We have reviewed Clover’s response to our report this morning and appreciate that the market now has significantly more information about the company than it did yesterday.

The company’s response consistently refers to us as “short sellers” but, as a reminder and as we disclosed in our report yesterday, we have no pecuniary interest in publishing our research on Clover, no short position in Clover stock and/or options, nor have we or will we receive any monetary compensation for this work.

We published our report yesterday to further discussion in the investment world about Clover Health, SPAC promotion and to underscore the importance of critical research. In that vein, we have identified key points from the company’s response we think investors should know:

1. The only people who didn’t know about the DOJ investigation into Clover were members of the public.

According to the company’s response to our report, Chamath and Clover’s corporate insiders – including counsel, underwriters, executives and Chamath himself – knew the DOJ was probing the company leading up to, and during, the time it went public. The only people who didn’t know, it seems, were the investors buying Clover’s stock and the general public.

2. The idea that a DOJ investigation is non-material when Clover derives nearly all its revenue from the government is farcical.

No matter how you want to lawyer-speak it, we believe this just boils down to common sense. If Clover was focused on simply doing the “right thing” for investors, the DOJ investigation, as “routine” as the company wants to make it appear, should have been properly disclosed to investors.

3. The company clarified that only a fraction of doctors actually use the Clover Assistant, after making claims in its prospectus that “…onboarded physicians are highly engaged, using the Clover Assistant for 92% of their member visits in 2019.” [Pg. 2]

Up until this morning, investors reading Clover’s SPAC prospectus were likely under the impression that the Clover Assistant was such a helpful tool that doctors were adopting it en masse.

Our research indicated that this was not the case, and that Clover appeared to insert the word “onboarded” (without defining it) into its adoption metrics in order give that impression.

In its response this morning, the company admitted that “onboarded” primary care physicians (PCPs), those actually using the tool, account for only 22% of PCPs that sign up with Clover. That number drops to 4% when specialists in the network are added to the total. Clover further stated that an additional 11% of PCPs are waiting to be onboarded.

Assuming this is accurate, investors are now seeing for the first time that nearly 70% of in-network PCPs are not even using Clover’s “disruptive” software solution.

4. Our report highlighted that a Clover subsidiary called Seek Insurance was misleading seniors by claiming to offer “independent” and “unbiased” advice on selecting Medicare plans. Clover’s response calls Seek Insurance an “affiliate” that “operates separately” from Clover, despite SEC filings showing it is, in fact, a “subsidiary”.

In our report, we noted that Seek Medicare, which is listed in Clover’s SEC filings as a subsidiary, operates a website that claims to offer “unbiased” and “independent” advice to help seniors pick Medicare plans. The website further insists that it is “neutral” and doesn’t “work for insurance companies.”

We pointed out the conflict of interest and what appears to be clearly misleading marketing, given that the website is owned by Clover, an insurance company offering Medicare plans, with zero disclosure of the relationship.

In its response this morning, Clover refers to Seek Medicare as “an affiliate” and somewhat ironically states:

“What makes Seek different is its fundamental belief that Medicare consumers are simply not well-informed and that hurts their ability to get affordable, great healthcare.”

We completely agree that consumers are not well-informed, which is precisely why seniors should know about the conflict. Furthermore, we hope that Clover spells out its relationship with Seek in the big print (not just the fine print), so that potential members can clearly understand it going forward.

Clover’s response also mentions that Seek’s website is still “version 1.0”, and that it plans to release an updated 2.0 version of the website next week. We hope – and suspect – this “update” will include a disclosure about Seek’s relationship with Clover for the first time.

5. The company admits that its Clover Assistant software “resurfaces” old diagnoses annually, even when doctors try to remove them.

One of the major issues we pointed out in our report was how Clover’s software retained old and often irrelevant diagnoses, making it hard or impossible for doctors to remove them. Doctors we spoke with asked why the simple ability to remove a stale diagnosis had not been added to the software.

Such a “feature” creates a painful user experience, according to doctors we spoke with. But the key underlying concern is that the software can facilitate upcoding, leading to unnecessary billing costs and a burden on both the government and ultimately taxpayers.

Clover responded by confirming our contention about its software: “We may also resurface a diagnosis the following calendar year for reconfirmation.”

