As some readers of Hindenburg may be aware, our founder, Nate Anderson, got his start in the fraud research world by investigating suspected Ponzi schemes and private market fraud. Prior to Hindenburg, Anderson had submitted whistleblower reports to regulators on the following funds:

- Platinum Partners, a ~$1.4 billion firm where 7 fund managers were arrested and charged criminally following Anderson’s work together with noted Madoff whistleblower Harry Markopolos.

- TCA Global, a ~$400 million asset manager that was subsequently alleged by the SEC to have fraudulently inflated performance results.

- RD Legal, a litigation finance firm with ~$150 million in assets which was subsequently alleged by the SEC to have defrauded its investors. The fund took the case to trial and lost on several claims.

- Statim Holdings, a ~$40 million firm that was subsequently alleged by the SEC to have defrauded its investors.

- West Mountain LLC, a ~$54 million asset manager that was subsequently alleged by the SEC to have fraudulently overvalued its assets.

Today, we go back to our origins. Over the last several months, we have been researching an investment firm that we believe to be a Ponzi scheme.

This firm, J&J Purchasing, has pitched potential clients on an investment offering 50% annualized returns with virtually zero risk. It claimed, at one point, to have raised $400 million from over 1,000 investors since 2016.

Through the course of our research, we submitted our findings to regulators through the SEC’s tip program. We recently also shared our work with reporters at the Wall Street Journal.

Our work has included in-house research, extensive document review, as well as in-person meetings and recorded correspondence with the firm’s principals and marketers under the guise of becoming a potential client.

As reported by the WSJ, part of our research included hosting one of J&J’s key marketing managers and a marketer in a private jet we rigged with hidden video and audio recording equipment.

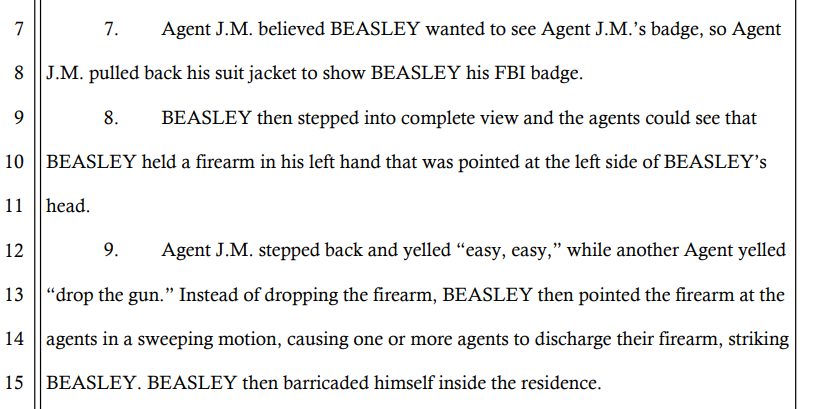

Earlier this month, Federal authorities visited one of the firm’s key principals, 49 year old attorney Matthew Beasley, in order to question him, according to court records.

Beasley had been tipped off about the prospect of an FBI visit by another individual at the firm who had also just been visited that day. Upon seeing FBI agents at his door, Beasley pointed a gun to his own head. The agents implored him to drop the weapon. Beasley instead pointed the weapon at the agents, who then opened fire, striking him in the chest and shoulder.

According to the same court records, Beasley survived the shooting and barricaded himself behind his door. The FBI then sent a negotiator, who attempted to convince Beasley to disarm.

Throughout the course of the 4-hour negotiation, Beasley “repeatedly confessed to his involvement in what he described as a Ponzi scheme”, according to a court transcript.

Eventually, a SWAT team was able to disarm and arrest him.

Beasley was released from the hospital the following week and was remanded into custody, according to local media. He was charged with 1 count of Assault on a Federal Officer and was denied bail. Thus far, neither Beasley nor anyone at the firm has been charged with fraud, though we expect that may change.

What follows is our research on just what happened with J&J Purchasing.

Background on J&J Purchasing/J&J Consulting Services, a Firm That Claims Perfect 50% Annual Returns Across Its Portfolio of 20,000 Litigation Funding Contracts, With Zero Defaults and Zero Late Payments in the Past 4 Years

Until earlier this month, an investment firm in Las Vegas run by a former sales rep for a local pharmacy was virtually guaranteeing returns that would put almost every investment manager on earth to shame.

Las Vegas resident Jeffrey J. Judd launched J&J Consulting Services, Inc. in May 2005, per Nevada corporate records, which describe him as President/Treasurer/Director of the entity. In October 2021, Judd also launched a new Florida entity called J&J Purchasing LLC.

Both J&J entities offer investments in “litigation finance”, a fast-growing investment field whereby funds provide loans to law firms or their clients.

As detailed below, J&J had no marketing materials or website. We were only able to learn about the investment proposal through calls and meetings with Judd and some of the firm’s marketers who pitched us as prospective investors. As Judd said to us during a call:

“The whole business is done off of referrals. There’s no direct consumer marketing, nothing like that. It’s just a referral-based business.”

According to a call we had with one marketer, J&J has 12-15 individual marketers canvassing for investors.

Jason Jongeward, a key J&J marketer whose prior work experience including running a small construction company before quitting to raise capital full time, told us that the reason for the new entity with its new name was to indicate to the SEC that it was not making financial offerings (even though it does):

“Jeff changed, or he created a new company called J&J Purchasing. Obviously, J&J Consulting does not give the right impression to the SEC that you’re not giving any financial advice, right? So he changed the name to J&J Purchasing.”

J&J’s litigation finance strategy solely involves investing in post-settlement claims in personal injury cases, offered to investors through a network of 66 law firms, according to its marketers. These are among the least risky forms of litigation finance because they take place after litigation has settled and after the amount of compensation to the victim has already been determined.

In other words, an insurance company has agreed to pay an injured party a settlement and the plaintiff is just waiting for the money to be sent. Shane Jager, a J&J marketing manager, said, “the bulk of the claims we work with are slip and falls.”

J&J’s Jongeward said “most of these injury claims are in the $225,000-$350,000 range” but the individuals entitled to payment are in “financial despair” so they can’t wait 90 days to receive the payment.

This is where J&J comes in, offering law firms and their clients an immediate 90-day advance for a 25% fee. It’s akin to the familiar TV commercials from well-known litigation funder J.G. Wentworth:

“I have a structured settlement, and I need cash now!”

The 25% interest rate for a 90-day advance translates to a simple interest rate of 100% per annum (or a 136% compounded rate of return). J&J’s principals say they keep half of the profit (12.5% every 90 days) with the other half going to the investor (12.5%).

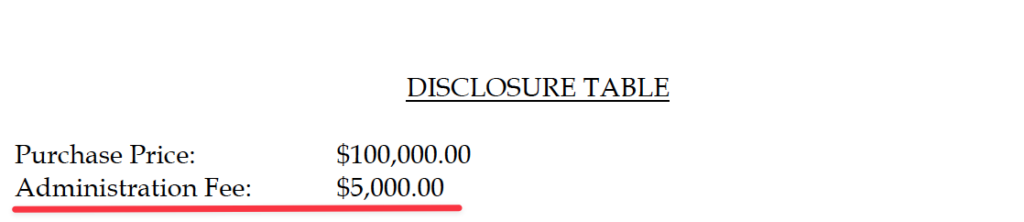

Investors were encouraged (but not required) to roll their capital back into new cases, for a simple 50% return per year (a 12.5% profit each quarter). Investors allocated either $80,000 or $100,000 to each investment contract. Investors could invest in multiple individual contracts, and many did.

