- Welltower Inc. (NYSE:WELL) is a healthcare REIT with a $32.1 billion market cap that is the largest owner of senior housing facilities in the U.S., with investments in 1,568 properties.

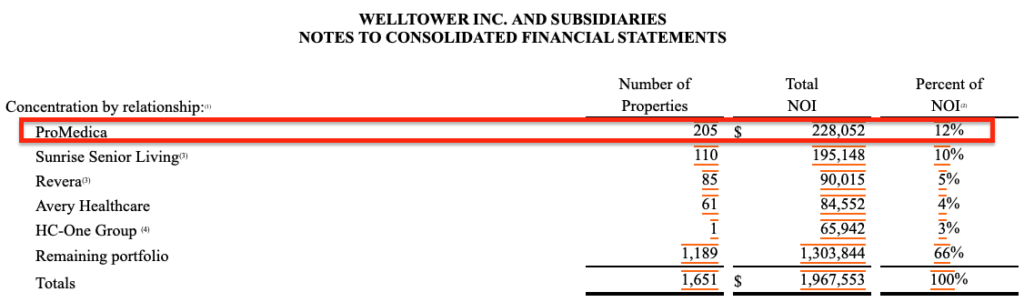

- Until last month, Welltower’s largest tenant was a non-profit health system in the Midwest called ProMedica, which accounted for 12% of the company’s annual Net Operating Income (NOI). ProMedica faced severe distress and began breaching bond covenants in early 2022, threatening Welltower’s investment.

- Given its size as Welltower’s largest operator, Welltower has stressed the importance of ProMedica’s financial health as a key risk factor.

- On November 7th, 2022, Welltower announced a solution: it would transfer the operation of 147 skilled nursing facilities out of ProMedica and into a new joint venture with a health care manager called Integra Health. The deal helped fuel a 9% spike in Welltower’s stock.

- Welltower’s CEO said that Integra provided a “well-capitalized strategic partner” resulting in Welltower being paid 4% more in cash rent under the new JV, coming out ahead despite the distressed situation.

- Despite the high praise from Welltower’s management and claims of being well-experienced in skilled nursing, Integra seems to barely exist. The entity was registered 6 months ago, according to Delaware corporate records. Its website was registered on the same day.

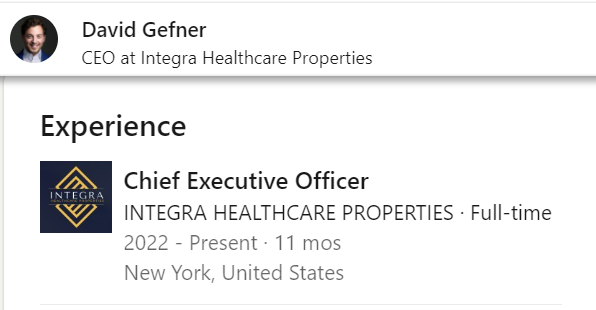

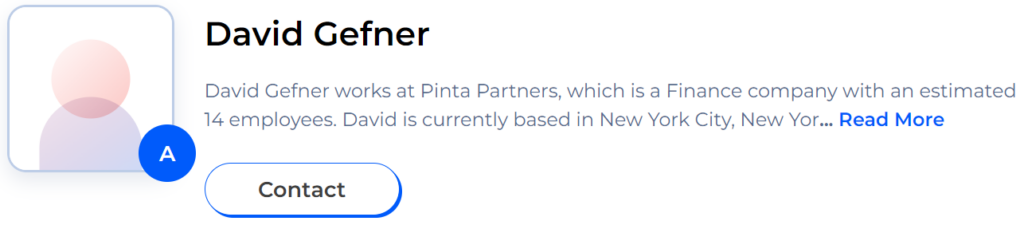

- Integra’s CEO, 29-year-old David Gefner, appears to have no background in the skilled nursing space at all. Integra has no employees on LinkedIn except for Gefner, who claims to have worked at the 6-month-old entity for 11 months.

- A senior ProMedica employee told us Integra had no operating experience and came in after the company couldn’t find genuine operators. A former Welltower executive told us he had never heard of Gefner, saying that Integra would need “a lot of people” to manage the deal with Welltower.

- Red flags indicate that another of Welltower’s distressed deals, a 2021 restructuring with its troubled 4th largest operator, Genesis Healthcare, mirrored the latest ‘miracle’ deal.

- In late 2021, evidence suggests that Welltower quietly disposed of 21 of its distressed Genesis assets to a Gefner-affiliated firm, once again handing skilled nursing facilities over to an inexperienced manager and clearing its books of the mess.

- We found signs of overt conflicts of interest with the deal. Gefner previously worked at the investment firm that owned Genesis, according to contact database records. Gefner’s own private equity firm at one point shared an office suite with an affiliate of the firm that ran Genesis. None of these relationships have been disclosed by Welltower or Gefner.

