CLICK HERE TO DOWNLOAD OUR POWERPOINT DECK ON THIS REPORT

- New Pacific is an exploration-stage silver mining company that is at least 10 years away from production. Its only active exploration projects are based in Bolivia.

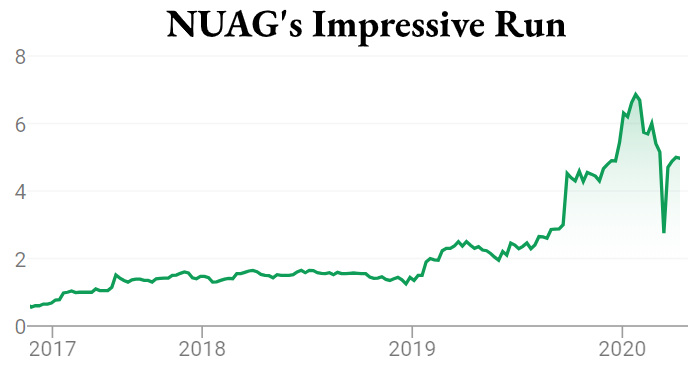

- Since acquiring its Bolivian assets, its stock has surged almost 400%. We believe the sharp move higher has been largely fueled by grandiose claims in newsletters and paid promotion campaigns targeted toward retail investors.

- The company is led by CEO Rui Feng, who is concurrently Chairman/CEO of Silvercorp. Feng’s history raises significant red flags. It includes historical allegations of inflating silver grades and using state influence to have a former short seller jailed in China for almost 2 years.

- Our review of New Pacific’s Bolivian deals shows that the mining concessions on its flagship property had previously been stripped from their previous holder by the state and were never fully restored, leaving the property in a state of legal limbo.

- All of the company’s deals in Bolivia seem to violate laws on the purchase/sale of concessions. Unlike in the U.S. and Canada, Bolivia does not permit the sale or transfer of mining concessions privately. Each deal requires state approval.

- New Pacific had a strong relationship with the Bolivian government at the time it purchased its mining concessions, which seemingly enabled it to bypass the law. However, in late 2019 the ‘friendly’ administration was ousted via coup, with the President and Minister of Mines fleeing to Mexico.

- The new administration has publicly accused the previous Minister of Mines of corruption, specifically relating to his dealings with New Pacific’s Bolivian subsidiary. The new administration has launched a criminal investigation into the Minister.

- We spoke with multiple legal and political sources as part of our analysis. A former Senior Legal Advisor to the State Mining Authority (AJAM) told us: “My understanding is that (New Pacific’s Bolivian entity) has been operating outside the law since these areas were revoked in 2015.”

- We brought the issues up with Victor Borda, former speaker of the lower house and a prominent member of the majority legislative party. He said “If concession-holders do not respect the rules then those areas return to the state.” He suggested he may launch a parliamentary inquiry.

- The former head of the Bolivian State Mining Corporation (COMIBOL) told us “Unless there’s a (comprehensive) framework regulation, I personally don’t think (the New Pacific deal) will get approved by Parliament.”

- Our base case is that New Pacific has its concessions and agreements with the state revoked entirely or negotiated on far less favorable terms.

- Even if the company retains its concessions (which we don’t think it will) New Pacific shares trade at vastly inflated levels, representing 85% downside on a purely fundamental basis.

- All told, we see 90%+ downside for shares of New Pacific and 25%-45% downside for shares of related Silvercorp, which owns almost a 29% stake in the company.

Initial Disclosure: After extensive research, we have taken a short position in shares of New Pacific Metals and Silvercorp through their U.S.-listed equities (OTC:NUPMF and NYSE:SVM). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Basics on the Business and the Bull Thesis

New Pacific Metals Corp. (TSXV:NUAG, OTC:NUPMF) is an exploration-stage silver mining company focused on what it calls its “flagship property” in Bolivia, known as the Silver Sand Project. The company is not actively exploring or developing any properties other than its Bolivian properties. [Pg. 7-8]

The company obtained the concessions to its Bolivian project in mid-2017 by acquiring a local Bolivian entity from a Chinese company [Pg. 6] and later expanded to several nearby properties. The stock has since soared on the interim drilling results of its Bolivian properties and other periodic updates.

Since announcing the purchase of its Bolivian entity, the once-beleaguered stock has gained almost 400%.

The excitement has been encouraged by multiple paid promotion campaigns and newsletters that have relentlessly touted the company’s prospects in Bolivia:

- Proactive Canada is paid $25,000 per year to promote New Pacific, and has issued a bevy of articles on the company [1,2,3,4,5,6]

- Stansberry Research, a newsletter, declared the project to be “the biggest silver opportunity in 50 years” containing a “mountain of silver.” (Stansberry was previously ordered to pay $1.5 million in a 2007 SEC stock fraud case.)

- GoldNewsLetter was paid $200,000 to promote New Pacific, calling it a “World Class Silver Project”:

Beyond hope for its prospects in Bolivia, which is estimated to be 10 years away from production, investors seem to also be buoyed by several other factors:

- Management, which is led by CEO Rui Feng. Feng holds the CEO role at New Pacific while concurrently serving as Chairman/CEO of Silvercorp Metals (NYSE:SVM), an NYSE-listed production-stage silver mining company.

- Backing from both Silvercorp and Pan American Silver, the latter of which is also a NYSE-listed production-stage silver mining company with a major mine in Bolivia.

- Recent unprecedented inflationary moves by central banks, which have increased interest in hard assets (we at Hindenburg own both gold and silver).

All told, investors see a strong management team, backing from major producers and an inflationary tailwind all supporting New Pacific’s quest to find the pot of silver at the end of the Bolivian rainbow.

Reality Check: New Pacific May Not Have Secure Control of Any of Its Bolivian Projects, A History of Stock Promotion (And 85% Fundamental Downside Even if It Did Control the Assets)

We think New Pacific’s largely retail investor base is entirely unaware of a multitude of red flags surrounding the company. In this report, we will show that:

- New Pacific faces a significant existential risk; it may have violated Bolivian law in its acquisition of mining concessions, including its flagship property, putting them at risk of being stripped by the Bolivian government.

- Furthermore, the entity that New Pacific acquired in Bolivia previously had its mining concessions stripped by the state. Those concessions appear to have never been fully restored, creating another legal hurdle for the company.

- The Bolivian administration that had previously worked with New Pacific on its questionable concession deals was recently ousted via coup, with the former administration’s President and Minister of Mining fleeing to Mexico.

- Bolivia’s new administration has accused the former administration of corruption specifically relating to New Pacific’s mining deals.

- New Pacific’s CEO has been previously been accused of inflating the silver grades of his mines and engaging in suspect related-party transactions.

- There is significant related-party overlap between Silvercorp and New Pacific, including a former Silvercorp employee leading an “independent” technical report of New Pacific’s flagship Bolivian property, and multiple questionable related party deals.

- New Pacific appears to be engaged in prolific paid stock promotion, leading to a massive fundamental overvaluation even exclusive of the other issues outlined in this report.

The most obviously alarming conclusion we’ve drawn from our research is that New Pacific may not have secure control of any of its properties in Bolivia.

Further, our review of the company’s deals shows that its purchases of mining concessions, including those for its flagship property, Silver Sand, may have been illegal under Bolivian law.

We also learned that Silver Sand didn’t seem to have a clear title to its mining concessions in the first place before they were supposedly transferred to New Pacific; instead, they had already been revoked due to a prior illegal purchase and appear to have never been fully restored.

We spoke about these deals with multiple legal and political experts, including Bolivian legislator Victor Borda, former speaker of the lower House and a prominent member of the majority MAS Party. He told us he would consider launching a Parliamentary inquiry into the matter, and explained:

“If this company sold areas that had already been revoked and reverted to the state then that would be very serious, quite simply it would be an act of corruption. I don’t understand how the Ministry of Mines has allowed this type of operation and the exploitation of mineral wealth if the areas had reverted to the state.”

The issue, it seems, may have been that New Pacific had a close relationship to the prior Bolivian administration, which allegedly engaged in acts of corruption and turned a blind eye to deals that violated Bolivian law.

That friendly support changed however, when that administration was ousted via coup late last year. The Mines Minster was also ousted and soon faced a barrage of allegations of corruption and fraud, including relating specifically to the deals with New Pacific. He then fled to Mexico.

We see little chance of the new administration looking favorably upon the alleged corrupt and illegal dealings made between the past administration and New Pacific. Consequently, we see a high chance that all of the company’s mining claims are revoked or renegotiated on substantially worse terms.

Meanwhile, we have also identified red flags relating to New Pacific’s CEO, Rui Feng. Feng has been accused in the past of inflating the silver grades of his mines and of questionable related-party transactions at Silvercorp, where he concurrently serves as Chairman/CEO.

The two companies have multiple parallels, including shared board members, shared office space, [Pg. 12] and shared contacts. Per the Canadian SEDAR profiles of each company, they also share a mailing address and a primary point of contact [1,2]:

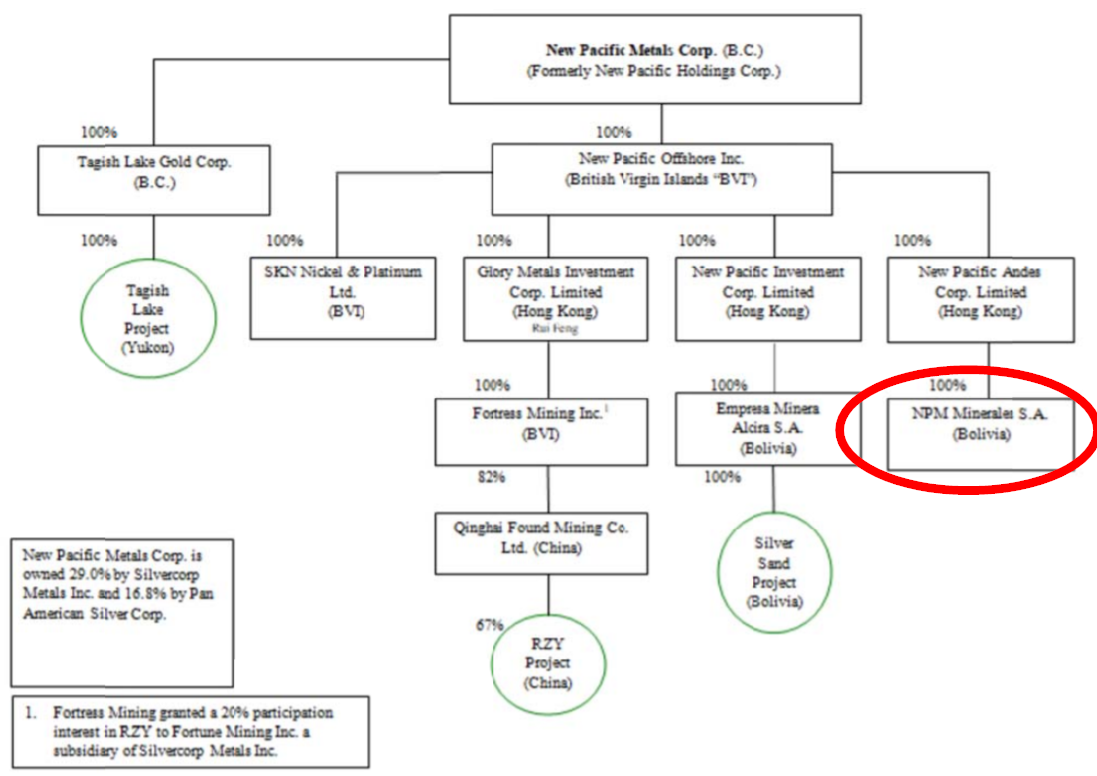

Silvercorp owns about 29% of New Pacific, according to a recent management circular, [Pg. 6] comprising over 23% of Silvercorp’s market capitalization.