Jongeward explained the mechanics to us as follows:

“We will give them [the plaintiff who has a settled claim] $80,000 or $100,000 in 72 hours. When they received the settlement after that 90-day period, the attorney and the plaintiff then pay us back according to the terms of our contract that $80,000 or $100,000. And with a 25% price tag on it.”

“Within two years, you’re able to get your entire investment back, which is unheard of.”

J&J has claimed to have entered into 20,000 such contracts since inception. Incredibly, the firm has told investors there have been zero defaults. Judd told us his firm has, “never had one of these go bad.”

Similarly, Jongeward told us, over multiple calls:

“We’ve closed over 20,000 contracts with zero defaults.”

“Fast forwarding to today, we are at 20,000 contracts, successfully closed, zero defaults.”

When asked about the risk, Jongeward said:

“We really, really struggle to see the risk. I think that’s probably why the performance has been—I’ll call it immaculate. We haven’t had any contract default, not one. So for me, it’s really about the performance history on an investment really is the true indicator of what it’s doing.”

Jongeward also claimed, on several occasions, that J&J hasn’t had any late payments in the past 4 years, an assertion that other J&J operators later repeated to us. Per Jongeward, early in J&J’s history, they had experienced three delays in contract repayment, all of which related to Medicare and Medicaid, so they stopped signing contracts that had government payors:

“So, since they’ve stopped with Medicare, Medicaid, they haven’t had any, any close slow. I think that was all have identified and adjusted in that first year. So, in years 2,3,4,5 and then coming into 6 now they haven’t had any late payments”.

Essentially, J&J’s pitch expected investors to believe that (1) for more than five years, J&J has issued and collected on ~20,000 contracts without any defaults, (2) that J&J has been able to generate a 25% return in 90 days (for every contract executed, for a 100% annual return), (3) that J&J’s network of 66 law firms have always sent in payments precisely within the 90-day time frame and (4) that all of this has been achieved with J&J’s paper-thin infrastructure (detailed further below).

The marketers for J&J Purchasing claimed to have placed over $400 million with over 1,000 participating investors. Jongeward described it to us as, “it’s just kind of this growing monster.” (J&J principal Matt Beasley, as he lay barricaded behind his door with multiple gunshot wounds, contradicted the $400 million placement figure when he acknowledged to an FBI negotiator that the firm only had $300 million in assets.)

If the investment pitch sounds too good to be true, that’s because it almost certainly is. Across our career in investment research, we have seen some brazen irregularities, but never have we seen clearer red flags than what we found at J&J.

J&J’s Claimed Investment Opportunities Have Abnormal Characteristics That Make No Sense For The Industry It Claimed To Operate In

The post-settlement litigation finance industry was studied in an academic paper published on August 10, 2020. Its findings underscore how J&J, if its claims are true, would represent a massive industry outlier in virtually every regard.

The study sampled over 3,200 post-settlement claims and found that the median gross case value, or the size of the plaintiff’s settlement, was $50,000. [Pg. 35] This is far below the $225,000 to $350,000 range claimed by J&J’s operators.

The research found that the median amount funded by litigation finance firms per post-settlement case was $5,000, far below either the $80,000 and $100,000 investment amounts offered by J&J. [Pg. 35] In a follow up with one of the study’s authors, he explained to us that a funding amount of $40,000 or above falls within the 1 percentile of the study’s sample.

Therefore, J&J’s claimed $80,000 to $100,000 funding amounts put each and every case deep within the top 1 percentile of funded amounts in the post-settlement industry.

J&J’s funded loan sizes are between 16x-20x the industry median. It simply defies all probability that J&J has financed 20,000 abnormally large post-settlement claims. We asked settlement funding industry experts what they thought about the consistent $80,000 and $100,000 investment amounts claimed by J&J. They told us:

“That sounds kind of insane to me, for a couple reasons. First, it’s just really high, like how many people are really getting $400,000 [settlements]? You know, like, I think, I think the average advance to personal injury claimants is like, in the four figures, nationally. So that’s really high, which means that, you know, sounds sketchy, and how are they finding so many of these?”

“The numbers don’t make sense in terms of their homogeneity, just the shape of the number, this thing at $80,000 to $100,000. Where does that come from? There’s no, there’s no reason in the world why that number would be that number”

Put simply, the number and size of cases in J&J’s portfolio may not even exist across the entire post-litigation funding industry.

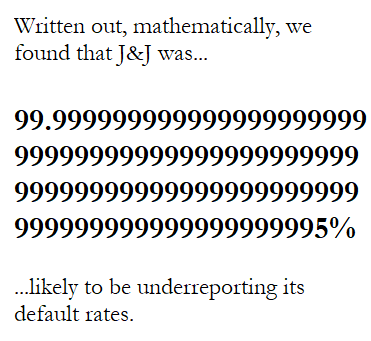

The academic research also shows that defaults for post-settlement claims are very low, albeit non-zero, at about 1%. [Pg. 42] Even with the low industry default rate, the claims by J&J of having no defaults across 20,000 claims becomes mathematically absurd: a roughly one in 2E87 (two with eighty-seven zeros) chance.

J&J Has No Website and Provides No Marketing Materials, Unlike Virtually Every Other Private Investment We Have Ever Seen. All Pitches Are Done Over the Phone

We learned of J&J Purchasing LLC and J&J Consulting Services Inc. from a reader. Apart from this tip, There would be little chance we’d have heard of it otherwise—J&J has no website, doesn’t share marketing materials with its prospective investors and confines its investor pitches to the phone only. J&J marketer Jongeward told us:

“There’s not that many people that know about it, because they, it’s all word of mouth. And its such a great investment that you don’t need to do any advertising.”

This differs sharply from virtually every other private investment opportunity we’ve seen (a figure that likely numbers in the thousands). Prospective investors in such opportunities are generally provided a series of basic marketing materials such as (1) tear sheets or summaries; (2) full PowerPoint presentations; (3) investor update letters; and (4) due diligence questionnaires (DDQ). These materials are considered industry standard because they help prospective investors thoroughly understand the details of the investment they are considering.

One reason for J&J’s secrecy, as indicated by Jongeward, is because the proprietary investment opportunity is so great that the group is worried it may leak out to the broader investment world:

“We don’t want anybody taking our documents and trying to create another company for competition.”

But that is not the only reason for secrecy. According to Judd, J&J stopped doing contracts in Las Vegas, because, “we didn’t want people knowing what we did in our backyard.”

When we engaged with J&J as prospective investors, the only documents we received were subscription documents for the investment, and several nondisclosure agreements (NDAs).

We couldn’t find any corporate offices for any of the J&J entities. J&J Consulting has a P.O. Box as a registered mailing address. J&J Purchasing’s registered mailing address corresponds with its registered agent address.

The operation seems to have no employees outside of Judd and his family. Judd explained his corporate operation:

“I manage the whole thing with my son. He is 26. Does a lot of the paperwork.”

We asked an industry expert what kind of corporate operation one would expect in order to execute J&J’s claimed investment operation. He described the need for extensive overhead (as may seem obvious for an investment executing 20,000 contracts and working with over 1,000 investors.) He said:

“You need underwriting people, you need people to follow up, you need people to document, you need people to talk to the attorneys’ offices, and there’s a lot of cajoling.”

Another industry expert provided some details about the kind of tasks involved when buying an interest in a settled legal claim:

“It’s a lot of work to be [done], doing due diligence, verifying the settlement … And then also controlling kind of how the money comes to you, right? Like, how do you make sure that, that when there’s a settlement, your cut actually gets paid back? And the client doesn’t just take it.”

As a comparable, an industry expert pointed us to Lawcash, a firm that focuses on litigation funding. According to the expert, Lawcash does $3.5 million in transactions every month; around $10 million a quarter. Despite Lawcash’s quarterly transaction volumes representing about 2.5% of what J&J purports to do, the company’s LinkedIn Page shows 35 employees.