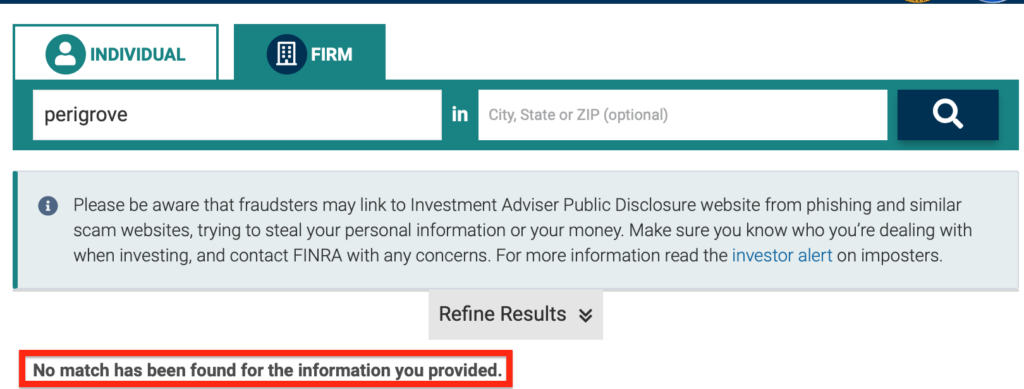

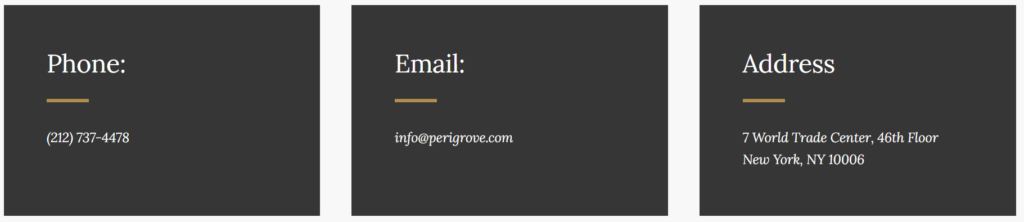

- In addition to his CEO role at Integra, Gefner is CEO of private equity firm “Perigrove”, which at one point claimed to have raised $3 billion. We found no regulatory Form ADVs or Form Ds for Gefner or Perigrove. We also found no association with a broker/dealer, indicating that Perigrove may have either lied about the size of its capital raises or raised the capital illegally.

- Perigrove claimed on its website to have run 12 prior real estate projects. We found no evidence to support this. Real estate records show all were led by other developers.

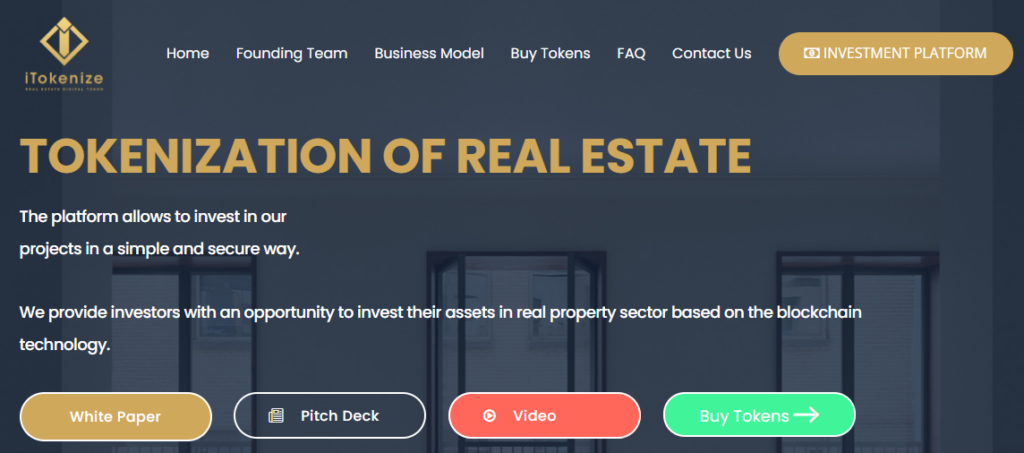

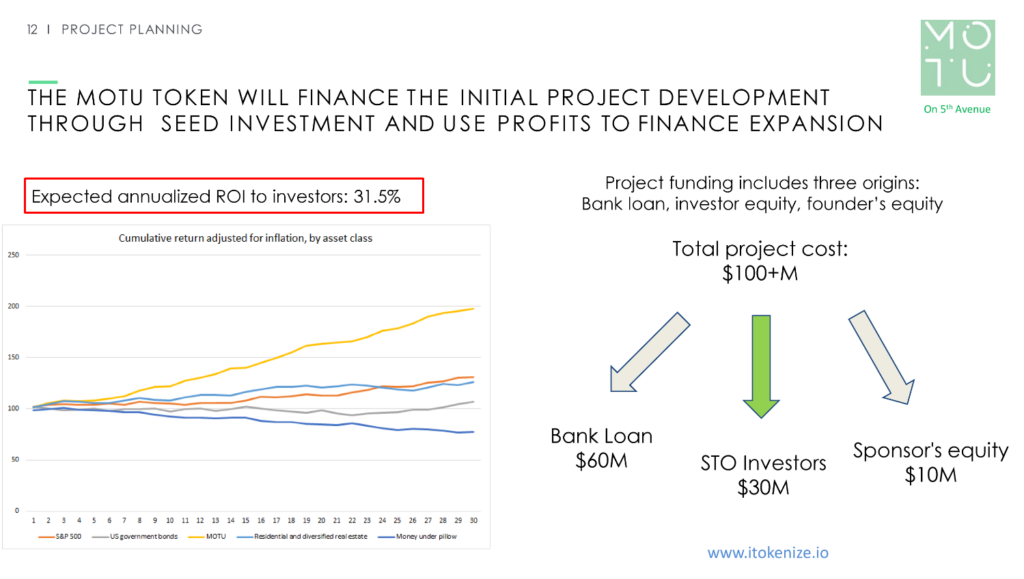

- Perigrove had a documented role in only 1 of the claimed projects on its website that we could find; an attempted launch of a $30 million crypto token to raise funds for a property once dubbed by Crain’s Business as the “city’s worst illegal hotel”. The token offering looks to have failed.

- Perigrove’s website claims it operates out of a prestigious office building in Manhattan. We visited and found the company has no presence at its claimed address.

- Instead, we found Perigrove’s office on the outskirts of New York City, in a strip mall sharing an address with an auto parts store. On the front door of the building, Perigrove’s name was spelled wrong, as “Perigove”, with stickers.

- Welltower trades at a premium to competitors, with its price/estimated NTM AFFO at 22.7x, 22% higher than the average multiple of comparably-rated peers. It has the lowest dividend yield of its peers, indicating that the market views it as a safe asset.