We strongly believe the company needs to publicly commit to allowing doctors to permanently remove old and irrelevant diagnoses.

6. The company admits it “directly” paid approximately $160,000 to B&H Assurance but has not clarified any “indirect” payments and/or payments to Hiram Bermudez’s spouse.

Our report noted that Clover had an undisclosed outside relationship with a brokerage company called B&H Assurance run by its head of sales, Hiram Bermudez.

We appreciate the company being forthcoming about the amount of money it has paid to B&H Assurance, and now disclosing that 8,200 members (or roughly 14% of Clover’s total members) were referred by B&H, a clearly material number. We also appreciate the company noting that Hiram does not receive any compensation, direct or indirect, from B&H for any work related to Clover.

However, we note that the company’s response raises additional questions. Specifically, as worded, the company has not clarified whether there have been any historical indirect payments to B&H (i.e. through Ritter Insurance Marketing or other entities). And while we recognize that Bermudez is now a Clover employee, the company has still not clarified whether any payments related to this relationship have been made to Bermudez or his, spouse directly or indirectly, from Clover. To the extent that there are or were any, we would expect this to be disclosed.

7. Clover’s response suggests that its CEO’s previous business, CarePoint, had nothing to do with Clover. This is contradicted by CEO Vivek Garipalli’s own testimony to New Jersey regulators in 2019.

In its response, Clover says, “It is important to note that CarePoint is a separate and independent business entity, with different management teams, investor structures, and boards of directors.”

While CarePoint is now separate, the statement conflicts with earlier testimony given by Garipalli himself to the New Jersey State Commission of Investigations as it was investigating allegations of what it termed “significant and questionable management fees paid to related entities” by the CarePoint hospitals.

That investigation revealed that on the very same day Clover was incorporated, one of the majority Garipalli-owned entities that operated the CarePoint hospitals, Sequoia Healthcare Management, took out a $60 million loan connected to the founding of Clover Health:

“Clover Health Investments Corp. was incorporated in the State of Delaware on July 17, 2014 ie. the date the $60 million loan closed. Garipalli confirmed in his testimony that there is a connection between the loan closing and the incorporation of Clover Health Investments. He explained: “We needed to raise outside capital. You cannot raise outside capital as long as the insurance company owed money, so we had to pay off that loan before anyone would invest capital into what became Clover.”

Such ties are the reason NJ legislators, in a letter to the governor in February 2020, called on the state’s Department of Health, Department of Banking and Insurance, and Attorney General to investigate Clover.

8. Clover accused us of “posturing as a white knight” by releasing a public interest report.

We found it amusing that the company accused us of posturing as “white knight” altruists for publishing a public interest piece, especially given the comprehensive media tour Chamath has undertaken over the last 3 weeks.

Clover is also, after all, the same company that released an investor presentation calling an investment in Clover’s SPAC a “once in a generation opportunity to do the right thing”.

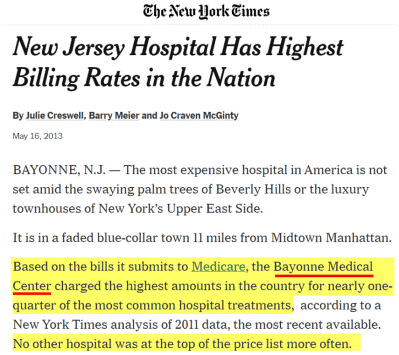

9. Our report highlighted that Clover’s CEO’s previously ran a hospital that charged the highest emergency room rates in the country. Clover responded by calling this fact an “ad hominem attack”.

Our report referenced a New York Times article (and other media reports) that highlighted out how Garipalli’s CarePoint owned a hospital (Bayonne Medical Center) that charged the highest emergency room rates in the country under his leadership.

Quizzically, Clover referred to this as an “ad hominem attack” in their response. They do not appear to disagree with the underlying point however, that Garipalli’s hospital network was notorious for price-gouging practices.

We highlighted numerous issues with CarePoint, including how New Jersey legislators accused Garipalli and associates of siphoning $158 million from the hospital network.