Apart from Judd, we found no other J&J employees on LinkedIn.

One Might Expect the Man Who Discovered Such a Flawless Investing Strategy to Have Extensive Experience In Litigation Funding

Founder Jeff Judd’s Prior Experience Was as a Sales Rep for a Local Pharmacy

Typically, brilliant investment strategies are discovered by those with deep knowledge and experience in a particular field. J&J’s stated field is litigation finance, a highly competitive market that as of 2020 included at least 46 funds with a combined $11.3 billion in assets under management, according to a survey by industry research firm WestFleet Advisors.

Those include funds run by asset management giants such as:

- Elliot Management (~$34 billion)

- D.E. Shaw (~$60 billion)

- Fortress Investment Group (~$54 billion)

It also includes dedicated funds such as Burford Capital, staffed with numerous litigation and industry personnel. The litigation funding field also has smaller, nimble competitors focusing on specialties such as pre- and post-litigation financing, intellectual property, mass tort, complex commercial litigation, and personal injury.

Top funds in the industry typically aim for returns in the 20% range while taking on substantial risk, far below the virtually guaranteed 50% returns, net of fees, offered by J&J.

A simple Google search for “post settlement funding” turns up dozens of immediate competitors offering litigants interest + fee rates of 20%-30% per annum or lower, vastly less than the 136% compounded rate supposedly collected by J&J.

So who came up with the J&J strategy that has consistently yielded perfect 50% returns for investors?

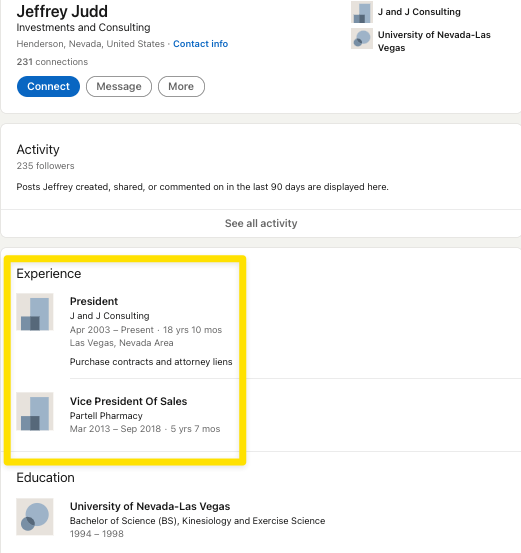

The principal of J&J, and its eponymous founder Jeff Judd, had no apparent experience in the field. Prior to J&J’s investment offerings, Judd was the Vice President of Sales at a local pharmacy, per his LinkedIn profile. Judd’s LinkedIn shows he has a degree in Kinesiology and Exercise Science from the University of Nevada-Las Vegas.

According to J&J marketer Jongeward, the entity began offering investments in 2016. Judd’s LinkedIn profile shows that he quit the pharmacy in 2018, presumably to focus on investing.

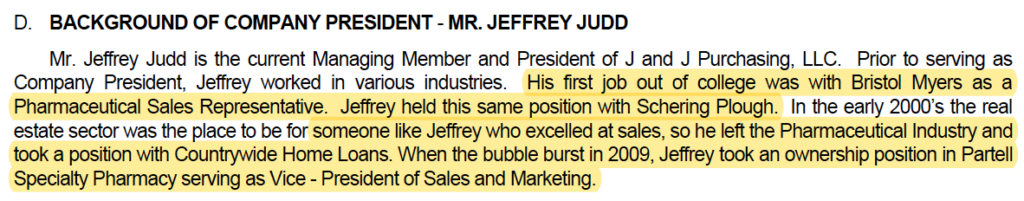

J&J Purchasing’s Private Placement Memorandum (PPM) portrays Judd as someone “who excelled at sales” and had sales roles in various industries unrelated to litigation finance.

Rather than crafting J&J’s essentially perfect investment strategy through years in the litigation finance field, Jongeward explained its origins as emerging from a chance encounter with Judd’s local lawyer friend, Matt Beasley:

“In 2016, he [Jeff Judd] was having lunch with a good friend of his named Matt Beasley. Matt Beasley is a personal injury attorney. So as Matt and Jeff were talking as they would often do, Jeff came up with the idea to you know, the comment typically was that, you know, how soon can I get my money from the plaintiffs once they knew that they reached their settlement? So, Jeff saw an opportunity to be able to give capital to someone who has a settlement coming but needs a little bit of capital right away. Because some of these a good portion of these individuals haven’t been working for 18 months to 2 years. So they’re in financial despair a little bit.”

Assuming it were all true, this is not the background or experience we would expect from what would be considered the best manager in the industry.

J&J Claims That a Local Law Firm, Beasley Law Group P.C., Has Managed All 20,000 Legal Contracts, Interfacing With At Least 66 Personal Injury Law Firm Counterparties

The Firm Has No Website and Appears to Have Only One Attorney, Matt Beasley, Who Works from Home

We spoke to both Judd and J&J marketers who described attorney Matt Beasley as critical to the operation. According to Judd, the key to the investment’s success is simply “to have the right attorney.” Beasley is the owner of Beasley Law Group, PC, founded in 2011, per Nevada corporate records, which lists him as the sole principal.

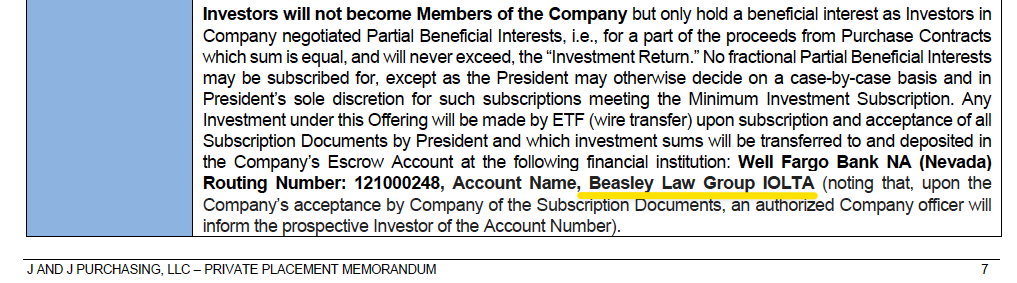

Prior to his armed standoff with the FBI, Beasley was said to manage J&J’s relationships with 66 law firms it claims to work with. He also manages all the paperwork and payments, which all pass through his law firm’s IOLTA account (similar to an escrow account). As Judd explained:

“He [Beasley] takes care of the attorneys because all the attorneys want to be arm’s length from me. They don’t want to know me. Which is smart, because then that way they can’t accuse them of steering or anything like that”

“He [Beasley] finds the other attorneys, and he writes the contracts”

Per Jongeward:

“Matt Beasley is the one that takes care of all the purchase agreements. That’s between Jeff and the participating attorney and the plaintiffs.”

Per J&J marketing manager Shane Jager:

“Jeff has no involvement with the attorneys. That’s all handled by [Matt]. Matt is Jeff’s attorney and he’s contracted to work.”

The firm’s private placement memorandum (PPM) also references Beasley’s IOLTA account as the destination of investor funds:

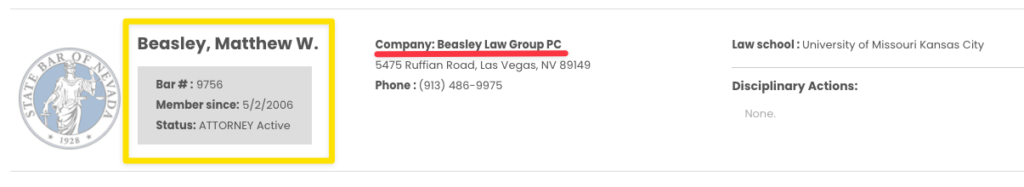

Nevada’s Bar Association shows that Beasley has been a member since May 2, 2006.