- Welltower’s valuation comes despite an industry in turmoil: a 2022 BDO report reported that 50% of long term / post-acute home health facilities had defaulted in the last 12 months. The report surveyed 100 Healthcare CFOs and found that one in four who had not defaulted in 2021 were concerned they would default on bond or loan covenants in 2022.

- Welltower also faces significantly larger maturities moving past 2023, with 2024 and 2025 debt totaling over $3.7 billion in a rising interest rate environment.

- Meanwhile, the company has been diluting its equity via at-the-market (ATM) offerings, having raised ~$4.5 billion in total net proceeds in the past 2 years. It has raised over $400 million in 5 months through its latest ATM, with $2.57 billion in remaining capacity as of September 30, 2022.

- Overall, we think Welltower is an overpriced-to-perfection REIT obfuscating its distressed assets, raising questions about both its portfolio and the credibility of management as it attempts to raise capital from investors.

Initial Disclosure: After extensive research, we have taken a short position in shares of Welltower, Inc. (NYSE:WELL). This report represents our opinion, and we encourage every reader to do their own due diligence. Please see our full disclaimer at the bottom of the report.

Introduction

Welltower Inc. (WELL) is a healthcare REIT with a $32.1 billion market cap that is the largest owner of senior housing facilities in the U.S., with investments in 1,568 properties. [Pg. 2] Its portfolio also includes an additional 272 properties in Canada and the UK. [Pg. 2] The company reports 3 segments: senior housing operations (54% of assets), triple net leases (28% of assets) and outpatient medical (18% of assets). [Pgs. 2, 78, and 102]

Bull Case: Welltower Is A Late-Stage Pandemic Reopening Play That’ll Be The Long-Term Beneficiary Of The Aging Baby Boomer Generation

Welltower’s portfolio was significantly negatively impacted by COVID, experiencing a decrease in senior housing operating occupancy, from 86.9% prior to the pandemic (Q1 2020) to 79.2% currently (Q3 2022). [Pg. 1 and Pg. 1] The trend has reversed off lows of 72.7% in Q1 2021, providing bulls hope the company’s operating occupancy can recover to pre-pandemic levels. [Pg. 1, Pg. 3]

On a long-term basis, bulls also hope that Welltower will be the beneficiary of an aging baby boomer generation’s need for nursing home care, propelling them back toward “peak occupancy” of 91.2% that the company reached in Q4 2015. [Pg. 16]

Despite stress across the industry, the company is considered by its investors to be an effective allocator of capital, having raised $4.5 billion in total net proceeds via at-the-market (ATM) stock issuances in 2021 and 2022. [Pg. 21, Pg. 97] Welltower has said it is using the proceeds of the ongoing offerings to mainly invest in new projects. [Pg. 36, Pg. 8 and Pg. 8]

Before diving into major risks the market seems unaware of, we first want to cover several general risks to the primary bull thesis.

General Risk #1: A Premium Valuation Compared To Peers With Similar Risk Profiles. Welltower’s Price/2023E Adjusted Funds From Operation (AFFO) Is 22% Higher Than Its Peer Average

Welltower has convinced the market that its senior living operations are set to rebound. The company trades at a 3.4% forward dividend yield, pricing in far less risk than peers like Ventas (3.89%), Sabra Healthcare (9.1%) Omega Healthcare (8.9%) and Healthpeak Properties (4.6%).

The company also trades at a sizeable premium to peers in key metrics with similar Baa1 credit ratings. Its price/estimated NTM AFFO is 22.69x, 22% higher than the average multiple of comparably-rated Ventas and Healthpeak. Its NTM EV/EBITDA is 21% higher than the Ventas and Healthpeak average of 17.65x.

Both metrics indicate that the market sees the company’s senior housing portfolio as a low-risk, high growth investment that should be afforded a premium to competitors.

With an average building age of 19 years, we expect Welltower’s recurring and renovation capex, which was $282.6 million for FY 2021, will continue to rise. [Pg. 51, Pg.1]

Despite this, the sell side projects an aggressive 28% increase in FFO by 2024, pricing Welltower at a 19.2x forward 2024 multiple.

General Risk #2: An Industry Facing A Massive Wave Of Defaults And Skyrocketing Operating Costs

The fundamentals of Welltower’s industry have deteriorated post-COVID. While senior housing occupancy has increased 1% over the last quarter, many operators are still in significant distress.

A 2022 BDO report stated that 50% of long term / post-acute home health facilities had defaulted in the last 12 months. [Pg. 10] The report surveyed 100 Healthcare CFOs and found that one in four who had not defaulted in 2021 were concerned they would default on bond or loan covenants in 2022.

Adding to this burden, the largest operating cost for senior living is staffing, a cost that is rapidly increasing due to labor shortages and inflation. McKinsey estimates that clinical wage growth will outpace inflation over the next two years.

We spoke with a senior executive of a large industry operator and Welltower partner who told us that government reimbursements have not caught up with rising labor costs, putting additional stress on the industry even despite some occupancy increases:

“Nursing homes are really struggling… there’s wage inflation, even outside of agency you’re seeing 6 to 8% wage inflation, and there’s a lag before government reimbursement catches up with that and the increases that CMS through Medicaid and Medicare that have been supporting are not covering those kinds of wage increases yet.”

Residual effects of the COVID pandemic also continue to ripple through nursing homes, according to CMS data. This has resulted in continued reluctance by the industry’s once-addressable market to move into an assisted living or nursing facility.

The industry has also faced other recent issues, such as an over-build of nursing supply and regulations meant to curb profits. [1,2]

The struggles of senior care providers directly affect Welltower, which derives 44.9% of its Net Operating Income (NOI) from its senior housing operations segment. [Pg. 1] In bankruptcy, leases can be canceled or renegotiated, which affects Welltower’s direct investment in properties that it leases to operators.

“Skilled nursing is just a very challenging business,” one industry executive told us.

