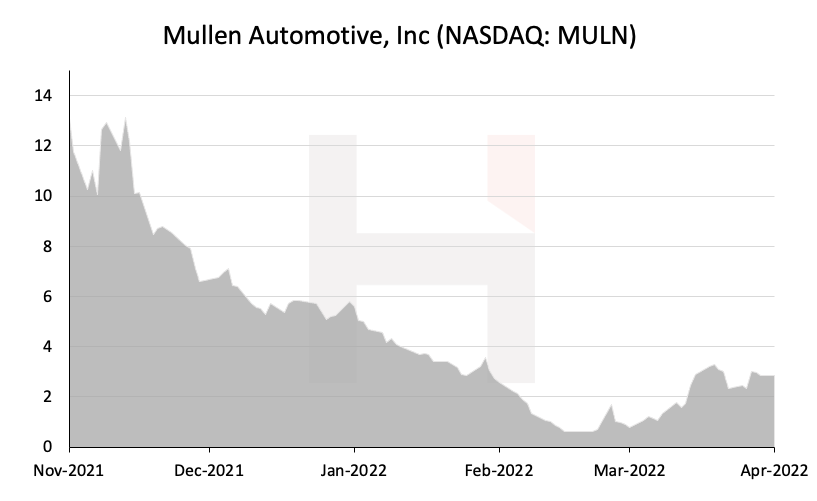

- Mullen is an aspiring EV manufacturer that came public in late 2021 via reverse merger. It has yet to produce a sellable vehicle.

- The company’s stock has spiked ~316% in the past couple of months driven by retail investor euphoria over bold claims of ground-breaking technology, near term production of its EV vans, and a major as-yet-unnamed Fortune 500 customer.

- Despite only spending ~$3 million in R&D in 2021, Mullen claims its solid-state battery technology is on track for commercialization in 18 to 24 months, putting it head of every major technology and automaker in the industry who have collectively invested billions on solving the problem.

- Mullen recently press released an update on its battery testing, sending its stock soaring 145% in a day. In reality, the “news” appears to be a rehash of testing the company had already announced in 2020.

- Mullen apparently misrepresented the test results, according to the CEO of the company that performed the tests. Its CEO told us of Mullen’s press release: “We never would have said that. We never did say it and certainly wouldn’t have said it based on the results of testing that battery.”

- In 2020, Mullen announced a joint venture to manufacture its sold-state battery technology. We spoke with a senior executive familiar with the supposed JV who told us “It didn’t exist at all”. It was an apparent fabrication. He called Mullen CEO David Michery “fast talking” and a “hustler”.

- Mullen’s battery claims were based on technology licensed from a 1-year-old Chinese battery technology company. After hyping the importance of the relationship, Mullen made one payment under the deal and promptly terminated the relationship. The Chinese company’s website no longer works.

- Recently, Mullen shocked the market by claiming it would begin manufacturing 2 models of electric vans within months for an unnamed “major, major Fortune 500 customer”. The news sent its stock up ~35% intraday.

- The 2 electric cargo vans that Mullen claims it will be manufacturing are actually Chinese EVs rebranded with a Mullen logo. Import records show the company recently imported 2 vehicles from China, one of each model.

- Mullen has other major production hurdles. The company has no EPA certificates for its vans (nor any vehicle), a requirement to sell vehicles in the U.S. that often takes 12-18 months. It has only a handful of job openings for its plant, and hasn’t begun significant hiring, according to the President of the Tunica County Chamber of Commerce.

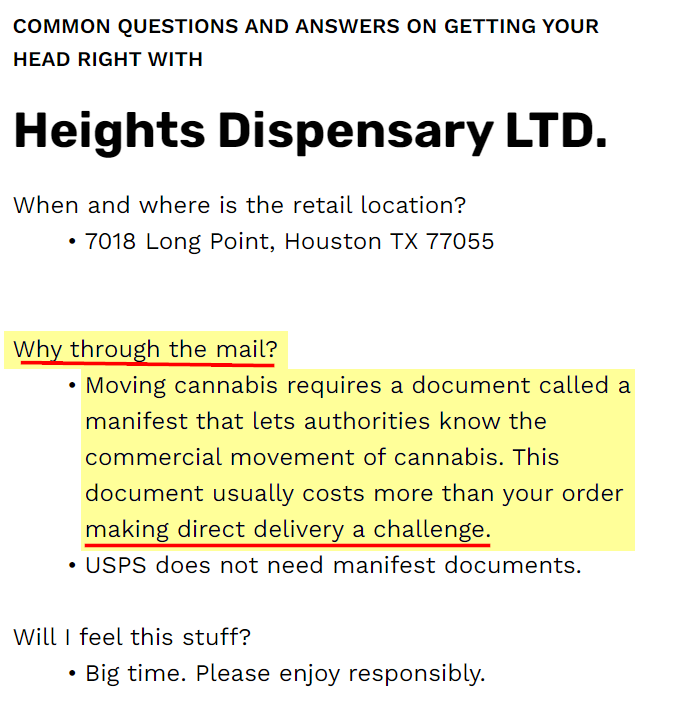

- Previously, Mullen had announced purchase orders valued at $60 million for 1,200 Class 2 commercial EV fleet vans. The order came from a small cannabis retailer with only one location and a new online store that says it prefers to ship via USPS.

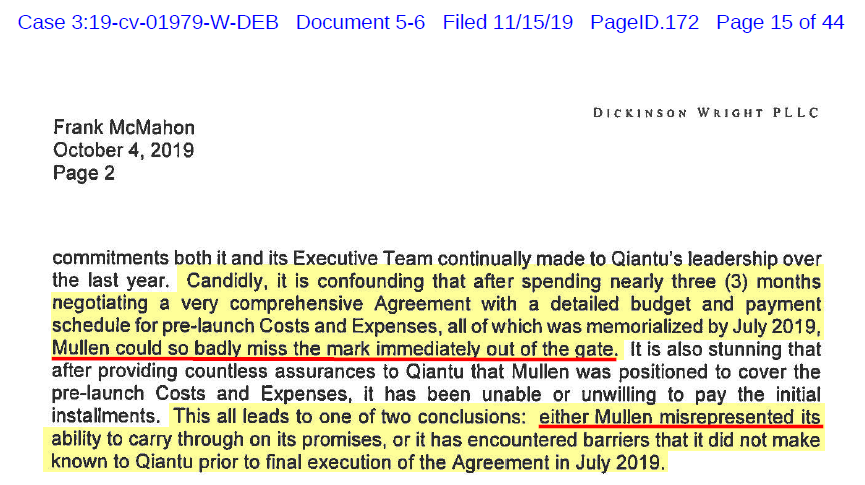

- In 2019, the Mullen DragonFly was revealed as a supercar built by Chinese manufacturer Qiantu Motors and was meant to be rebranded and sold by Mullen starting in 2020. Following the reveal, Mullen immediately defaulted on its payment obligations to Qiantu, leading to termination of the agreement in October 2019.

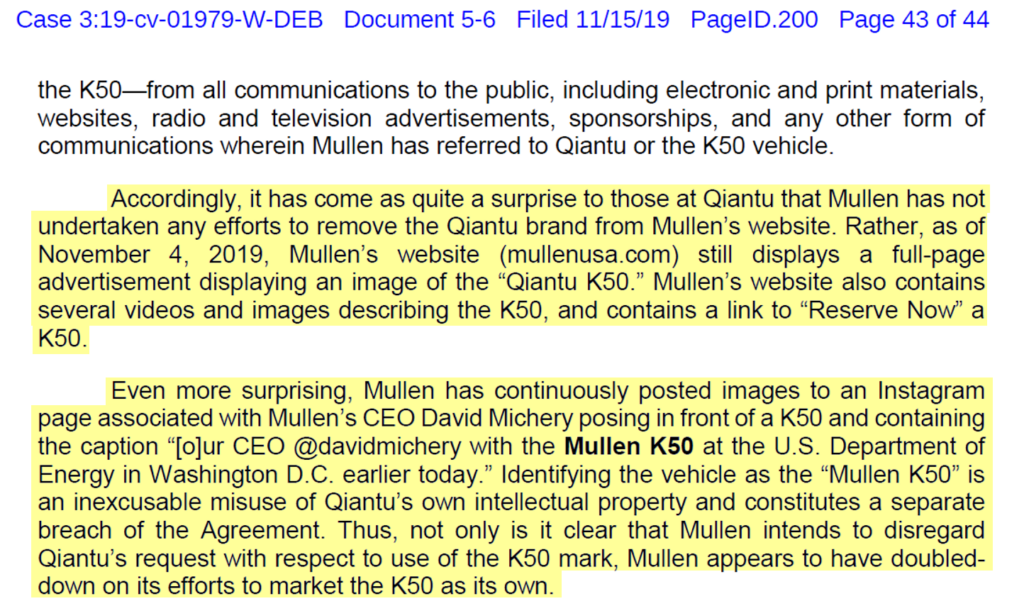

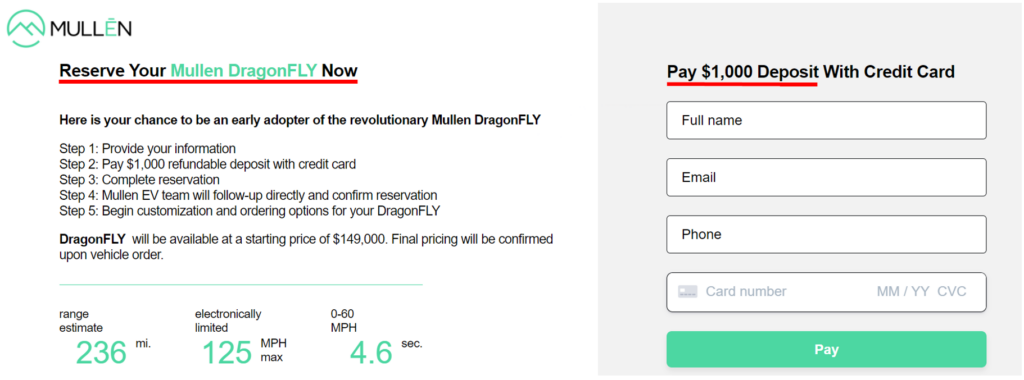

- Mullen continued to market the vehicle as its own. In legal documents, Qiantu alleges this is “an inexcusable misuse of Qiantu’s own intellectual property”. Despite the termination of the agreement, Mullen to this day still says the DragonFly is “Coming Soon” on its website and is soliciting $1,000 reservations for the vehicle.

- For its other proposed vehicle, an electric SUV, Mullen previously announced it received an order for 10,000 vehicles, representing $500 million in potential revenue. We called the South Florida contractor firm that placed the order. It currently has only around 11 vehicles, none of which are electric.

- Mullen’s plant in Tunica Mississippi was previously tooled to build a pizza delivery car, but prior owners never managed to sell a single vehicle.

- Mullen originally said the 124,700 sq/ft facility would serve as a pilot plant, but after abandoning several other plant projects, Mullen now claims it intends to expand the plant 10x, or an additional 1.2 million sq/ft, with no details on how this will even be physically possible.