Given the incredible volume of paperwork required to manage 20,000 contracts, investor inflows and outflows, and the relationships with 66 law firms, we would expect the Beasley Law Group to be a bustling operation staffed with dozens of paralegals and attorneys. Even Jongeward acknowledged the administrative burden:

“If you’re only wanting to put it in for one contract cycle [90 days], maybe this isn’t the right spot for you, because it’s a lot of work for us to pull people out and redo that. And there’s a lot of documentation.”

Contrary to this expectation, we found that Matthew Beasley is the Beasley Law Group’s sole employee on LinkedIn.

The only addresses we found associated with the firm through Nevada corporate records was that of its registered agent and Beasley’s personal residence.

Jongeward confirmed what corporate records show, that Beasley works from home:

“So I mean, you know, you don’t have to have a location anymore. Things are just done differently than they used to be. But yeah, this is all that he [Beasley] does. He puts all the purchase agreements together. He works for Jeff. And we use his IOLTA account, to pass money back and forth.”

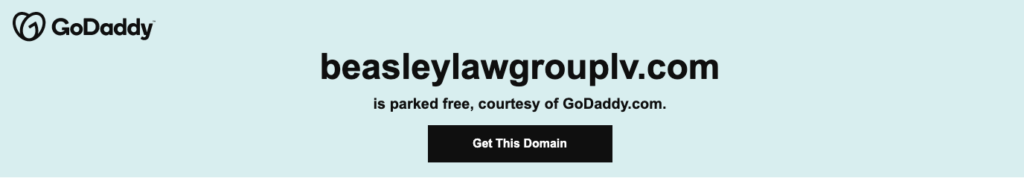

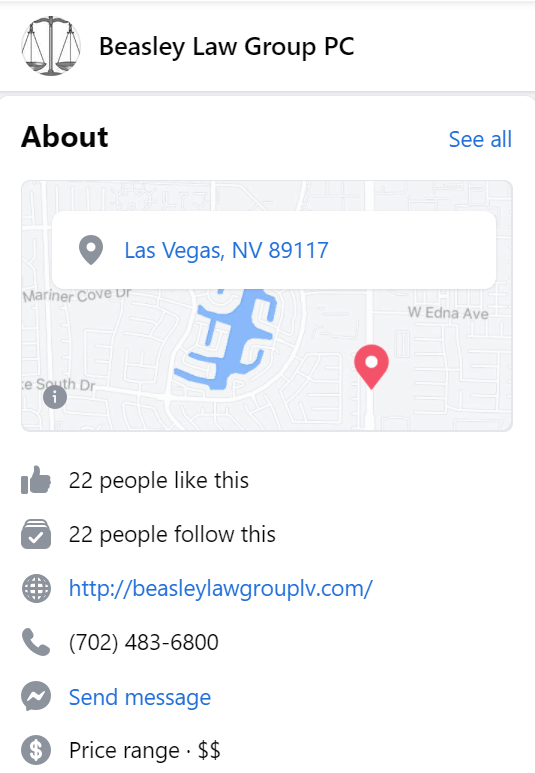

If the Beasley Law Group is supposedly interacting with 66 law firms and seeking to develop new relationships, one would presume it has some kind of public presence. We found that its web domain, listed on its Facebook page, leads to a GoDaddy landing page.

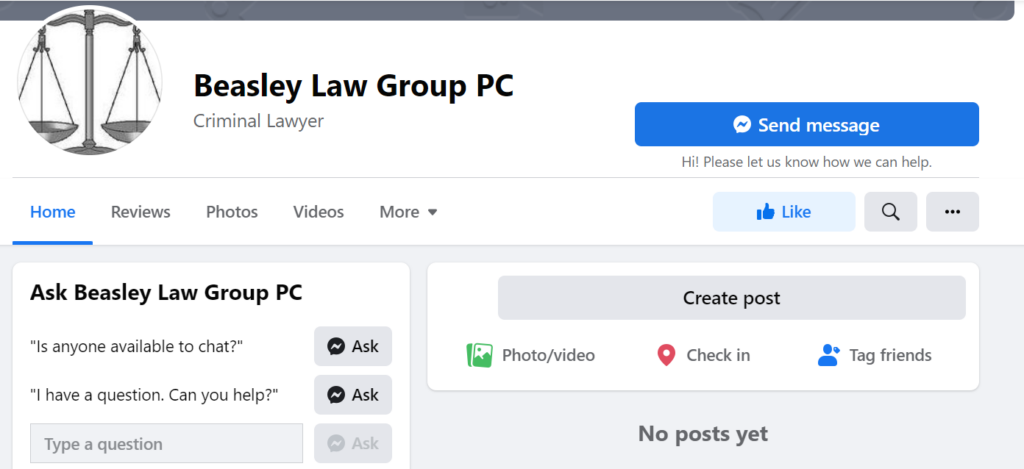

The only other public presence we found was a Facebook page with 22 followers, no posts and almost zero engagement.

One of the litigation finance practitioners we talked to described a very administratively and operationally intense process. He said that it required about 4 hours of work to draft each contract.

At that rate, it would take Beasley roughly 40 years to draft 20,000 contracts, assuming he worked 8 hours every single working day of the week.

This strikes us as implausible. Beyond the obvious reasons, Beasley’s recently purchased fleet of luxury cars, private plane, and sports all-terrain vehicles (detailed later) paint the picture of a man with plenty of leisure time.

Rather Than Seeking Large, Sticky Institutional Capital, As One Would Expect for Such a Successful Strategy, J&J Appears to Have Targeted Non-Financial Professionals Who Are Mainly Members of the Mormon Church

Often, when an incredibly attractive investment with limited capacity exists, investment managers forgo outside investor capital altogether in order to generate great returns for themselves. Had Judd simply deployed internal capital only, he could have turned $2.5 million into about $423 million, without raising any external capital, assuming he was able to reinvest at 25% for the 23 quarters between September 2016 and March 2022.

If Judd chose to raise outside capital anyway, one would expect the firm to seek institutional capital to efficiently raise large, long-term capital from qualified investors better positioned to understand the risk and complexity of the strategy.

J&J marketer Jongeward explained that Judd chose to forgo these approaches, out of apparent altruistic generosity:

“So essentially, the 25% comes back to Jeff and Matt. And they divide that they cut that in half, and they share 12.5% with the investor and they keep the other 12.5%. So, what you have is you got the owner of a company that’s willing to split the profits with the investor. That never happens.”

J&J marketing manager Shane Jager said “He [Judd] sees the people as benefiting,” and then explained how a family member is “living her best life” thanks to her J&J investments. Judd himself explained:

“It’s changed a lot of people’s lives. I wasn’t greedy when I did that. I mean, we pay out a high percentage. So my thought process was, it’s not my money, I’m gonna make my money on each deal, then why wouldn’t I pay out a high percentage? So that’s the way we set it up.”

It seems that Judd and his colleagues chose to “bless” many members of his Mormon church with this investment strategy.

Based on individuals we’ve interviewed, including prospective J&J investors, the marketers for J&J, and others familiar with the offerings, J&J’s investor base mainly consists of regular, non-financial professionals such as small business owners and doctors.

And despite the fund’s self-imposed marketing hurdles (i.e., no marketing materials at all), the J&J Purchasing investment opportunity has spread rapidly via word of mouth, largely through the Mormon communities centered around Nevada, where the firm and its principals are based.

Jongeward claimed to us that it was helping members of the religious community, for which he had a personal affinity:

“We kind of feel like we’re building the (Mormon) church financially.”

