.

From a Senior Leader of the Co-op: “We Are Worse Off Now Than We Were Then.”

Despite repeatedly touting its own positive impact on regional farmers, the reality is that PharmaCielo appears to be the latest multinational firm to take advantage of the Cauca farming community.

A senior leader of the co-op informed us that its farmers are now worse off as a result of its dealings with PharmaCielo:

“We got involved in this because we thought it was going to be a quick process and it has taken a very long time. Some of [us] used to grow marijuana illegally interspersed with legal food crops. But we had to pull the illicit crop when we signed this agreement. And now we have neither one thing nor the other. We are worse off now than we were then.”

Finally, the cooperative leader concluded, they were still hopeful, but the company seems to be blaming the government for the inactivity and washing its hands of the matter:

“PharmaCielo have told us they’re very worried about the situation but it’s out of their hands. It’s in the hands of the state. We have been talking about the situation but we haven’t been able to do anything. On top of all that because of the law and order situation it is going to be very difficult for us (the cooperative) to start operations in other towns, including Toribio and Jambalo. We’re still hanging in there. We haven’t given up yet. We want to do this but we’re losing motivation. After three years there have been no results and there’s only two years left on our contract.”

According to the same source, PharmaCielo intermediaries are telling the cooperative that licenses for psychoactive cannabis in the Cauca region may be withdrawn because of the public order situation (instability in law and order due to an uptick in political violence).

We contacted the Colombian government’s Justice Ministry to inquire about this. A spokesperson stated categorically that psychoactive cannabis licenses will not be withdrawn in Cauca province:

“That is not true. The licensing process will continue as normal.”

All told, we think PharmaCielo may just be offering excuses for why it has abandoned the indigenous farmers immediately after executing its suspicious land deal.

Undisclosed Related-Party Transactions: Signs of a Quid Pro Quo with PharmaCielo’s Telemedicine Acquisition (And Signs of Impairment – The Website No Longer Appears to Function)

PharmaCielo has reported a total of C$130,130 in revenue to date (figure not in thousands) [Pg. 3]. Of that, 53% (or C$69,287) has been generated through an acquired company called Ubiquo Telemedicina (“Ubiquo”).

PharmaCielo paid ~CAD $1.6 million for Ubiquo (consisting of C$880,000 in cash and 156,058 shares valued at $4.40 [Pg. 20])

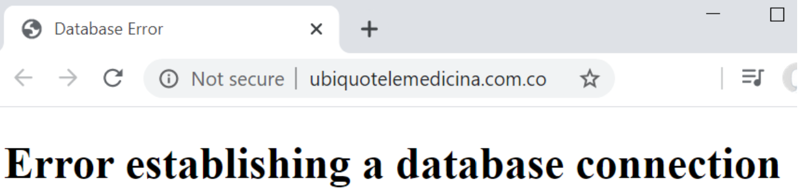

Ubiquo is described by PharmaCielo as “a knowledge management and medical consultation system”, although you wouldn’t know it from the company’s website, which appears to have been down for the past several weeks:

Ubiquo does not appear to be very active in general. The company’s Facebook page last posted in early 2016, and its Twitter page with 199 followers last posted in 2011. Historical captures of the website show a credible but fairly basic website describing its telemedicine platform.

The strategic pretense for the transaction had struck us as odd in the first place. In its acquisition announcement, PharmaCielo stated the rationale was as follows:

“(The) acquisition will enable expanded access to medicinal cannabis expertise among the Colombian medical community”

But is it really that hard to meet doctors?

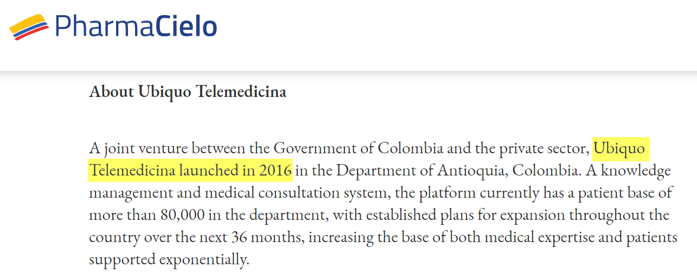

There were some other obvious red flags. In PharmaCielo’s original acquisition announcement, it stated that Ubiquo was launched in 2016 in Antioquia.

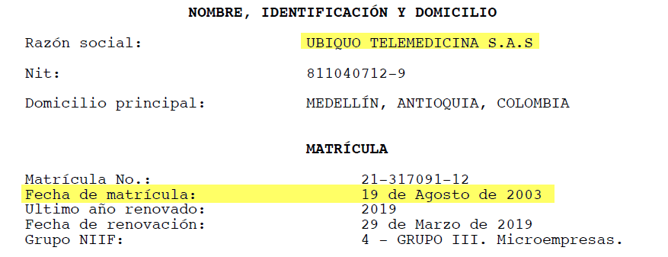

Colombian corporate records show the company was actually launched in 2003:

Similarly, the company’s social media presence alone predates its supposed 2016 founding by more than half a decade.

We dug further and found that the company may have been acquired as part of a quid pro quo arrangement with its backers.

At the time of the sale, Ubiquo was a slow-growing asset in an internationally financed venture capital fund’s portfolio.[4] The sale to PharmaCielo looks to have been contingent on the venture capital fund injecting capital into one of its other investments…a company founded by none other than PharmaCielo co-founder Federico Cock-Correa.

- In August 2009, a newly-launched venture capital fund managed by Medellin-based banking group Promotora SA acquired a 49 percent stake in Ubiquo Telemedicina as its first investment, paying 1.6 billion Colombian Pesos (or U.S. $771,000) for the stake. [Pg. 11]

- The fund’s second investment in November 2009 was in Ecoflora SAS, the extract company founded by PharmaCielo co-founder Cock-Correa and his uncle and which was being managed by his cousin at that time. [Pg. 11 & Pg. 6]

We had a short phone interview on February 25, 2020 with Nicolas Rios Sanchez, who heads Promotora SA’s venture capital unit and also sits on the Ecoflora board.

Rios said the fund has made follow-on investments into Ecoflora since its initial investment. He said its latest investment into Ecoflora was “around early 2018” after a decision by the fund’s limited partners at a general assembly meeting. He did not specify the date nor gave the amount of investment agreed at that time.

When asked if funds from the Ubiquo Telemedicina sale to Pharmacielo (where Cock-Correa is director) were reinvested in Ecoflora (where Cock-Correa is founding partner), Rios initially said yes.

He later retracted that and said the decision to increase its investment in Ecoflora was taken before the sale of Ubiquo. He said the funds used for investment in Ecoflora came from an escrow held after the sale of another of the seven companies in the fund’s portfolio. He then did not specify which company.