General Risk #3: A Large, Expensive Debt Load And Continued Dilutive Capital Raises

A general risk affecting REITS is debt burden. Welltower has a $15 billion debt load, with the company reporting net debt to adjusted EBITDA of 6.93x. [Slide 23] The company faces higher interest expense pressures going forward due to several factors:

- Rising interest rates;

- The company’s debt rating, currently at BBB+ (3 notches above junk); and

- Roughly $2.3 billion needed from refinancings in 2023-2024.

The company also faces significantly larger maturities moving past 2023, with 2024 and 2025 debt totaling over $3.7 billion. [Pg. 25]

Meanwhile, the company has been diluting its equity via a $3 billion at-the-market (ATM) offering since April 2022. [Pg. 21] In just 5 months it has raised over $400 million through the offering, with $2.57 billion in remaining capacity as of September 30, 2022.

The company has indicated that the capital raises are mainly focused on taking advantage of investment opportunities and growing Welltower’s portfolio. [Pg. 4]

Beyond general risks, we have identified several key risks that we think raise serious questions about Welltower’s portfolio, along with management’s credibility.

Key Risk #1: Welltower’s Largest Set of Properties Is Being Propped Up By A Shell Game While the Company Dumps Shares On Equity Holders

Last month, on November 7th 2022, Welltower announced that it had found a new partner for a portfolio of 147 skilled nursing facilities whose operator, ProMedica, was distressed. The company described its new partner as a well-capitalized JV partner that was willing to pay 4% more in cash rent.

Critically, we believe the new JV partner is little more than a sham designed to obfuscate weakness in the portfolio.

2021-Present: Welltower’s Largest Tenant, ProMedica, Represented 12% of 2021 NOI

ProMedica Faced Severe Distress And Began Breaching Bond Covenants In 2022, Threatening Welltower’s Investment

Until recently, Welltower’s largest tenant was a non-profit health system in the Midwest called ProMedica, according to company SEC filings. [Pg. 92] Welltower acquired the properties in 2018 after the prior tenant declared bankruptcy and ProMedica took over operations. As of year-end 2021, Welltower was invested in 205 properties run by Promedica, which accounted for 12% of its net operating income for the year. [Pg. 92]

Given its size as Welltower’s largest operator, Welltower stressed the importance of ProMedica’s financial health in the risk factors of its most recent annual report:

“We depend on ProMedica Health System (“ProMedica”) for a significant portion of our revenues and any failure, inability or unwillingness by them to satisfy obligations under their agreements with us could adversely affect us” [Pg. 32]

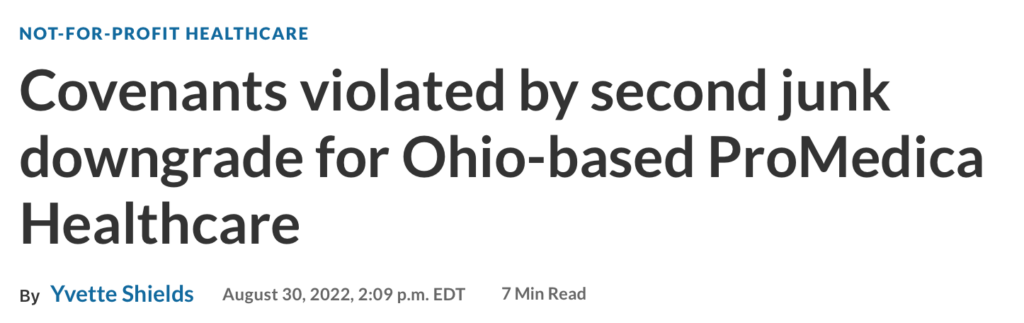

Following the prior tenant’s bankruptcy, ProMedica has continued to experience significant distress. It began taking on substantial losses in 2021. By August 2022, S&P downgraded ProMedica’s credit to junk, representing a breach of its loan covenants, according to news reports. [Pg. 13]

Moody’s also later downgraded the company’s debt to junk in September 2022, citing material cashflow losses exceeding expectations and narrowing headroom on bank covenants. In November, Moody’s revised ProMedica’s Ba2 rating outlook to negative.

November 7-8th 2022: Welltower Announced A Solution to Its Looming ProMedica Problem—Moving 147 Distressed Skilled Nursing Facilities Into A New Joint Venture Formed With A Company Called Integra Health

The News Helped Fuel A 9% Surge In Welltower’s Shares

On November 7th, 2022, after market close, Welltower announced it would transfer the operation of 147 skilled nursing facilities out of ProMedica and into a new joint venture with a health care manager called Integra Health.

The deal seemed like a major win, bailing Welltower out of a distressed situation while securing 4% more cash rent in the process.

Shares rose 9% the next trading day, then added another 4% over the next week, fueled by both the ProMedica solution and the company’s earnings release.

Welltower’s CEO, Shankh Mitra, offered more color on the third quarter investor call, stating that Integra provided the dual benefit of a ”well-capitalized strategic partner to focus on the skilled nursing properties” and also leaving ProMedica in “substantially better financial state”.

Mitra continued, saying Welltower had transacted with Integra and its unnamed parent entity on 21 assets previously, adding:

“I fundamentally believe in the expertise, and we have worked with Integra and its parent company on many of these transactions before. There’s no question that they are significantly better in the skilled nursing business than we are and will ever be.”

“Integra or its parent entity which we have done multiple transactions with previously, has successfully executed many turnarounds, including those involving HCR assets that we sold it (sic) to them in the last couple of years and is well positioned to return these assets to its previous glory”.

An analyst from Credit Suisse applauded the deal, noting its irregular favorable economics, saying:

“Again, congrats on the quarter and the transition. I have been covering this from 15 years. I don’t think I’ve ever seen a rent restructuring where the rents went up. So that’s pretty cool to see.”