Finally, we did not start the discussion about character, though we do think understanding character is important. In fact, Chamath seems to agree. In a podcast just this week, Chamath was asked what common traits are shared by founders of companies he takes public, such as Garipalli. His response:

“I think their moral and ethical starting point, I deeply resonate with. I think that to a one, all of these guys are just incredible human beings. We’ve all had our own struggles, but I see them just live with integrity.” [45:25 mark]

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. As of the publication of this report, Hindenburg Research has no position in any stocks (and/or options of the stock) covered herein. To our knowledge, none of our members, partners, affiliates, employees, and/or consultants, clients and/or investors have any positions in the stocks (and/or options of the stock) mentioned herein. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

56 thoughts on “Our Response to Clover: Regular Investors And Senior Citizens Shouldn’t Be the Last to Know”

Comments are closed.

$CLOV LFG!!

Hit pieces are beneath you. The timing is too transparent and targeted to be anything but.

Hi guys,

Excellent work on the initial report and the follow-up response. These days most people rely on people like Chamath for investment advice and blindly follow “celebrities” who promote anything.

By reading all of your reports I have definitely learned a lot and have always stayed away from all these new promotion tactics, which have created an army of people taking investment decisions in under 5 seconds.

Thanks,

Dimitris Pantermalis

I see that shorting is not the only way to ddrive a stock price down.

You guys are the devils people and you need to stop this manipulation right now !!! Speaking for all retail investors that live in Florida

What manipulation do you see ?

Great forensic work! I think that they just publicly acknowledged that they are under SEC review as indicated by the reporting yesterday, says a lot!

Hey shorty. Still paying those borrow fees? Tick tock, shorty. Leavenworth awaits. You and your hedge fund cronies and short cabal members will loose it all.

Lose not Loose. LOL. Mispelling = poor education = poor understanding of this issue right here.

Thank you for the informative research, and keep up the good work. I especially appreciate your work on SPACs, since they skip the formal vetting of an IPO.

Regards,

If your goal is to “CLEAN” the slate. You have 100s of stocks to clean up but you only pick a couple dozen a year. Work smarter, not harder.

I have seen some dumb comments on this website so far, especially from ‘degenerate’ retail investors, but this is on a whole other level.

The amount of time and effort invested in each case clearly prohibits going after hundreds of companies.

If you had ever put any effort into serious financial/investigative work you would have been smarter with your attempted baiting.

Thank you for your diligence.

You should ask around if it is common for a managed care org to receive a CID like this. Further, you should ask why was DOJ looking to speak to an ex-employee? It’s not because the request was run of the mill.

You’re trying to paint yourself as being somewhat a savior….but at the end of the day, you are a hired gun paid by hedge funds and short sellers. You know this, we know this, and you will never be able to remove this perception. If you truly want to be as transparent as you claim others should be…why don’t you say who paid you for months worth of “research” into CLOV and I guarantee it had nothing to do with Clover…but everything to do with Chamath…

Good point, it would be nice to see a response to your question. Who paid for the months of investigation? With such a disclaim about how noone ownes,shorts or benifits from this report what skin does hindenburg have in the game ? Where and how much money was generated from this report ?

Lol exactly my point. This thorough research would require countless amount of $ spent and if they know this is a fraudulent company then why aren’t they shorting? Screw making billions right? Ironically funny how they said clover thinks they’re the white knight when that’s exactly what Hindenburg trying to portray GTFO LOL I’m going to buy 5k more if it drops below $8

Give it a rest. Your research is suspect. Lets talk in a year and see what their revs look like. Until them, do dig a hole and bury yourself.

Your name says all one needs to know about you. The name fits you well, genius.

Well done Hindenberg.. Time to bring these SPAC mania down to earth.. so many mushrooms trying to fool the retail investors..

I am a physician. Your report and rebuttal are poor. Every single emr that im forced to use: meditech, epic, and cerner, ALL regurgitate diagnosis no matter how many times you delete them. Your ny times article about er charges is from 2013! Every single health insurance that i work with has been sued, accused of corruption and lied to the public. A united healthcare senior official admitted to denying claims without even reading the documentation in the charts! My practice is swamped in denials and endless documentation and i welcome a company like clover to fix it. Every single year cms reduces our reimbursement forcing us to see more patients per day to make the same income to the point that i can only see patients for 5 to 10 minutes before i have to move on to the next. I trained in my subspecialty until i was 34 years old making resident wages up to that point. When divided by the hours worked per week i was making less than minimum wage. What is your next bullet point going to be? Doctors make too much money?