We also found troubling red flags when comparing the two companies. For example, the “independent” geologist who prepared almost all of New Pacific’s technical report on its Bolivian property also worked for Silvercorp for 3.5 years as its VP of Exploration, according to his LinkedIn profile.

Additionally, prior to New Pacific’s Bolivian endeavors, it had purchased 3 Chinese mining projects from Silvercorp. New Pacific issued years of positive press releases about these ‘exciting’ projects, but in the end, they all fizzled out. As we detail later, the projects were respectively suspended, sold at a loss, or surrendered back to the local government. [Pg. 2, Pg. 2, and Pg. 4]

The company’s Bolivian projects are the latest ‘exciting’ projects that have sent the stock soaring (with the help of multiple paid promotion campaigns and newsletters). New Pacific appears to be at least 10 years away from commercialization, if any of its projects do make it to that point.

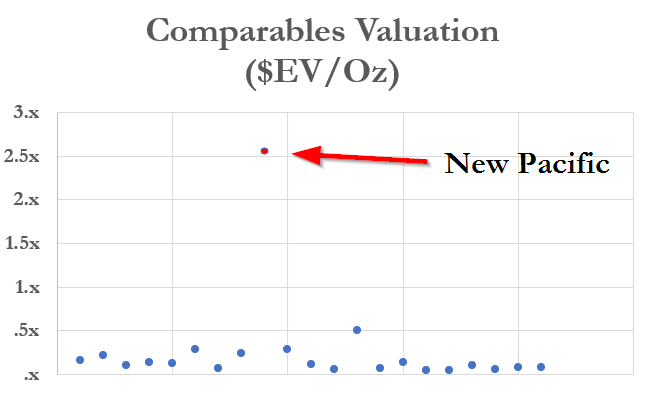

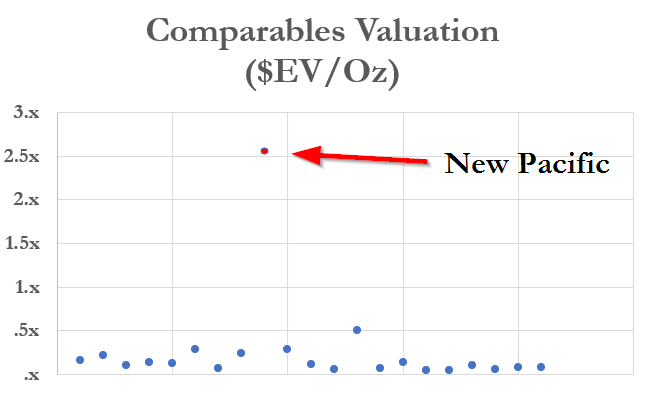

Finally, we have found that New Pacific’s valuation when compared to peers – assuming the business is operating legally without any issues at all – is at least ~7x too high.

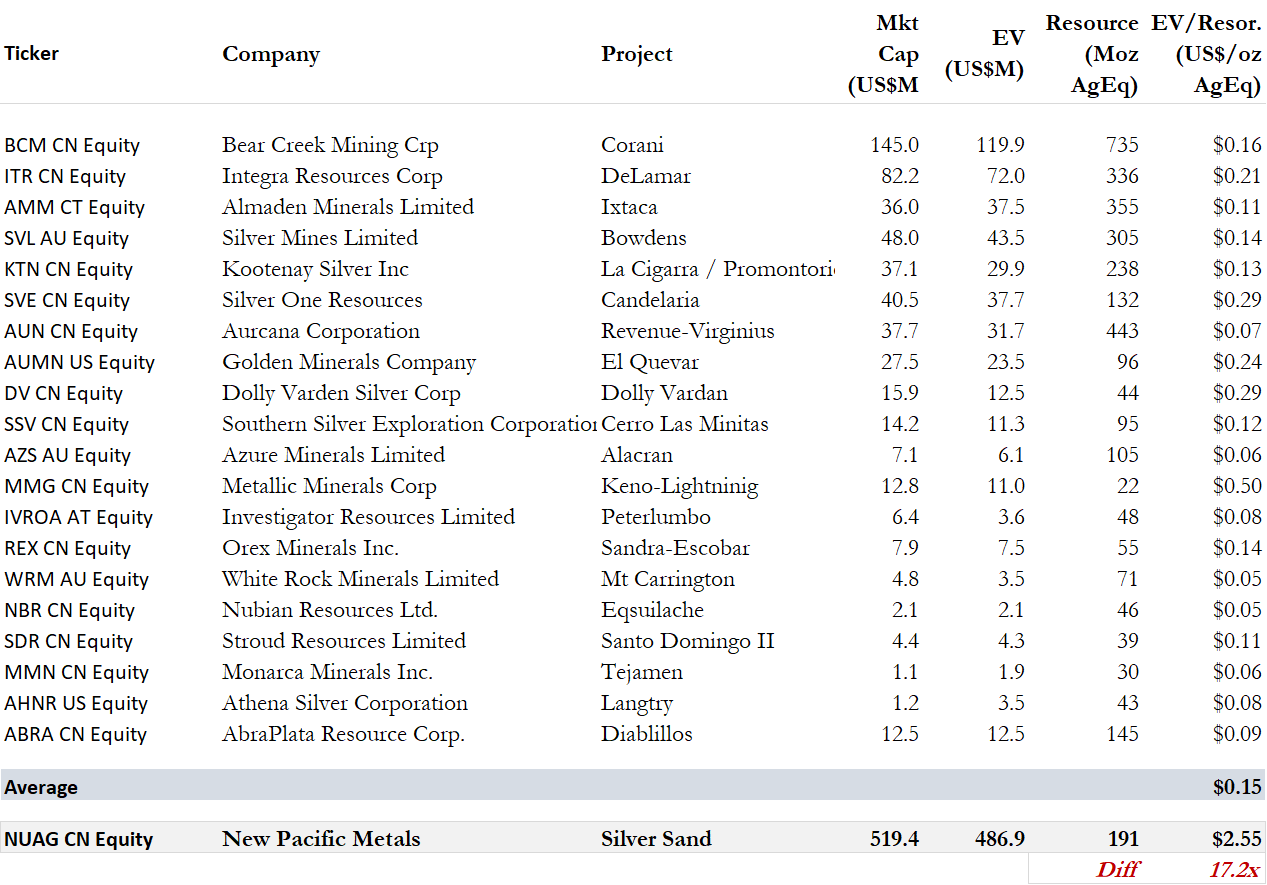

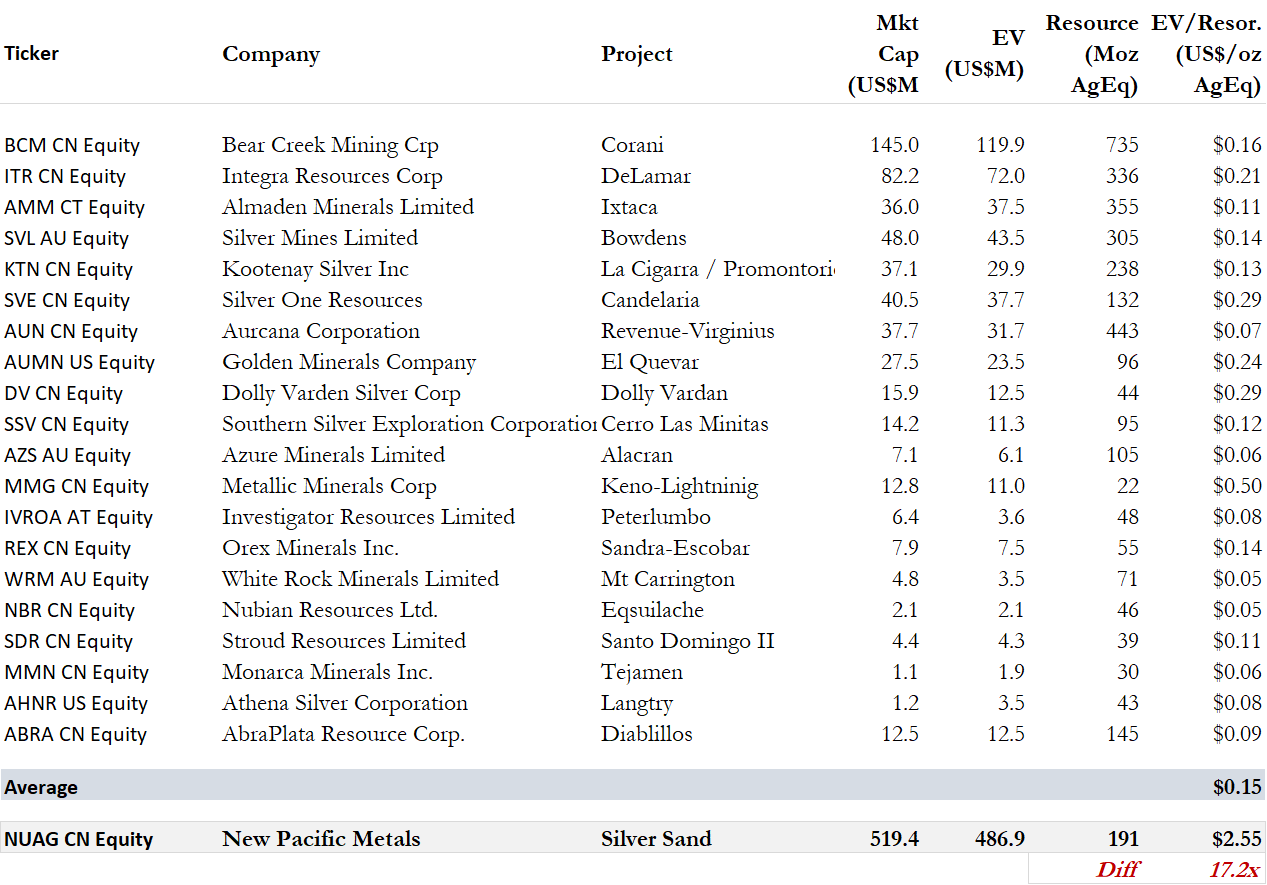

The company recently released its maiden resource estimate, which showed that Silver Sand contains a total of only 191 million ounces of silver, well below average analyst expectations of 223 million. We used this resource estimate to assess its valuation, and found it is trading at ~17x its mining peers:

Here are the projects we reviewed for comparison:

We also hired a mining expert to provide a full technical report on Silver Sand, which can be found in Part III of this report.

Given the company’s outrageous valuation when compared to peers, we see fundamental downside of 85%. When factoring in the uncertainty around its Bolivian concessions and management red flags, we see 90%+ downside.

Part I: New Pacific Doesn’t Appear to Actually Control Its Bolivian Concessions and We Think It’s Unlikely That It Ever Will

The biggest issue we see with the company is that New Pacific may not have control over its Bolivian silver projects.

The key problem is that in order to control mining areas (concessions) in Bolivia, companies must negotiate them legally in conjunction with the state mining corporation (COMIBOL) and the national mining authority (AJAM). For new mining areas, companies must also receive approval from the legislature.

New Pacific does not appear to have acquired its concessions legally, as we will show. Furthermore, on its flagship Silver Sand property, the concessions had already been revoked from its prior holder and do not appear to have been fully restored; meaning that New Pacific appears to be sitting on concessions that are, at best, in a state of legal limbo.