Welltower’s third quarter report said that ProMedica will surrender its 15% interest and “provide significant working capital support for the new operators to ensure a smooth transition.” In exchange, ProMedica will be released from its skilled nursing lease obligation. [Pg. 29]

Integra Is Set To Take Over A Master Lease For 147 Skilled Nursing Facilities, A Major Responsibility

Integra’s Entity And Website Were Set Up 6 Months Ago And It Has 0 Employees On LinkedIn. Industry Veterans, Including One Former Welltower Exec, Told Us They Had Never Heard Of It

Integra now has responsibility for 147 skilled nursing facilities.

Despite the high praise from Welltower’s management and claims of being well-experienced in skilled nursing, Integra seems to barely exist.

Far from having a long operating history, Integra’s entity was registered 6 months ago, according to Delaware corporate records.[1]

Integra’s corporate website was registered on the same day.

The Integra website provides a generic business description and offers no names of people associated with the firm. Instead, the website claims it has an extensive staff, including an “in-house team of attorneys, underwriters, and market analysts”.

Despite these claims, Integra has no employees on LinkedIn except for its CEO David Gefner, who claims to have worked at the 6-month-old entity for 11 months.

Gefner is 29 years old, according to UK entity filings. Far from being an experienced operator, we found no evidence that he has managed skilled nursing facilities or healthcare facilities.

One former Welltower executive we spoke with, who left the company in mid-2021, had a problem recalling any past deals the company had done with Integra, despite management’s claims to have done numerous deals with it and its unnamed parent. “There was maybe a minor portfolio with Integra before,” they told us, unable to furnish further details.

The same executive didn’t seem to know Integra’s 29-year-old CEO, either:

“David Gefner. Don’t know David…when you Google him you get this company called ‘Perigrove’. Yeah, no, I never…this kid’s a young guy too. He’s a young frickin’ guy…I never met this dude…”

“As Far As We Know, There Is None”: Senior ProMedica Employee Told Us Integra Had No Operating Experience And Came In After The Company Couldn’t Find Genuine Operators

In light of our findings into irregularities with Welltower’s claims, we spoke with a high-ranking ProMedica employee to learn more about the deal with such an unknown, questionable counterparty.

They told us Integra came in after ProMedica/Welltower couldn’t find new operators, despite searching extensively:

“It’s a very complicated mess, I know this [ProMedica/Integra deal] follows discussions going back to the beginning of the year, on divesting and exiting out of certain markets, and certain buildings, I think that ProMedica was actively attempting to negotiate, along with Welltower, with new providers but they just couldn’t get the deals done, and so I think the board’s position was, we’re not going to allow this to continue on to the new year, because we could be sitting here six months from now no better off than we are right now.”

Further contradicting Welltower’s claims, the employee speculated that Integra wouldn’t be able to get state licenses because of its lack of operating history.

“Integra is going to have to operate these buildings under ProMedica’s licenses because Integra is never going to get approved as an operator because of their lack of a portfolio and track record and a team to operate these buildings, which are questions that all the regulatory entities will ask, when they’re seeking approval is how do plan operate, what’s your team, what’s your management structure?”

We asked about Integra’s management team and structure:

“As far as we know there is none.”

They also told us that Welltower’s rent payments could be in jeopardy.

“I think that’s one of the things that is holding…any potential transaction is holding up… Welltower is seeking…knows that these problems can continue with the operators sustaining losses and that rent payments could be jeopardy, and I think that Welltower is seeking security.”

Despite Welltower advertising a 4% increase in rent from a well-capitalized partner, the employee then speculated that Welltower was going to cover any losses for Integra’s portfolio.

“My guess is, I don’t know exactly how that was arranged. It has been speculated that this is sort of an arrangement that was made between Integra and Welltower where Welltower is going to indemnify Integra from their losses”

When asked about the value attributed to the portfolio, they said there was some, but it was questionable in today’s operating environment:

“There’s definitely value in the portfolio, you know. How much is questionable.”

Integra’s CEO Claims To Also Be CEO And Founder Of Perigrove, A “Prolific” Private Equity Firm That Claimed To Have Raised $3 Billion

Reality: We Found No Regulatory Filings Such As ADVs or Form Ds Relating To David Gefner or Perigrove’s Capital Raises, Indicating That They Likely Either Lied About The Amount of Capital Raised Or Raised Capital Illegally

The CEO of Integra is David Gefner, per Welltower’s press release announcing the deal. He describes himself as the Founder and Principal of Perigrove, a “prolific” private equity firm formed in 2012, when he was around 19 years old.

While unclear, Perigrove may be the parent that Welltower’s CEO referred to in on its earnings call because it is the only entity with obvious public ties to Gefner.

Perigrove’s website describes itself as a multi-billion-dollar private equity investment firm focused on healthcare:

“Perigrove is a prolific private equity firm strategically diversified across every segment of the global healthcare sector. Headquartered in New York City Perigrove has conducted billions in transactions over the past decade. On behalf of our stakeholders and the tens of thousands of lives we impact, we continue to create outsize opportunities in all we engage.”

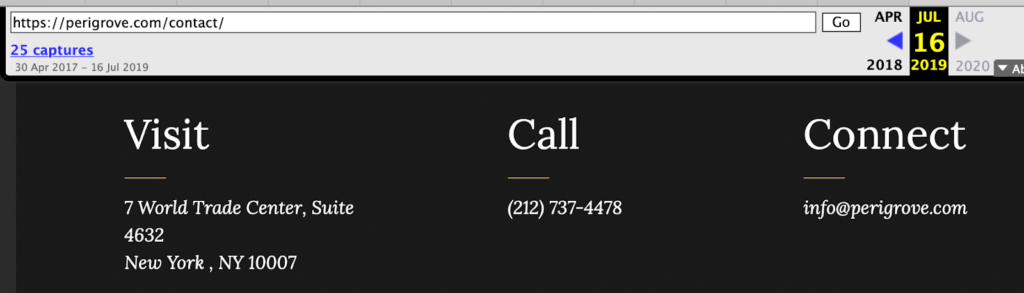

Perigrove’s claimed focus on healthcare appears to be relatively new. Earlier archived versions of its homepage from 2019 made no reference to healthcare, instead professing a focus on real estate.