- Mullen claims its former pizza car manufacturing facility in Mississippi is stocked with state-of-the-art equipment and machinery, but photos and video of the facility show it has limited equipment.

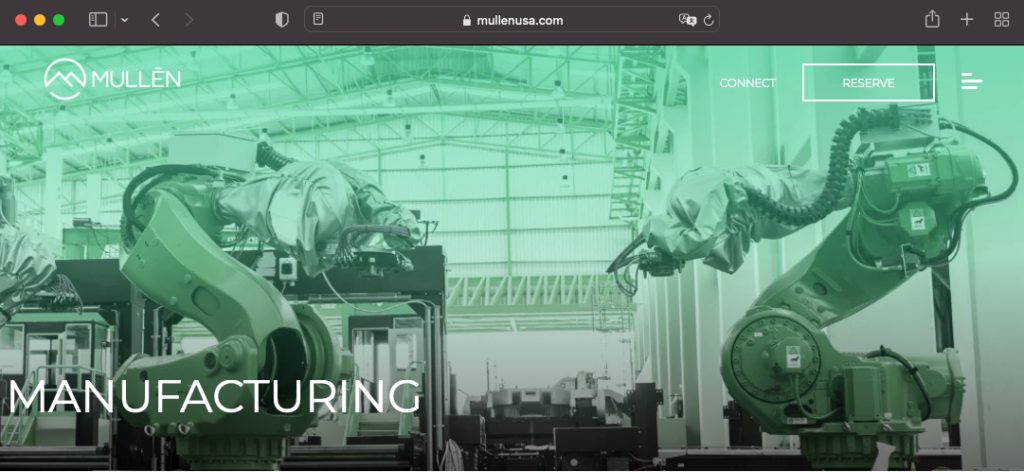

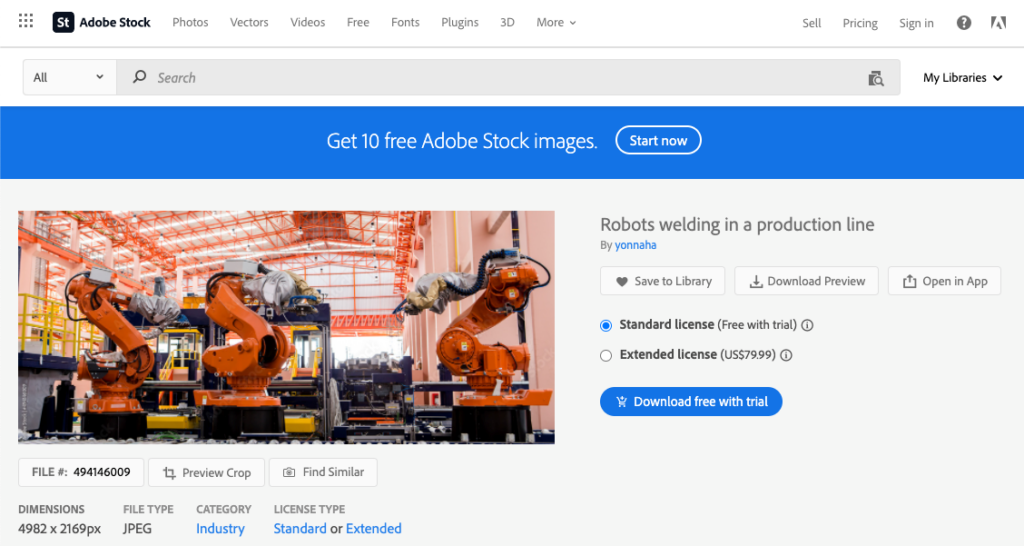

- Mullen’s website features one photo of advanced manufacturing equipment. We found that it was a stock photo which appears to have been purchased from Adobe stock images.

- Mullen’s Founder, Chairman and CEO, David Michery led 5 failed penny stock companies prior to Mullen. Two had their securities registrations revoked by the SEC, two terminated their securities registrations, and the last one merged with a speculative gold mining company.

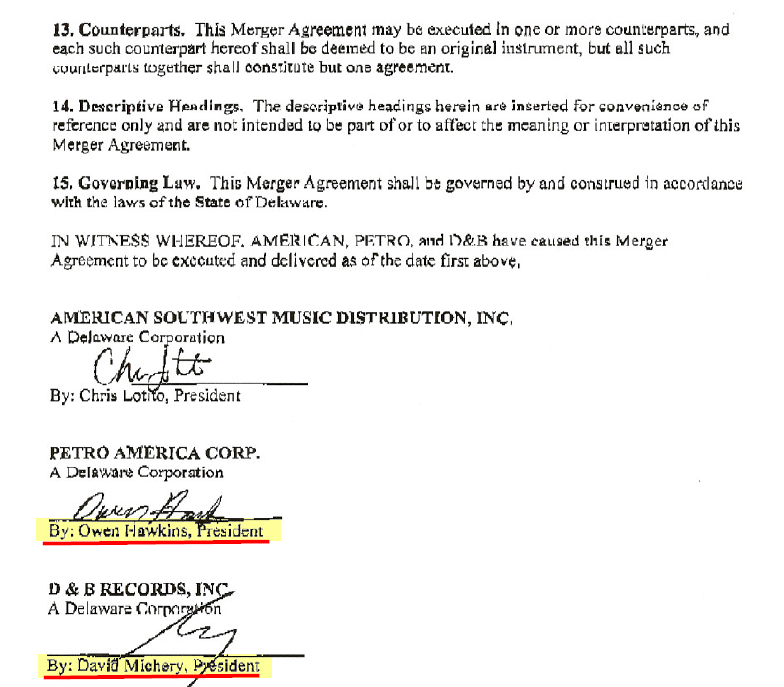

- Michery merged one of his prior entities as part of a 3-way deal with an individual who was later charged with criminal securities fraud and sentenced to 30 years in prison. Prosecutors alleged that the merger deal involving Michery’s prior company was part of the scheme.

- Michery lists no educational background in his Mullen biography. Contrary to other top electric vehicle executives that have engineering and manufacturing backgrounds, Michery’s past work experience was largely in the entertainment industry.

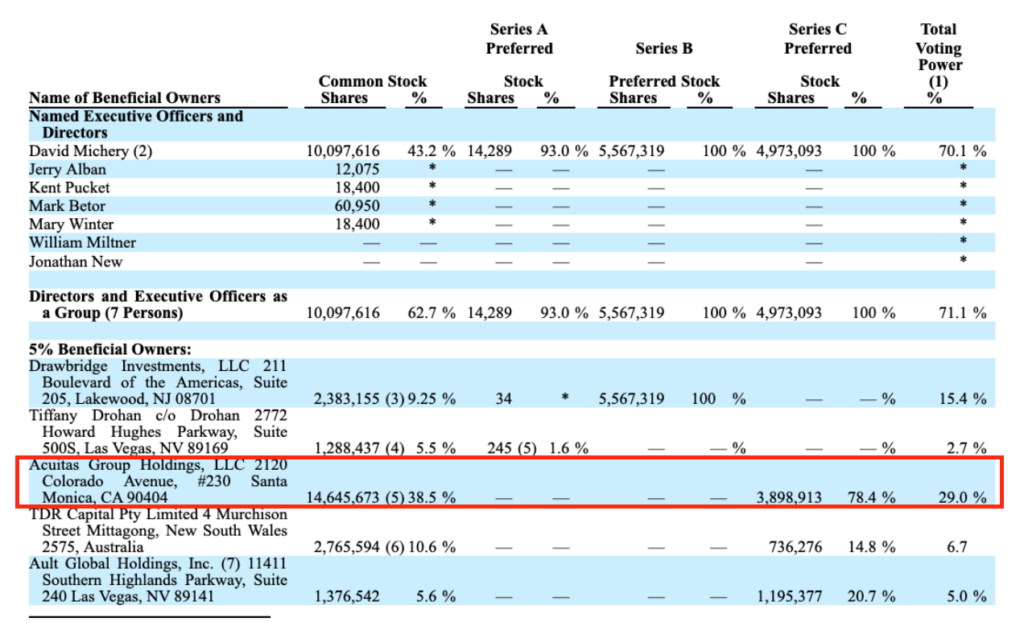

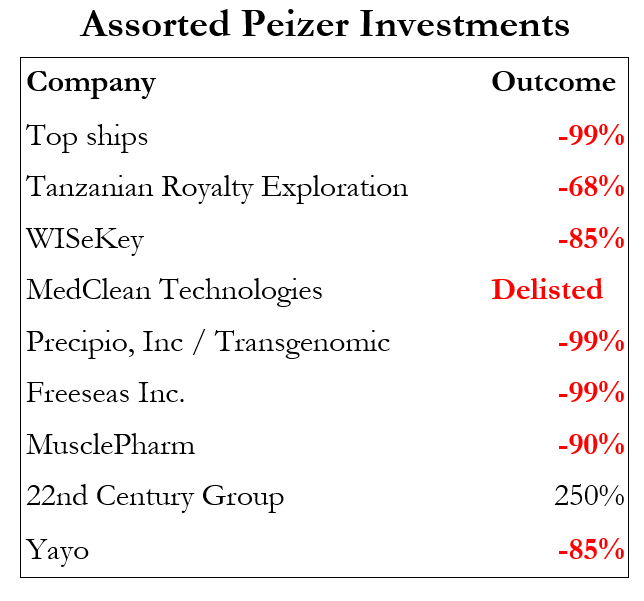

- Mullen’s top holder is Terren Peizer, who controlled 29% of the company’s voting power as of fiscal year-end. Peizer has backed numerous companies whose stocks have spiked to euphoric highs, only to plummet later.

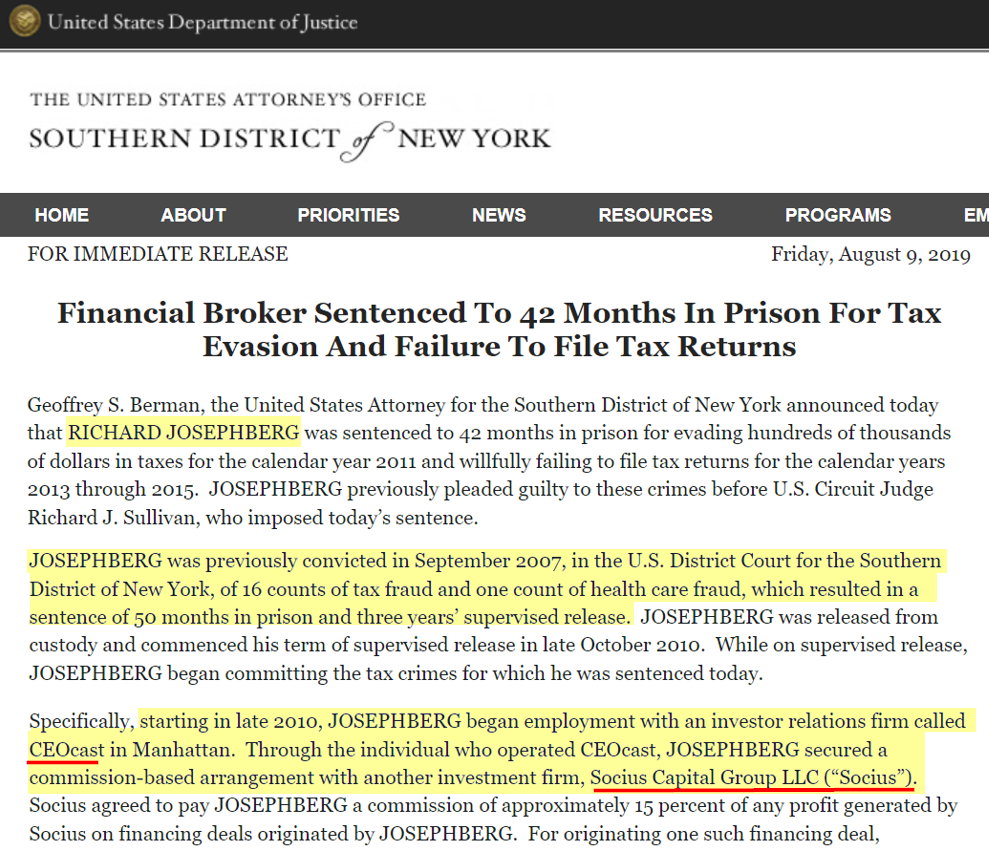

- Peizer hired an individual just released from prison for fraud to one of his investment vehicles. The individual was later re-indicted on new fraud charges and sent back to prison.