It is extremely unusual for a venture capital fund to make an investment in one company contingent on the sale of a supposedly unrelated company.

The timeline of the “escrowed” sale is consistent with PharmaCielo’s acquisition of Ubiquo. PharmaCielo originally announced the acquisition in April 2018 and stated that “the acquisition is anticipated to be completed in 60 days or less.” It didn’t close until a year later. We suspect the delay was related to the escrow contingencies.

We also suspect the real reason PharmaCielo made the bizarre acquisition was to secure the investment in one of Cock-Correa’s other companies.

We asked two of the fund’s international partners about the possible link between the Ubiquo deal and the fresh financing for Ecoflora. The Spanish government international development agency AECID said it could not comment due to a confidentiality clause. BID Lab (formerly MIF), part of the Inter-American Development Bank, said it did not track specific investments but said the fund should not have made fresh investments in 2018 given that it was already in its distribution period.

Undisclosed Related-Party Deals: PharmaCielo’s New U.S. Distribution Deal with General Extract LLC Is Yet Another Questionable Deal with A Former PharmaCielo COO

Beyond questions about the propriety of the company’s acquisitions, we also found irregularities with PharmaCielo’s new distribution deals.

On September 25, 2019, PharmaCielo announced that it was entering the U.S. market by inking a $3 million sales agreement with an “established multi-state” distributor called General Extract, LLC. PharmaCielo’s CEO gushed over the deal’s implications:

“To say we are excited about this milestone is an understatement.”

But what the company did not disclose seems far more important: General Extract appears to be a related party entity with no credible operations run by PharmaCielo’s former Chief Operating Officer.

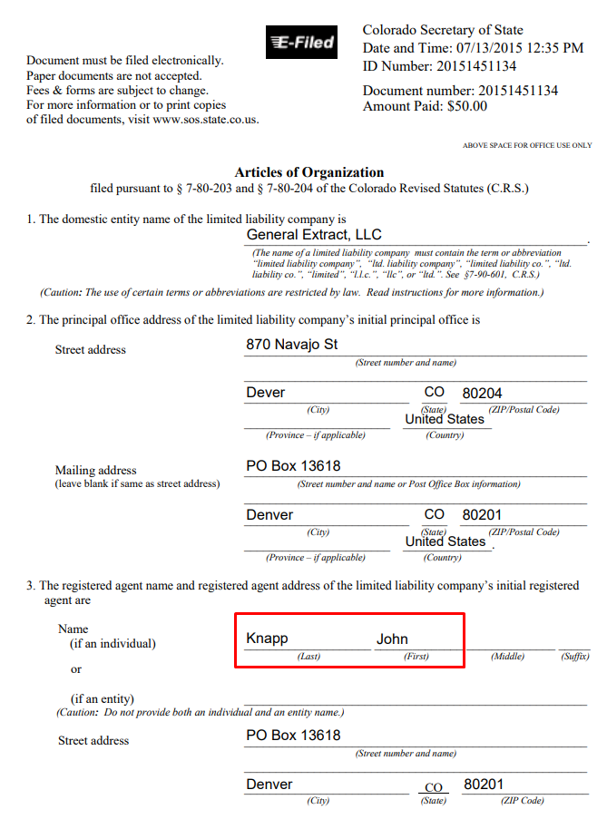

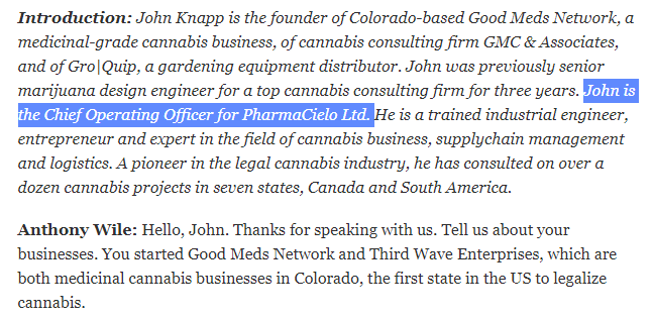

The articles of incorporation for General Extract, LLC show “John Knapp” as the company’s registered agent.

Mr. Knapp was former “Chief Operations Officer” of PharmaCielo, per this 2016 regulatory filing with British Columbia Securities Regulators.

Hilariously, his title was also confirmed in an interview of Knapp by none other than Anthony Wile in 2015. The interview starts off as introducing Knapp as the “Chief Operating Officer for PharmaCielo, Ltd.”

General Extract, Which PharmaCielo Described as an “Established Multi State Distributor” Appears to Have No Products and No Credible Operations Whatsoever

Most “established” companies at least have a website.

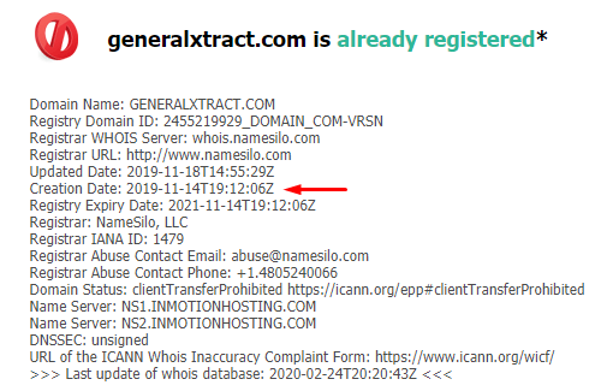

When we examined General Extract, we found that its website domain was registered on November 14, 2019, about 3 weeks after entering into its sales agreement with PharmaCielo.

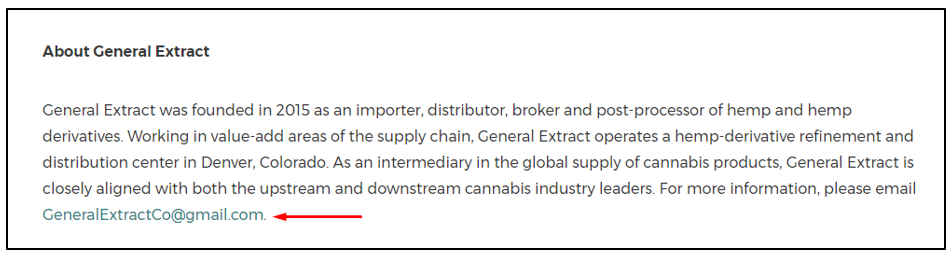

Along the same lines, the email address used by General Extract in its press release with PharmaCielo was a Gmail address (presumably because they didn’t even have a domain registered at the time):

General Extract’s newly created website looks rather bare, with no information on company executives, and no listed e-mails or contact information, except for contact forms that visitors can fill out to request additional information.