Additionally, while New Pacific received approval from COMIBOL for a large, new mining deal in early 2019 it never received legislative approval. Before it could, a coup ejected the Bolivian government it had been working with and pulled the rug out from the company (and likely its legislative approval).

New Pacific’s Deal for Its Largest Bolivian Assets Was Never Ratified by the Legislature. Rights to Its “Flagship” Property, Silver Sand, Also Looked Tenuous to Begin With

None of that Seemed to Matter at the Time. New Pacific Had a Very Friendly Relationship with the Government, Including the Minister of Mines, Cesar Navarro

New Pacific acquired Bolivian mining entity Alcira in 2017 for $45 million. That deal was focused on a small 3.17 km2 core area that New Pacific refers to as the Silver Sand Project, which we detail further below.

In January 2019, New Pacific announced it had reached a large deal with state mining company COMIBOL, and signed a contract for a much larger swath of surrounding land – an additional mining area of ~57 km2.

The deal was reportedly the first foreign company to sign a new contract with COMIBOL since President Evo Morales took office in 2006.

The Minister of Mines, Cesar Navarro, appears to have been instrumental in the process. In 2019 he held two separate signing ceremonies for the contract between New Pacific and COMIBOL. At the signing ceremony of a January 2019 agreement for mining rights to the 57 sq. km area of land, New Pacific President Gordon Neal stated that he:

“commend[s] the Minister of Mines and Metallurgy and the President of COMIBOL for committed focus to complete this transaction. It is a benchmark achievement that shows that Bolivia is open to foreign investment.”

Here is a picture from one signing ceremony showing Navarro, along with New Pacific President Gordon Neal and New Pacific’s Bolivian country manager Hernan Uribe:

And another from an April 2019 meeting that included the three:

Things were progressing relatively smoothly and it seemed as though the company was on track to win legislative approval to secure and begin exploiting its new, expanded mining areas.

The Administration it Was Working with on These Deals Was Later Ousted Via Coup

But the deal wasn’t sent to Bolivian parliament to be ratified until September 2019. And before it had a chance to be approved, the October 20, 2019 national elections catalyzed a political upheaval in the country.

In November 2019, the Bolivian administration that New Pacific had closely worked with, led by President Evo Morales, was ejected in what was described as a coup.

In Potosi, where New Pacific’s mining operations are based, the electoral court building in the region was burned to the ground, giving a sense of how the region has become a literal political tinder box:

The New Administration Has Accused the Old Administration of Acts of Corruption Relating Specifically to New Pacific’s Bolivian Subsidiary, Alcira.

Former President Evo Morales and Minister of Mines Cesar Navarro Have Since Fled to Mexico.

Immediately following the coup, Evo Morales fled to Mexico. His Minister of Mines, Cesar Navarro – who over the last decade had become part of the President’s trusted inner circle – took refuge in the Mexican Embassy residence in Bolivia and finally managed to escape to Mexico himself in February this year.

Just days before he fled, the new Minister of Mines Carlos Huallpa publicly accused Navarro of corruption relating to the Alcira deal (the subsidiary of New Pacific). Navarro was also being threatened with criminal charges of trafficking political influence, relating to allegations he helped rig the results of the October 2019 elections. Per a Google translated version of media reports at the time:

And the Google translated version of a January local media article:

Both former Minister Navarro and Minera Alcira SA denied the improper association with Minera Alcira saying:

“Cesar Navarro, former Minister of Mining, does not have or has never, directly or indirectly, had a strategic partnership with Alcira or any company in which New Pacific Metals Corp participates”.

We Spoke with Multiple Local Sources to Get A Better Sense of the Political Risk to New Pacific Investors and Details on the Corruption Allegations. As a Result, We Believe Silver Sands’ Mining Production Contract May Never Be Ratified.

We hired local consultants, including international investigation firm Kreller Group, to perform checks with local sources and officials to further understand the corruption investigation and potential political risk to New Pacific.

We wanted to learn whether the company’s much-publicized 57 km2 mining production contract will ever be ratified and what the implications are for tenure at the core 3.17 km2 Silver Sand Project.

What we found is that the political risk is high. In fact, our base case is that New Pacific’s deal for the expanded mining area will never be ratified. We also expect the Silver Sand property will be contested and, if any deal is ever approved, we expect the economics to be materially worse.

Multiple sources we spoke with also indicated that there was potential for graft in the kind of deal Navarro’s ministry was putting together with Alcira, thus lending credence to the allegations.

Former COMIBOL Chairman Hector Cordova: “Unless There’s A (Comprehensive) Framework Regulation, I Personally Don’t Think (The New Pacific Deal) Will Get Approved by Parliament”

We spoke with former COMIBOL chairman (2011-2012) and former Vice Minister of Mines (2010-2011) Hector Cordova. Cordova predicted the New Pacific contract may prove difficult to pass even if or when parliament debates it. Here are some quotes from our interview with Cordova:

“The (New Pacific-COMIBOL) contract had been under review by other parts of government that saw the percentage (of state-take) as very low. Others wanted a framework regulation in place before they gave their approval because they wanted to understand the basis for the calculation for approving this percentage (of profit split).”

“The contract is currently suspended. It’s been signed by COMIBOL and the company but without (parliamentary) approval it does not enter into effect. Until there’s a framework regulation, I personally don’t think this will get approved by parliament.”

“I think there’s a lack of political will and technical capacity to produce something this subtle (the framework regulation). Right now all the heads of mining are from the cooperative sector and they’re the least technically prepared for this.”

“That’s a great limitation and it will be an obstacle to drawing up a coherent proposal. I think it would be more practical to wait for a new government and new legislation. But of course we’re subject to coronavirus now. Everything has been left hanging in the air.”

Bolivian Journalist Who Reports on the Local Mining Industry: “My Personal Opinion is that Cesar Navarro is Totally Corrupt”

A local reporter focused on the mining industry in Bolivia flagged specific irregularities with the New Pacific deal that he believed indicated corruption.

In particular, mining companies under (Article 148) the 2014 mining law are required to pay 55% of the income (profit) from a mine to the state if it has a joint venture agreement. New Pacific somehow managed to negotiate what was termed a mining production contract with a payment of only 4% of gross production value going to COMIBOL. [Pg. 2]

While that low percentage comes off the top line sales (rather than bottom line net income), the reporter indicated that the deal results in a significantly lower proportion of overall proceeds to the state:

“My personal opinion is that Cesar Navarro is totally corrupt and even more politically protected by President Evo Morales himself (another great corrupt too).”

“…Particularly in the case of Minera Alcira and Cesar Navarro, the secrecy with which they handled the issue and the speed of procedures in all administrative instances, to grant prospecting areas, is very suspicious. This fact clearly shows Navarro’s interest in Minera Alcira.”

This analysis was also corroborated by local media articles at the time.

Political Advisor to the New Bolivian Government: According to the Current Minister of Mines, There Was a Government-Based Group that Had an Economic Interest in Obtaining Money from Alcira

Our investigators also spoke to a political advisor to the new administration to get a sense of what areas might be under investigation, and whether any preliminary findings indicated that corrupt acts took place.

We also asked what type of interests Cesar Navarro would have had in Minera Alcira. Our source reported that according to the current mining minister, there was a group called “INTI” in the Ministry of Mining which had an economic interest in obtaining money from Minera Alcira, helped facilitate the New Pacific’s concessions and charged for doing so. This statement was also corroborated by local media articles at the time.

They pointed out that Navarro’s appointment to the position of Minister of Mining was political, as he “does not have the technical or moral training for such a sensitive position.”

Prior to his appointment as Minister of Mining in 2014, Navarro did not have experience in the sector. He and his brother were experienced regional political operatives in their hometown of Potosi and between 2010 and his appointment to the mining portfolio, he was in charge of mass, grassroots political organizing under direct control of the President’s office.

Former Minister of Mines: “Navarro Was One of the Most Corrupt Ministers There Has Been.” [He Was] “Always Open For Business”.

As a socialist government and part of the Latin American leftist alliance with Venezuela, Cuba, Ecuador and Nicaragua, Evo Morales’ administration gave the impression that it was hostile to doing business with foreign multinationals. Yet New Pacific was the first foreign company to sign a new contract with state-run COMIBOL since Morales took office in 2006.

A former Minister of Mines told us Cesar Navarro, despite his leftist credentials, was “always open for business”. He further said:

“I think this contract was more an initiative of Minister Navarro than of the MAS Party. Cesar Navarro has been one of the most corrupt ministers that there has been. The most probable thing is that he has asked for money from New Pacific. But that he’s actually a shareholder? I don’t think so…

“…The policy of the MAS Party was seen as anti-business but I have many business acquaintances who have had a good relationship with Cesar Navarro. There was always a fluid dialog.”

In Addition to The Corruption Scandal, We Found That New Pacific’s Purchase of Mining Concessions May Have Been in Open Violation of Bolivian Laws

Thus far, we have reviewed allegations of corruption relating to New Pacific’s Bolivian mining dealings. Beyond this, however, our work has found that New Pacific’s concession deals were in apparent violation of Bolivian law, which strengthens the case that New Pacific’s mining rights may never get final approval.

Background on Bolivian Mining Law: Unlike in The U.S. And Canada, Bolivia Does Not Permit the Sale or Transfer of Mining Concessions Privately. Each Deal Requires State Approval

Unlike most other mining economies, Bolivia does not permit the sale or transfer of mining areas (formerly known as concessions). This differs from normal practices in Canada and the U.S., where junior mining companies can own and develop land and sell it to a major producer.

Contrary to that approach, mining wealth, including surface and subsurface rights, are deemed to be the property of the Bolivian people, a notion prevalent since the 1952 nationalization of private mines but reinforced after the socialist Evo Morales came to power in 2006.

The Constitutional Court ruling 0032 of May 10, 2006, the 2009 Constitution and the 2014 Mining Law 535 state clearly that mining areas (formerly known as concessions) cannot be “transferred, mortgaged or inherited”.

From the 2009 Constitution [translated to English]:

The 2014 Mining Law Art. 5 (c) sets out the “basic principles of the mining law” and reiterates: “non-transferability of mining areas”.

A key reason behind these rules was to prevent private individuals or companies from acquiring mining areas/concessions from the state mining company COMIBOL, sitting on them as a nest-egg and then selling them on at a large profit to actual mining companies.

The laws were effectively aimed at removing those people who were acting as private middlemen for state-owned resources.

New Pacific’s Purchase of Silver Sand Looks As Though It Violated Bolivian Law on the Sale of Concessions

Given the above, a key legal question emerges in relation to New Pacific’s $45 million purchase of Alcira, the Bolivian entity that controlled the company’s flagship Silver Sand property: did New Pacific pay in order to acquire its concessions (which would likely be illegal) or was the price tag purely to acquire the assets of Alcira?

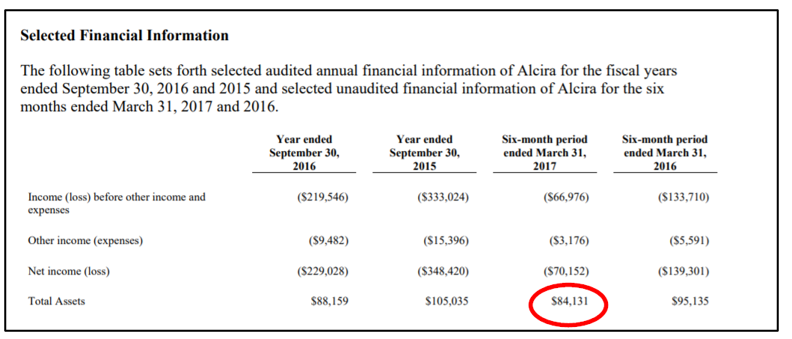

The answer seems quite clear. The information circular detailing New Pacific’s acquisition of Alcira showed that the entity had total assets of only $84,131 just prior to the acquisition: [Pg. 62]

Similarly, since Alcira’s creation in 2008, it had never generated any income and had conducted only very limited exploration. The prior holders drilled only 8 core holes totaling 2,334 meters. [Pg. 19] Thus, there were no major ongoing operations being acquired either.