The same archived website captures show that Perigrove stated that it raised more than $3 billion in total equity.

Despite its claims to be a large asset manager, Perigrove is not registered with the SEC as an advisor. All U.S.-based investment advisors with $100 million or more in assets under management are required to register with the SEC as investment advisors.

When raising private capital, investment firms are also required to file “Form Ds” reporting details of the capital raises. We found No Form D’s referencing Perigrove or Gefner, despite claimed numerous large capital raises. Similarly, a search on FINRA BrokerCheck to see if Perigrove or Gefner were affiliated with any broker/dealer turned up no results.

The lack of required regulatory filings suggest that Perigrove either exaggerated its capital raising activities or raised the capital illegally.

We reached Gefner by cell phone to ask him about Integra and Perigrove. He declined to provide any information but said he would take our name and number and call back, saying he was in the middle of something. He did not call back and did not answer when we phoned 3 subsequent times. He eventually responded to our WhatsApp message saying “I’m on a plane traveling overseas.” He had not mentioned any impending trip when we briefly spoke with him earlier. We have heard nothing further as of this writing.

An Earlier Version Of Perigrove’s Website Claimed Involvement In 12 New York Properties

We Found That None Were Run By Perigrove

Our review of Perigrove indicates the company hasn’t raised anything close to $3 billion. Perigrove’s current website lists no specific projects the firm has completed. An archived 2019 version of Perigrove’s website features 12 New York City area building development projects that the company completed.

We reviewed each project and found that none were actually run by Perigrove.

As a starting point, a search of New York City’s property ownership database, ACRIS, returns no results for David Gefner or Perigrove, suggesting Gefner and Perigrove don’t hold controlling interests in any of the claimed real estate developments.

A check of each address showed that 10 of the projects listed by Perigrove were actually developments led by a different group, Hello Living, a New York real estate company founded in 2005.[2]

We spoke with Eli Karp, head of Hello Living who told us Gefner helped raise some funds for him on projects around 2012, aiding in 2 projects. He estimated the total capital Gefner raised for him was about $10 million.

The two other projects listed on Perigrove’s website were:

- 200-206 Kent Avenue which is being developed in Williamsburg by Cornell Realty.

- 19 West 55th Street, Manhattan. According to ACRIS records, 19 West 55th is controlled by Abraham Leifer of Aview. This was the only project we saw a documented role for Perigrove, as detailed below.

Perigrove Had a Documented Role In Only 1 Of The Claimed Projects On Its Website; A Manhattan Hotel Once Dubbed The “City’s Worst Illegal Hotel” By Crain’s Business

Perigrove’s Role In the Deal Seems to Be That It Attempted To Launch A $30 Million Crypto Token To Raise Funds For The Property. The (Likely Illegal) ICO Offering Looks to Have Failed

When examining the 19 West 55th Street property from Perigrove’s earlier website, we found that Perigrove did have a role, though not as its primary developer.

In 2019, Perigrove launched a $30 million crypto token offering to sell an interest in the property. Unlike traditional investments, the token claimed it would “democratize” investor access to real estate by removing the broker fee and reducing the minimum investment to $10,000. [Pg. 5]

We found multiple red flags in the token offering documents, including an unrealistic 31.5% projected IRR for token investors over the next 30 years. [Pg. 12]

The proceeds were intended to “democratize” access to the redevelopment of 19 West 55th Street, which was previously dubbed “the city’s worst illegal* hotel” by Crain’s Business.

A promotional video told investors that blockchain technology helped “guarantee security for the investments”:

“To build on our successes we have decided to use the blockchain technology to increase the profitability of our real estate projects and guarantee security for the investments.” [00:25]

The token offering seems to have failed. The iTokenize website did not appear to be updated after the offering. We decided to visit the address to confirm if any renovations had taken place.

Renderings for Perigrove’s offering projected completing renovations of the building in 2021. The redevelopment involved overhauling the aging brick exterior to white and adding large pillars to the roof.

When we visited, we found the building looking exactly like it had in 2019, indicating that the money had not been raised for the project, or it had been allocated elsewhere.

Perigrove’s Website Lists Its Corporate Address At A Prestigious Office Address In Manhattan. We Visited The Address And Found Perigrove Was No Longer There

On its website, Perigrove reports its current address as being on the 46th floor of 7 World Trade, a large, well-known, high-end office building.

We visited the location to learn more about Perigrove’s claimed bustling operation. At the address, we found a coworking firm called Inspire.

We spoke with the receptionist, who had never heard of Perigrove, telling us the company didn’t have a physical suite in the workspace. They checked their electronic records and found that Perigrove had been in the system, indicating that perhaps they were part of the virtual office offering at some point.

An earlier version of the company’s website listed a specific suite on the same floor, 4632. The suite number has been removed from the most recent website, with only the floor and address remaining.

We checked suite 4632 anyway and found it occupied by a completely unrelated company called Global Gateway Advisors, with no relationship we could find to Perigrove.

Source: Hindenburg Investigator)

We phoned Global Gateway to ask whether it shared an office with Perigrove. The representative we spoke with had never heard of Perigrove and confirmed Global Gateway was the only firm at the suite, saying it had been there for about 2 years.