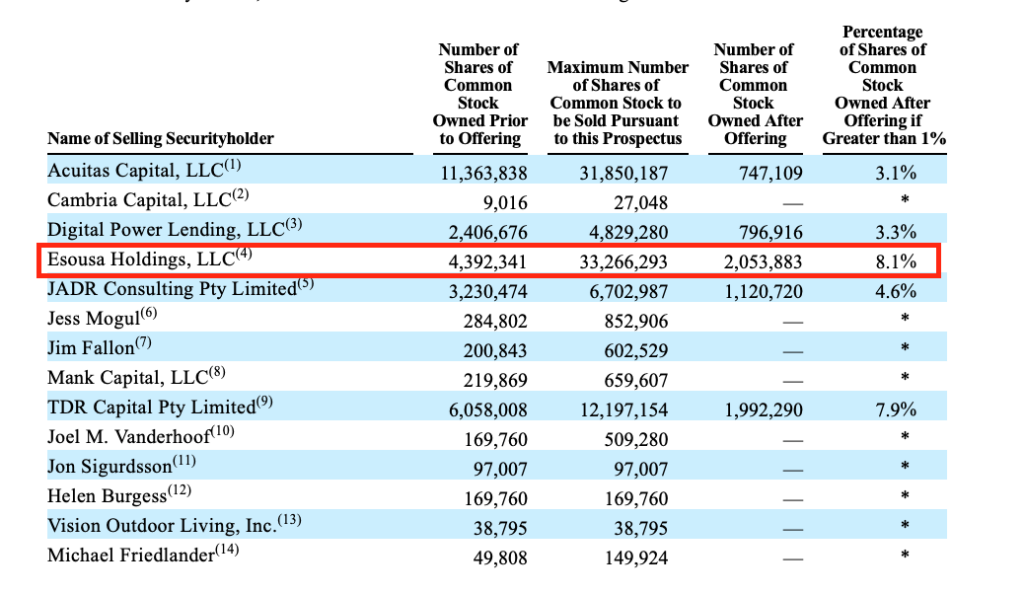

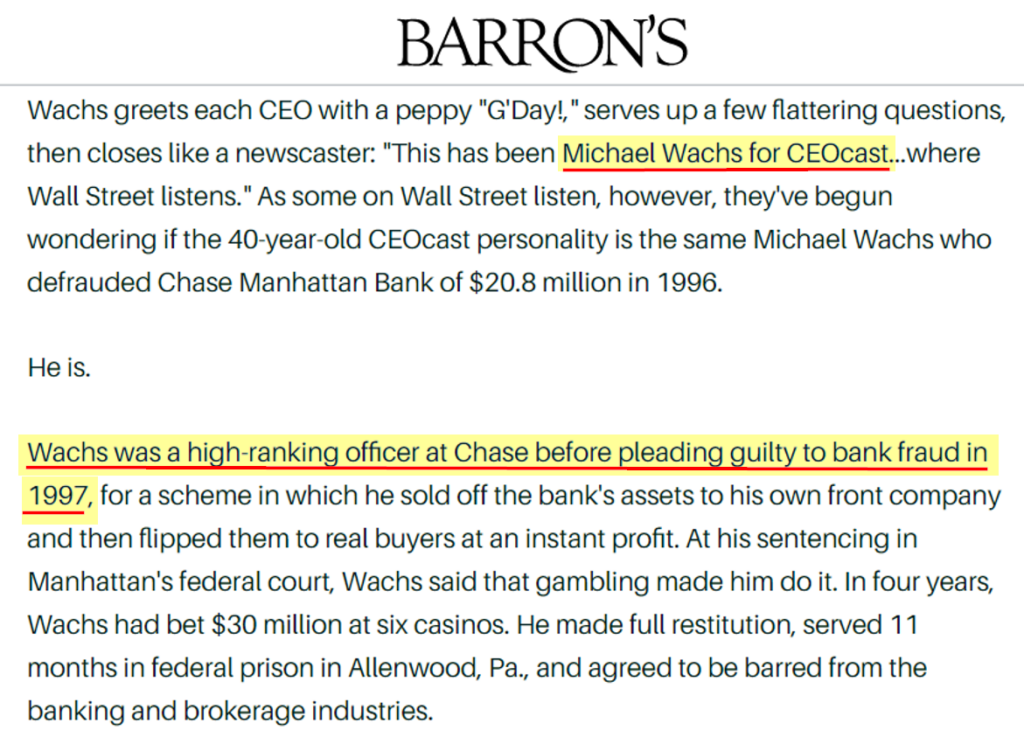

- Peizer also has close business ties to Michael Wachs, Mullen’s 3rd largest shareholder who controlled 8.1% of the company as of a recent prospectus. Wachs served time in jail for bank fraud after he pled guilty in 1997 to defrauding Chase Manhattan Bank for $20 million.

- We have seen this story before, but Mullen strikes us as one of the worst. With echoes of Nikola, Lordstown, Kandi and Ideanomics, we think Mullen is just the latest in a long line of EV hustles.

Initial Disclosure: After extensive research, we have taken a short position in shares of Mullen Automotive, Inc. (NASDAQ:MULN). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction: Basics on Mullen and Its Founder, Chairman & CEO’s History Of Failed Penny Stock Companies

Mullen Automotive is yet another aspiring electric vehicle manufacturer that has burst onto the market with grand promises – and little to back them up.

Founded in 2018 and yet to manufacture a single sellable vehicle [Pg. 17], Mullen Automotive aims to revolutionize the electric vehicle market with multiple offerings including a luxury SUV, a Sportscar, Cargo Vans, and its solid-state battery technology.

In an industry where most successful EV companies are run by top engineers, Mullen is led by an unlikely leader. Its Chairman, CEO & Founder David Michery lists no educational experience in his biography and came from a career in entertainment. [Pg. 51, 2] Michery formed the company after combining several distressed automotive assets. [Pg. 51]

As we detail later, Michery’s bio leaves out his CEO roles at nearly half a dozen failed penny stock companies, several of which had their securities registrations terminated or revoked by the SEC.

His experience also includes signing a deal with an individual that would later be criminally convicted of securities fraud and sentenced to 30 years in prison. In the indictment in that case, prosecutors outlined evidence of fraud that included the dealings involving Michery’s company.

Mullen seems to be Michery’s first professional foray into the automotive space. In a recent interview, Michery said he “spent 27 years in the entertainment industry: film, music, TV and played there for a little bit” before deciding to follow his passion, which is vehicles.

Michery’s description of his professional background sounds like the credentials of a hobbyist:

“I was always an avid car collector and just an admirer of all vehicles. I always said at some point in my life I would build a car.”

Background: Mullen Burst Onto the EV Scene With Bold Promises That Sent Its Stock Soaring

Mullen came public in the midst of EV mania. On June 15, 2020, less than 2 weeks after Nikola’s SPAC merger, Mullen announced its intention to go public through a merger with a troubled payment processing company called Net Element. Mullen completed the reverse-takeover and began trading on Nasdaq on November 5, 2021.

On its first trading day, Mullen’s stock closed at $11.77. Three months later, on February 22, 2022, the stock had fallen 94% to a low of $0.61. Today, the stock trades closer to $3 per share, putting its fully diluted market value around $800 million.

With only $360 (numbers not in thousands) in unrestricted cash as of December 31st, 2021, nearly $19 million in near-term debt, $48.4 million in current liabilities and consistent operating losses, the company seemed to be teetering on insolvency right out of the gate. [Pg. F-2]

Then, on February 28th, 2022 the company made a surprising announcement. Despite spending only $3 million in R&D during its entire fiscal 2021, Mullen claimed it had made progress and “significant advancement” on development of solid-state batteries, a widely regarded “holy grail” of the EV battery industry that has long-eluded tech and automaker giants such as Panasonic and Volkswagen. [Pg. 44] The stock rallied ~145% on the day.

Starting around March, the company also went on a media blitz, issuing a series of press releases with additional claims like how the yet-to-be-developed Mullen FIVE vehicle is “conceptually” competitive with the Tesla Model Y. [1,2,3]

The series of representations kicked off a collective multi-week 316% rally in Mullen’s stock, fueled by an explosion of trading volume, driven by retail investors excited over the next hot EV name.

Mullen followed up with additional exciting promises. Despite having a limited staff of just 44 full-time employees as of 2021 fiscal year-end, Mullen announced that it would imminently begin manufacturing electric vans for an unnamed Fortune 500 customer.[1] [Pg. 17] The prospect of near-term revenue and a major, credible customer resulted in an immediate 35% intraday stock spike.

Background: Mullen Almost Instantly Began Raising Dilutive Capital From a Cast Of Stock Promoters And Convicted Securities Fraudsters

Those Shares Will Likely Become Available for Sale in a Matter of Weeks, Which We Expect Will Crush the Stock

The company wasted no time in transforming shareholder enthusiasm into shareholder dilution. Mullen reported having ~35 million shares outstanding as of February 11th, 2022. [Pg. 1] By March 1st, company filings show there were over 188 million common shares outstanding, a 5x increase in weeks.

By March 28th, Mullen filed a prospectus to permit its stockholders to sell up to 253 million shares of common stock, suggesting vast further dilution.[2]

While rivals like Tesla, Rivian, and Lucid have attracted investment from major institutions and strategic investors, Mullen’s key shareholders include an individual who served time in jail for bank fraud and an “investor” with a notorious track record of incinerating investor capital across numerous companies.

Part I: Mullen’s Bold Claims of Being on the Cusp of Revolutionizing the Solid-State Battery Market

Mullen’s Claims About Its Solid-State Battery Development Would Put It Ahead of Every Major Automaker, Which Have Collectively Invested Billions into The Technology

The auto industry is collectively investing billions into developing solid-state battery technology. Given Mullen’s tiny 2021 R&D budget of $3 million, which it acknowledged mainly went toward building show cars, we found its claims to have ground-breaking solid-state battery tech to be exceedingly implausible. [Pg. F-26]

In a January 28th, 2022, interview, Michery claimed Mullen was on track to commercialize solid-state polymer batteries in the next 18 to 24 months, putting it well ahead of every other major automaker working on this critical industry issue.