All of its products appear to be “coming soon”:

The one coming soon product with a description is its “CBD isolate”, which it describes as grown from Colombian hemp (presumably from PharmaCielo).

Despite the claim by PharmaCielo that General Extract is a “multi-state” distributor, we were unable to find evidence to confirm this. Nothing on General Extract’s website as of 3/1/2020 says anything about multi-state distribution, multiple locations, or suggests any clients exist other than PharmaCielo.

We Visited General Extract in Colorado And We Found Its “Offices” Bore the Logo of a Different Company. Its Parent Company’s Office “Suite” Was Actually A Mailbox at A UPS Store

In order to find out more about General Extract and its parent company, Redwood Green Corp., we sent investigators on the ground to its office address in Colorado, at 866 Navajo St in Denver.

There was no indication that the address housed any entity called General Extract. The back of the building was unmarked and there was simply a “No Trespassing” sign hanging up.

Our investigator said that from the outside, there was no indication of what company occupied the address. They said that #866 is hidden away in the back of a parking lot.

Our investigator, did, however, see people leaving various parts of the building around 4:50pm local time; some of whom were wearing grey sweaters with a logo that resembled a “Good Meds” logo. “Good Meds” is the other brand owned by Redwood Green and operated by John Knapp, the individual listed on General Extract’s corporate documents.

They also said there was a large “Good Meds” logo when they entered General’s Extract’s address, but that they didn’t see any “General Extract” signage inside.

Our investigator also inquired with the front desk as to the nature of the business and was told it was a “grow op” (a grow operation), which is consistent with Good Meds business description.

Note that for a grow operation we expect its external presence to be somewhat minimal (for security purposes) but also anticipated that there would be some sign or acknowledgement at the front desk that General Extract existed at its stated location.

Instead, it appears that General Extract exists largely on paper.

Undisclosed Related-Party Deals: General Extract’s Parent Corporation, Redwood Green, Is Also Replete with Related Party Ties to PharmaCielo

General Extract’s parent company, Redwood Green also consists of multiple people tied closely to PharmaCielo. Redwood is a public company that trades on the OTC markets under RDGC and averages about ~2,500 shares traded per day.

Redwood Green Corp.’s CEO was Christopher A. Hansen until his conveniently timed resignation last Wednesday. Hansen was the former CEO and President of PharmaCielo, according to his LinkedIn profile.

John Knapp also served as a director of Redwood Green until his conveniently timed resignation last Tuesday. (Note: LinkedIn bios disappearing and resignations like these started to occur as our investigation and inquiries into the company picked up steam.)

And effective December 2019, Delon Human, who is listed on his LinkedIn profile as PharmaCielo’s current President of Head Health and Innovation, is the Chairman of the Board of Redwood. Large shareholders of Redwood also appear to have significant ties to PharmaCielo.

Carlos Manuel Uribe (Lalinde) and Andres (Fernandez) Acosta, for instance, are both directors of PharmaCielo Colombia, per PharmaCielo’s website. Miguel Cock-Gomez is the son of PharmaCielo co-founder Federico Cock-Correa.

Like General Extract, parent Redwood Green also sports a relatively bare looking website which appears to have used the same template.

The address listed for Redwood Green Corp. on its website, described as “Suite D-357”:

When we visited the address, we found it was actually a UPS store:

And Redwood’s “Suite D-357” was nothing more than a medium sized mailbox inside of that store.

The woman working at the counter at the UPS Store confirmed to our investigator that Box 357 did, in fact, belong to Redwood Green.

All told, nearly all of the key people at PharmaCielo’s new U.S. distribution partner General Extract (and its parent Redwood Green) appear to be related to PharmaCielo.

Most importantly, none of this was disclosed to investors when the company touted its “milestone” distribution deal.

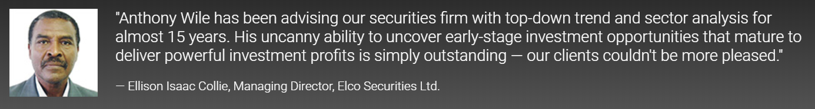

The Role of Bahamian Broker Elco Securities—Doing Anthony Wile’s Dirty Laundry?

Recall from the SEC’s 2007 action against Anthony Wile, Bahamian broker LOM Securities Ltd. was also implicated. The brokerage firm was used as a vehicle for dumping shares onto the market after Wile’s alleged deceptive press releases were issued.

We believe that Wile could be using the same playbook he was using in 2007 by using a Bahamian brokerage firm to conceal his ownership. This time, it appears to be a firm called Elco Securities. We found numerous direct links between Elco Securities and Wile in his dealings both in Colombia and with PharmaCielo.

1. Recall the directors list from the Panamanian entity SAADC, associated with the highly suspicious Rionegro land deal:

David Hoang and John Derek Benjamin, registered directors and officers of SAADC, also turn up as “Registered Personnel” of Elco Securities, based on Bahamian regulatory documents:

Also recall from above that Hoang worked as Chief Trading Officer of High Alert Capital, a private investment firm where Anthony Wile served as Chairman & CEO, according to Canadian corporate records.

2. Elco appears to have been an early backer of PharmaCielo. We see on a 2016 British Columbia Regulatory form for PharmaCielo that Elco Securities, Ltd. is shown to own 7.987 million common shares and 479,610 warrants of PharmaCielo.

3. Anthony Wile’s personal website has a testimonial from the managing director of Elco

4. Elco Securities advised on an acquisition made by Redwood Green. The senior leadership of Redwood Green included multiple former PharmaCielo executives, and the company recently entered into a suspicious U.S. distribution agreement with PharmaCielo, as described above.

5. Anthony Wile is the Chairman/CEO of a private equity firm called Grupo Jaque. We found another entity called Jaque Proyectos Inmobiliarios (translation: Jaque Real Estate), per corporate registry documents. The entity was registered in the name Lawrence Collie, the Secretary/Company administrator for Elco Securities, per his LinkedIn profile. Both entities share the same address. [1,2]

6. Jaque Real Estate listed another address on its Rionegro Chamber of Commerce forms, which were on the first floor of a shopping mall in Rionegro (Centro Comercial Complex Llano Grande KM8 Oficina 1, Rionegro). We found that it is actually used as a corporate office for PharmaCielo. Our investigator visited and spoke with a cleaning staff member. She said “(It) is the PharmaCielo office.”

The office had no signage whatsoever, but when our investigator approached, personnel came out to speak to him. He asked if it was the PharmaCielo office. The office employee responded:

“Yes this is PharmaCielo but there’s nobody here right now. Better go to the plant (the growing facility in Rionegro).”