New Pacific’s press release that described the rationale for the deal corroborates that the deal included concessions. It described Alcira as having seven Temporary Special Authorizations (essentially concessions), which seems to make the intent clear.

Furthermore, this is made all the more obvious to us given that New Pacific paid ~85x more for Alcira than its prior holders (China-based Ningde Jungie, which paid $530,000).

We emailed New Pacific and asked for clarification on how its purchase of Alcira differed from other deals that saw concessions stripped and have not received an answer as of this writing.

All told, it looks like the company’s first step toward development in the region may have been in violation of Bolivian law. At the time, this may have been something the administration ignored, but with the changing political landscape this represents a clear risk to investors.

The Prior Holder of the Alcira Silver Sand Concessions Had Allegedly Purchased Them in Violation of the Constitution. As A Result, Those Areas Were Stripped by the State.

They Do Not Appear to Have Been Fully Restored, Placing the Company’s Flagship Property in a State of Legal Limbo.

Controversy surrounding New Pacific’s Bolivian entity (Minera Alcira SA) is nothing new. Our research revealed that the entity has been contested for years amidst allegations of the illegal transfer of mining concessions.

Minera Alcira was formed in mid-2008, according to Bolivian corporate records.[1] It was originally jointly controlled by a company called Minera Tirex, run by former Minister of Mines Jaime Eduardo Villalobos, and the ex-wife and an employee of another former Minister of Minues Oscar Bonifaz. [Pg. 27]

Villalobos is still facing criminal corruption charges from his time in office. Bonifaz was a former COMIBOL chairman and business associate of a former Bolivian president, Gonzalo Sanchez de Lozada, who fled into exile in the face of criminal charges, including corruption, during a wave of privatizations.

In 2010, a Chinese entity called Ningde Jungie Mineria Co., Ltd bought Alcira from Tirex, paying $530,000, according to the deed of sale and local media reports.[2]

Recall from above that it is illegal in Bolivia to outright sell mining concessions (as concessions require approval from the state). Page two of the deed of sale seemed to openly violate these rules, stating:

“Mining concessions. There are 17 mining concessions registered and included in the assets of Alcira Minera SA.”

Shortly thereafter it states:

“17 concessions are included in the company’s assets and these have been duly entered into the Mining Register and Rights of Potosi under the name Alcira SA”.

It then lists the 17 concessions by name in a tabulated format.

In a 2011 obligatory baseline environmental impact study, drawn up by Bolivian Environment Ministry engineers, those concessions still appeared in the name of individual concession-holders, including Oscar Bonifaz’s son, Roberto Bonifaz. [pgs. 13-14]

In May 2015, the newly-created Bolivian mining authority (Autoridad Jurisdiccional Administrativa Minera, or “AJAM”) took notice, and revoked the concessions. It also threatened criminal legal proceedings against Alcira’s original directors and shareholders.

During a press conference in August 2015, the executive director of AJAM declared that the original sale of the mining areas had been constitutionally invalid, because the assets are state-owned:

“We revoked mining areas that they had transferred, something that they did not have the right to do because they are not owners”

From state mining company COMIBOL’s website:

On June 2, 2015, Alcira appealed the revocation decision to AJAM, arguing it was simply transferring ownership of shares in the company and not the concessions themselves. But as shown above, the original deed of sale from 2010 blatantly contradicted this, showing that the concessions were listed as “company assets”.

AJAM upheld its order, saying the deal was unlawful and expressly forbidden by the constitutional court ruling 0032 of 2006 and enshrined in the 2009 constitution.

Cesar Navarro Conveniently Moved to Reinstate the Concessions Prior to the Sale to New Pacific

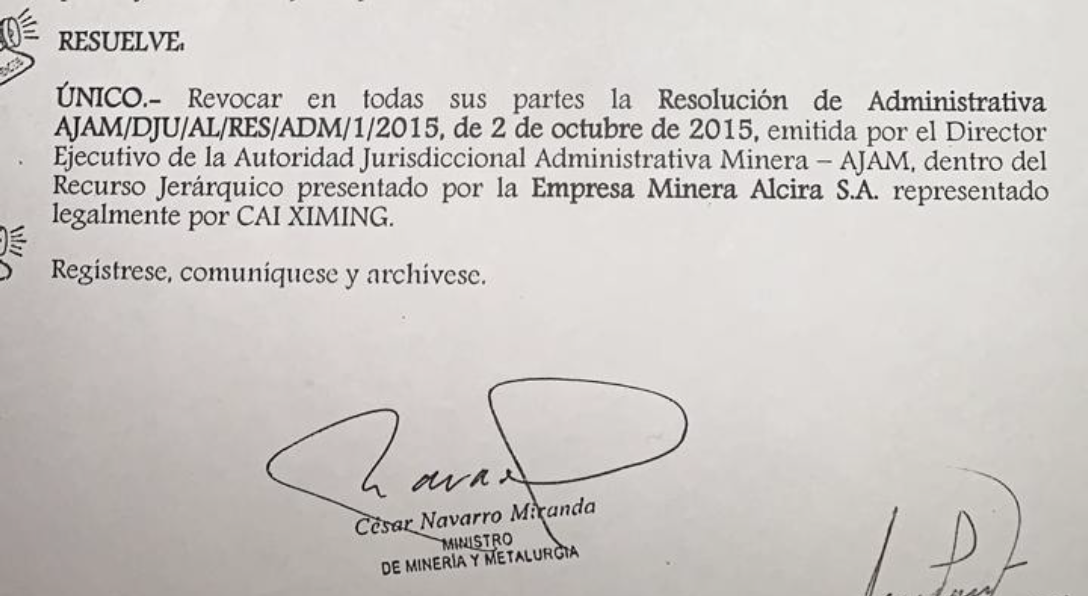

However, Alcira SA lodged a second appeal with the Mines Ministry on October 2, 2015. This time, Cesar Navarro directly intervened and ruled in Alcira’s favor.

We received a copy of the decision from a former Senior Legal Representative at AJAM, where we can see that Navarro signed the decision himself:

Navarro Initially Supported the Revocation of Alcira’s Concessions But Then Later Overturned an Appeal That Had Revoked Them.

Former Senior Legal Representative at State Run AJAM: “You Never Know How Those in Power Make Their Decisions”

Our former senior legal AJAM source said the original Alcira revocation decision had been thoroughly consulted with AJAM directors, the Minister of Mines and even as far up as the presidency. He said he did not understand why that decision was later reversed although there was heavy legal, political and diplomatic pressure exerted by Alcira’s lawyers, administration allies and the Chinese Embassy:

“It wasn’t like we took our original decision on impulse. We explained the situation to the (Mines) Ministry and to the Presidency and everybody at the time was in agreement. This company had no assets. They transferred a couple of old trucks but had nothing else and they were charging $600,000 USD (approx..). And so, it was clear in fact that they were transferring the concessions.”

“…We told Cesar Navarro of our decision to revoke Alcira’s claims at the time and he agreed. Then later he went and changed his mind. You never know how those in power make their decisions.”

Navarro Overturned the Appeal, But Not the Original Revocation Order. The Property Still Looks to Operate in a State of Legal Limbo.

Former Senior Legal Advisor to AJAM: “My Understanding is that Alcira Has Been Operating Outside the Law Since These Areas Were Revoked in 2015”

Following Navarro’s ruling on the Alcira concessions (despite the apparent constitutional and legal issues), the entity was soon sold from its Chinese owners to New Pacific.

New Pacific announced the agreement to acquire Alcira on April 10, 2017, from Ningde Jungie Mineria Co., Ltd. and two Chinese individuals. The purchase price was U.S. $45 million in cash to be paid by New Pacific. [Pg. 6]

As described above, the Mines Ministry ruling issued on Jan. 15, 2016 and signed by the Minister of Mines Cesar Navarro overturned AJAM’s appeal ruling regarding the revocation of the Silver Sand concessions.

However, that Mines Ministry ruling does not appear to have overturned the substantive decision in May, 2015, to actually revoke the Alcira’s 17 concessions. In other words, the appeal upholding the revocation was tossed, but the original revocation of the Alcira mining concessions was never actually reversed.

That view is shared by our former senior AJAM legal source:

“…when the Mines minister considered the appeal, they ruled against the AJAM’s first appeal verdict but they left the original revocation of (mining) areas in place.”

“Maybe (prior owner) Jungie thought the ministry had ruled in their favor and so they carried on and look where we are now…Maybe the Mines Ministry did not fully understand the norms. I understand the situation remained like that and since then they have been operating outside the law.”

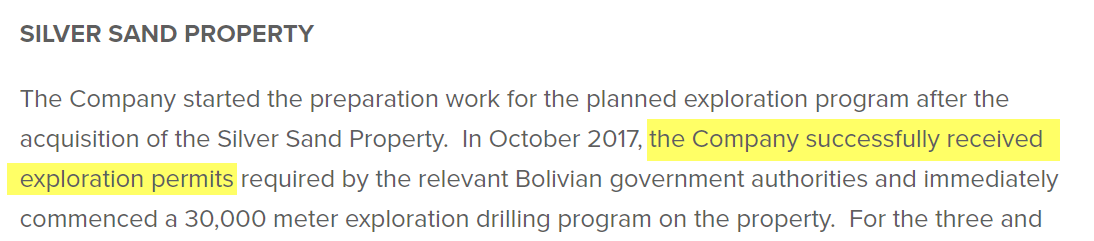

That same legal source helped identify a key red flag indicating that New Pacific is aware of this, and failed to fully disclose this issue to investors. A press release stated that in October 2017 the company was granted exploration permits for Silver Sand:

But an exploration permit would be unnecessary if it already had secure title to the property. (For further analysis of this issue see Appendix A). The former AJAM legal expert we interviewed said:

“They could not have given out an exploration permit if Alcira already had (legal) title to those (Silver Sand) areas. Because according to the mining registry that AJAM operates, you cannot give an exploration license for an occupied area. But that is an indication that the concessions were (and remained) revoked….my understanding is that Alcira has been operating outside the law since these areas were revoked in 2015.”

We emailed New Pacific and asked why it would need an exploration permit if its tenure was already secure on those areas, and have not yet received a reply.

In short, when New Pacific purchased Alcira, thinking it was buying the entity’s mining concessions (which itself would be illegal), it may have actually paid $45 million to essentially buy nothing. At best it looks to have purchased an entity with a contested interest in mining concessions.