By comparison, solid-state technology developer Quantumscape has raised a cumulative $1.2 billion in order to develop solid-state battery technology, with $300 million coming from Volkswagen. The company said it aims to commercialize production in 2024-2025. [Pg. 11].

Other major auto companies have later targets. Toyota has thousands of patents in the solid-state battery field with its partner Panasonic, and aims for deployment in 2025. Mercedes and Stellantis aim to introduce their solid-state technology by 2027 and 2026 respectively, while Nissan and BMW aim to produce it by 2028 and 2030, respectively. Other major automakers like GM, Ford, and Hyundai have all announced major investments or partnerships in solid-state technology without clear timelines for production.

Mullen Claims Its Solid-State Polymer Battery Was Independently Tested by A Company Called EV Grid, Yielding Astonishing Results

The CEO of EV Grid Said of Mullen’s Press Release About Its Testing: “No, We Never Would Have Said That. We Never Did Say It And Certainly Wouldn’t Have Said It Based On The Results of Testing That Battery”

Mullen’s February 28th press release that made sweeping claims about its solid-state battery testing and kicked off its epic stock rally made no mention of any outside battery developer or an independent testing partner. The press release cited that their cell “yielded 343 Ah at 4.3 volts”.

In an interview a month earlier, CEO Michery described how the test results referenced in the February 2022 press release was apparently recycled news from 2020:

“So, we actually tested back in, was it, ‘20 Jason? In 2020 our 300-amp hour solid-state polymer cell—it came in rated from the lab at 343 amp hours at 4.3 volts. It exceeded expectations. So we feel not only are we on the path to changing the landscape as it relates to an SUV. We’re also going to change the battery landscape when we commercialize solid-state polymer battery solutions which we’re on track to do in the very near future, in the next 18 to 24 months.” [3]

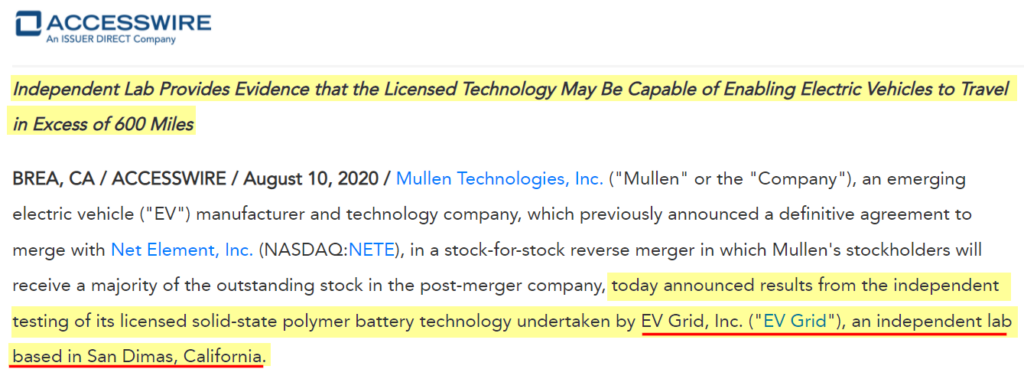

These claims reference Mullen’s original August 10, 2020 press release that announced similarly incredible test results of its licensed solid-state polymer battery technology. The release detailed how an independent lab based in San Dimas, California, named EV Grid Inc, tested Mullen’s battery.

According to the press release, Mullen’s range was almost double that of other top EV companies. Its charging was also substantially faster.

We called Tom Gage, CEO of EV Grid, to verify the test results. He described the battery in unflattering terms:

“It was big, which created question marks in my mind too. And it was misshapen and really kind of an ugly thing.”

Describing the actual testing, we asked if the press release statements were the types of statements they would have signed off on. He replied:

“No we would never have said that. We never did say it and certainly wouldn’t have said it based on the results of testing that battery…but the timing is a little off. EV Grid more or less ceased operations by June or July of 2020 and for the first half of the year it was basically shut down and I was moving out storing stuff in a warehouse because I had this other job at Indi EV. So that makes me think that whatever testing we did probably was in 2019 or even 2018. That´s my timeline as I recall it.”

Mullen’s Solid-State Batteries: Built Around A Joint Venture That “Didn’t Exist”, According to A Senior Executive Who Expressly Denied Any JV Was Formed with NextMetals

Mullen’s other partnership announcements raise further serious questions.

In January of 2020, David Michery announced on Twitter that Mullen had formed a joint venture with NextMetals Ltd. to manufacture, under license in the U.S., the same solid-state batteries referenced in the apparently falsified tests.

In its subsequent June 2020 press release announcing its go-public merger, Mullen cited its “valuable lithium battery patents” that it would use to “create batteries rivaling Tesla’s technology”, reiterating the importance of its joint venture:

“It has a joint venture with Ukrainian company NextMetals Ltd. to create a solid-state battery under a new division called ‘Mullen Next.’”

To verify Mullen’s and Michery’s claims about the NextMetals JV we spoke to a senior executive with detailed knowledge of the supposed JV. They told us bluntly that the joint venture was a “nonstarter” and “didn’t exist”:

“It didn’t exist at all [the joint venture]. Not a single piece of paper. And he proudly goes and shows the Tweet—and about that time was when [the Nextmetals representatives] did get up and walk out. And [they] said, you know, ‘you’re nothing but a hustler. You have no substance’…”

Commenting on Mullen’s vehicle at the time, the senior executive told us he thought it was “a joke”:

“And then of course they had a mockup car which had regular batteries in it and was the copy of some car. It was a Chinese sports thing he brought over and dropped some batteries in. A kind of plastic thing. I thought you´re kidding me, this is a joke.”

“They flew in…some typical New York promoters, between New York and Florida…They got extremely nasty and belligerent that [they] didn’t need to see the contract and they needed $5 million immediately.”

Mullen initially declined to show any agreement with its battery technology licensing partner, Linghang Boao, citing confidentiality. (More on this below). When NextMetals was grudgingly shown a few sheets of the agreement, the executive said:

“Clearly they had no rights to do it in the U.S. So when it finally goes in production the Chinese would make it and sell it to them. But there was no defining spec sheet and the whole thing was beyond ludicrous… What a can of worms.”

The executive continued:

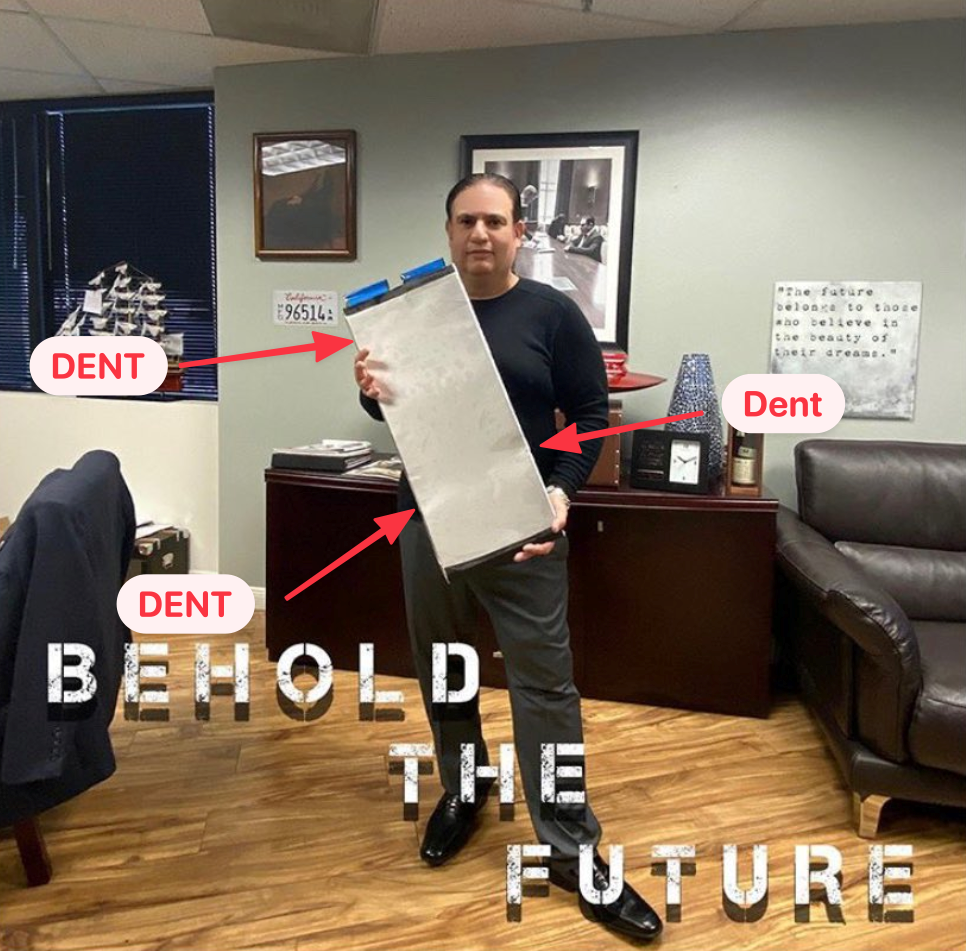

“… he (Michery) couldn´t produce the specs and finally pulled out this battery which was bent. And as you know if you use a solid-state battery, you should not bend it at all because usually you’ll damage this…either a ceramic or polymer electrolyte in the middle. “

We believe this was the same battery that was sent to EV Grid for testing.

Michery posted pictures of the battery on social media. It is easy to spot the numerous dents above the caption that says “BEHOLD THE FUTURE”.

On January 24th, 2020, Michery posted what appears to be the same mangled battery in a picture, announcing that the apparently non-existent JV would “change the world!”.

Describing his impression of Michery during those business negotiations, the senior executive said:

“[Michery] is a little short guy, fast talking. Just a hustler…a sales type character, always stretching the truth. Or maybe there wasn´t any [truth].”

Mullen’s Battery Claims Were Based on Technology Licensed from A Newly Formed Chinese Battery Technology Company Called Linghang Boao

Mullen Made Only One $390,000 Payment Under Its Licensing Deal. It Then Announced the Importance of the Relationship Around Its Go-Public Merger, Then Promptly Then Terminated the Deal

Linghang Boao’s Websites No Longer Work

In November 2019, Mullen entered into a three-year Strategic Cooperation Agreement (“SCA”) with Linghang Boao Group Ltd to co-develop a solid-state battery management system with a 480-720-mile driving range. [Pg. F-32]

The Company’s total financial commitment under the agreement was $2,196,000. On December 3, 2019, the Company paid the first installment of $390,000. It would be the only payment made in the agreement. [Pg. F-16]

Linghang Boao was registered in China in November 2018, just one year before its agreement with Mullen, according to Chinese corporate records. It shares a cell phone number with at least 99 other companies and listed its address inside a high-rise building (not a factory).