We think it is tremendously odd that Elco Securities, an opaque Bahamian broker, has so many direct ties to Anthony Wile and the slew of undisclosed-related party deals surrounding PharmaCielo. We would bet just about anything that many of the shares involved in these suspicious deals have been deposited into Elco Securities accounts.

Another Sketchy “Partnership”: PharmaCielo Is Paying a Company Called XPhyto To Buy PharmaCielo’s Product with PharmaCielo’s Money

Aside from General Extract, the other major distribution deal PharmaCielo has in place is with a small penny stock company called XPhyto Therapeutics.

On January 27, 2020, PharmaCielo announced a 30,000 kg cannabis extract agreement for the German market with XPhyto Therapeutics Corp.

PharmaCielo CEO David Attard pitched the partnership as:

“…a significant opportunity to export an ever-expanding range of medicinal products into the German market, including those containing THC…”

It was described as a catalyst to potentially ramp up sales in a big way for PharmaCielo:

“We expect to generate meaningful revenue through this agreement over the next three years and are focused on continuing the ramp-up of our sales efforts through 2020.”

But upon examining the XPhyto deal closer, we don’t believe this deal holds promise.

XPhyto’s financials show that the company was in apparent distress leading up to the deal. In the 9-month period prior to announcing the deal, XPhyto reported revenue of $45,000, operating losses of $5,351,789, and cash of only $791,030. In other words, they look to have been at the brink of insolvency.

At the very end of the press release announcing the deal with PharmaCielo, in a section called “Additional Information”, we see that PharmaCielo “invested” CAD $500,000 into Xphyto as part of the deal.

When it boils down to it, this partnership appears to us to be a sham. PharmaCielo is paying a distressed company to “buy” its product. Aside from the splashy headline, the “deal” appears to offer no economic advantage.

In a best-case scenario, we think PharmaCielo will get its own money back and have to hand over valuable product. So far, we haven’t seen any purchases by XPhyto as the partnership announcement was recent, on January 27, 2020.

Realistically, given the state of XPhyto’s current balance sheet and its dwindling cash, we expect PharmaCielo will simply lose most of its investment in XPhyto with little to show for it.

XPhyto’s CEO Has A Perverse Track Record of Being an Insider or Director At Companies That Have Gone Bankrupt, Been Delisted or Have Seen Their Equity Get Demolished

In case there is any doubt that PharmaCielo’s “investment” in Xphyto is wrong-footed, we reviewed the track record of XPhyto’s CEO, Hugh Rogers, through his SEDI disclosures and his LinkedIn biography.

Success seems to have a way of eluding Rogers.

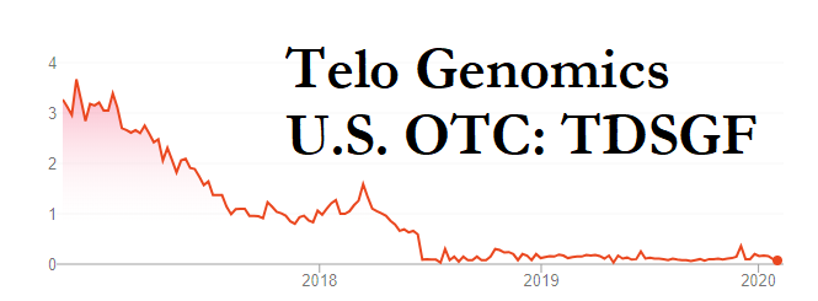

Most recently, in addition to Xphyto, Rogers’ LinkedIn and SEDI disclosures list him as Chairman of the Board of Telo Genomics Corp., beginning in September 2018 and effective through present day.

Telo Genomics was previously known as 3D Signatures, which announced intentions to file for bankruptcy in May of 2018, before changing its name to Telo Genomics in April 2019.

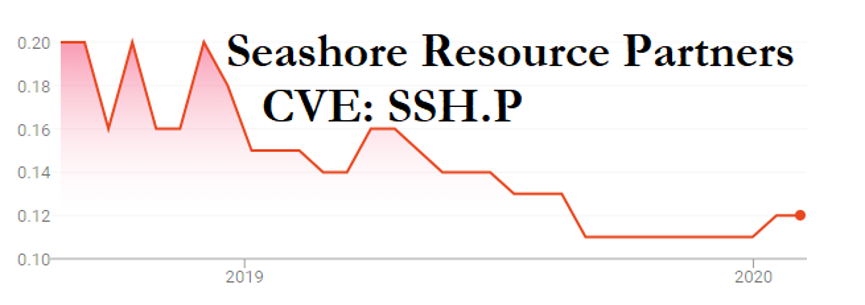

Rogers is also listed as a Director and Senior Officer of Seashore Resource Partners Corp. a company founded in 2017.

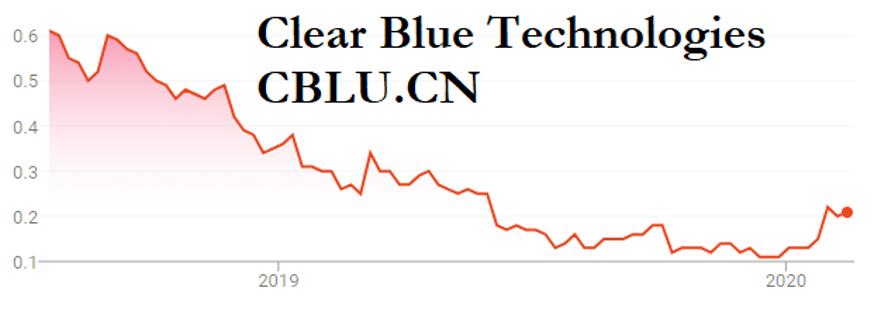

Rogers’ LinkedIn profile also lists him as a former Independent Director of “Clear Blue Technologies International, Inc.” from July 2018 to June 2019.

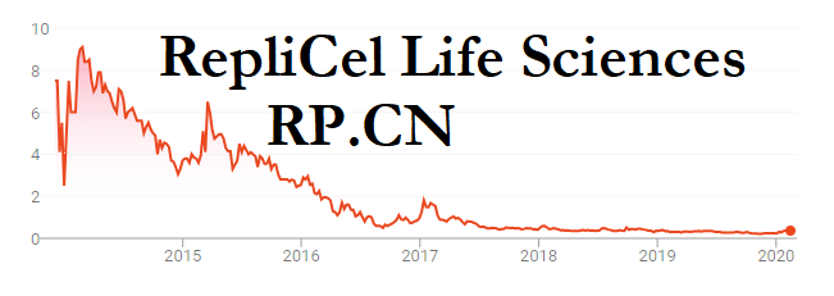

Prior to Clear Blue Technologies, Rogers’ LinkedIn lists him as an “Independent Director” of RepliCel Life Sciences, Inc. from February 2017 to December 2018. RepliCel has been decimated since 2014.