According to Judd, at least 50% of the investors are Mormon. Jongeward estimated the number around 70%.

To put a finer point on it, this all flies in the face of what one would expect from a genuine strategy and appears more so to have all of the hallmarks of an affinity scheme.

But investors seem to have taken the bait. We have heard of investors taking out second mortgages to invest in J&J and even putting their life savings into the opportunity.

We mentioned the notion of taking out a Home Equity Line of Credit (HELOC) in order to participate in the fund. Jongeward told us:

“I took a HELOC out myself personally, it’s easy to pay 5% on a HELOC and still gain 45%.”

J&J’s Subscription and Legal Documents Make No Mention of an Auditor or Administrator (Basic Independent Service Providers That Serve As Key Pillars of Safety For Investors)

Monthly “Statements” Appear to Be Simple Tables Created By the Investment Manager In Microsoft Word

Every credible investment manager, including those with less than $50 million under management, seek to have independent administrators, a key service provider that manages investor subscriptions and redemptions, cash inflows & outflows, and provides independent reporting.

Similarly, every investment manager also has an auditor to ensure that books & records are balanced and independently monitored. (Even Madoff had the appearance of an auditor, though it was a tiny firm that simply rubberstamped his reports).

Given that J&J now claims to be a bustling $400+ million investment manager, it should be a given that an administrator and an auditor are in place in order to offer investors basic protections.

Yet J&J’s offering documents make no mention of any administrative agent, paying agent, or an auditor.

It seems that its marketers are playing a key part in managing these roles. Per Jongeward:

“I have 150 investors in the group here that I manage. And it represents about 53 million of operating capital, including my own personal capital I have. So, I take care of the interest payments, I send those all out to everyone to take care of all of the document initial interaction and walk everyone through how to get that taken care of and reconciliation, spreadsheets, interest payouts, 1099 at the end of the year. We really, I really am kind of, you know, the full, the full turnkey manager for the entire group and it we’re about 1000 investors total.”

We have never heard of an investment management company where a marketer performs tasks like distributing interest payments to investors. Put simply, they are wildly divergent tasks that have unique responsibilities and require distinct training.

Jongeward provided several details of how the payments get executed:

“When capital comes in, Matt [Beasley] forwards it to Shane [Jager], and Shane forwards it to me.”

“90 days later, when that capital is returned with interest, then I would then send you if you did 100, I would send you $12,500 into your bank account that you provided for me, so I can set you up in the Wells Fargo Direct Pay system. So that makes it really easy to get our investors set up there. It takes about five days to verify. And then once you’re in there, it’s really easy. It saves me quite a bit of capital to have all of these people. I have about a little over 150 people in my Wells Fargo Direct Pay system, so they only charged me $200 a month to have that, and then I can, it’s as easy as clicking on your name, put any amount in. And then I always put the contract name that’s maturing there.”

The way Jongeward described the flow of funds resembles a multi-level marketing organization. The lawyer initiates the payment to the marketers and then those marketers pay downline to the other marketers, who distribute payments to investors.

We have seen a copy of the “monthly statement” sent by a J&J marketer to one investor. It appeared to be a simple word table with labels for “Amount invested,” “Name,” “Date Started,” “Date Matured,” “Payout,” and whether it had already been paid.

According to J&J, the Attorneys Firms Are Benefiting, Making Up To $50,000 a Month, From Selling the Contracts to J&J.

According to One Industry Expert, “That’s Like an Egregious Conflict of Interest. That’s Very Problematic.”

The law firms that refer borrowers to J&J do “very well,” said Jongeward, explaining how they benefit from the transactions:

“So the attorneys are there benefiting from this as well … Everyone’s benefiting [indistinguishable] There’s an administration fee, on top of that, I think it’s $5,000 … So if an attorney does 10 of these contracts in a month, you know, that’s, that’s $50,000 pretty easy to calculate that. So, there’s definitely incentive for these attorneys to do that as well.”

We asked Shane Jager if the attorney that is representing the plaintiff also gets paid, the marketer replied: “Yeah. It’s a couple of thousand dollars, I think.”

Judd also made it clear to us:

“They [attorneys] split halve the admin fee, which is perfectly fine. My attorney takes care of all that.”

The sample Contract found in the PPM, shows a Disclosure Table showing an Administration Fee, confirming the marketers’ representation of the fee.

We asked an expert in the litigation finance field about whether it was “perfectly fine” that the attorney firms got paid a fee for sending contracts to J&J. He said:

“There’s no way, it’s impossible! That an attorney would get a cutback … Any plaintiff’s lawyer who would take a kickback or in any way would stand this, is like kryptonite. You don’t understand, you probably do understand, but it is a Kryptonite like wrapped in barbed wire, right? Because if you have any fiduciary financial impropriety, if something stupid as this you could be disbarred in one second. Most people who are disbarred are for stupid shit like this. This is ridiculous. Never, sorry, will not happen.”

Even when we proposed a scenario where the clients signed a tightly written and detailed permission to waive the conflict of interest, the industry expert categorically said:

“No, no, no never happened. Are you kidding? That is the funniest thing I’ve heard anyone ever tell me. That is the most ridiculous. This is like asking Moses, if he’d like a cheeseburger. Like I can’t even begin to understand and explain to you. That is fucking just not even remotely possible.”

Another industry expert told us:

“What the hell are they thinking [the lawyers]? Were they thinking this will never be discovered? Once this is discovered we’re looking at violations of ethical rules and also maybe some criminal rules. If they are aiding and abetting violating of usury laws, depending on the state, that might be criminal.”

He added:

“They’re risking their careers and freedom in such a way.” And described it as “So clearly problematic.” In states where these violate usury laws “waivers aren’t going to help you”. He explained that usury laws may apply given that post-settlement should be easy for courts to deem as loans.”

Given the above, it seems unlikely that lawyers at 66 law firms would collectively risk mass disbarment in order to accept a fee to direct their clients to expensive funding sources, as described by Judd and his marketers. Likewise, we struggle to see a scenario where 20,000 high-risk events took place without one single disciplinary action, which would inevitably produce delays or other issues.

Judd Almost Always Makes Himself Unavailable to Speak to Prospective Investors, Contrary to Industry Practice

Other Members of the Team Seem to Be Siloed From Each Other As Well. One Marketing Rep We Spoke With Claimed To Not Know Who Was On The Rest of the Team

Initially, when we asked about the possibility of talking to Judd or other higher-level officials on the pyramid we were told “we don’t do that anymore.” Judd was so inaccessible and such a god-like, not-to-bother figure that Jongeward said that he had met Judd only once for a 45-minute lunch. It seemed an odd treatment for a marketer that was forecasting to generate $50 million of inflows, in 2022, for J&J Purchasing.

In contrast, most asset managers find it very important to let investors know the professional and educational backgrounds of who works for them. We found no J&J Purchasing marketing materials that identified employees. When we asked Jongeward who else worked at the firm, he told us he didn’t know, as he only knew Jeff Judd, attorney Matthew Beasley, his direct report Shane Jager, and one other marketer.

The structure, in short, struck us as incredibly atypical. It also seemed designed to “silo” each member of the team should anything ever go wrong.