Its U.S. website, registered just 9 months prior to its agreement with Mullen, no longer works. Nor does its Chinese website. An online slide deck about the company, uploaded 2 years ago, claims it “has been continuously breaking through in the field of power and energy storage batteries”.

Nonetheless, the agreement with Linghang Boao seemed to serve as the foundation for Mullen’s bold battery claims. During its announced go-public merger on June 15, 2020 Mullen said:

“…becoming public at this time should allow us to accelerate the development of our unique battery technology which is non-flammable, puncture proof, capable of maintaining full capabilities after 500,000 cycles, and is synthetic, requiring no mining of natural resources.”

Just months later, around September 2020, Mullen terminated the relationship, claiming that COVID was a force majeure event. [Pg. F-20]

Our Overall Take: Mullen’s Battery Tech Claims Are Smoke And Mirrors

We think Mullen has severely and repeatedly misled investors on its claimed battery technology. Its latest iteration of its battery story is an agreement with Nextech Batteries, a small Nevada-based R&D firm with about 17 employees on LinkedIn. (Note: no relation to Next Metals detailed above).

We spoke with Nextech’s CEO, Bill Burger, and found him to be straightforward about the stage of his technology. He explained that while they are optimistic, they are presently in the prototype and R&D phase, and aiming to secure financing in order to build out a manufacturing facility, continue testing, and move toward higher volume.

We suspect that Mullen is once again attempting to borrow credibility from others in order to make grandiose claims to investors, pitching aggressive short-term timelines that bear little resemblance to reality.

Part II: Mullen’s Proposed Vehicle Offerings

Mullen’s Vehicle Offering #1: Electric Fleet Vans

Recently, Mullen Shocked the Market By Claiming It Would Begin Manufacturing 2 Models of Electric Vans Within Months For An Unnamed “Major, Major Fortune 500 Customer”

In a January 28, 2022, interview, Michery teased a bold announcement relating to near-term deliveries of electric vans to “some major companies”:

“We have a Class 1 and Class 2 vehicle and we have no issues with chips and no issues with getting vehicles to consumers. And we’re going to prove that in the second quarter of this year by delivering Class 1 vehicles to some major companies out there.”

Mullen had initially announced it would be offering Class 1 and 2 vans in a September 2021 press release, shortly prior to going public. It stated the vans were manufactured by Tenglong Automotive of China and that “Mullen will homologate and assemble the vans…in Tunica, Mississippi”:

“The agreement provides Mullen with an effective solution for the fast-developing EV cargo van market and its existing EV fleet van orders. Mullen will homologate and assemble the vans at its Advanced Manufacturing and Engineering Facility (AMEC), located in Tunica, Mississippi. Vehicles will be assembled in the United States and branded: “Assembled in the United States.”

But six months later Mullen was presenting its upcoming vans as its proprietary, home-grown product. On March 28, 2022, the company announced:

“The Mullen ONE, coming to market in Q2 2022, will be available in two classes of electric vans and will be designed, manufactured and customized by Mullen at its Tunica, Mississippi, manufacturing facility.”

Then, in a March 30, 2022, interview on Benzinga, Michery further elaborated its upcoming offering of electric vans, specifically representing that it would be building the vans in America, without dependency on outside entities, for an unnamed major Fortune 500 customer:

“We’re going to be delivering our class 1 [van] vehicle in the second quarter of this year. We’re excited about that. We can’t disclose to who – that hasn’t been publicly made available yet. But we plan on doing that shortly and we plan on announcing that it is a very large company that is going to buy a lot of these vehicles…We’re doing it here in America. We’re doing it in Tunica Mississippi. And we’re going to show the world that the dependency on outside entities no longer exists. We can do it ourselves here in America.”

Interviewer: “Is that order confirmed? That’s not like a pre-order, right?”

“No, no, we’re actually building for them. So, we’re, we’re excited. We’re going to deliver the pilot vehicles to them in the second quarter, as we stated, and we’re excited about it. This is a major major Fortune 500 company, I’ll put it that way.”

Predictably, the claims of near-term mass production for a Fortune 500 customer sent the stock surging immediately. It spiked about 35% intraday, to close at $3.03 per share on over 341 million shares of volume.

The 2 Electric Vehicle Cargo Vans That Mullen Claims It Will Be Manufacturing Are Actually Chinese EV Vans Rebranded With a Mullen Logo

Import Records Show The Company Recently Imported 2 Vehicles From China, One Of Each Model

Mullen’s website currently displays two models of EV Cargo Vans, a “Class 1” and “Class 2” version.

Casting doubt on Mullen’s claims that it would be manufacturing vans in America without “dependency on outside entities”, we found that Mullen’s current van offerings seem to entirely consist of 2 electric vans imported from China, made by Chinese manufacturers.

Import records via ImportGenius reveal that Mullen imported 2 vans, one in November 2021 and one in February 2022.[4]

In November 2021, Mullen imported a single “Pure Electric Logistics Vehicle”, manufactured by Tenglong out of China. Pictures of the Tenglong vehicle correspond precisely to Mullen’s claimed Class 2 Commercial EV Fleet van.

In March 2022, Mullen imported a single model C35 City Delivery Vehicle, manufactured by DFSK out of China. Pictures of the DFSK model correspond precisely to Mullen’s claimed Class 1 Commercial Cargo Van.

We strongly doubt that Mullen’s claims to be designing and manufacturing its own EV vans are true.

History Is Repeating Itself: In 2015, Mullen Offered an Electric Vehicle Cargo Van That Was Also Actually a Chinese EV Van Rebranded With a Mullen Logo. It Never Came To Market.

Mullen’s “new” van offering follows a historical pattern. Per website archives, Mullen started offering EV vans to its customers in 2015, beginning with what it dubbed the “Mullen 200e”.

The model appears to have just been a Mullen logo photoshopped on an EV van produced by Jonway Automobile, a Chinese manufacturer.

Here are the two side by side:

The Mullen 200e was never commercialized in the U.S., as it also never obtained an EPA Certificate, according to the EPA website.

The Reality On The Ground Seems to Starkly Differ From Mullen’s Claims of Imminent Production

The Company Has No EPA Certificates for Its Vans (Nor Any Vehicle), A Requirement to Sell Vehicles in The U.S. That Often Takes 12-18 Months

Furthermore, Mullen Hasn’t Begun Significant Hiring for Its Plant, According to The President of The Tunica County Chamber of Commerce

Even if Mullen does choose to surreptitiously import and/or assemble and rebrand Chinese vehicles, additional hurdles prevent its claimed near-term U.S. customer deliveries.

According to the EPA website, neither Mullen, Tenglong nor DFSK have certificates required to sell vehicles in the U.S. We also checked with the EPA press office who wrote us they had received no certificate applications for any Mullen vehicles.

The EPA makes it clear these certificates are compulsory:

“A Certificate of Conformity is the document that EPA issues to a vehicle manufacturer to certify that a vehicle class conforms to EPA requirements. Every class of motor vehicle introduced into commerce in the United States must have a Certificate of Conformity. Certificates are valid for only one model year of production.”

We consulted an Independent Commercial Importer (ICI), one of 6 entities that have obtained official EPA credentials to legally import vehicles into the United States, about how long it could take Mullen to obtain certificates of conformity for Chinese passenger vehicles and light vans. A representative for the ICI told us:

“Cost and time to be determined – after inspection average 12 to 18 months.”

According to experts we consulted, in order to qualify, vehicles must go through crash testing and inspections. Vehicles sold in Europe or China must often be reworked to suit the safety requirements of the U.S. market, such as adding airbags, changing belts, and modifying wheels and other components.

Even Michery, in a recent interview with Benzinga described these issues in response to a question on Mullen’s “biggest hurdle”:

“Our standards here in the US are very complicated. You know, certification in Europe, you know, isn’t as difficult.”

All vehicles sold in the U.S. must also comply with Federal Motor Vehicle Safety Standards (FMVSS) testing required by the NHTSA. Mullen has yet to disclose whether its vans have begun this process, let alone satisfied these criteria.

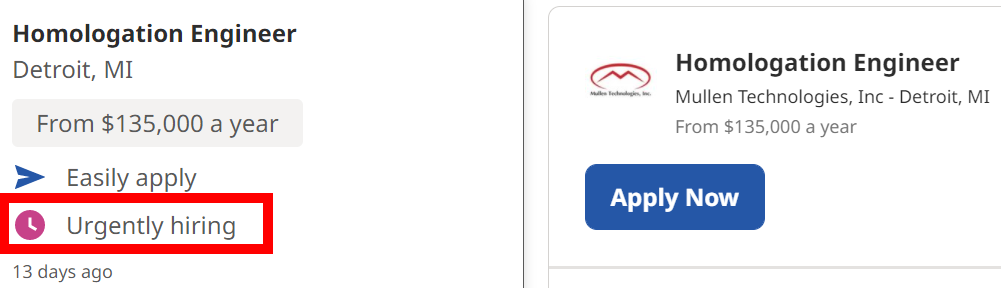

The company seems to be aware of the significance of these hurdles. Roughly two weeks ago, Mullen posted an “urgent” job listing for a homologation engineer, a role specifically tailored to help with its required regulatory approvals process.

Beyond its need for regulatory approvals, significant hiring for assembly plant workers will not even begin until after midyear 2022, according to Charles Finkley, the president of Tunica County Chamber of Commerce and Economic Development Foundation. He told us:

“We were selected for this project and Mullen has been a great community partner. I would say (hiring will start) mid-year.”

Job board Indeed currently shows only 5 openings for Mullen in the Tunica area, which appear to be focused on basics like front-desk admin and managerial positions like “Director of Vehicle Integration”.

Given that Mullen has no apparent EPA certificates, no apparent FMVSS testing and no apparent adequately staffed factory, we estimate that the company is years away from ever delivering a vehicle should it actually take genuine steps to do so.

Previously, Mullen Had Announced a Purchase Order Valued at $60 Million for 1,200 Class 2 Commercial EV Fleet Vans

That Order Came from a Small Cannabis Retailer with Only One Location and A New Online Store

The unnamed “major, major Fortune 500 company” customer teased by Michery would be a big step up compared to Mullen’s prior key customer.

On August 3, 2021, Mullen issued a press release announcing a letter of agreement with Heights Dispensary Ltd to purchase 1,200 Mullen One electric vans. The value of the purchase order was reported at $60 million ($50k per unit). James Gooch, managing partner of Heights Dispensary, issued a brief statement about his excitement to be working with Mullen.

James Gooch incorporated Heights Dispensary in Colorado just one year before the announcement, on April 22, 2020. Its incorporation records list 2 addresses: (1) a Houston residence and (2) a mail drop location.

Heights Dispensary holds a license to retail hemp in Texas and operates one retail location, according to its website. Google shows that the location is based in a small strip mall.

It also runs an online store that carries about 25 products, 5 of which are t-shirts. We found no employees for the operation on LinkedIn.

Currently, according to Heights’ website, its preferred method of delivery is not by its own fleet of vans but by mail, to avoid having to fill out a “manifest”.

We obtained two telephone numbers that went to voicemail for Heights Dispensary and a third that went to James Gooch´s voice recording. We called and left multiple voice and text messages over more than five days but received no response.