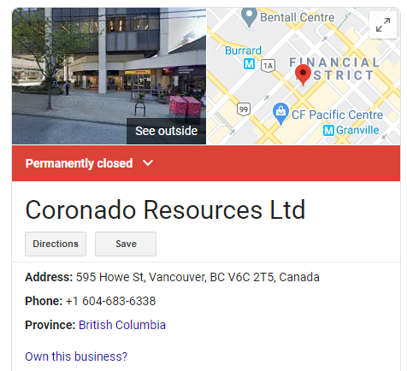

Prior to his stint at RepliCel, Rogers listed himself as CEO & Director of Coronado Resources, Ltd. from March 2015 to October 2017. Coronado Resources was ultimately delisted around 2018.

Rogers’ SEDI disclosure also lists him as a former Director of Kootenay Zinc Corp. (formerly Oceanside Capital Corp.).

We think Rogers’ previous ventures telegraph the direction of PharmaCielo’s investment in Xphyto.

PharmaCielo’s CEO Tries to Calm the Market as PCLO’s Stock Falls. Meanwhile, Co-Founder Anthony Wile Is Spraying the Open Market with Stock

Currently, co-founder Anthony Wile owns 12.8 million shares of PharmaCielo, making him the largest holder of shares (almost 13% of shares outstanding, per FactSet).

Per his SEDI disclosures, Wile recently unloaded 200,000 shares of PCLO into the open market roughly a week ago, on February 20, 2020.

Just four days after Wile dumped his shares, PharmaCielo’s CEO, David Attard, released a letter to shareholders where he seemed to attribute the share price pressure to the market being in a “secular transition” after saying he’d like to “acknowledge that both my team and I understand the stock price performance has been difficult to experience”. (Note that this was prior to the market-wide meltdown last week.)

“While the sell-off in our stock is unjustified in our view, we see it as temporary,” Attard says in his letter. “Each member of the senior management team has individually allocated significant personal dollars – outside of any option grants – to buy the Company’s stock, and we remain confident holders.”

Given the fact that the TSXV listed stock trades, on average, only 147,000 shares per day (per FactSet as of this writing), any additional unloading of stock from Wile could act as a significant headwind.

Financials and Operations: Overview of Assets, Cash Burn, and Revenue

Here are some basics on the financials, and why we think Wile is dumping stock at these levels.

Starting with the assets, as noted in the introduction, the company has land and greenhouse assets, primarily in Rionegro Colombia. We have confirmed that the company continues to grow cannabis at those facilities, providing a flow of inventory and biological assets, which stood at CAD $3.7 million last quarter. [Pg. 2]

We also confirmed the company’s cannabis licenses with local authorities. [1,2,3,4]

Company financials as of September 30 2019 showed cash of roughly CAD $21 million, as well as PP&E of $23.4 million. [Pg. 2]

While this typically supports an argument for some equity value, the company is burning cash at a rapid rate. In the 9-month period ending in September, the company had burned $21.1 million in cash from operations. The burn rate amounts to about $7 million per quarter, which we estimate leaves it with ~$11.7 million remaining, or less than 2 quarters worth of cash.

As shown above, we think the property is highly overvalued, and in either case the physical assets have not been able to produce any return on assets for the company (nor did they when it was a flower business that remains in receivership).

Total reported revenue to date has been only CAD $130,000, including ~$61,000 in cannabis revenue and ~$69,000 in revenue from what appears to be a now-defunct telemedicine acquisition. We expect the company may report some additional revenue through its related-party distribution deal with General Extract, but, as shown above, we do not view this as sustainable (or entirely credible).

Financials and Operations: Cap-Ex Needs and the Company’s Delayed Oil Processing Centre

We think the company can unlock some additional revenue once it completes its oil processing facility. Note that Colombia currently allows the export of cannabis oils and only limited dried flower for medical purposes, making the ability to process oils important.

On April 18, 2019 the company announced hopeful signs of progress on its construction of the facility:

“(The) oil processing facility is on track for commercial operation and GMP certification during Q3-2019, enabling large-scale production and sale of refined cannabis oil.”

“We anticipate the completion of our first major processing expansion in Q2 and our GMP certification in Q3.”

By May 27, 2019 the company announced further progress and reiterated its timeline:

“Construction of Colombian processing facility progressing toward production in late Q2/early Q3”

By August 25,, 2019 the facility was “nearing completion”.

As of the most recent quarter ending September 2019, however, the company pushed back its estimates to “late 2019.” [Pg. 24]

We also see from the same filing that despite the company claiming the oil processing centre was “nearing completion” in August 2019, by September it estimated that over U.S. $7 million in anticipated capital expenditures would be needed in order to complete the project. [Pg 8]

“To date, the Research Technology and Processing Centre costs have been USD$10 million and management projects that the completion of facility will require an additional USD$7 million.”

The company has not yet announced whether the facility is completed. We contacted investor relations and asked about its status and have not yet received a reply. The facility does appear to be under construction, according to pictures posted by a development group associated with the project:

The photos were posted around June 2019. Based on the timing, we anticipate that the external elements of the building are completed or close to being completed. We attempted to visit the facility to examine its progress but were unable to.

In either case, investors should factor in the additional estimated $7 million cash burn from the cap-ex required to complete the facility. We also think the company should provide investors with an update on progress, with pictures.

Financials and Operations: Reported Issues with Mold and Heavy Pesticides in the Company’s Rionegro Facility

Additionally, a source that our investigator spoke with, a businessperson who is part of the flower-growing industry, said based on their recent knowledge and entry to the PharmaCielo facility, they believed the cannabis crop there was “suffering from a bad outbreak of the fungus botrytis (or gray mold.)”

They said the fungus was a major problem with certain flower cultivations, especially daisy poms (pompoms) – which is the type of flower that our investigator was told was being cultivated on the property prior to PharmaCielo taking it over.

The source said that, in their experience, the only way to treat it when present in flowers was to “treat it very hard with chemical fungicides”. They also said the cultivation of daisy poms required heavy usage of pesticides, fungicides and other chemicals. These types of issues are no doubt familiar to most cannabis investors with experience in large grow operations. Ultimately, they can affect the ultimate quality and quantity of production.

The other salient land issue is the flood risk from an adjacent stream. An officer at the Rionegro planning department explained about one-third of the 27 hectare facility could not be used for building or agriculture because it was on a flood plain and subject to strict environmental controls.

Conclusion: Completely Uninvestable

To us, it’s easy to see the forest for the trees: what looks to investors like a promising Colombian marijuana company appears to us to simply be another self-enrichment scheme by Anthony Wile and other executives with histories of destroying shareholder value.