New Pacific’s Other Purchases of Bolivian Concessions Appear to Be in Open Violation of Bolivian Law

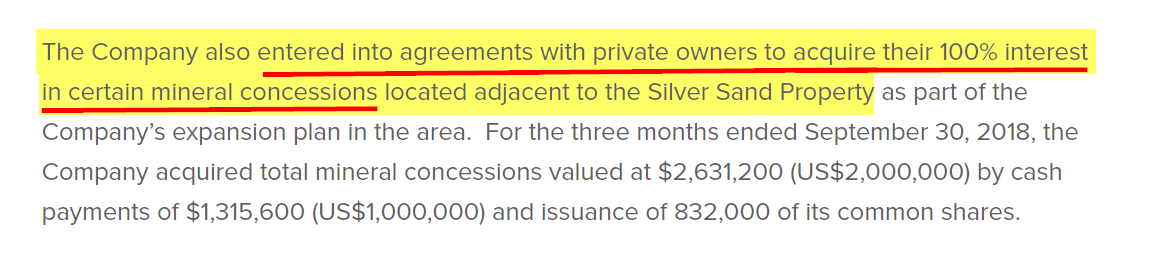

Beyond the original purchase of Alcira, which held the Silver Sand project, New Pacific also made subsequent purchases of three nearby concessions. Once again, these acquisitions in July 2018 and December 2019 appear to be in open violation of Bolivian law.

For example:

And another example:

The brazenness with which these purchases seem to violate Bolivian law on purchasing concessions indicates to us that perhaps New Pacific felt it had powerful allies within government that permitted them to disregard the law and the constitution and push the deals through regardless.

Local Cooperative Miner: There Must Be Money Changing Hands Because Navarro Was Minister of Mines…And COMIBOL Was Telling Us Everything (All the Mining Areas) Was for Alcira

We also talked by phone to a senior source at a local mining cooperative who lives and works, mining and herding llamas, immediately next to Silver Sand. He described to us the key players in the purchase of three concession sales (1,2) and the signs of corruption he witnessed:

“When Wascar Veltran (holder of several concessions) saw that Alcira (New Pacific) was in the area and doing checks, then he went to (Hernan) Uribe (New Pacific country manager). Then Uribe, Wascar Veltran and Villalobos have done this deal.”

Villalobos – Jaime Eduardo Villalobos Sanjines – is a former mines minister who is currently facing criminal charges for corruption during his past time in office. He had a 50 percent stake in Tirex S.R.L., which sold the original Silver Sand concessions to Chinese mining company Jungie in 2010 [Pg. 27]. Although he remained as Jungie’s general manager until at least mid-2015 [1,2] it is not clear whether he helped negotiate any part of the deals with New Pacific.

Our mining cooperative source tells us the first two concessions (locally referred to as Jisas and Jardan) were “virgin” sites with no mine development. He tells us the third, known locally as Bronce, had a small artisanal mine. He said:

“Those areas are changing hands for millions. I don’t know too much about it because I can’t stick my nose in too much. But you know that by law concessions can’t be sold anymore. But up until last year they were still being sold. And tomorrow they’ll be being sold as well.”

Our senior cooperative source, who by his own description is an “uneducated man but not stupid”, believes corruption is the only explanation why concessions are being traded and why land, where he has dug for tin and silver for decades , and where he has grazed his llamas, is now selling for huge amounts. He said:

“…What can a poor man like me do against big business. I can’t even make a complaint. The best I can hope for is to get some work there.”

“…I have no idea how they could have increased the value to those huge numbers of millions in just 7 years. I don’t know who will be paying that amount because the poor community members can’t afford that. “

“…There must be money changing hands because Navarro was Minister of Mines and he gave the orders to COMIBOL. And COMIBOL was telling us everything (all the mining areas) was for Alcira.”

“…All the COMIBOL mining areas around here in 2018 and 2019 were being given to Alcira (New Pacific). Alcira has had some kind of a political negotiation.”

We Asked a Prominent Bolivian Legislator About New Pacific’s Purchases: “This Sounds Very Serious…If Concession-Holders Do Not Respect the Rules Then Those Areas Return to the State”

We spoke with Victor Borda, former speaker of the lower House and a prominent member of the majority MAS Party, in order to understand a legislator’s take on the sale to New Pacific and the deals taking place in the area. President Evo Morales and Minister Navarro belonged to the same party as Borda.

Upon learning more details of the Alcira SA sale to Jungie in 2010 and to New Pacific in 2017, congressman Borda suggested he may launch a parliamentary investigation into the validity of the proposed contract. Here are some quotes from our interview with him:

“Even before the 2009 constitution it was clear that mineral wealth is the property of the Bolivian people and (concessions) cannot be the subject of private transfers, mortgages and even worse to sell those concessions. “

“Concession-holders have use of those concessions but cannot dispose of them at will because those areas belong to the state. If concession-holders do not respect the rules then those areas return to the state.”

“If this company (Alcira/Jungie) sold areas that had already been revoked and reverted to the state then that would be very serious, quite simply be an act of corruption. I don’t understand how the Ministry of Mines has allowed this type of operation and the exploitation of mineral wealth if the areas had reverted to the state.”

“This sounds very serious. As a member of parliament I will try to investigate this subject. Sometimes public officials get members of parliament into problems because they pass us contracts in a big package (with other contracts) and sometimes these (bad) contracts and irregularities get camouflaged.”

“If there’s corrupt people or people who have made the government look bad then they must be sanctioned.”

What are the Odds That the New Bolivian Administration Blesses the Alleged Corrupt and Illegal Dealings of the Old Administration They Ousted Via Coup? We Think Low, But Greater Than Zero

We think the odds are high that the Bolivian government and parliament could revoke the company’s Silver Sand concessions, and scrap the production contract for the expanded 57km2 mining area with Alcira, leaving New Pacific with essentially nothing.

We emailed New Pacific and asked for more clarification on several issues, including:

- Is approval by the legislature required for Silver Sand, or just the expanded mining area?

- Why would an exploration permit be needed if tenure was already secure on those (Silver Sand) areas?

- How has Alcira’s historical purchase of concessions, which were subsequently stripped by the state, differed from New Pacific’s purchases of concessions?

We have not received replies to these questions as of this writing. Should New Pacific provide us answers we will update this piece accordingly.

It’s worth noting that the company has disclosed approval delays as a risk, though most investors seem to have just ignored it as a boilerplate risk factor. Per the latest MD&A

“The (company’s mining production contract) was approved by Bolivia’s Ministry of Mining and Metallurgy on January 7, 2019, but remains subject to ratification and approval by the Plurinational Legislative Assembly of Bolivia. As of today, the MPC has not been ratified nor approved by (sic) Plurinational Legislative Assembly of Bolivia.” [Pg. 3]

We think investors need to weigh three possible scenarios:

- Total revocation of contracts and mining areas. We believe there is a 60% chance of this happening.

- A renegotiated deal with COMIBOL/the legislature, which would likely be on far less favorable terms. We believe there is a 30% chance of this happening.

- The deal somehow passes through Bolivia’s congress as-is. We believe there is a 10% chance of this happening.

Between the new administration’s allegations of corruption around the deal, the signs we found of illegality around the terms of the concession purchases and the current political environment, we think the company has an uphill battle in getting contracts approved and legally retaining its mining areas.

That all being said, we don’t think anyone can credibly claim to know with certainty which direction the political winds will blow in a country with as much recent upheaval as Bolivia.

Aside from political volatility, the country was ranked 123rd out of 180 countries in Transparency International’s survey of public sector corruption, which also always has the potential to swing the balance.

Clearly, at least with historical administrations, laws in Bolivia seem to have been bent or ignored outright when enough money was involved.

A Bolivian Lawmaker Asked Us (On A Recorded Call) Whether We Had an Interest in Seeing the New Pacific Deal Approved.

Us: “Would It Come at a Price?”

Lawmaker: “Yes Exactly”

It’s not entirely clear yet how the interim, center-right Bolivian administration will handle potential corruption. Political power remains divided and the MAS Party retains majority control of Bolivia’s lower house and Senate, despite its leader Evo Morales being ousted from the presidency.

As part of our research, we spoke with one lawmaker influential in mining issues. (Note: We have this call recorded)

When we asked about New Pacific he said initially he could not specifically recollect the proposed deal but offered to check. He later came back with what sounded like an unsolicited offer to help pass or block the contract between New Pacific and COMIBOL when it came up for consideration by parliament:

“I’m going to look for an alternative to see if I can bring that (Alcira/New Pacific) contract up for consideration and get it passed because I have been able to bring up several contracts like that and get them passed.”

“And now a little question. Would you be interested in this going ahead, so that I can take an interest in it? Or on the contrary would you prefer it to stop? I just wanted to talk to you a little about that because if you’re interested then I can do something …to push forward this mining contract otherwise I can just ask about the situation, yes or no.”

When asked if his intervention would come at a price, he said:

“Yes exactly that’s true and that’s exactly what I wanted to say. And so we’d have to work with the technical experts (of the senate) and something could be done.”

We prefer to let the lawmaker’s comments speak for themselves. But we came away with the impression that public sector graft may still hold sway over parts of the political decision-making process.

Our Conversation with the New Minister of Mines Carlos Huallpa: More Conciliatory than When He Leveled Corruption Allegations In January

We also talked by phone with the new Minister of Mines Carlos Huallpa about New Pacific’s purchase of Alcira and his predecessor’s offer of a major mining contract on generous terms.

The right-wing interim government, running Bolivia until new general elections can be held, has an interest in showing the country remains open to foreign investment. That may be one reason why Huallpa appeared to strike a more conciliatory tone compared to his remarks in January when he accused Navarro and Alcira of being in a corrupt alliance.

He said New Pacific’s legal team had already been in touch about rescuing the contract deal but was insistent that if a new deal was reached, the Bolivian state’s percentage share of production or the profits would be significantly higher.

Even if new terms are hammered out with the Mines Ministry, however, a deal would still need approval by the legislature.

For now, the legislature is not meeting in person—coronavirus quarantine restrictions in Bolivia have been extended until at least April 30th. Even when it does meet, its first priority will be rescheduling general elections for the presidency and congress, which had originally been planned for May 7th.

Part II: Management Red Flags, Multiple Related-Party Deals with Silvercorp And Other Warning Signs

When assessing a speculative early-stage mining investment, the credibility of management is critical. Our review of New Pacific’s management team uncovered significant red flags.

Before we dive in, here are some basics showing the tight relationship between New Pacific and Silvercorp:

Leadership Overlap: Rui Feng, CEO and director of New Pacific, also serves as Chairman/CEO of Silvercorp. David Kong also serves as director at both companies.

Cross-Ownership: Silvercorp owns about 29% of New Pacific, according to a recent management circular [Pg. 6] Historically, New Pacific had also owned stakes in Silvercorp’s equity, per company filings. [Pg. 3]

Shared Office Space. The companies also share overhead expenses and office space [Pg. 12]. This can also be seen from the Canadian SEDAR profiles of each company [1,2]:

New Pacific’s Management Has Been Accused of Inflating Silver Grades, And Other Improprieties, At Related Company Silvercorp

New Pacific CEO Rui Feng has come under fire previously over allegations of falsifying silver grades at his other public company, Silvercorp.

In late 2011, fraud researcher Jon Carnes, who has among the best track records in the industry in identifying irregularities with China-based companies, issued a report on Silvercorp that alleged, among other things:

- The company’s technical reports were based on a 2-man team that used resource estimates provided by Silvercorp, and who hadn’t visited the site in years.

- The quality and resource estimates of its mines were overstated.

- That a related-party transaction had enriched a relative of CEO Rui Feng.

Following issuance of the report, Silvercorp responded and retaliated with a multi-year legal war (that we detail further below.)

The British Columbia Securities Commission (BCSC) investigated Silvercorp after the report. According to the Globe and Mail, the commission’s chief mining advisor, Robert Holland, wrote to the company, outlining major irregularities:

“Holland wrote that the reports used resource estimation methods that were inconsistent with best practices, and contained ‘errors that could individually or collectively result in material overestimation of mineral resources.’