We talked to employees at a guitar store in the same strip mall as Gooch´s dispensary. They told us they had seen Gooch “in the last few days” but said the dispensary only open by appointment.

Mullen’s Vehicle Offering #2: The Mullen “DragonFly”

2019: The Mullen DragonFly Was Revealed as A Supercar Built by Chinese Manufacturer Qiantu Motors, Meant to Be Rebranded and Sold Through Mullen Starting in 2020

Another of Mullen’s key prospective product offerings is the DragonFly, a luxury sedan supercar manufactured by Qiantu out of China.

The vehicle, known as the Qiantu K50, was introduced in China in 2015. In December 2018, Mullen and Qiantu announced a cooperation agreement to “homologate and assemble cars in the US for sales in North America.”

Mullen put its logo on the car and revealed it as the rebranded “DragonFly” to the U.S. market in April 2019 at the New York International Auto Show. During the presentation, Mullen’s then-CTO Frank McMahon announced that it would be on the market the following year: “Sales beginning in 2020.”

Following the Reveal, Mullen Immediately Defaulted on its Payment Obligations to Qiantu, Leading to Termination of the Agreement in November 2019

Yet Mullen Continued to Market the Vehicle as Its Own. In Legal Documents Qiantu Alleges This is “An Inexcusable Misuse of Qiantu’s Own Intellectual Property”

Behind the scenes, the partnership quickly went south. Subsequent litigation records reveal that Mullen immediately defaulted on its obligations, missing its first payment to Qiantu to cover pre-launch costs.

With an outstanding balance owed by Mullen to Qiantu of almost $23 million, Qiantu terminated the agreement in November 2019. [Pgs. 3, 8] It also expressed surprise in its earlier Notice of Termination to Mullen that “Mullen could so badly miss the mark immediately out of the gate.”

Rather than acknowledge the end of the deal, Mullen continued to market the partnership as if it were ongoing, Qiantu alleged in legal documents. It even continued soliciting reservations for the vehicle, calling it the “Mullen K50” on social media posts.

The court ordered the matter to arbitration, per Qiantu’s request. It is set to be heard August 1, 2022. [Pg. 39]

Despite the Termination of The Agreement with Qiantu, Mullen Continued to Market the Offering, Including During Its Go-Public Period

To This Day, It Still Says the DragonFly Is “Coming Soon” On Its Website and Is Soliciting $1,000 Reservations for the Vehicle

Despite the termination of the agreement and the ongoing dispute, the DragonFly has been continuously marketed by Mullen as an ongoing offering.

On June 15, 2020, 7 months after the Qiantu agreement had been terminated and had devolved into litigation, the press release announcing Mullen’s go-public merger said:

“Mullen expects to launch the DragonFly K50, a luxury sports car, in the first half of 2021”

Chairman/CEO Michery was then quoted as saying:

“[The merger] comes on the preparation of our launch of the DragonFly K50, which will be available in Q2 of 2021.”

To this day, the DragonFly is featured on Mullen’s website, which is currently soliciting reservations with a $1,000 deposit.

Other parts of the Mullen website claim the DragonFly is “coming soon”.

In its most recent annual report, Mullen claimed to be pursuing the purchase of intellectual property rights relating to the K-50. [Pg. F-30] Should it succeed, it would presumably need to figure out a way to actually manufacture the vehicle, a process we expect would not be “coming soon”.

Chinese Media Reports That Qiantu Ran into Financial Trouble Around 2020 And Halted Production of the K50

A closer look at the timing and subsequent collapse of the Qiantu-Mullen deal reveals a Chinese company that lacked finances to build the vehicle negotiating with an American company that didn´t have the cash to buy it.

Chinese-based media viewed the K-50 as a low volume, expensive product that sold less than 60 units in its first year of production. Other media outlets described the K-50 as having quality control issues and calculated Qiantu only ever sold 200 K-50s before production ceased in 2020, just months after the Mullen deal headed to litigation.

By Spring 2020, Qiantu appeared to be teetering on bankruptcy and was laying off workers.

Rick Curtis, former consolidated president of Mullen, was one of the architects of the deal. He suggested to us that Qiantu ran into financial problems as a result of the Covid pandemic:

“I spent four months in China working that deal out. It was phenomenal car. A great car but shortly after that car was developed and started to go into production you know of course Covid hit and that just really put a tough squeeze on a lot of different companies over there.”

We also reached out to Daniel Darancou, one of the former designers of the K50, now based in the U.S. He explained that the K50 had been largely a vanity project for Qiantu, never intended as a big seller but more a vehicle to showcase technical and design capabilities:

“Unfortunately Covid derailed and interrupted the momentum we had going. Currently, Qiantu is focused on the Chinese market with new models and outlets. What has changed is there´s now 40 EV brands backed by all the major OEMs vying for attention and sales.”

He also explained that Qiantu is restarting operations, with its focus being on mass-market vehicles, not the K50:

“The K50 was never intended to be a large volume vehicle. It provided a wonderful platform to tell the story of the brand. The K20 and K25 are meant to reach a much larger customer base, which is what is being readied now.”

Mullen’s Vehicle Offering #3: The Mullen FIVE, a Compact SUV The Company Aspires to Develop, Manufacture and Deliver by The End of 2024

The Mullen FIVE is pitched on the company’s website as a “premium compact sport utility electric vehicle” that was “born out of [Mullen’s] love” for California. The company says it is “designed, engineered, and manufactured entirely in the USA”.

In 2021, Mullen reported only $3 million in R&D expenditures, which consisted “primarily” of Mullen FIVE EV show car development by “employees and consultants”. [Pg. F-26]

We estimate that the company would likely need billions in capital to launch the FIVE, given that Mullen proposes to essentially build the vehicle and retool/build a manufacturing facility from the ground up in order to mass-produce the vehicle.

The company has barely made any progress toward this massive goal, acknowledging in its recent annual report that it is still negotiating with various manufacturing integration companies to assist in all aspects of design and development of a facility. [Pg. 9]

Nonetheless, Mullen said it hopes to complete its manufacturing facility by Q1 of 2024, and have a sellable Mullen FIVE 9 months later, by the 4th quarter of 2024. [Pgs. 8-9]

December 2020: Mullen Announced That Its Electric SUV Received an Order for Up to 10,000 Vehicles, Representing $500 Million In Potential Revenue

We Called the South Florida Contractor Firm That Placed the Order. It Currently Has Only 11 Vehicles, None of Which Are Electric

On December 30, 2020, Mullen announced a non-binding letter of intent with Unlimited Electrical Contractors Corp (UEC), for the purchase of up to 10,000 of the company’s electric SUVs at $50,000 per unit, branded the MX-05 at the time.

The massive order, worth up to $500 million by 2025, served as major validation for Mullen, which by then was still in the process of completing its go-public merger that had been announced 6 months earlier.

UEC is an electrical contracting firm based in South Florida with roughly 30 employees listed on LinkedIn.

We called UEC and repeatedly attempted to speak with its CEO. We also called UEC´s legal representative and asked them to clarify whether their client had in fact pre-ordered half a billion dollars-worth of EVs but they did not respond.

Instead, we spoke with the company receptionist who said she had the insurance information for the company’s vehicles and told us UEC has only around 11 vehicles at present, mostly pick-ups and none of which are electric.

Following its initial announcement, we have seen no update provided by Mullen on the UEC mega-deal.

Part III: Mullen’s Manufacturing Facility

In just two years, between April 2019 and March 2021, Mullen made frequently conflicting announcements of at least 4 separate locations for the site of its vehicle production facility.

According to media reports, Mullen abandoned its first 3 planned facilities. At present, Mullen owns what it previously characterized as an R&D facility, contrary to its current claims of having a manufacturing facility with advanced production equipment.

Location #1: Washington State (April 2019)

The Company Announced It Had “Chosen” Spokane for a 1.3 Million Sq/Ft Facility In Order To Mass Produce Vehicles. The Plans Were Scrapped Roughly 2 Years Later

In April 2019, Mullen announced its intention to build a 1.3 million square foot plant near Spokane International Airport, in Washington State, to produce the Qiantu K50.

Chairman/CEO David Michery said of the decision:

“We are thrilled to be finalizing this critical first step in bringing the Qiantu K50 by Mullen to North America”

Six months later, in October 2019, Qiantu commenced legal action and ultimately terminated its agreement with Mullen over a failure to make initial payments for “pre-launch costs and expenses” of the flagship Qiantu K50.

But 9 months after the termination, Michery doubled down on claims it was setting up in Washington State to build the K50, in a July 2020 interview with local media.

The plans never went anywhere, with local media later reporting:

“Mullen is remaining silent on its plans in Spokane and has not responded to multiple requests for comment on project updates.”

An official at the public authority development agency that Mullen had tapped for support and incentives told us it became suspicious that Mullen did not have sufficient finances to set up operations:

“Our letter of interest had some thresholds in their (Mullen´s) capital raising that they needed to meet before we got overly engaged and started spending too much of our financial capital. And so, they really never got to that point before they went to Tennessee… There was just a lot of signs on whether or not it was smoke and mirrors.”

Location #2: Monrovia, California (September 2020)

Plans to Build Out A “State-of-the-Art Pilot Facility” Were Scrapped After Just Five Months

In a September 2020 press release, two months after Michery had doubled-down on Spokane, Mullen unveiled plans for the “build-out of its pilot manufacturing facility” in Monrovia, California. It stated:

“Mullen Technologies’ high voltage battery R&D center in Monrovia, California, begins its transformation into a state-of-the-art pilot facility for its line of fully electric SUVs on the first of October (2020).”

Five months later, plans for Monrovia were also abandoned.

In reality the Monrovia R&D center, according to a former battery specialist who worked for Mullen at that site, is an aging 22,000 sq. foot industrial unit. It was used to assemble Chinese battery packs for Coda cars – a bankrupt EV that Mullen sought to return from the dead as the Mullen 700e from 2014.

The ex-employee told us:

“It’s pretty small…it’s an old industrial building.”

“What I was brought on board to help them with is going over the batteries on the assets he purchased for the Coda car… but it was really difficult since he didn’t really purchase the correct equipment, you know the power cycler – so [that] you could actually cycle the batteries and test them…so we were in limbo on that.”

He said he finally left when Michery failed for months to pay his salary:

“The owner wasn’t paying us…he wasn’t paying us our salary. We were like 3 months behind on paychecks and there was too many empty promises…So we had to file a claim with the state to get paid. So we filed a claim against him, most of us, the employees. There was other people.”

“That’s the way the owner is…if you don’t say anything, he won’t pay you, he could care less. So that’s the kind of person he is…He’s not ethical at all…besides being that of my opinion, that’s my experience…”

Location #3 – Memphis, Tennessee (March 2021)

Plans For A $336 Million “Large Scale EV” Production Facility in Memphis Were Shelved Within Months

After shrinking away from Washington State and California, Mullen arrived in Tennessee.

In a March 2021 press release, the company announced “Mullen Set to Rock n´Roll in Memphis”.

The company made familiar claims that it was about to create hundreds of jobs and work toward mass-production of vehicles on an aggressive timeline:

“Mullen plans to create up to 800 jobs and deliver 100,000 vehicles over a five-year period, commencing in Q4 of 2023.”