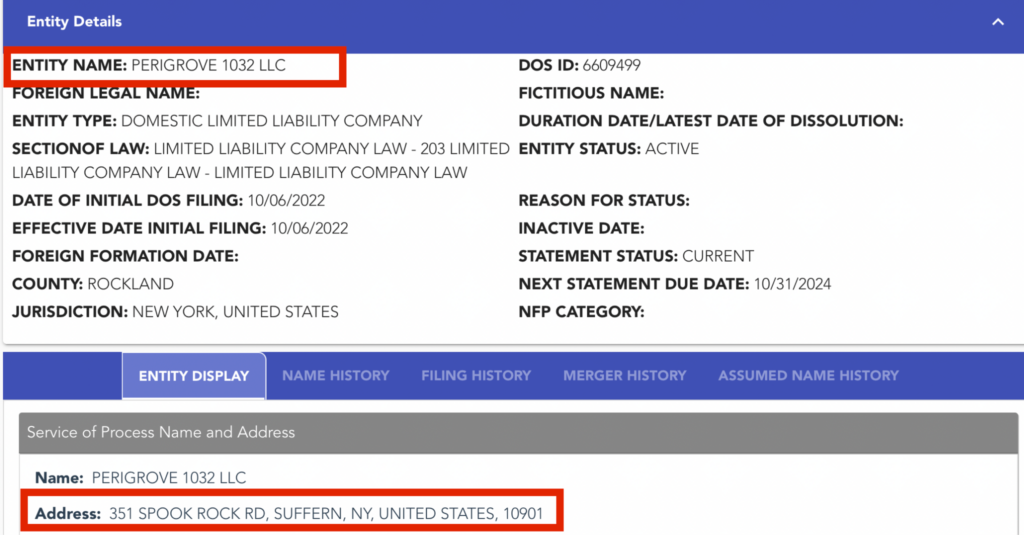

Next, We Visited Perigrove’s Registered Address From Its Corporate Entity Filings

We Found Its Office In A Dilapidated Building Shared With An Auto Parts Store On The Outskirts Of New York City

The Claimed $3 Billion Private Equity Firm Misspelled Its Name On Its Front Door As “Perigove”

We continued our search for Perigrove on the outskirts of New York City at an address that multiple Perigrove entities are registered to, 351 Spook Rock Rd. Suffern, New York.

We found Perigrove next to an auto parts store in a worn-down building in a strip mall.

The 351 Spook Rock Road address shared signage for Perigrove and an auto parts company called AutoPlus. Perigrove’s name on the sign was put up with stickers and was misspelled as “Perigove”.

The building’s lobby had visible wear and tear and was piled high with auto part boxes. In between a high pile of cardboard boxes and a tire, a large mailbox had Perigrove LLC marked on it.

We spoke with a representative at the auto parts store who told us that Perigrove worked upstairs. We asked which days David Gefner or Jay Leitner came to work at the office. He told us:

“I have no idea. That´s their own business. I don´t know when they´re there. I just hear them up there. I know somebody is up there.”

Former Welltower Senior Employee On Integra Running ProMedica: “They’re Going To Need A Lot Of People To Manage This Deal With The Different Operators…It’s Not Something You Run Out Of Your House”

We spoke with a former high level Welltower employee to get additional color on Gefner and the portfolio. He told us he thought that Integra would try to get out of the deal quickly, adding:

“I would hope that patient care doesn’t get impacted.”

The former employee went on to tell us that David was young and hasn’t belonged to the industry, instead he was doing a “hedge fund opportunistic play”:

“They’ve never been…David’s a young guy that’s never been someone who’s belonged to the industry, so he’s truly just doing a hedge fund opportunistic-type play.”

He also told us that the managing the portfolio is something that a partner would need an experienced team for:

“They’re going to need a lot of people to manage this deal with the different operators and that type of stuff. It’s not something you run out of your house and I would assume Welltower would have vetted a company and would not want someone that would be fly-by-night…”

Key Risk #2: We Suspect This Isn’t The First Time—Red Flags Indicate That Part of Welltower’s 2021 Distressed Genesis Healthcare Restructuring Deal Mirrored The Latest ‘Miracle’ Deal With Integra

Evidence Suggests 21 Of The Worst Distressed Assets Were Quietly Disposed To Gefner’s Affiliated Private Equity Firm

Prior to Covid, another significant operator of Welltower assets was Genesis Healthcare. At the end of 2019, Genesis was Welltower’s 4th largest operator, managing 76 properties, accounting for 4% of NOI. [Pg. 2]

In 2021, Genesis, like much of the industry, experienced severe distress due to Covid and other operational challenges. [Pg. 3]

On March 2021, Welltower announced what would be another ‘miracle’ deal. Through a complicated multi-way agreement, it had achieved a “substantial exit” of its Genesis Healthcare operating relationship, consisting of 51 assets.

Welltower was exiting its distressed Genesis relationship largely unscathed, with some assets sold off to ProMedica (which would itself later become distressed), among other parties.[3]

The deal valued Welltower’s real estate at an astronomical $144,000 per bed according to the press release, more than double the industry average. During the first quarter of 2021, CBRE put the average nursing home bed at around $70,000. [Pg. 12]

Welltower Appears to Have Quietly Disposed of 21 Of The Most Deeply Distressed Genesis Assets To A Gefner-Affiliated Firm, Once Again Handing Skilled Nursing Assets Over to An Inexperienced Manager and Clearing Its Books of The Mess

Later, in November 2021, Welltower mentioned in an earnings release that it had sold another 21 assets of Genesis, presumably the deeply distressed assets it was unsuccessful at disposing in the earlier deal.

The “21” number of assets is the same number of assets Welltower management later claimed to have transacted with affiliates of Integra on its most recent conference call.

A former senior Welltower employee confirmed that Gefner’s affiliated firm had previously bought assets related to Genesis:

“This construct [dealings with Gefner/Integra] had already been done on some other skilled nursing assets…They bought some Genesis facilities, which is another skilled nursing operator that Welltower had and they had closed on some of those assets.”

We asked about the timing of the Gefner-associated purchases to see if it was part of the main Genesis deal, or later in the year:

“Yeah they did sell the last of the remaining Genesis assets and I believe it was to Integra…they were other Genesis assets not tied to a larger transaction.”