We saw some signs of management self enrichment when we began our investigation, but we initially expected it to be relatively contained. Our research over the course of several months has taken that conclusion and flipped it on its head:

The best case for shareholders, in our view, would be if the company is eventually acquired (at significantly lower levels from here). After repricing, a new owner may try to attempt to correct current management issues. We expect the far more likely scenario is the company just continues to burn through its cash and assets on the way down however.

Whether regulators, operational financing realities or the open market get to the company first is irrelevant – we believe PharmaCielo’s equity is headed to $0 over the course of the year.

Disclosure: We are short shares of PCLOF (PharmaCielo’s U.S. OTC equity)

Please see our full legal disclaimer at the bottom of our report.

Appendix A: PharmaCielo’s Colombian Government Contacts

Part of PharmaCielo’s “success” to date has been driven by Anthony Wile’s close association with high-level members of the Colombian government. It is unclear that they truly knew what they were getting involved with.

PharmaCielo was the first company – Colombian or international – to be granted a license to grow cannabis and produce derivatives on June 27, 2016. [Pg. 10] From that date until time of writing, 607 licenses have been issued in Colombia, according to the Justice Ministry.

On Aug. 2, 2018 Anthony Wile was granted Colombian citizenship by decree of President Juan Manuel Santos, whose government enacted new laws to allow the growing of medicinal cannabis.

In a photo of the event, a beaming Wile is pictured with his arm around the then Colombian foreign minister Maria Angela Holguin.

A PharmaCielo press release congratulated Wile and said:

“The granting of citizenship recognizes Mr. Wile’s significant contributions to Colombia and commitment to bringing Canada and Colombia closer together.”

In that same statement, Wile was attributed as saying:

“I would like to thank President Santos and his administration for bestowing upon me this tremendous honour”

PharmaCielo, whose board includes a former agriculture minister, clearly retains fluid communications with the Colombian government.

Last week, on Wednesday, February 26 Justice Minister Margarita Cabello Blanco visited the PharmaCielo plant in Rionegro. Media were not invited but in a written statement afterwards, her press team said she “emphasized that one of the main objectives of the national government was to stimulate a legal, safe and high-quality medicinal cannabis industry.”

She said: “We continue promoting the industry based on clear rules of control, quality and entrepreneurship and with total transparency regarding the process of licensing and quotas that fulfill the legal requisites.”

Here are several pictures from the recent visit:

Appendix B: PharmaCielo’s Italian and Mexican Joint Ventures

We examined PharmaCielo’s JVs in Mexico and Italy but left them to an appendix simply because they are preliminary and don’t appear to have generated business thus far.

Mexico. On January 28, 2019 PharmaCielo announced a joint venture in Mexico with MINO Labs S.A. de C.V, described as “a specialty pharmaceutical company and medical supply distributor”.

Mino Labs is run by Manuel Cosme Odabachian, who has some experience with JVs. Odabachian ran another Mexican company called Vitel Laboratories, which signed a JV with publicly traded OncBioMune Pharmaceuticals, Inc (OTC:OBMP) on August 19th, 2016

He then served as director of OncBioMune from March 13, 2017 until his resignation on December 22nd 2017.

The stock is down ~99.9% since the signing of the JV:

Mino labs now looks to share the same phone number as the ill-fated Vitel Laboratories:

Italy. On December 31, 2018 PharmaCielo entered into a joint venture agreement with Italian-based Eugene S.r.l, which holds two genetic research and technology patents. [Pg. 30] The Italian corporate registry documents for the JV entity (translated) show no obvious signs of financial activity aside from the initial nominal capital contribution.

The CEO of the JV entity, Adriano Aldegheri, runs a DNA testing company called DNApro.

Appendix C: PharmaCielo’s Attempted Acquisition of Creso Pharma (Another Distribution Company it Lent Money To Prior to Purchasing its Products)

Creso Pharma is medicinal cannabis manufacturer, which develops, registers, and commercializes pharmaceutical-grade cannabis and hemp-based nutraceutical products and treatments.

On June 6, 2019, PharmaCielo announced that it would be acquiring all issued and outstanding shares and options of Creso for A$122 million in PCLO shares.

As of Creso’s financials before the loan, the company was running a current account deficit, had 6-month operating losses of $6.2 million, and cash on hand of only $3.6 million.

Just 3 days after the announced deal, PharmaCielo advanced CAD $3.5 million to Creso under the terms of a bridge loan announced as part of the acquisition – once again lending cash to a “partner” as the company did with XPhyto.

On July 25th, PharmaCielo announced it had received the first commercial CBD isolate exporting permit from the Colombian government and on August 19th, about 2 months after loaning Creso millions of dollars, Creso received its first commercial CBD export from PharmaCielo, according to this press release.

The order doesn’t appear to have been large. PCLO’s cannabis sales to date total $60,843.

In the end, the acquisition deal fell apart, but Creso did pay back the loan with interest, marking a clean exit out of this arrangement for PharmaCielo. Creso’s stock currently trades at $0.08 and a market cap of $12 million.

It does not appear any sales to Cresco have taken place since the initial shipments however. We included this simply in the interest of being thorough, though the partnership does not appear to be ongoing.

Appendix D: Further Details on the Colombian Properties

In land registry certificates, deeds and company incorporation certificates, the PharmaCielo property in Rionegro is referred to by different names including: Finca Santangelo, San Angelo, Lote Vilachuaga, Suspiro or La Margarita.

The address on company incorporation certificates is standardized as: KM4 Via Rionegro-La Ceja, Vereda El Capiro, Finca Sant Angelo.

The land is registered broadly under two land registration ID numbers, #020-10719 and #020-50485.

Parts of #020-50485 were then subdivided to create smaller plots including 020-192903. Finally #020-10719 and #020-192903 were consolidated into a single larger plot #020-192904.

According to land registry certificates, the accurate revised measurement of plot #020-10719 is 21.5 hectares and #020-192903 is 4.76 hectares. The total measurement of the consolidated plot #020-192904 is 26.26 hectares. That is the accurate land area of the Pharmacielo facility, although company press releases round up to 27 hectares.

The plots of land had been in the same family for 75 years or more and date from a time when land boundaries were measured often by eye and general, visible topographic markers including stones, rivers and paths. Only when land changed hands more recently were more modern surveying techniques used to give accurate measurements.