In a pivot from Monrovia, the announcement made clear that Memphis would serve as its large-scale EV production facility:

“Mullen will spend the next 33 months creating the necessary infrastructure and installing the required machinery and equipment for the Memphis facility to support large-scale EV production.”

A week prior to announcing it would establish a manufacturing facility in Memphis, Mullen had also said it planned to buy a factory 50 miles south in Tunica, Mississippi. Mullen explained that Memphis and Tunica would work in tandem. Chairman/CEO Michery made clear that Tunica Mississippi would serve as a pilot plant:

“Our pilot facility in Monrovia, California, has now been moved to Tunica, Mississippi.”

Mullen had explained that the smaller Tunica plant would be used to build prototypes and for initial engineering and certification while the much larger Memphis plant would be used for full-scale EV manufacturing.

Despite the loud public proclamation, as of November 2021, Mullen had failed to pay an $817,274 licensing fee to secure the Memphis facility, abandoning the plans almost immediately. [Pg. F-24]

Location #4 – Tunica, MS (November 2021)

The Plant Was Previously Tooled to Build a Pizza Delivery Car, But Its Prior Owners Never Managed to Sell a Single Vehicle

Mullen Originally Said The 124,700 sq/ft Facility Would Serve as A Pilot Plant. But With Its Memphis Plans Abandoned, Mullen Claims It Intends to Expand the Plant by an Additional 1.2 Million sq/ft, With No Details On How This Will Even Be Physically Possible

On November 12, 2021, Mullen closed on the acquisition of a manufacturing facility in Tunica, Mississippi for $12.0 million. [Pg. 50] As described above, the facility was earlier described as a “pilot facility”, with mass-production intended to be in Memphis.

Yet with the abandonment of its Memphis plans, Mullen has suddenly shifted its disclosures, declaring its intention to expand the Tunica facility 10-fold through the help of outside contractors that it has yet to hire. Per its most recent annual report:

“We are currently in negotiations with several manufacturing integration companies that will assist in all aspects of design and development of the facility with completion by Q1 of 2024. The final constructed facility will be the location for testing functional vehicle prototypes as well a high-volume production assembly plant.” [Pg. 9]

The facility previously belonged to a company called GreenTech Automotive, which intended to produce a micro two-seater electric vehicle, named MyCar, at Tunica. In fact, the car was so small that the first sales deal announced was as an on-campus pizza delivery vehicle – far different from the SUV Mullen is now proposing.

According to the Mississippi State Auditor, Greentech’s electric car plant closed “before it ever produced a car.” An article quoted the state auditor as saying:

“On the day when they cranked up those energy-efficient electric cars and blue smoke bellowed out, you knew that this was a sham from the very beginning.”

The auditor further noted:

“The 350 jobs and $60 million of investment never materialized. In fact, the auditor says, Greentech never ended any year with more than 100 employees.”

Other media reports, citing federal documents, said Greentech may have produced a total of 25 vehicles at the Tunica plant, but not a single one was reportedly sold.

Mullen Claims Its Former Pizza Car Manufacturing Facility in Mississippi Is Stocked with State-of-the-Art Equipment and Machinery

But Pictures and Video of the Facility Show It Has Limited Equipment

The Company’s Website Features One Photo of Advanced Manufacturing Equipment. We Found That It Was a Stock Photo

Mullen Automotive calls the Tunica, Mississippi facility its Advanced Manufacturing Engineering Center (AMEC). The company states that “AMEC is fully tooled with state-of-the-art equipment and machinery.”

Given Greentech´s limited history of production, it is not clear how much assembly line equipment was ever installed nor how much was in place when the Tunica plant was shuttered.

However, a 2017 review by the Mississippi State Auditor mentioned assembly equipment and car parts offered as loan collateral by Greentech amounting to only $3.4 million. It is not clear if that was the total value of assembly equipment at the factory when Greentech went bankrupt.

Mullen’s website has a brief video that shows the interior of the factory. It looks to have storage space, tables and chairs for employees, and several lifting cranes. It does not appear from the video that there are any assembly lines, or robotic manufacturing machines.

However, Mullen’s website does feature one picture that shows advanced manufacturing robots. An online search shows that it’s a stock photo, which appears to have been purchased from Adobe stock images.

Part IV: Mullen’s Founder, Chairman & CEO David Michery – An 18-year History Of Penny Stock Failures, Securities Revocations, And An Association With A Convicted Securities Fraudster

“Just say the truth. We tell people all along; honesty is the best policy. We’ve never deviated.”

– David Michery, Mullen Founder, Chairman & CEO

David Michery is the face of Mullen, appearing at car shows, and investor-facing interviews.

On Michery’s LinkedIn, the only experience he lists prior to Mullen is his role as CEO at a company called American Music Corporation.

1999: CEO of AMC American Music Corporation – a Pink Sheets Company That Later Merged with an OTC Gold Miner and Quietly Let Its Corporate Registration Lapse

Michery became CEO of AMC American Music Corporation in 1999, according to an SEC biography. [Pg. 43]

In 2004, the company transferred its assets to a related company, then reverse merged with a speculative mining company called Mercantile Gold Company. AMC then let its corporate registration lapse in California.

2004: CEO of American Southwest Music Distribution, Inc (ASWD) An Entity Embroiled in Litigation That Alleged Michery Fraudulently Transferred Assets to an Entity He Controlled

In October 2004, Michery was appointed to CEO at American Southwest Music Distribution, Inc., formerly “GL Energy and Exploration, Inc.” Current Mullen independent director, Kent Puckett, was appointed CFO, Secretary, and treasurer for ASDM.

The company owned a music catalog purchased from Celestial Breakaway Records’ and Out of Control Records’. [Pg. 4]

In May 2005, a company called Vestcom, Ltd. filed suit against Michery, ASWD and other related entities and individuals. The lawsuit was related to a loan made by Vestcom in 2003 for $500,000 to AMC American Music Corporation. Vestcom alleged that AMC American Music Corporation fraudulently transferred its assets to Celestial Breakaway Records, which was owned and controlled by David Michery. [Pg. 14] The case settled in 2006 for undisclosed terms.

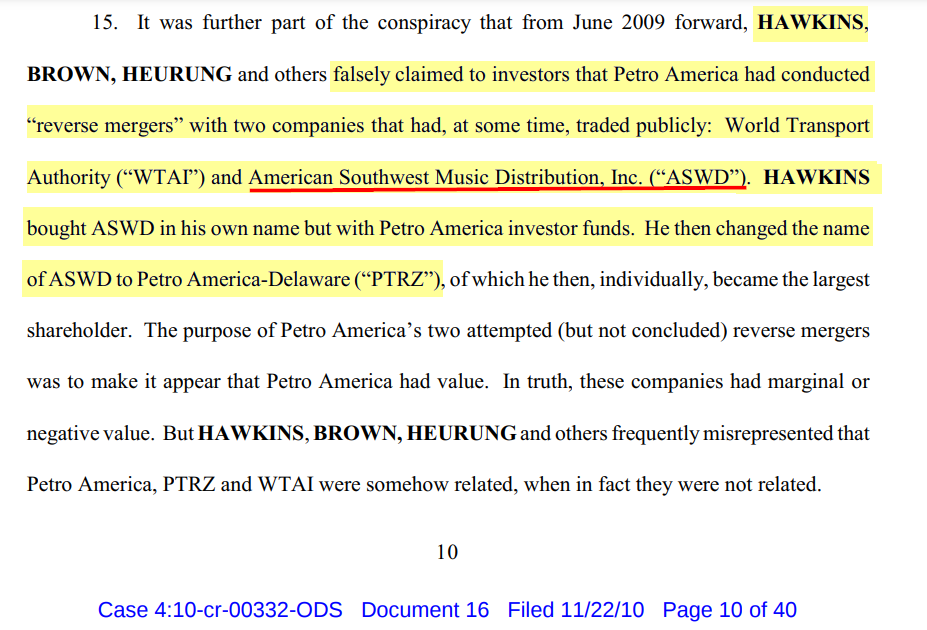

2008: ASWD Attempted to Merge with An Entity Run by An Individual Later Criminally Indicted for Securities Fraud and Sentenced to 30 Years

Prosecutors Alleged the Attempted Merger with ASWD Was Part of The Scheme

The company’s SEC filings around late 2008 get murky. In March, Michery approved the transfer of all company assets to an entity called D&B Music, then agreed to let ASWD be acquired by another company. By November 2008, ASWD terminated the registration for its common and preferred stock. The termination notice was signed by Owen Hawkins, with Michery having apparently departed for D&B.

A week later, David Michery, Owen Hawkins, and another individual agreed to merge their 3 respective entities, according to a Delaware corporate filing.

Two years later, Owen Hawkins was indicted on allegations of securities fraud by that Department of Justice.

Federal prosecutors specifically alleged that Owens falsely claimed to have engaged in reverse mergers with two companies, one of which was ASWD, in order to make his company seem more valuable to investors. In truth, the FBI alleged the two companies had marginal or negative value. [Pg. 10] Owens was sentenced to 30 years in prison.

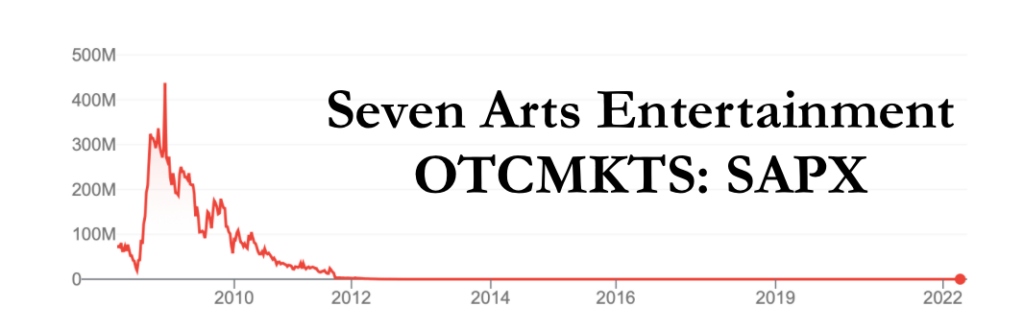

2012: Seven Arts Entertainment—The Company Acquired Assets from Michery and Appointed Him Director and CEO of A Subsidiary. Shares Fell 99% And Its Securities Registration Was Terminated in 2015

In 2012, Seven Arts Entertainment closed a purchase of 52 completed sound recordings by rap artist DMX from David Michery, along with the rights to additional albums. The same year, Michery became a company director. He was also appointed CEO of a subsidiary. [Pg. 57]

In just two years, the company announced it couldn’t file its annual report, and has not filed one since. Shares fell over 99% since Michery became involved in the company. The company terminated its securities registration with the SEC in February 2015.