Once again, we find it unusual that Gefner, with little to no experience operating or managing skilled nursing assets, came in and bought the last assets in a distressed deal, helping Welltower clean the mess off its books.

Furthering our concerns, we identified several signs of an undisclosed affiliation between Gefner and Genesis, raising questions of overt conflicts of interest.

Integra CEO Gefner Previously Worked At The Investment Firm That Owned Genesis, According to Contact Database Records

Gefner’s Private Equity Firm Perigrove Also At One Point Shared An Office Suite With The Firm Run By The Owner Of Genesis

The Undisclosed Relationship Raises Questions of Conflicts Of Interest In The Gefner/Welltower/Genesis Dealings

As part of the Genesis deal involving Welltower, Genesis received a $50 million injection from an affiliate of private equity group Pinta Partners.

David Gefner worked for Pinta Partners, and had an email address at the firm, according to contact database ZoomInfo records. Gefner has not otherwise made this relationship clear in his LinkedIn profile or in other biographies.

Further, as we wrote earlier, Perigrove at one point claimed to operate at 7 World Trade, Suite 4632 before removing the suite address from its website. That claimed suite matches the older office address of Allure Group, another firm controlled by the owner of Pinta Partners.

In short, Gefner appears to have a close, undisclosed connection to the firm at the center of the Genesis Healthcare restructuring deal with Welltower.

The lengths taken to obfuscate these relationships and deal details suggest to us that Welltower is simply using Gefner-affiliated entities to park its bad assets.

Beyond Its Sketchy Deals With Integra and Gefner, Welltower Management Has Obfuscated The Rest Of Its Portfolio

Welltower Stopped Detailing Its Individual Property Operators Around Q2 2020, Right When Covid Began To Devastate The Industry

Beyond the obfuscation of issues with Welltower’s key tenants, we are concerned by management’s obfuscation of the rest of the Welltower portfolio.

For years, Welltower provided the regular list of its specific properties and associated operators on its website. By Q2, 2020 COVID shrunk the nursing home population by 10%. Around this time, Welltower stopped updating its list of properties and hasn’t provided the full list since. [1,2] [4] An address list, without associated operators, is now the only portfolio information disclosed. [Pg. 119]

Given the new opacity, and issues with key tenants, we suspect Welltower’s management has obfuscated other lurking issues with its portfolio.

Conclusion: The Gefner/Integra Deals Appears To Be A Shell Game Designed To Hide Financial Weakness As The Company Dumps Shares On Unsuspecting Investors

Integra offers a significant glimpse into Welltower’s highly opaque and complex portfolio of investments that we believe is under substantial stress.

Instead of being transparent about its situation, Welltower’s management has obfuscated the issues through a shell game, while claiming that the deals will magically result in more cash rent or asset recovery than before.

As to Integra, we suspect Integra’s CEO has misled the public on his fundraising activities or has raised capital illegally. This is significant to Welltower, whose CEO has endorsed Integra and its CEO, along with claiming to have already done multiple deals with an entity associated with Integra.

Now, Welltower plans to expand the relationship to make Integra one of Welltower’s largest partners. We think this bodes poorly for whichever assets Welltower hopes to offload onto Integra next.

We think the company should answer several questions:

- Why did Welltower place control of 147 nursing homes into a JV with a 29-year-old with no apparent track record in the skilled nursing industry?

- Did Welltower also sell 21 assets originally operated by Genesis to Gefner or an affiliate of Gefner? If so, why haven’t the details of this transaction been disclosed to investors?

- Why has Welltower not disclosed the material agreements associated with its deal(s) with Integra and/or Gefner?

- Has Welltower indemnified Integra or its affiliates for losses or provided other inducements that help it meet the claimed 4% increase in cash rent?

- Who is Integra’s parent entity and why has this information been withheld from investors to date?

- Is Welltower aware of any relationship between Gefner and Pinta Partners, The Allure Group, or Joel Landau?

- Was Welltower aware that Perigrove, the private equity firm affiliated with Integra and Gefner, claimed to have raised $3 billion, yet has not filed any requisite form Ds or a form ADV or have any clear association with a broker/dealer? Does Welltower have any comment on the legality of these claimed offerings?

- What was Welltower’s due diligence process on Integra before agreeing to the deal(s)?

- How does Welltower expect Gefner to manage 147 nursing homes when he can’t even manage to spell the name of his own firm on the door of the office correctly?

- Does Welltower recognize the risks to thousands of patient lives by placing the care of these facilities into the hands of someone with no experience managing them?

Disclosure: We Are Short Shares of Welltower Inc. (NYSE: WELL)

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect trading losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. You should assume that as of the publication date of any short-biased report or letter, Hindenburg Research (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our clients and/or investors has a short position in all stocks (and/or options of the stock) covered herein, and therefore stands to realize significant gains in the event that the price of any stock covered herein declines. Following publication of any report or letter, we intend to continue transacting in the securities covered herein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation, conclusions, or opinions. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.

[1] Note that we found no entity for “Integra Healthcare Properties”, the name indicated on its website. The closest match was the Delaware entity “Integra Health Properties” registered on the same day as the company’s website. We have reached out to David Gefner and Perigrove to check whether they misspelled the name of their entity on their website, among many other questions, and have not yet heard back.

[2] 9 of Perigrove’s claimed projects appear on Hello Livings website. 291 Livingston isn’t on Hello Livings website but according to news releases it’s a partnership between Hello Living and another firm, Aview. Two of the deals appear to have gone south: the Nostrand Avenue project is now in foreclosure, and the Livingston Street project is facing foreclosure.

[3] On announcing the substantial exit of the Genesis relationship, Welltower’s CEO said “I am also pleased that Welltower will expand its highly successful relationship with ProMedica.” Promedica would later face restructuring the next year, with Welltower seeking to exit the relationship.

[4] Google the following phrase “site:welltower.com Welltower-Facility-Address-List”