We found that the Rionegro facilities had actually been operated by Cock-Correa’s bankrupt Tahami as a tenant, until PharmaCielo acquired the land. Here is a filing from as early as 1992 pulled from the Rionegro Chamber of Commerce showing Cock-Correa operating on the plot PharmaCielo now owns:

The land is the hamlet of El Capiro, part of the municipality of Rionegro, in mountains just above Medellin, Colombia’s second largest city. Rionegro is a traditional hub for flower production and also home to Medellin’s international airport, José María Córdova.

When family company Inversiones Villegas y Uribe Cia. was liquidated, the Rionegro property passed to the four children Agustin Uribe Villegas, Pedro Javier Uribe Villegas, Olga Marcela Uribe Villegas and Maria Paula Uribe Villegas.

Both plots of land that now make up the present-day PharmaCielo facility were sold in a single transaction.

The #020-10719 parcel is sold by the four owners to PharmaCielo Colombia Holdings SAS on June 1, 2016. The value of the transaction is listed as 8,401,699,500 pesos (8.4 billion pesos).

On 19 April 2017, the boundaries of the property are corrected at the registry. And on 30 August 2017, this property is joined with another #020-192903, sold on the same day to PharmaCielo Colombia Holdings SAS at a registered value of 1,809,000,000 pesos (1.89 billion pesos)., to make a single, consolidate area with a single new property registration number #020-192904.

The total, revised land area is now listed as 26.26 hectares.

The Uribe Villegas family later signed a deed ceding “rights of way” (transit rights) to PharmaCielo across an adjacent property. One of the siblings, Olga Marcela Uribe Villegas (a Catholic nun) sold “quota rights” for her share in those transit rights to her brother Agustin (10 pct), 5 percent each to her nieces Amalia and Monica Angel Uribe (daughters of her sister Maria Paula) for a value of 190,500,000 pesos.

The following day she sold an additional 5 percent quota rights to her third niece Patricia Angel Uribe for a listed 50,000,000 pesos.

Appendix E: Further Details on The Caucannabis Cooperative

On its website, PharmaCielo says: “(Our) inclusive approach ensures that Colombia’s indigenous communities, which have decades and even centuries of experience cultivating ancient Colombian strains of cannabis for spiritual and medicinal use, have their rightful seat at the table of the cannabis industry.”

The Nasa indigenous group have a reservation in northern Cauca province but the cooperative/PharmaCielo venture is not on indigenous lands.

The reservation is governed by a series of tribal councils known as “cabildos” and the organization that represents them (CRIC) has issued public statements firmly opposing the legalized marijuana industry because of the violence that the illicit drug industry has fueled in the region.

The CRIC statement, the association representing 20 indigenous councils published in 2016, stated:

“None of the 20 indigenous cabildos is taking part in the Caucannabis initiative. Indigenous peoples refuse to fuel economic growth in this fashion especially when the government’s intention is to open up the market to multinationals….we believe there’s a hidden plan behind Caucannabis and that is the intention to patent common indigenous seed stock, take those seeds away and then oblige us to purchase only certified and probably imported seeds.”

This area of northern Cauca continues to be one of the epicenters of Colombia’s illegal marijuana industry. It is currently facing serious security issues as Colombia’s long-running civil conflict continues to rage there.

Dissident units of the Revolutionary Armed Forces of Colombia (FARC) who refused to demobilize as a result of the peace deal with the rebel leadership and the government continue to be active in the region. The other leftist guerrilla group, the National Liberation Army (ELN), is active in the area. Drug mafias and right-wing paramilitary squads are also heavily present in the area.

The violence in this region centers on control of lucrative drug plantations (cocaine, marijuana and a lesser extent heroin), drug trafficking routes (over the western cordillera of the Andres and down to Colombia’s Pacific coast) and also income from illegal gold mining (hard rock and alluvial gold deposits).

PharmaCielo also appears to overstate its relationship with grassroots and indigenous communities elsewhere as part of its PR effort.

In a corporate press release to investors issued on December 13, 2018, PharmaCielo said it was “to produce 500-year-old cannabis strain in the ancestral territory of the Arhuaco”.

It stated the company had “received a 500-year-old ancestral cannabis strain (the “Seeds”) for its exclusive use, from the Arhuaco indigenous people (the “Arhuaco”).”

The accompanying photo showed Andrew Wile and Federico Cock Correa posing with Luis Guillermo Izquierdo Torres, a “mamo” or spiritual authority of the Arhuaco community at the Rionegro premises – far from the Arhuaco indigenous lands.

The Arhuacos, like the other estimated 81 other indigenous ethnic groups in Colombia, have (on paper at least) special protections (Law 21 of 1991 which ratified ILO convention 169) and have jurisdictional control over their territories (Art. 246 Constitution of 1991) as long as those laws do not conflict with national laws.

The Arhuacos from the Sierra Nevada mountain range in northern Colombia were, like neighboring tribes, severely affected by the violence, killings and land invasions fueled by Colombia’s illegal “marijuana boom” in the 1970s which was centered along the Caribbean coast.

For that reason, coupled with the experience of violence at the hands of Communist guerrillas and right-wing death squads, the Arhuaco people are very cautious about the commercial cultivation of any drug crop, legal or otherwise.

In the cosmovision of the Arhuacos, who call themselves the “Elder Brothers”, all plants are sacred and have their role in ensuring the balance of life. They use many plants for their medicinal properties but are reticent about over-producing one or the other because of the impact on the “natural balance”.

The Arhuacos are also very wary about any commercial dealings with non-indigenous partners, whether it is for tourism, mega-projects or mining. Before reaching any agreement with outsiders Arhuaco leaders will consult the “mamos” (the spiritual leaders) for their divinations and wisdom on the subject. They will also consult with traditional, non-spiritual leaders the so-called “governors” or “gobernadores”.

In general terms, any company wishing to conduct business on indigenous territories would need to obtain “prior informed consent” (PIC) with the entire community under the terms of that ILO 169 convention.

With this in mind, one of our Colombian investigators talked to one of the Arhuaco governors about PharmaCielo’s claims about their seedstock and a deal to grow cannabis on indigenous land.

He said: “I have no information about any deal with any company.” He went on to say that no representative of the Arhuaco people had been authorized to hand over seed stock to third parties and said “if that has been done then it would be illegal”.

He stated that there were no licensed marijuana plantations within the Arhuaco reserve and no licenses had been applied for.

The investigator then contacted the Arhuaco spiritual leader Luis Guillermo Izquierdo Torres. He said he had “bonded with specialists at PharmaCielo over their interest and deep knowledge” of medicine but suggested their conclusions were misinterpreted.

He said: “Until now there’s no Arhuaco community producing cannabis as such. There are some mamos who may make potions for local use. Until now we have got nothing (no commercial arrangement). Maybe in the future we can make some laboratory experiments. “

When asked if he had handed a specific strain of cannabis to multinational corporations for their “exclusive use” as stated in its press release, Izquierdo said: “No seed of whatever kind or cannabis can be monopolized. Nobody is the owner of the seeds but we are all the custodians…It may be that multinationals, like others, are looking at this in a more commercial sense but we are looking at it in terms of service (to humanity).”