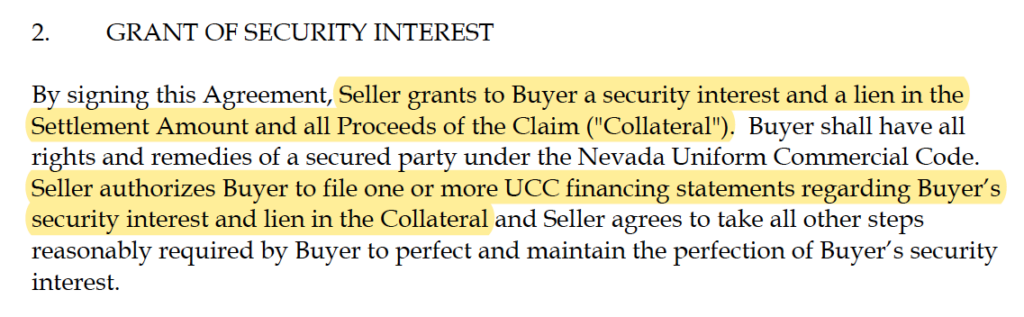

In Accordance With J&J Purchasing’s Contracts Stipulations, The Company Has the Right to Secure Their Lien On The Claim’s Proceeds

We Couldn’t Find Any Lien Registered in Favor of J&J Purchasing Or Its Preceding Entity.

During calls with Jongeward, he made the following representations:

“So we basically place a lien through a purchase agreement with the attorney and their plaintiffs. And, and so after 90 days, they give us that 80 or $100,000, back to us through the terms of the contract with interest”

“[The purchase agreement/Contract] is essentially a 14-page lien on the on the settlement”

“…if you look in the PPM if you looked at that purchase agreement that’s between Jeff Judd and the client and his attorney. It’s a half-page of who we are and then the other 13 pages are what how we’re going to make sure we receive our capital so it’s basically a lien on a future settlement.”

The sample contracts annexed to J&J Purchasing’s PPM show a clause where the seller grants J&J Purchasing a security interest and a lien in the proceeds from the seller’s claim.

J&J Purchasing states that the contracts backing their investments are a robust lien on a future cash flow. Given the importance of the liens in the collections process, and given that liens are publicly reported in state Uniform Commercial Code (UCC) databases, we would have expected to see the tens of thousands of liens reported through the dozens of law firms J&J works with.

However, based on UCC (lien) filling searches, we couldn’t find a single UCC filling with any of the J&J entities as creditors. This was a massive red flag.

J&J Seems To Be In Open Violation Of Several Securities Laws

The Firm Claims To Have Over $400 Million In Assets, Well Above The Threshold Of Being Legally Required to Register With the SEC As An Investment Advisor

It Is Not Registered with The SEC (Even Though a Marketer Claimed It Was “Licensed” By the SEC, Which Isn’t a Thing)

Given that Federal law requires investment managers with greater than $100 million in assets to register with the SEC, we would have expected to find that J&J had registered as early as 2019, when, according to its own marketer, the firm had ~$125 million in assets.

We found no registration for either the firm or its principal Jeff Judd. This is more perplexing given that J&J is now well above that legal threshold, per both Judd and its own marketers, who repeated on several calls that the firm has over $400 million in client assets:

“When I got started, in the end of 2019, November, I put my first contract in we had about 125 million of operating capital within the investment. They had closed 4,500 contracts, to that point. And 26 months later, since I’ve been involved, we’re now up over 400 million, and we’ve closed over 20,000 contracts with zero defaults.”

“We’re at 400 million of operating capital. And we have just over 1000 investors”

Judd claimed to a prospective investor to have “about $475 million” in assets.

Given the above, it seems that J&J is either violating Federal securities laws by not registering as an investment advisor or is lying about its asset base, which would also be a violation of Federal securities laws.

Bizarrely, Jongeward explained that Judd had created his recent new funding vehicle because he is “licensed” with the SEC:

“He [Judd] just created a new entity this year [2022], because he’s now licensed with the SEC, this has really expanded and grown. So, he did a business review with two attorneys out of Texas. They both previously worked for the SEC and so they put together a whole different program of documents.”

Note that while there are registered investment advisors, the SEC doesn’t actually provide licenses. The difference isn’t trivial, as licensure infers some sort of formalized credential that doesn’t exist. (Consider: you may register to attend a conference, but that doesn’t mean you have been licensed by the organization hosting the conference.)

Shane Jager pitched the same aura of legitimacy by saying:

“He [Judd] recently had a Texas based firm come in and essentially audit his company, a company that works with the SEC and FBI. And he had them come in, spent a couple 100k to do that. And they revised docs, they looked at everything, and said: `Okay, we like this’.”

(As most investment professionals are aware, financial firms are usually audited by audit firms, not legal advisers. In either case Jager didn’t name the actual law firm involved.)

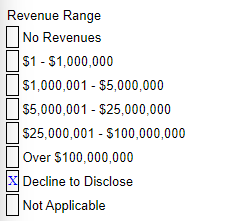

The only SEC document we found relating to J&J is a Form D filed with the SEC on December 13, 2021. A form D denotes that an entity may be offering private investments. It in no way blesses or “licenses” the offering.

The company’s Form D, under section 5 “Issuer Size”, declines to disclose its revenue:

In this case, given that the Form D to register a private placement offering took place roughly 6 years after an offering first took place (per the fund’s principals and marketers), it seems to be an indirect admission that the firm had been raising capital without filing the requisite legal documents. Judd characterized the form D filing to a prospective investor:

“I registered the company with the SEC, Section D. And so now we have all that in place with the private money and the subscription agreement and all that”.

How did they raise capital before? In the context of explaining how the firm’s new legal paperwork is really great, Jongeward informed us that J&J’s prior legal documentation was “really anemic”:

“I was able to raise $49 million worth with a three-page confidentiality agreement and a two-page buyer’s agreement. Okay, so that the paperwork was really anemic and didn’t really match the investment.”

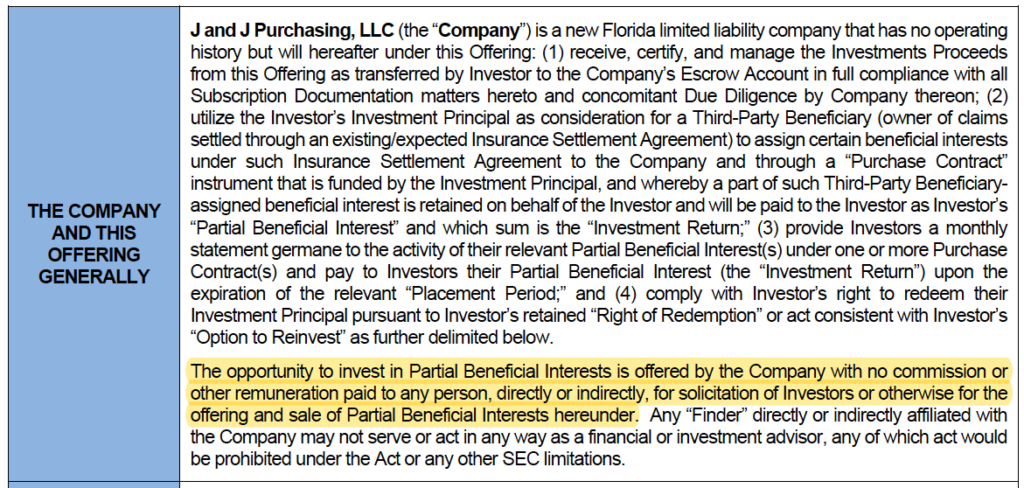

J&J Purchasing Legal Documents: We Don’t Pay Commissions for The Sale Of Our Securities.

Marketer: “I Make a Small Percentage Of Each Contract” (i.e., A Commission)

J&J Purchasing’s PPM stipulates that no commission or remuneration is paid for the sale of its securities.

In other words, J&J’s legal documents explain that no independent marketers are getting compensated to solicit investments. Despite this, Jongeward, the independent marketer we spoke with, confirmed that he was compensated for every investment he solicited:

“So my agreement is I make, you know, I make a small percentage on each contract.”