Holland pointed to one technical report that, he said, relied ‘unduly’ on information from the company’s chief operating officer and president, and had ‘uncorrected errors in mineral resource tables.’ He added that there were large unexplained differences in the report between two measures of a mine: resources and reserves.

In summary, he wrote: ‘We consider the Company to be in material default of its technical disclosure and filing requirements.’ He threatened to put Silvercorp on the BCSC’s default list—exposed publicly as a company that was in violation of the BCSC’s rules.”

Despite this, the BCSC eventually dropped its investigation without detailing why. A private lawsuit went forward in the U.S., however, resulting in the company paying a $14 million settlement, without admitting wrongdoing.

Troubling Parallels at New Pacific: One of the Two “Independent” Geologists Who Wrote the Silver Sand Technical Report (and the Only One to Actually Visit the Site) Worked at Silvercorp for 3.5 Years

A technical report is meant to provide a summary of material scientific and technical information of mining projects so investors have a clear, objective view of its prospects. In order to achieve this objective, the role of independent geologists in preparing technical reports is critical.

A fulsome technical report for Silver Sand is all the more important given that the project’s prior owners “conducted no commercial mining or material processing but only surface exploration and limited surface core drilling” [Pg. 16]. The prior owners drilled only 8 core holes in two separate campaigns totaling 2,334 meters. [Pg. 19]

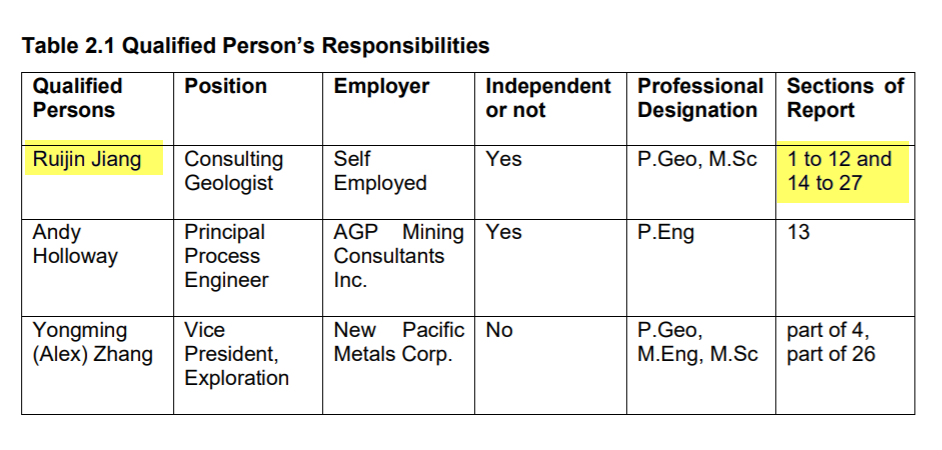

New Pacific released its latest technical report for the Silver Sand property on October 31, 2019, effective August 31, 2019. [Link]. The report was prepared by 2 “independent” geologists, and one additional geologist associated with the company.

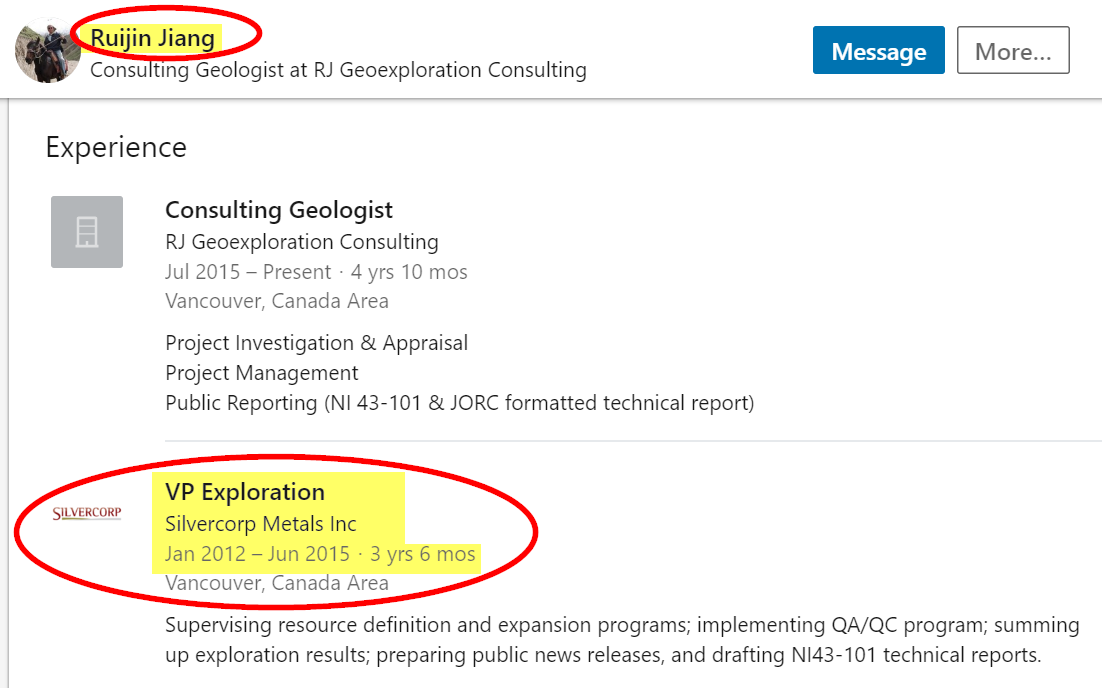

Of the two “independent” geologists, only one, Ruijin Jiang, actually visited the site. [Pg. i] Jiang was also responsible for almost all of the report (everything except for 1 section):

Given his prominence in the report (and especially given the historical allegations faced by management), the independence of Jiang’s opinion would be essential.

But we see from his LinkedIn profile that he was actually an employee of Silvercorp for 3.5 years, representing an obvious conflict:

Troubling Parallels at New Pacific: Key Individuals in New Pacific’s Bolivian Operations Held Senior Positions at Another Nearby Silver Project That Allegedly Inflated Silver Grades in Order to Pump Up a Different Public Company

In a 2015 opinion column in the El Diario newspaper, former Minister of Mines and private mining industry consultant Jorge Espinoza publicly accused Prophecy Development Corp. (now OTC:ELEF) of manipulating mineral values at its Pulacayo-Paca prospect, near the city of Uyuni.

Key Prophecy personnel have significant overlap and/or links to New Pacific and its Bolivian subsidiary, Alcira. New Pacific also had a small stockholding in Prophecy. [Pg. 5]

At the time of the public newspaper accusations, Hernan Uribe Zeballos was Chief Geologist at Prophecy, per his LinkedIn profile. He later became Country Manager of New Pacific/Alcira, a role he serves to this day.

The Prophecy manager at the time of the accusations was Gustavo Miranda Pinaya. The same individual is quoted in the Silver Sand technical report as having provided due-diligence on matters of Bolivian mining laws, and the property title of the Silver Sand project. Recall that the first half of our report raises massive red flags on these very subjects: [Pg. 3]

We found further evidence of the close association between these individuals and the company. February 2017, Miranda and Uribe incorporated NPM Minerales, a subsidiary of New Pacific Metals [Pg. 5]

We find it unnerving that key individuals associated with allegations of silver grade inflation, working with an executive team accused of silver grade inflation, have teamed up to work on New Pacific’s key project.

Troubling Parallels at New Pacific: Multiple Chinese Mining Projects Bought from Silvercorp Were Hyped for Years Before Ultimately Failing

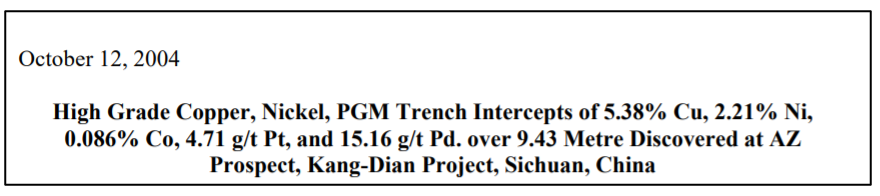

New Pacific has purchased 3 Chinese mining projects through Silvercorp. All were hyped considerably around the time of purchase, but have since been suspended, sold at a loss, or surrendered back to the local government.

- Kang Dian Project. New Pacific came public via reverse merger in October 2004 with options to acquire a majority stake in the Kang Dian Project in China from Silvercorp. (The project was owned by a Silvercorp subsidiary at the time.)[3] New Pacific ultimately exercised the options, paying 6.5 million shares at a deemed price of ~$2.4 million. [ 5]

Here are several examples of press releases promoting the project’s “high grade” zones (1, 2):

The project was ultimately suspended and written off in 2008. [Pg. 2]

- The Huaiji “HNK” New Pacific purchased these mining projects from a Silvercorp subsidiary for C$37.7 million. [Pg. 2]

The company issued years of positive press releases on these areas. Here are several illustrative examples (1, 2):

After much hype and about C$4.3 million in exploration expenditures, New Pacific quietly reported that it sold the project for C$30.5 million, representing a loss. [Pg. 2]

- RZY Silver‐Lead‐Zinc Project. New Pacific paid U.S. $3.5 million for a stake in this China mining projected from Silvercorp in 2013. Some initial promising results were reported:

Later, the company disclosed that it would surrender the project back to the local government for a one-time cash payment of C$3.8 million. [Pg. 4]

An Odd Related-Party Deal Between New Pacific and Silvercorp…Involving a Travel Website for Chinese Tourists

In October 2015, with its historical mining projects not working out, New Pacific announced it was changing its business from a mining issuer to focusing on making investments in privately held and publicly traded corporations.

One of these investments, made sometime around 2016, was a private placement for CozyStay holdings, a travel/accommodations website similar to AirBnB geared toward Chinese travelers. [Pg. 3]

In 2019, (after New Pacific renewed its focus on mining) its shares of CozyStay were sold to Silvercorp. We fail to understand why a silver producer would purchase an interest in a privately-owned travel website from another silver mining company.

New Pacific CEO Rui Feng’s Unhealthy Habit of Using Aggressive Litigation and State Influence to Silence Criticism

We at Hindenburg take pride in reporting on companies that try to silence criticism with intimidation. A functioning market requires diverging views and opinions in order for investors to be able to make informed decisions.

We also believe that companies engaging in such practices are vastly more likely to have something to hide. In one recent example, MiMedx Group sued its critics, only to be charged criminally with fraud two years later:

New Pacific CEO Rui Feng has taken it a step further, with a history of using litigation and state influence (including payments to Chinese authorities and pressure on Canadian regulators) to silence criticism against his business interests.

As reported in the Globe and Mail, following a critical piece on Silvercorp written by fraud researcher Jon Carnes, the company sued Carnes and used its influence in China to advance an investigation into his local analysts. Per the Globe expose:

“Silvercorp helped pay for police expenses in the investigation of Carnes’s operation. Evidence also shows that Silvercorp passed results of the Chinese police investigation to the BCSC.”

One analyst, Kun Huang, was thrown in a crowded Chinese prison cell without charges and interrogated for a month by local police. The company appears to have aided in the police interrogation of the analyst, as well as his eventual prosecution:

“For the first few days, the police were receiving texts and phone calls before and during these sessions. ‘I have a strong suspicion it was someone from [Silvercorp].’”

“In the summer of 2013, Huang was charged with ‘criminal defamation’ for criticizing a Chinese company. His trial in September of that year lasted one day and was closed to the public, at Silvercorp’s behest. Silvercorp was also granted standing.”

“In the end, Huang received a two-year sentence and was returned to the same overcrowded cell to serve out the rest of his term.”