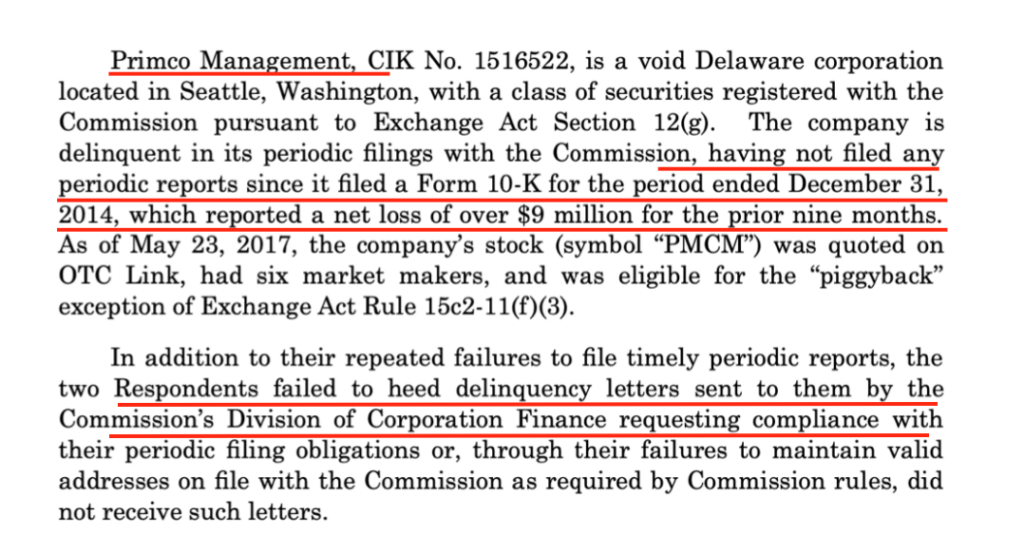

2013: CEO of Primco Management, Which Invested In (a) Entertainment Assets, (b) Mullen and (c) Medical Cannabis Before Flopping and Having Its Securities Revoked By the SEC

Following the Seven Arts deal, Michery joined Primco Management, Inc. in January 2013.

Primco was a real estate management services company that executed a reverse merger with an entity controlled by David Michery called ESMG, Inc.

ESMG described itself as a “multi-media entertainment enterprise with a music production and distribution division, and plans to launch a motion picture and TV production and distribution division.” [Pg. 3]

The company embarked on a series of scattered projects. In December 2013, it executed a $150,000 line of credit agreement with Mullen Motors Company. [Pg. 22] In 2014, it expanded its operation into medical cannabis. [Pg. 3] In May 2015, the company announced a LOI to acquire a Canadian solar power panels manufacturing company, Solgate, Inc.

The ventures flopped, and by October 2017, Primco had its registrations of each class of its registered securities revoked by the SEC for failure to file required reports.

2014: CEO of Shades Holdings, a Luxury Sunglasses Company That Failed Within 2 Years and Also Had Its SEC Registration Revoked

Michery became CEO and President of Shades Holdings in December 2014. Shades was a developmental-stage company engaged in the acquisition and marketing of luxury sunglasses.

In less than 2 years, Shades had its securities registration with the SEC revoked for failure to file periodic reports.

Following the collective string of failed public companies above, Michery took the reins at Mullen.

Part V: Mullen’s Largest Shareholders Have a History of Shareholder Destruction, Financial Crimes

In 2021, Mullen went public by reverse merging into a struggling cryptocurrency company called Net Element, controlled by Terren Peizer. [Pg. 234] The reverse merger made Peizer one of Mullen’s largest holders.

A Terren Peizer-controlled entity, Acuitas Holdings, controlled 29% of the voting power of the company as of its most recent annual report. [Pg. F-31]

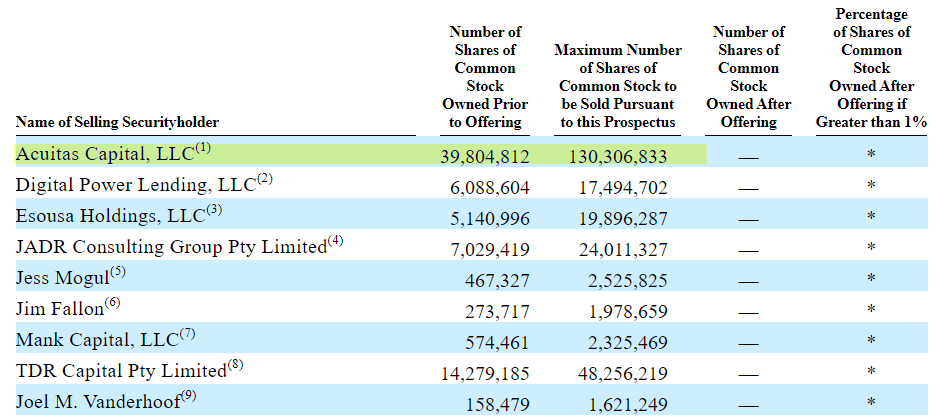

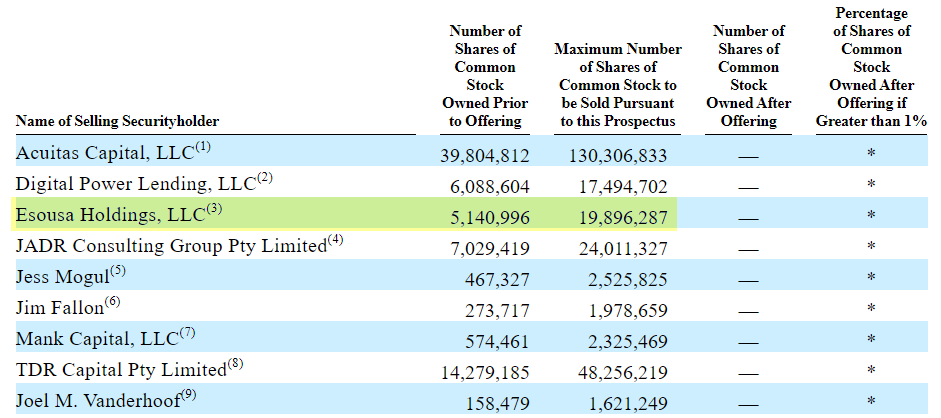

As of Mullen’s latest prospectus statement, Peizer’s holdings have surged in light of Mullen’s recent massively dilutive offerings. He has registered to be able to sell all of his shares, which now total up to 130 million. [Pg. 10]

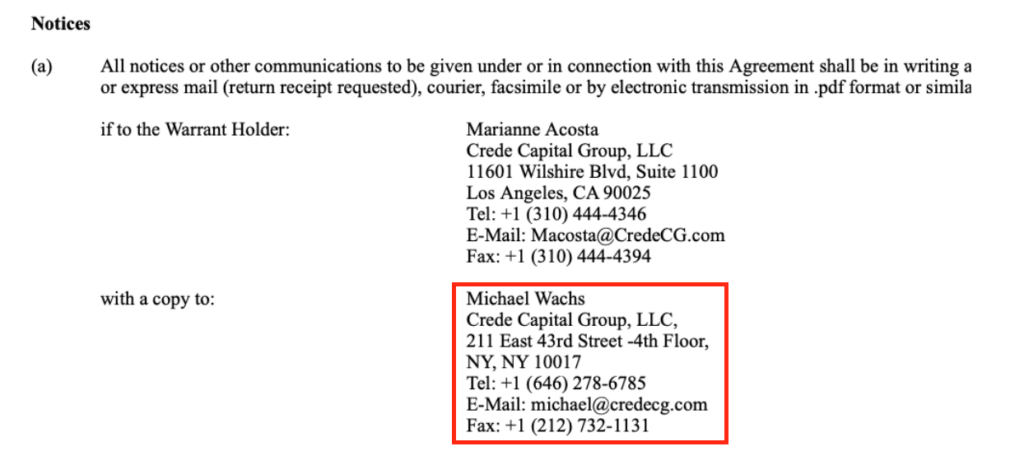

Prior to Acuitas Group Holdings. Peizer managed Crede Capital Group and Socius Group. [Pg. 3-4]

According to a Department of Justice release, Richard Josephberg had just completed a 50-month jail term in 2010 when he was hired by one of Peizer’s investment vehicles, Socius Capital Group LLC, to originate financings. [2010, 2012]

We did a search for companies that had disclosed financings from Terren Peizer or his related entities (Crede, Socius, Acuitas) and found several that had imploded, often following stock spikes.

Mullen Key Holder Esousa Holdings Is Controlled by Michael Wachs, Who Previously Served Time in Jail for Bank Fraud

Wachs Controlled 8.1% Of the Company as Of A Recent Prospectus Filing

Another large holder of Mullen is Esousa Holdings, LLC, an entity beneficially owned by Michael Wachs. The entity held 8.1% of the company as of a recent prospectus filing. [Pg. 14]

As of Mullen’s latest prospectus statement, Wachs continues to hold a significant number of shares. He has registered to be able to sell all of his shares. [Pg. 10]

Michael Wachs Served Jail Time for Bank Fraud After He Pled Guilty to Defrauding Chase Manhattan Bank For $20 Million In 1996

Michael Wachs pled guilty in 1997 to defrauding Chase Manhattan Bank for $20 million. Wachs did this by using his high-ranking position at the bank to jump in between asset sales by using a front company he secretly controlled, according to a Barron’s article.

The predecessor to FINRA, NASD, handed down a lifetime ban to Wachs in 1998. He also holds a ban from the board of governors of the Federal Reserve.

He is now a key Mullen shareholder.

Peizer And Wachs Have Close Business Ties, And Have Backed Mullen for Years

Michael Wachs has close business ties to Peizer. He was previously listed as a representative for Crede Capital Group, an entity controlled by Terren Peizer, in a financing as recently as 2018. [Pg. 5]

Vehicles controlled by Terren Peizer and Michael Wachs have financed Mullen since October 2021. Acuitas purchased $20 million in preferred stock the day before Mullen began trading on NASDAQ. [Pg. F-23]

On September 1, 2021, Wachs agreed to purchase $30 million over 12 months. CEOcast, Inc, another entity controlled by Wachs, bought $15 million in warrants. To pay for the warrants, CEOcast issued a promissory note to Mullen (no cash outlay). Also, as part of the deal, CEOcast received approximately 265,505 penny warrants. [F-36, F-37, F-38]

Note that CEOcast is the same investor relations firm that hired convicted fraudster Richard Josephberg, per the DoJ indictment above.

Conclusion: Mullen Is Among the Worst EV Hustles We’ve Seen in A Crowded Field of Contenders

Disclosure: We are short shares of Mullen Automotive, Inc. (NASDAQ:MULN)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] For comparison, Tesla has about 100,000 employees.

[2] Note that in a subsequent 8-K, Mullen said that its warrants have an exercise price of $8.84 per share, suggesting they are far out of the money. But a careful reading of Mullen’s warrant agreement shows it has a cashless exercise feature allowing holders to convert based on a calculation of the Black Scholes value of the warrants. [Pg. 9] Furthermore, the company recently modified its warrant agreement to add $3 in value to the Black Scholes calculation for no obvious reason, all but guaranteeing significant profits for warrant holders at the expense of its regular shareholder base.

[3] We checked with Mullen to see if there has been any more recent testing but have not heard back as of this writing.

[4] This would be more consistent with Mullen´s earlier September 2021 claims to be merely assembling a van for Chinese manufacturer Tenglong Automotive, rather than its later misrepresentations from March 2022, that fueled the stock price rise. [1,2]