Note that marketers of private placement offerings such as J&J are required to be licensed to offer private placement securities and operate through a broker/dealer. The broker/dealer would be registered with FINRA, as is required by law.

The marketer we spoke with had no licenses and was not associated with any broker/dealer, per a check of FINRA’s BrokerCheck system. Operating as an unlicensed broker could be considered a violation of Section 15(a)(1) of the Securities Exchange Act of 1934.

Judd and Beasley Appear to Have Gone on a Luxury Spending Splurge by Acquiring a $5 Million Private Jet, Luxury Properties and at Least 16 Luxury Vehicles Estimated to be Worth $2.6 Million

With their newfound “wealth,” Judd and Beasley have apparently embarked on a luxury spending spree in the past several years. On July 28, 2021, an entity owned by J&J and Beasley’s law firm was registered as the owner of a Hawker 900XP private jet.

On February 20, 2020, Judd purchased a $5.5 million property in Henderson, Nevada, per Zillow.

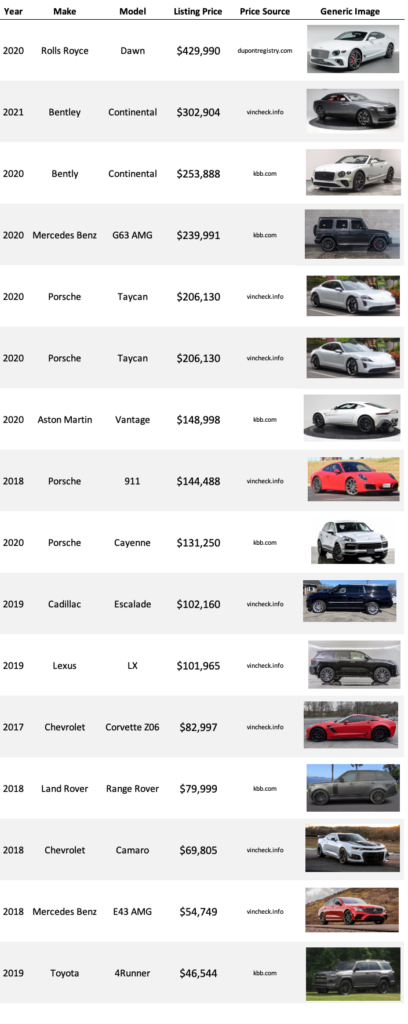

An asset search by Hindenburg revealed that, over the last several years, Judd and Beasley have bought 16 luxury vehicles estimated to be worth $2.6 million, as shown in the table below. These include a $400,000 Rolls Royce Dawn, a Bentley Continental, and 4 Porsches owned by Judd. Beasley’s collection also includes a Bentley Continental, an Aston Martin and a Mercedes Benz G Wagon.

Public records also reveal that Judd and Beasley appear to own several ATVs and boats. In the oral hearing that resulted in the denial of Beasley’s bail, the Department of Justice also identified that Beasley owned a $300,000 Ferrari.

We Believe J&J Is a Ponzi Scheme

Based on our research, we believe J&J is a Ponzi scheme. Additionally, we believe that all or a substantial portion of J&J’s claimed $400+ million in investments simply don’t exist.

Beasley’s confession earlier this month certainly bolstered our conviction on this point, but it also shouldn’t be a surprise to other J&J managers like Shane Jager, who told us:

“You know we’ve had some people say it’s a Ponzi scheme”

In defense of this apparently common objection, Jager informed us that he had personally seen the attorney’s payments, putting those fears to rest:

“I’ve seen the attorney’s IOLTA account- Jeff’s attorney. I just signed some NDAs, but I’ve seen it— actual payouts to the attorneys on the contracts…it’s legit.”

Earlier This Month, J&J Imploded Following FBI Visits to At Least 2 Key Members of The Firm

As we noted in the introduction, earlier this month, the believed scheme ran face first into reality when FBI agents visited the home of attorney Matt Beasley.

The criminal complaint against Beasley, alleging one count of assault on a federal officer, filed on March 4, 2022, gives further insight into the confrontation.

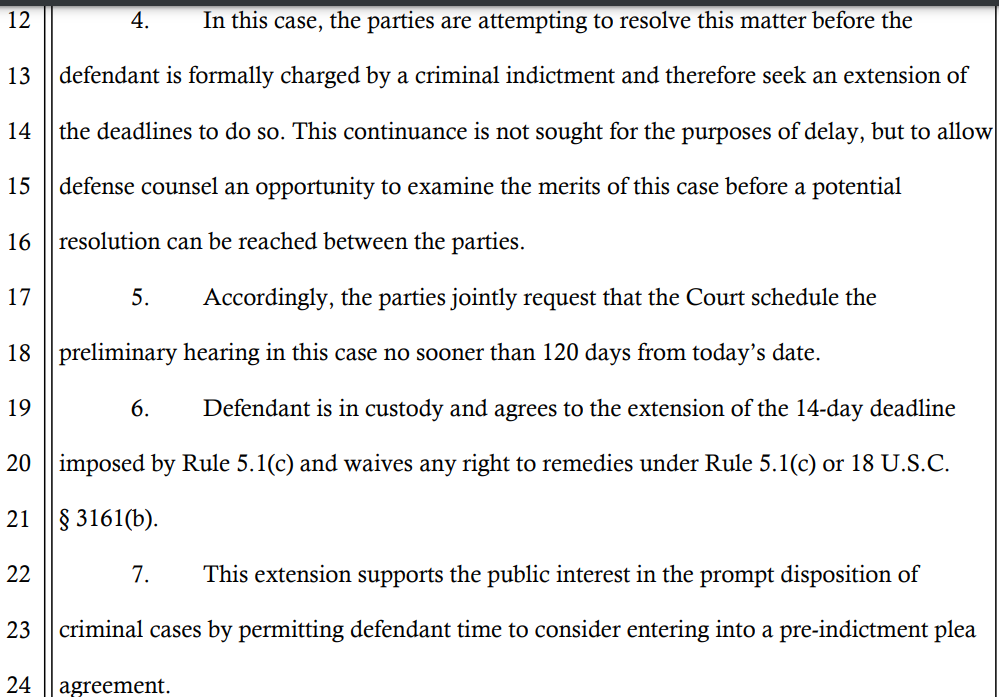

On March 9, 2022, additional court filings appear to show Beasley is on the path to a plea bargain for the charges stemming from the incident with the FBI, with Beasley’s lawyer suggesting he expects additional forthcoming charges.

J&J’s Other Marketers Appear to Now Be Claiming Ignorance

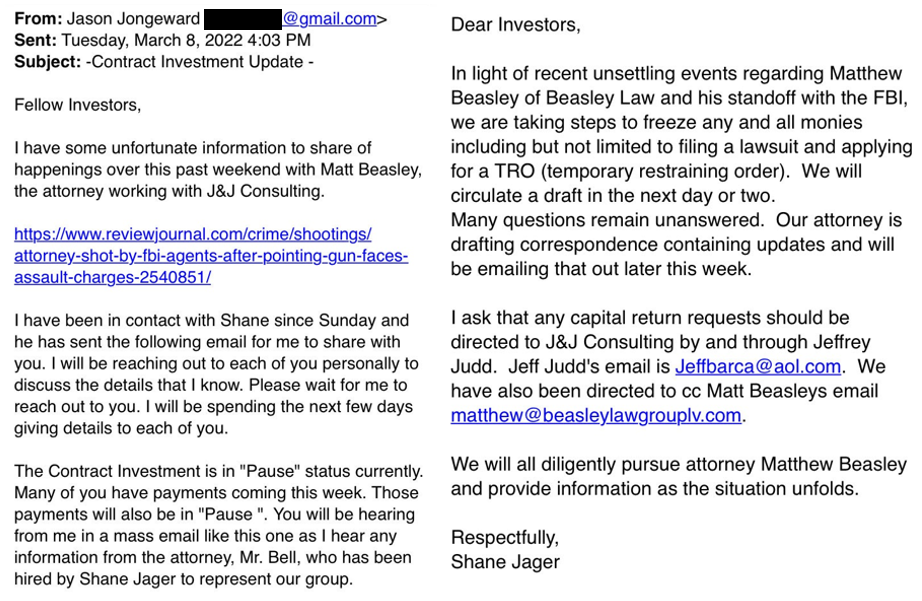

After the story was made public on March 8, 2022, investors and potential investors received an email from Jason Jongeward with a purported “Contract Investment Update”. The email shared the “unfortunate information” about Beasley’s “unsettling” stand off with the FBI, and said “The Contract Investment is in ‘pause’ status currently”.