You seem to be attacking this company for dubious reasons. There are so many idiotic companies that exist, and somehow you needed to go after healthcare.

I really hold no regard for your research or opinions.

Furthermore, I beg everyone who is actually interested in this to go onto a search engine and type: :department of justice cigna”. Then search department of justice humana. And do that for primecare, and then for kaiser permanente, united healthcare, etc. Here are some excerpts that DO NOT pertain to clover but do pertain to EVERY OTHER insurer that exists. They havent uncovered anything that doesnt already routinely go on to every other health carrier.

Cigna 2020: This isn’t Cigna’s first brush with the DOJ — in 2016 it was temporarily banned from selling its MA plans after CMS found it failed to abide by compliance program requirements.CMS overpaid Cigna an estimated $1.4 billion from 2012 to 2017 and DOJ is seeking equal to three times that amount in damages, along with a civil penalty of $11,000 for each violation.

Humana 2018: Humana, Inc. faces new scrutiny from the Justice Department over allegations it has overcharged the government by claiming some elderly patients enrolled in its popular Medicare plans are sicker than they actually are.

Primecare 2018: Prime Healthcare Services, Inc., Prime Healthcare Foundation, Inc., and Prime Healthcare Management, Inc. (collectively Prime), and Prime’s Founder and Chief Executive Officer, Dr. Prem Reddy, have agreed to pay the United States $65 million to settle allegations that 14 Prime hospitals in California knowingly submitted false claims to Medicare by admitting patients who required only less costly, outpatient care and by billing for more expensive patient diagnoses than the patients had (a practice known as “up-coding”), the Justice Department announced today. Under the settlement agreement, Dr. Reddy will pay $3,250,000 and Prime will pay $61,750,000.

Kaiser Permanente 2020: Kaiser Foundation Health Plan of Washington agreed to pay the federal government $6.3 million to settle allegations it submitted invalid Medicare and Medicare Advantage diagnoses and received higher payments.

United Health 2017: The Department of Justice has joined a whistleblower suit against UnitedHealth and one of its subsidiaries that accused them of engaging in a scheme to overcharge Medicare by inflating patients’ risk scores.

Thanks for the report – the information appears to be factual and important for investors to know about. I’ve not bought/sold or shorted Clover – and have no plans too. My primary interest in signing up for your newsletters is to see what type of material you actually provide – to gauge the quality of your work and efforts.

Chamath, the self proclaimed savior of retail traders turns out to be a corporate scumbag just like the rest of them. Can’t say I’m surprised.

Thanks for the report. Interesting insight into what was not reported. Hope that Clover has an adequate response.

I’m just an investor trying to understand things. If you are not invested in shorting clover, then are you really white knights or should some interest be disclosed to people reading this?

Thanks

Fabio

Hindenburg is collecting fees from someone. They are a for profit business.

Fact they end on “character” vs. sticking to the fact and allowing people to come to their own conclusion kinda spells everything out.

Every publisher “news outlet” has a bias!

They just hit you over the head with their bias vs. many others where it can take hours and hours of reading, listening or watching before it becomes apparent.

Cheers

Good report. After a quite a bit Googling, I realized that Vivek Garipalli is no “Innovation Tech Entrepreneur” who is about to make this world a better place. He is more like a Mini-me version Martin Shkrelli.

My bad that I didn’t do my diligence before putting money on the table. Thank you

I’m curious as to why you went to the effort to research and publish this report as you say you have no pecuniary interest, yet you stake your reputation on such claims. This article is laden with rhetoric and character attacks.

Having read all of this, I am still wondering, so what?

Businesses including banks, oil companies, hotels, airlines, big tech, have issues and accusations. Insurance companies in particular are the most regulated and litigated companies. I remember people flying banners over Progressive Headquarters accusing them. Big techs are accused of using private data and pretending “do no evil” type shit. Nothing in the above back and forth seemed out of what is part of running a big business.

Appreciate the skeptical work that you have done. We need folks like you to uncover companies not being transparent.

Chamath is no robinhood.