That statement is in line with the viewpoint one would expect from an Arhuaco spiritual leader. Their world view is that humankind, and specifically the indigenous groups of the Sierra Nevada, are the “guardians” of the world.

Izquierdo said the Arhuacos rejected any suggestion that seeds should be mutated or genetically modified.

He said: “Humankind does not know how to manage most plants and we have to generate that conscience first…as Mamos we are concerned that all plants should be used with dignity and that they should be in the service of life not for death.”

All told, PharmaCielo’s press release on the matter looks to have been inaccurate.

[Yes folks, we went this deep down the rabbit hole. Thank you for reading if you have made it to the end. We know it’s a long report and we hope you appreciate the level of detail.]

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Based on $21 million as of September 2019, with historical cash burn of ~$2.3 million per month

[2] The filing statement generally references share sales around that time as being effected at U.S. $2.25 per share, although no specific value was assigned to the 1.7 million shares in the Rionegro deal.

[3] Currency calculation is 8.4 billion pesos (per the land record prices) at a prevailing exchange rate of 1 USD/2918 COP. Note that the second parcel was much smaller and closed almost a year later, likely not requiring any advance.

[4] An April 2016 report by another investor in Ubiquo, the Multi-lateral Investment Fund (MIF), it described the investment in somewhat disappointing terms: “Ubiquo’s founders and initial investors are very good businesspeople but they are accustomed to organic growth over a 20-year period. VC sector industries need to grow far more rapidly.” [Pg. 16]

22 thoughts on “PharmaCielo: 100% Downside on Co-Founder’s History of Securities Fraud Allegations, Numerous Undisclosed Related Party Transactions and Operational Failures”

Comments are closed.

Kudos. Look into Khiron, shouldn’t take you long to set up your next short.

I’m sorry, but you are wrong on this one. Pharmacielo is a real company with real assets. Caucas region is yet to be developed as soon as Rio Negro is up at 100%. How do I know that? I was there twice and know the company since 2016. The ones with the best strategy and cost control will survive. The entire market is changing right now, look at Aurora or Tilray as an example, they were once at 140 and are now hovering at 15. Think about it, Tilray could buy Pharmacielo as it’s cheap production facility, or any of the big Cannabis corps, they are all struggling with their high production costs. Pharmacielo predicted exactly that and it was the very reason to develop in Colombia. That is know to investors since the very beginning.

Anthony Wile’s record is publicly know, the company never hid anything about him. BTW, anyone who follows the company knows exactly how much cash they have on hand, they have always been very transparent about it, about everything for that matter. Predicting that they will need to raise cash some time into the future is nothing anyone couldn’t figure out by themselves. You should subscribe to their newsletter, you would be better informed.

I don’t know if you are a serious company and if your intentions are really to protect investors, if so, you should issue a correction. Anyone shorting Pharmacielo will lose everything.

Vaudrait il mieux vendre toutes les actions

Pharmacielo ou y a t il un espoir de rebond

The Hindenburg report is an excellent attempt at character assignation. I don’t know Antony Wile but now I hate him.

I don’t really know much about Pharmacielo but I do know where it is and I have seen the the operation. I have seen the workers lined up to be searched as they leave their work. I have seen the vast stretches marijuana growing with huge buds and a beautiful dark green. I have seen the fibre optic controlled security fence. I have seen the the distillate being produced in labs. I have seen the 3000 sq meter research building much advanced from when I saw it 6 months ago. Hindenburg says it is in the wrong location .A place where flowers have been grow commercially for at least 30/40 years. Perfect for growing weeds

To obtain the licences and permits was a monumental task. Try getting a visa extension. Wile had to put a 12000 page application together to get the permissions he needed

Maybe Wile is a crook but the business has all of the ingredients to be a major player, If the management doesn’t screw it up.

I am disappointed that they haven’t generated any income yet but they are close to starting a sales stream.

One other point Hindenburg does not explain clearly is that Cock-Carrera is working his way out of bankruptcy. A ten year restructuring program with only 2 years left to go.

If the Canadian government gets their act together and facilitates importation Pharmacielo could fly.

With all the attributes PCLO has I think it will be a winner, unless there is pilot error.

Interesting points, but the overcosts in land and company acquisitions are very suspicious (the documents show clearly how, for example, the land prices were artificially inflated). Could you please give me a plausible reason for such a high price inflation different from the managers wanting to enrich themselves? I really hope you can do it (it would be a shame to realize that the management team ruined a great business opportunity because of its greedy practices–let’s hope that’s not true!). On the other hand, at this point I see that the only good asset the company has are the licenses they got from the Colombian government. Although it’s true that the Rionegro’s land is in a premium location, the land prices reported would pay for way more hectares of equally good land in other parts of the country.

toute cette enquête et les informations sont très interessantes

Je suis actionnaire depuis quelques temps , dont la société m’a été proposée par l’intermédiaire de la Société Agora ( Ray Blanco) qui indiquait un cours d’achat jusqu’à 10,50 € et ensuite 3,50 € que j’ai signalé comme étant surprenant . vu qu’en plus j’ai perdu une partie de mon investissement alors que l’on me faisait miroiter des grosses plus-values.

Malheureusement je suis retraité et pensais améliorer ma pension §

J’étais sur le point de demander une enquête et de déposer une plainte

Pouvez-vous me rassurer

bonjour Gil merci de votre participation à ce forum,j’ai investi également sur les conseils de Ray Blanco et me trouve dans la même situation que vous mais en retraite anticipée pour raisons de santé. J’ai investi sur PCLO TSX Toronto et je vois que plusieurs cabinets d’avocat américains proposent leurs services pour défendre les intérêts des investisseurs qui ont placé sur PCLOF OTC .

Pensez vous qu’ils s’occupent également de ceux qui ont investi sur PCLO qui est la bourse canadienne. Les cabinets: Bronstein Gerwitz and Grossman; Rosen law firm; Bragal Eagle and Squire;Shall law firm…. à savoir que pour certains il faut avoir investi au moins 100000 dollars.

Avez vous des infos sur un cabinet qui s’occuperait des dossiers sur TSX ,investisseur européens et pas trop cher.Merci

You should take a look at the stockhouse billboard ,you will find some interesting stuff about pclo.and theire is some one that knows a lot

By the way nice report about the PharmaCielo.

You will find this persone on the site

Thanks.

Exactly stock house you will Probably see some one unmasking those people that work for this compagny.