The email, which included an attached email from Shane Jager to investors, noted that the group had hired a lawyer and was seeking to “freeze any and all monies”, potentially via a Temporary Restraining Order (TRO).

“Many questions remain unanswered,” the attached email from Jager said.

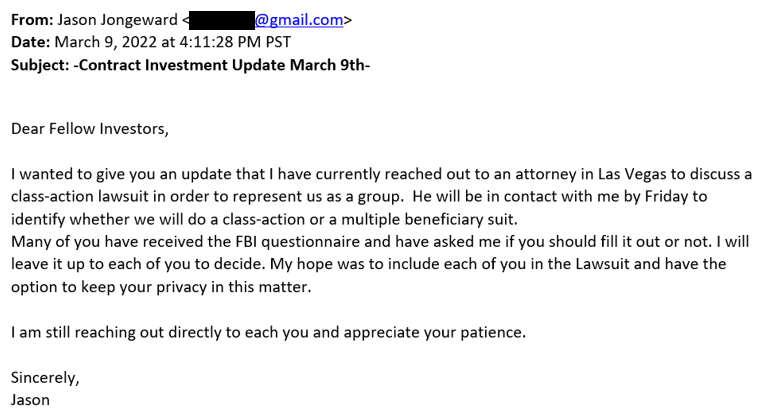

On March 9, 2022, Jongeward sent another email to investors, wherein he said that he contacted a lawyer to discuss a class action lawsuit.

In the same email, Jongeward also suggests it might be best for investors not to fill out a questionnaire that the FBI has set up for potential victims, saying that if they instead file a lawsuit it will somehow give them the “option to keep your privacy in this matter.”

This, of course, is nonsense on multiple levels. A class action does not ensure privacy, and helping regulators doesn’t prohibit privacy.

Despite the Recent Meltdown of J&J, Several J&J Marketers Are Pushing A Battery Start-Up Opportunity as the New “Safe” Investment

Remarkably, the recent events don’t seem to have slowed J&J’s marketers down all that much. Days ago (and only about a week after the armed standoff,) Shane Jager called one of our contacts. On the call, he explained the shocking unraveling of the alleged Ponzi scheme, despite having pitched it as virtually risk-free weeks earlier.

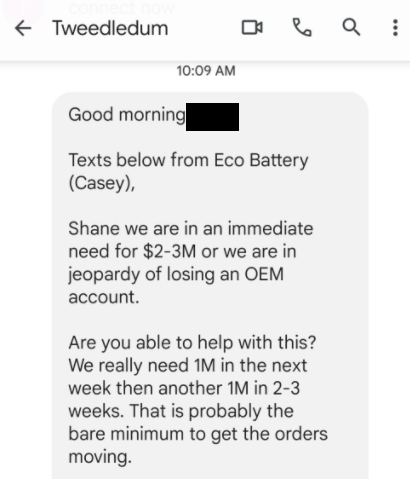

After expressing his surprise and blaming the events around J&J squarely on attorney Matt Beasley, halfway through the call Jager suddenly pivoted and pitched an investment in a start-up battery company. Per Jager, it’s a “safe”, hot opportunity that is time-sensitive:

“On a side note, I know we talked about Eco-battery, something that is safe, I will say. I talked to the partners just a few days ago and it may be a good opportunity for you and maybe some of your close friends to, they need an injection of capital really quick. Like $2 million probably in the next week or less.”

The same day, Jongeward emailed saying he’d “had a few fires to put out” but wanted to schedule a call to “bring you up to speed on the contract settlement investment as well as another investment we were doing with the battery company here in St. George.”

Jager then followed up with another high-pressure text message on the battery investment:

J&J is An Example of Effective, Prophylactic Enforcement By Regulators

Ponzi schemes generally have three phases: (1) early stage; (2) rapid growth; and (3) ultimate collapse.

The public is often critical of regulatory agencies for going after Ponzi schemes after they have already collapsed (like Madoff). Such post-mortem enforcement can make recovery for victims more difficult (even though Madoff victims were, thankfully, ultimately made nearly whole.)

Practically speaking, it is not always possible to identify Ponzi schemes early because they tend to intentionally fly under the radar. In the case of J&J, the firm seemed to have taken great efforts to minimize its paper trail.

Despite those hurdles, regulators moved expediently and effectively to investigate and to take action. This is likely to result in vastly more favorable recovery scenarios for J&J’s suspected victims. Given the pace that regulators worked, we would not be surprised if they had been onto J&J well before we even began our own research.

The tendency is often for the public to criticize regulators, while rarely spotlighting effective efforts. Based on everything we have seen thus far, we believe this will ultimately be a success story for regulators that deserves highlighting.

Important Message For Potential Victims of J&J

Based on what we know thus far, there seem to be hundreds of victims of J&J. We have been in those shoes before. In fact, those experiences largely fueled our efforts to identify and expose fraud.

We have felt the shock of learning that people you trusted, who in many instances were introduced by friends, family, or members of a local religious community, turned out to have been lying in order to take advantage of you.

It’s incredibly painful, both for victims who are now worried about their finances, and for those who thought they were doing friends and family a favor by introducing them to an opportunity they genuinely believed in.

It’s also an experience that makes one question one’s own judgement and ask questions like “if I’ve missed this, what else have I missed?” It’s extremely unsettling, but know that it is also something that decent people are susceptible to. Often when we have good intentions towards our friends and family, we assume that others we meet do as well. And thankfully, that is usually the case. Most people are decent people. There are a small number who aren’t, but they can unfortunately have a large negative impact through their actions.

On the prospect of recovery, given the expediency of the regulatory action, we hope there is a high recovery. It’s certainly not an exact science, and the process typically takes several years, but often the recovery on Ponzi schemes can be quite substantial, especially when there are numerous physical assets such as property and vehicles, as is the case here.

We also do not think potential victims should take Jongeward’s and Jager’s advice to not reach out to regulators, and believe that advice could be self serving. Anyone who believes they may have been a victim of this scheme should fill out a survey on the FBI’s website. An expedient resolution is often the best outcome for everyone. Often regulators take a role in establishing a receiver and collecting/distributing funds and proactive outreach could help aid that process.

You can also reach out to us with information or just to talk about the situation, as desired. Our email is info@hindenburgresearch.com. Keep your heads up, it gets better from here (unless you’re a part of J&J, we reckon).

Legal Disclaimer

Use of Hindenburg Research’s research is at your own risk. In no event should Hindenburg Research or any affiliated party be liable for any direct or indirect investment losses caused by any information in this report. You further agree to do your own research and due diligence, consult your own financial, legal, and tax advisors before making any investment decision with respect to transacting in any securities covered herein. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Hindenburg Research is not registered as an investment advisor in the United States or have similar registration in any other jurisdiction. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind – whether express or implied. Hindenburg Research makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and Hindenburg Research does not undertake to update or supplement this report or any of the information contained herein.