In Canada, the BCSC alleged fraud against Carnes, who published under a pseudonym with a fictitious biography. The case was later dismissed, and Carnes’ work was eventually largely vindicated.

The above episode should say something about management’s approach on matters of transparency. We believe that the same executive team has once again failed to thoroughly disclose to investors the major issues relating to New Pacific.

Part III: If New Pacific Actually Controlled the Bolivian Concessions (We Don’t Think It Does) We’d Still See 85% Downside Purely on Fundamentals

Given Part I about how New Pacific might not control any of its Bolivian mining areas, and Part II which identifies significant red flags relating to the credibility of management, we think there’s a great chance this part of our report is largely superfluous.

That being said, in the interest of being thorough, we looked closely at New Pacific’s balance sheet, comparables with other similar mining projects and hired a consultant to perform a detailed technical analysis on the ‘flagship’ Silver Sand project.

What we found leads us conclude that New Pacific could have 85% fundamental downside even if there were none of the political risk factors or management red flags detailed above.

A Comparables Analysis Shows That Silver Sand is Valued 17x Higher than Competitors

As a basic check, we analyzed New Pacific relative to other publicly traded mining companies with key silver projects, and found that it represented a blatant outlier:

And here is the scatter plot of New Pacific/Silver Sand relative to the other companies (Enterprise value / estimated resource ounces):

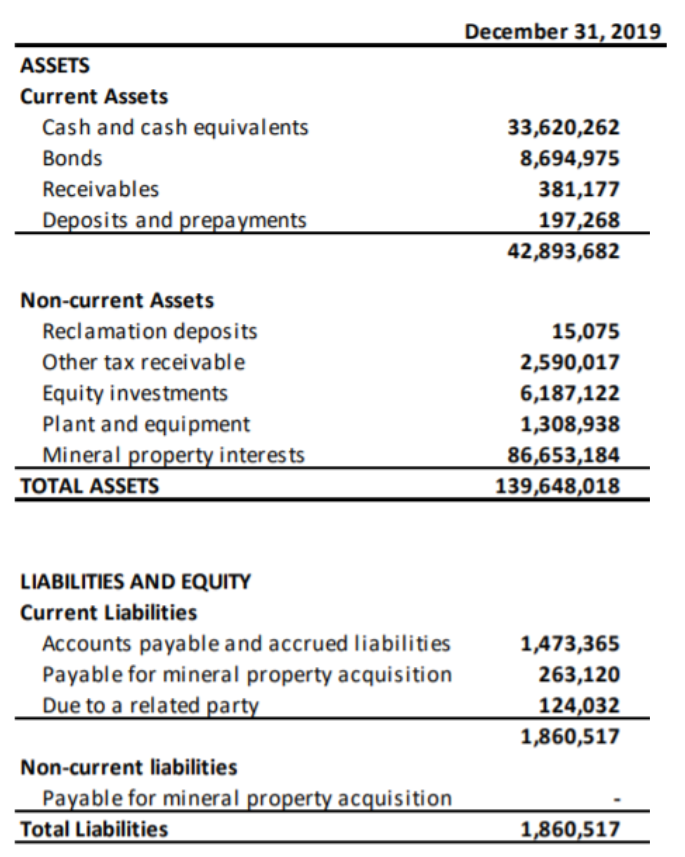

Beyond a comparables analysis, we did a balance sheet analysis and engaged an expert to provide a full technical report in order to see if there was anything that could warrant New Pacific’s massive outlier status.

Balance Sheet: ~C$44.5 Million in Net Liquidation Value (C$0.30 Per Share) Excluding Mining Interests

On the balance sheet side, as of the latest financials (ending December 2019), New Pacific had about C$43 million in current liquid assets (including C$33.6 million in cash and C$8.7 million in bonds.) [Pg. 1]

With ~C$5.3 million free cash flow burn last quarter [Pg. 4], we estimate C$38 million in liquid assets remaining. We discount the equity investments 20% (due to market decline) to arrive at C$5 million of value. All told, ex mineral property interests (which we dig into below) we see ~C$44.5 million of net liquidation balance sheet value which translates to about C$0.30 per share.[4]

Technical Analysis of New Pacific’s Silver Sand Project Arrives at an Estimated Value of C$0.29 Per Share

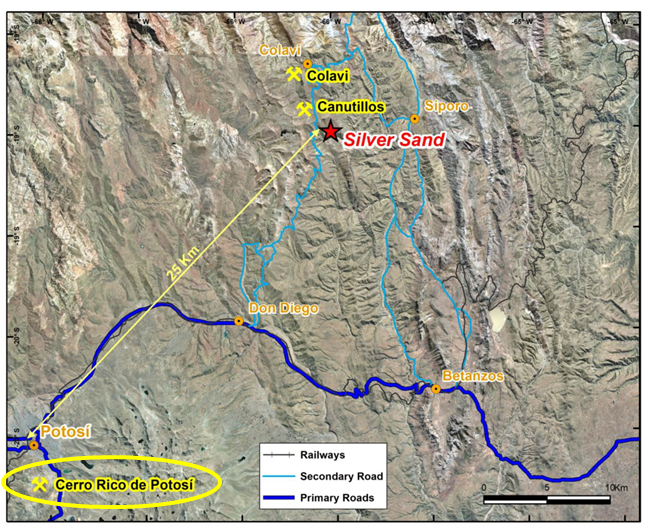

Background: Bolivia’s Potosi Region and the Legacy of the Cerro Rico Silver Mine

Silver Sand is a sandstone-hosted primary silver deposit located in Potosi, Bolivia. The Potosi region is well known for its world-class silver deposits, especially the Cerro Rico mine. Upwards of 2 billion ounces of silver have been mined from Cerro Rico since 1545, with early mining grades averaging 7,000 ounces of silver per tonne.

This jaw-dropping quantity and grade of silver resulted in decades of exploitation and abuse by the Spanish Empire and other foreign entities since the discovery, resulting in the death of an estimated 8 million people. That is why Cerro Rico is known locally as “the mountain that eats men” and “the mouth to hell“. Eduardo Galeano, journalist and author of the now-classic political work “The Open Veins of Latin America” wrote about Cerro Rico, he said:

“You could build a bridge of pure silver from Potosi to Madrid with ore extracted. And you could build a bridge back with the bones of those who died mining it.”

(Location of Silver Sand relative to Cerro Rico)

Despite the abundance of riches that sat within Cerro Rico, the silver has brought mostly death and misery to local people (Potosinos), which has instilled hostility towards foreign miners in the region.

Given this history and social/political backdrop, deposits in Potosi arguably need to be “world-class” to make it worthwhile for foreign mining companies and their investors to try to develop such deposits.

Technical Analysis: Silver Sand – A Low Grade, Highly Complex Deposit

Silver Sand is only about 27 km from Cerro Rico, so it is definitely in a world-class silver district. But is Silver Sand a world-class silver deposit? The grades within the Silver Sand deposit are low, at about 132 g/t Ag (about 1.2 g/t Au if using gold-equivalents) based on the resource estimate, which envisions this to be mined using low-cost open pit methods.

However, investors should not expect this to be a low-cost open pit, heap leach project. The metallurgy is much more complex and includes sulphides, which may not be cyanide-leachable like oxides. Therefore, processing capital and operating costs could be quite high, as both cyanidation and flotation plants may be required. Furthermore, recoveries may not achieve the levels suggested by preliminary testing.

As a low-grade deposit with complex mineralogy, Silver Sand then needs gargantuan size to qualify as world-class. Based on the market capitalization, investors are pricing this as a foregone conclusion. Our technical expert, however, suggests that Silver Sand is not a world-class silver deposit based on drilling to date and evidence suggests that exploration upside may be limited.

Our Expert Consultant Estimates That Resources Would Have to be 6x Larger to Warrant Current Valuation

New Pacific trades at a market capitalization of approximately C$700 million. The only way to justify such a lofty valuation for a mineral asset, located in Potosi, Bolivia, is if the project has in the ballpark of a billion ounces of silver.

Silver exploration and development companies, most of which are at a more advanced stage of exploration than New Pacific, currently trade at a valuation of significantly less than US$0.50 per silver ounce in the ground. Even ascribing an in situ value of US$0.50/oz to New Pacific would mean that it would need a resource of ~1 billion ounces. The recently released maiden resource estimate contains a total of only 191 million ounces of silver, or about 80% less than that.

Analysts had estimated that the Silver Sand resource would contain between 170 and 250 million ounces of silver, with an average of 223 million:

- Roth Capital – predicted that the initial resource estimate at Silver Sand would be about 250 million ounces of contained silver. (1, 2)

- BMO – estimated 91 million tonnes of ore at a grade of 85 g/t for 248 million ounces of contained silver. (1, 2)

- PI Financial – estimated 58 million tonnes of ore at a grade of 92 g/t for 170 million ounces of contained silver. (1, 2)

The resource estimate came in well below most of the analysts’ expectations. More importantly, we believe that the market’s expectations were much higher, in part due to the aggressive aforementioned stock promotion.

Technical Analysis: Silver Sand’s Resources Implies a Valuation of About C$0.29 Per Share

Using 191 million ounces of contained silver, as per the resource estimate, New Pacific currently trades at about US$2.56 per ounce of in situ silver. According to the technical consultant we worked with, that is in the ballpark of advanced silver developers and producers, not early stage explorers.

A more appropriate comparable for New Pacific is likely Bear Creek Mining (TSX: BCM), which currently has a market capitalization of US$145 million. Bear Creek’s primary project is Corani in southern Peru, a more politically stable mining jurisdiction than Potosi, Bolivia. Corani is an open pittable, silver-dominant polymetallic deposit that contains approximately 735 million silver-equivalent ounces (two-thirds of which are classified as Reserves). Bear Creek is currently being valued at US$0.16 per silver-equivalent ounce, which is more in line with the majority of silver explorers and developers than the valuation at which New Pacific is currently trading.

Applying a US$0.16 per silver-equivalent ounce valuation to the Silver Sand resource implies a valuation of US$30.6 million or about C$0.29 per share. New Pacific is trading ~7.5x that (when adding the value of balance sheet assets) which suggests a major overvaluation.

Technical Analysis: New Pacific’s Infill Drilling Suggests Exploration Potential is Limited

Early exploration drilling is usually widely spaced with the goal of delineating the mineral resource, leading to inferred resources. Once the resource has been reasonably well defined, or gets so large that further growth is meaningless, companies then turn their attention to new zones or upgrading the resource through infill drilling.

New Pacific drilled 195 holes in the “discovery exploration” program conducted in 2017 and 2018. [Pg. 1] Then, rather than continuing to expand the resource footprint, the company conducted mostly infill drilling in 2019 (Figure 2).

The location of the infill drill holes (yellow dots on Figure 2) do a good job of showing the best zones within the Silver Sand deposit and indicate that the footprint is relatively small. An additional 19 holes were drilled on the Snake Hole target, but as previously mentioned, mineralized widths there are narrow and often too deep for economic open pit extraction.

(Figure 2 – Silver Sand plan map showing drill collars)

Our technical consultant believed that New Pacific switched from exploration drilling to infill drilling because the resource expansion potential was dwindling. Mineralization to the south and the west falls off a cliff, literally (Figure 3) and appears to be cut-off by geology/structure to the east. Mineralization appears to be open to the north, but drilling and the plan map suggest that mineralization plunges and pinches out to the north (Figure 4). All that is to say that Silver Sand may not get much bigger.

(Figure 3 – Drill plan map draped over Google satellite map, our interpretation)

(Figure 4 – Dec. 2, 2019, Silver Sand drill results between sections 36 and 38 –> narrower widths, deeper, and low grade)

Technical Analysis: Metallurgy—Oxides + Transition + Sulphides = Complexity + High Cost

In August 2019, New Pacific announced “high recovery of silver from various metallurgical processes for sulphide, transition and oxide styles of mineralization”. High silver recoveries (i.e., >80%) were quoted for flotation, bottle roll cyanidation, and coarse column leach cyanidation testing. The high-level results provided the appearance that any of these processing methods could be used for all of Silver Sand mineralization, which struck our expert as dubious. First of all, the news release quoted recoveries qualified as “up to”, which should not be confused with anticipated recoveries.

A review of the technical report filed in November 2019 provides better insight into potential silver recoveries. What it revealed is that neither flotation nor cyanide leaching seem to provide an optimal processing approach for all of the mineralization. As well, the maximum silver recovery numbers quoted in the metallurgical testing news release seemed misleading.

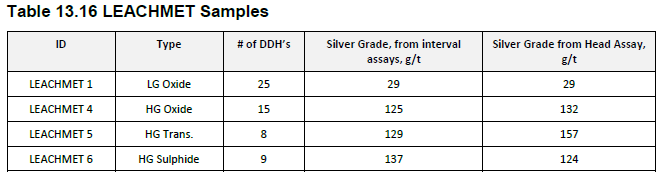

The low-grade oxide material (LEACHMET 1) demonstrated silver recoveries of only 59.1% to 77.5% in bottle roll tests at room temperature, using air as the sparge gas, and with reasonable cyanide consumption. Results for the high-grade oxide sample (LEACHMET 4) were even worse, achieving recoveries of 69.0% or less of the silver at lower temperatures and cyanide consumption.

The news release stated that bottle roll cyanidation testing had silver extraction up to 96.3% for oxide mineralization, but that was only achieved at elevated temperatures, using O2 as sparge gas, and with hefty cyanide consumption. Processing costs would be high under those conditions, so it is much more likely that silver recoveries would be below 80% once economics are factored in.

Flotation is an alternate approach, wherein the silver would be directed into a concentrate that would then need to be transported to a smelter for further processing. However, no flotation testing was done on the low-grade silver samples, suggesting that cyanidation is likely the only viable processing method for low grade silver in oxides.

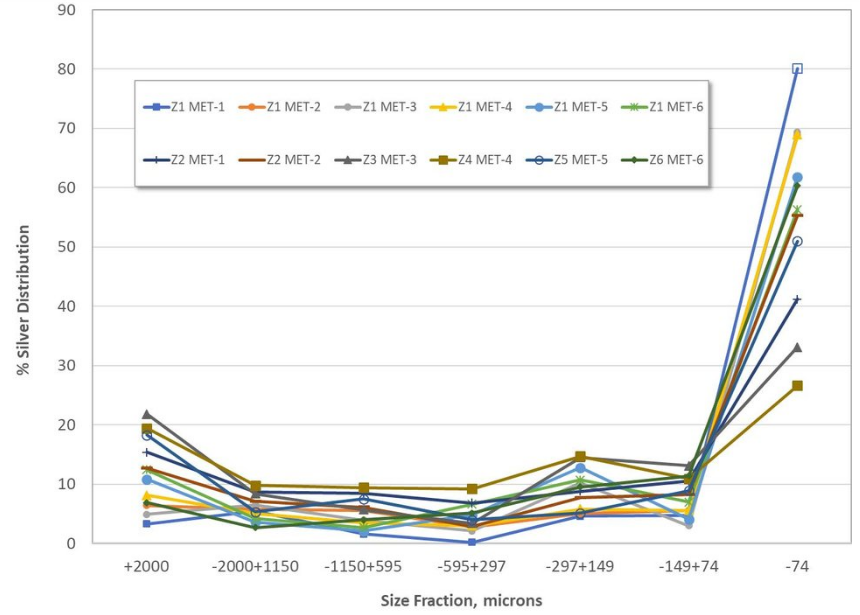

The silver at Silver Sand is very fine grained. As shown in Figure 5, the majority of the silver falls into the smallest size fraction of -74 microns (1 micron = 0.001 mm). That means most of the silver grains are about the thickness of a human hair, which is very small and will require very fine grinding for cyanidation or flotation to be effective. The finer the grind, the higher the cost, so this should also be noted. In addition, fine grinding can lead to sliming issues during flotation.

(Figure 5 – Silver Distribution by Size Fraction, [microns])

In summary, the metallurgy at Silver Sand is complex and varied. In the opinion of our expert, the news release issued by New Pacific on high silver recoveries was misleading. High silver recoveries are possible, but likely not practical when costs are factored in. It is our expert’s sense that Silver Sand will either require both a cyanidation plant and a separate flotation plant to achieve good recoveries, or a single cyanidation plant with lower overall recoveries.

Compared to low grade gold projects that can use open pit mining and heap leaching, our consultant suggested Silver Sand is likely to require significantly more capital investment for processing facilities and the operations will have high processing costs.

Technical Analysis Conclusion: A World Class Valuation for a Mine That Is Not World Class

Given the balance sheet assets and resource estimates of C$0.30 and C$0.29 per share respectively, we arrive at a total value of C0.59 per share, representing over 85% downside from current levels purely on a fundamental basis.

Overall Conclusion: 90%+ Downside

Our price target for New Pacific is C$0.37, representing over 90% downside from current levels.

To arrive at our final price target, we weighted 3 scenarios:

- Total revocation of the Bolivian mining areas (concessions) (60%). In this scenario we assign a price target of C$0.30, the estimated value of the balance sheet assets.

- A renegotiated deal on the Bolivian concessions (30%), to which we assign a price target of C$0.45 (balance sheet assets plus half of the value of the mining project, given the historic profit splits Bolivian deals have typically entailed).

- The deal (somehow) passing through Bolivian legislation as-is (10%), to which we assign a price target of C$0.59, representing our estimate of the balance sheet assets and the Silver Sand project.

Given the issues above, and those relating to management’s lack of clear communication on subjects that are of critical importance to investors, we are short both New Pacific and Silvercorp. Best of luck to all.

Appendix A: Red Flags Relating to the Company’s Ownership of Silver Sand

We found multiple red flags, based on company statements and our interviews with Bolivian lawmakers, raising doubts about whether it actually had secure tenure of mining rights to its flagship Silver Sand property.

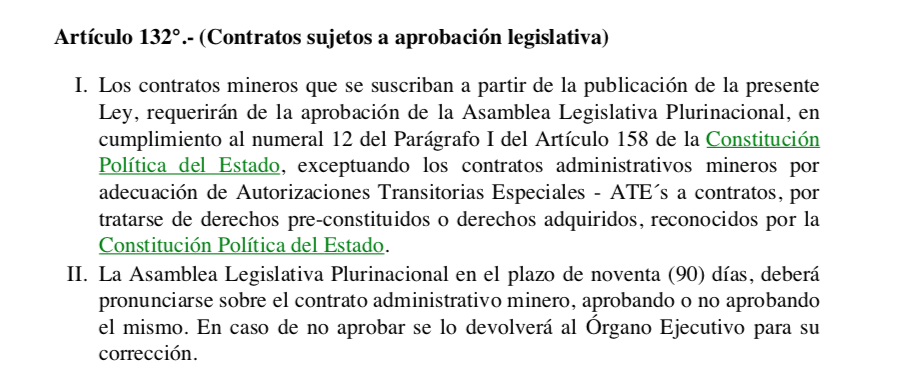

- The company suggests that it needs Congressional approval for its consolidation and conversion of its Silver Sand property, but if it already held secure title why would this be necessary? The company suggests, in relation to Silver Sand, it needs Bolivian Congressional approval to convert what it presents as 17 existing and legally held ATEs (formerly known as concessions) into administrative mining contracts.

But Congressional approval is only needed if there are no pre-existing mining rights in place.

Article 132 of the 2014 Bolivian Mining Law 535 states mining contracts based on ATEs (concessions) that were legally held prior to the new law do not need congressional approval, only approval from AJAM. Congressional approval is only needed for contracts if there were no pre-existing mining rights in place.

Article 132 – (contracts subject to legislative approval):

Mining contracts which are signed following the publication of this Law will require approval from the Plurinational Legislative Assembly in accordance with numeral 12 of Paragraph I of Article 158 of the Political Constitution of the State, except administrative mining contracts based on the conversion of Special Transitory Authorizations – (ATEs) to contracts by virtue of the fact that these represent pre-constituted or previously acquired rights, recognized by the Constitution.

Regarding this red flag raised by New Pacific – by their own words – a Senior former member of AJAM legal department told us:

“This is a contradiction. If they’re in the process of transitioning (from special temporary authorizations to mining administrative contracts) they do not need parliamentary approval.”

A former senior COMIBOL executive told us:

“I think there are inaccuracies in the (New Pacific) statements. The change from (pertenencias) to “quadrilles” (25 ha mining areas) is nothing new. I’m surprised the previous owners had not done that. That change (from ATEs to contracts) does not need parliamentary approval.”

- The company says it was granted exploration permits for Silver Sand, which it wouldn’t need if it already held secure title to the property. A 2018 press release stated that in October 2017 the company was granted exploration permits for Silver Sand:

We, and the industry experts we consulted, were unclear why New Pacific needed “exploration permits” if the company already had secure mining rights (concessions) within the 3.17 km2 area of the Silver Sand project.

Article 92 of the 2014 Bolivian Mining Law 535 stipulates that the legal holder of a mining right (concession) already the necessary rights to prospect, explore, produce and process minerals. The only additional permit necessary may be an environmental permit.

Article 92 – (Mining Rights) Mining rights (formerly known as concessions) grant the holder the permission to prospect, explore, exploit, concentrate, smelt, refine, industrialize and commercialize the mineral resources either using both their own and complementary mining activities in all or part of the productive chain.”

In contrast, exploration permits are granted to individuals or companies for areas in which they do NOT, nor anybody else, hold any mining rights.

Article 164 states exploration permits are given for vacant, or free areas, where no other mining rights are in effect:

Regarding the issue of why New Pacific felt the need to apply for exploration permits for the Silver Sand mining areas where it says it has had full, legal rights to since acquisition in 2017, our industry experts said:

A senior former COMIBOL executive said:

“As far as requesting authorization for exploration – they would not need an exploration permit but they may have been referring to the environmental license which they would need. I would be very surprised if they’ve paid more than $40 million dollars for something that was not 100 percent assured.”

The former AJAM legal expert we interviewed said:

“They could not have given out an exploration permit if Alcira already had (legal) title to those (Silver Sand) areas. Because according to the mining registry that AJAM operates, you cannot give an exploration license for an occupied area. But that is an indication that the concessions were (and remained) revoked….my understanding is that Alcira has been operating outside the law since these areas were revoked in 2015.”

[1] Alcira was constituted as an anonymous society by means of testimony No. 0119/2008 dated April 14, 2008, with tax identification number No. 155512027, and full registration with FUNDEMPRESA according to commercial registration No. 130345. Full registration does not seem to have taken place until at least July because of Alcira’s directors’ failure to supply accurate paperwork.

[2] Alcira SA was sold to Jungie Mining Industry via deed of sale 1058/2010 on Sept. 10, 2010

[3] Note that Silvercorp was named SKN Resources at the time.

[4] Based on common shares outstanding of 147.5 million [Pg. 14]

Disclosure: We are short shares of (OTC:NUPMF) and (NYSE:SVM)

Legal Disclaimer